Monetary Policy, Growth, Housing and more...

This Week In Data #104

In this edition of This Week In Data we discuss:

RBI keeps interest rates unchanged but cuts the CRR

RBI cuts growth estimate for FY25 but keeps guidance unchanged but with dissension on the MPC

Improvement in the High frequency data for Dec qtr compared to Sept qtr

Households are the most optimistic about housing in a decade

Bank credit to property has seen a sharp uptick

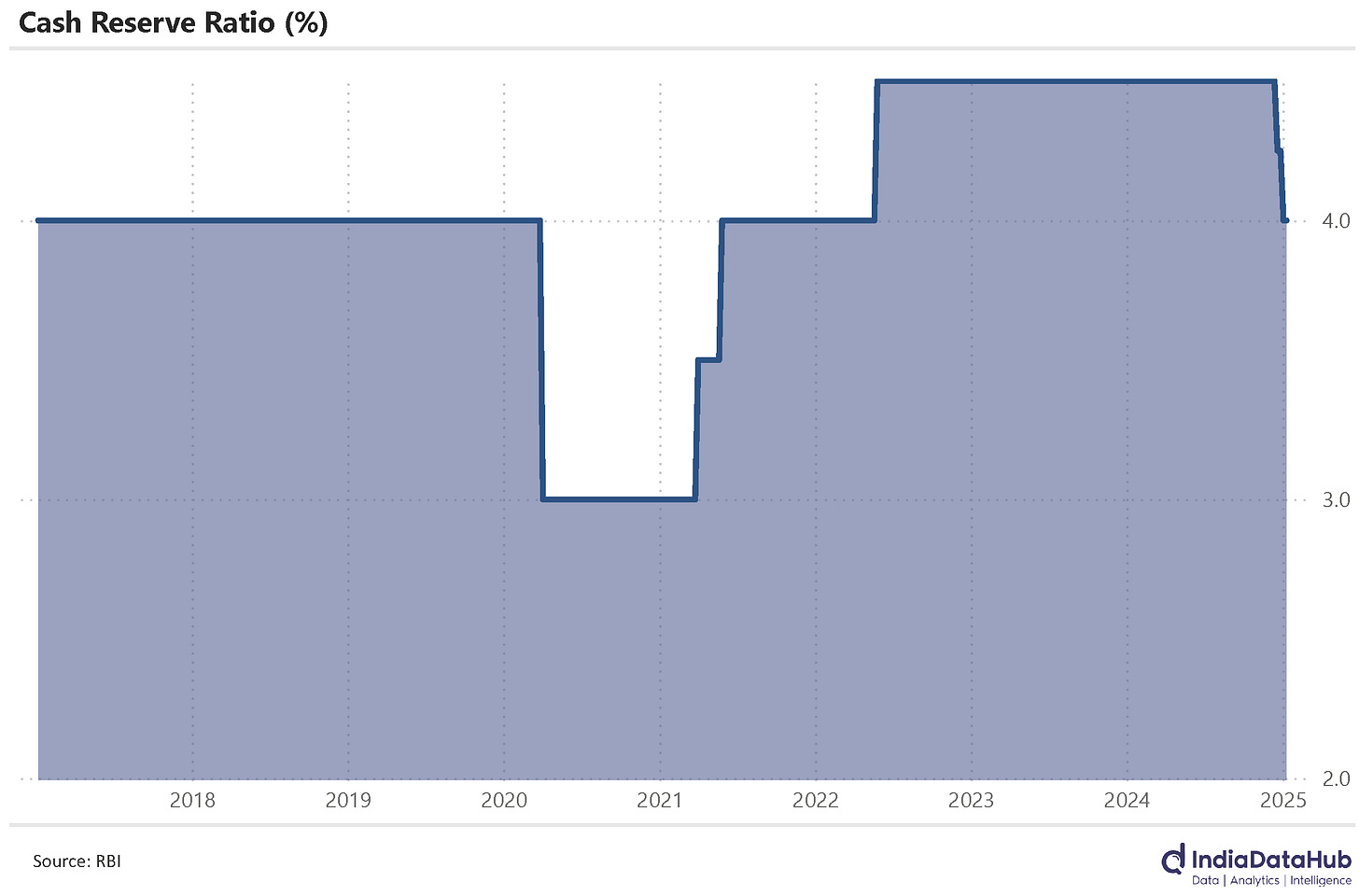

So the Monetary Policy Committee (MPC) did not cut interest rates on Friday. This was broadly as expected. But the RBI has cut the Cash Reserve Ratio (CRR) by 50bps. This will infuse liquidity. We discussed how the RBI’s intervention to defend the rupee, which has been under pressure due to the large FPI outflows that we have seen, is a net drain on liquidity. The 50bps reduction in CRR adds primary liquidity of just over US$13bn offsetting a large of the recent FX drain. At 4% the CRR is back at the level it was before the pandemic – in the initial wave of the pandemic the RBI had cut the CRR to 3% and then increased it to 4.5% as it sought to withdraw the excess liquidity.

But the biggest takeaway from the MPC’s statement was how sanguine the MPC is about growth. While the MPC has reduced its full-year FY25 GDP forecast from 7.2% to 6.6%, a large part of this is down to the slowdown in the first half of the year. In the second half, the RBI still expects growth to recover to 7% YoY, up from 6% growth in the first half and down only 40bps from earlier estimate. And partly due to this, the MPC has not changed its stance – it has maintained its ‘neutral’ stance. Effectively the MPC is saying that we believe the 5.4% growth in 2Q was a blip. Growth will recover in the second half and thus, there is no imminent rate cut on the anvil. That said, it is worth pointing out that the MPC’s stance was not unanimous. We had 2 dissensions, but both were from the external members of the MPC. So perhaps just 1 more MPC member needs to be a bit more worried about growth and we could still get a rate cut at the next meeting.

It all boils down then to the growth data in the next couple of months. And we have received the first set of data for November. As expected, Automobile sales (retail) were soft due to the shift in the timing of the festival season this year. But adjusted for this the data is encouraging. So retail sales of Cars and SUVs have grown by 11% YoY in the last 2 months, which is much better than the 2% decline during the September quarter. Similarly, 2W sales have seen a recovery growing 24% over the past 2 months as against a modest 5% growth during the September quarter. Even tractor sales have been strong in the last 2 months growing 15% YoY as against a 7% decline during the September quarter.

Power generation growth has similarly picked (albeit modestly) up in the last two months compared to the preceding quarter. Power generation has grown by ~3% YoY during Oct-Nov, slightly higher than the 1.4% growth during the September quarter. That said Cargo traffic at major ports continues to remain weak. November was the second consecutive month of decline in Cargo throughput at the major ports. This is the first decline since June last year. Most of the decline is due to lower throughput of Coal and Iron Ore. That said, container traffic has also been weak growing by just over 1% over the past 2 months.

So, there is some merit in the MPC’s expectation that the 5.4% growth during the September quarter was an aberration and a recovery is likely during the current quarter. We will know about the magnitude and the durability of the recovery as more data flows in over the next few weeks.

Lastly, housing. While the focus remains on equity markets, the housing market is also going through a strong phase. Property prices have been rising but the property price indices we have do not capture this efficiently. But one indicator that does capture this is the RBI’s Inflation expectations survey conducted in the major cities. The optimism surrounding housing is currently the highest in over a decade. Almost 2/3rds of the respondents expect housing prices to rise faster than they have done in the recent past. Just 2% of the respondents expect housing prices to decline – this is once again the lowest number in the last 10 years.

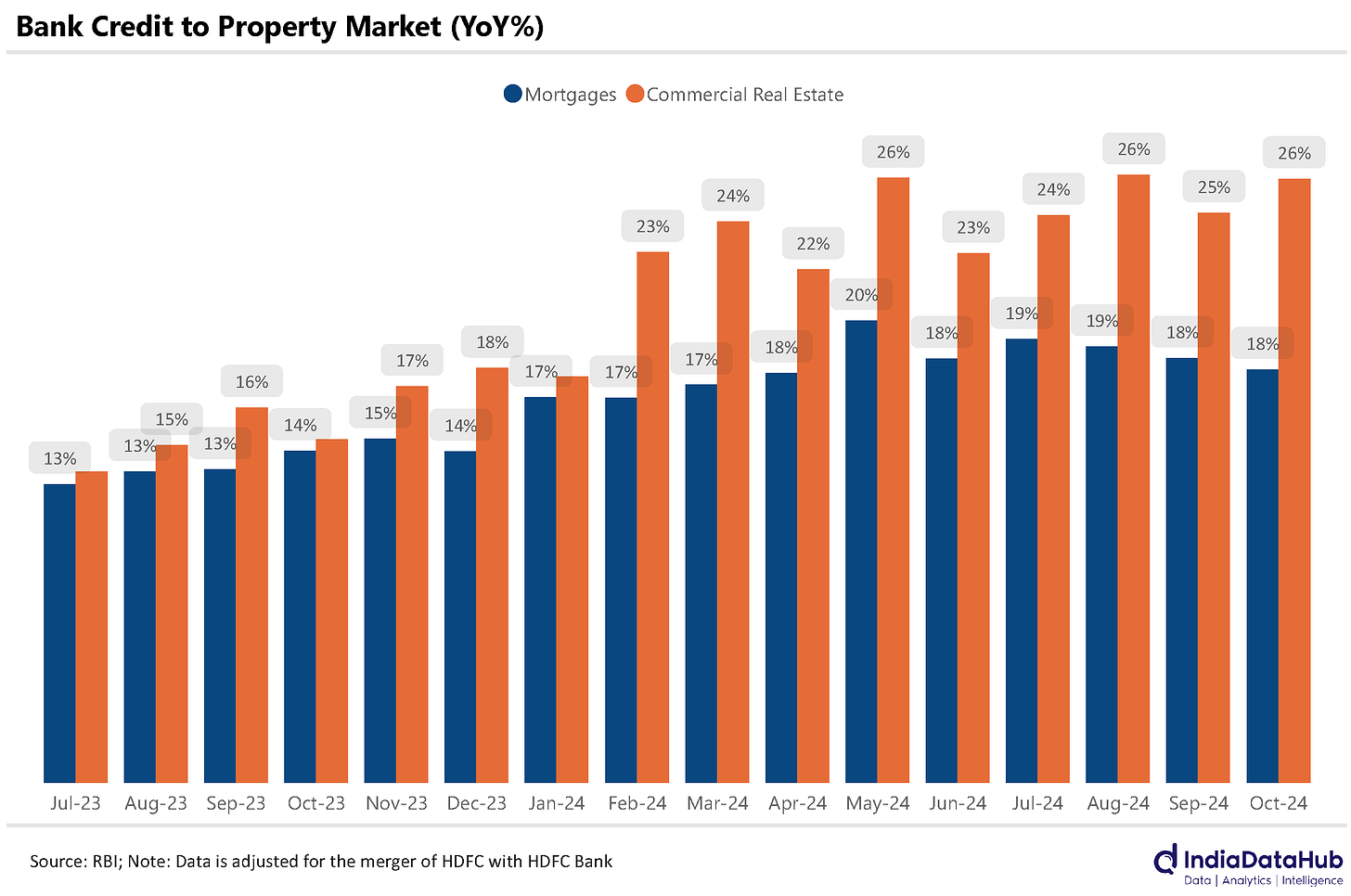

It is not surprising then that housing loans have seen a sharp uptick in growth over the past year. In July last year, housing loans from the commercial banks (adjusted for the merger of HDFC with HDFC Bank) were growing at 13% YoY whereas as of October this year, they have grown by 18% YoY. Loans to Commercial real estate have seen a doubling of the growth rate from 13% to 26% YoY during this period.

That’s it for this week. In case you have not been following the World Chess Championship (an Indian is playing, so you better be following 😊), the scores are tied at 5 a piece after 10 games. Four more games before we get to the tiebreaks in case the scores remain tied. Games start 2.30pm India time.