RBI Rates, Capex recovery, Slowing US Growth and more...

This Week In Data #111

In case you missed, we started publishing IndiaDataHub's proprietary yield curve data, the first in several analytical datasets we will roll out in the coming months. We began with yield curves for the Commercial Paper (CP) and the Certificate of Deposit (CD) market. The data is being published daily across multiple tenors with several years of history. You can read more about it from hereIn this edition of This Week In Data, we discuss:

RBI cuts interest rates, are further rate cuts likely?

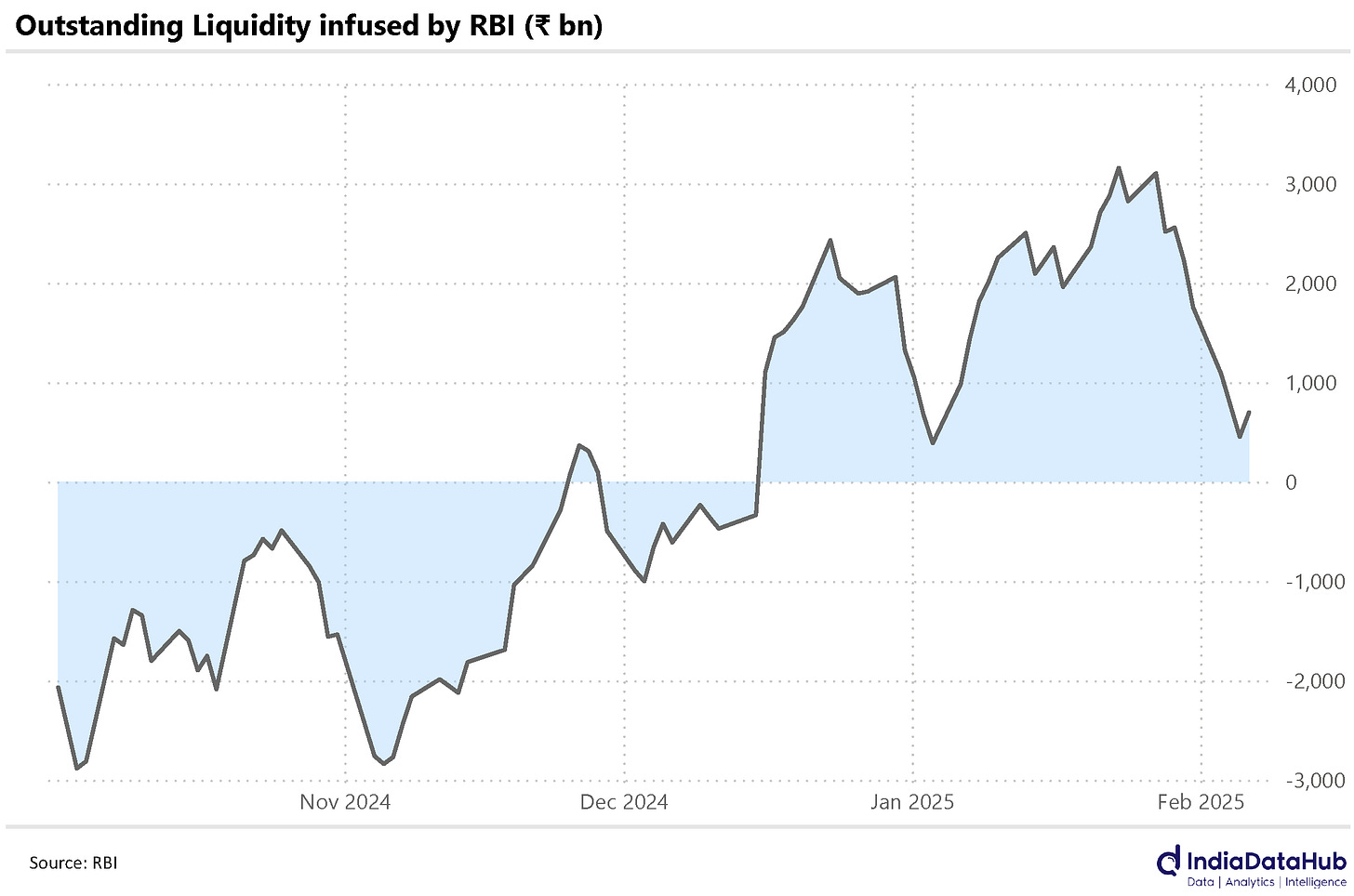

Liquidity situation has improved significantly

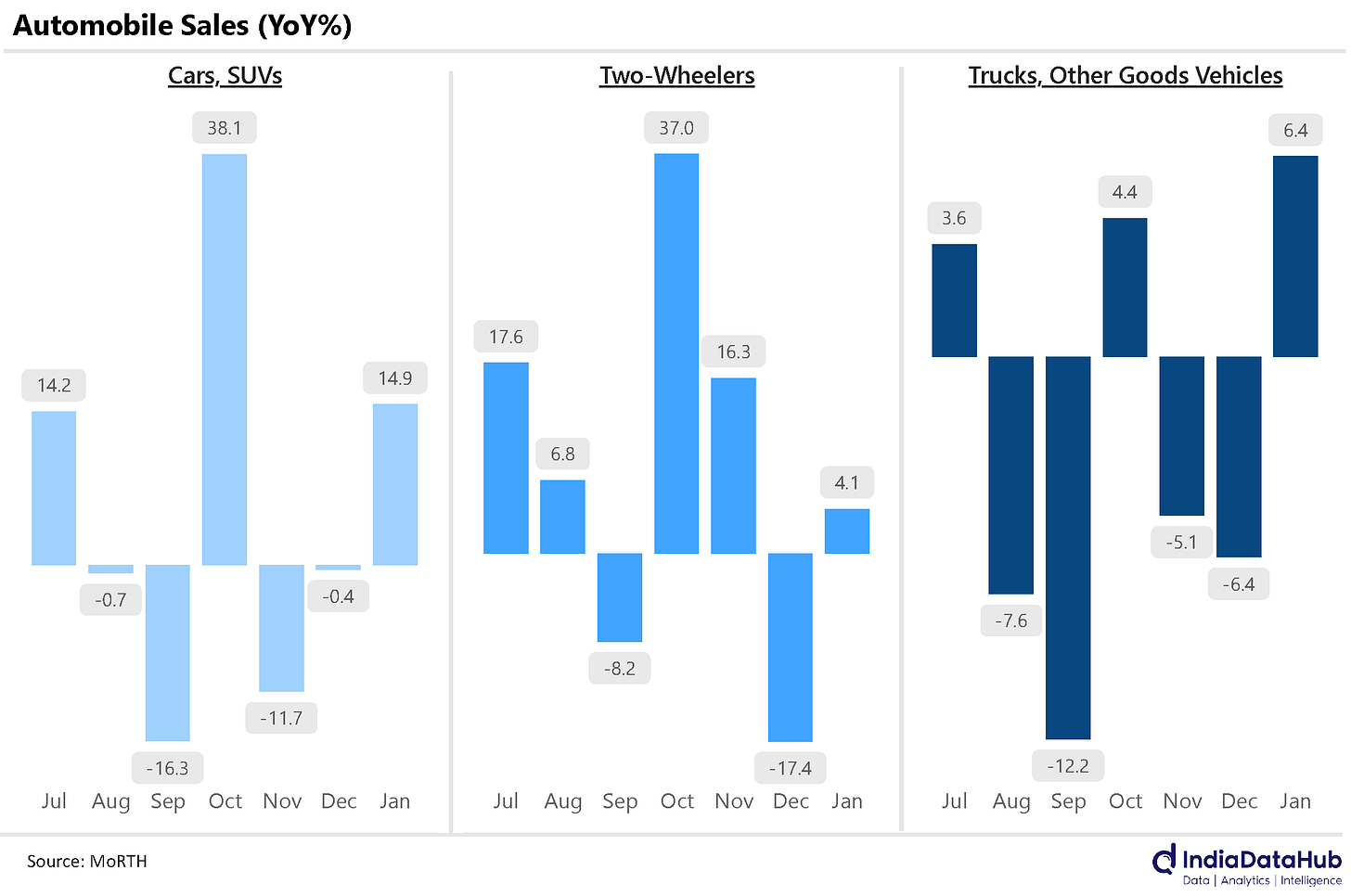

Automobile sales recovered in January

Energy consumption in January was mixed

Container throughput at the major ports is growing rapidly

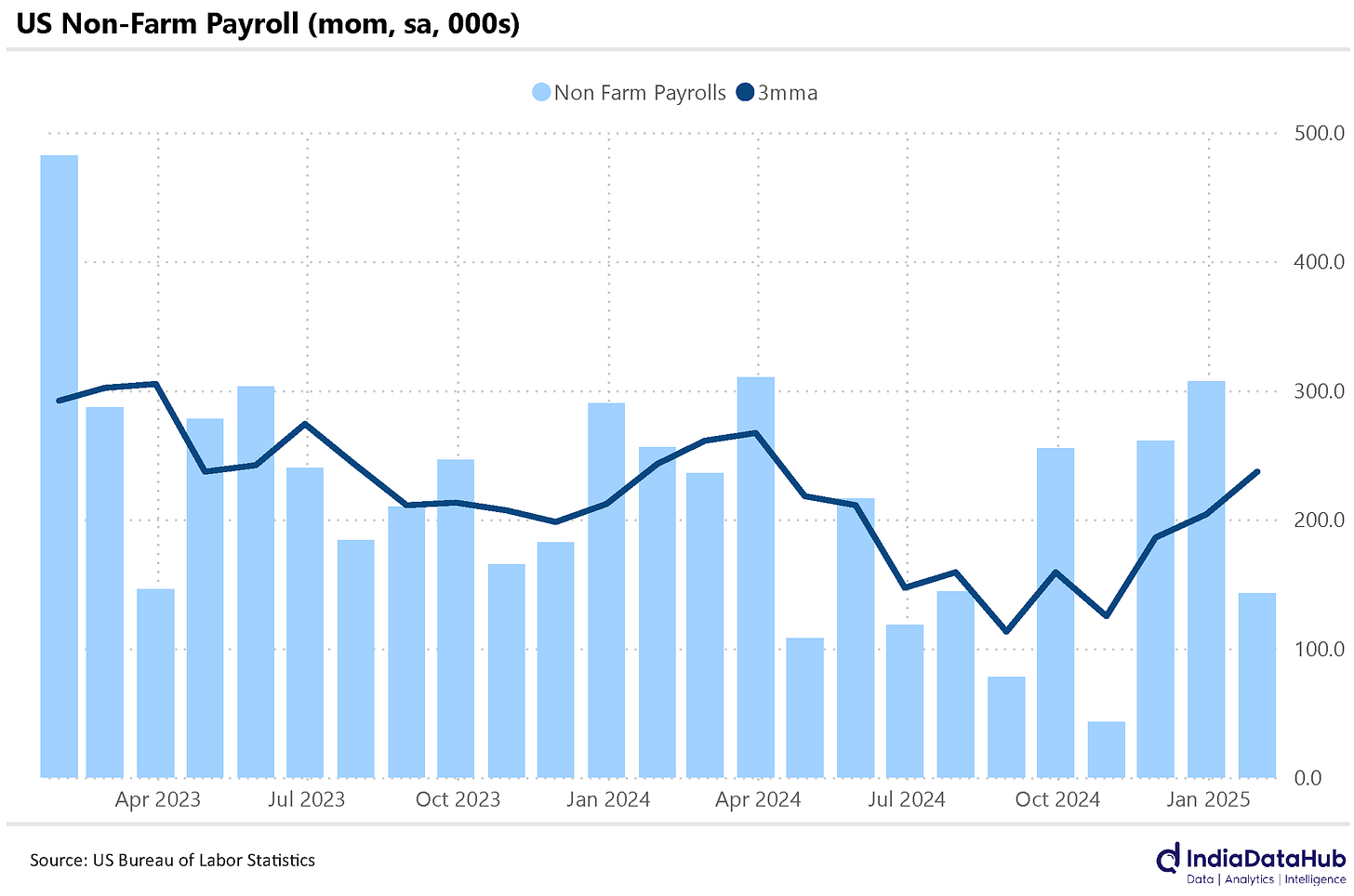

US labour market remains strong but growth is weaking

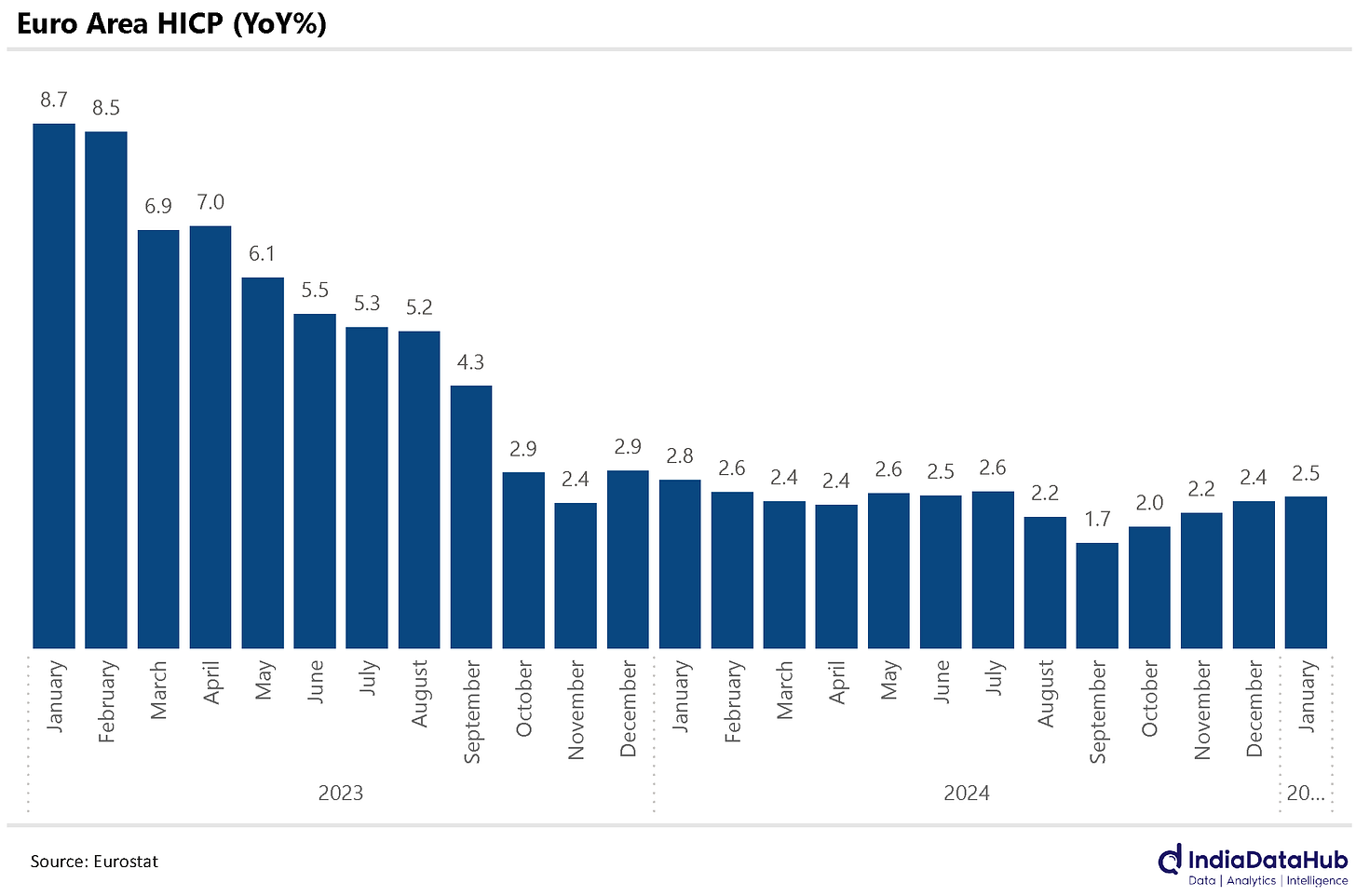

Inflation is rising in the Euro area complicating ECB’s job

A rate cut it is! February 2023 was the last time the RBI had changed rates (it had increased the repo rate by 25bps to 6.5% on 8th Feb 2023). So, after remaining unchanged for 2 years, interest rates are now headed down. This rate action was mostly along expected lines. Indeed, the commentary from the economists suggested that some of them were even expecting a 50bps rate hike, but the large consumption stimulus in the budget and the rising external risks probably prevented the rate to 25bps.

While it is logical to expect that there will be another 25bps rate cut in April (since a single 25bps rate cut does not move the needle in any meaningful way), the MPC does not want to commit to this. Hence the MPC is not suggesting that yesterday’s rate cut is the start of a rate-cutting cycle. And so the MPC has maintained its neutral stance which does not lock itself into either a loosening or tightening action for the next policy. This is principally because of the evolving external environment – which can on one side constrain growth or also spur inflation or even cause both, with large trade tariffs in the play. Much will depend on how the domestic growth data and the global environment evolve over the next couple of months.

The liquidity infusion by the RBI in the last couple of weeks has brought down the deficit sharply – from a peak of over ₹3 trillion in the last week of January to ~₹600bn in the last two days. While policy rate changes are in the domain of the MPC, the liquidity situation is entirely up to the RBI.

There were quite a few high-frequency data for January released this week and the data is generally mixed.

Firstly Automobile sales. As we discussed in our monthly Automobile Trends report January saw a broad-based recovery in sales. Sales of Buses and other passenger vehicles, surged by 30% YoY, while Cars & SUVs, and Construction vehicles, saw a 15% growth. Sales of Two-wheelers, Trucks, and other goods vehicles also saw an uptick. Tractors were the one exception where sales growth moderated to just 4% YoY after seeing over 20% growth in the preceding two months.

Consumption of petroleum products grew 3.1% YoY in January, slightly higher than the 2.3% growth in December. However, the growth in the consumption of LPG, Petrol as well as Diesel moderated. The growth in Power generation however moderated to a 3-month low of just 2.5% YoY in January. Cargo traffic at ports however grew 6.2% YoY in January, the fastest growth in five months. Container traffic grew in double digits for the second consecutive month suggesting strong throughput in manufactured goods.

Some signs of revival on the government capex. As we noted in our monthly report Fiscal Matters, the central government's capital expenditure is finally picking up. In the last two months, it has increased by over 70% YoY. However, a large part of this increase is due to higher loans (mostly capex loans to states). In the last two months, the Centre has given almost ₹550bn of loans, a 5x increase on a YoY basis. Actual capital outlay has thus increased by a much lower, but still strong 20% YoY.

The revised estimate for FY25 is for an 8% increase in capital outlay. Meeting this target would imply a 40% growth in capital outlay during the current quarter. This would be a strong push for growth if this were to get materialised. And State capital outlay also picked up growing over 20% in December. And given the increase in central capex loans to states, states have the resources to significantly step up capex during the current quarter. Combined, this would imply a significant boost to the economy.

On the Global side, we saw strong labour market data in the US. The US economy added 143k non-farm jobs in January and the job addition for the previous two months was revised upwards by 100k. Cumulatively, over the past three months, the US economy has added over 700k jobs, the highest in almost a year. And the unemployment rate has declined back to 4%. So the labour market in the US is not yet showing signs of any sustained slowdown.

However economic growth is slowdown down. As per the preliminary estimate from the Bureau of Labour Statistics, the US economy grew at an annual rate of 2.3% during the December quarter. This is significantly slower than the over 3% growth witnessed in the preceding two quarters and the second slowest growth in the last 10 quarters.

Finally, Eurozone inflation ticked up in January to 2.5% YoY from 2.4% in December as per the flash estimate by Eurostat. This is the highest point in the last six months. Slowing growth on one hand and rising inflation will complicate the ECB’s job.

That’s it for this week. See you next week…