Record power generation growth, Tax buoyancy, Disconcerting NREGA and more...

This Week In Data #42

In this edition of This Week In Data we cover:

Record growth in power generation in October

Connection between Rainfall and Power generation

Strong growth in direct taxes

Disconcerting growth in demand for NREGA

Decline in Services exports

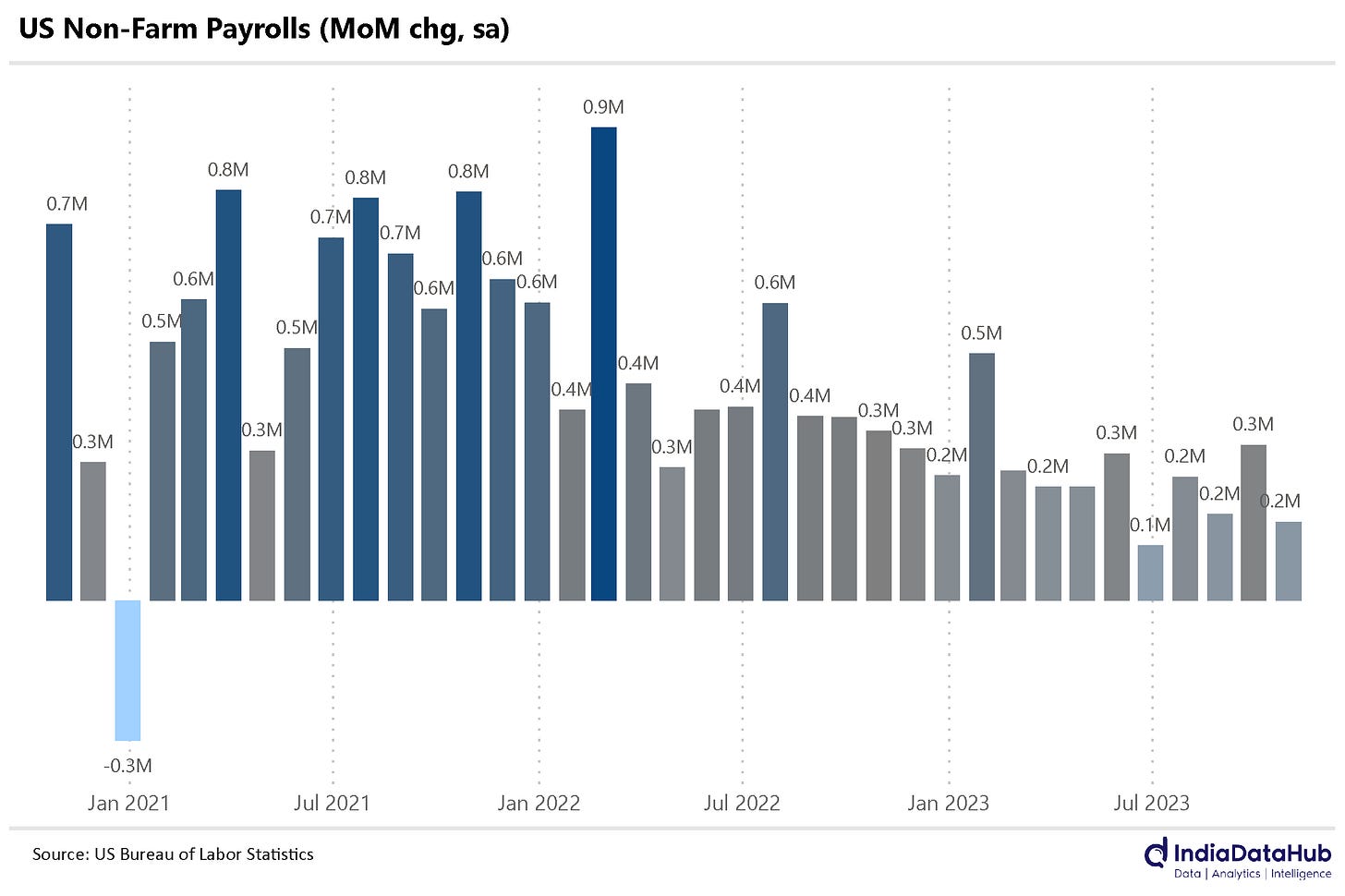

Moderating US Job growth

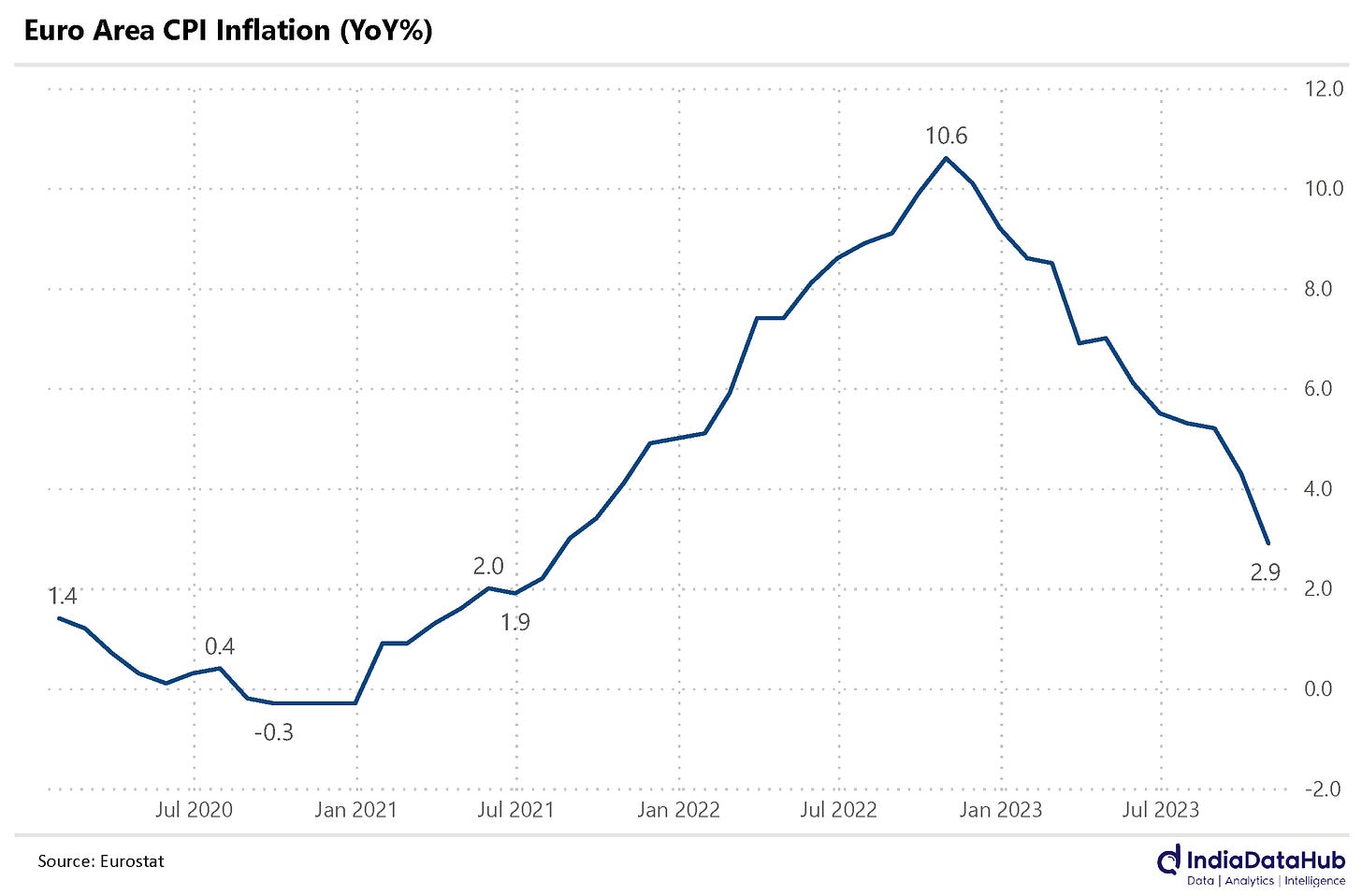

Sharp decline in Euro area CPI

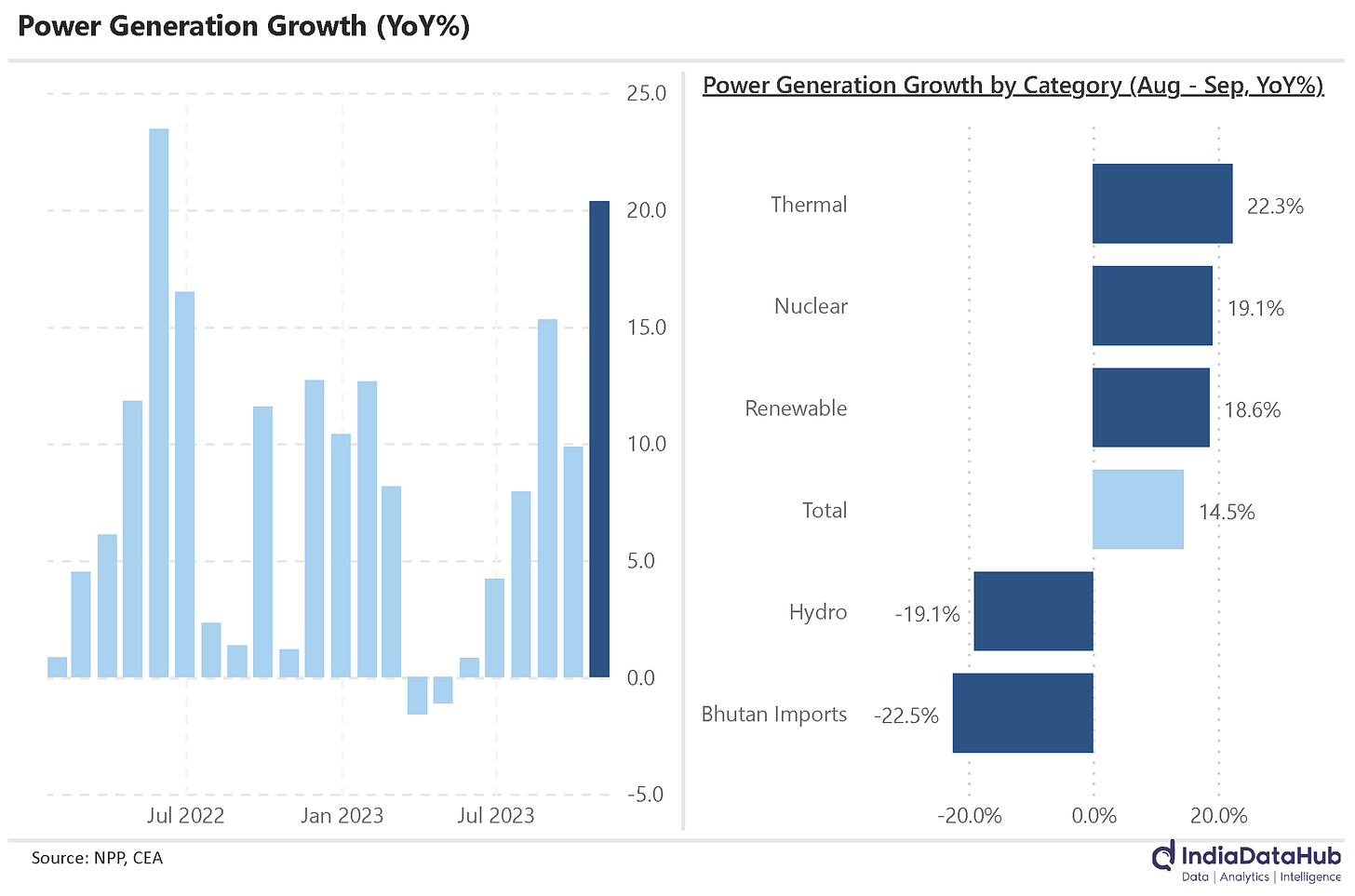

TWID comes to you on a Sunday this week due to some unavoidable personal reasons. We will get back to our Saturday schedule from next week onwards.October was a blowout month for Power generation. Overall power generation grew 20% YoY in October, the highest growth since May last year (which was skewed due to the pandemic). A large part of this growth though is due to the Diwali effect. Diwali (a period when factories are closed for a few days) was in October last year and this year it is in November. So last year industries were closed for a few days in October which wasn’t the case this year. So, power demand and hence generation is higher this October on a YoY basis. And this will normalise next month when power generation should see a sharp deceleration in November on a YoY basis. However, given the strength of the growth, the Diwali effect probably does not fully explain this. Outside of the pandemic-driven recovery, the growth in October is the highest in the last two decades and there would have been several years which have seen this Diwali effect.

The other explanation is the weak and erratic monsoon. Overall monsoon rainfall in the country was 6% below normal and the water levels in major reservoirs are also well below that of last year. This would push up power demand, especially from the Agriculture sector. And because water levels in reservoirs are below average and the rainfall is also below average, hydro generation is currently declining and it is thermal (largely coal) which is stepping in to meet the higher power demand. So, a consequence of lower monsoon is higher burning of coal!

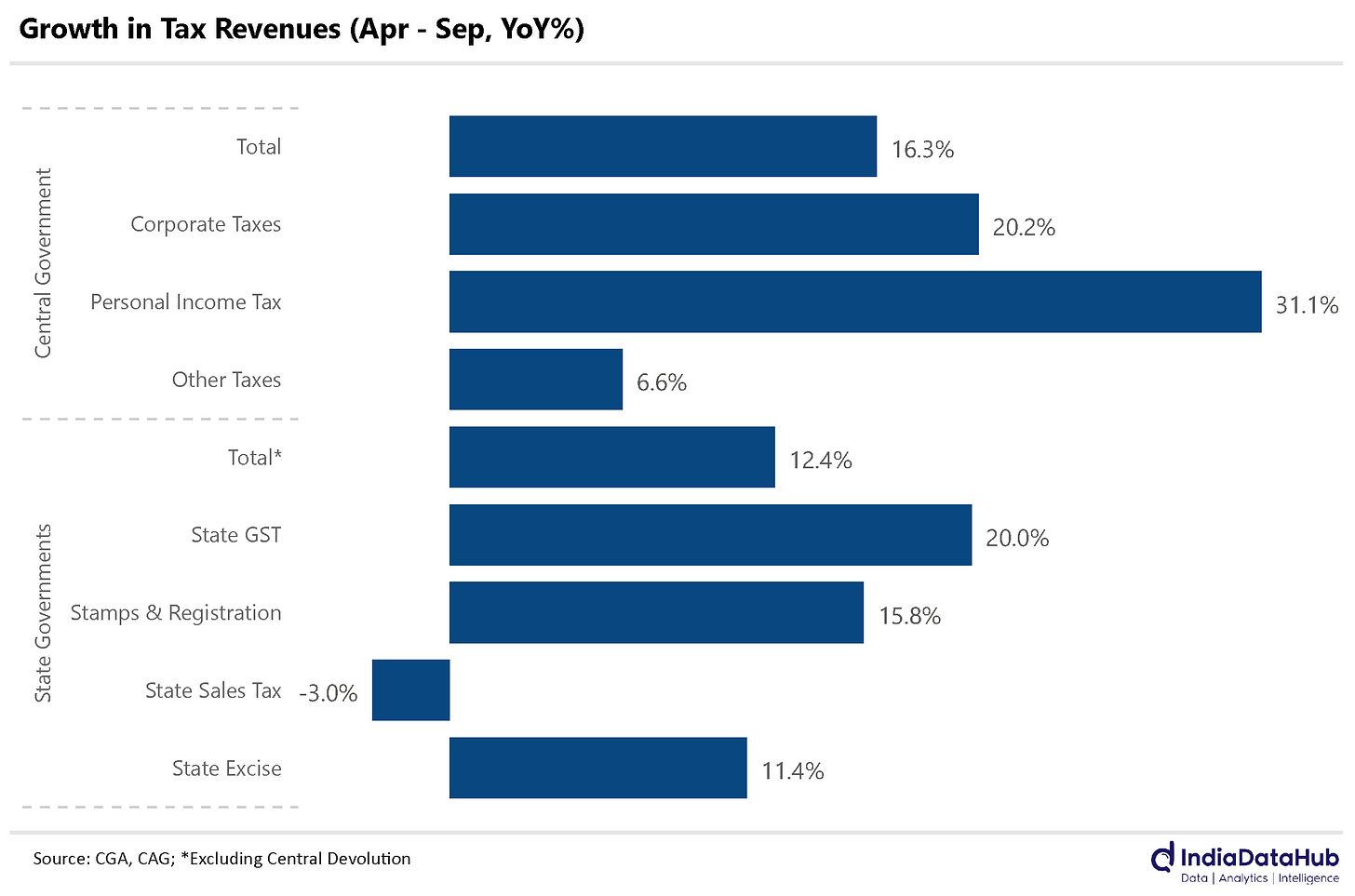

September was another strong month for Central Government tax revenues. Overall tax revenues grew 16% YoY in September, the second consecutive month of strong growth after low single-digit growth in the preceding four months. This growth was driven by strong growth in both corporate and personal income taxes (indirect taxes have grown in mid-single digits). This is especially relevant since companies and individuals pay their second instalment of advance tax in September. YTD tax collections have grown by 16% YoY, well above the budget estimates.

States too are seeing strong tax buoyancy. While the indirect taxes of the Central government are growing in the mid-single-digits, the Own tax revenues (excluding devolution from the Centre) of states have grown by 12.5% YoY till September. Given that we are in an election year, this strong tax buoyancy will mean that there is as yet no pressure to cut back on expenditure to meet the deficit targets. We will discuss this in more detail in our monthly Fiscal Monitor in the coming week.

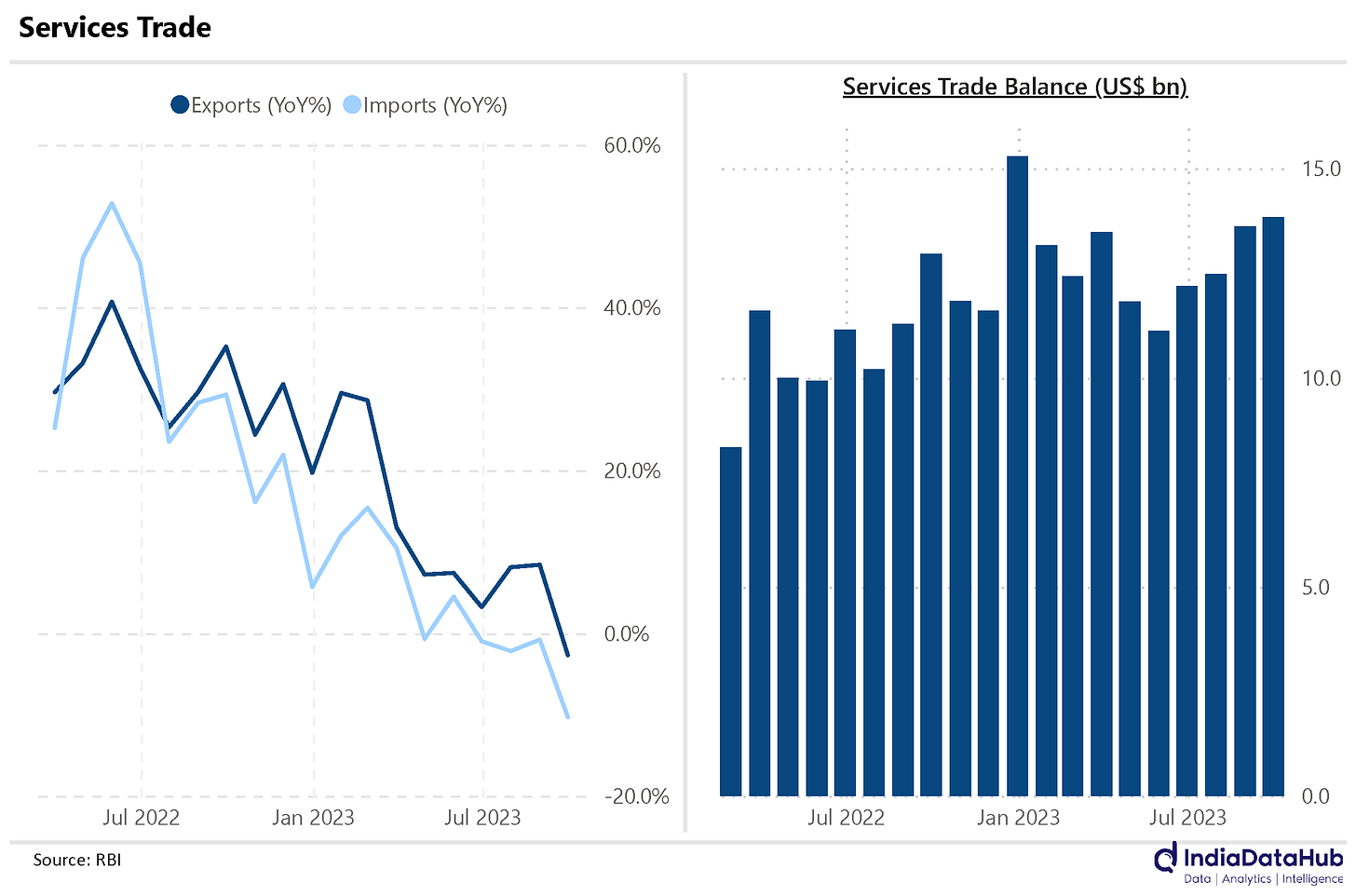

India's Services exports declined in September for the first time since January 2021. According to the provisional data released by RBI, exports in September declined by 2.7% YoY. Services imports declined even more sharply at 10% YoY. This is the 4th consecutive month of decline in imports and the fifth month of decline in the past six months.

A sharper decline in Imports relative to Exports has meant that the trade surplus has expanded on a YoY basis. In absolute terms, the trade surplus was US$13.8bn in September, the highest in the current calendar year.

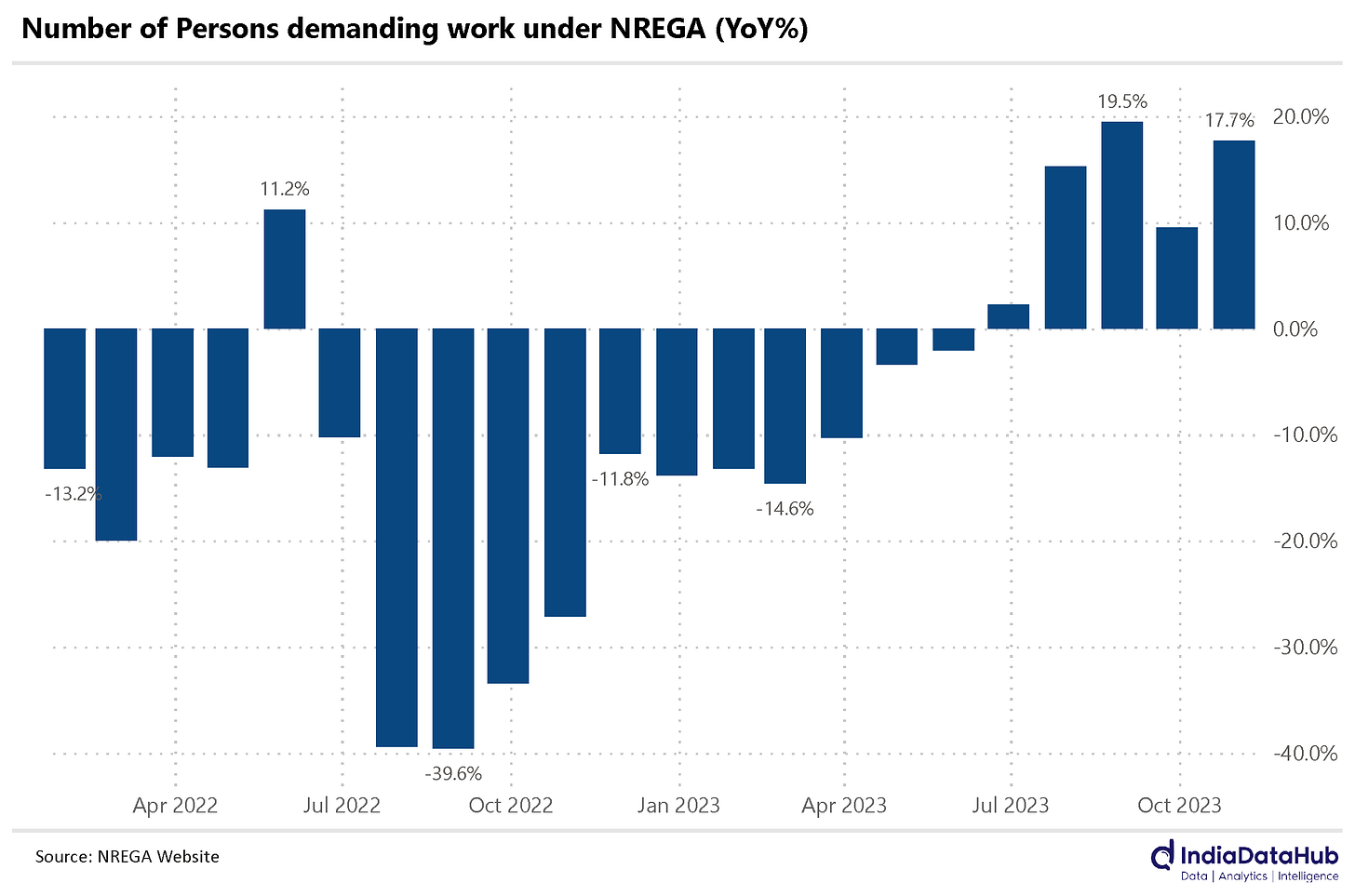

NREGA data continues to be a bit disconcerting. Demand for work under NREGA increased 18% YoY in October, the fourth consecutive month of strong growth. ET yesterday reported that the NREGA has almost run out of budget, so the Central Government is allocating an additional ₹100bn towards the scheme.

The regional spread of the demand is also a bit counter-intuitive. Industrial states such as Gujarat and Maharashtra have seen a 50% growth in demand in the last three months. Even Tamil Nadu has seen an almost 40% growth in the number of people demanding work under the NREGA. The Diwali effect may have partly distorted the data for October, in which case November should see a decline. We shall monitor and keep you updated!

Globally also it was a fairly data-heavy week. Job growth in the US has moderated with the Non-Farm Payrolls data in the US suggesting a slightly lower-than-expected 150k jobs being added in October. This is the second-lowest monthly job growth since the start of 2021. More importantly, job gains for the previous two months were revised downwards (the preliminary estimate for September was for a spectacular 300k+ job growth) by a total of 100k. The unemployment rate also ticked up slightly (10bps) to 3.9%, the highest in 21 months.

Earlier in the week, the Fed had kept the policy rate unchanged. The softer employment data coupled with softer inflation data earlier in the month has meant that the markets are now starting to once again expect rate cuts from the Fed around the middle of the next calendar year with at least three rate cuts in the next 12 months. The recession trade seems to be back.

The Euro Area reported its flash CPI estimate for October this week. As per it, the CPI inflation fell 140bps to 2.9% YoY in October from 4.3% in September. This is the lowest reading since July 2021. Among the Euro-member countries, Italy saw the steepest decline in inflation – 340bps decline to 1.9% in October. Germany and France also saw over 100 basis points decline in October to 3% and 4.5% respectively. And CPI in Belgium and the Netherlands has now fallen to 0%.

Separately, Turkey continues to see no respite from inflation. CPI came in at 61.4% YoY in October from 61.5% in September. Lastly, the Bank of England this week kept the policy rate unchanged at a 15-year high of 5.25% while Brazil’s Central Bank cut its policy rate, the SELIC rate, by 50bps to 12.25%.

Looks like the global central bank car, is starting to shift from Drive mode (or was it Sports mode?) to Reverse mode.

That’s it for this week. More next week…