Monetary policy, Consumer confidence, China deflation and more...

This Week In Data #52

In this edition of This Week In Data, we cover:

Monetary policy review

Optimistic rate cut timeline

Divergent consumer confidence

Continued deflation in China

The Monetary Policy Committee (MPC) resolved to keep the policy interest rates unchanged this week. This was widely expected. The policy repo rate thus remains at 6.5% and it has remained unchanged since the February policy meeting last year when it was last raised from 6.25% to 6.5%. What was noteworthy though was that the decision to keep rates unchanged was not unanimous – there was one dissention. One of the doves on the MPC, Prof JR Varma, wanted the repo rate to be cut by 25bps. Notwithstanding this, the bond market reacted with a yawn to the policy with the yields remaining largely unchanged, both at the short-end and the long-end of the curve.

The markets are currently expecting the MPC to cut rates in either the April policy or the June policy. The median expectation from the RBI’s professional forecasters survey (conducted before the policy) is for the repo rate to be at 6.25% as of June end. However, there is reason to believe that this might turn out to be optimistic. For one, the RBI has generally revised upwards its growth estimates while keeping the inflation estimate largely unchanged. The RBI expects GDP growth of 7% for the next financial year, FY25, the same level as in the current year (FY24). So, the RBI is not anticipating growth to moderate due to the tight monetary policy. On the other hand, it is expecting inflation to average 4.5% in FY25 which while lower than the average of 5.4% for the current year, is still above the inflation target of 4%.

Equally important is what is happening globally. The expectation of the first rate cut from the US Fed continues to get pushed back. A month back, the markets were ascribing an over 90% probability of a rate cut from the Fed in May. As of yesterday, this has fallen to 60%. It is not just in India that the growth data has remained strong in the face of tight monetary policy. The US has seen the same. For example, the non-farm payrolls for January came in at almost 350k as against the consensus estimate of 190k. The job growth in the US during January was the highest in the last 12 months.

Along with the monetary policy, the RBI releases the results of some of the surveys it conducts. One such survey it conducts every alternate month (coinciding with the MPC meeting schedule) is the Consumer Confidence Survey (CCS). This survey is conducted in 19 large cities in the country (13 cities till January 2021) so it covers urban areas. In aggregate, the household’s assessment of their current and future situation is the highest since July 2019. So, this is a positive. However, there is a big divergence among the components that make up this index.

While household assessments about their incomes are back to and even slightly above the pre-covid levels, their assessment of their discretionary consumption is still below the pre-covid levels. Thus in the most recent round of this survey (January 204), about 4% of the households, on a net basis, responded that their incomes had increased over the last year. This is broadly the same as in the previous round (November 2023) and the highest since May 2019. So, almost a 4-year high. Their expectations of their future incomes are similarly the highest since mid-2019.

However, when it comes to non-essential spending their assessment is lower than even March 2020. During the January survey, almost 10% of the households on a net basis responded that their non-essential expenditure declined over the past 12 months, this is 15ppt lower than their net response during the May 2019 round. This suggests that while households feel confident about their incomes, this is not flowing through to either actual spending or even expected spending over the next few quarters.

This is in sharp contrast to the responses from the RBI’s Industrial Outlook survey where the responses from the manufacturing firms suggest that their optimism about a host of metrics such as order books, financial situation or profit margins is well above the pre-pandemic levels.

So, consumer sentiment is mixed while business sentiment is robust. K shape anyone? Or time for some other alphabet?

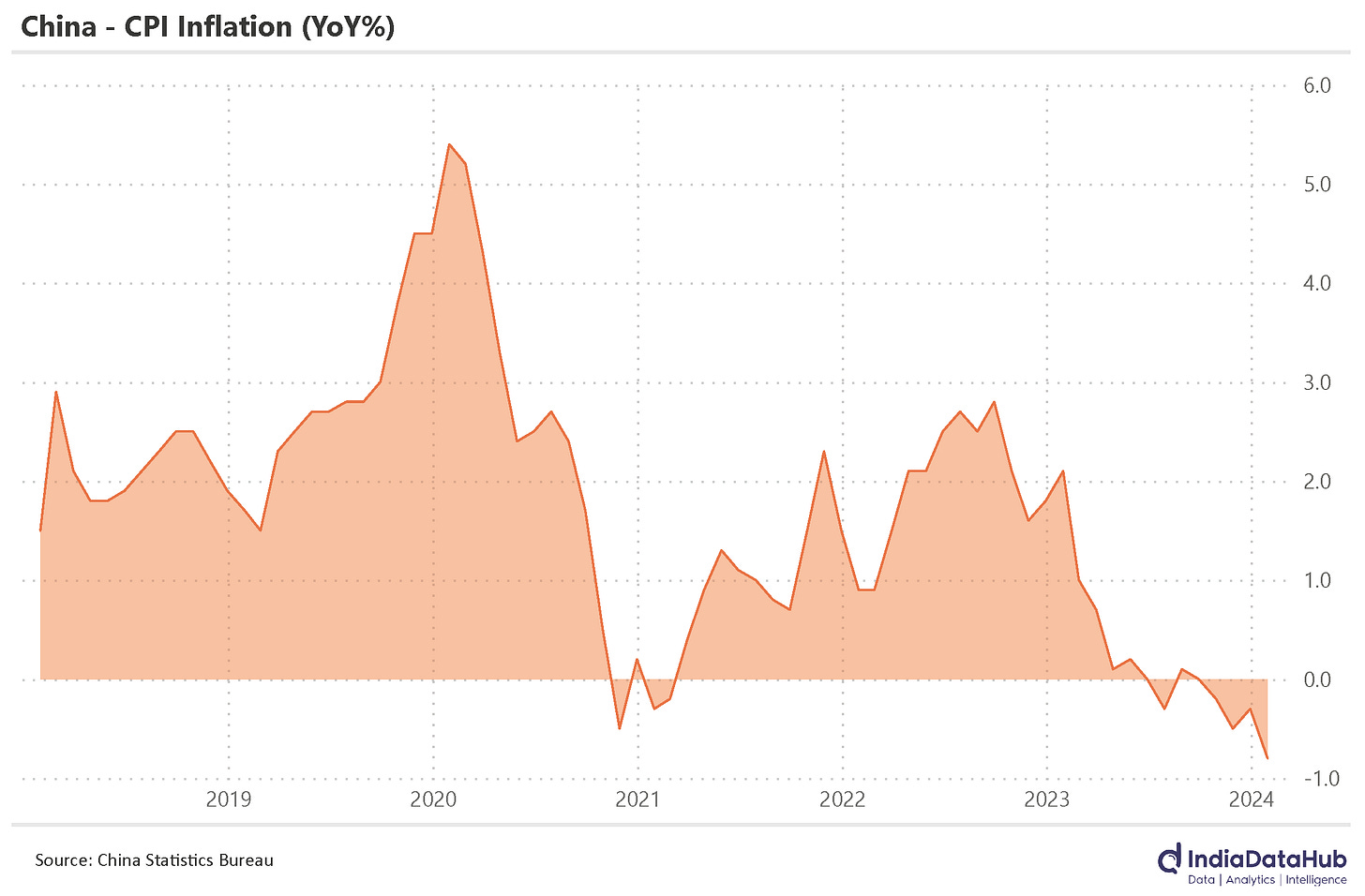

Onto the global data and the key release this week was China’s inflation data for January. And China’s CPI went deep into negative territory. In January, China’s CPI declined 0.8% YoY, the 4th consecutive month of deflation in consumer prices. More importantly, this is the lowest reading since 2009! Food prices fell by 5.9% YoY as pork prices declined further and transportation prices declined by 2.4% YoY. Non-food inflation increased by 0.4% YoY.

That’s it for this week. It's Valentine’s Day next week. We are happy to report that while overall consumer prices are up in mid-single digits as of December (compared to the previous year), prices of Roses are up less than 1%. So, in a relative sense, roses have become cheaper. So go on, get some roses. Red, White, Yellow, Pink, anything will do…