Monetary Policy, Recovering credit growth, Uptick in Power Generation and more...

This Week In Data #141

In this edition of This Week In Data, we discuss:

RBI keeps interest rates unchanged and is getting more optimistic about the economy

Corporate tax collections continue to struggle

Credit growth is picking up, albeit modestly

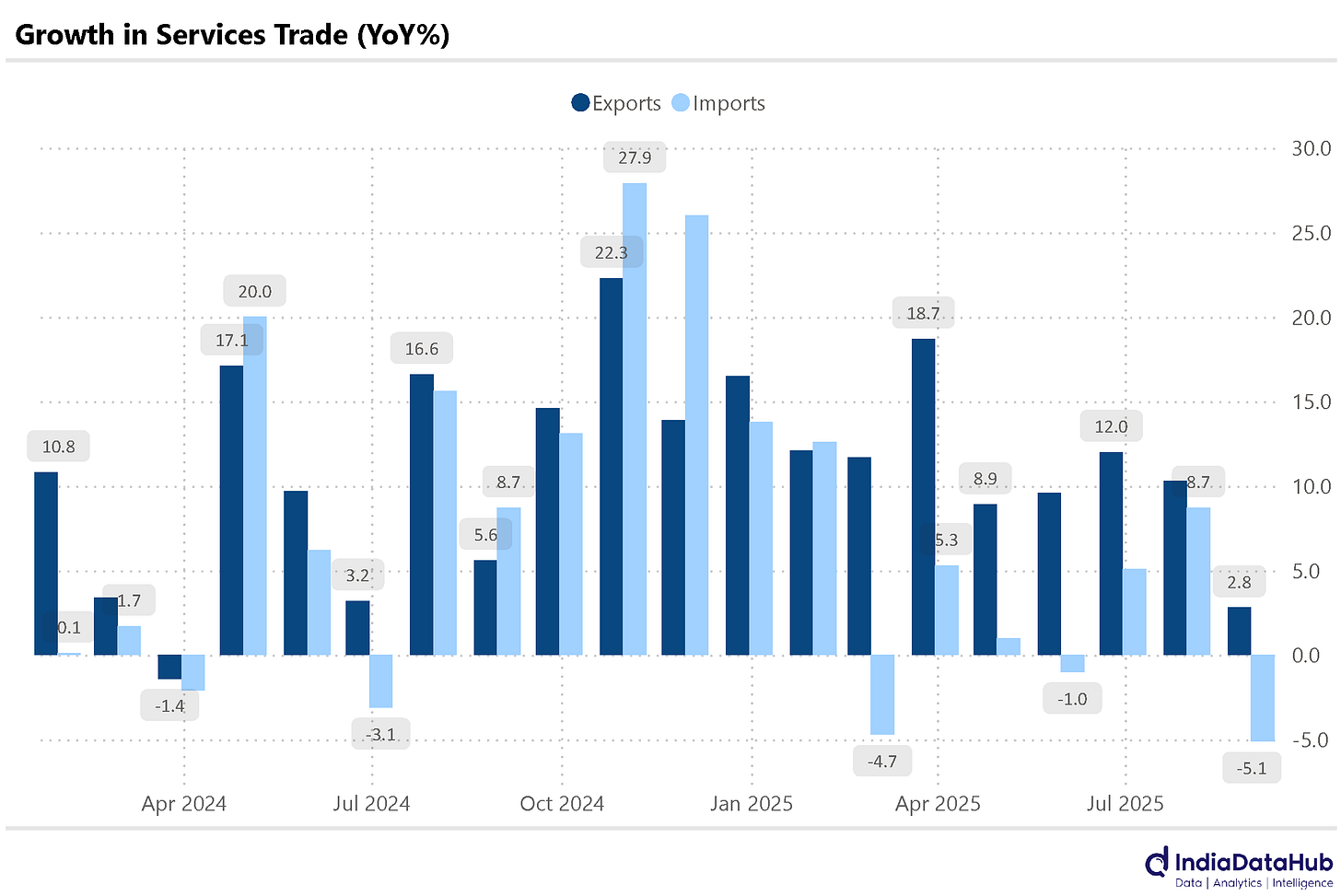

Services trade decelerated sharply in August but is otherwise having a strong year

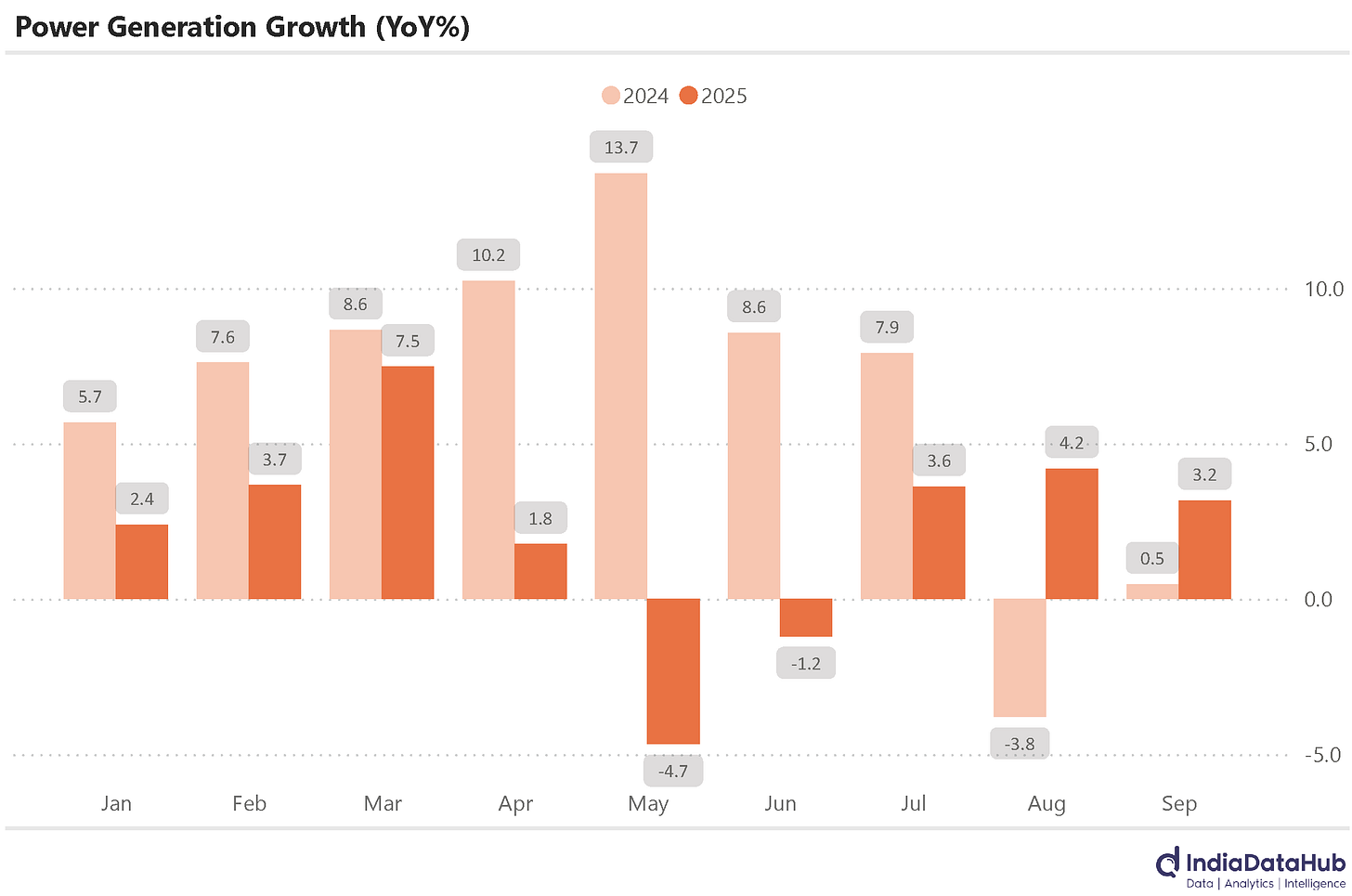

Power generation has improved in last two months but continues to struggle on YTD basis

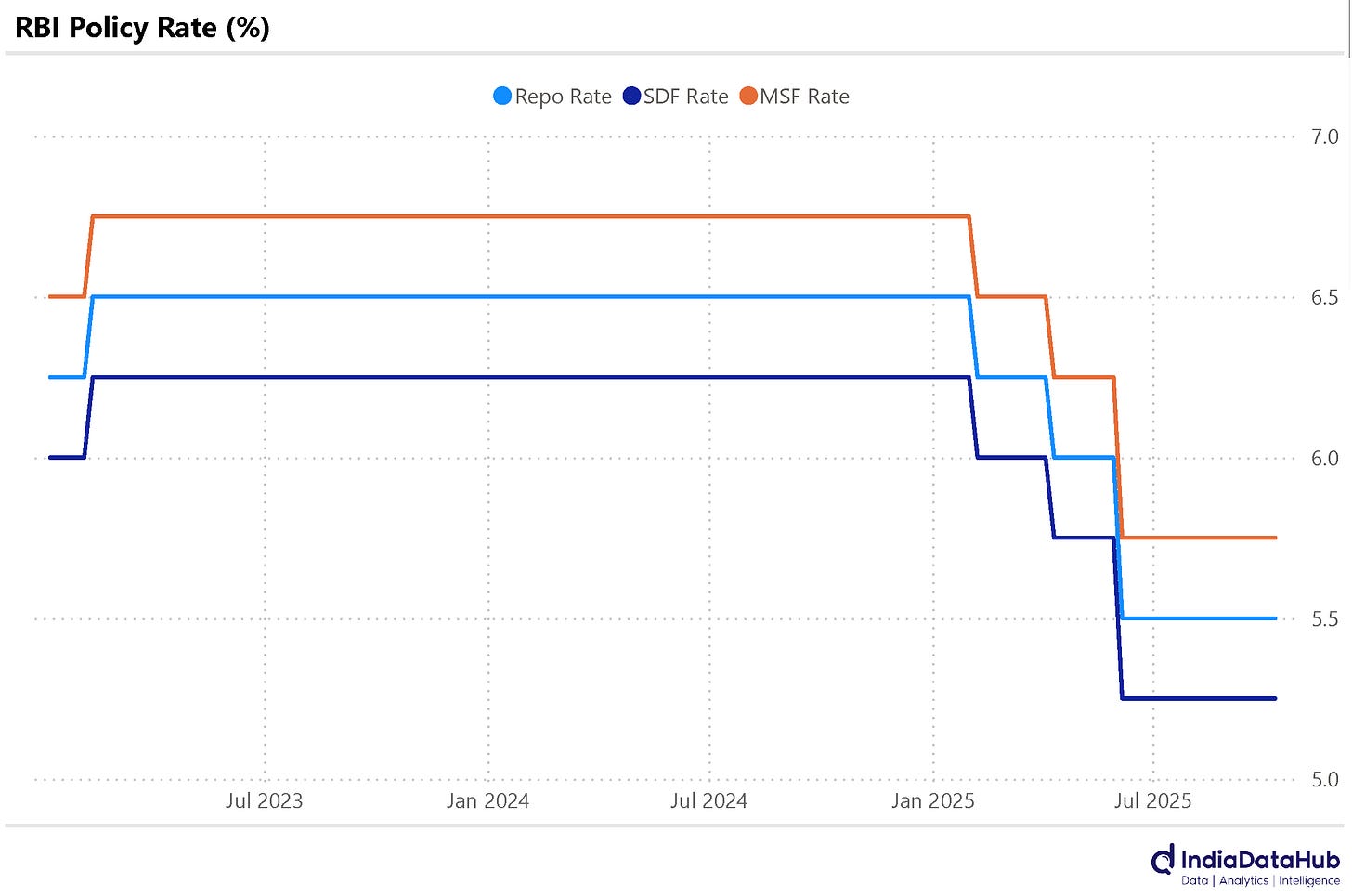

As expected, the RBI’s Monetary Policy Committee (MPC) kept the key policy rates unchanged. The repo rate remains at 5.5%, the SDF rate remains at 5.25% and the MSF rate at 5.75%. The policy rate has remained unchanged now for the second consecutive MPC meeting, with the last cut being in the June policy meeting. This was, however, as expected, so nothing noteworthy here.

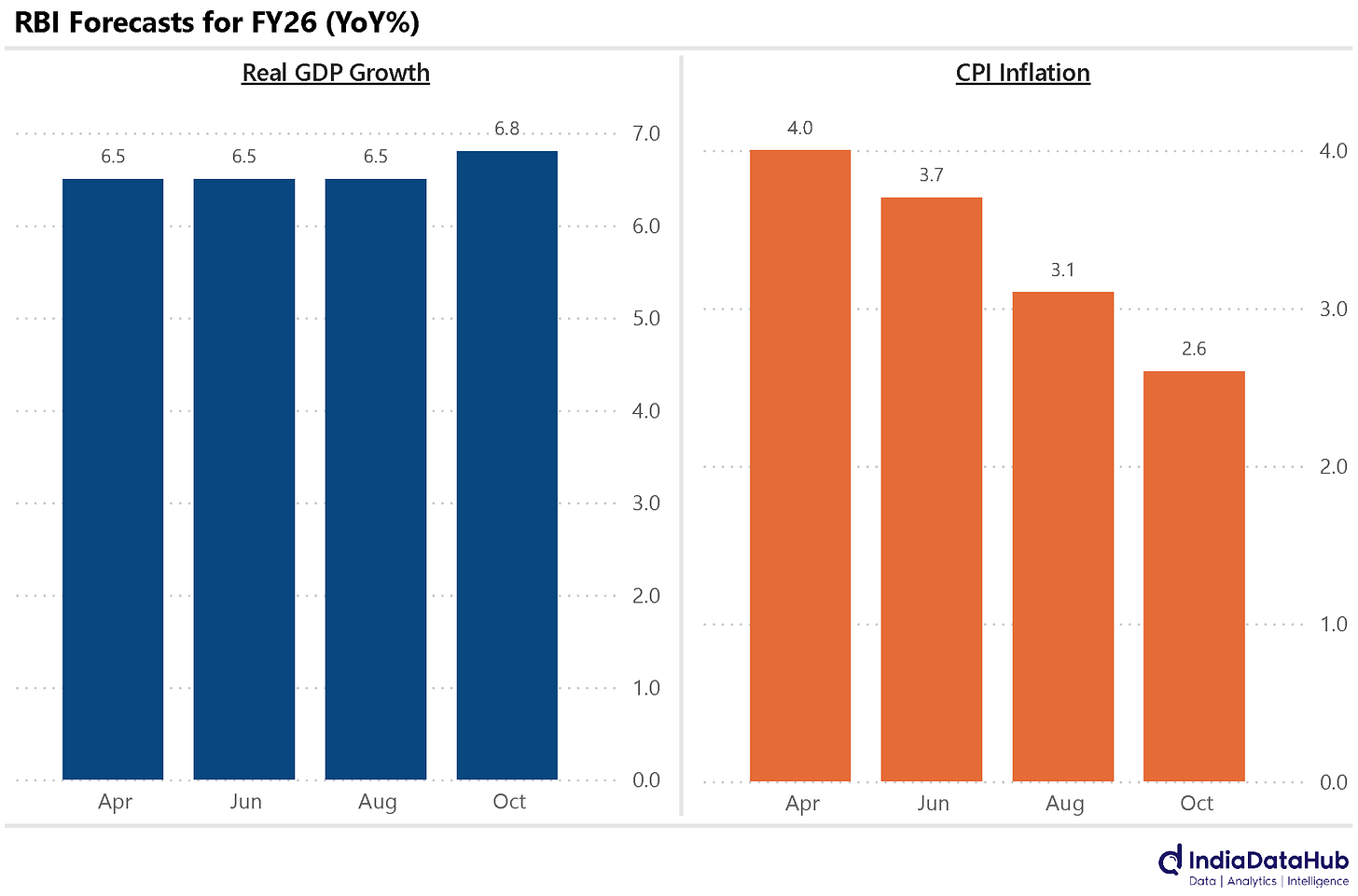

What matters, though, is what is likely to happen in the subsequent meetings. And the clue for that is that on one hand the RBI has revised lower its inflation expectation for the current year, noting that the near-term inflation outlook has “has turned even more benign in the last few months”. And, at the same time, the RBI has increased its GDP growth forecast for FY26 by 30bps to 6.8%.

So while the inflation outlook has become more enabling of a rate cut, the outlook on growth has improved and thus, does not warrant a rate cut. So, unless this dynamic changes – growth outlook deteriorates, or inflation outlook worsens – a status quo is the most likely to continue for the foreseeable future. Worth remembering is that the CRR cut announced in June was effective from September in 4 equal tranches till the end of November. So the impact of that CRR cut is flowing through to liquidity currently.

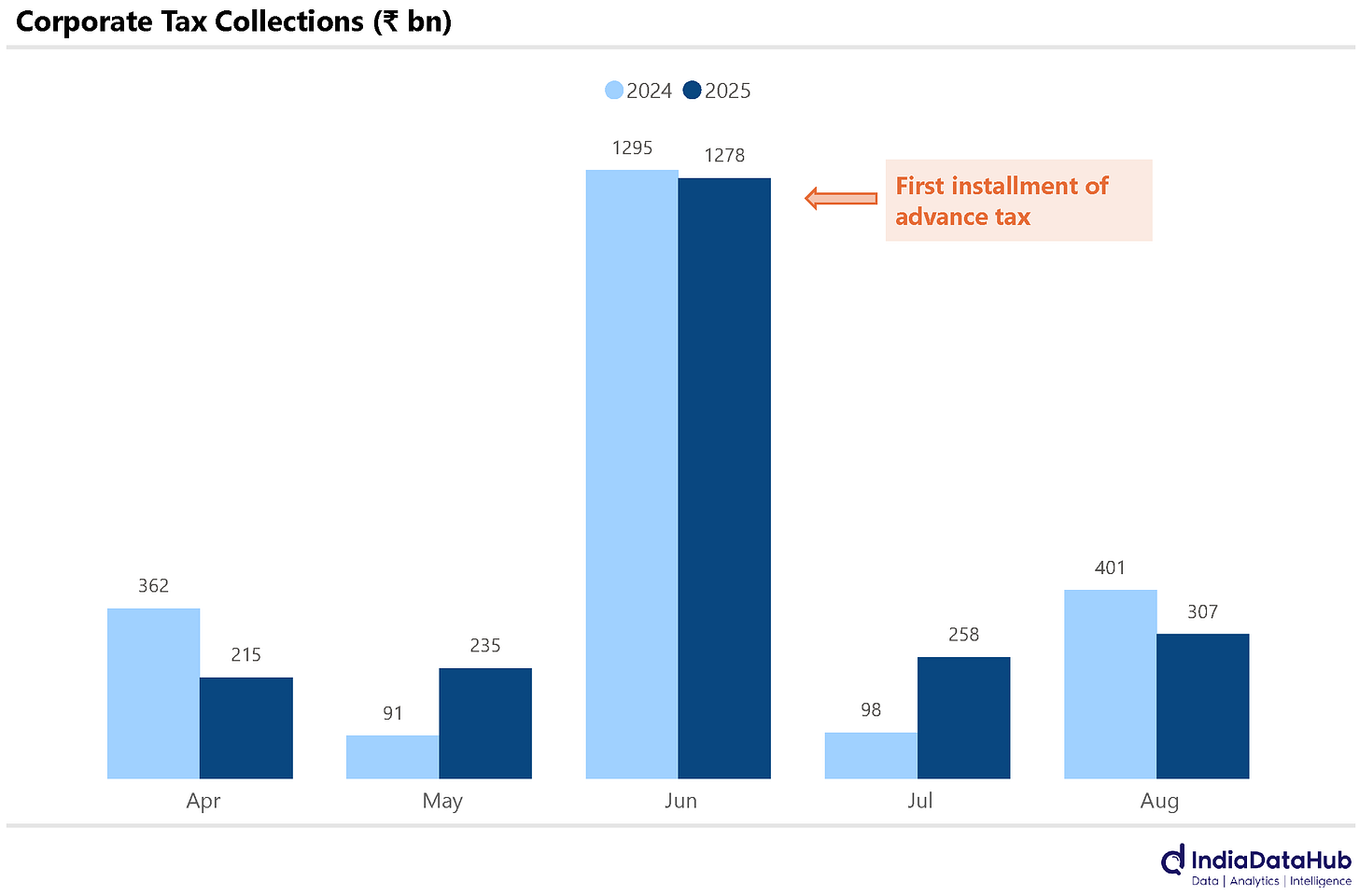

August was another weak month for corporate tax collections. They declined 25% YoY. Corporate tax collections have declined in 3 of the 5 months this year, and cumulatively in the first 5 months of FY26, corporate tax collections have grown by just 2% YoY. This, coupled with the decline in personal tax collections, has meant that till August, overall tax revenues have grown by less than 1% as against a budget estimate of ~10% growth.

The GST cut will come into effect from September. And so, it is very likely that tax revenues will miss budget estimates, and thus meeting the deficit target will warrant a cutback in expenditure in the second half of the year.

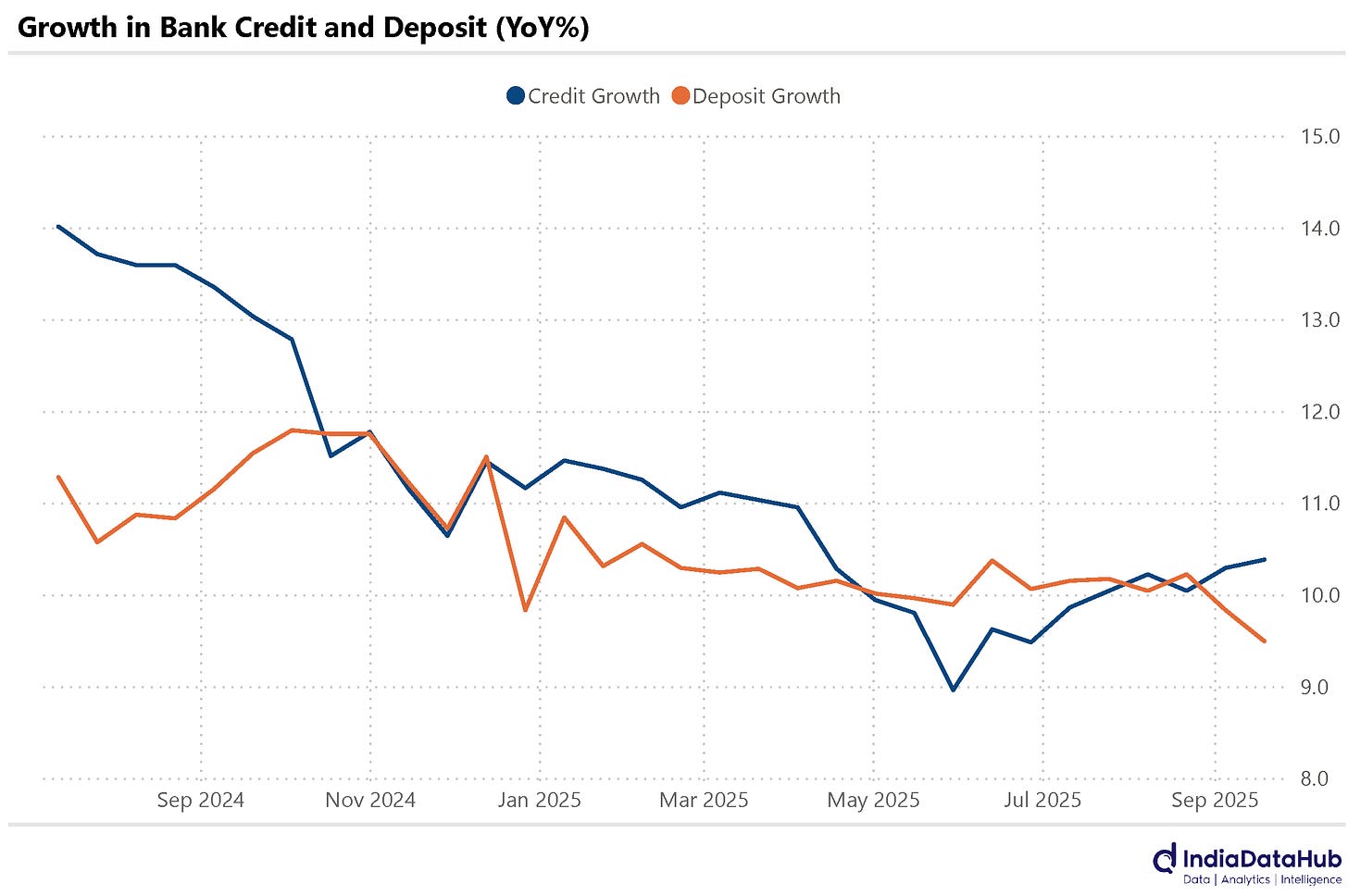

Bank credit growth has gradually ticked up in recent months. As of 19th September, bank credit grew at 10.4% YoY, the fastest growth since early April. The uptick is modest (~100bps) but comes even as deposit growth has moderated to 9.5% as of mid-September, the lowest in recent months. Thus, the loan-deposit ratio (LDR) has risen back above 80% and is close to the highest ever. There is thus fairly limited slack on bank balance-sheets to support outsized credit growth.

Services trade had a rough August. Exports rose just 3% YoY, the slowest growth since March last year, when exports had declined 1%. Services imports declined 5% YoY, the sharpest decline since November 2023. And a combination of slow but still growing exports and a decline in imports meant that the services trade surplus rose in double digits to US$16bn.

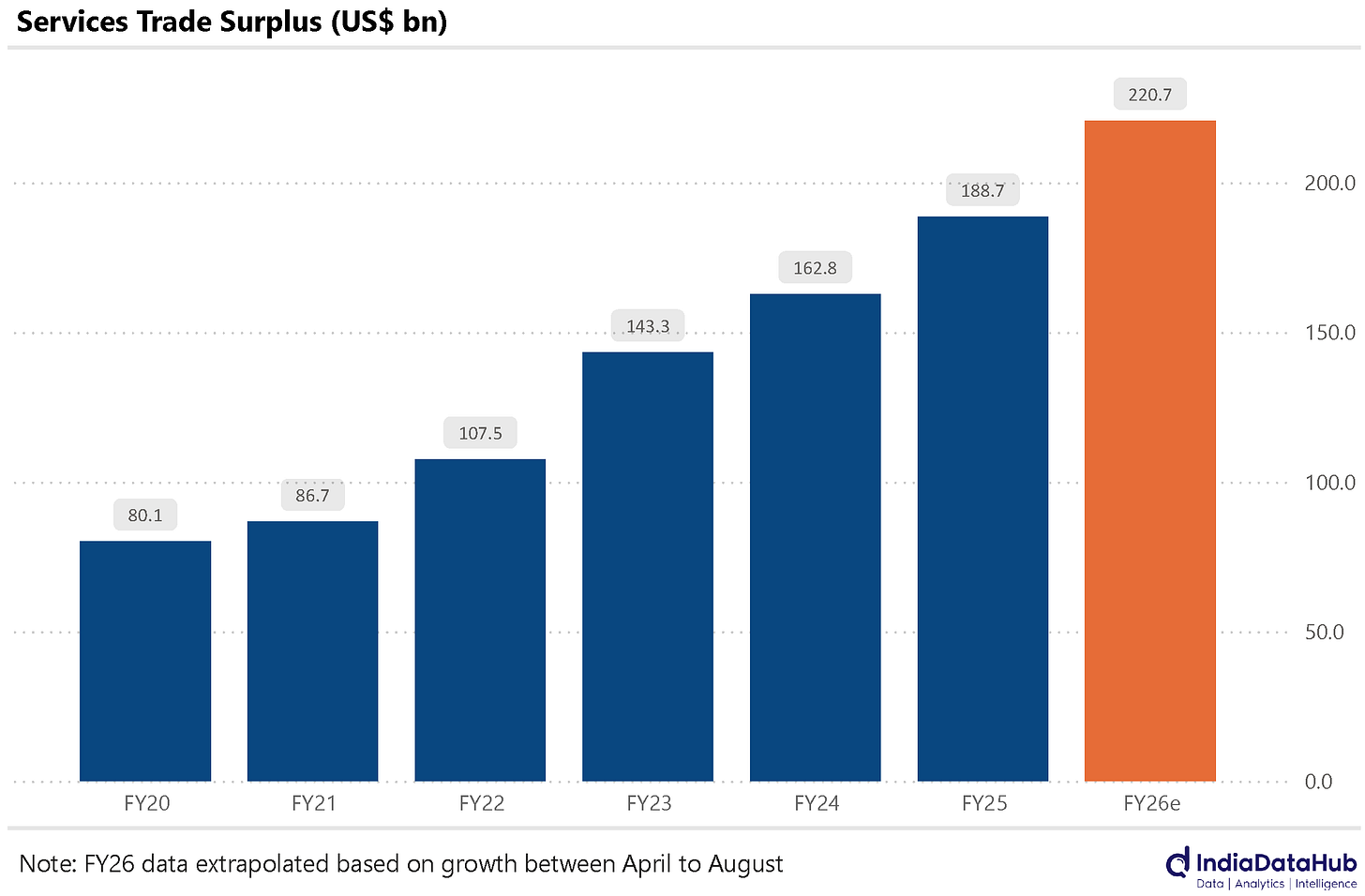

The first 5 months of this year have seen services exports rise 9% YoY while imports have risen by just 2%. And this has meant that the services trade balance (surplus) has risen by 17% YoY to US$80bn. For the full year, this will translate to ~US$220bn, which is more than 5% of the GDP!

Lastly, power generation continues to remain soft. As per the provisional data, Power generation grew a modest 3% YoY in September, broadly the same pace as the previous couple of months. The first six months of this year have seen power generation grow by a modest 1% YoY, as against 6% in the same period last year, with power generation growth being lower than last year in every single month, barring the last two. Going just by power generation, economic growth has seen a sharp slowdown so far this year, but things seem to be picking up in the last two months.

That’s it for this week. See you next week. 2Q earnings season kicks off from this week, and so This Week In Earnings will return from next week onwards.

No TWID this week? Hope all good at your side Ashutosh?