Rains, Kharif sowing, Deteriorating US Jobs market and more...

This Week In Data #74

In this edition of This Week In Data, we discuss:

Status check on overall and regional distribution of monsoons

Kharif acreage is up so far driven by Pulses

Strong growth in services surplus keeping overall trade deficit in check

Deteriorating US Labour market

Bank of Japan raises rates while Bank of England cuts rates

Weak Euro Area GDP even as inflation ticks higher

We are halfway through the monsoon season and the rainfall picture has changed since we last did a rain check. July has seen above-average rainfall and thus the cumulative all-India rainfall since 1st June is now 4% above the long-term average. There is though significant inter-regional divergence with South India in general receiving more rain than North India.

Kerala is a key exception in South India where rains have been slightly below average while Rajasthan is the key exception in North India as it has seen above average rains. While Punjab, an important agricultural state has received almost 40% below normal rains, it is a well-irrigated state so this will not immediately result in a drastically lower agriculture output in that state. But East UP, Bihar, and Odisha which have seen below-normal rains, will see an impact on crop production. But half the season is still pending, and rains can improve. So fingers crossed…

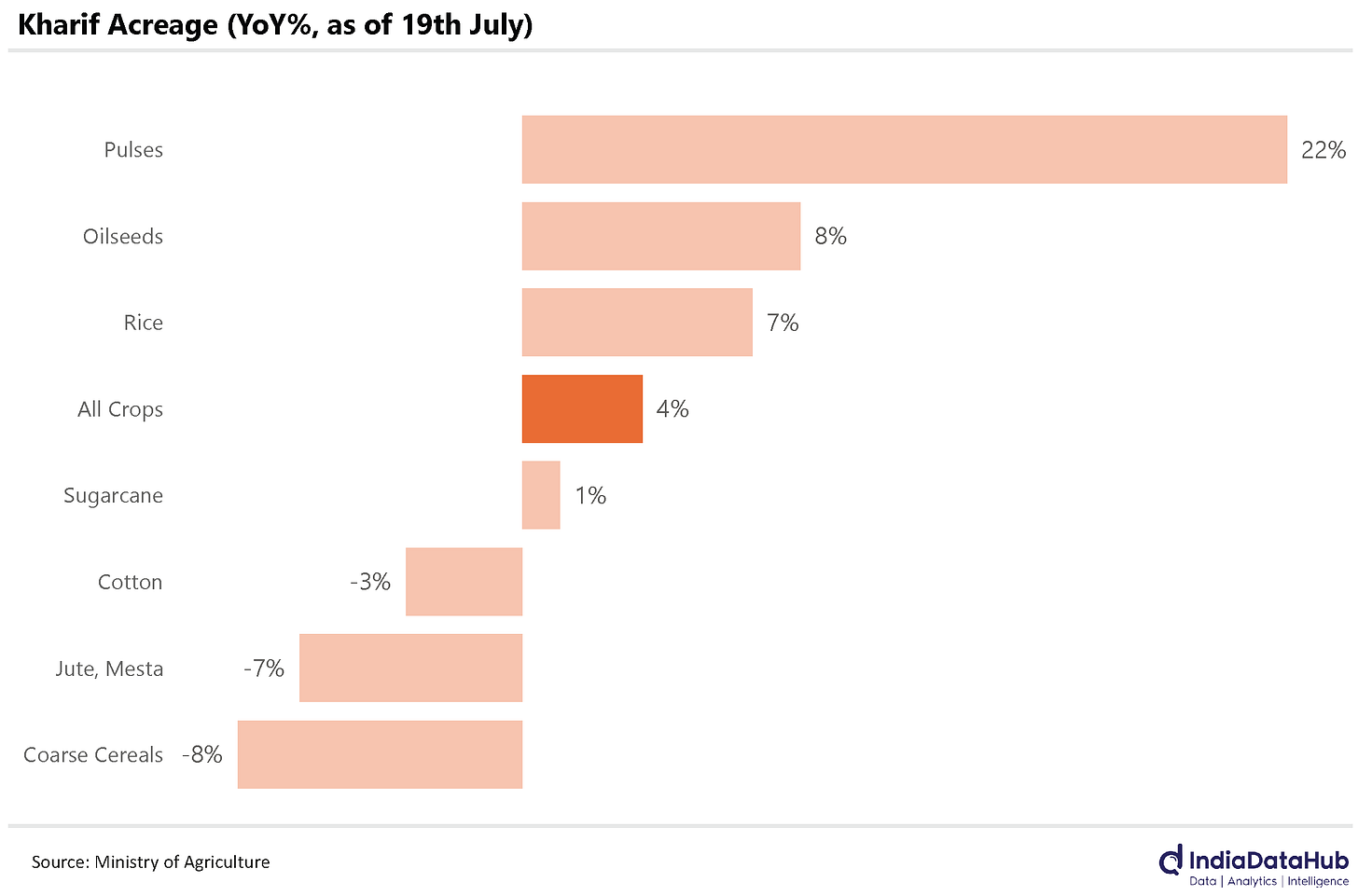

The Kharif sowing so far has been reasonably strong. Till 19th July, the latest we have the data for, overall Kharif sowing was up 3.5% YoY. Pulses have seen over 20% increase in acreage so far while Oilseeds and Rice have seen a high single-digit increase in acreage compared to last year. On the flipside, Coarse cereals, Jute and Cotton have seen a lower acreage so far compared with last year.

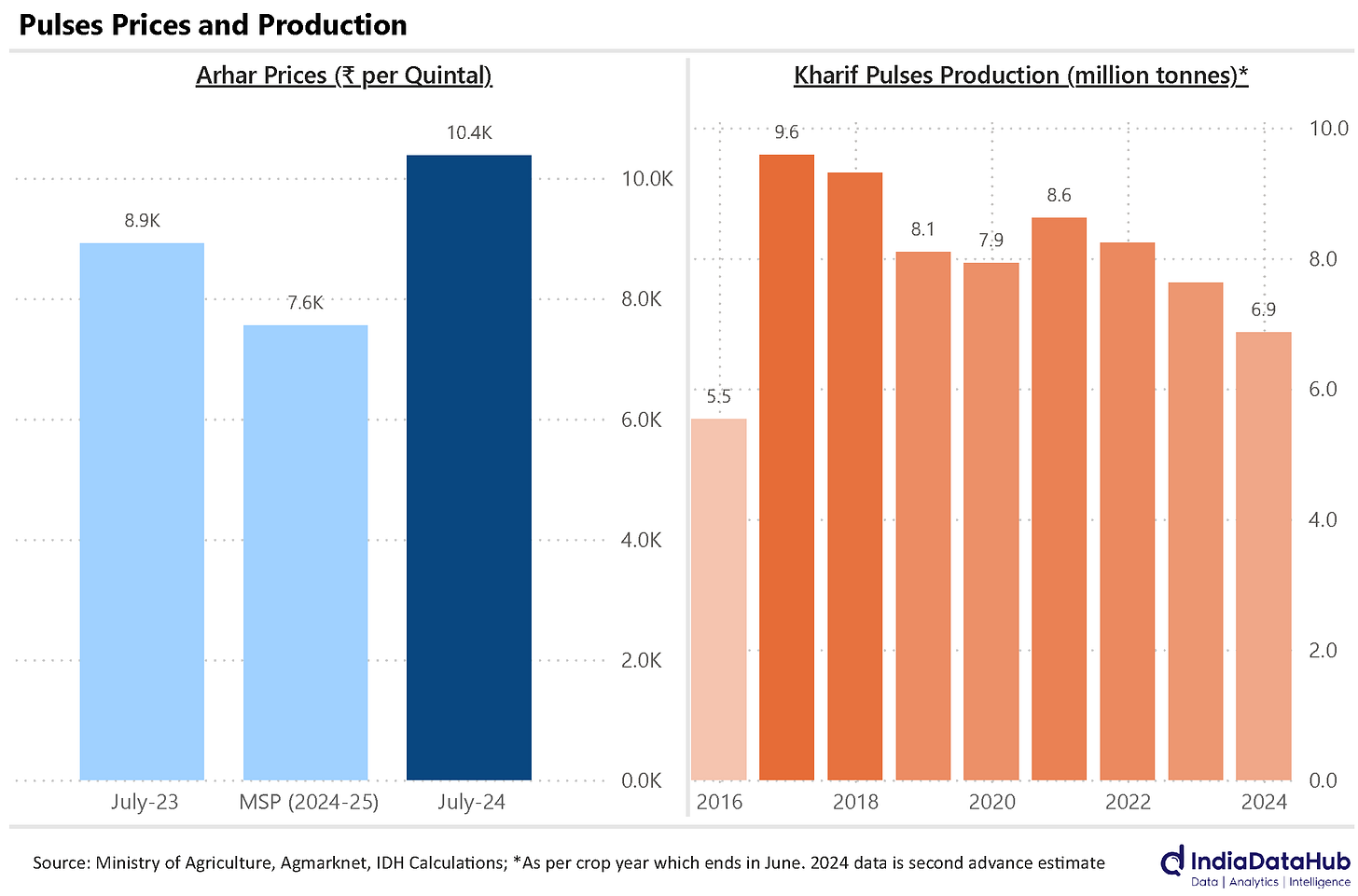

The increase in the acreage of Pulses is largely due to Arhar which is the biggest Kharif Pulses crop. Arhar has seen a 70% increase in acreage so far this season. And this is largely explained by the fact that the current market (Mandi) price of Arhar is 15% higher than last year and almost 33% above the MSP. And what is driving this increase in prices is lower production. Last year (crop year ending June 2024), the Kharif pulses output was estimated to have been the lowest in 8 years. So, it’s a case of demand and supply. When supply falls, prices rise ensuring that supply picks up.

Services trade slowed down sharply in June. Exports grew just 4% YoY, down from double-digit growth in the preceding two months. However, imports declined 4% YoY. The decline in imports however meant that services trade balance rose 13% in June, the third straight month of double-digit growth. What this has meant is that despite the deficit on goods trade having increased by 10% during the June quarter, the overall trade deficit is largely flat on a YoY basis at US$22bn for the quarter.

Now on to the Global events where there was a lot of action last week. Firstly, the US Non-Farm Payrolls data for July came sharply below market expectations. While the market was expecting an increase of 175k, the actual increase was only 114k. This is the second-lowest job growth since the start of the pandemic. Also, the data for the prior two months has seen a downward revision. The unemployment rate also ticked up to 4.3% in July, the highest since October 2021.

The Federal Reserve kept rates unchanged last week. But post this weaker labour market data, the markets now expect (a 100% probability of a rate cut and a 22% probability of 50bps rate cut!) a rate cut from the Fed in its next policy meet in mid-September. The rate cut by the Bank of England has already set the tone for policy easing – the BoE cut its policy rate, the Bank Rate, by 25bps to 5% in a split 5-4 vote.

That said, the Bank of Japan is at the other end of the spectrum. It raised its policy rate to 0.25% given that inflation has persisted above 2% for several quarters now. It also decided to cut back on the purchase of long-term government bonds (JGBs) to increase long-term interest rates. A multi-decade-long monetary experiment in Japan seems to be coming to an end…

Lastly, the Euro area flash GDP estimate for the June quarter was a modest 0.6% YoY growth. This is the 5th consecutive quarter of below 1 % real GDP growth. And July CPI ticked up 10bps 2.6% as per the flash estimate. With the Fed likely to cut rates next month, and with Euro area growth below 1% and inflation above 2.5%, the ECB faces a very unenviable task.

That’s it for this week. We will review the high-frequency data for July next week as well as do a status check on the quarterly earnings season in next week’s edition. And there is the RBI policy to review. So, a lot of action next week. But till then, enjoy the Olympics…