In this edition of This Week In Data, we discuss:

RBI cuts interest rates after pausing the previous two occasions. What has changed?

How much more can interest rates fall?

Monetary transmission has broadly kept pace with policy rate changes

GST collections decline in November as the GST rate rejig takes its toll

Oil prices are down 10% YoY even in INR terms

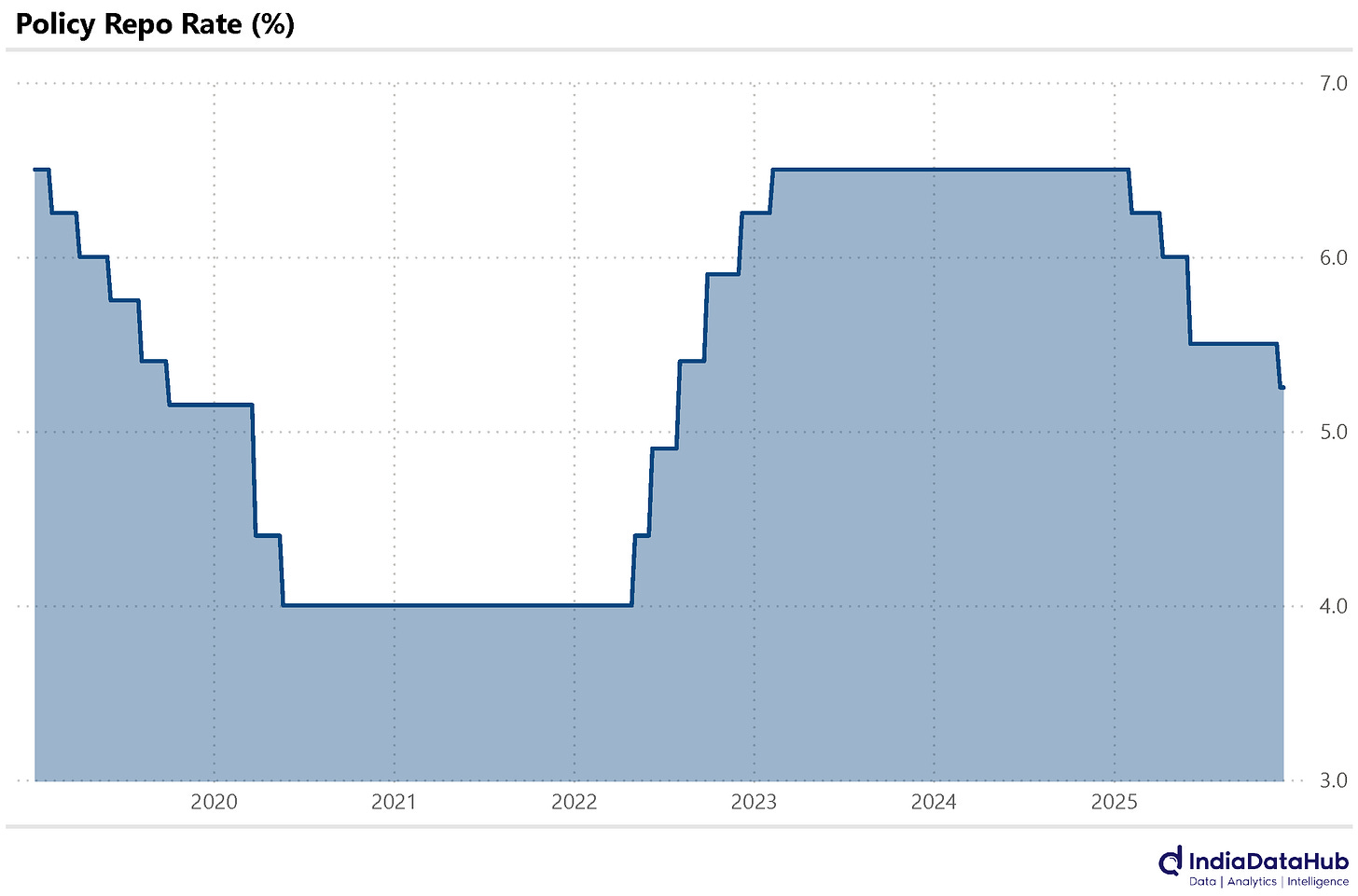

So as was expected, though by no means an overwhelming consensus, the RBI’s Monetary Policy Committee did cut the policy repo rate by 25bps last week. This comes after a pause in August and October policy reviews, which had come after a 50bps rate cut in June. The repo rate now stands at 5.25%. The RBI also announced liquidity measures, which should result in more effective transmission of the lower policy rate through to the money markets and into the economy.

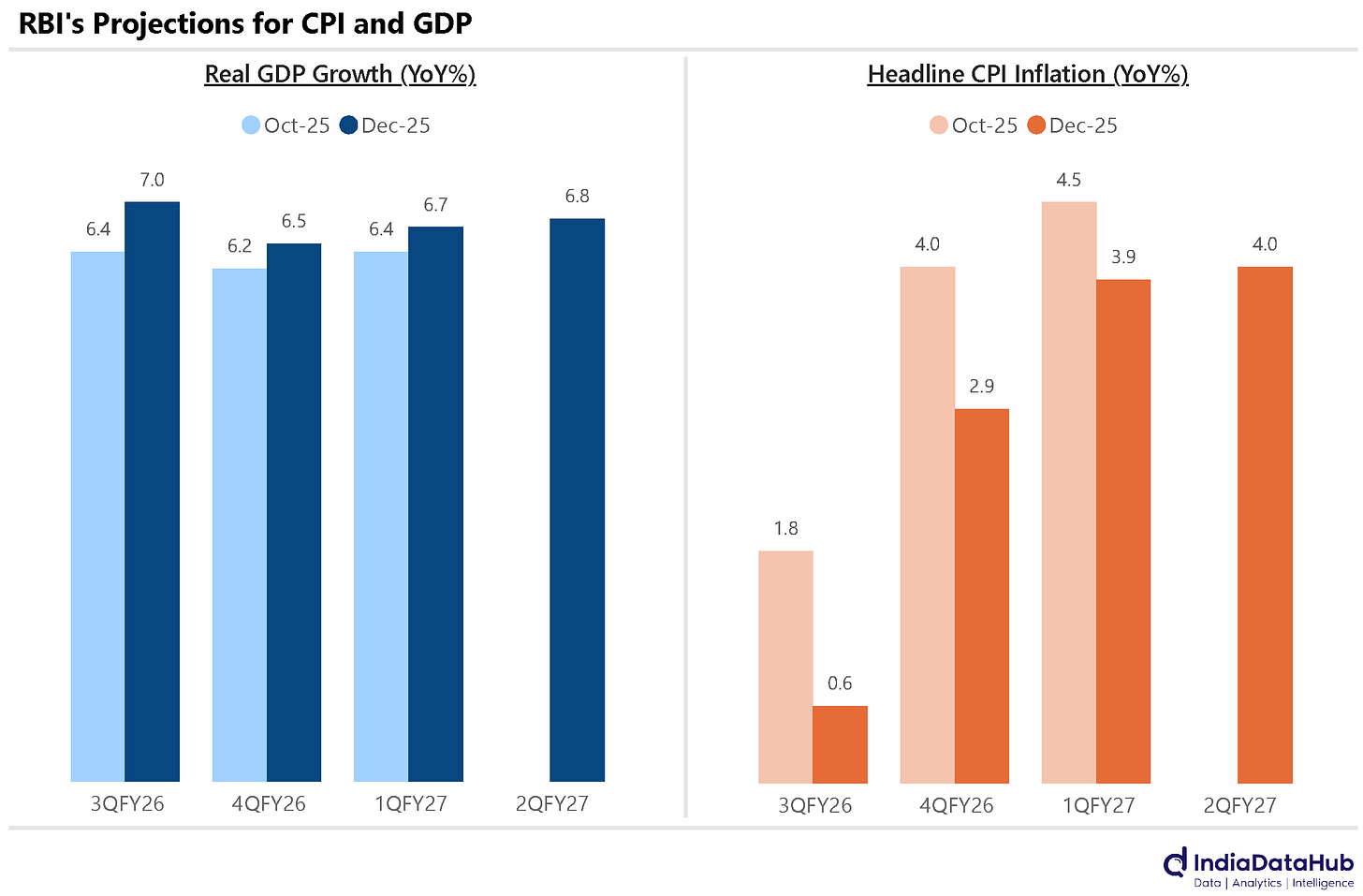

What has driven the rate cut is lower inflation. Inflation has continued to surprise on the downside, leading the RBI to reduce its inflation forecast pretty much across the board. For instance, the RBI has reduced its inflation forecast for the June quarter next year from 4.5% in the October policy to 3.9% in this policy. So lower inflation for longer. And at the same time, growth remains reasonably strong. While the RBI does not expect 8% growth in 2Q to sustain, it has increased the growth forecast for say the June quarter next year from 6.4% in the October policy to 6.7% currently.

The natural question to ask is whether rates can go down further. And for that, we need a bit of context. And that is that by historical standards, interest rates are fairly low currently. Outside of the COVID-19 pandemic, the policy rate was last this low in late 2019 and early 2020. And before that, in 2010, when the economy was recovering from the Global Financial Crisis! And the last time we saw sub 5% interest rates was more than two decades ago. And in each of these occasions, economic growth was significantly slower either due to global factors or domestic cyclical factors. While currently there is no such risk to growth. So there is probably not much room for interest to go much lower than the current level. Maybe another 25bps or so. Unless GDP growth sees a material slowdown. It is hard to argue that interest rates should fall significantly from these levels if growth remains resilient around 6-7% as is currently expected.

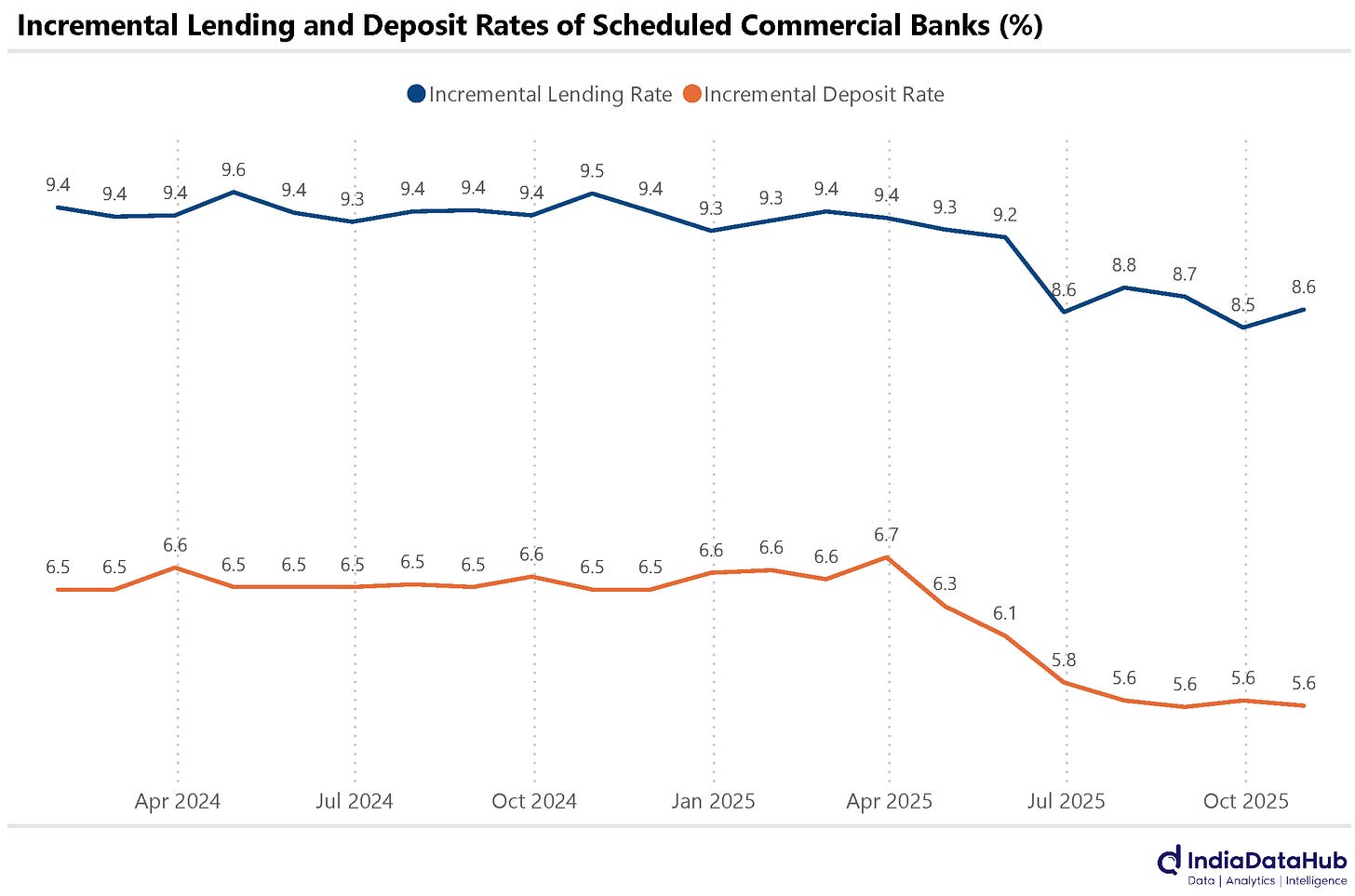

Actual lending rates have already fallen a fair bit over the past 12 months. The average interest rate on fresh loans given by banks has fallen by ~90bps over the past year from 9.5% to 8.6% currently. This compares to the policy repo rate having fallen by 125bps during this period (of which 25bps happened just last week). So there is possibly another 25-50bps for lending rates to fall further and keep up with the delta in policy rates, but that’s about it.

Interest rates on fixed deposits have also fallen by approximately the same amount. In October, banks paid 5.6% on average on fresh term deposits, down 90bps on a YoY basis. So, like lending rates, deposit rates have another 25-50bps to fall to keep up with the change in policy rates. What this underscores, though, is that monetary transmission, long a bugbear of monetary policy, has been fairly strong in this easing cycle. A number of factors, such as liquidity management from the RBI, a slightly mature debt market and a larger proportion of personal loans being linked to an external market-linked benchmark, have contributed to this.

GST collections declined in November (capturing business activity in October), the first full month for which we have data after the GST cuts came into effect in September. Aggregate GST collections declined 4.4% YoY in November, driven primarily by a 70% decline in GST Cess collections. SGST collections also declined 1% YoY, while CGST collections slowed down to a modest 2% growth. The pace of decline could potentially be slightly in December (business activity of November), as Diwali was entirely in October this year, while last year it was partially in November also. We shall see.

Lastly, one of the factors in India’s favour currently is Oil prices. In November, the Brent Crude Oil prices averaged US$63.6/bbl, down 15% YoY. Thus, even adjusted for the depreciation in the rupee, Crude oil prices are down ~10% in INR terms. And this will have a salutary impact on inflation. And this is also one of the factors keeping the current account balance in check, but for which the rupee would have been under even bigger pressure than it is.

That’s it for this week. See you next week…