Record company registration, Data consumption plateaus, Cord cutting and more...

This Week In Data #122

In this edition of This Week In Data we discuss:

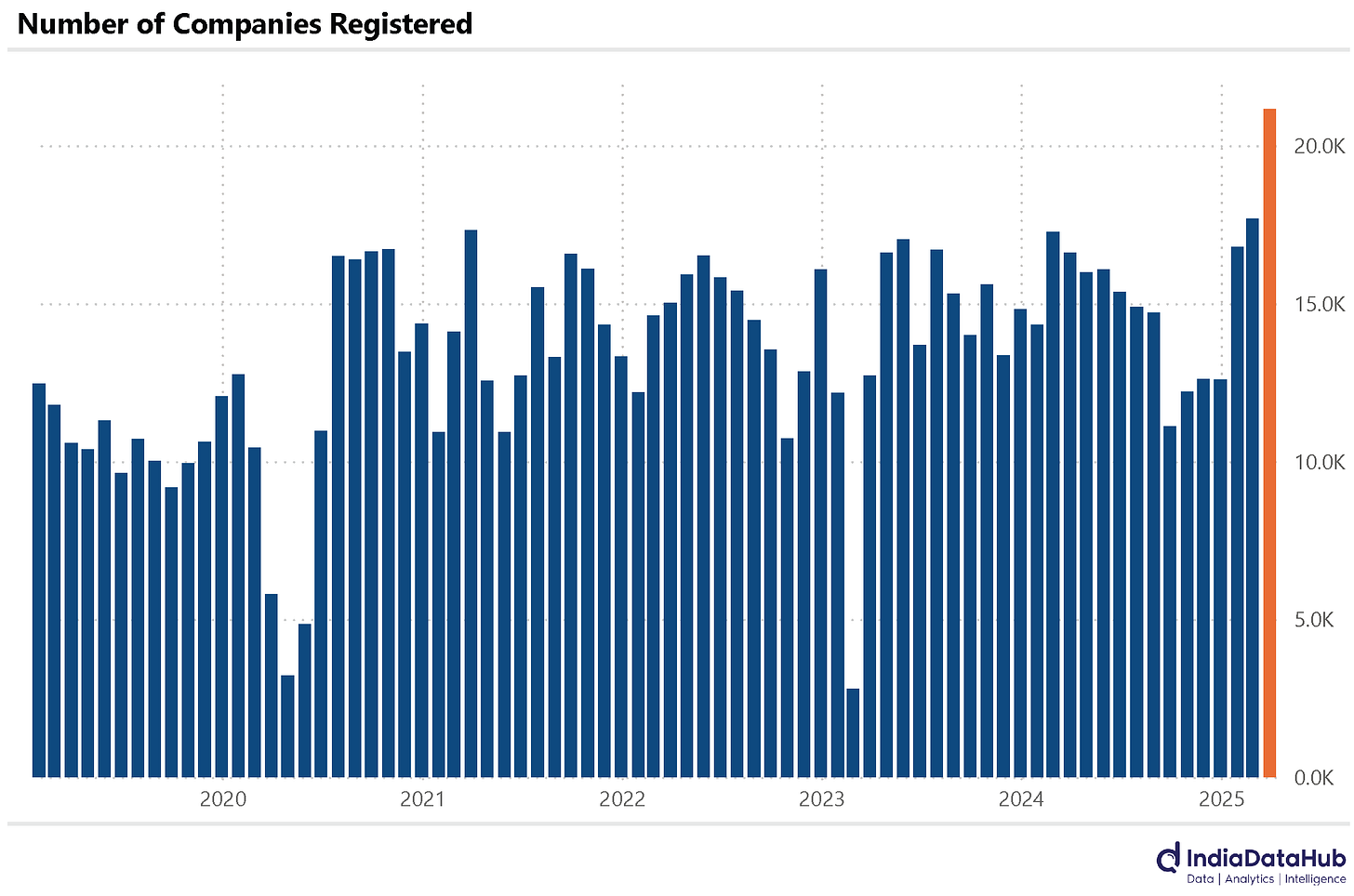

March saw record number of companies being registered

Share of services sector in company registrations is rising

Regionally, the erstwhile ‘BIMARU’ states are seeing strong growth in company registrations

Data consumption has plateaued in the last 2-3 quarters as has internet user base

Credit card payments saw a sharp uptick in March

POS terminals have doubled in the last 4 years

March was a record year for new company registrations. A total of 21,157 companies were registered in March, the highest ever. The previous highest was 17,679 companies being registered in a single month and that was in February this year itself. However, despite this, for the full year FY25, the total number of companies that got registered (~181k) was slightly lower (by ~2%) than in FY24.

Not surprisingly, the services sector sees the most number of new companies being registered. In FY25 over 70% of the companies were from the services sector. And the share of the services sector has only increased in recent years. In FY23 for instance, 65% of the companies were from the services sector and in FY20, 69% of the companies were from the services sector.

Regionally though there is a significant shift underway. A number of the (economically) smaller states have seen significant growth in corporatization in the last decade. Rajasthan for one has seen the number of companies being registered annually increase from just under 1700 in FY15 to over 7500 in FY25. Bihar and Madhya Pradesh have similarly seen strong growth in company registrations. Effectively most of the erstwhile so called ‘BIMARU’ states are seeing strong growth in new companies or formal enterprises.

Delhi and West Bengal have been the two big laggards during this period. Delhi is partly explained by the fact that it has grown at the periphery which technically extends to Haryana at one end and UP at the other. However, the decline of West Bengal reflects the general economic decline of the state.

Just for reference, in FY15, West Bengal saw almost as many companies being registered as Rajasthan, Bihar and MP put together. In FY25, these three states have seen more than twice as many companies registered as West Bengal. In fact, in the current year (FY26) Rajasthan itself will see more company registrations than West Bengal.

The other state that stands out and this is particularly notable in today’s backdrop is J&K. In FY15 it saw less than 200 companies being registered. In FY25 it saw almost 1400 companies being registered. And this is more than the number of companies registered in Himachal Pradesh. So, business activity has really picked up in J&K in the last few years.

The growth in wireless data consumption has stabilized at just over 55 billion GB per quarter in the last 3 quarters. Consequently, the YoY growth rate has fallen from 25% at the start of 2024 to the mid-teens towards the end of 2024. In part, this reflects that the growth in the wireless internet user base has also stabilized in the last few quarters at just under 930 million users. In part, this also reflects that the cost of mobile data is now increasing. The December quarter was the second consecutive quarter when the cost of wireless data increased sequentially (~12% cumulative increase in 2HCY2024).

Cord cutting has continued in 2024 and in fact accelerated. The number of DTH subscribers as well as the subscriber base of the large Cable TV operators both declined in 2024, the 4th consecutive year of decline. Since 2020, the subscriber base of DTH operators has declined by 18% and for the large cable operators by 17%.

Lastly, in another sign that March was a strong month for consumption, credit card spending grew 22% YoY, the highest growth since September last year. Payments through wallets and other prepaid instruments which had been declining for several months also saw strong growth in March growing 18% YoY. UPI also saw an uptick in growth in March after a weak February. But unlike credit cards or wallets, the growth in March was lower than during December or January.

And the growth in the POS terminal base continues to accelerate. March saw 25% YoY growth in the number of POS terminals, 2x the growth 6 months back.

That’s it for this week. See you next week.

We wrote an article that addressed this issue in a different light. Great read!

https://open.substack.com/pub/lionwithinyou/p/39-protecting-economic-opportunity?utm_source=share&utm_medium=android&r=316u5j