Onion surge, Weak Auto sales, strong Freight growth, China deflation and more...

This Week In Data #43

In this edition of This Week In Data, we cover:

The surge in Onion prices and its impact on CPI

Decline in Car and 2W sales in October

Double digit growth in port traffic and railway freight

Insurance sector back in positive growth

Negative CPI in China

Continued decline in China’s exports

In case you missed, we added weekly state borrowings auctions to the Bonds dashboard on IndiaDataHub. See this video for a quick walkthrough.We await the all-important CPI data on Monday. And it is going to be all about Onions. In terms of the CPI basket, Onions (0.64%) have a slightly higher weight in the CPI than tomatoes (0.57%). The all-India modal price of Onion which was averaging around Rs30/kg in early October is currently averaging Rs60/kg. On a YoY basis prices are currently up over 100% on a YoY basis. Even Tomato prices have doubled in the last few days. After having fallen sharply to Rs20/kg in most of October they have now increased to rs40/kg in the last few days. So both of these will flow through to the CPI.

However, the full impact of this increase will be felt not in October, the data for which gets released on Monday, but in November. In the case of Onions, for example, the YoY increase in prices in October was 46% as against a 36% increase in September. But if prices remain around the current level, then the YoY increase in prices for November will jump to 100%. So, while CPI will rise sequentially in October, the big worry will be for November if the current price trends are sustained in the case of Onions and Tomatoes.

Automobile (retail) sales were weak in October. Two-wheeler sales declined 12% YoY while Car sales declined 2% YoY. Tractor sales however grew 6% after having declined in September. This decline in 2W and Car sales though again reflects the shift in the timing of Diwali that we discussed last week. So, this decline in October should reverse through a big growth in November and we will then compare sales for the two months relative to the trend. As things stand now, there is not much to read into this decline in October. And the reverse of automobile sales has happened with Port traffic and Railway freight.

The cargo throughput of the major ports expanded 14% YoY in October. This is the highest growth in over a year. And the freight carried by the Railways grew 17% YoY in October, also the highest in over a year. This strong growth once again reflects the timing of the Diwali. The Diwali surge in supply chains happens a few weeks (so the month prior) to Diwali. And since Diwali was in October last year, the surge would have happened in September 2022. And this year it has happened in October since Diwali is in November. We should expect this to normalise next month through a decline as supply chains revert to steady state demand. So once again, not much to read into the strong growth in October.

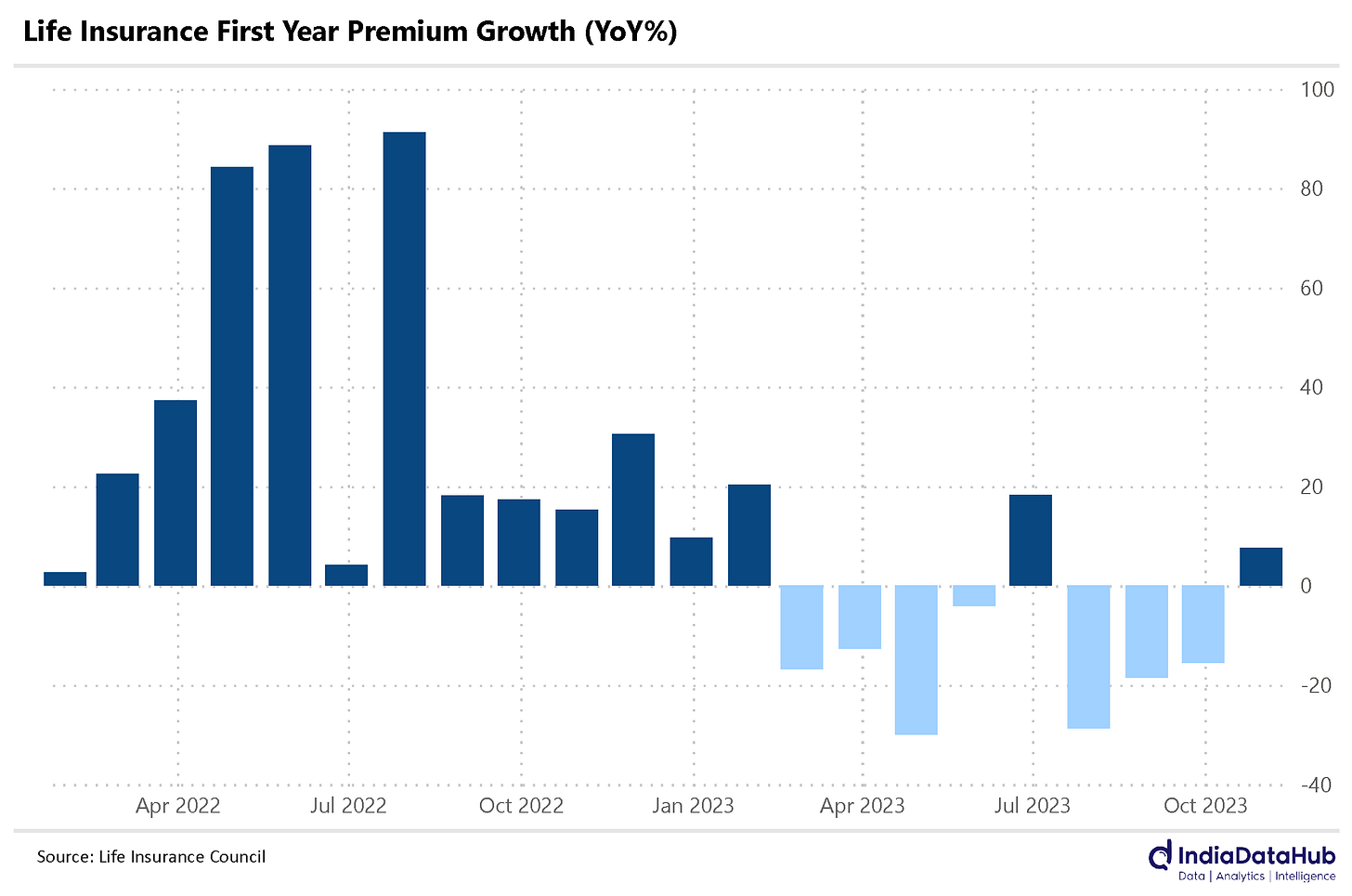

The life insurance sector grew in October after three consecutive months of decline. The first-year premiums grew 8% YoY in October. However, the growth was entirely due to private sector companies. First-year premiums for LIC declined in October for the 4th consecutive month (albeit by a modest 2%). And they have now declined in eight out of the ten months this year.

Most of this decline in the case of LIC was due to large declines in group business which had seen a big increase last year, especially around the IPO. However, October saw a decline in individual single premiums and first-year premium collections in Individual non-single premiums have moderated to low single digits in the last three months. LIC thus seems to be struggling a bit.

While we are worried about a spike in inflation due to Onion prices, China this week reported a 0.2% decline in their CPI (yup, deflation!). This is the second month in the last four that China has reported a decline in its CPI. And the Producer Price Index or the PPI which is a proxy of the costs that the manufacturing sector faces declined 6% YoY in October. This is the 12th consecutive month that the PPI has seen a decline. So, businesses are seeing benign costs and that being manifested as benign CPI does not come as a surprise.

China also reported its trade data for October. Exports declined 7% YoY in October while imports increased 3%. Exports have now declined for six consecutive months and the decline in exports in October comes on top of a decline in October last year. The decline in exports and an increase in imports meant that its trade surplus declined by over 25% to US$ 57.5bn. Between January and October this year, Chinese exports have decreased by 6% YoY while Imports have decreased by 6.5%. The trade surplus has declined by a modest 3% YoY totaling just under US$700bn (more than India’s annual merchandise exports!).

That’s it for this week! From the entire IndiaDataHub team here’s wishing you and your loved ones a very happy and prosperous Deepawali. See you on the other side in Samvat 2080…