Record FX Intervention, Rock and a hard place, Inflation and more...

This Week In Data #108

In this edition of This Week In Data, we discuss:

RBI’s record FX intervention

Continued large FPI outflows

Declining FX reserves

Tightening domestic liquidity

CPI Inflation

RBI sold a record US$20bn on a net basis from its reserves in November. This is the highest ever. This is on top of a US$9bn net sale in October. This is also the highest intervention over two months ever. And by a wide margin.

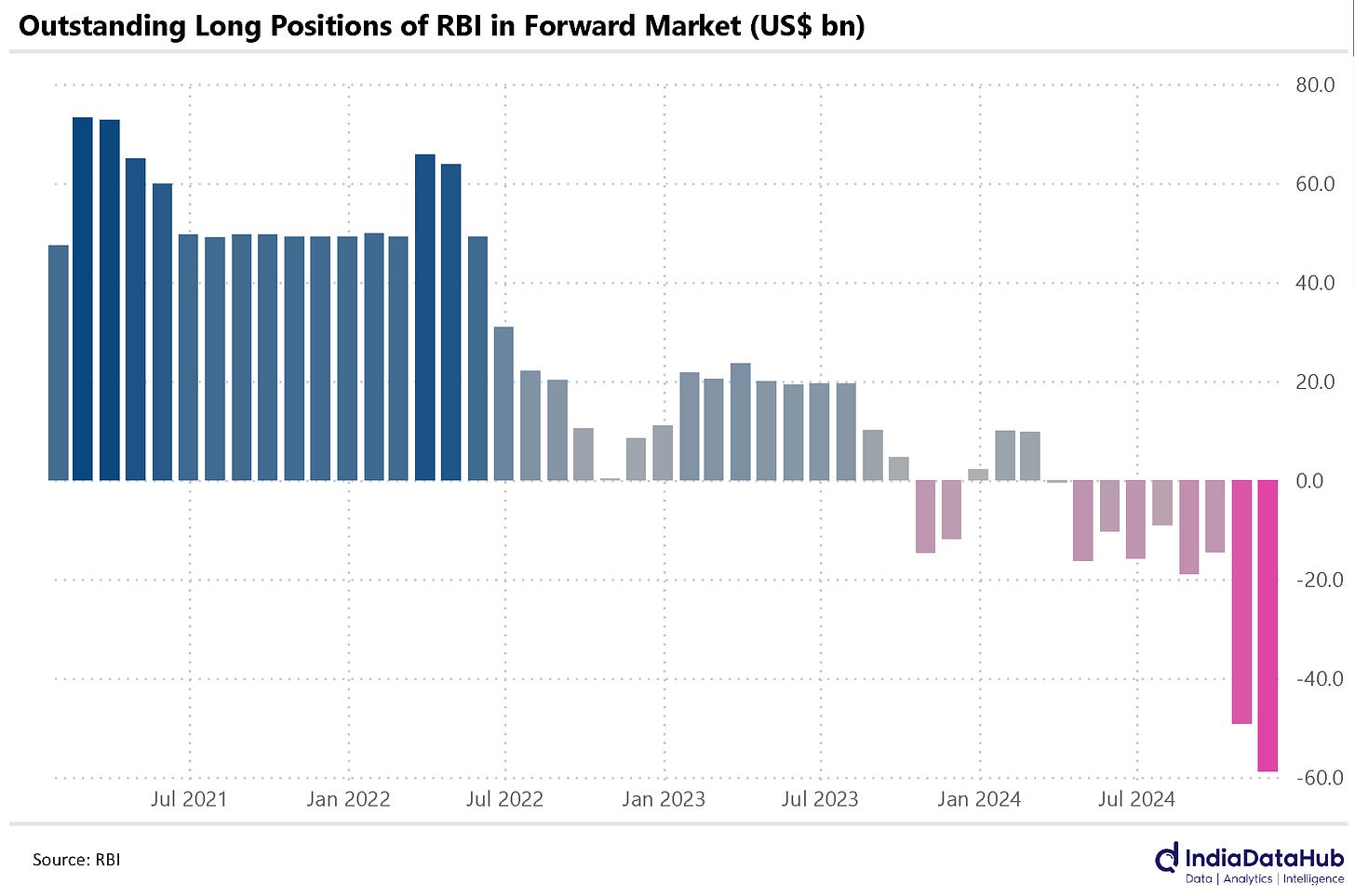

During this period the RBI has also increased its short position in the FX forwards by almost US$45bn. The RBI is supplementing its intervention in the cash market (where it is supplying dollars in the spot market) by supplying dollars in the forward market as well. And at almost US$60bn, the RBI’s FX short position is also the highest ever. Most of the short forward position is at the short-end (less than 1-month maturity) which means the RBI would have most likely rolled them over in December or closed it through a much higher intervention in the spot market.

And this intervention is likely to have continued not just in December but also in January. FX Reserves declined by another US$9bn during the week ending 10th January to US$626bn. FX Reserves are now broadly at the same level as at the start of 2024.

It is a bad idea for countries that run chronic current account deficits, are dependent on volatile portfolio flows to try to have a de facto currency peg. And we are finding that out now. Figuratively speaking, the RBI is now caught between a rock and a hard place. Arvind Subramaniam, Josh Felman and Abhishek Anand have a nice piece in BS about the situation the RBI now finds itself in. While the article is paywalled, here is Josh Felman talking about it on X.

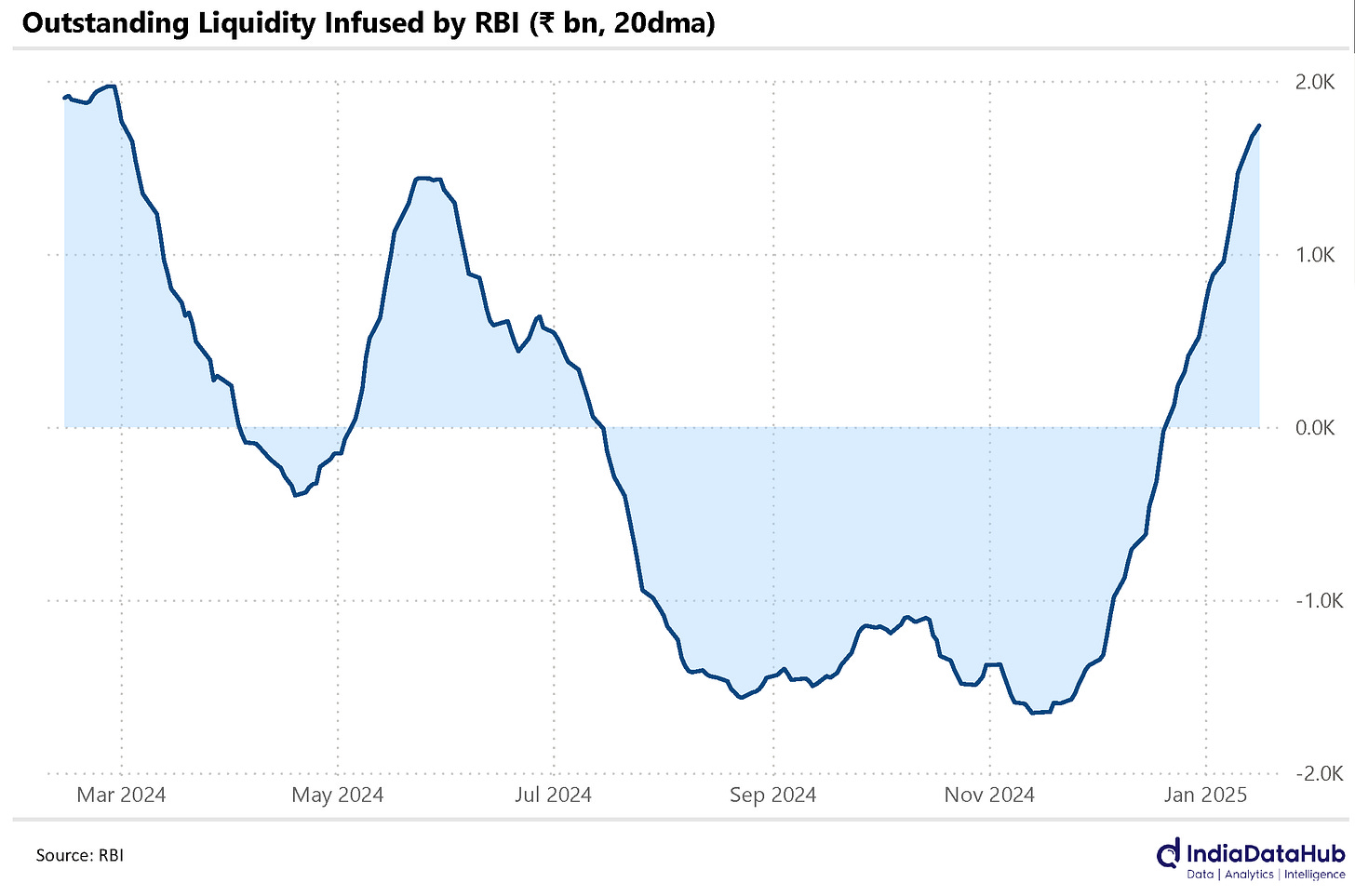

The flip side of this massive intervention in the FX market is the tightening of domestic money market liquidity. Since the middle of December, the domestic money market liquidity has shifted to a large deficit requiring an infusion of liquidity from the RBI. This is despite the 50bps reduction in CRR, but for which the liquidity deficit would have been substantially higher. And this past week the RBI announced additional liquidity infusion through daily variable rate repo auctions. The RBI conducted two such auctions last week and these daily auctions will likely continue for the foreseeable future.

Liquidity infusion through repo auctions though are short-term liquidity measures. The RBI itself calls these ‘fine-tuning’ liquidity operations. Open Market Operations (OMOs) are a more durable (nay, permanent) source of liquidity infusion. However, the RBI has so far refrained from using OMOs. Since October, the RBI has done no OMOs. Unless the liquidity situation changes materially in the next few weeks which will warrant a change in the FX situation, the RBI will have to either bring the OMOs out of their quiver or once again use the CRR. The CRR though outside of the Covid19 pandemic has never been below its current level of 4% since at least the 1980s.

In large part, the trigger for this spurt in volatility is the selling by FPIs. So far in January, FPIs have been net sellers of almost US$5.5bn and even the debt market has seen FPI selling of over US$1bn. If this pace of selling continues in the remainder of the month, FPI selling in equities will be comparable to the all-time high selling of US$11.2bn in October and the selling in the Debt market would be the highest in recent years. This is the context for the RBI to determine, given the situation it finds itself in, if it should continue to calibrate the fall in the rupee or let it free and find its level on its own. As the article above mentions, both options have consequences. There are no free lunches.

Lastly, Inflation. Headline CPI Inflation moderated to a 4-month low of 5.2% YoY in December. After rising above 6% in October, inflation has fallen below it in the last 2 months. Consequently, for the December quarter, the headline CPI averaged 5.6%. This is slightly lower than the MPC's projection of 5.7%. The moderation was entirely due to lower food inflation as non-food CPI remained stable at 3% and core CPI remained stable at 3.6% YoY. Core inflation has remained below 4% for 13 consecutive months now and remains close to its lowest level in over a decade.

From a monetary policy perspective, inflation continues to remain a hurdle in cutting rates. While headline CPI has moderated as expected after rising above 6% in October, the moderation has not been faster than expected and thus unless inflation demonstrably moderates further, it is difficult for the MPC to claim victory on the inflation front. The rupee's depreciation is another headwind for policy easing. Moreover, even globally, it appears as if monetary easing has taken a pause. Fed fund futures suggest the next rate cut from the US Fed will only be in June. Thus, it appears likely that the RBI will most likely continue to remain on hold in its February policy meeting.

While not quite as dramatic as when Dr Subbarao took over as RBI Governor (Sept 2008 – global financial crisis) or when Dr Rajan took over in 2013 (Sept 2013 – taper tantrum), the new RBI governor is having a mini baptism by fire…

And on that somber note, we call it a day. More next week as we preview the Union budget. Also, the Australian Open is on, and Djokovic is going for his 11th title there and his 25th Grand Slam. His 4th round match starts shortly. Should be fun…!