Lower CPI, fall in Petro demand, China trade and more...

This Week In Data #17

In this edition of This Week In Data, we discuss:

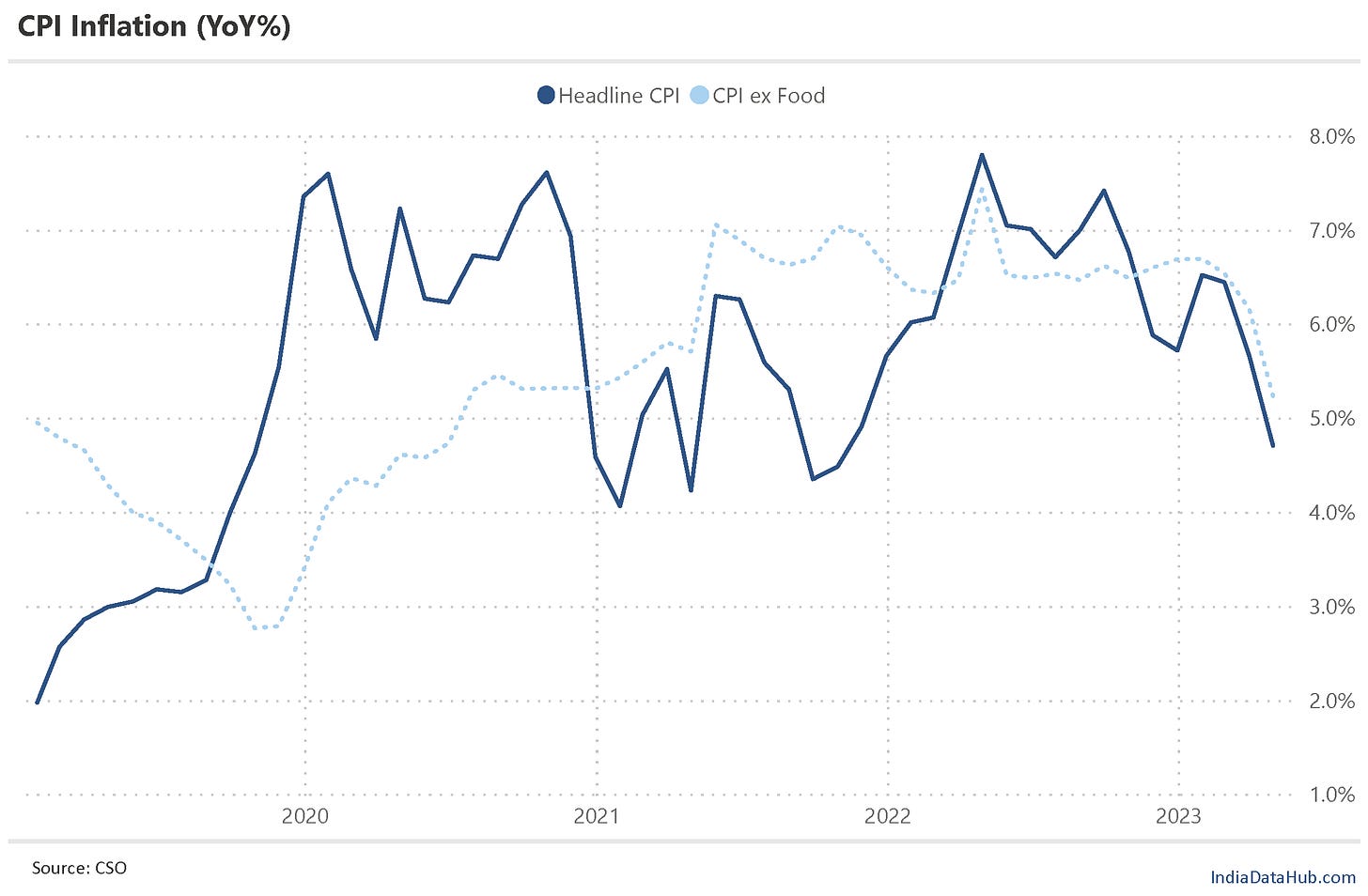

Decline in CPI Inflation

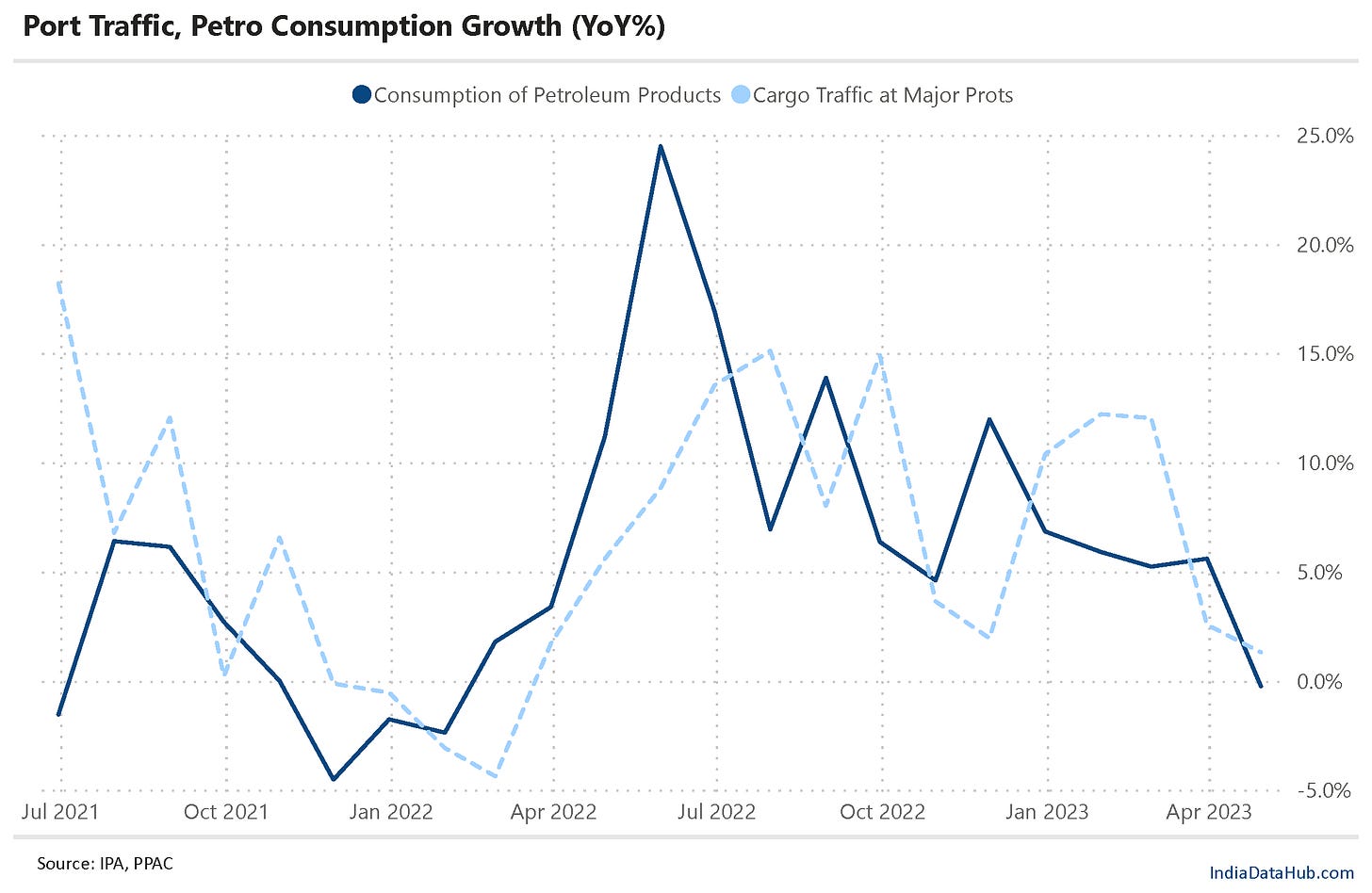

Decline in petroleum product consumption

Sharp slowdown in cargo traffic at ports

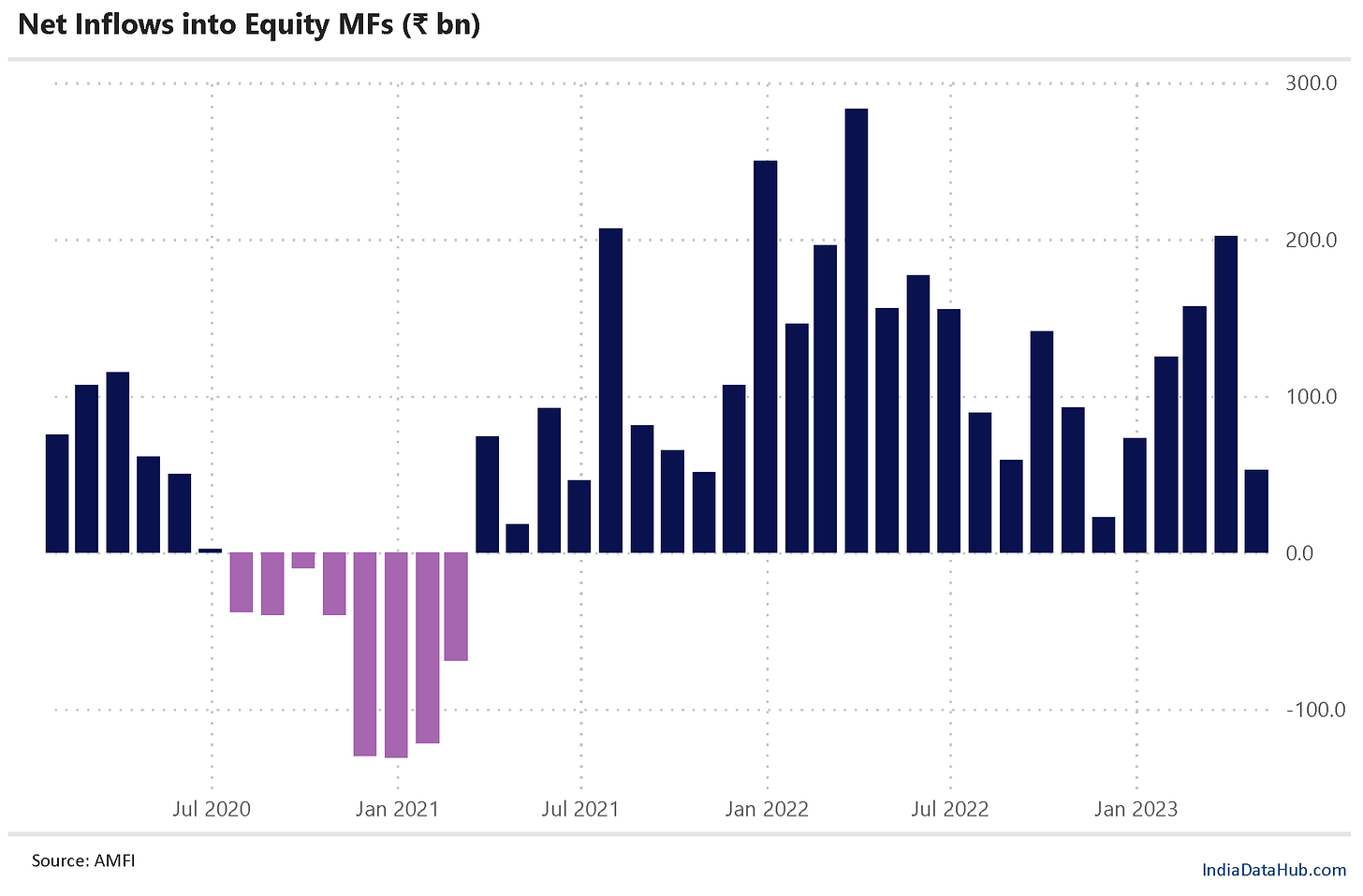

Continued strength in inflows in Equity Funds

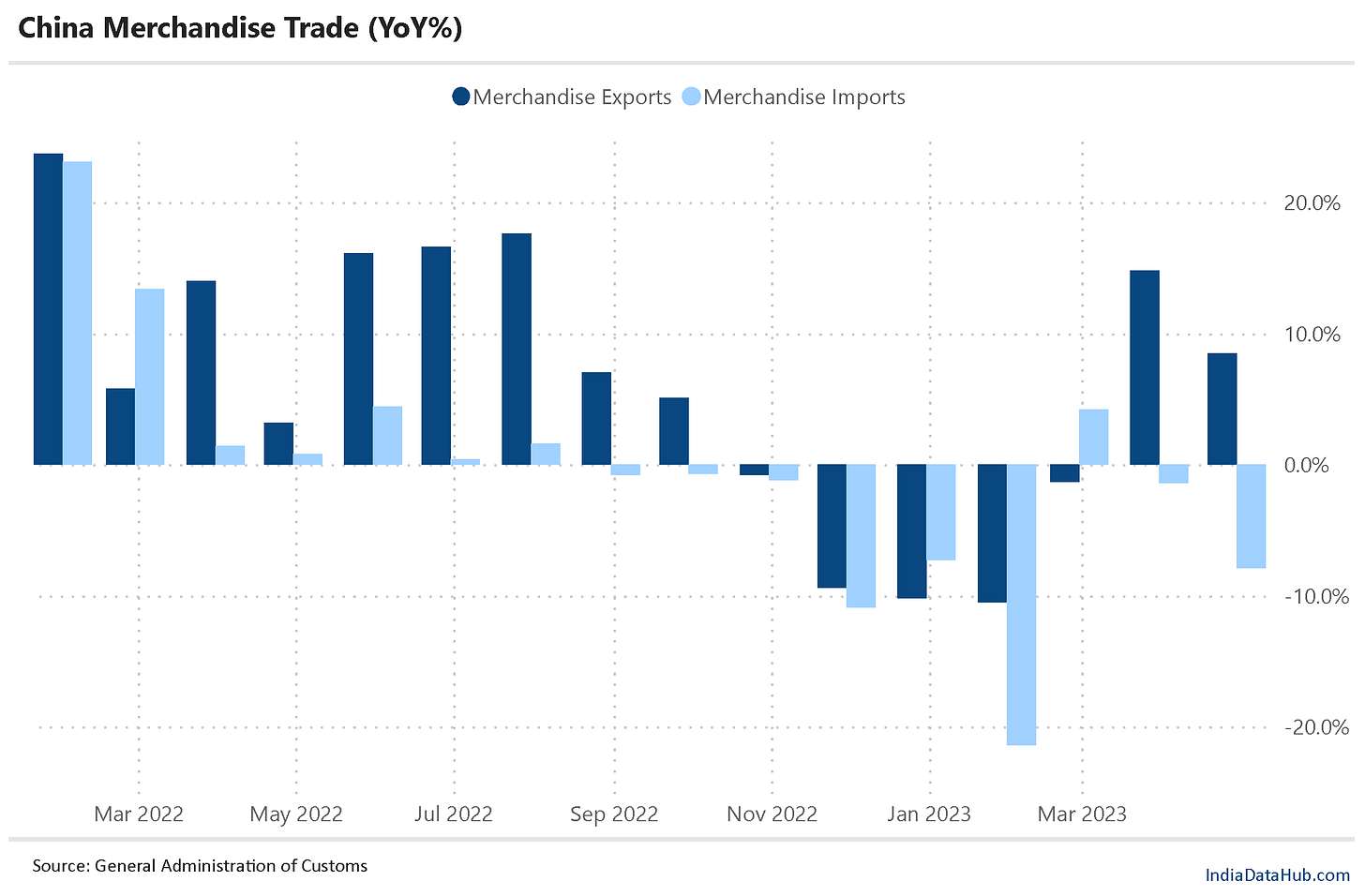

Divergence in Chinese trade growth

So, yesterday’s CPI release was the most important data print of this past week. Both food and non-food categories contributed to this decline. And it was both positive and along the expected lines. CPI Inflation declined sharply to 4.7% YoY in April, down from 5.7% YoY in March. The magnitude of the decline while large, was broadly as per market expectation given the base effect. So, it was ‘as good as expected’ and not ‘better than expected’. That said, April CPI Inflation is the lowest in the last 18 months. While the risk of El Nino remains, for now, inflation worries will recede in the background and RBI will remain on the sidelines in terms of monetary policy.

That said, from trying to second guess when will the RBI pause at the start of the year, markets will now try and second guess when will the RBI cut rates. Given that growth data has turned a bit soft (more on that later in this piece), a rate cut towards the end of this year or early next year looks like a good marker to be penciling in. We shall see…

We highlighted last week that some of the early April data has been soft and the data releases this have also been soft. Thus, the cargo traffic at the major ports grew just 1.3% YoY in April. This is the second consecutive month of weak growth in cargo traffic. In March, traffic at grown by 2.6% but traffic had grown in double digits in the three months prior (Dec – Feb).

Similarly, consumption of all petroleum products declined modestly in April, the first monthly decline since January last year. While diesel consumption grew at a strong 9% YoY, petrol consumption grew just 3% YoY and LPG consumption has been declining for 4 months in a row now. The growth in diesel consumption likely reflects the shift in traffic away from railways – railway freight traffic has been growing in the low single digits for the past few months.

Domestic mutual funds continue to attract inflows, though the pace moderated in April. Equity funds attracted net inflows of just over ₹50bn in April. This is less than half of the average inflows in the preceding 3 months. What is impressive though is that April was the 26th straight month of net inflows into equity funds. Hybrid funds also saw inflows in April after seeing large outflows in March. The big picture here though is that hybrid funds have seen practically zero net inflows in the past 18 months.

Lastly, globally among the more interesting data releases last week was the China trade data. Merchandise exports grew 9% YoY in April, lower than the 15% growth in March. But the growth in Mar-Apr comes after five consecutive months of decline (Oct-Feb). Russia is a key driver of exports. Merchandise exports to Russia grew almost 70% YoY in April. Imports in contrast declined 8% YoY in April, higher than the 1.5% decline in March. Imports have now declined for 8 of the previous 9 months.

This divergence between export and import growth suggests that even as global demand remains strong, domestic demand in China has weakened. On the flipside though, stronger exports and weaker imports have resulted in a sharp increase in its trade surplus. The merchandise trade surplus in April was US$90bn, 80% higher on a YoY basis.

That’s it for this week. Have a good weekend folks. Hasta la vista…!