Monetary Policy, Interest Rates, Equity Inflows and more...

This Week In Data #120

In case you missed, we are significantly expanding significantly expanding our coverage of global trade data. We begin with the country that is at the center of this - the United States. We now track detailed monthly (and annual) trade data (goods trade to begin with), across countries and categories for the USA. 30 countries and 60 categories to be precise. This is long term time series data with over 2 decades of history. Read more and see a quick overview of the data structure from hereIn this edition of This Week In Data, we discuss:

RBI cuts policy interest rates by 25bps with a shift in stance

More rate cuts will probably follow given the rising growth headwinds

Auto sales recover in March after a dismal February

Trade volumes rise sharply in March in anticipation of tariffs

Inflows into equity funds moderate sharply and for hybrid funds turn negative

SIP Closure rate remains above 100% for third consecutive month

We start with the monetary policy. As was widely expected the RBI’s Monetary Policy Committee (MPC) decided to cut the policy repo rate by 25bps. The repo rate now stands at 6%. The other policy rates such as the MSF rate and the SDF rate accordingly stand adjusted downwards by 25bps.

What has also changed is the stance of monetary policy which was ‘neutral’ going into the policy. The policy stance is now accommodative. This means that the MPC will either cut rates in the next policy meeting or keep them unchanged. The possibility of a rate hike is now off the table. And in sync with this, the short-term interest rates are now below the policy rate. The yield on the 3mth GSec closed at 5.9% yesterday, 10bps below the repo rate. A week ago it was 10bps higher and in the last two weeks it has fallen by over 50bps. Markets are thus expecting another rate cut in June. Long bond yields have not fallen in sync implying markets see this fall in interest rates as being cyclical rather than structural.

What has driven this change in the policy stance is the change in the growth-inflation dynamic. RBI now expects GDP growth in FY26 to be 6.5%, down 20bps from its projection in February. Similarly, it expects inflation in FY26 to be 20bps lower now at 4% from 4.2% in the February policy. So lower growth and lower inflation driving a rate cut makes perfect logical sense.

There is of course global uncertainty due to the tariff situation. But if anything, this will be negative for growth and unlikely to be significantly negative for inflation (given the way oil prices have behaved). So this external risk, which is as yet unquantifiable, also warrants a rate cut(s) to support the economy. So the monetary policy actions and stance align perfectly well given the current macro backdrop.

In the near term, the domestic growth data has however been encouraging. In March, all Auto segments saw a sequential improvement in growth after a weak February. Buses and passenger vehicles saw a sharp 25% YoY growth, up from February's 1% growth. Cars & SUVs saw 5% growth in March after an 8% decline in February.

Trucks and other Goods carriers also saw a 2% growth in March after an 8% decline in February. Sales of Construction vehicles improved 10ppt sequentially but still declined 1% in March. Two Wheelers saw the weakest recovery in March with sales still declining 2% YoY in March as against a 6% decline in February.

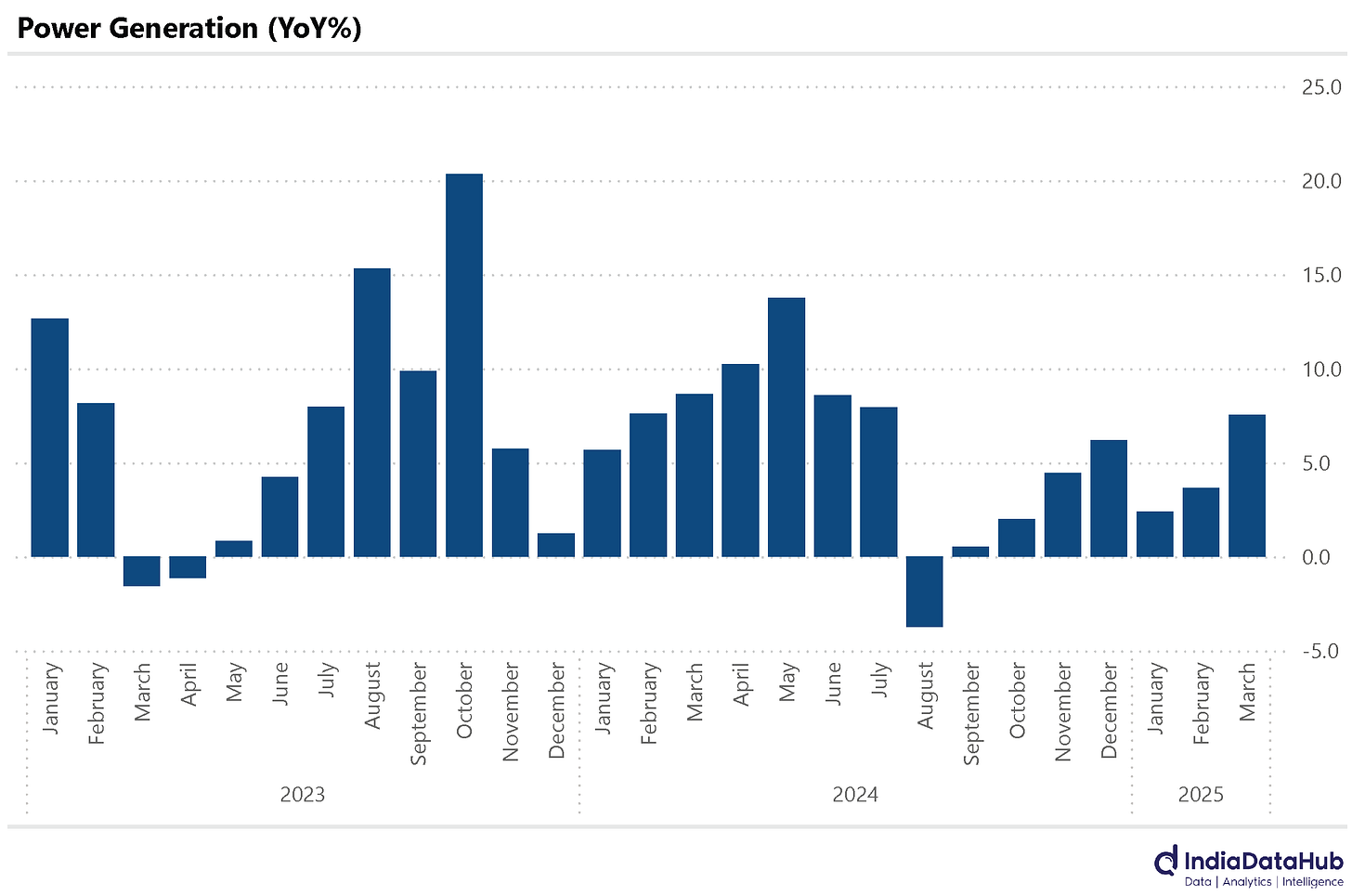

Power generation and consumption rose sharply in March. Power generation rose 7.5% YoY in March as per provisional data. This is the highest growth since July last year. This was driven by a 6.6% increase in power demand. The central and eastern states were key drivers of growth in demand. States like Madhya Pradesh, Chhattisgarh, Bihar, and West Bengal for example saw double-digit growth in power demand in March.

A large part of this is due to the higher temperatures. March was the third consecutive month that the pan-India average maximum temperature was above the long-term (30-year) average. In contrast, last year the temperatures were below the long-term average.

As we have discussed before there is a bit of front-loading of trade in anticipation of the tariffs in April. In sync with that, the cargo throughput at the major ports grew 13% YoY in March, the highest growth since November 2023. February had also seen a 7% growth in cargo throughput, the second-highest growth since November 2023.

The volatility in equity markets meant that net inflows into the domestic equity mutual funds moderated further to an 11-month low of ₹250bn in March. This is the 49th consecutive month of net inflows in the equity category. Hybrid funds, after seeing inflows for every single month since April 2023, saw outflows in March.

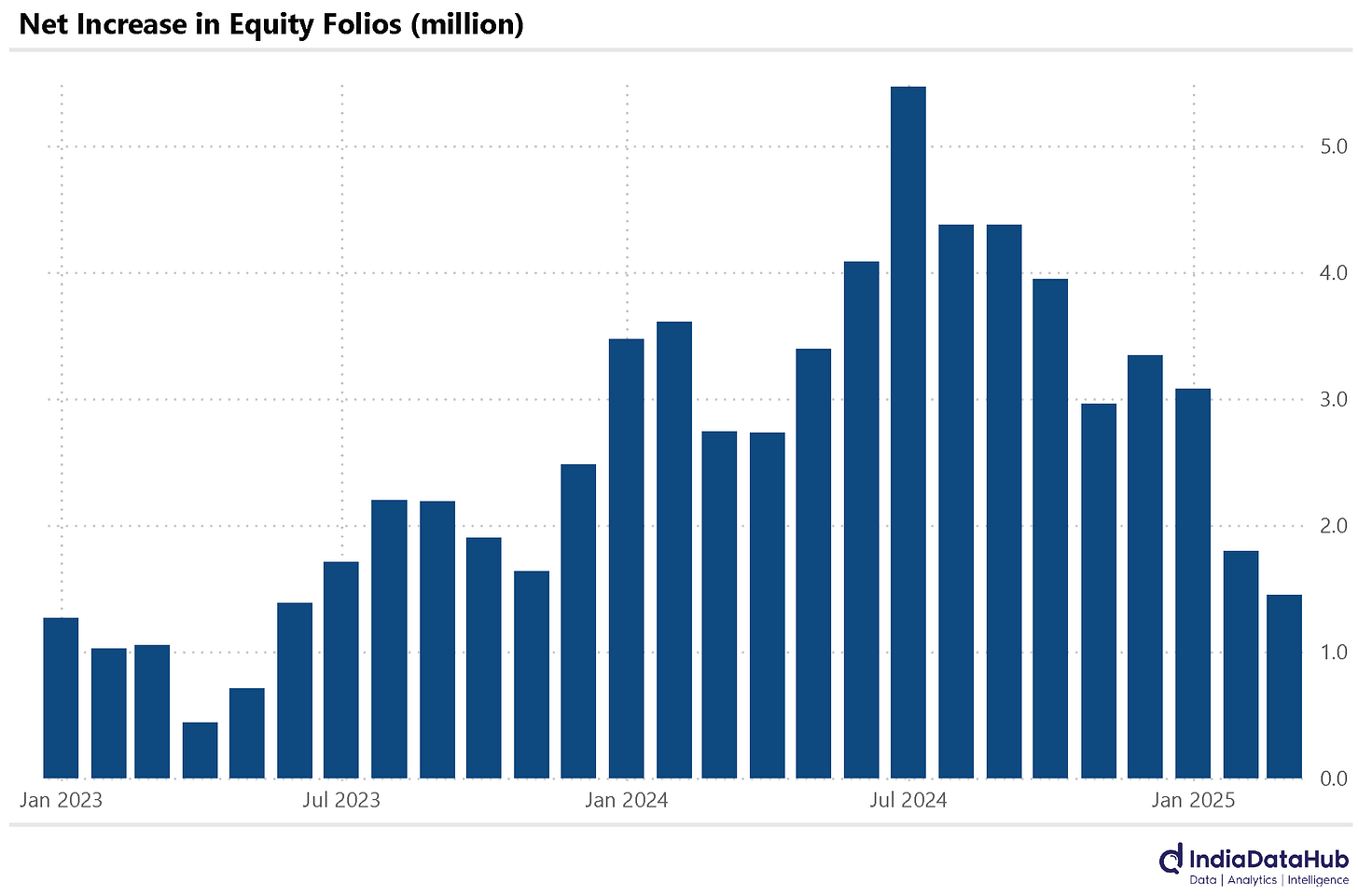

The growth in the number of equity folios also continues to moderate. March saw 1.4 million new folios being added in the equity category. This is the lowest number since June 2023. For reference at the peak in July 2023, 5.5 million folios were added in the equity category.

While the gross inflows under the SIPs continue to remain strong, the SIP closure rate continues to rise. March was the third consecutive month when the number of SIPs closed or discontinued was higher than the number of new SIPs being created.

On a net basis, the last three months have seen almost 3 million SIP accounts being discontinued. While domestic flows remain strong, the underlying momentum is moderating.

That’s it for this week.