Much ado about GST collections, Services exports catching up with Goods and more...

This Week In Data #16

In this edition of This Week In Data, we discuss:

The overinterpretation of absolute GST numbers

Continued strong growth in Services exports

Declining power generation

Declining Auto sales

We now cover Global data on IndiaDataHub. We track key high frequency data such as GDP, Exports, Inflation, Unemployment, Industrial Production, House prices and many more for over a dozen large countries. Check the Global Indicators category in the search by category section on the site. And by next week, all of this data should be accessible in a comprehensive Global data dashboard. Yay!GST Collections rose to a record high of ₹1870bn in April this year. A lot and perhaps too much has been made of this number. GST collections in April pertain to business done in March. Now March generally tends to be the strongest month of the year in terms of activity and thus it is natural for tax GST collections to be the highest in April in any year. Furthermore, given that it is a nominal metric, it is quite logical also, that it will continue to hit a record high every April – unless there is a pandemic like Covid. Thus, April 2022 had seen record-high GST collections until that point in time. And while April 2021 and April 2020 were heavily impacted by Covid, April 2019 as well as April 2018 had seen record-high tax collections until that point in time.

And this is true of GDP as well. And hence we look at GDP growth. And thus, the more relevant metric is growth in GST collections which was 12% YoY in April. This is a healthy number, (ever so) slightly higher than the expected nominal GDP growth rate for the March quarter, but it is slower than the growth in the preceding few months. The slower growth rate itself is partly due to lower inflation and is thus not perturbing. Net net, GST collections were healthy in April because the growth rate was reasonable and not because in absolute terms the number was at an all-time high.

The above discussion reminded us of this comment by Warren Buffett in the 1977’s letter to the shareholders of Berkshire Hathaway:

“Most companies define “record” earnings as a new high in earnings per share. Since businesses customarily add from year to year to their equity base, we find nothing particularly noteworthy in a management performance combining, say, a 10% increase in equity capital and a 5% increase in earnings per share. After all, even a totally dormant savings account will produce steadily rising interest earnings each year because of compounding.”March was another strong month for services trade. Exports rose 13% YoY in USD terms while imports rose a modest 6% YoY. Consequently, the trade surplus rose over 20% YoY to US$14bn. What is more interesting is to note the secular growth in services exports relative to goods exports. While the focus and thrust of government policy remains on increasing goods and specifically manufacturing exports, it is services exports that are growing faster. In FY23, services exports totalled 72% of merchandise exports, the highest ever. Just a decade back, services exports were less than 50% of merchandise exports and at the turn of the last century, they were just over a quarter of merchandise exports. It is quite conceivable that over the next decade, services exports will overtake goods exports. India would be probably an outlier country if that were to happen. (are there any countries whose services exports are more than goods exports – a topic for a DataByte next week!)

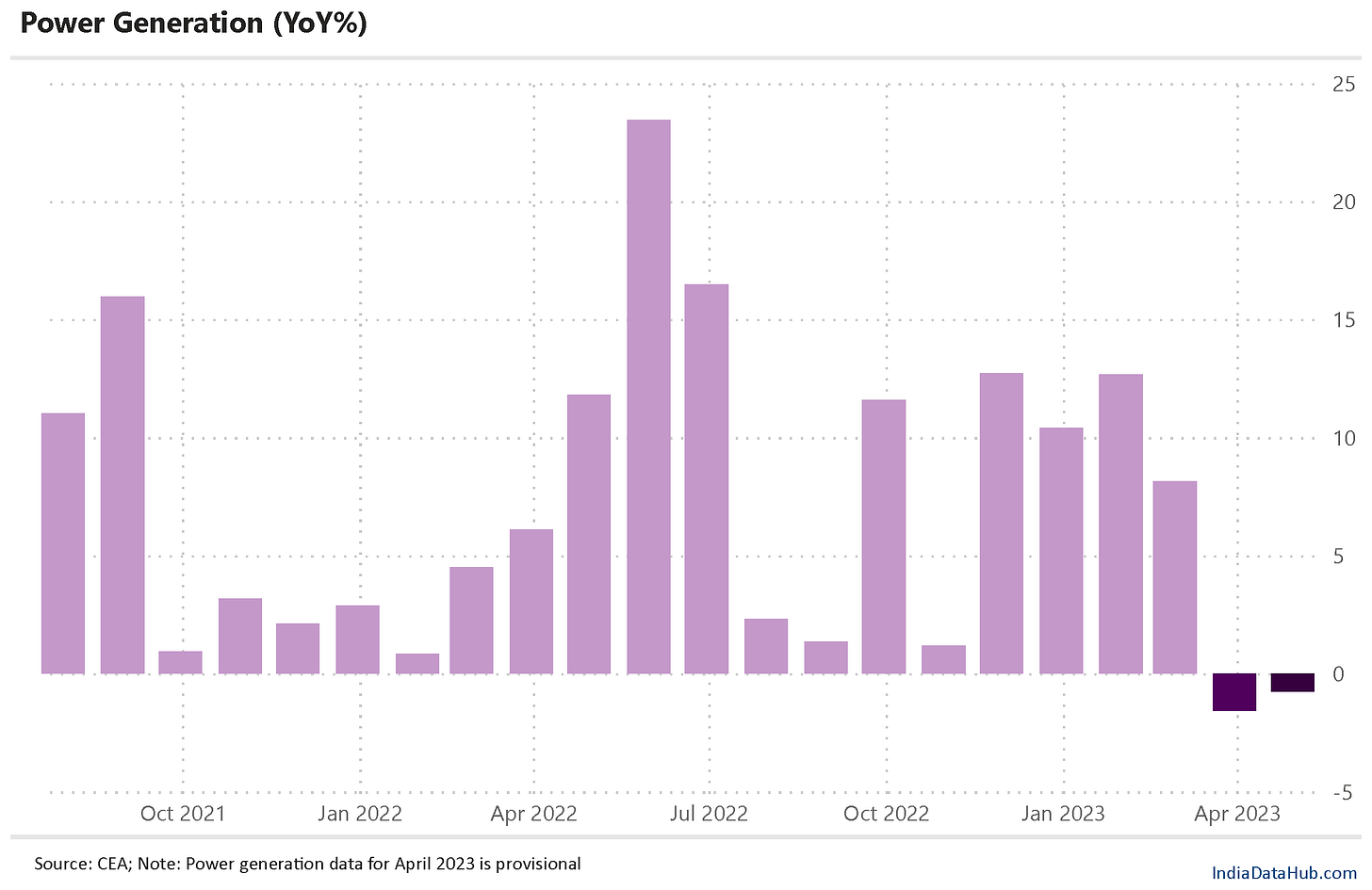

April was the second consecutive month of decline in power generation. In March power generation had declined ~2% YoY and in April, as per the preliminary data, power generation seems to have declined 1% YoY. A decline in power generation with other growth indicators being robust is slightly counter-intuitive. Supply and not Demand is the more likely explanation for why power generation is declining. Thus, in the last two months, hydro generation has declined almost 25% YoY whereas it had been growing in the preceding months. Thermal generation has been flat and looks like it has been unable to offset this decline in hydro. And the most likely reason for the thermal generation not being able to pick up the slack is Coal – as of early May, coal stocks at the thermal plants are just 54% of the normative levels and in 54 of the 180 coal plants, coal stocks is critically low (less than 25% of normative consumption). Given that this year is likely to be a record year in terms of summer heat, power generation will remain an issue till monsoons arrive.

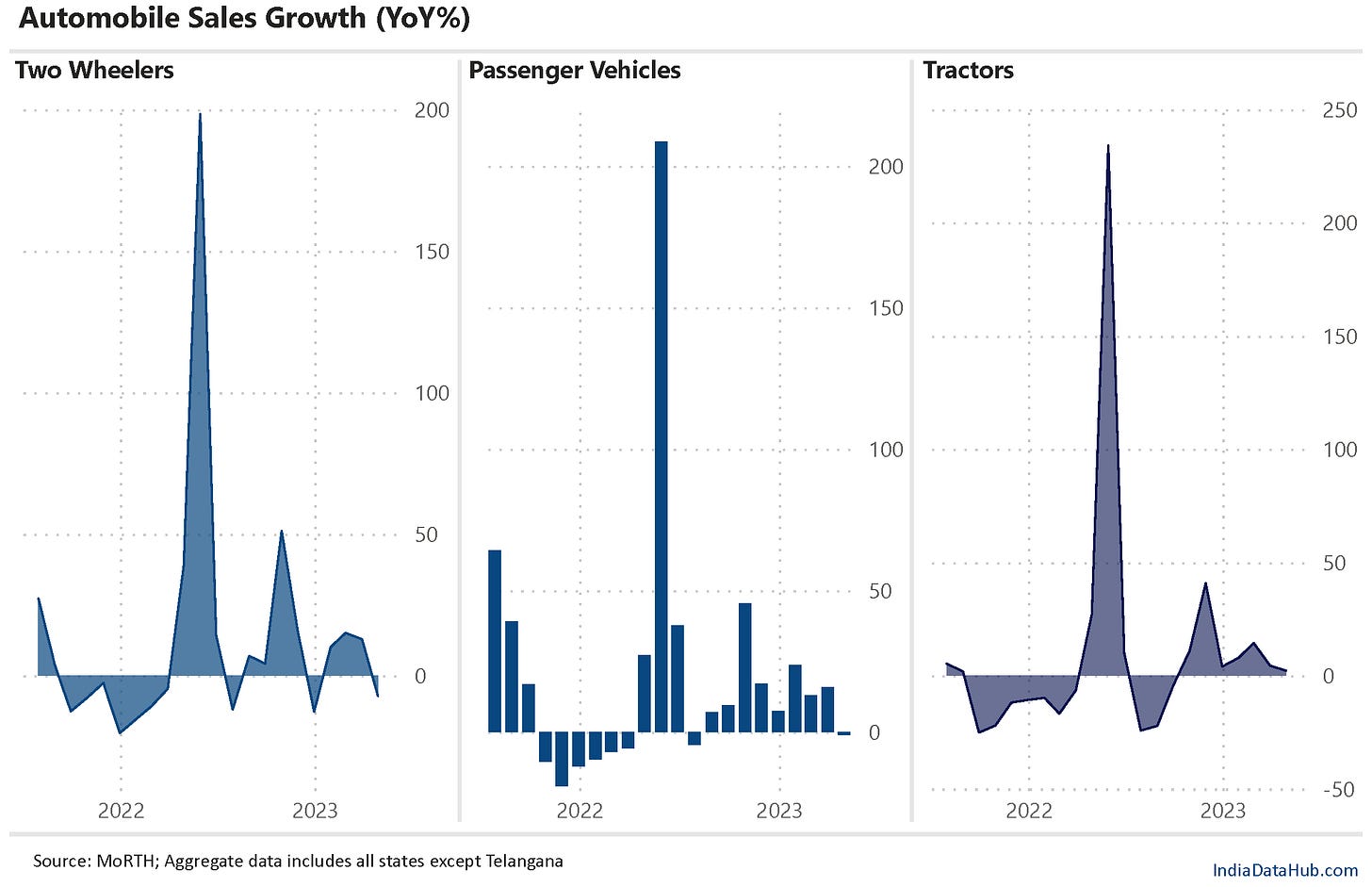

Lastly, some more negative news for the economy. April was a bad month for Automobile sales. Both Passenger Vehicle and Two-Wheeler sales declined on a YoY basis after having grown in double-digit terms in the last few months. Tractor sales growth also slowed down to just 2% YoY, the weakest growth since September last year. Media reports are attributing some of this decline to a preponement of demand in March due to a change in emission norms from April which was expected to result in higher prices. While that would imply the sales in April are understated, it would also imply that sales in March (and thus the double-digit growth) were overstated.

We will get more data for April next week, but the early read so far is not very encouraging. And we shall end this edition on this slightly sombre note. See you next week when hopefully we will have something more cheerful to write!