RBI Dividend, Weak FDI and some stranger things...

This Week In Data #64

In this edition of This Week In Data, we discuss:

RBI’s large dividend to the Government

Weak FDI into India

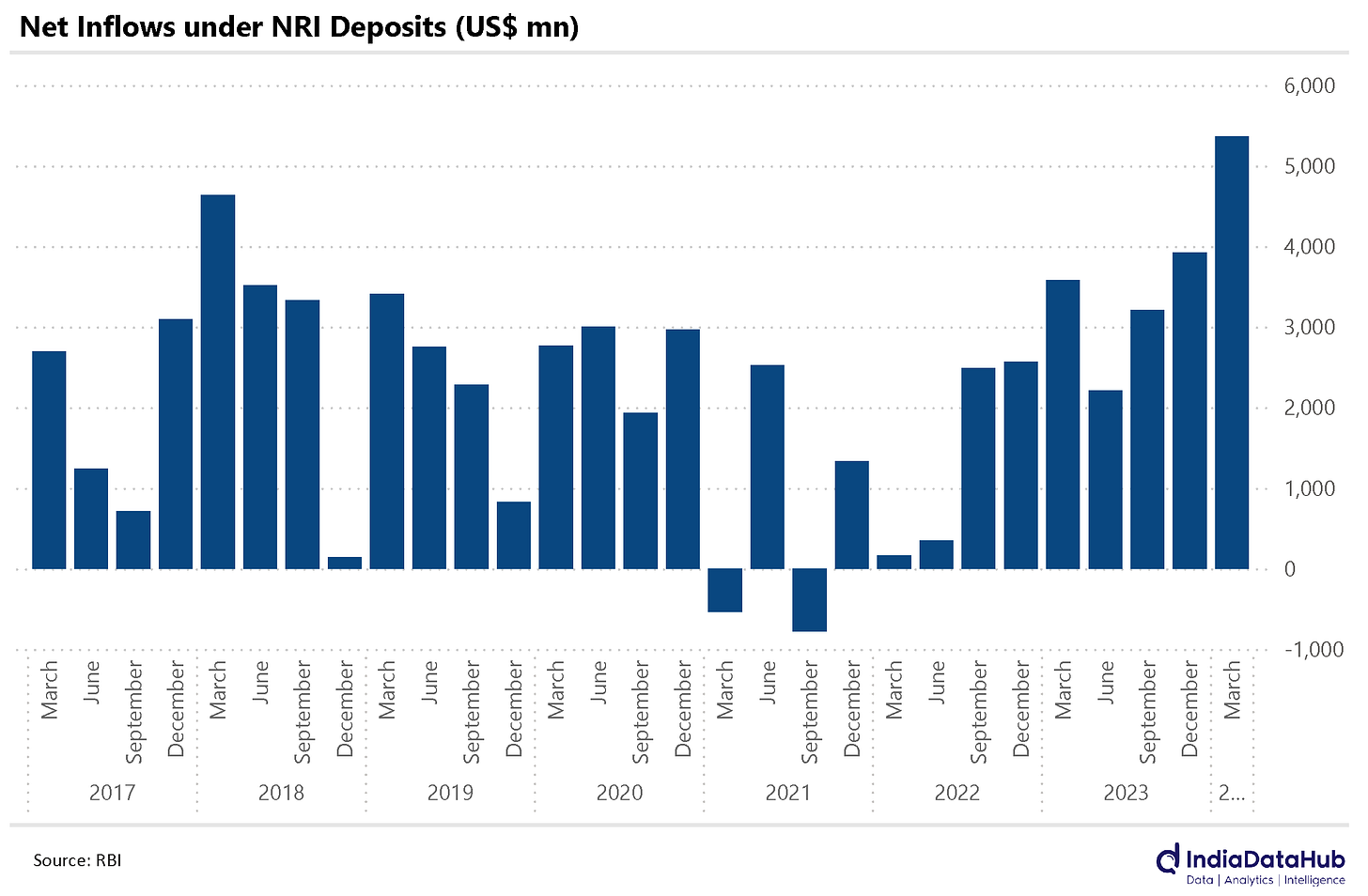

Pick up in inflows from NRI deposits

UK and Japan CPI

Turkish policy rate at 50%

A fairly light week in terms of data flow, but the big news of the week was the record dividend from the RBI to the Central Government. For the year FY24, the RBI will transfer ₹2100bn (~0.7% of GDP) as dividend to the Central government. This is more than 2x of the amount last year. Because the Government accounts are on a cash basis, this dividend will be accounted for during the current year.

While the RBI’s accounts for FY24 are not yet available, it is quite likely that a key source of increase in income was the changed liquidity scenario. For the past three years (FY21-23), domestic money markets were in surplus liquidity. Which meant that the RBI was absorbing liquidity or borrowing money from Banks. And that meant that the RBI was paying interest to banks. In FY24 however, for most of the year, the RBI was infusing liquidity into the money markets and thus RBI was lending money to banks and thus earning interest income. Another factor that would have contributed to higher earnings in FY24 was exchange fluctuations where RBI books income only on a realised basis (mark-to-market gains or losses don’t impact RBI’s P&L). In FY23, exchange gains was the biggest component of RBI’s income.

The higher dividend from the RBI will increase the Central government’s flexibility when the new government presents the budget in July. In the interim budget, the Central government had budgeted for a total dividend of ₹1000bn from Banks and other Financial Institutions (including RBI). The dividend from the RBI is thus substantially higher than the total dividends expected from all financial institutions and this additional money (~0.3% of GDP) will allow the government to either step up spending or cut back on the deficit, as it chooses.

While portfolio flows into India remain strong, India’s FDI woes continue. On a net basis, there was a net outflow of FDI of almost US$4bn in March. The big contributory factor was a sharp increase in outward FDI by Indian companies. In March alone, FDI by Indian companies (in overseas countries) totalled US$3.8bn, the highest monthly number since monthly data became available in 2011. For the full year FY24, outward FDI from India totalled almost US$16bn, up 15% from FY23, but down 10% compared to FY22. So, the increase in March does not, as yet suggest a new trend.

That said, the trend of increase in repatriation of existing FDI into India has also continued. In March alone just over US$6bn of existing FDI investments were repatriated back to source countries. And for the full year FY24, existing FDI worth US$44bn was repatriated back to source countries – an increase of almost 50% YoY and the highest ever. This meant that while the Gross FDI received by India was largely flat in FY24, the net FDI received by India (Gross FDI minus Repatriation of existing FDI minus Outward FDI by Indian businesses) was a modest US$10bn, down more than 60% YoY and the lowest in over a decade. The one unknown at this stage is how much of the slowdown in fresh FDI and the increase in repatriation is a reflection of the slowdown in PE/VC activity. We suspect that this is a material component of it.

On the flipside, Inflows under NRI Deposits have seen a strong uptick. In March alone, the net inflows totalled US$2.9bn, the highest monthly inflows since November 2013 (that was during the taper tantrum when RBI had sharply increased interest rates and had offered to cover the currency risk of banks). Inflows were strong during Jan and Feb as well and for the March quarter, the net inflows totalled US$5.4bn, the highest quarterly inflows since the June quarter of 2015.

On the Global side, the UK's Inflation edged down to a 33-month low of 2.4% in April, down 80bps from March. Goods inflation turned negative in April to 0.8% YoY, the first time since Feb'21. Inflation also moderated in Japan to 2.5% YoY in April from 2.7% in March. And while a decline in Inflation is positive, what stands out is that in April, CPI Inflation in Japan was higher than that in the UK. For long-term inflation trackers, that inflation in Japan would be higher than that in any other developed country is almost unthinkable. But there we are! And yet, the policy rate in the UK is 5.25% while that in Japan is close to 0%. So #StrangerThings…

And while we are talking of an inflation rate of between 2 and 3 per cent, Turkey saw CPI Inflation of ~70% YoY in April. And despite this, the Central Bank decided to keep the policy rate unchanged at (just) 50%, implying a real policy rate of just -20%. So once again, #StrangerThings…

That’s it for this week. Don’t miss the big sporting spectacle tomorrow. No, not the IPL Final. But the Monaco Grand Prix. It is going to be a cracker…