RBI's pause, negative power generation, strong Auto sales and more...

This Week In Data #13

In this edition of This Week In Data we discuss

The RBI’s surprising pause

Decline in power generation in March

Weak but stable Railway freight growth

Decelerating Bank credit

Strong Automobile sales

So, the big news of this past week was what the RBI didn’t do. At its meeting this week, the monetary policy committee voted unanimously to keep the policy repo rate unchanged at 6.5%. And while some people had been expecting the RBI to pause, the market consensus was for a 25bps increase. We were also expecting a 25bps hike. The end of the rate tightening cycle, at least for now, is positive for markets. However, as we noted here, interest rates in the economy will continue to rise, perhaps another 100bps or thereabouts over the next few months. So as borrowers, we will see interest rates go up and as depositors benefit from higher deposit rates.

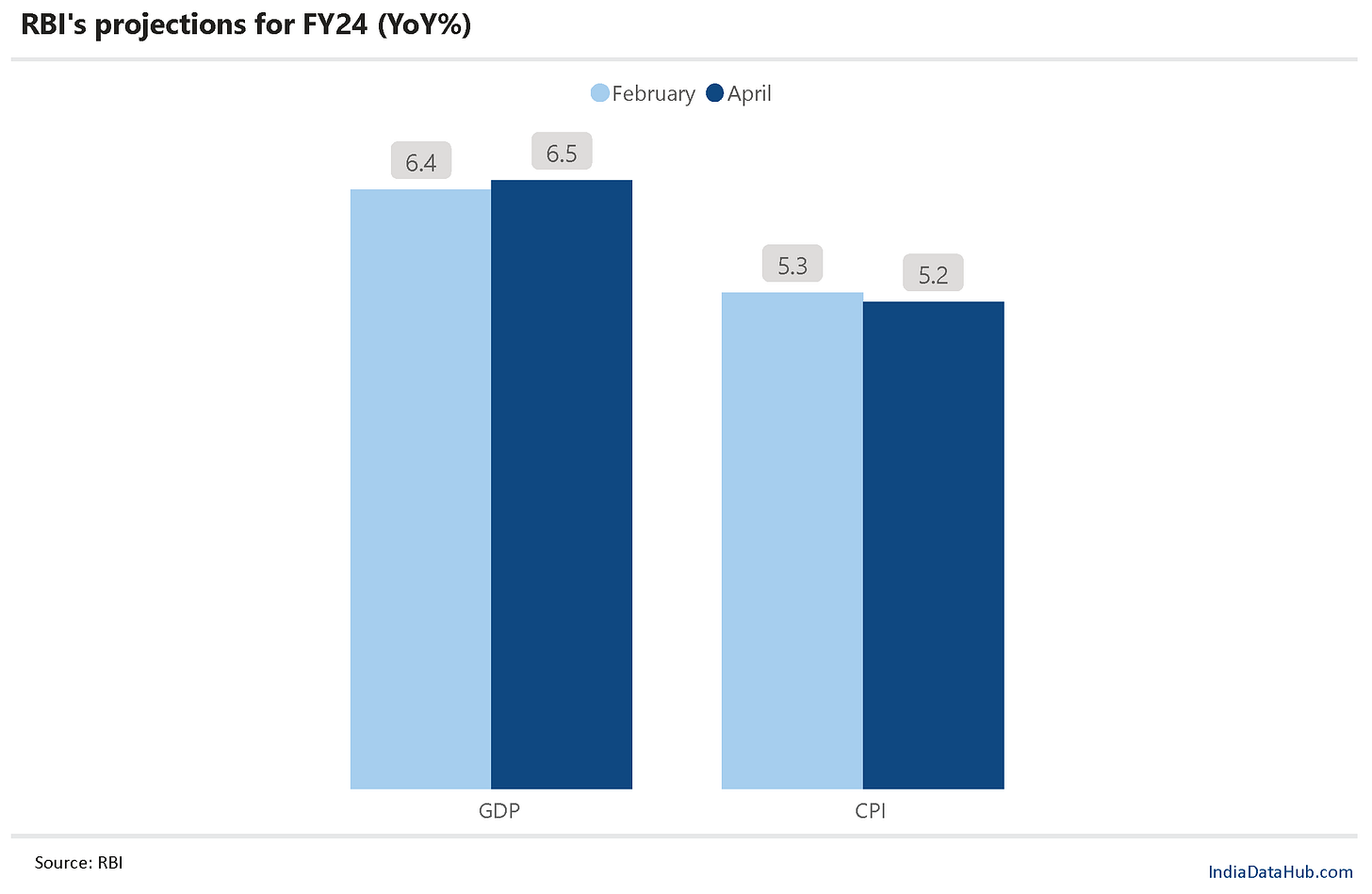

The curious thing about the MPC’s decision, or the lack of it, was that it was backed by basically no change in either inflation or GDP growth projections. For the record, the CPI projection for FY24 was revised downward by a modest 10bps and the GDP growth projection was revised upwards by an equally modest10bps. But basically, despite not seeing much change in either inflation or GDP growth between February to April, the MPC went from suggesting a further rate hike in February to no rate hike in April. Global factors – the mini-banking crisis and the consequent lower rate hike from the Fed – seem to have played a role in bringing the hawks on the MPC around to the doves.

Another implication of the RBI’s projections is that despite the 250bps hike in interest rates, the RBI does not see much of an impact on economic growth. Indeed, the RBI’s FY24 GDP growth estimate of 6.5% is 50bps higher than the consensus expectation which is for a 6% growth. A 6.5% growth in an environment of slow global growth or even a recession in major developed countries, would be a very positive outcome.

So let us turn our attention to growth. We got a few high-frequency growth data this week and they were not necessarily positive! Electricity generation declined ~1.5% YoY in March. The last time electricity generation was declining (outside of the pandemic period) was towards the end of 2019 when GDP growth was averaging ~3%. That said, the decline in power generation then was much higher than it was in March and as of now, it is just one month of decline.

Growth in railway freight continues to remain subdued but stable. It was grown in low single digits for 6 consecutive months now (Oct–Mar average growth of 3.4%), down from an average of 10% growth in the preceding 6-month period.

Bank credit growth remains healthy but is at the margin decelerating, albeit modestly. As of 24th March, bank credit grew 15% YoY, which barring the technicality of the last fortnight of December is the lowest since August last year. Some of this is due to lower inflation and thus lower working capital requirements and is thus not unduly worrying.

What remains healthy though is consumption. 2W sales grew in double digits in March, the third consecutive month of double-digit growth. Car sales grew 17% YoY in March, a three-month high. So as things stand now, core activity indicators seem to have decelerated in March even as consumption momentum seems to have remained robust.

Normally one would expect end demand to drive core activity indicators – so if consumption were to remain robust, core activity indicators like freight growth and power generation to tick up. But we do not have a lot of high-frequency consumption indicators so the core activity indicators in a sense become a proxy for end consumption. As of now, the data is not unduly perturbing. But we shall see…

That’s it for this week. Next week we will get the all-important CPI data for March. The last two months have seen CPI data trend up due to higher food inflation. The expectation is that this increase was temporary and inflation to moderate sharply in the next few months to ~5% from ~6.5% in February.