Lower FDI, Rising outward remittances, pick up in Rabi acreage and more...

This Week In Data #26

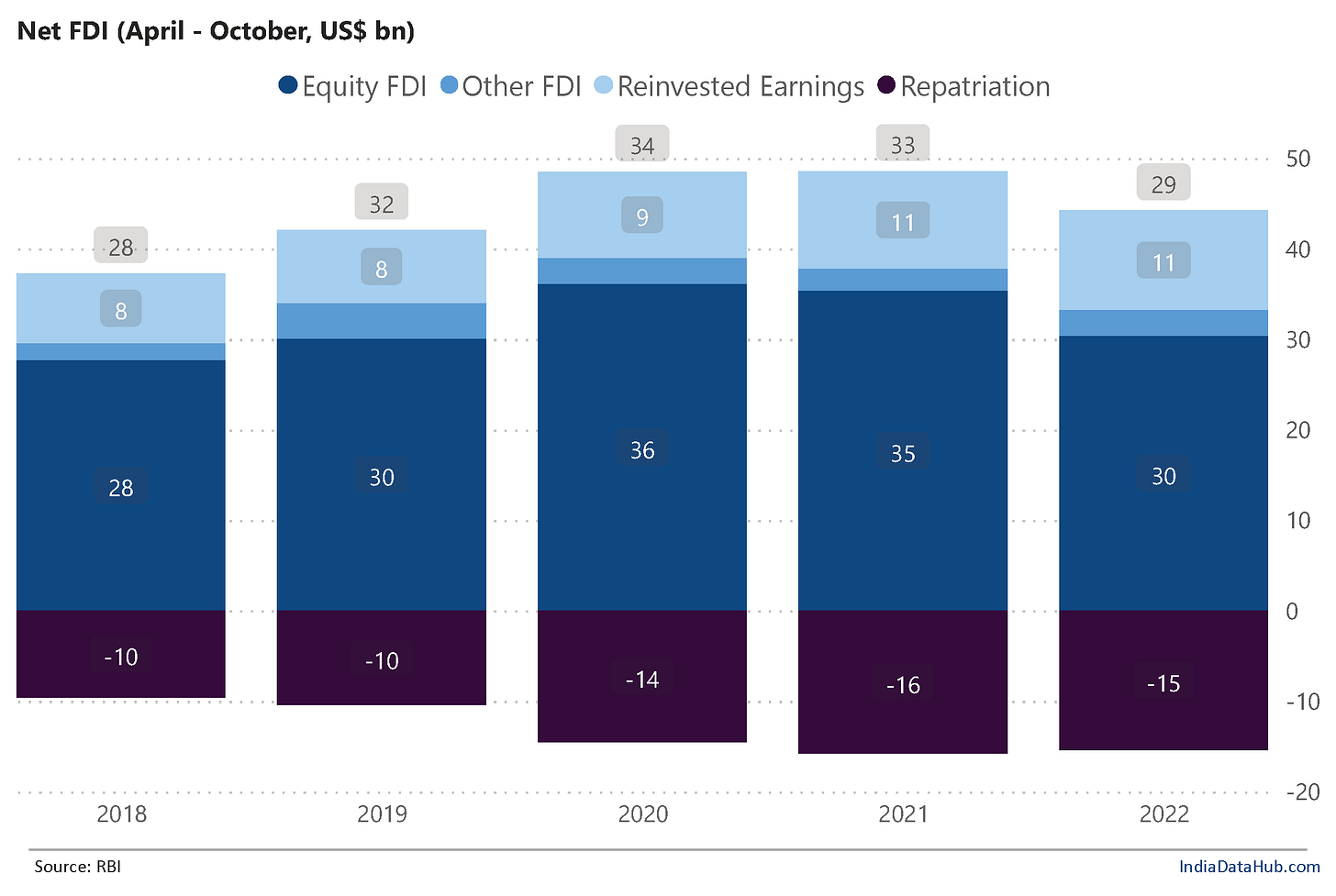

After two strong years, the inflow of FDI into India has slowed down during the current year. As per the data released this week, the net inflow of FDI into India totalled US$28.8bn between April – October this year. This is down 12% against the same period last year. Disappointingly, the FDI Equity flows, which is the actual FDI that has come into India, has declined 14% YoY so far and on the flip side, the pace of repatriation of existing FDI from India has remained at an elevated rate.

After two strong years, the inflow of FDI into India has slowed down during the current year. As per the data released this week, the net inflow of FDI into India totalled US$28.8bn between April – October this year. This is down 12% against the same period last year. Disappointingly, the FDI Equity flows, which is the actual FDI that has come into India, has declined 14% YoY so far and on the flip side, the pace of repatriation of existing FDI from India has remained at an elevated rate.

As the economy has come back to normal, outflows under the RBI’s Liberalised Remittance Scheme have picked up. In October this year, they rose 30% YoY and YTD the inflows are 45% higher. At the current run rate, outflows will be close to US$30bn for the full year FY23! As we wrote a couple of months back, overseas travel is the key driver of this uptick. Till October, outflows under overseas travel have almost tripled this year. Indians are currently remitting over US$1bn per month on overseas travel.

Once a structural growth story, the wireless telecom market is now declining. Wireless operators lost 1.8 million subscribers in October, the second consecutive month of decline. Since September last year, the wireless operators have cumulatively lost over 40 million subscribers on a net basis. This is 4% of the total subscriber base. In contrast, the fixed-line operators are seeing steady subscriber additions, reverting the long-term structural decline. Till October this year, they have added 3 million subscribers. This is on top of a 3.7 million subscriber gain in 2021. The fixed-line subscriber base has increased by almost 30% since 2020.

Lastly, Rabi sowing has seen a notable pickup in Pulses. As of mid-December, total Rabi acreage is almost 5% higher than last year. More importantly, though, acreage of Pulses is now higher than last year by 4%. Note that the Pulses acreage as well as output is estimated to have declined during the Kharif season. Wheat acreage is also running higher than last year. With the government extending the distribution of increased food grains till next year, the higher wheat output is crucial to achieving this given that wheat stocks with the FCI are already very close to the buffer stock levels.

Have a good weekend folks…