In this edition of This Week In Data, we discuss:

New series of CPI is here and it does not change the big picture of CPI trajectory

Wireless telecom subscribers spiked sharply in last two months due to Airtel

Life insurance sector is seeing strong growth driven by LIC

General insurance sector is also seeing strong growth

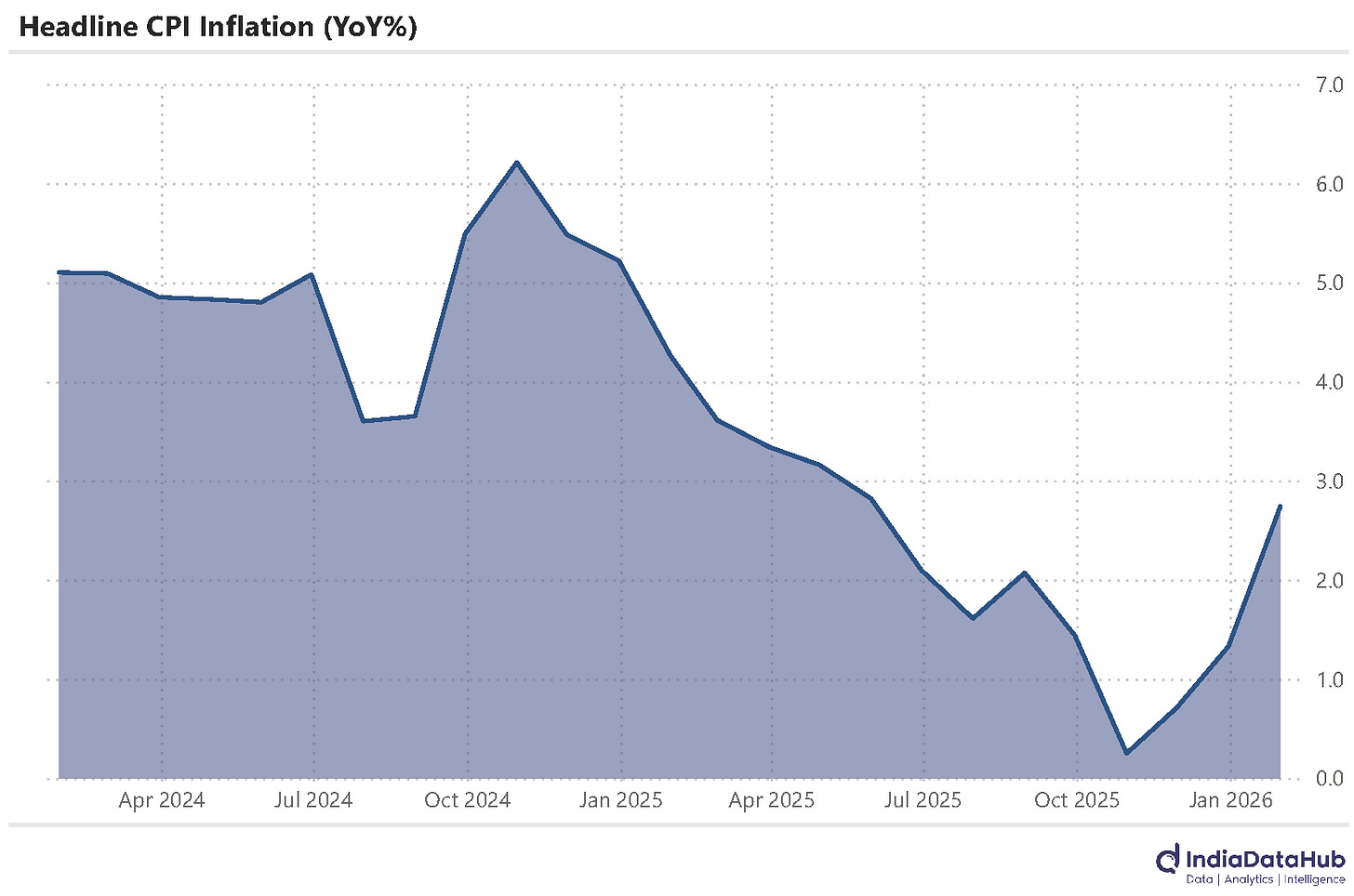

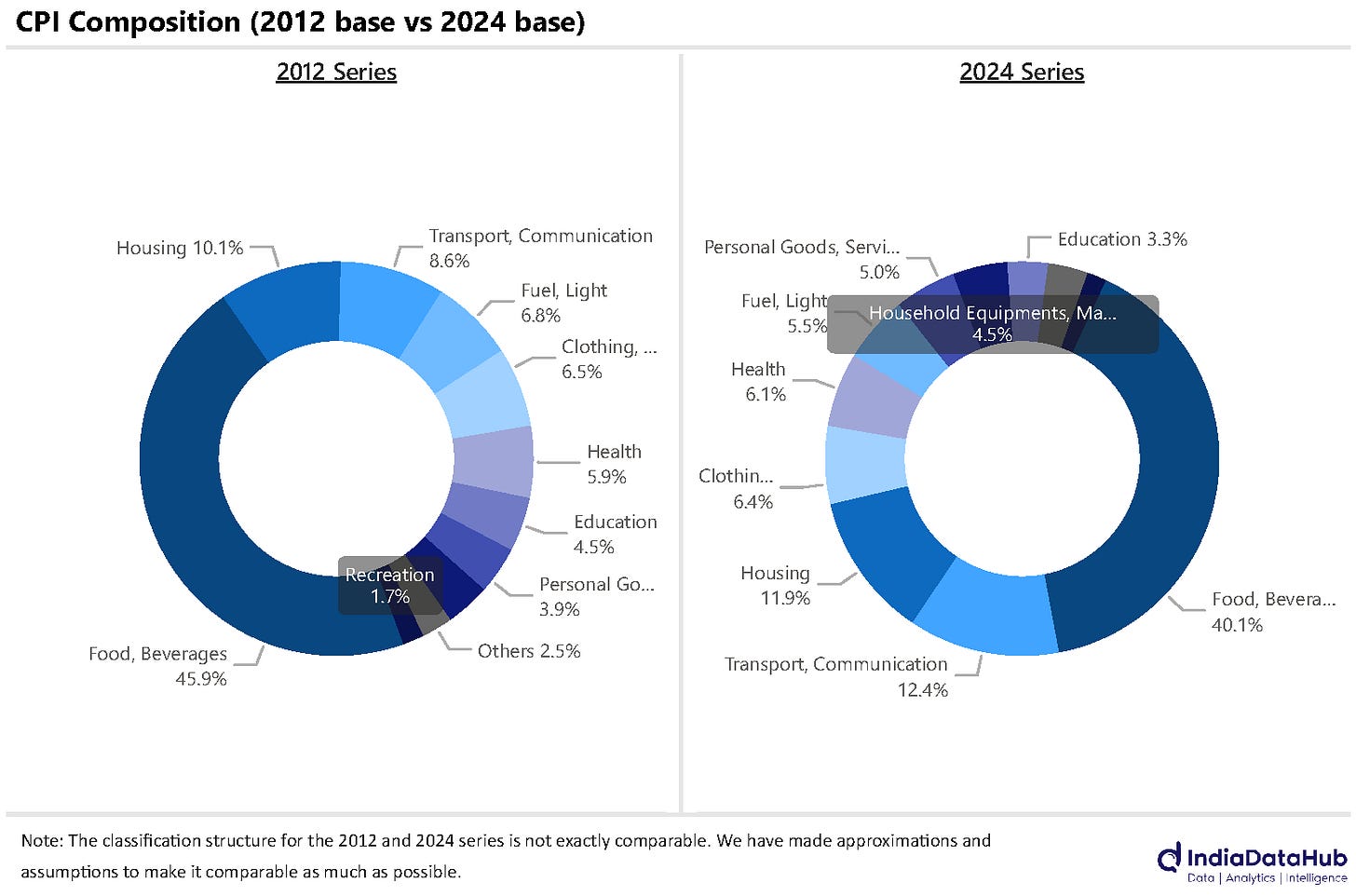

The long-overdue shift in the CPI base is over. On Thursday, we got the new CPI series. Inflation, as per the new series, continues to be low at below 3% in January. The big picture remains that inflation is inching up, as expected, but still remains comfortable. And so, it will not immediately change monetary policy or interest rates.

One of the key changes in the new series is the lower weight for food relative to the earlier series. Given that food is the most volatile component of the CPI, this lower weight will make the CPI series less volatile. There are, of course, several under-the-hood changes in terms of a more representative basket of commodities, a larger number of commodities, more markets from which price data is collected, and so on, which should improve its credibility.

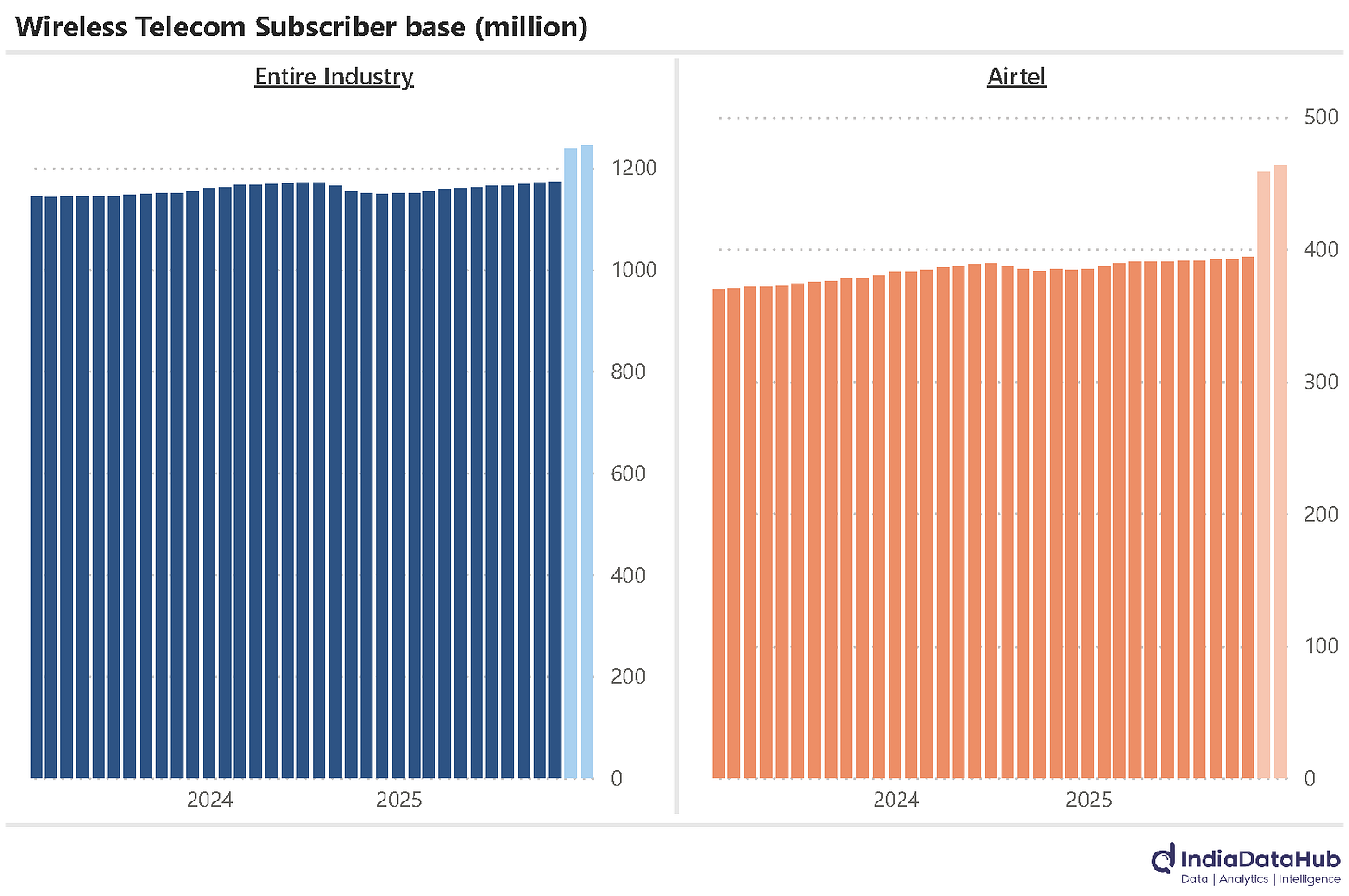

The wireless subscriber base in India increased significantly in the last two months. November and December saw a cumulative increase of over 70 million subscribers. This is an over 6% increase in just two months. But turns out this increase was due to a technicality.

Almost the entire increase is due to Airtel, which hitherto was not reporting its M2M subscriber base (sim count) in its monthly filings. Other operators were already including their M2M sims in their subscriber base. Airtel corrected this anomaly in its December filing, due to which its subscriber base increased by almost 70 million or by 18%. Airtel did not split out how much of its subscriber base increase is due to M2M and how much organic increase, but in the 6 months before this, Airtel’s monthly subscriber growth was just over 600 thousand or ~1.2 million in two months. Not a large number.

So what are M2M sim cards? They are machine-to-machine SIM cards. SIM cards that are embedded into IoT devices, such as in modern cars, which offer internet connectivity. Or in the smart metering systems that the power distribution companies are putting in place. What is absolutely fascinating, though, is the sheer scale of this! If for Airtel, a sixth of its subscriber base is just M2M sim cards or non-human sim cards, it is fair to assume that other wireless operators have a similar number. If we just include Airtel and Jio, this implies that there are over 150 million M2M ‘active’ sim cards in the country currently. And if we include all the operators, this number rises to over 20 million. That is a very large number of sim cards embedded directly into machines.

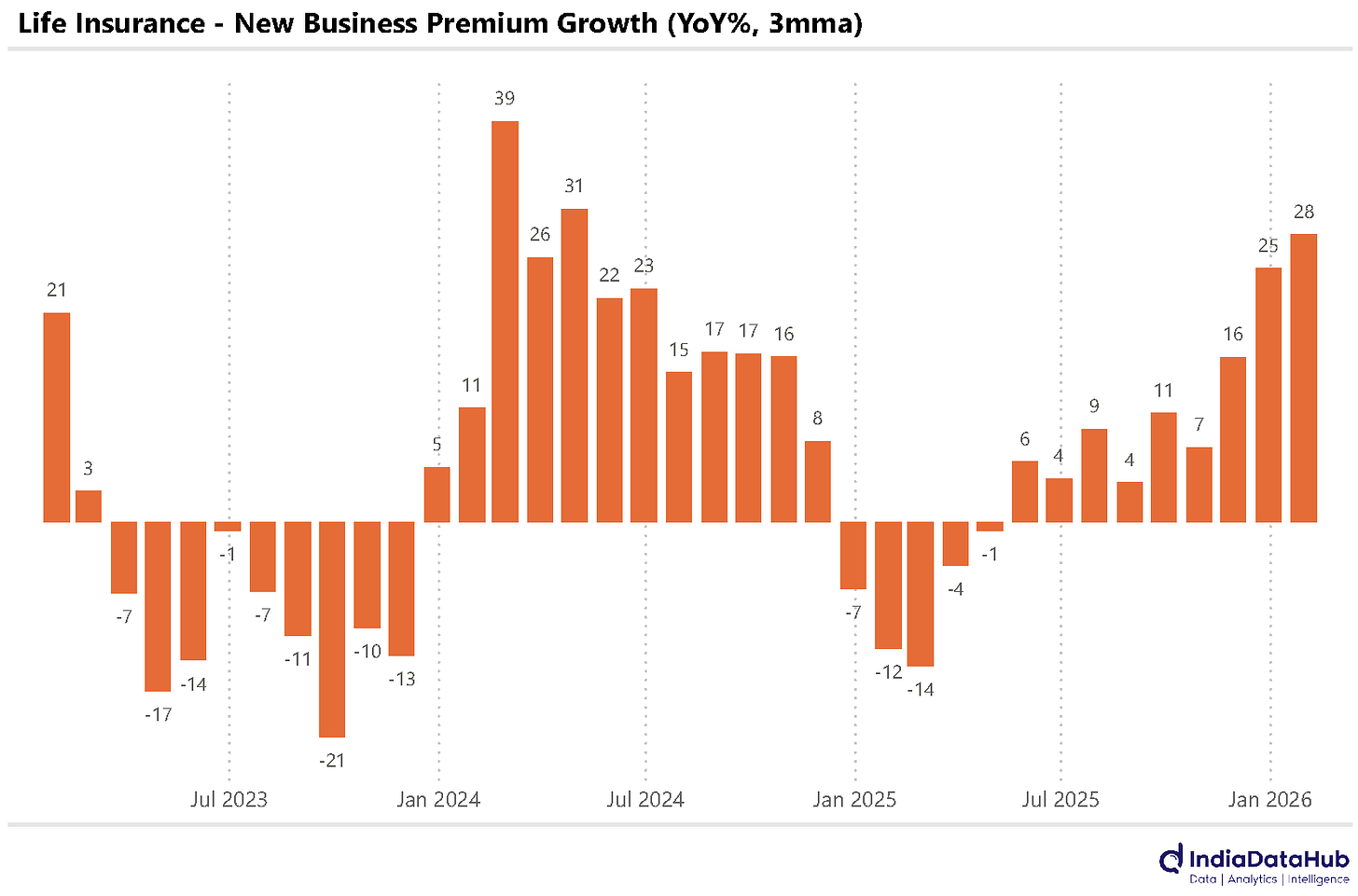

The last few months have been good for the life insurance sector. New Business Premiums have grown by almost 30% YoY over the past 3 months, the highest growth in the last few quarters. The growth is being driven by single-premium group policies, which have seen over 40% growth. And because LIC has a much higher share of business here, it is LIC which is driving this.

But even the traditional individual non-single premium segment has seen growth tick up to almost 20% YoY over the past three months after remaining in single digits through most of 2025. And the growth is driven by higher policies – the number of individual non-single premium policies sold has grown by 28% over the past 3 months. So, things are looking good!

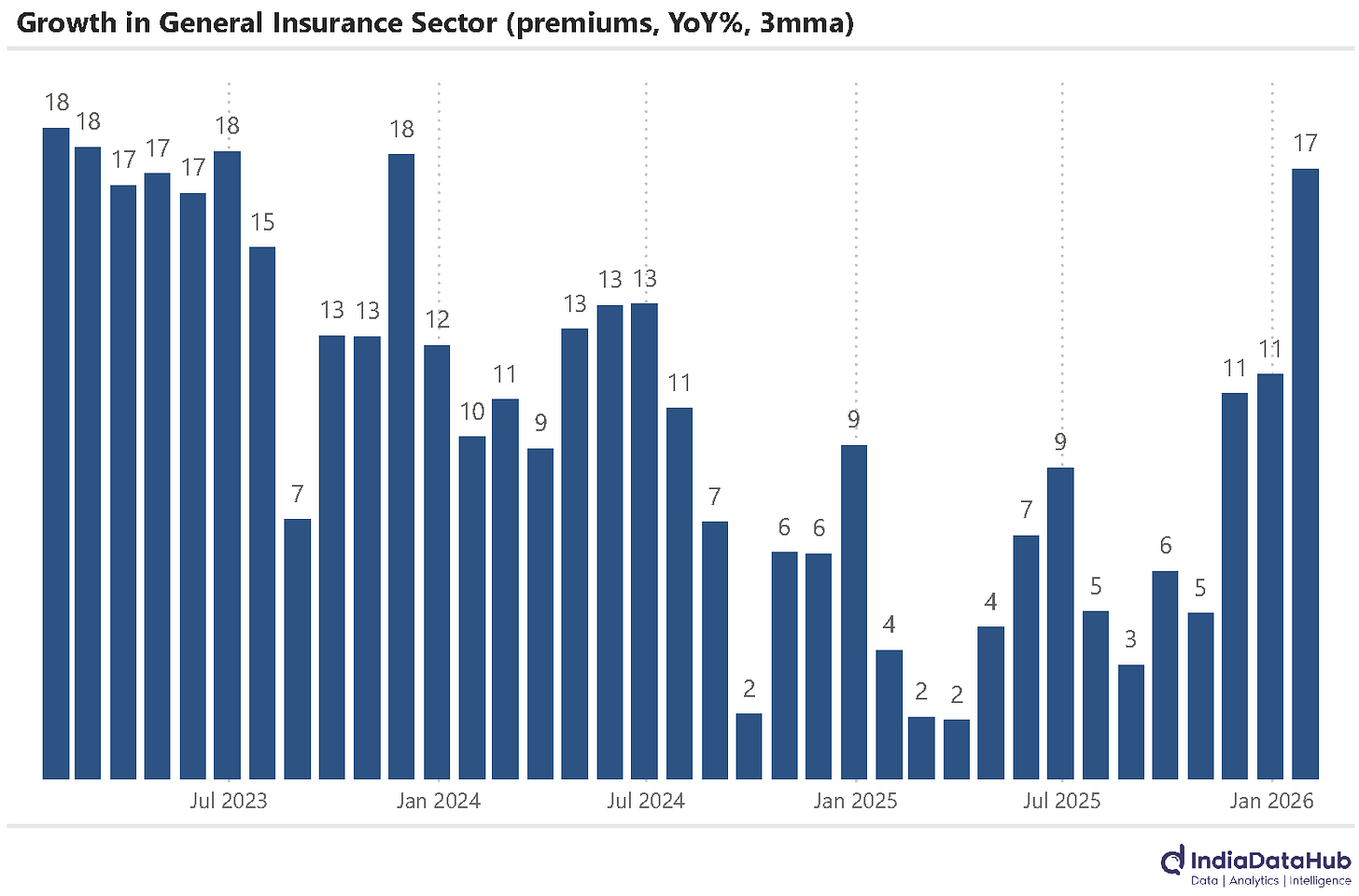

The general insurance sector is also seeing a pick-up in growth. Over the past three months, the total business of the general insurance companies has grown by 17% YoY, the strongest growth in over 2 years.

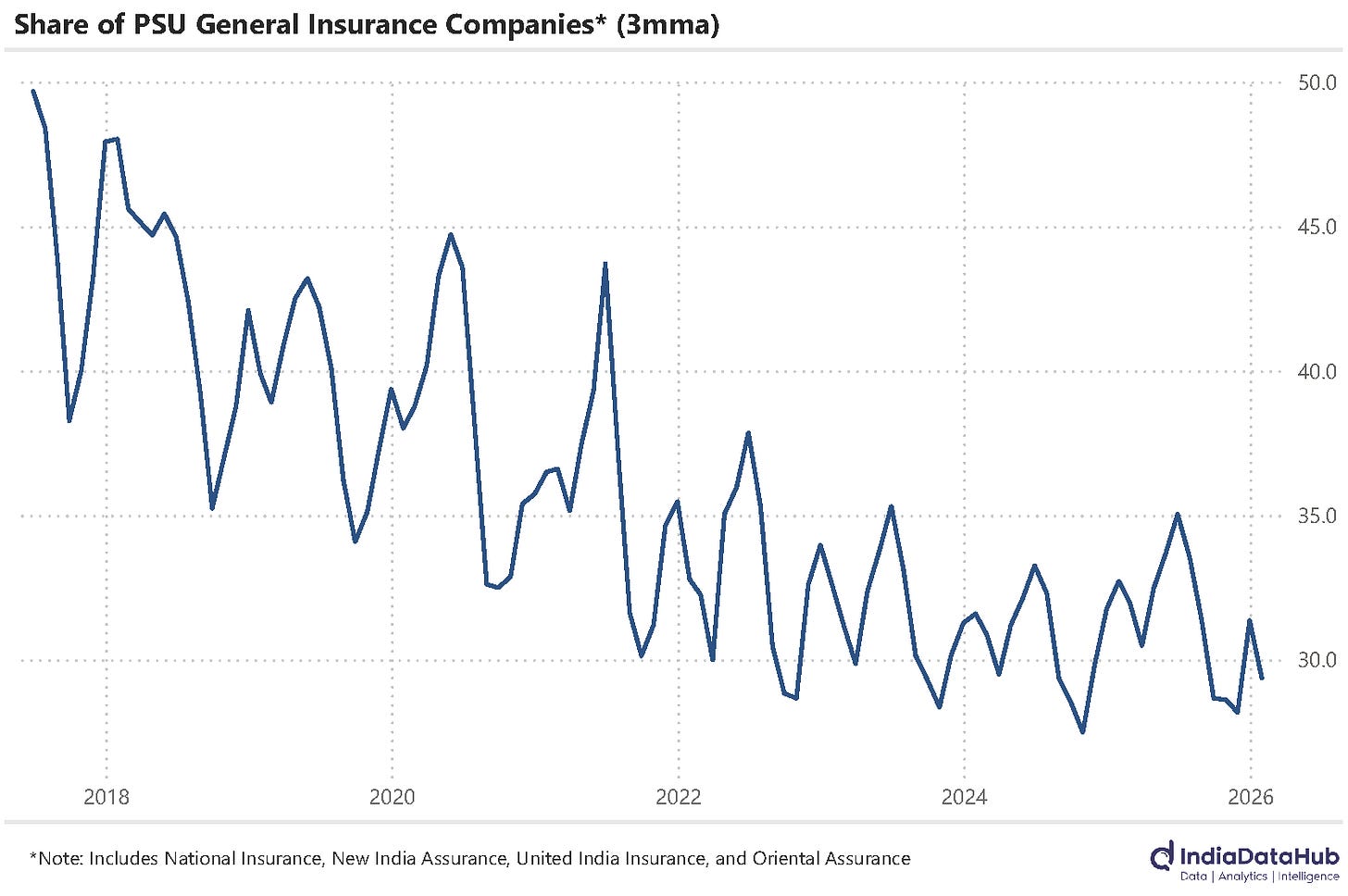

Among the larger companies, Bajaj, HDFC, Kotak, and SBI have seen a sharp pick up in growth. The erstwhile public sector general insurance companies continue to lose market share. Their market share has fallen from close to 50% in mid-2017 to less than 30% currently.

That’s it for this week. See you next week…