Monetary policy review, Mixed core sector data, Disconcerting NREGA data, Global GDP growth

This Week In Data #21

In this edition of This Week In Data we discuss:

Outlook for interest rates

Mixed core sector data

Recovery in Automobile sales

Uptick in NREGA work demand

Global 1Q GDP round up

We cannot but start with a review of the monetary policy. As expected, the monetary policy committee (MPC) kept the policy rate unchanged. It also kept its growth and inflation estimate for FY24 largely unchanged (CPI estimate ticked down by 10bps). Even the consensus GDP estimate for FY24 has remained unchanged over the past 2 months while the inflation estimate has seen a modest downward revision. Worth noting is that RBI’s FY24 GDP growth estimate is 50bps above the market consensus. To some expect this is because the consensus estimate is before the March quarter data release on 31st May. However, even after assuming some upward revision, it will still be the case that RBI is more optimistic about FY24 growth than the market.

Thus, incrementally, it is growth rather than inflation that will be the key for the MPC now. If incoming growth data remains healthy and by implication, this will mean an unchanged FY24 GDP growth projection, then the MPC will remain on an extended pause. If growth data starts to falter, then things will get tricky for the MPC, and it will then have to make a trade-off between the upside risks to inflation and the growth sacrifice they are willing to make. Either way, it appears that the path for interest rates is down after a pause – the length of the pause being the key unknown.

And the incoming growth data has been a bit mixed. After two consecutive months of decline, power generation grew in May. But the growth was less than 1%, so only a modest uptick in trajectory. Railway freight growth however decelerated further to just under 2% YoY in May. This is only the second time freight growth was below 2% since the early months of the pandemic.

On the flip side, petroleum product consumption grew 9% in May, the fastest growth since November last year. Both petrol and diesel consumption grew by double digits. Automobile sales recovered in May. After a decline in April, 2W sales grew 9% and Car sales grew 4% after close to 0% growth in April. That said, the growth in both cases remains below the double-digit growth seen during the March quarter.

Earlier this week we wrote about the labour market. Data from the 1Q 2023 PLFS data suggested a further improvement in the labour market with the unemployment rate declining and the participation rate increasing. That data was however for Urban areas and pertained to the March quarter.

The closest rural proxy for May – demand for work under NREGA – has not been strong. The number of people demanding work under NREGA in May was 22% higher than during the pre-pandemic period. In April it was 16% higher. And during the March quarter, it was just 8% higher. This either suggests, the job market has incrementally turned soft during the current quarter or that Rural and Urban areas are having divergent trends. Either way, the data is a bit disconcerting.

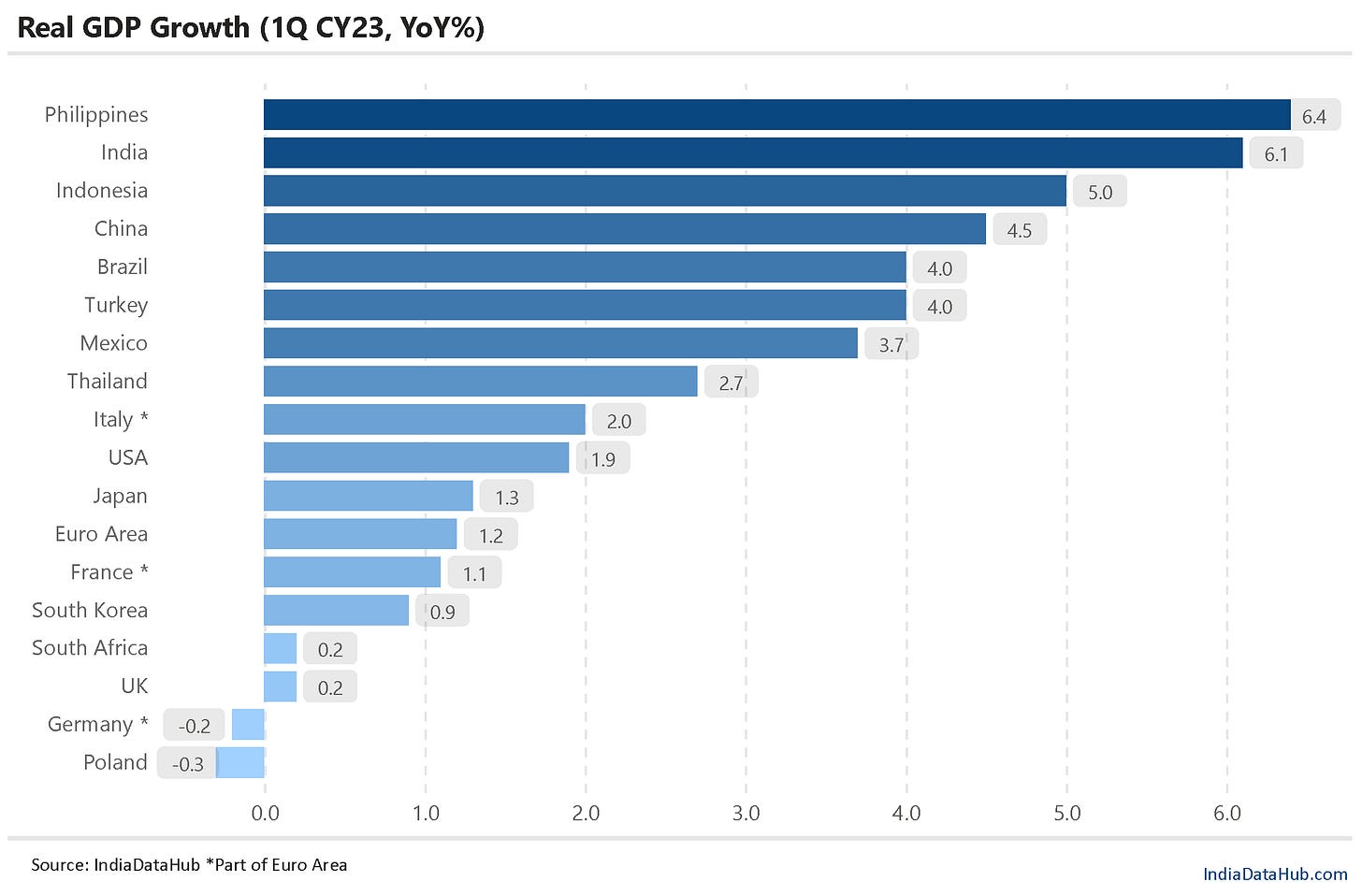

Globally among the more important data releases this week was the 1Q Euro area GDP data. Euro area GDP declined sequentially for the second consecutive quarter. In popular parlance, this translates into a technical recession (although recessions are marked by a wide range of variables and not just GDP). On a YoY basis though growth was reasonable (by developed country standards) at 1.2% YoY. UK for instance saw just a 0.2% YoY growth in 1Q. Among the larger economies, Germany along with Poland, saw a decline in GDP growth during 1Q. At 6.4% Philippines saw the strongest growth with India seeing the second fastest growth at 6%. China saw a relatively subdued growth of 4.5%.

That’s it for this week. The CPI awaits us next week. And we shall also start tracking the Monsoon which has finally reached the God's own country! The WTC is not looking good. But hopefully, we can show some spine in the second innings. Amen…