Lower Inflation, Corporate Results & State Budgets

This Week In Data #112

In this edition of This Week In Data, we discuss:

CPI declined sharply in January

RBI to follow through with another rate cut in April?

Corporate profitability improves during December quarter

State budgets suggest muted capex

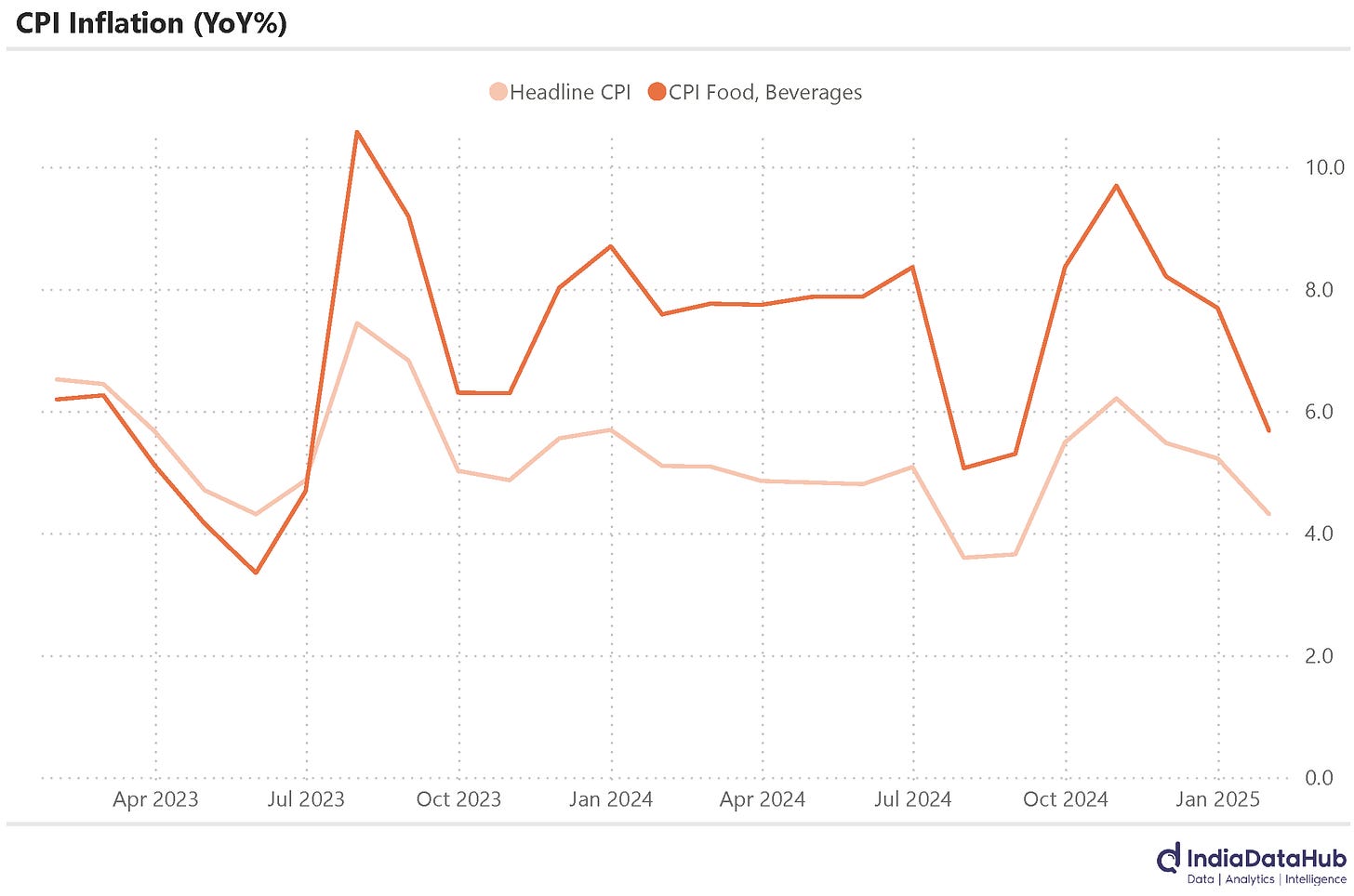

So we begin with January CPI. And it declined almost 100bps MoM to 4.3% YoY. CPI is now at a 5-month low and more importantly close to the 4% target set for the RBI. Almost all of this decline was due to lower Food inflation. CPI Food and Beverages declined 200bps to 5.7% YoY in January. Most of this decline was due to lower inflation in the Vegetable basket, offset partially by an uptick in the Fruits basket.

And core inflation continues to remain steady. CPI excluding Food and Beverages for example has remained steady at ~3% for the last 5 consecutive months. This benign reading in inflation has come after the RBI cut the policy rate earlier this month. And this means that a further rate cut in April now looks more probable. Recall that in the policy, the RBI had refrained from committing to further policy easing by maintaining a neutral stance because of the (mostly global) uncertainties. Headline inflation dropping towards 4% along with stable core inflation has made it easier for the RBI to follow through the February rate cut with another rate cut in April.

The 3Q reporting season has come to an end and it was a better quarter for corporate profitability compared to the last few quarters. Based on a sample of over 4000 quarterly results (excluding Insurance and Investment Trusts), reported profits grew at a 3-quarter high rate of 13% YoY during the quarter. This was driven by a 4-quarter high growth of 10% in operating profits (EBITDA). Revenue growth was, however, a modest 7%, broadly the same growth rate as in the preceding few quarters (indeed modestly lower if one were to nitpick).

So margin expansion was a key driver of profit growth during the quarter. EBITDA margins expanded almost 100bps on a YoY basis during the quarter after having declined in the preceding two quarters. And comes on top of a 100bps margin expansion during the December quarter of the previous year.

The improvement in profitability is broadly in sync with data suggesting that the December quarter was stronger for the economy compared to the September quarter. And we should get a validation for this on the 28th of this month when the December quarter GDP data will be released. If anything, the fact that the interest coverage ratio has continued to improve suggests that corporates are not yet borrowing in a meaningful way and thus corporate investment cycle has most likely continued to remain muted. Sometimes, too much of a good thing is also not that good 😊

The Central Government presented its budget a couple of weeks ago. But the states have now started presenting their budgets. And one of our pet peeves is that the State budgets do not get the attention they deserve. This is largely because the State budgets are less accessible than the Union budget – the data is difficult to comprehend, there is no uniformity in reporting the statements and often some of the releases are not even in English. But in aggregate, the state budgets are as important, if not more, than the Union budget.

So like last year we are tracking the state budgets as they are presented, updating the data and (this year) writing short summaries. Among the larger states, Kerala and West Bengal have so far presented their budget. The broad takeaway from both is the same – both states have had to cut down on their capital expenditure due to revenue shortfall. A large part of the revenue shortfall for both states is lower grants (mostly central grants).

West Bengal has had to cut its capital expenditure for FY25 by over 20%, while Kerala has had to reduce it by 7%. For both states, capital expenditure will see no growth in FY25 as per the revised estimates.

And despite expenditure cutback, both states now expect their FY25 fiscal deficit to be higher than the budget estimate - and more than the 3% threshold for both the current financial year as well as the next! For the next year, both states have projected strong growth in capital expenditure and a decline in the fiscal deficit. But it will boil down to whether their revenue estimates are realized. The budget estimates for FY26 are thus to be interpreted just as their statement of intent at this stage.

That’s it for this week. See you next week…