RBI Policy, Global Rates, Weak May data and more...

This Week In Data #66

In this edition of This Week In Data, we cover:

MPC Policy decision on Friday

Rate cut by ECB and Fed Rate cut probability

Continued strong labour data from US

Soft May data from India

Elections and implications for policy

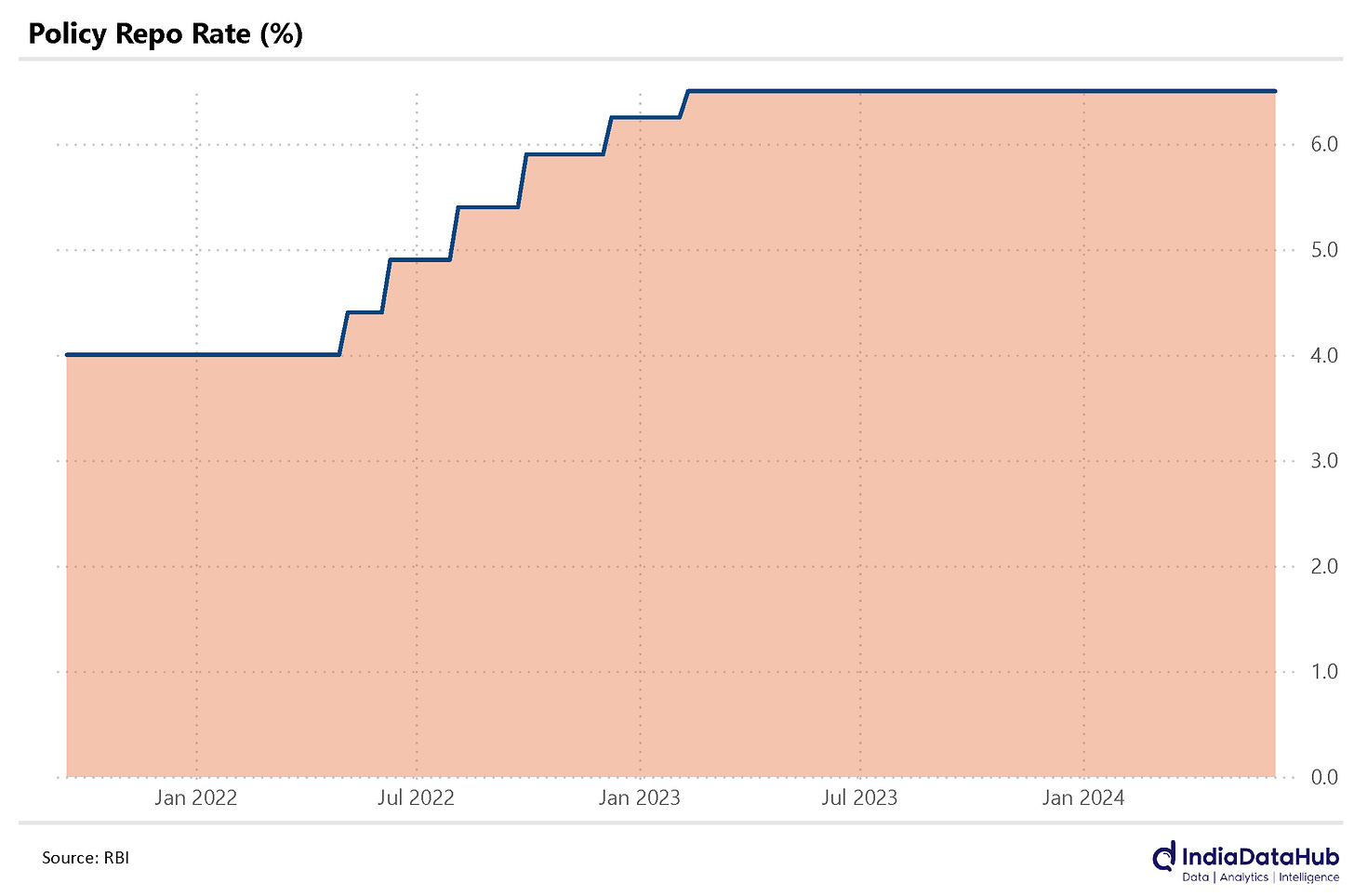

Lots to cover this week as well. Let’s start with interest rates. The Monetary Policy Committee (MPC) kept interest rates unchanged on Friday. So, the repo rate remains at 6.5%. And it has remained unchanged at 6.5% since February last year.

But things are changing internally within the MPC. In the MPC resolution last week, there were two dissentions. Two external members – Prof JR Varma and Dr Ashima Goyal wanted the repo rate to be cut by 25bps. In the previous few meetings, there was only 1 dissention – Prof JR Varma. But because the remaining 4 members wanted the repo rate to remain unchanged, they had the majority and so their view prevailed.

The decisions in the MPC are made through a majority and because there are 6 members, the Governor has the casting vote in case of a tie. So, for the MPC to reduce the policy rate, we need at least 2 more members to shift their views (or the Governor himself because he can break the tie through his casting vote). This change though does not look likely immediately in the next policy meeting. For they collectively remain confident about growth. Indeed, the MPC has revised upwards its GDP growth estimate for FY25 to 7.2% from 7% in April. So, the MPC will need to see some concerns about growth develop before it starts to cut interest rates.

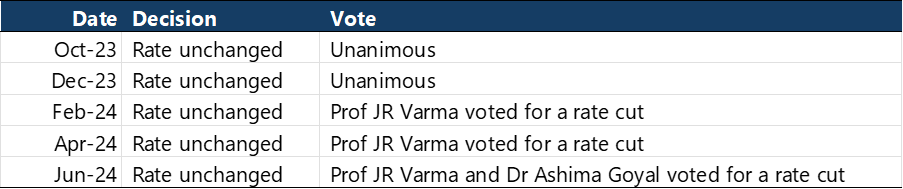

Globally, also the rate cycle is in a bit of a flux. The ECB cut its policy interest rate on Thursday by 25bps to 4.25%. ECB thus becomes the third major developed market central bank to cut rates this year – the Swiss Central Bank (the SNB) had cut its policy rate by 25bps earlier in March and the Bank of Canada cut the policy rate earlier this week. However, the US Fed is not expected to cut interest rates anytime soon. As of yesterday, the Fed Fund futures are implying a more than 90% probability of rates remaining unchanged in the Fed fund rates in July and only a 50% probability of a rate cut in September.

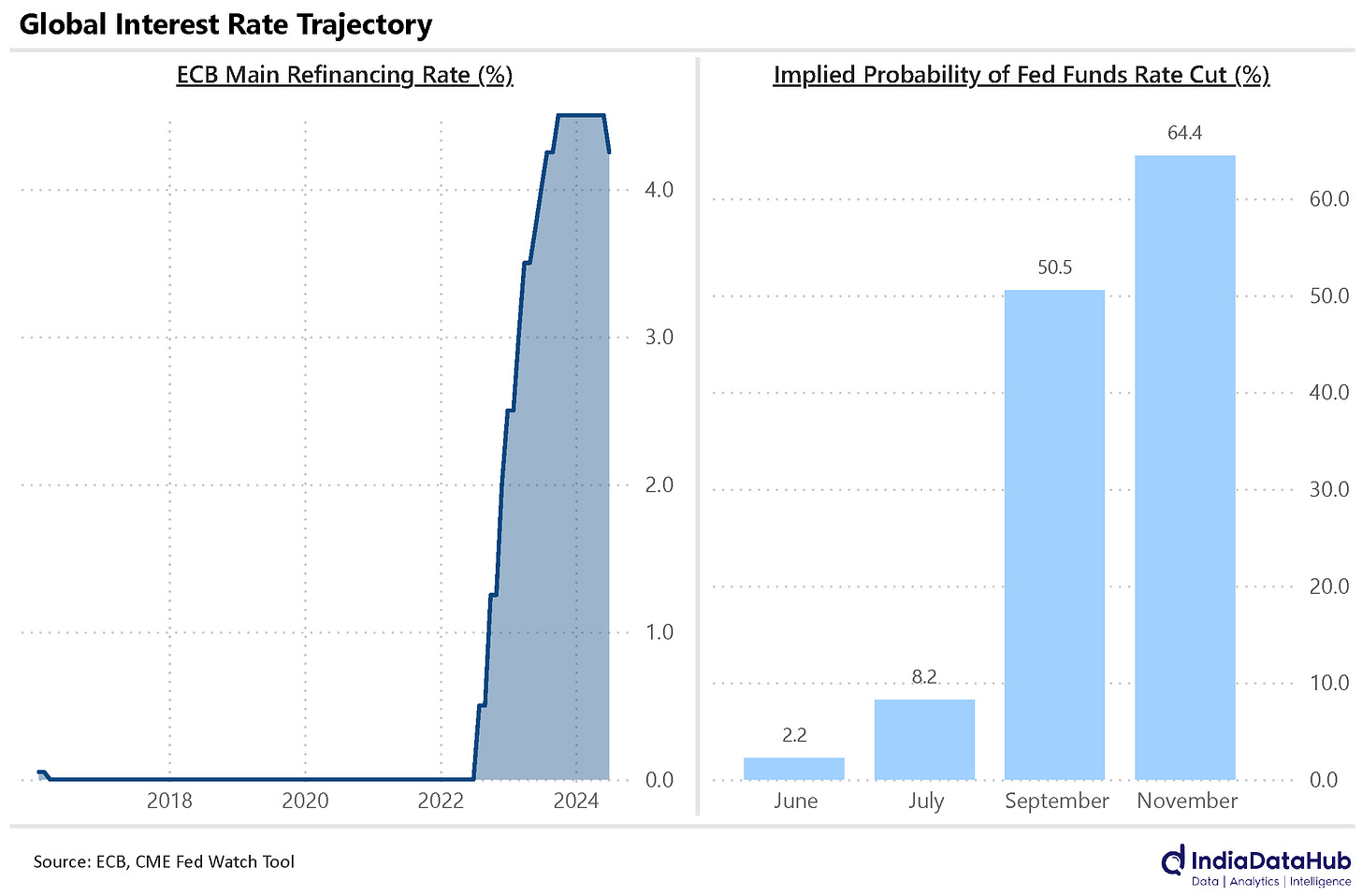

And one of the things weighing on the Fed is that the US labour market continues to remain fairly strong. The non-farm payroll data released on Friday exceeded expectations with a job gain of 272k in May as against a market expectation of just 182k.

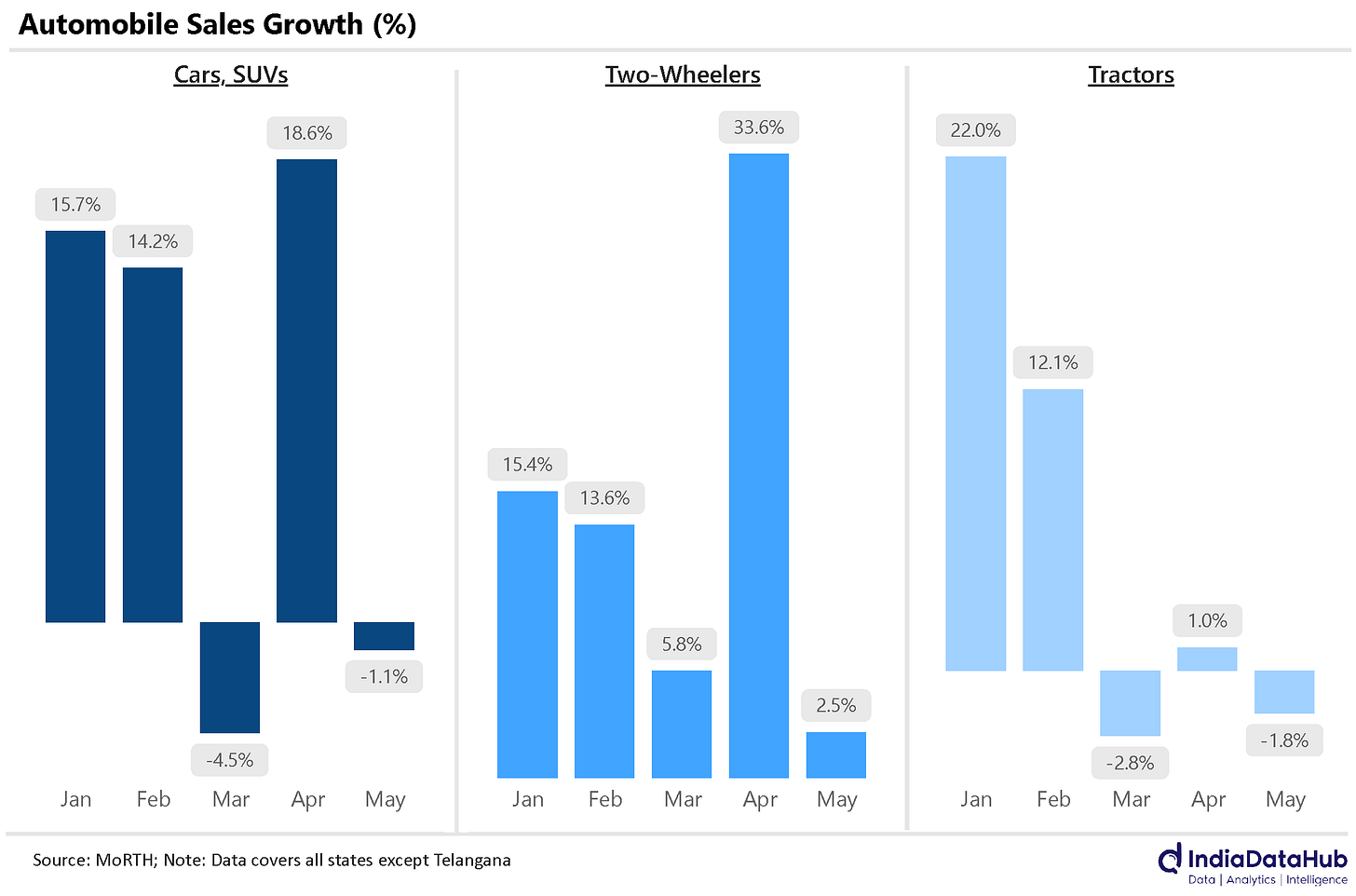

Ok back home. A flurry of high-frequency data as a new month starts. And in general, the data was soft. Car sales declined 1% YoY in May. Two-wheeler sales rose, but by a modest 2% YoY. Tractor sales also declined modestly. GST Collections grew by just under 11% YoY in May, but this was also a 4-month low.

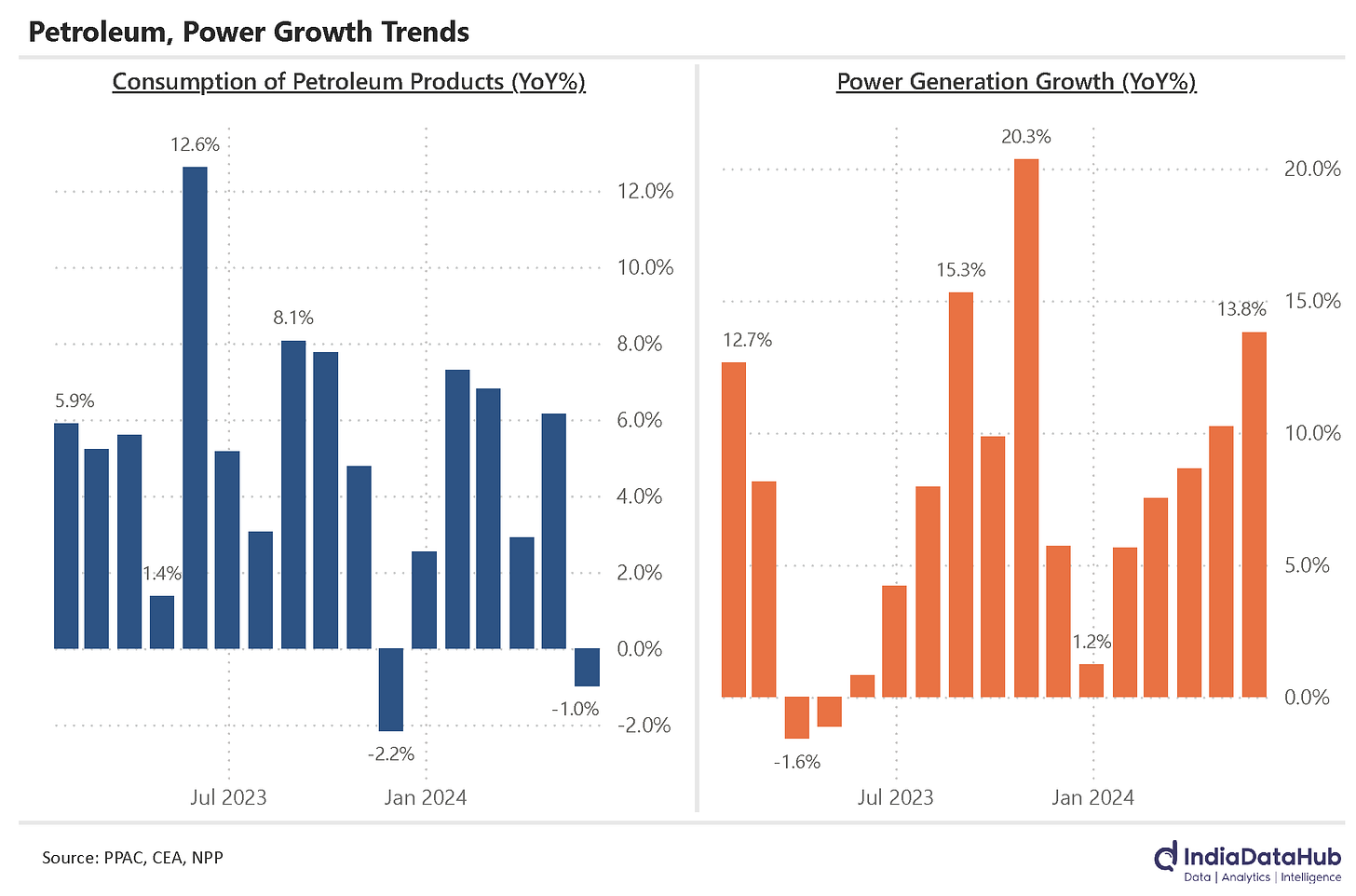

Consumption of petroleum products declined 1% YoY in May, the weakest growth since November last year when consumption had declined 2% but that was largely because of the Diwali timing effect. Outside of that, petroleum consumption had last declined in January 2022 in the middle of COVID-19. On the flipside, the only indicator that accelerated in May was power generation which grew by 14% YoY, the highest in the last few months. But a large part of this increase is likely attributable to the heatwave in large parts of the country that prevailed in May.

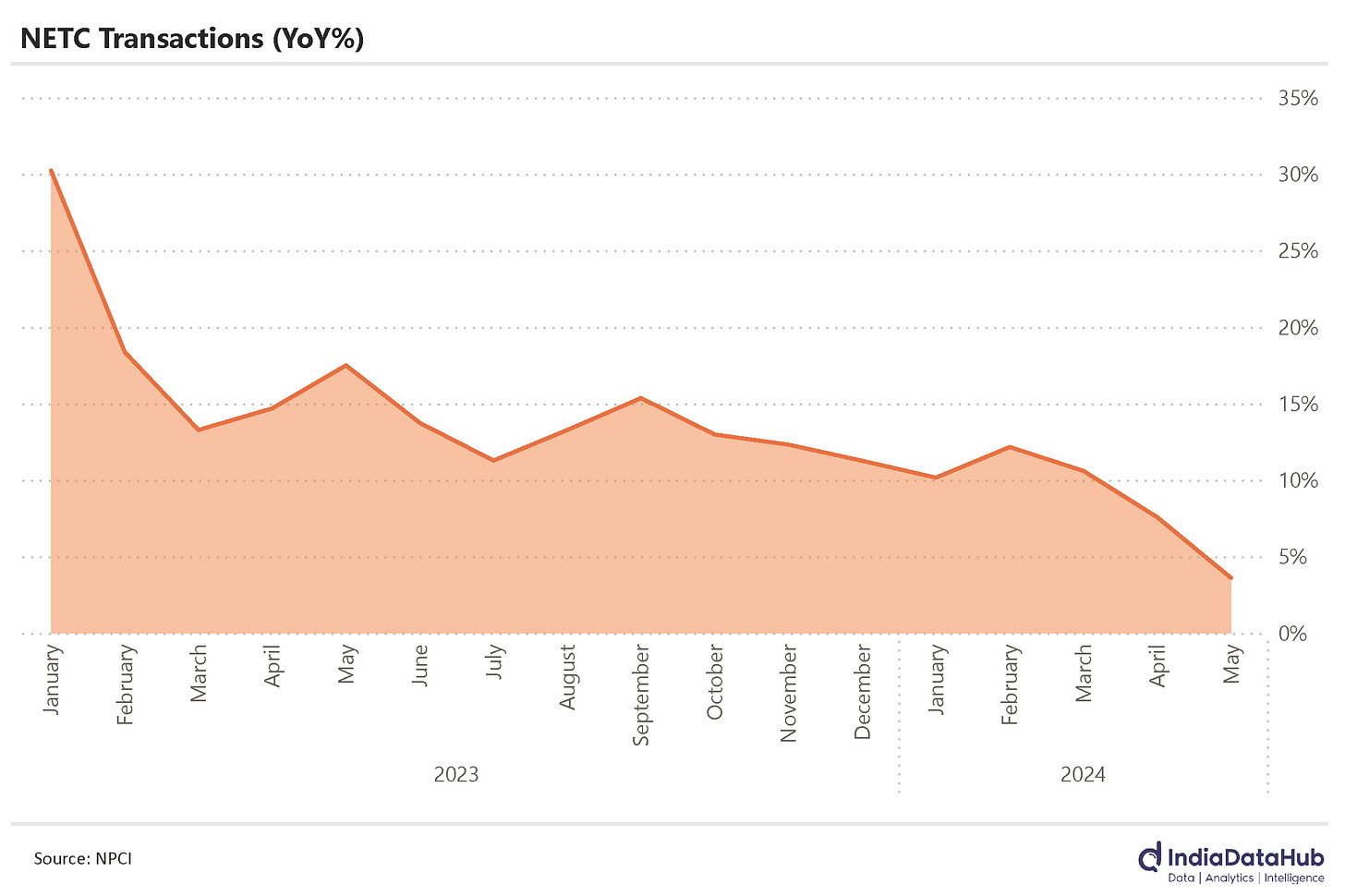

But perhaps the most worrying metric was the sharp slowdown in the number of ETC transactions (toll payments), which is a proxy for the movement of vehicles on the roads. In volume terms, May saw a growth of just 3.6% YoY, down from 7.5% growth in April and 10% growth during the March quarter.

It is possible that some of this softness in data could be attributable to the elections which were in full swing in May. In which case we should see data reverse in June and July. But if it does not, it will mark a shift in the economic cycle. So we shall see…

Lastly, the elections. Suffice it to say the results were surprising and different from what the market expected. It is tempting to conclude that the government will have to take a decisively populist turn and some of the structural reforms might have to take a backseat. But this might be too simplistic a conclusion. Much will depend on how the BJP interprets its lack of seats. The first tangible implication of the relatively fractured mandate on policy will be visible in the budget that the government will present in early July. The budget will in a sense lay out the agenda of what to expect from the government over the next 5 years. We shall see!

That’s it for this week. See you next week…