Rates, Debt flows, Recovering payments, Weak FDI and more...

This Week In Data #23

In this edition of This Week In Data, we discuss:

Rate hike by the Bank of England and prospects of further rate hike by the Fed

RBI’s intervention in FX market

Recovery in payments data in May

Weak start to FDI in FY24

Lagging Kharif acreage

This has generally been a relatively quiet week in terms of data with no major data releases. But we must talk about rates again this week. This will be the third consecutive week that we will discuss rates in this newsletter. First, it was the pause from the RBI two weeks ago, then the Fed pause and the 25bps rate hike from the ECB last week. And this week the Bank of England raised the policy rate by 50bps to 5%. This was higher than the market expectation of a 25bps hike. The hike follows UK CPI printing 8.7% YoY in May, unchanged from April. And markets are currently assigning an almost 75% probability for the Fed to hike rates by 25bps next month. So, global monetary tightening will continue, even as that in India has ended and thus rate differentials will narrow to unprecedented lows.

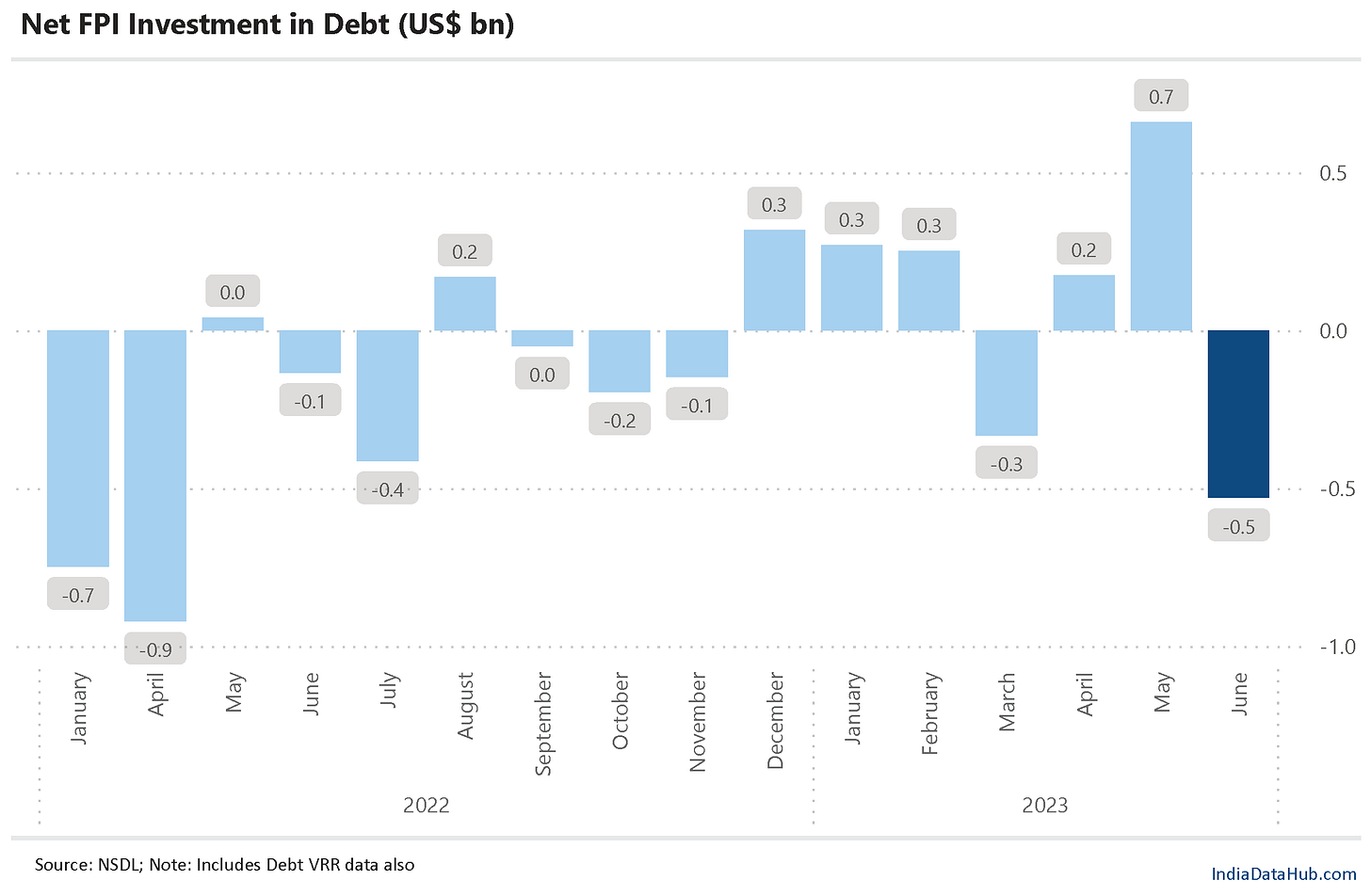

FPI investments in Debt have surprisingly been resilient so far in the face of this narrowing rate differential. YTD FPIs have been net buyers of Indian debt (albeit modest) although June has seen modest selling of US$0.5bn. What has helped is the significantly improved external balance which has stabilised the rupee. With rate differentials having narrowed as much as they have, (the stability of the) rupee is thus the key to retaining the FPI investments in debt (currently at just under US$50bn).

Speaking of exchange rate stability, the rupee is in a state of forced stability in a sense. Or at least that was the case in April when the RBI intervened in the FX market by buying almost 8bn worth of USD. This is the highest FX intervention in almost 2 years and but for this, the rupee will almost certainly have appreciated. As of mid-June, FX reserves have increased to almost US$600bn and are just US$45bn short of the all-time high.

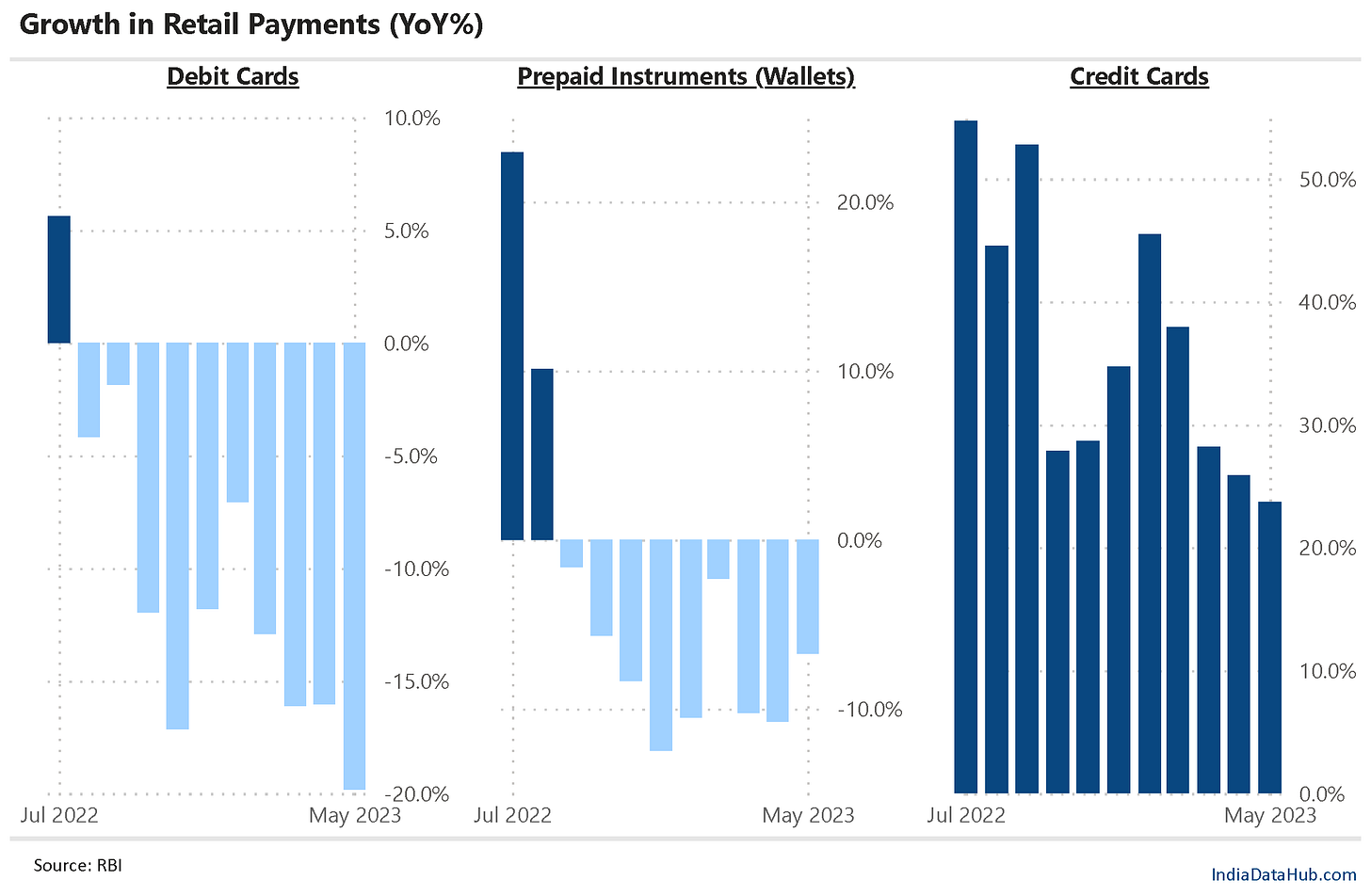

The RBI released the payments data, and it was broadly in sync with other high-frequency data that had suggested an uptick in activity in May after a weak April. Overall payments grew 17% YoY in May, significantly higher than the 10% growth in April. Retail payments (non-RTGS) grew over 20% YoY while B2B payments grew 15%.

The more interesting trend though is that prepaid payment instruments (of which mobile wallets are the key component) have seen a decline in payments on YoY basis for 9 consecutive months. And debit cards have seen a decline for 10 consecutive months. Credit cards seem to be the only consumer payment mode that cannot just survive but thrive in the UPI landscape – credit card payments have been growing at over 20% YoY for over 2 years now.

FY23 was a disappointing year for FDI, as we have highlighted a few times now. And FY24 has not got off to a good start either. Gross FDI in April declined 15% YoY. And repatriation of FDI was 40% higher and thus net FDI into India declined by over a third. FDI has declined on a YoY basis in 5 of the previous 6 months. While there is enough and more optimism over the long-term India growth story, it has as yet not translated into a surge in FDI. Maybe the PM’s US visit will change that in the next few months.

Lastly, Agriculture. Kharif acreage as of 23rd June is almost 5% lower than last year. This is not surprising given the late start to the monsoon - as of today, monsoon rainfall is 30% below normal with most regions seeing below-normal rainfall. These are still early days for sowing so not much to read into this except that if rains pick up, so will acreage. The real worry of a suboptimal monsoon is not so much of lower acreage, but it is of lower yields. And that is something which will be visible only around harvest time.

Thats it for this week. See you next week…