Lower CPI, Narrowing Trade Deficit, US CPI, China Trade and more

This Week In Data #39

In this edition of This Week In Data we discuss:

The sharp decline in CPI in September

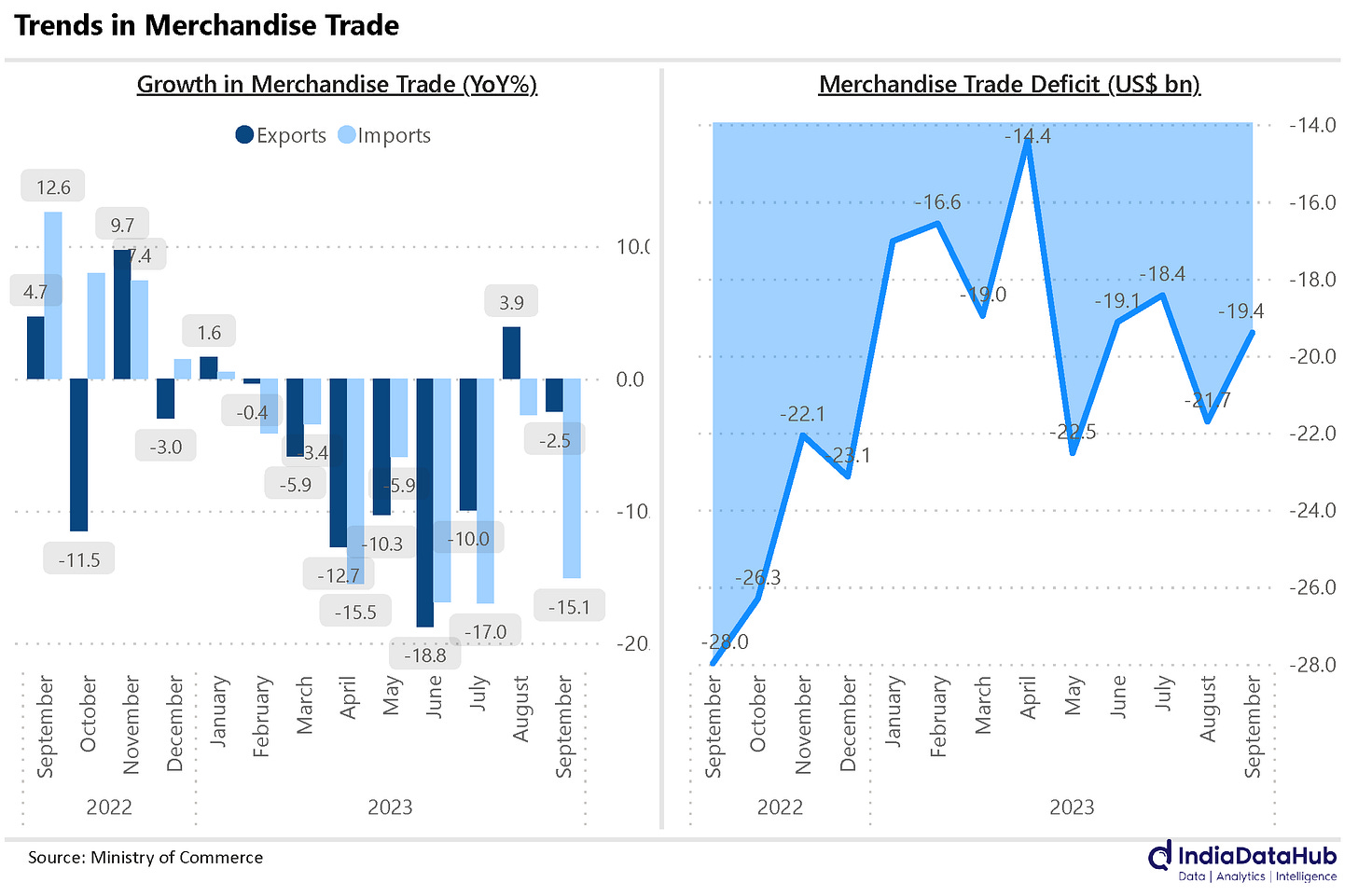

Decline in exports in September

Lower trade deficit in September

September CPI for US and China

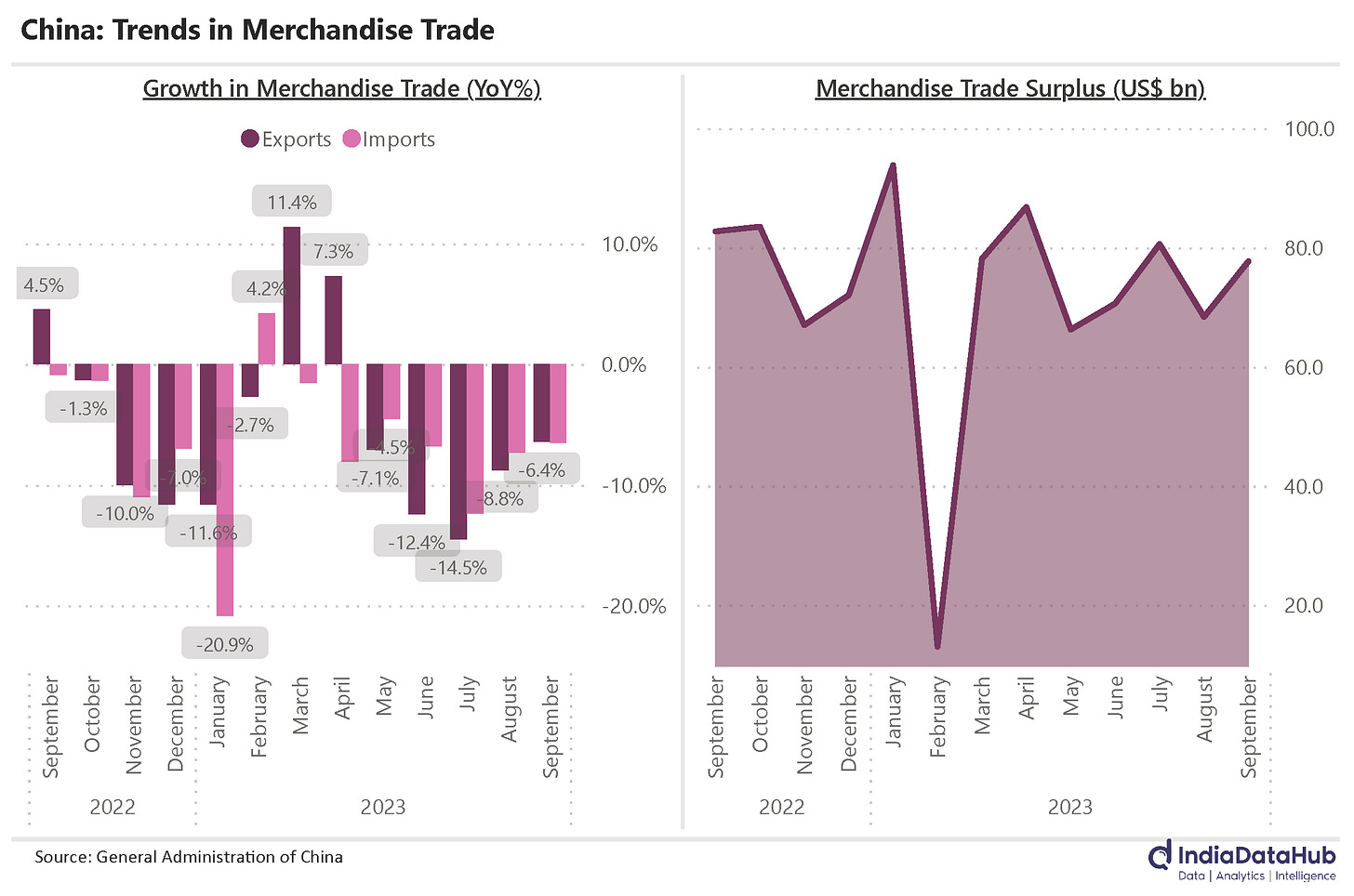

China trade data

In case you missed, we released upgraded version of our excel plugin that allows users to download district data directly into their spreadsheet in addition to India, States as well as Global data. Click here to see a quick overview of how the plugin works. And there is something new next week as well. Stay tuned...Apologies for the delay in getting this out. But it's not our fault you see. Ahmedabad Airport has run out of parking slots. So we were busy looking for a spot to park our sparkling new jet. At last, we could put our bird down on a narrow lane outside the stadium and start writing the piece. 😊 But seriously, Vistara is flying the Dreamliner on the Mumbai-Ahmedabad route (that’s a `wide-body aircraft for a flight time of less than an hour). The craze is at another level!

Ok back to our business.

So Inflation. It fell sharply in September to 5% from almost 7% in August. It is now back to the level it was before the Vegetable price shock (in June it was 4.9%). And as expected a large part of this decline is due to the fall in Food inflation. Food inflation fell to 6.3% YoY in September from 9.2% in August. However, food inflation has not fully normalised. Before the spike in July-August, food inflation was averaging 4-5%, so the September inflation is still 150bps above that level. And that means that non-food inflation has moderated even further.

In September, non-food CPI printed at 3.9% YoY, the lowest since December 2019. And core-core inflation (which excludes retail fuels and precious metals in addition to food and fuel) printed at 4.4% YoY, the lowest since February 2020. So, the September inflation data was fairly benign whichever way one looks at it.

The bond yields however did not move much. The 10-year yield closed at 7.3% on Friday, the same as the prior two days. The short-end yields also did not change much. So this fall in inflation has not come as a surprise for the money markets. This notwithstanding, this will restart the speculation as to when will the first rate cut happen. The current consensus estimate is for CPI to average 4% during the September quarter next year. Going by that estimate, the current repo rate of 6.5% implying a real policy rate of 2.5ppt looks high. But much will depend on how growth trends and what the Fed does. And Fed fund futures are still implying a 30% chance of a further rate hike from the Fed in the next 2-3 months. It is also worth remembering that we are extrapolating this basis just 1 month’s favourable print. And if anything the last three months should caution us against doing just that.

Exports declined once again in September. They had grown 4% in August. However, at -2.6% YoY, the pace of decline was modest. Imports however continued to decline in the mid-teens and consequently, the merchandise trade deficit fell to just under US$20bn, the lowest since April. The recovery in exports was driven by a 9% growth in Pharmaceuticals exports and a 7% growth in Engineering goods exports. Disappointingly though Electronics exports declined 4% in September, the first time they have declined in the last few years.

While imports declined in double-digit terms, that was largely due to lower Oil, Coal, and Precious stone imports. These three categories accounted for half the decline in imports. Machinery imports continued to see growth. They rose 4% YoY in September and have seen double-digit growth YTD. Electronics imports also rose in September. And interestingly, YTD now the absolute increase in electronics imports is higher than the absolute increase in electronics exports.

Ok, let us turn to the world now. And even globally, the key data releases were inflation and foreign trade.

US CPI was unchanged at 3.7% in September. China however saw a 10bps decline in inflation from 0.1% to 0% - prices were unchanged, on average, compared to a year ago! Mexico also saw a 20bps moderation in inflation to 4.45% in September. Brazil however saw inflation tick up 60bps to 5.2% which is the highest in the last seven months.

According to the data released by the General Administration of China, Exports and Imports declined by 6.2% YoY in September. This is the fifth consecutive month of decline in foreign trade for China although the pace of decline moderated sequentially to a four month low.

YTD (Jan-Sep), Chinese exports have declined by 6% YoY while imports have declined by 7% YoY. The trade surplus however has remained flat YTD at US$635bn, that’s just over US$70bn per month - in contrast India has averaged a trade deficit of ~US$20bn a month.

That’s it for this week. You can now go back to watching the match 😊