Mixed Auto sales, Services exports decline, CAD in surplus and more...

This Week In Data #63

In this edition of This Week In Data, we discuss:

GST Collections in April

Strong Car and 2W sales in April but weak Tractor and Truck sales

Decline in services exports and imports in April

Current account likely to be in surplus in March quarter

Demand for NREGA continues to decline, but there is a catch

Weak US Non-farm payrolls

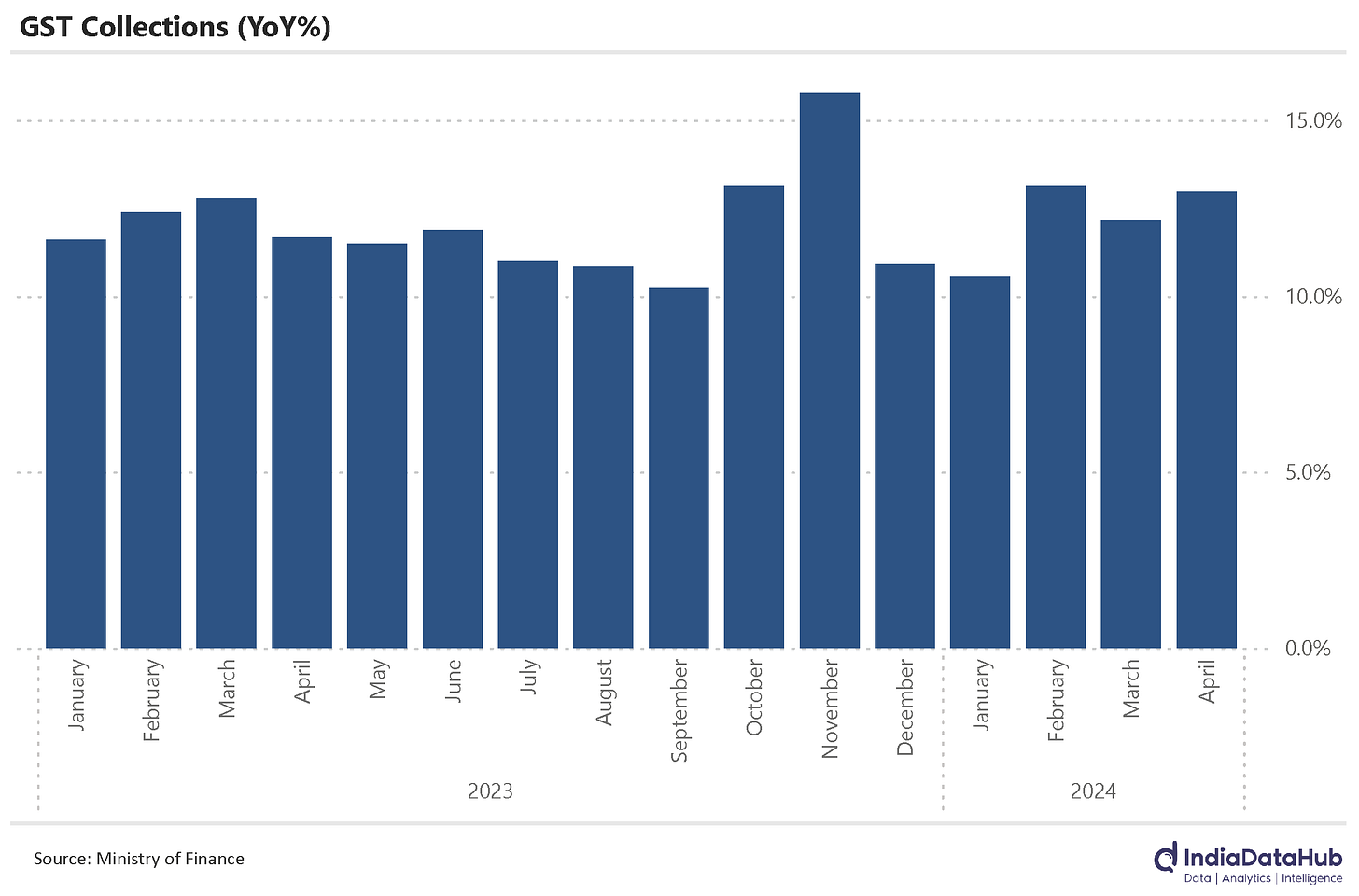

A new month and so a raft of high-frequency data to pore through. Let us begin with the GST numbers. GST collections in April (pertaining to business activity in March) grew 13% YoY, broadly the same growth as in the last few months (growth had averaged 13% between the October – March period).

Growth in GST collections is being driven largely by domestic collections – IGST Collections on imports have been growing in single digits for the past few months. This again reflects the weak nominal growth in imports – in the last six months (October – March), merchandise imports have grown by an average of 3% YoY. So steady as she goes on the GST front.

Automobile sales were mixed in April. 2W sales were strong in April growing 33% YoY, the highest since October 2022. Part of this was due to the low base since 2W sales had declined in April last year. On a 2-year basis, the growth in April is broadly in sync with the growth during the March quarter. Sales of Cars and SUVs grew 15% YoY after having declined 5% in March.

On the flip side, Tractor sales have been weak for two consecutive months now. In April they grew just 1% YoY and in March they had declined 3% YoY. Between December – February Tractor sales had grown by 11% YoY. Sales of Trucks have also been declining for the past six consecutive months.

Services exports surprisingly declined in March. Although the decline was modest at 1.4%, this was the first time since January 2021 that services exports declined in any month. Imports also declined by a modest 2% YoY and consequently, the services trade surplus was almost unchanged from March last year. But what this means is that for the March quarter, India had a combined trade deficit of just US$7.5bn, down almost 45% from last year.

This is likely to have translated into a current account surplus of almost US$5bn for the quarter! The last time India had a current account surplus during the March quarter was in 2020 and before that in 2007! So it is kind of a big deal.

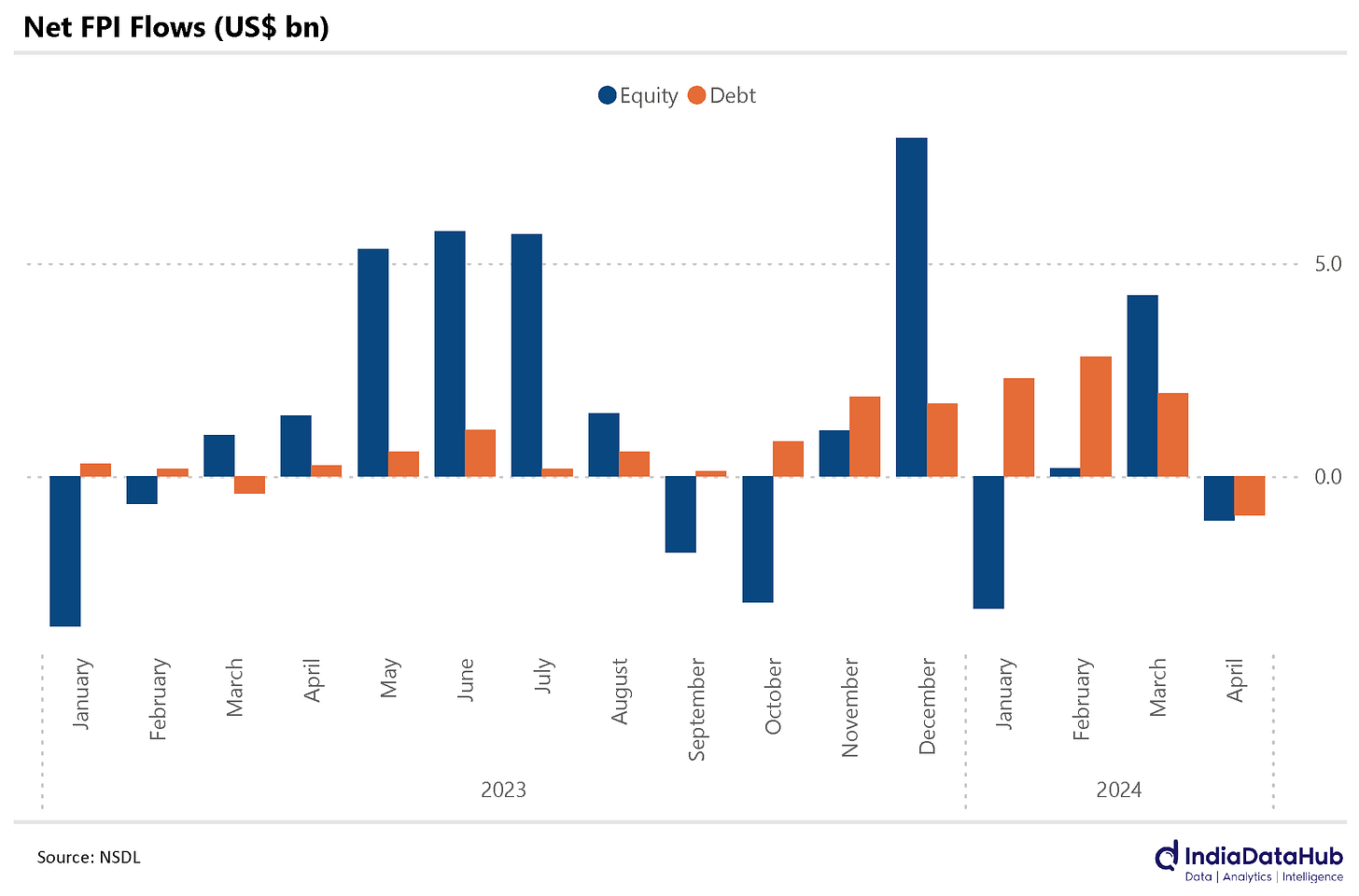

While a current account surplus is good news for the exchange rate, in the near term, capital flows drive exchange rate movements. And April saw FPI outflows of almost US$2bn of which almost US$1bn was in debt markets. India’s FX reserves have accordingly declined by almost US$11bn in the last three weeks reflecting a combination of USD strength and RBI intervention to defend the rupee. The rupee continues to remain stable against the USD and thus continues to outperform most EM currencies.

Demand for work under NREGA declined 5% in April, the 6th consecutive month of decline. There is however a significant inter-state divergence in demand for work. On one hand, there is West Bengal which has just completely stopped NREGA with 0 activity since October. Tamil Nadu has also seen an almost 75% decline in the number of people demanding work under NREGA in the last three months. Odisha has also seen an almost 40% decline in the number of people demanding work. On the flipside, Maharashtra has seen more than a doubling of the number of people demanding work. Madhya Pradesh has seen a 40% increase and Telangana has seen a 36% increase.

While in principle, NREGA is a demand pull-driven scheme, in reality, the large declines also reflect budgetary constraints and/or political factors at play (such as expenditure priorities of the respective states). Thus, the NREGA data is skewed – an increase in demand almost certainly reflects rural stress but on the other hand, a decrease in demand does not, ipso facto, imply a benign labour market in rural areas.

And globally we had some soft data from the US. After a weak GDP print last week, we had soft payroll data for April. The US economy added 175k jobs in April as against a consensus estimate of 240k. This is the lowest job growth in the last six months. Also, job addition for the previous two months was modestly revised down by a cumulative 22k.

Despite the softer data in the last two weeks, markets are now expecting the US Fed to begin cutting interest rates only in September. So rate cut expectations continue to get pushed out.

That’s it for this week. Some more high-frequency data next week. So till then, sit back, relax and stay hydrated…