Lower inflation, rising consumption, surging exports to US and more...

This Week In Data #121

In this edition of This Week In Data we discuss:

CPI Inflation falls sharply in March

Falling inflation is pushing up consumer confidence on spending

Trade balance widens in March thanks to higher Gold imports

Exports to USA are booming!

Overall spending under NREGA remains unchanged but coverage of people drops

ECB cuts policy rates while Central Bank of Turkey raises them

Chinese GDP growth holds steady in 1Q

First Inflation. CPI inflation declined to 3.3% YoY in March. This is the lowest print since August 2019. This is also the second consecutive sub-4 % reading on the CPI. Food inflation was the biggest driver of the fall in inflation. Food inflation fell 100bps to 2.9% YoY in March and it is now at its lowest level since November 2021.

Core inflation ticked up but modestly. Core – Core CPI which excludes retail fuel prices, and precious metal prices (in addition to Food and Fuel) ticked up a modest 7bps to 3.4%. The inflation data thus justifies both the rate cut from the RBI a few days back and the change in its stance. Furthermore, as things stand now, a further 25bps rate cut from the RBI looks to be on the card.

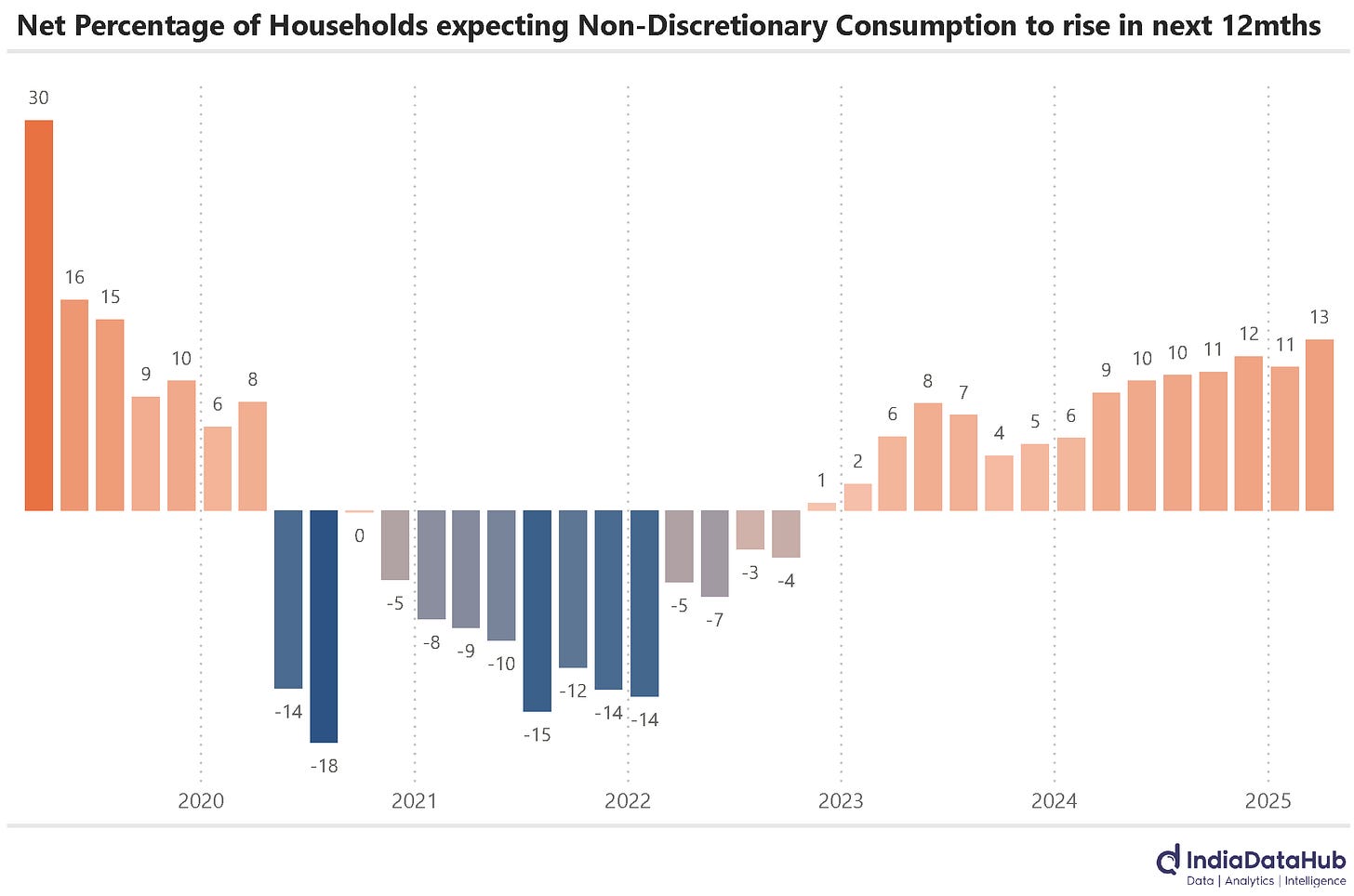

Falling inflation and especially food inflation seems to be pushing up consumer confidence in spending also. As per the RBI’s consumer confidence survey in March, 13% of the respondents on a net basis said that they expected their non-discretionary consumption to increase over the next 12 months. This is the highest net score since mid-2019.

In rural areas too (where the data starts only from 2023) the net score for non-discretionary consumption has increased to an 18-month high. So we might start seeing a broad-based revival in consumption soon.

India’s trade balance widened sharply in March, primarily due to Gold. Gold imports tripled in March on a YoY basis and contributed to almost half of the increase in merchandise imports. Petroleum imports rose 16% YoY despite falling Oil prices suggesting a higher volume of imports and this also contributed to the rise in imports.

In aggregate imports rose 11% YoY, the strongest growth since November last year. Exports, however, were subdued, growing less than 1% YoY in March. Drugs and Pharmaceuticals saw the strongest growth at over 30% YoY. Exports of electronic goods also rose almost 30% YoY.

But the real story of exports is the sharp growth in exports to the USA. As we have mentioned before, there is a massive front loading of trade globally before the kicking in of tariffs. And in sync with that, India’s exports to the USA rose 35% YoY in March. In February also, exports to the USA had risen 10% YoY when India’s overall exports had declined by 11%.

The thing is, while the tariffs will be contractionary for global trade when they kick in, in the short term, it is causing a global trade boom!

FY25 was an interesting year for NREGA. The total expenditure under the scheme was almost unchanged at just over ₹1 trillion. The expenditure on the scheme has remained broadly around this level for the past 5 years. However, the average daily wage rate under the scheme has continued to increase. In FY25 the average daily wage paid under the scheme was ₹253, up 6% YoY. Between FY21 and FY25 the average wage rate has increased by 25% even as total expenditure has remained unchanged. What gives? The total number of households or the total number of person-days under the scheme has fallen. In FY21, 112 million persons were provided work under NREGA. In FY25, this has fallen to 79 million.

In theory, this should be good news since NREGA is designed as a demand-driven scheme. If people demand work, the state has to provide work or if it is unable, it has to still pay them the stipulated wage rate. So lower work provided means lower work demanded which means lower rural distress. But when an entire state like West Bengal has 0 households demanding work for the entire year, you know that in practice NREGA does not function as a demand-driven scheme. So lower work under NREGA does not ipso facto translate into lower rural distress.

Alright, let us turn to rest of the world. The European Central Bank (ECB) lowered its policy rate by 25 basis points last week. The interest rate on the main refinancing facility now stands at 2.4%. This decision aligns with the recent disinflation trend seen in the Euro area. The flash HICP for March came at a 5-month low of 2.2%. But more than inflation the rate cut reflects the weakening growth outlook on the back of US tariffs.

In stark contrast, the Central Bank of Turkey raised its key repo rate by 350 basis points, increasing it from 42.5% to 46%. This aggressive monetary policy aims to strengthen the disinflation process by moderating domestic demand and promoting real appreciation of the Turkish lira.

Lastly, China's GDP grew by 5.4% year-over-year in 1QCY25 as per the provisional data. This is the same growth as in the previous quarter. And this is broadly the same rate as in the previous few quarters as well. Thus, going into the tariff storm, the Chinese economy is doing reasonably ok.

That’s it for this week. See you next week…