Welcome to this the first edition of This Week In Earnings newsletter. Our aim through this newsletter is to help you navigate the quarterly earnings season which sees over 4000 companies declare their results, every quarter, in a short-span of just 45 days (ok, 60 days for annual results).

We hope you find this useful. And do share your feedback on how we can make this newsletter better. With this preamble, lets dive right in.

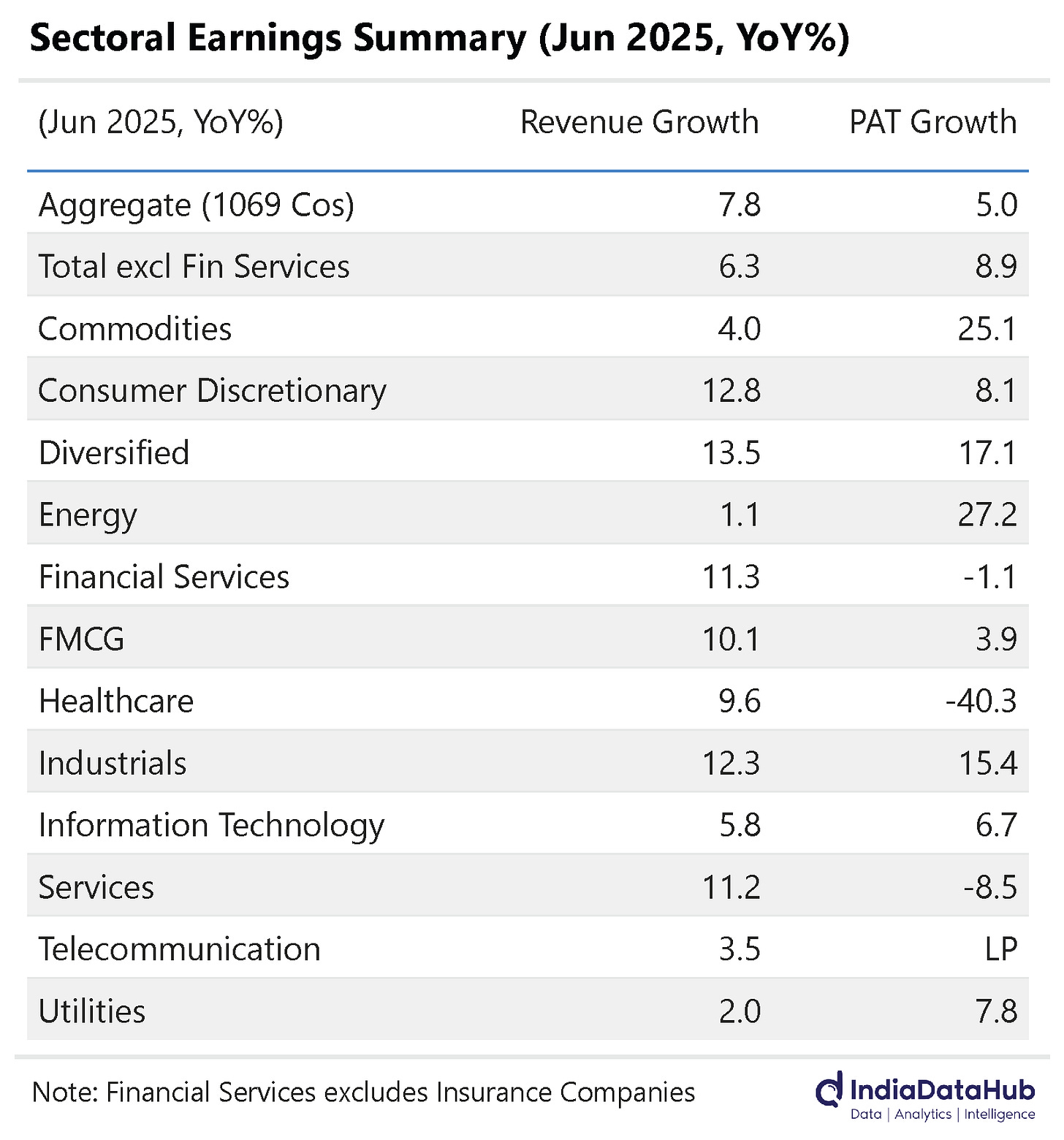

This newsletter is structured in two sections. The first section covers the trends in aggregate, across sectors. And the second section reviews the key company results declared during the week.As of August 2, 1,069 companies have declared their 1Q FY26 results. The season is now past its halfway mark, offering clearer signals across sectors. Aggregate revenue is up 7.8% YoY, broadly the same pace as in the last few quarters. However, there is divergence across sectors. Most domestic sectors – Consumer Discretionary, FMCG, Industrials, Services – are seeing double digit revenue growth. But aggregate profit growth has slowed to 5%, down from double digit growth in the preceding couple of quarters. If this trend continues, this suggests that while topline growth remains reasonable, margin pressure in aggregate, is dragging down profitability.

Sectorally, Industrial, Commodity and Energy sector is seeing the strongest profit momentum with profits growing over 20% YoY so far. Most of this is coming from margin expansion as revenue growth is lagging profit growth by a wide margin. On the flipside, Healthcare and Financial services are seeing profits decline, in aggregate. While revenue growth is weak in aggregate, it is being dragged largely by the global sectors.

Sectoral Result Trends

Let us track the key results this week across the different sectors:

1. Consumer Discretionary: [#238] [Rev:+12.8] [PAT+8.1%]

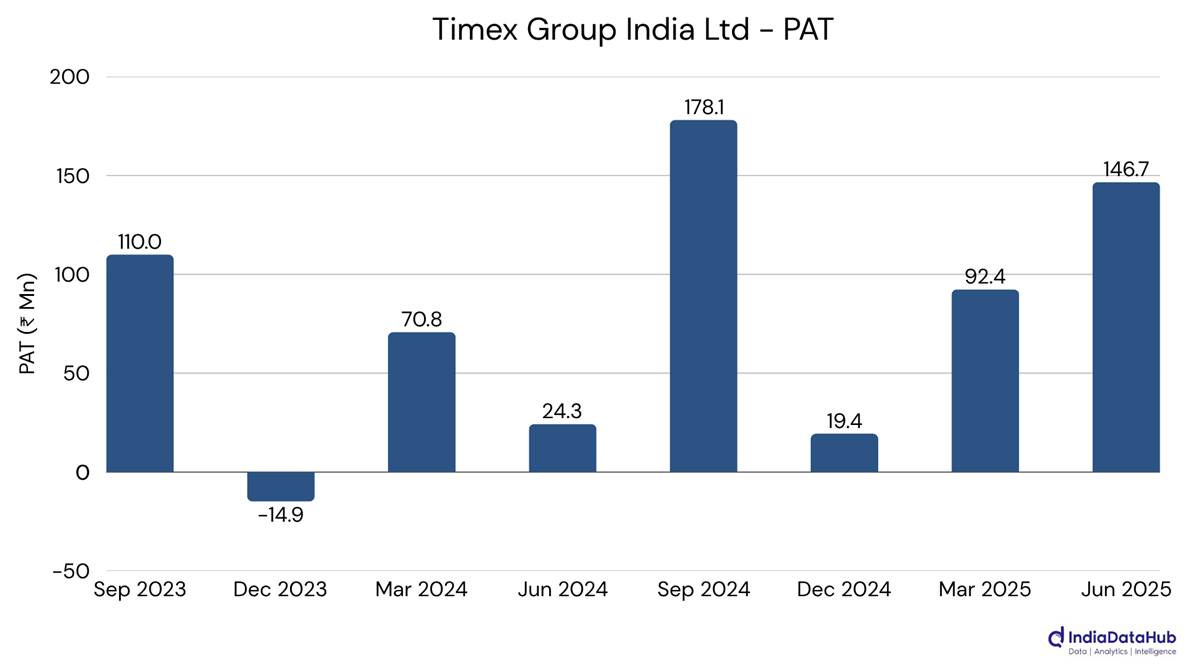

● Timex Group India: PAT rose sixfold, powered by operating leverage and a 55% revenue surge. Premiumisation and strong e-commerce traction likely lifted both topline quality and margins. Structural tailwinds in mid-premium watches may be sustaining this momentum.

● Jay Bharat Maruti: PAT surged 333% YoY, driven by margin gains and stronger plant utilisation. A shift toward higher-margin components and tighter cost discipline lifted per-unit profitability. As volumes rebound, earlier capex and OEM ties are likely yielding steady operating leverage.

● Chalet Hotels: PAT surged 235% YoY, boosted by strong core performance and a one-time ₹439 Cr gain from its Bengaluru residential project. Pricing power and RevPar growth held firm despite softer occupancy, while annuity income doubled. The mixed-use model and premium brand focus might be amplifying post-pandemic hospitality tailwinds.

● Taj GVK Hotels: PAT jumped 142% YoY, marking its best-ever Q1 revenue. Margin gains and stronger yields reflect robust demand in premium hospitality, though part of the surge may stem from non-operating income. Its positioning in key metros and high fixed-cost leverage are presumably amplifying profit recovery.

● Nahar Spinning: PAT rose 140% YoY despite flat revenue, driven by tighter cost control and stronger pre-tax efficiency. Margin gains and improved interest coverage signal better cash flow and debt servicing. Stabilised input costs and productivity upgrades likely underpinned the operational rebound.

● CarTrade Tech: PAT jumped 106% YoY, with record revenue and strong margin gains across all segments. Remarketing and OLX India drove sharp profit growth, aided by integration synergies and scaling efficiencies. Rising digital adoption and a diversified auto commerce model can underpin this momentum.

● Shankara Building Products: PAT doubled YoY to ₹32.4 Cr, marking its most profitable quarter to date. Record steel volumes and improved realizations drove margin gains, despite muted non-steel performance. Its marketplace-led model and infra tailwinds are presumably reinforcing operating leverage and network efficiency.

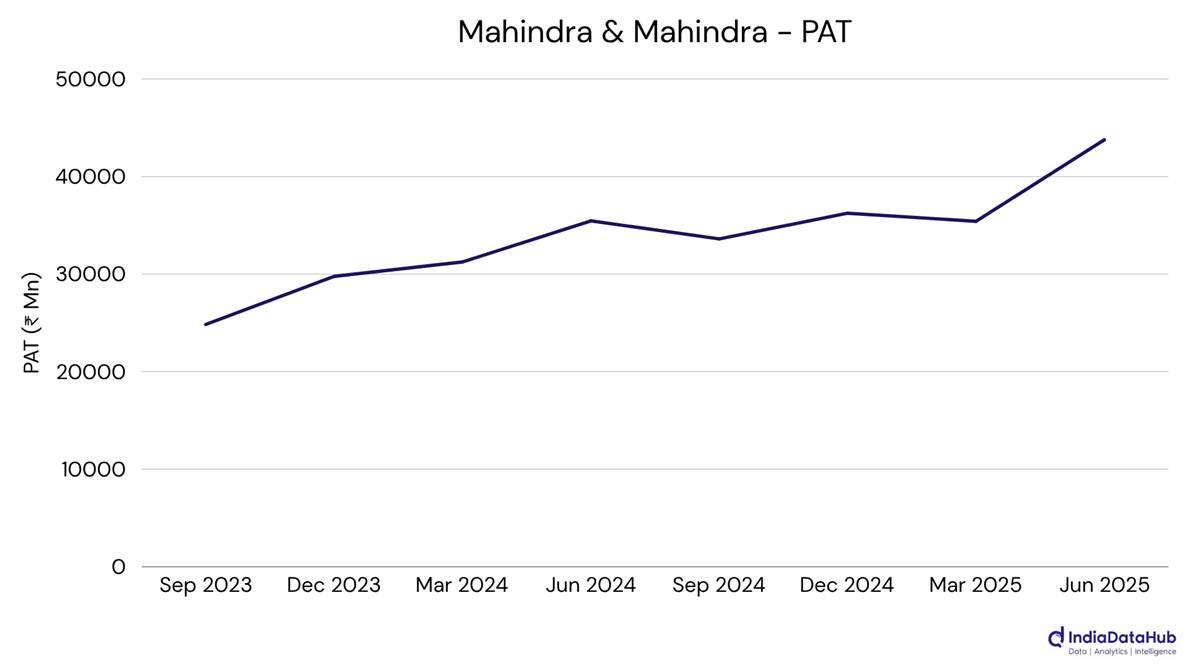

● Mahindra & Mahindra: Revenue rose 22.3% YoY, led by record SUV and tractor market share gains. Strong demand across the XUV and Thar lines, along with robust rural traction in farm equipment, drove broad-based growth. Structural tailwinds in SUVs and rural recovery likely reinforced segment leadership.

● Maruti Suzuki: Revenue rose 7.9% YoY, with record exports offsetting weak domestic sales, especially in entry-level segments. A richer product mix and SUV shift supported topline resilience, though margins came under pressure from input costs and forex headwinds. Structural softness in small car demand continues to weigh on volume growth.

2. Financial Services: [#189] [Rev:+11.3%] [PAT:-1.1%]

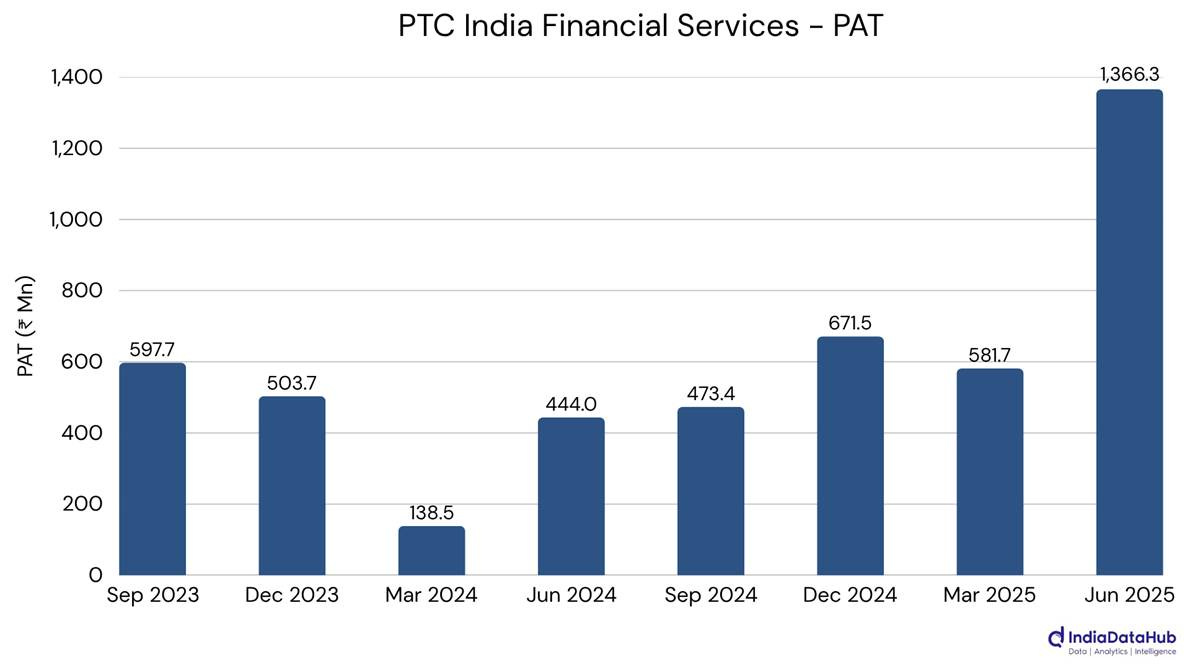

● PTC India Financial Services: PAT surged 208% YoY, driven by sharp asset quality recovery and tight cost control. Stage 3 NPAs improved markedly, while expenses dropped over 20%. The beat probably reflects resolution-driven gains and tailwinds from India’s infra and energy financing cycle.

● Capri Global Capital: PAT rose 131% YoY, led by retail loan growth, margin expansion, and tech-enabled operating leverage. AUM surged 42%, with gold and housing loans driving disbursement momentum. Co-lending gains and strong capital buffers may position the firm for sustained scale-up.

● MCX: PAT rose 83% YoY to ₹203.2 Cr, fueled by record trading volumes and margin-rich growth in bullion options. With ADT up 80% YoY and strong institutional participation, operational leverage kicked in sharply. Structural tailwinds in hedging demand and product innovation seemingly reinforced the surge.

● Piramal Enterprises: PAT rose 52% YoY, powered by 37% retail AUM growth and steady margin expansion. The shift to a high-quality loan book and improved asset quality reflects its post-repair strategic pivot.

● TVS Holdings: PAT rose 40% YoY, reflecting strong operational leverage across its diversified businesses. Robust growth in automotive components and a recent foray into financial services likely drove margin gains. Capacity utilisation and cost efficiency appear to be amplifying bottom-line momentum.

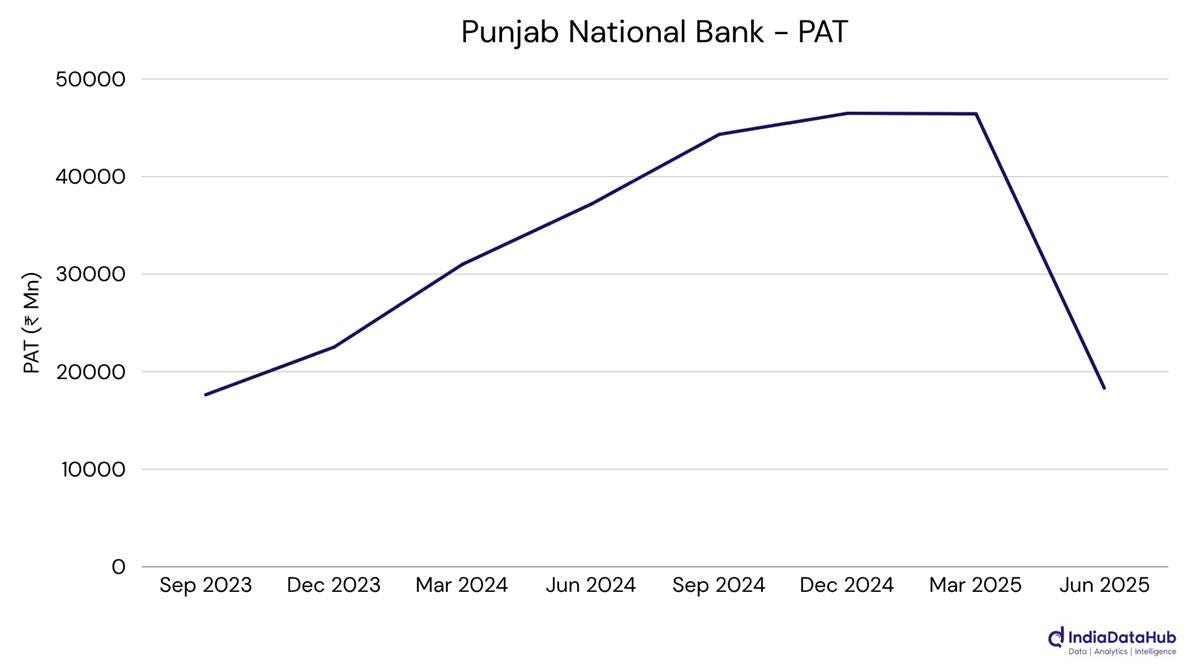

● Punjab National Bank: PNB’s PAT dropped 51% YoY, largely due to a one-time tax hit from switching to the new regime. Core operations remained strong, with a record operating profit and improved asset quality. The decline masks an underlying shift toward long-term profitability and retail-focused growth.

3. Industrials: [#155] [Rev:+12.3%] [PAT:+15.4%]

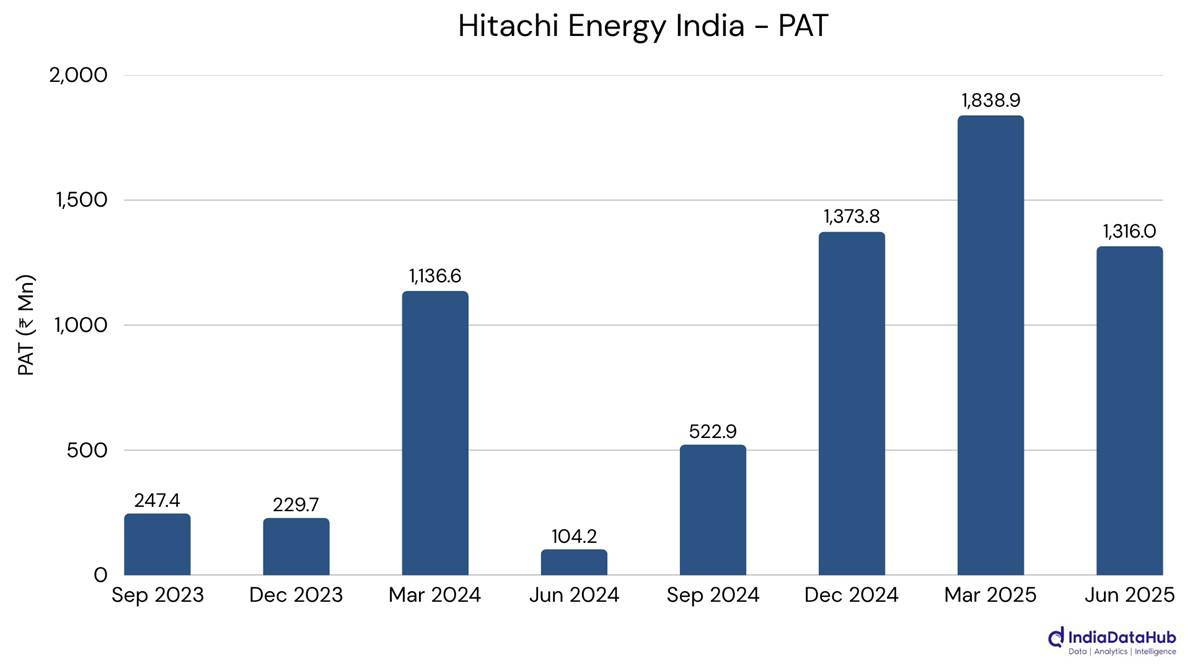

● Hitachi Energy India: PAT soared over 11x YoY, propelled by high-margin project execution and a 365% spike in order wins. Record backlog and surging demand for grid infrastructure are reinforcing operating leverage. India’s energy transition and export tailwinds can underpin this breakout quarter.

● GE Vernova T&D India: PAT more than doubled YoY, driven by strong grid equipment demand and disciplined focus on high-margin orders. Revenue rose 39%, while EBITDA margins expanded to 29.1% on tight cost control. India’s transmission push and export diversification may have fueled this standout quarter.

● HEG Ltd: PAT surged 355% YoY, driven by strong operating leverage and a sharp swing to mark-to-market gains on US investments. EBITDA margins more than doubled as cost controls and stable demand lifted profitability.

● Transformers & Rectifiers: PAT tripled YoY, powered by 64% revenue growth and a 556 bps margin expansion. Strong execution and cost control unlocked sharp operating leverage, making this the company’s best quarter yet. Grid modernization and robust order inflows likely anchor its next growth phase.

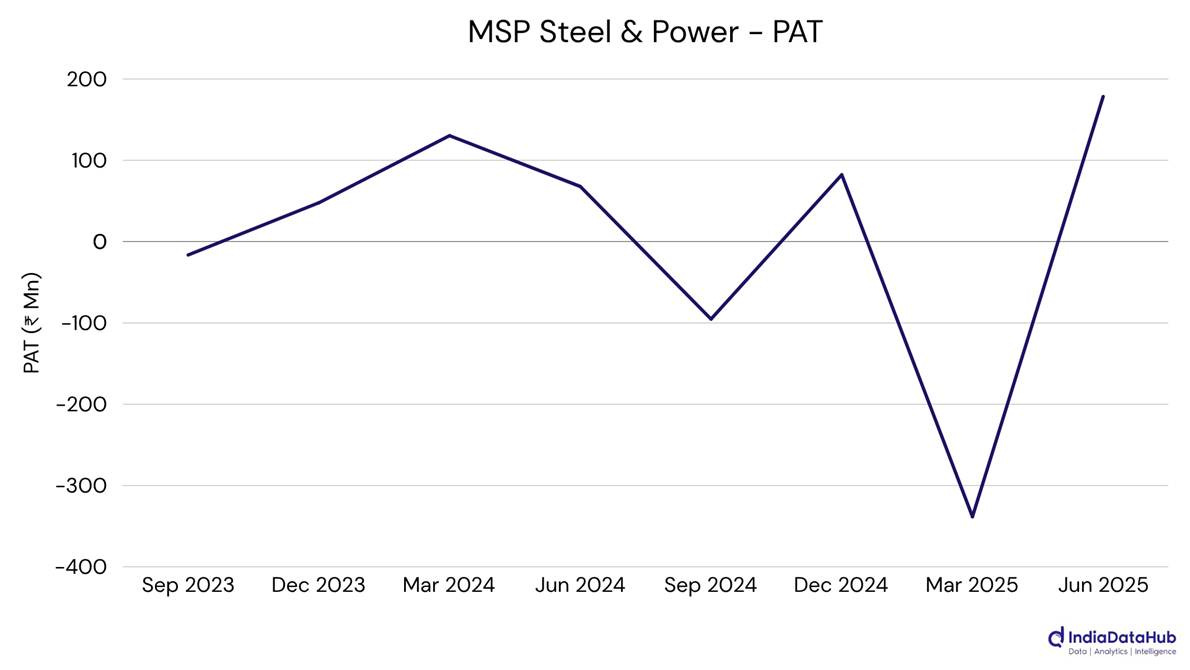

● MSP Steel & Power: PAT rose 163% YoY despite an 8% revenue drop, driven by tighter cost control and improved plant efficiency. Operating profit hit a five-quarter high, aided by margin gains and better leverage. The sharp turnaround probably reflects disciplined execution and sector tailwinds in infrastructure-led demand.

● Nahar Polyfilms: PAT rose 119% YoY, with margins expanding to 12.8% despite muted revenue growth. Strong cost control and a shift toward value-added packaging likely drove the profit surge. Operational leverage and stable input costs appear to be sustaining margin gains.

● Apollo Micro Systems: PAT more than doubled YoY, driven by record revenue and a 600 bps jump in EBITDA margins. Strong execution in defense electronics and cost efficiency unlocked sharp operating leverage. India's defense indigenization push and high-tech systems work seem to have underpinned the growth.

● Larsen & Toubro (L&T): PAT rose 30% YoY to ₹3,617 Cr, supported by record Q1 order inflows and robust international execution. Revenue beat estimates, with Energy and Hi-Tech segments leading growth despite slight margin compression. Strong overseas traction and a ₹6.1 lakh Cr order book can anchor long-term momentum.

● Apar Industries: PAT rose 30% YoY, led by strong domestic demand and a 44% surge in high-margin conductor sales. Stable margins amid rising volumes reflect operational discipline and product mix optimisation. US growth and a ₹7,779 Cr order book may position the firm for continued momentum.

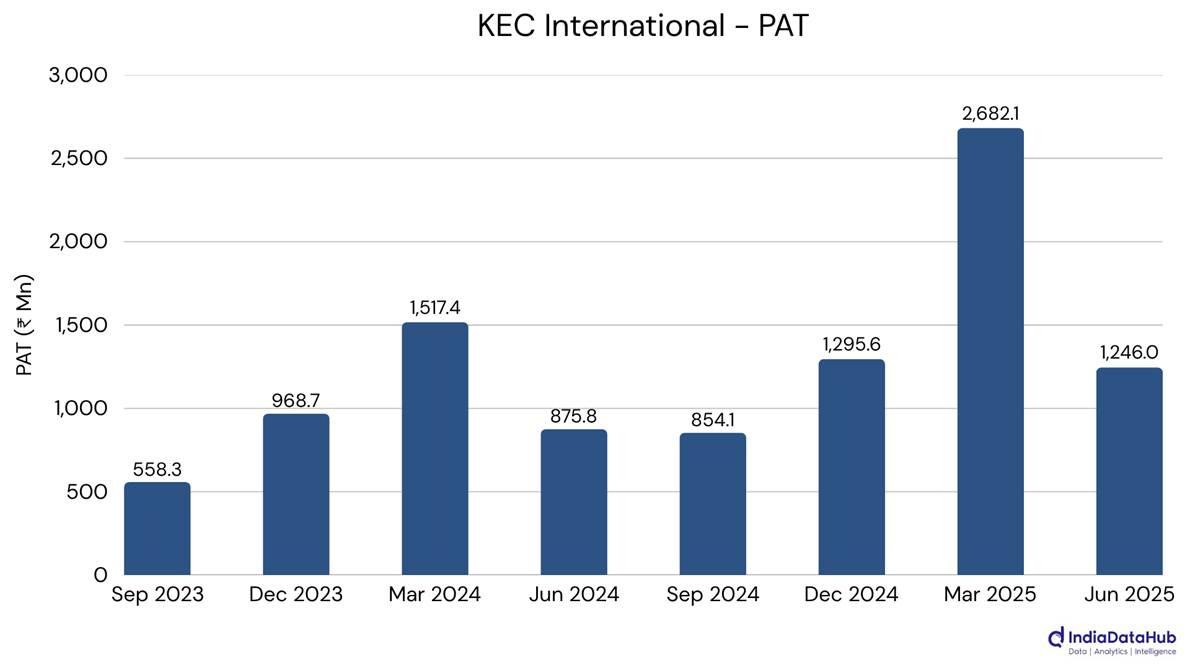

● KEC International: PAT rose 42% YoY, fueled by strong T&D execution and 50 bps margin expansion. Transmission revenue surged 26%, now forming 63% of the topline, while order inflows topped ₹5,500 Cr. Operational discipline and debt reduction likely strengthened its financial position amid infra tailwinds.

4. Commodities: [#123] [Rev:+4.0%] [PAT:+25.1%]

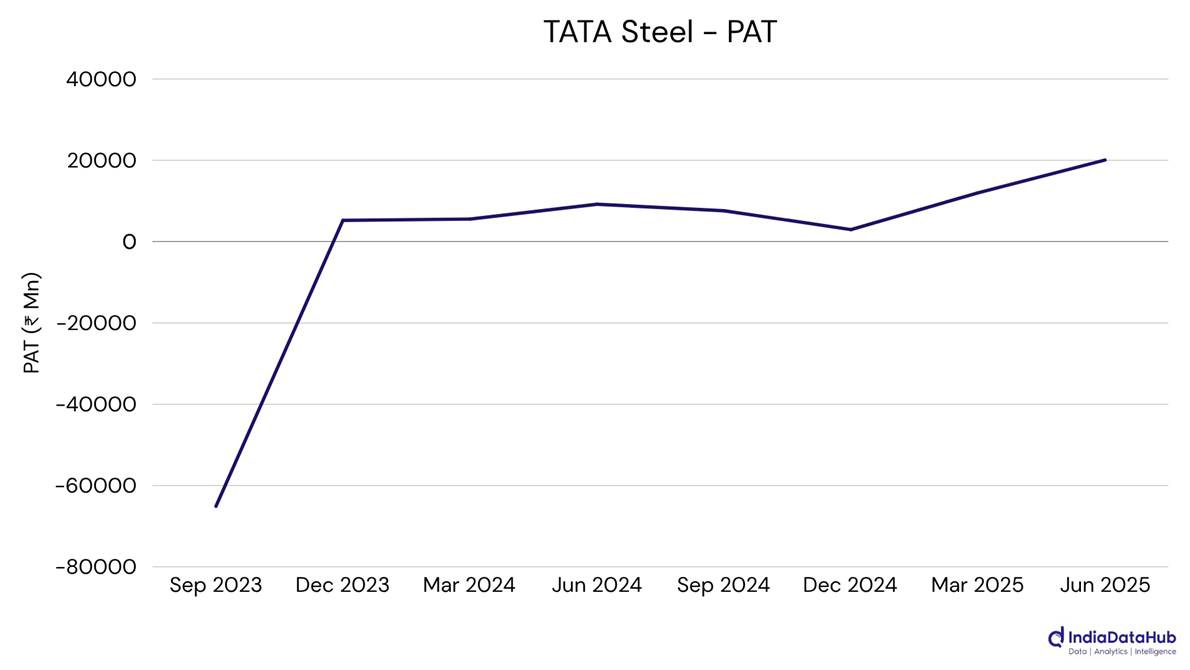

● TATA Steel: PAT more than doubled YoY to ₹2,007 Cr, despite a 3% dip in revenue, as cost takeouts and higher realizations boosted margins. India operations stood out with 24% EBITDA margins and ₹2,510/ton gains. Strategic cost control and value-added product focus likely drove the profitability surge.

● Navin Fluorine: PAT surged 129% YoY, driven by 935 bps margin expansion and broad-based growth across all verticals. Strong capacity utilization, especially at the R32 plant, and premium product mix boosted profitability. Structural tailwinds from the China+1 shift and specialty demand may underpin this momentum.

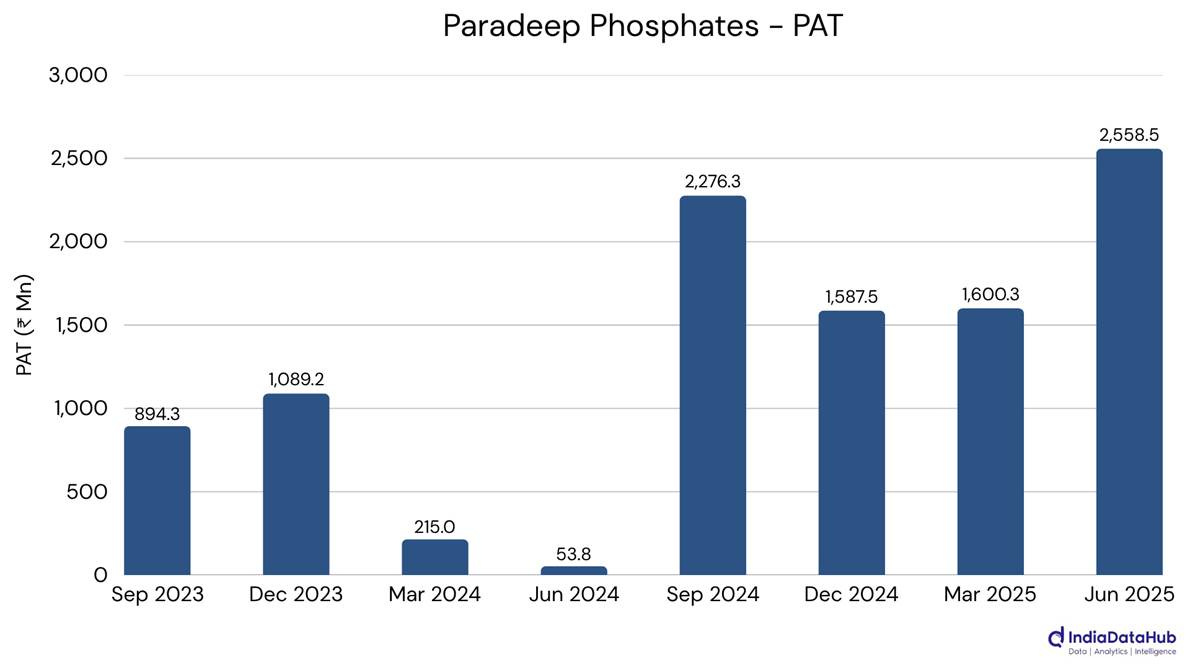

● Paradeep Phosphates: PAT soared 4,656% YoY to ₹256 Cr, led by record fertilizer sales, margin-rich NPK blends, and strong volume growth. Operational leverage and higher capacity utilization drove a dramatic profit swing.

● Vedanta Ltd.: PAT fell 12.5% YoY due to a sharp rise in tax expenses, despite record Q1 EBITDA and margin gains to 35%. Strong zinc and alumina output and cost efficiencies lifted operational performance. Adjusted PAT grew 13%, pointing to underlying strength masked by one-offs.

● Orient Cement: PAT surged 459% YoY, driven by margin expansion and strong volume growth, as it integrates into the Adani Group. EBITDA margins rose to 21% on cost discipline and pricing gains. Synergies from the Ambuja acquisition and infra-led demand may have fueled this sharp turnaround.

● Zuari Agro Chemicals: PAT soared 334% YoY to ₹127.4 Cr, powered by strong demand, cost control, and operational leverage. Revenue rose 14% while margins expanded sharply, reflecting improved capacity use and input cost stability. India’s agri push and favorable monsoon trends seem to have bolstered this turnaround.

● Manaksia Steels: PAT surged 298% YoY, driven by 30% revenue growth and sharp operating leverage from better capacity utilization. Margins expanded as expenses rose slower than topline, reflecting tight cost control. Strong infrastructure demand and focus on value-added steel probably sustained the rebound.

● Birla Corporation: PAT surged 298% YoY, driven by 30% revenue growth and sharp operating leverage from better capacity utilization. Margins expanded as expenses rose slower than topline, reflecting tight cost control. Strong infrastructure demand and focus on value-added steel likely maintained the rebound.

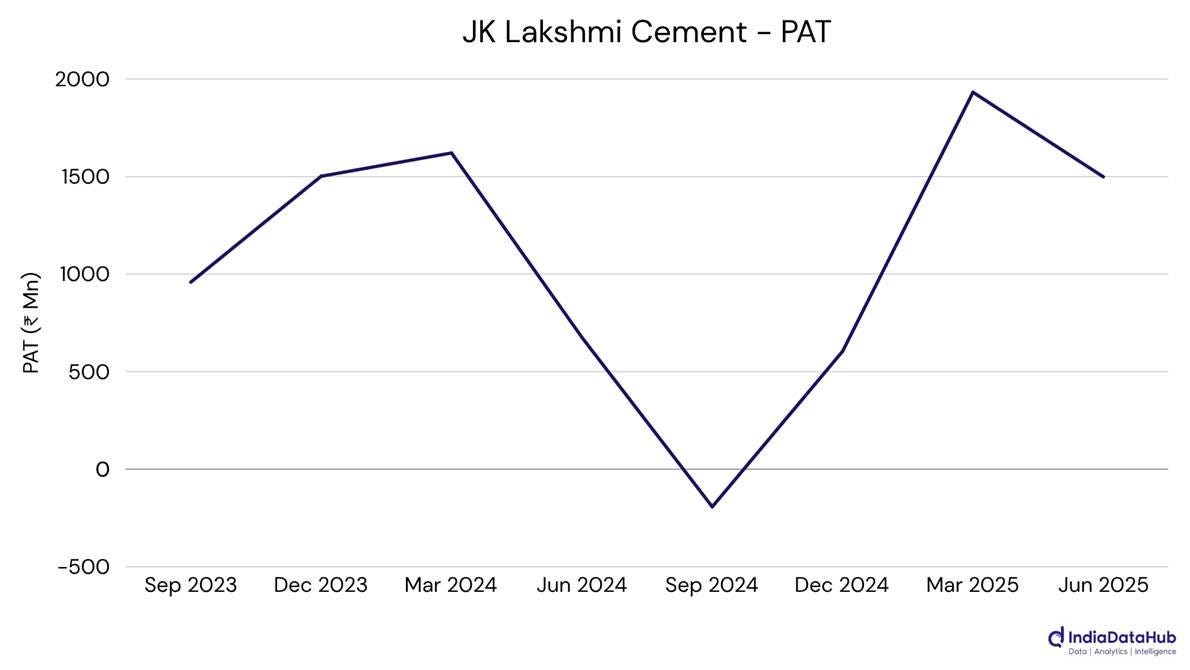

● JK Lakshmi Cement: PAT rose 122% YoY, aided by a 10% volume uptick, improved mix, and lower fuel costs. Despite modest revenue growth, margins expanded meaningfully on energy savings. Sector-wide input softness and infra-led demand may have sustained this sharp profitability gain.

5. Services: [#82] [Rev:+11.2%] [PAT:-8.5%]

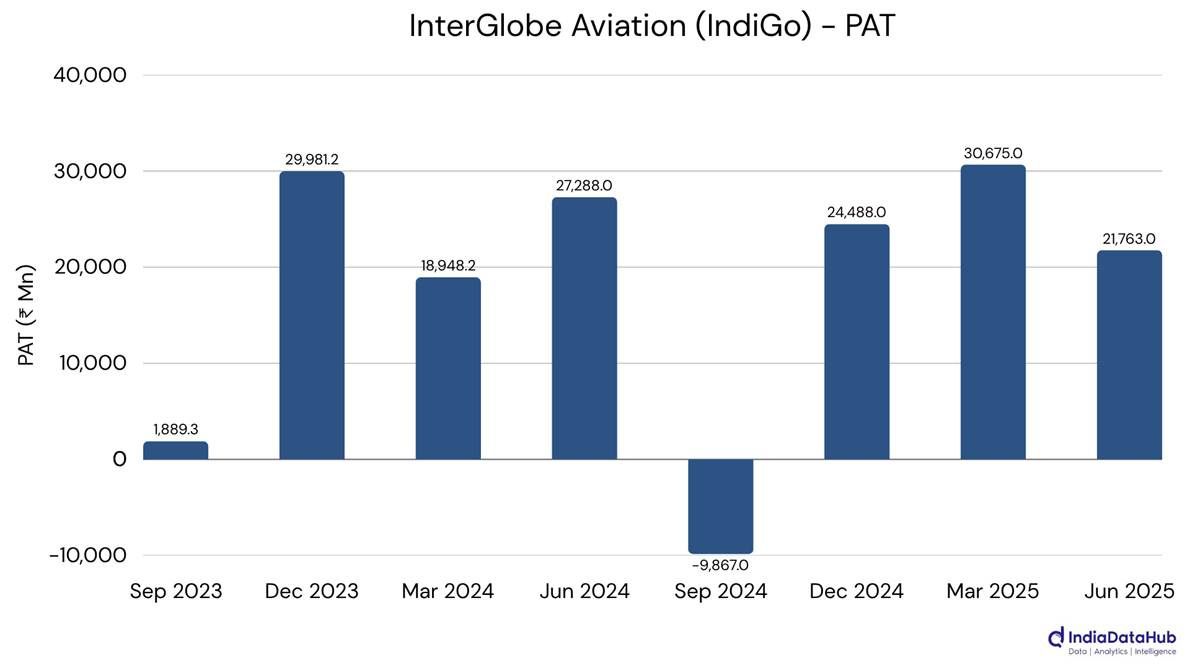

● InterGlobe Aviation (IndiGo): PAT fell 20% YoY amid geopolitical disruptions, subdued travel demand, and rising non-fuel costs. Yield dropped 5% while RASK slid 10%, reflecting fare pressure and weak load factors. Sector-wide overcapacity and Q1 seasonality may have compounded margin strain.

● Redington Ltd.: PAT rose 7.3% YoY on record Q1 revenue of ₹26,002 Cr, driven by 20–40% growth across cloud, mobility, and tech solutions. Strong execution in India, UAE, and Saudi Arabia boosted topline, while margin gains reflect improved mix and operational efficiency.

● Quess Corp: PAT rose 4% YoY to ₹51 Cr, with adjusted PAT up 8%, aided by cost controls and stable margins despite soft revenue growth. Staffing demand remains muted, but operational efficiency supported a 10% EBITDA rise. Post-demerger focus on core operations seems to have sharpened profitability.

6. Information Technology: [#73] [Rev:+5.8%] [PAT:+6.7%]

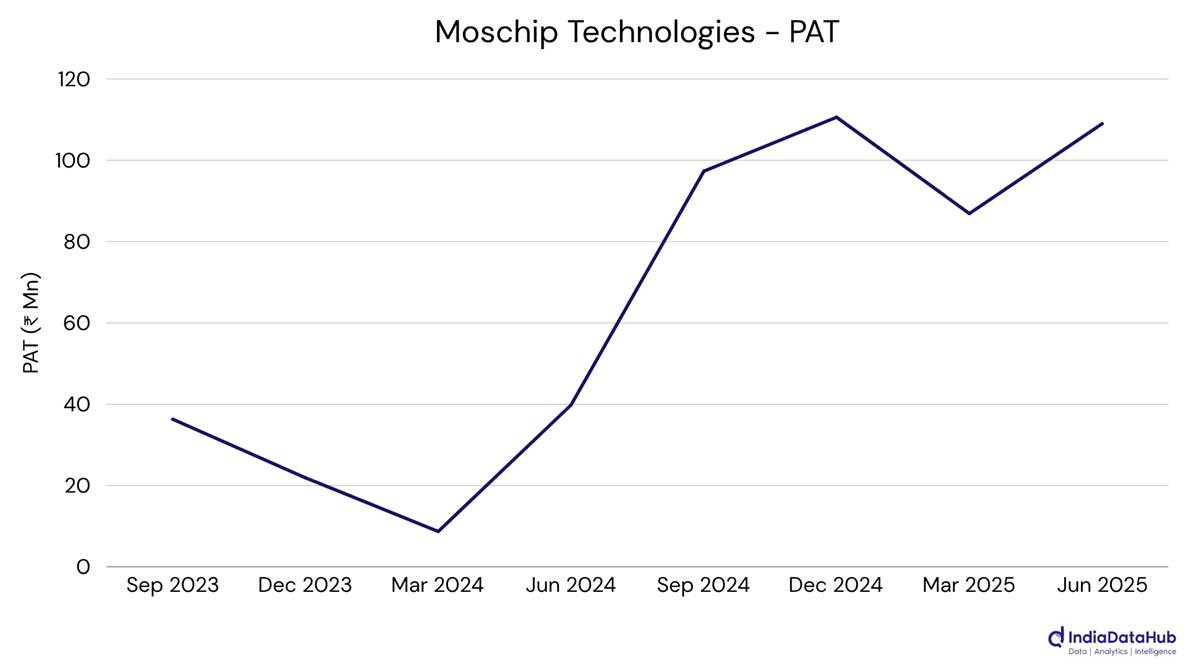

● Moschip Technologies: PAT up 174% (₹10.9 Cr)! The semiconductor and design services firm reported its best PAT in recent quarters, likely due to project-based execution and margin tailwinds. However, prior earnings show volatility; therefore, this spike will need further confirmation before signaling trend reversal.

● Ceinsys Tech: PAT up 166% (₹31.6 Cr)! The GIS and infra-tech firm continues to gain from infra-linked execution cycles. With both revenue and PAT more than doubling YoY, this may reflect improved delivery on past order backlogs. Margins appear more stable than FY24.

● Netweb Technologies: PAT up 97% (₹30.5 Cr)! A standout in the AI/HPC infrastructure space. With growing institutional and public sector demand, this PAT surge seems structural rather than episodic. Revenue has also steadily climbed across recent quarters, validating scale momentum.

7. Healthcare: [# 61] [Rev: +9.6%] [PAT: -40.3%]

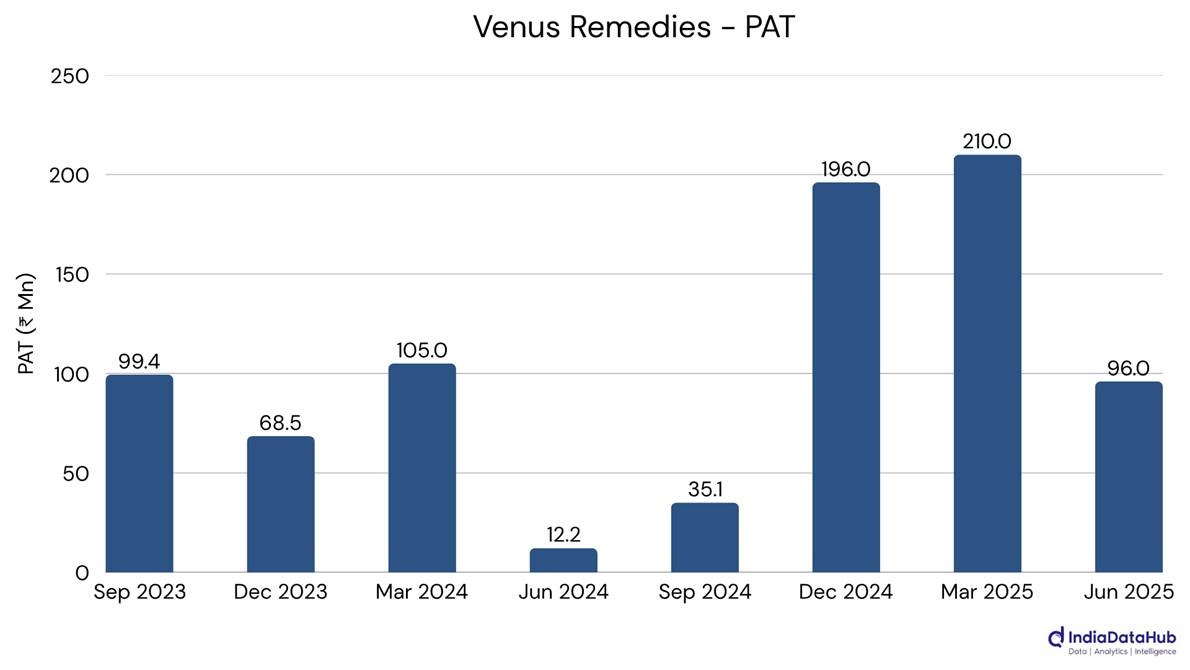

● Venus Remedies: PAT surged 687% YoY to ₹9.6 Cr, driven by strong topline growth and margin expansion on contained costs. A lower tax outgo also amplified bottom-line gains. Demand for specialty antibiotics and post-COVID normalization appears to have supported the improved product mix and pricing power.

● Strides Pharma: PAT rose 55% YoY, thanks to margin expansion and cost discipline, with operational PAT up 81%. Gross margins rose 300 bps as the company sharpened its focus on high-margin regulated markets. US growth and portfolio mix shift probably reinforced profitability gains.

● Sun Pharma: PAT fell 20% YoY due to one-time charges worth ₹818 Cr, though adjusted PAT rose 5.7% on strong operational performance. Revenue grew 9.5%, led by India and global innovative medicines..

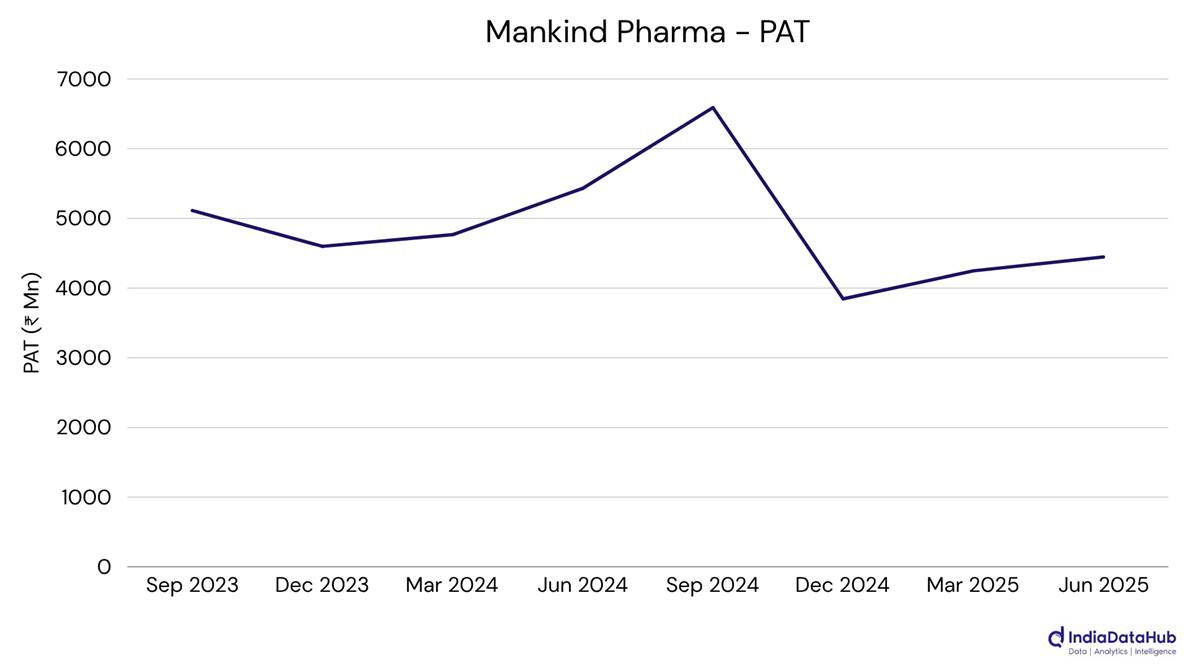

● Mankind Pharma: PAT declined 18% YoY to ₹445 Cr, hit by a sharp rise in finance costs post-BSV acquisition. Despite 24% revenue growth, profit margins compressed 630 bps due to input cost inflation and integration-related expenses.

● Torrent Pharma: PAT rose 20% YoY to ₹548 Cr, driven by strong growth in India and international markets, particularly chronic therapies and recent US launches. Margins expanded to 32.5% on better mix and scale efficiencies. Chronic care demand and focus on complex generics seem to have underpinned the performance.

8. FMCG: [# 52] [Rev: +10.1%] [PAT +3.9%]

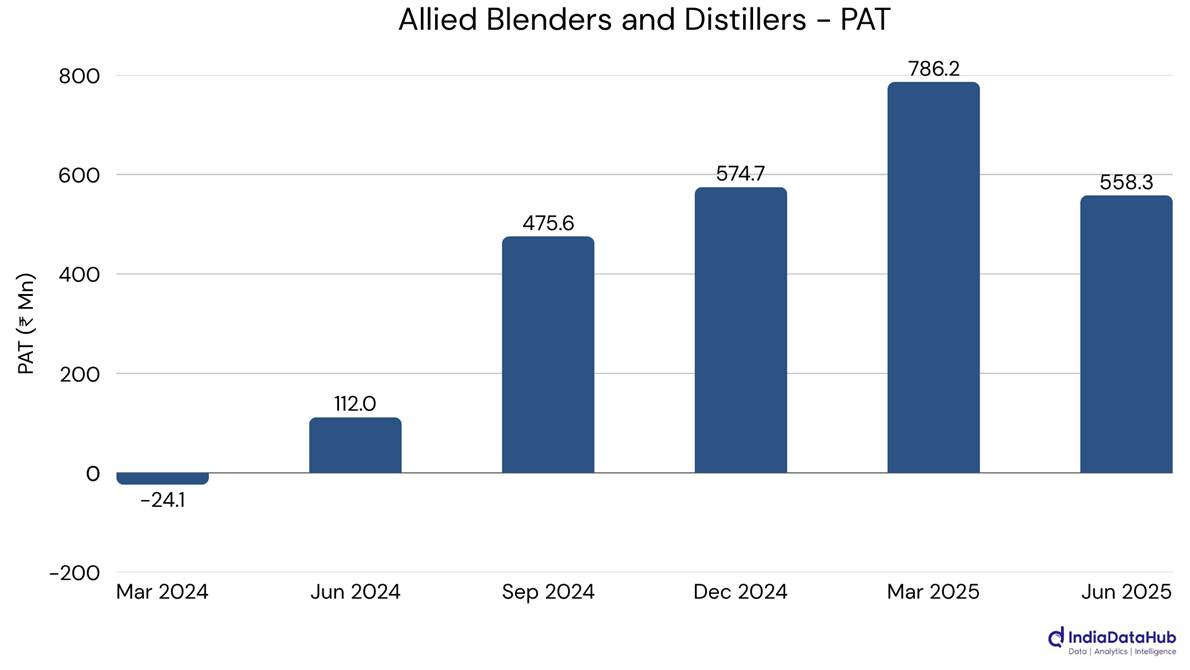

● Allied Blenders and Distillers Ltd.: PAT up 398.5% (₹55.8 Cr)! The alco-bev company reported its best PAT in the last six quarters. As per quarterly data, PAT has grown consistently from a loss in Dec ’23 to over ₹700 Cr annualised by Apr ’25. This quarter marks a slight pullback from the previous peak, but overall earnings remain strong.

● Radico Khaitan Ltd.: PAT jumped 73% YoY to ₹130.5 Cr, driven by record IMFL volumes and a premium-heavy product mix. Revenue grew 32.5%, while EBITDA surged 56% on stable input costs and expanding margins. Premiumisation and recovery in social consumption appear to have sustained the growth momentum.

● ITC Ltd.: ITC’s PAT rose 3.2% YoY to ₹5,343 Cr, as strong revenue growth in cigarettes, agri, and FMCG offset margin pressures from elevated input costs. EBITDA margins dipped to 30% due to high-cost inventory and inflationary headwinds.

● Hindustan Unilever Ltd. (HUL): PAT rose 6% YoY, aided by a sharp drop in tax expenses, including a one-off re-estimation benefit. Revenue grew 5% with 4% volume-led growth across all key categories, despite 130 bps EBITDA margin compression. Rural demand recovery and strong execution seem to have supported topline momentum.

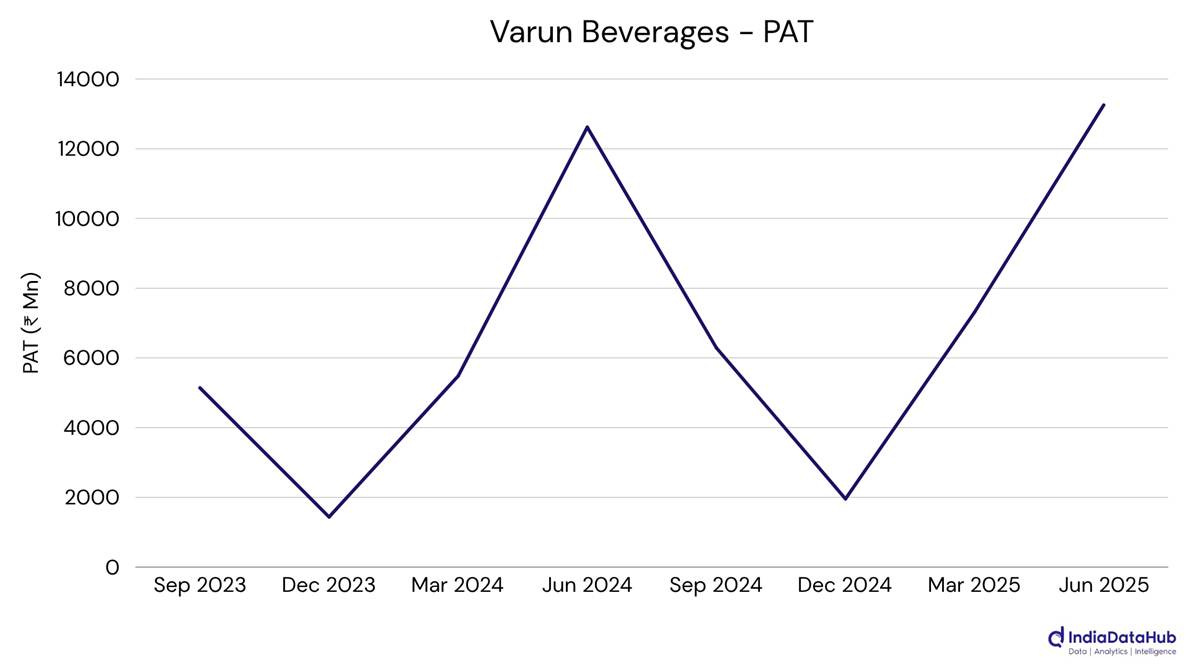

● Varun Beverages: HUL’s PAT rose 6% YoY to ₹2,768 Cr, aided by a sharp drop in tax expenses, including a one-off re-estimation benefit. Revenue grew 5% with 4% volume-led growth across all key categories, despite 130 bps EBITDA margin compression.

9. Utilities: [# 18] [Rev: +2.0%] [PAT +7.8%]

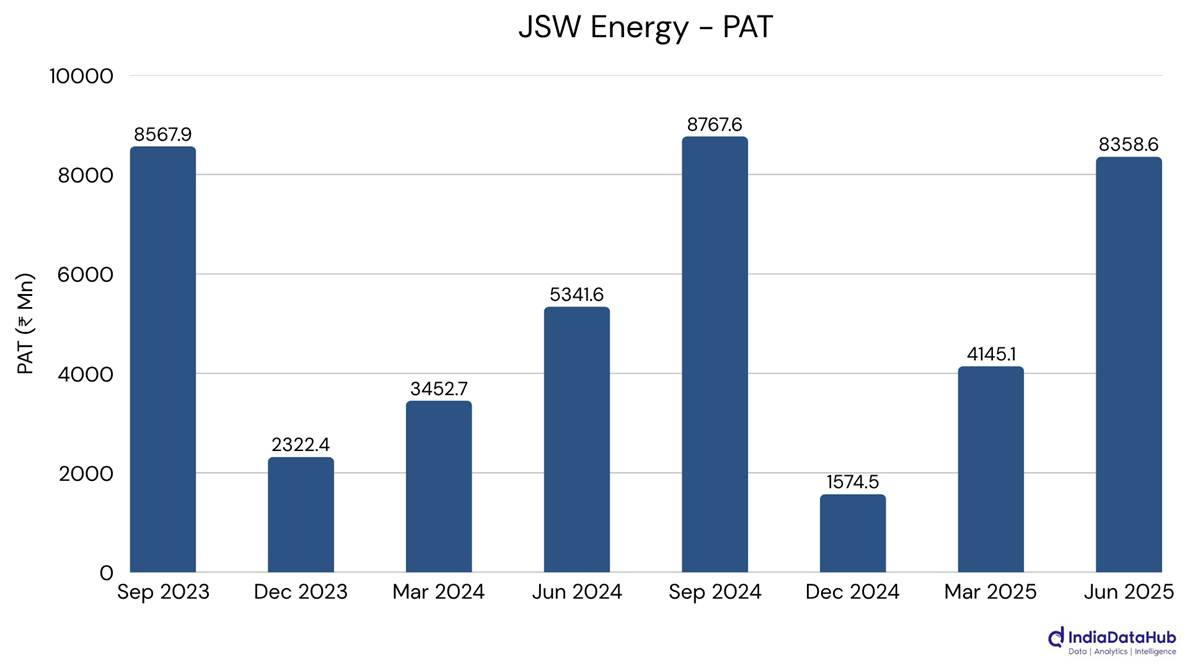

● JSW Energy: PAT jumped 56.5% YoY to ₹835.9 Cr, led by a 93% surge in EBITDA to ₹3,057 Cr, fueled by Mahanadi and O2 Power acquisitions and 71% growth in power generation. Revenue rose 78% to ₹5,143 Cr, while capacity additions of 1,893 MW boosted scale and margin. Gains reflect renewable tailwinds, strong PPAs, and operational leverage from disciplined capex.

● GMR Power and Urban Infra: GMR Power swung from a one-time gain of ₹1,362 Cr last year to a ₹7.2 Cr loss in Q1 FY26, as rising project costs outpaced sluggish 2.3% revenue growth. Operating profit to interest ratio fell to a five-quarter low of 0.91x, while debt-equity surged to 17.5x. Margin and cash flow stress possibly stem from long-cycle infra project overruns and capital cost pressures.

● NTPC Ltd.: PAT rose 10.9% YoY to ₹6,108 Cr, despite a 3% revenue dip, driven by a 10.3% cut in fuel costs and a 67% jump in other income. High plant load factor (75.2%) and regulated tariff-linked fixed charge recovery helped protect margins.

● Tata Power: PAT rose 6.2% YoY to ₹1,262 Cr, led by a 95% jump in renewable energy profits and strong gains in T&D and manufacturing. Rooftop solar revenue more than doubled, with record 270 MWp installations boosting clean energy momentum. The solar manufacturing unit’s ₹100 Cr PAT signals rising domestic demand and policy-driven growth.

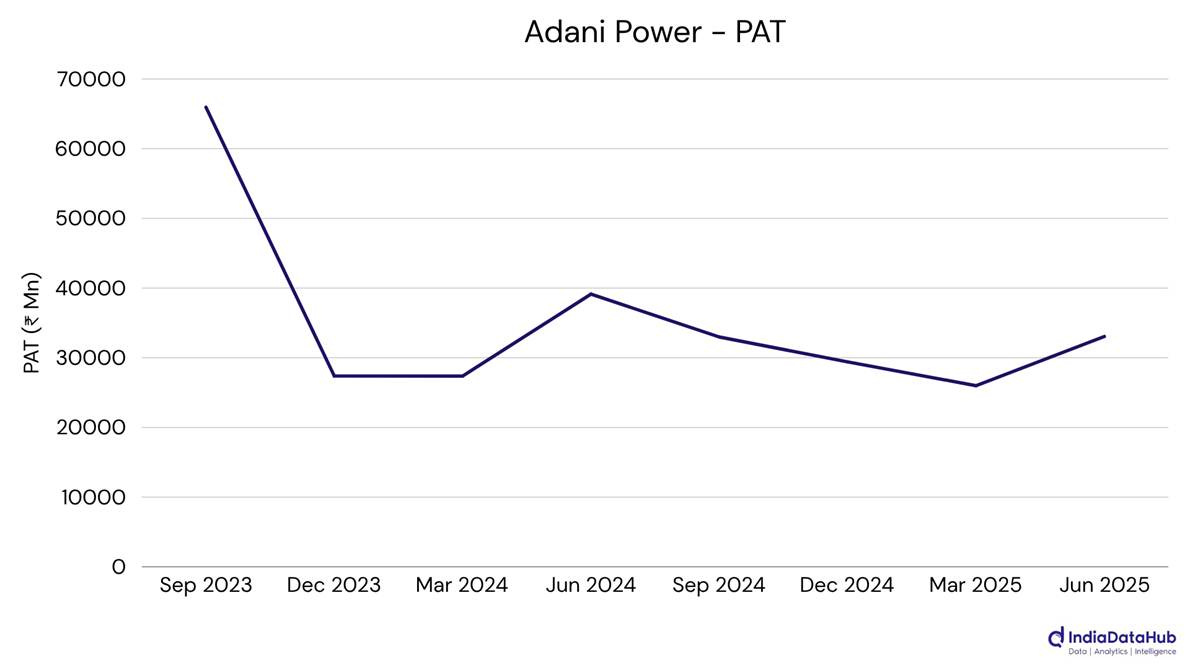

● Adani Power: PAT declined 15.5% YoY to ₹3,305 Cr due to lower merchant tariffs, underutilized capacity (PLF fell to 67%), and rising post-acquisition costs. Revenue dropped 5.9% amid erratic demand from heatwaves and early monsoons. Recent plant acquisitions pushed capacity up 15%, but volumes fell 1.6%, pointing to a demand–supply mismatch.

10. Energy: [# 13] [Rev: +1.1%] [PAT +27.2%]

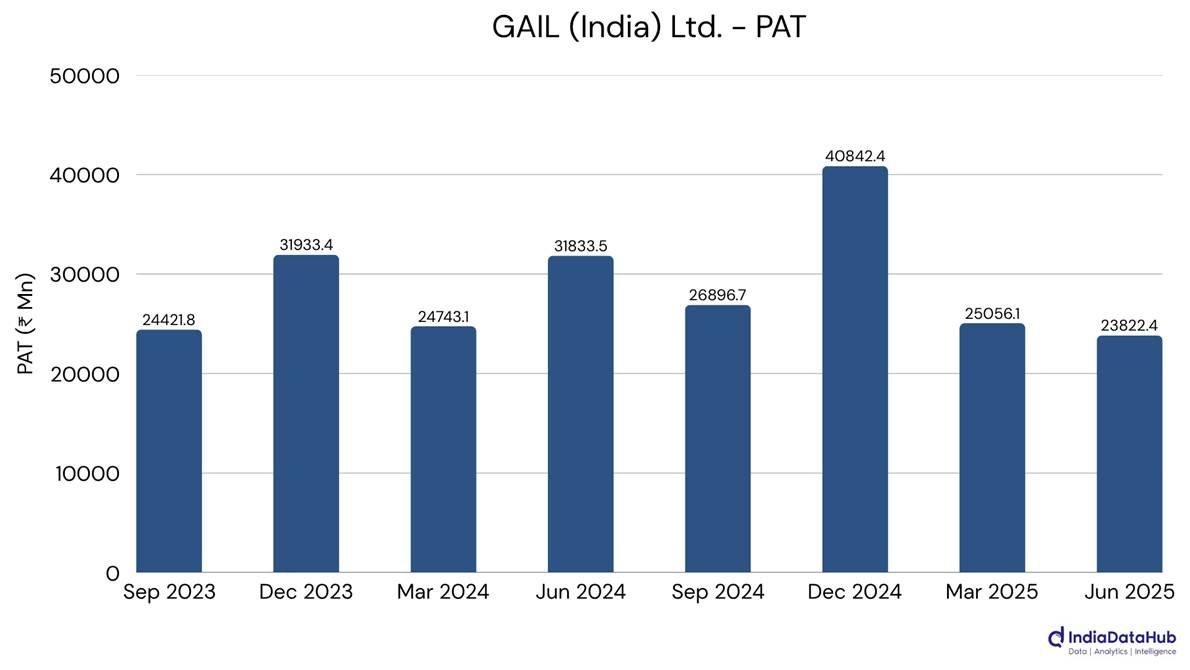

● GAIL (India) Ltd.: PAT declined 25.2% YoY to ₹2,382 Cr, hurt by a 22.7% spike in raw material costs and reduced allocation of low-cost domestic gas. Gas marketing volumes fell 5.3%, while EBITDA margin dropped to 10.4% from 15.2%. Profitability was squeezed across segments as the company relied on pricier alternatives to maintain supply.

11. Telecommunication: [# 10] [Rev: 3.5%] [PAT: L->P]

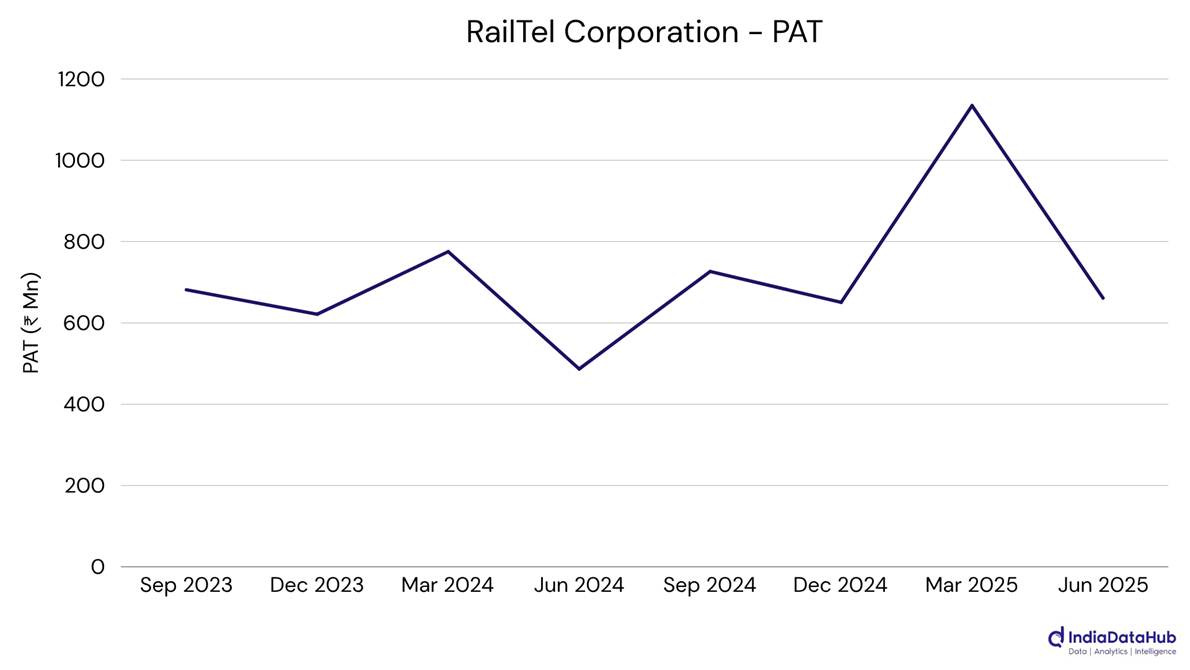

● RailTel Corporation of India Ltd.: PAT surged 35.8% YoY to ₹66.1 Cr on the back of a 33.3% rise in revenue to ₹744 Cr, led by a 78% jump in project services. Order inflows quadrupled YoY to ₹721 Cr, including a ₹166 Cr BSNL order. Despite a 36% rise in expenses, margin gains came from operational leverage and higher realizations.

● Indus Towers Ltd.: PAT declined 9.8% YoY to ₹1,737 Cr despite a 9.1% revenue rise, as total expenses surged 29% and EBITDA margins compressed 710 bps to 54.5%. Power and fuel costs—84% of opex—rose 5.8% YoY, squeezing profitability. A partial offset came from an ₹88 Cr provision write-back on Vodafone Idea dues.

That’s it for this week. See you next week!