Reducing Oil dependency on Russia, Stable exports to USA, Shrinking NREGA and more...

This Week In Data #150

In this edition of This Week In Data, we discuss:

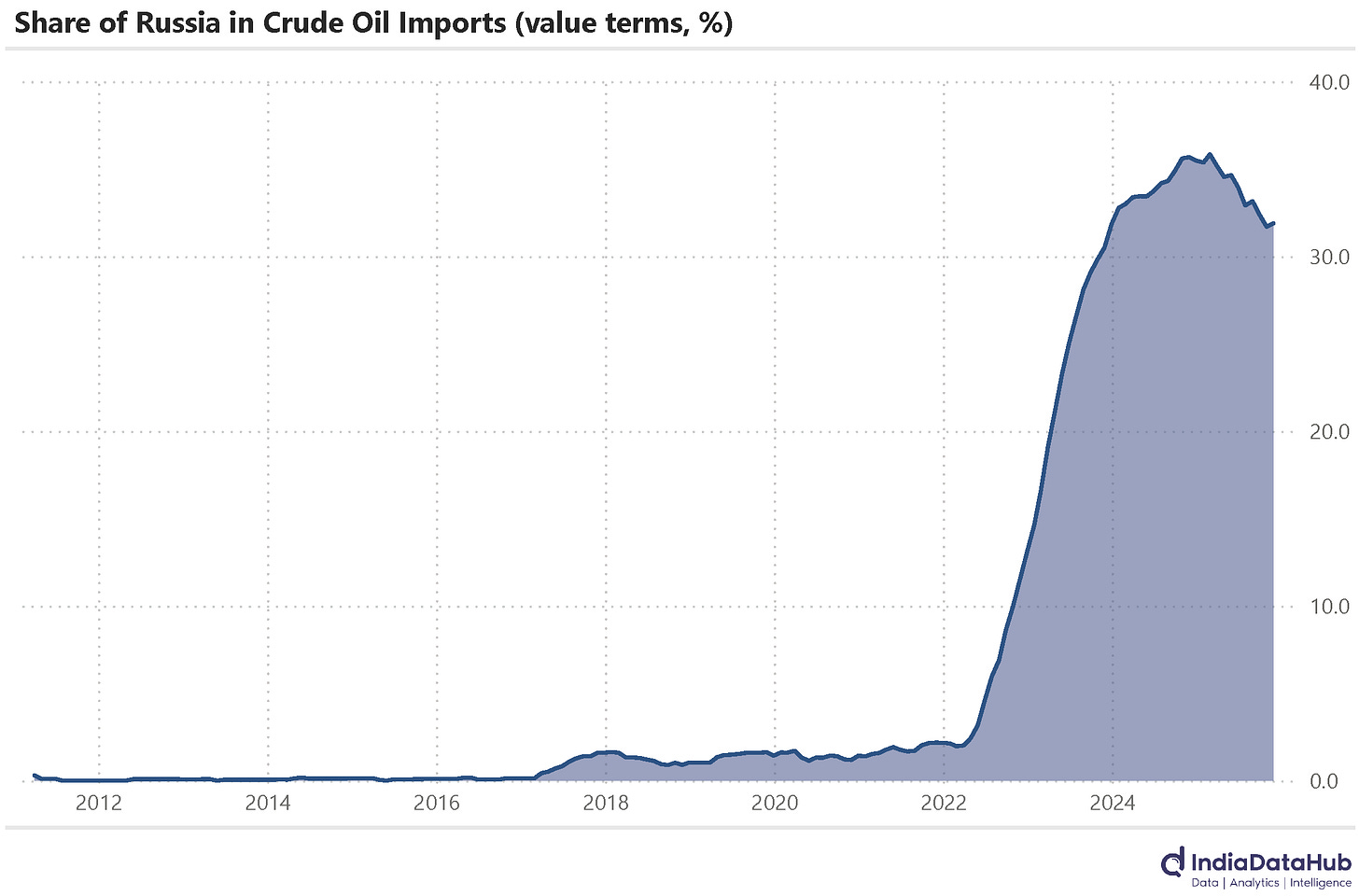

Share of Russia in crude oil imports has started to decline

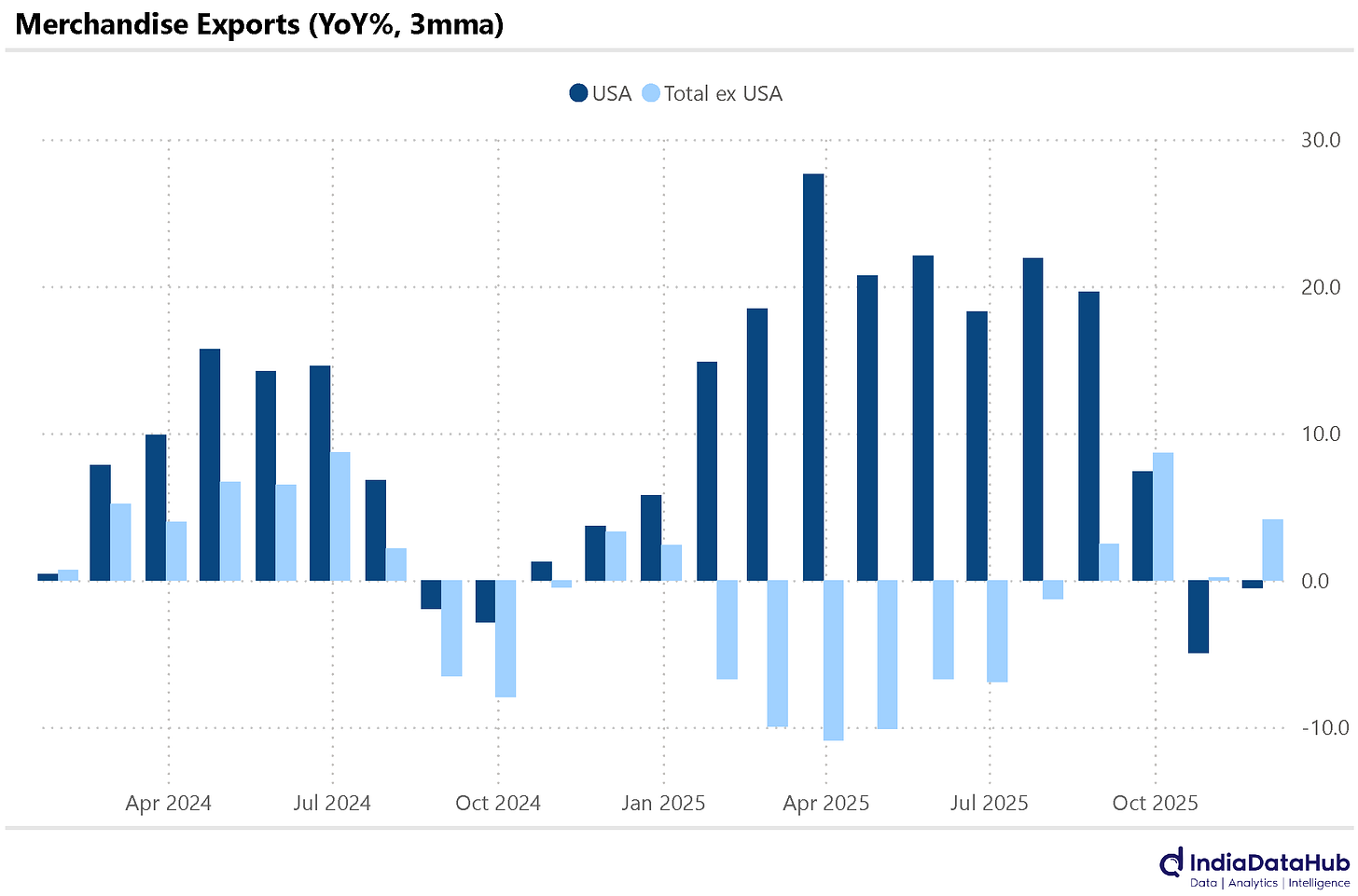

Exports to USA rose sharply in November and are broadly flat over the past 3mths

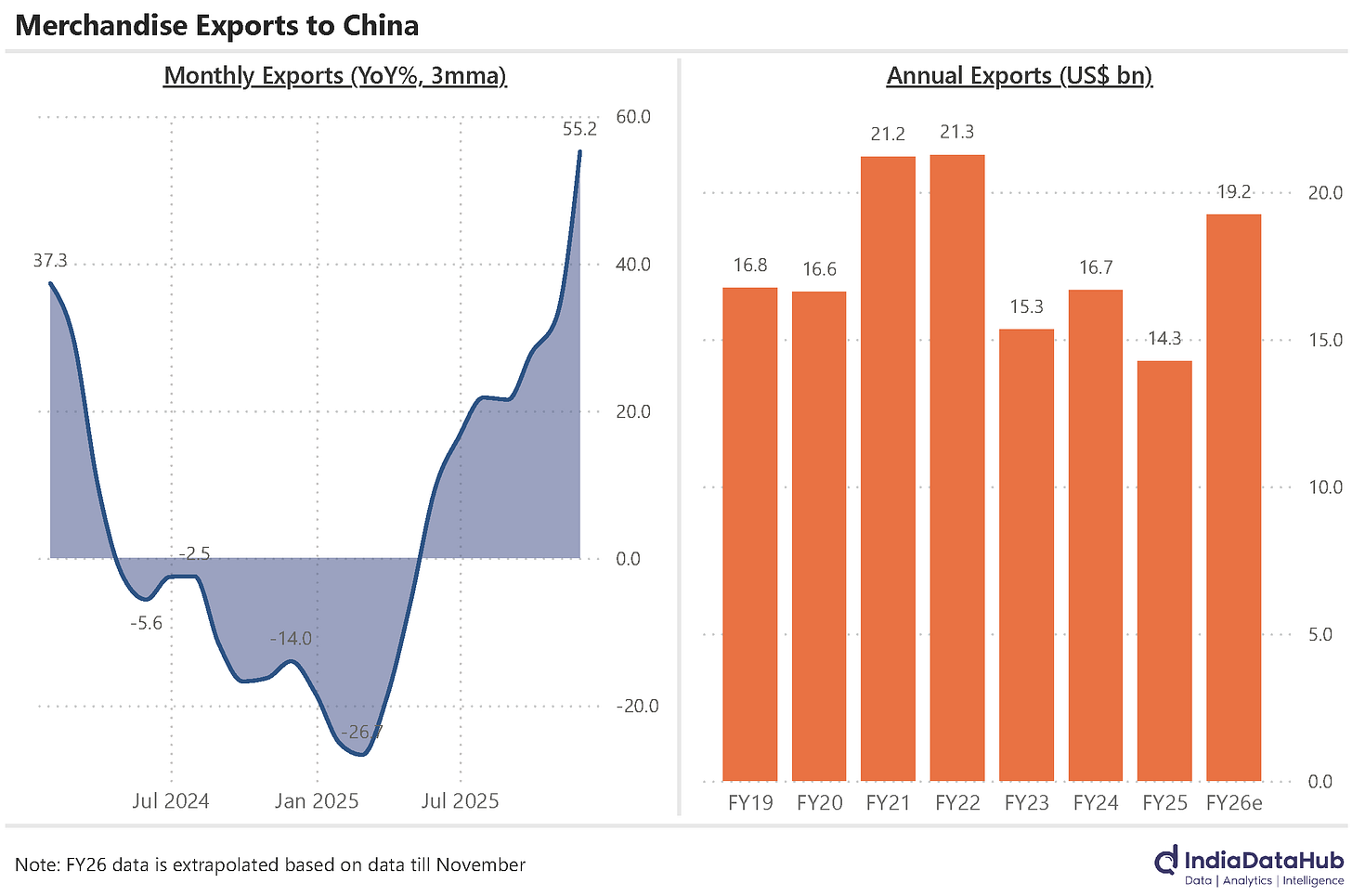

Exports to China are rising but off a low base

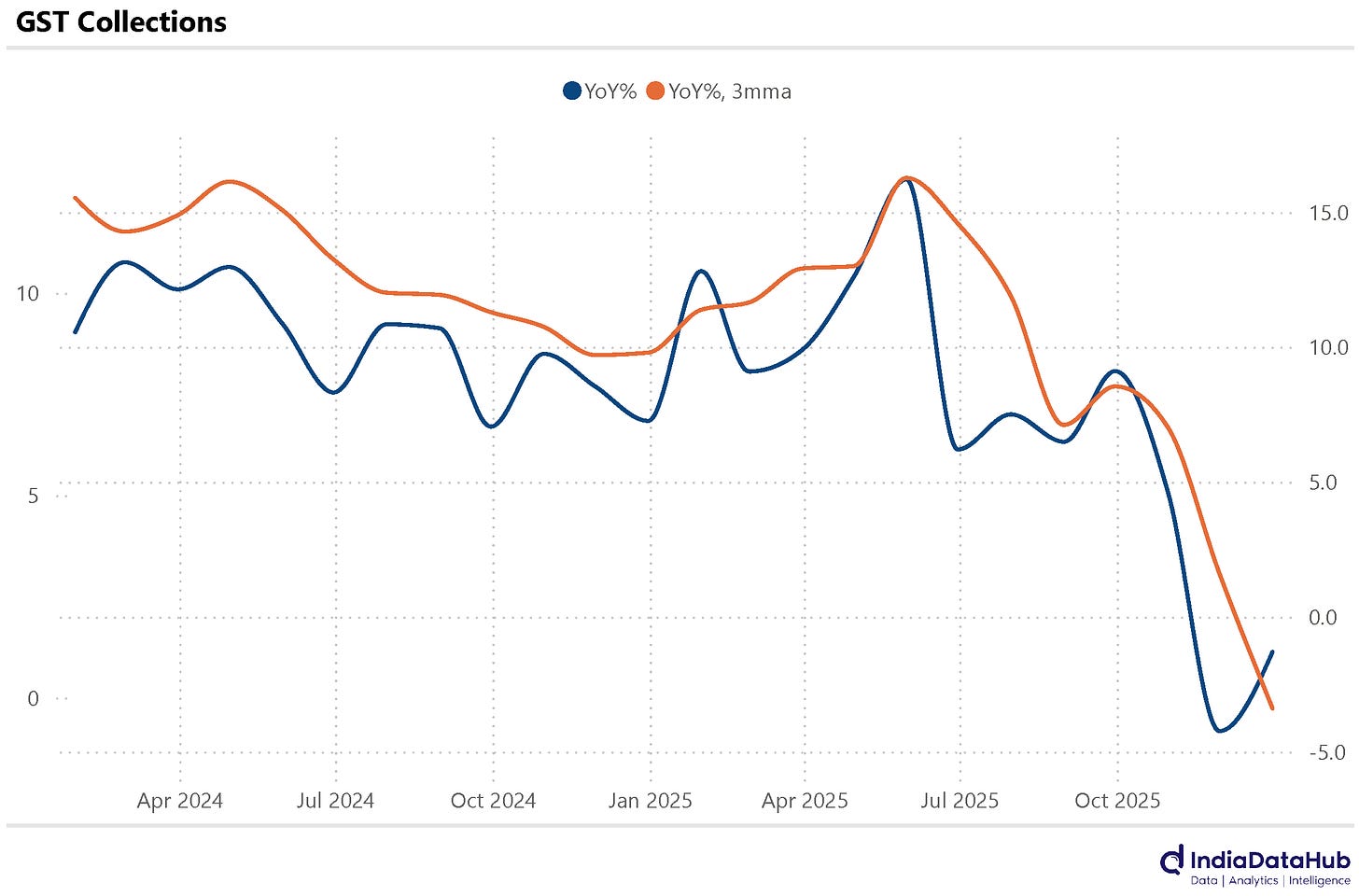

GST collections declined in December for the second consecutive month

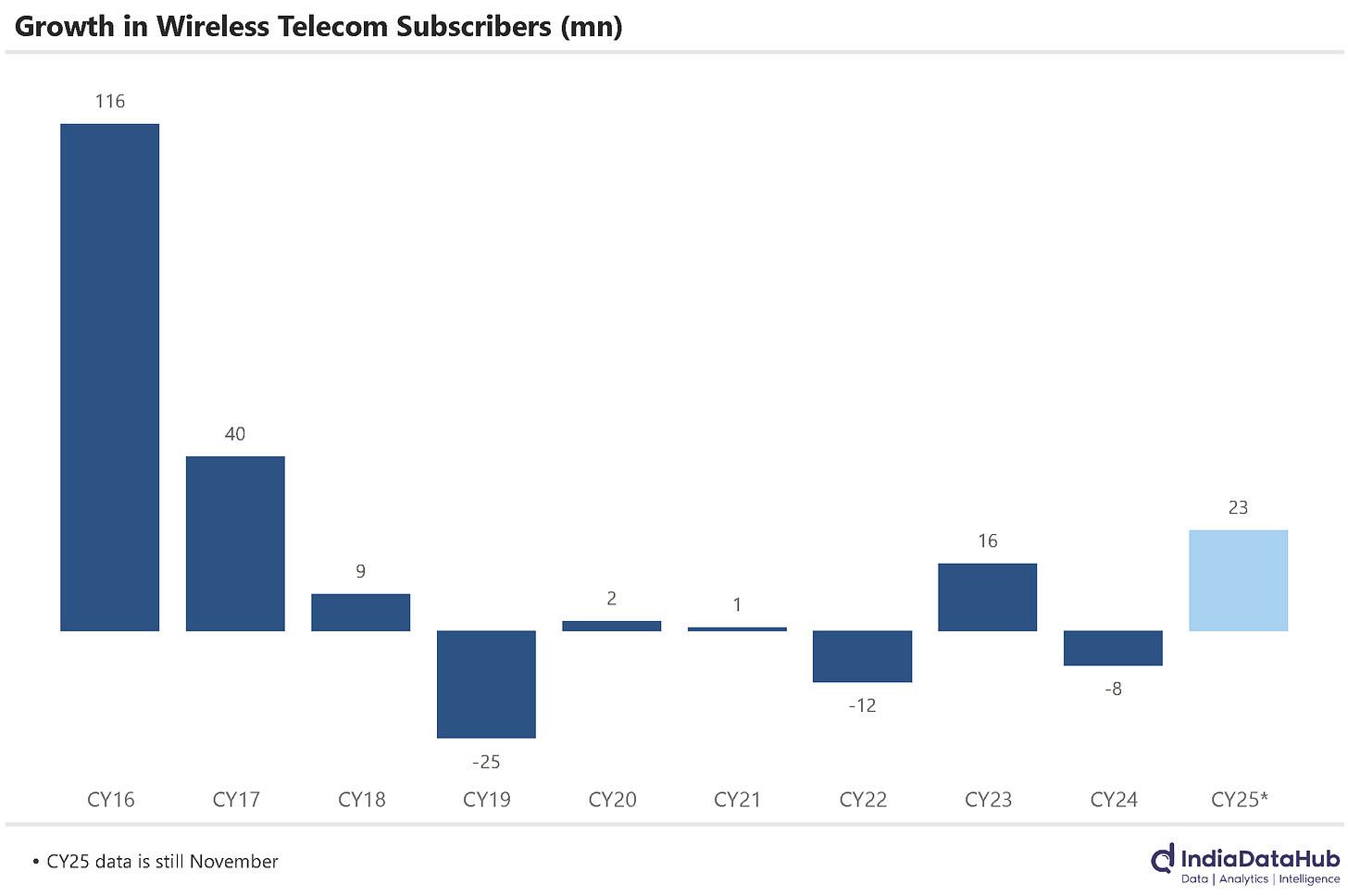

Wireless subscriber growth has been very strong in 2025 led by Jio and Airtel

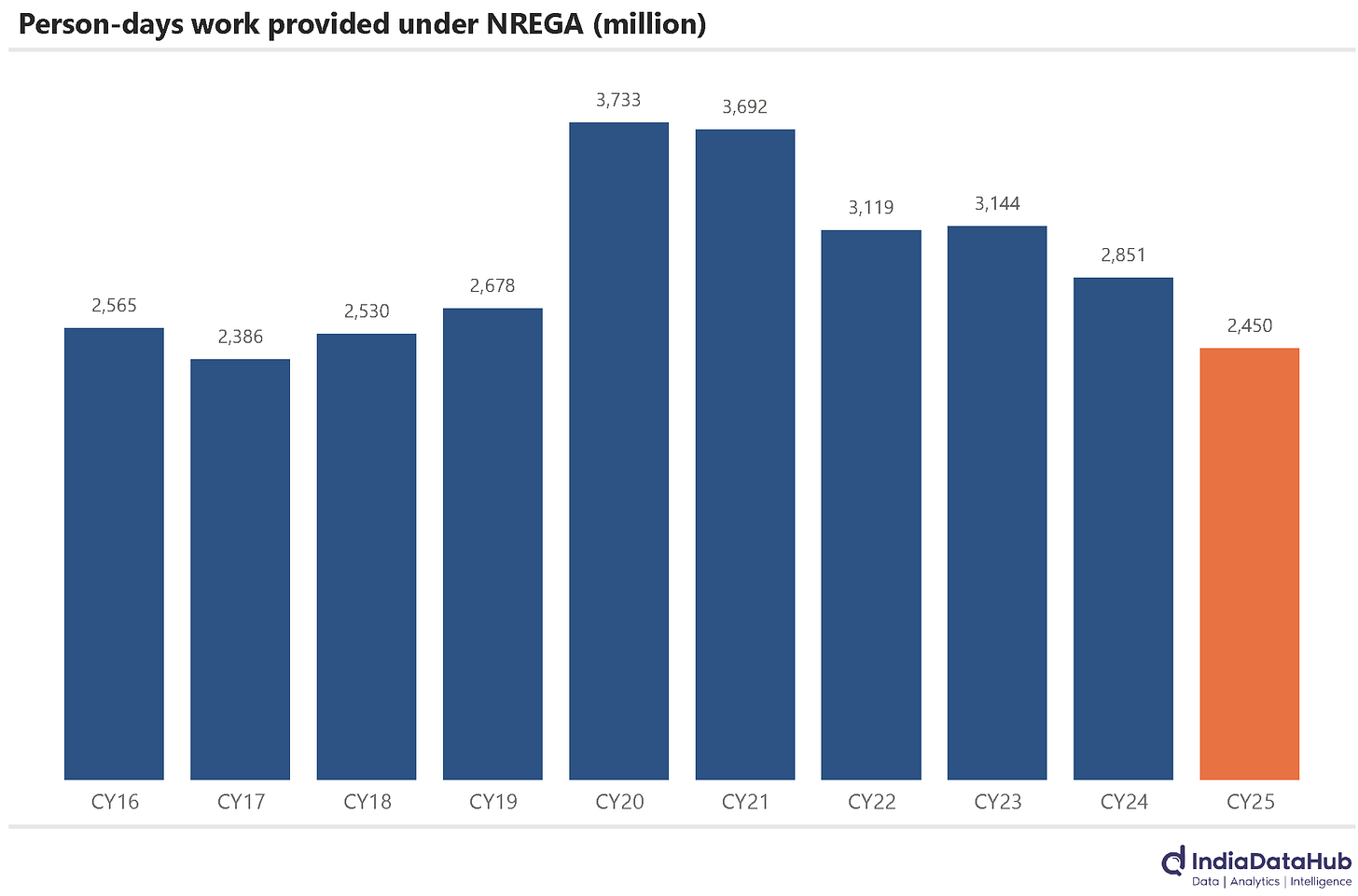

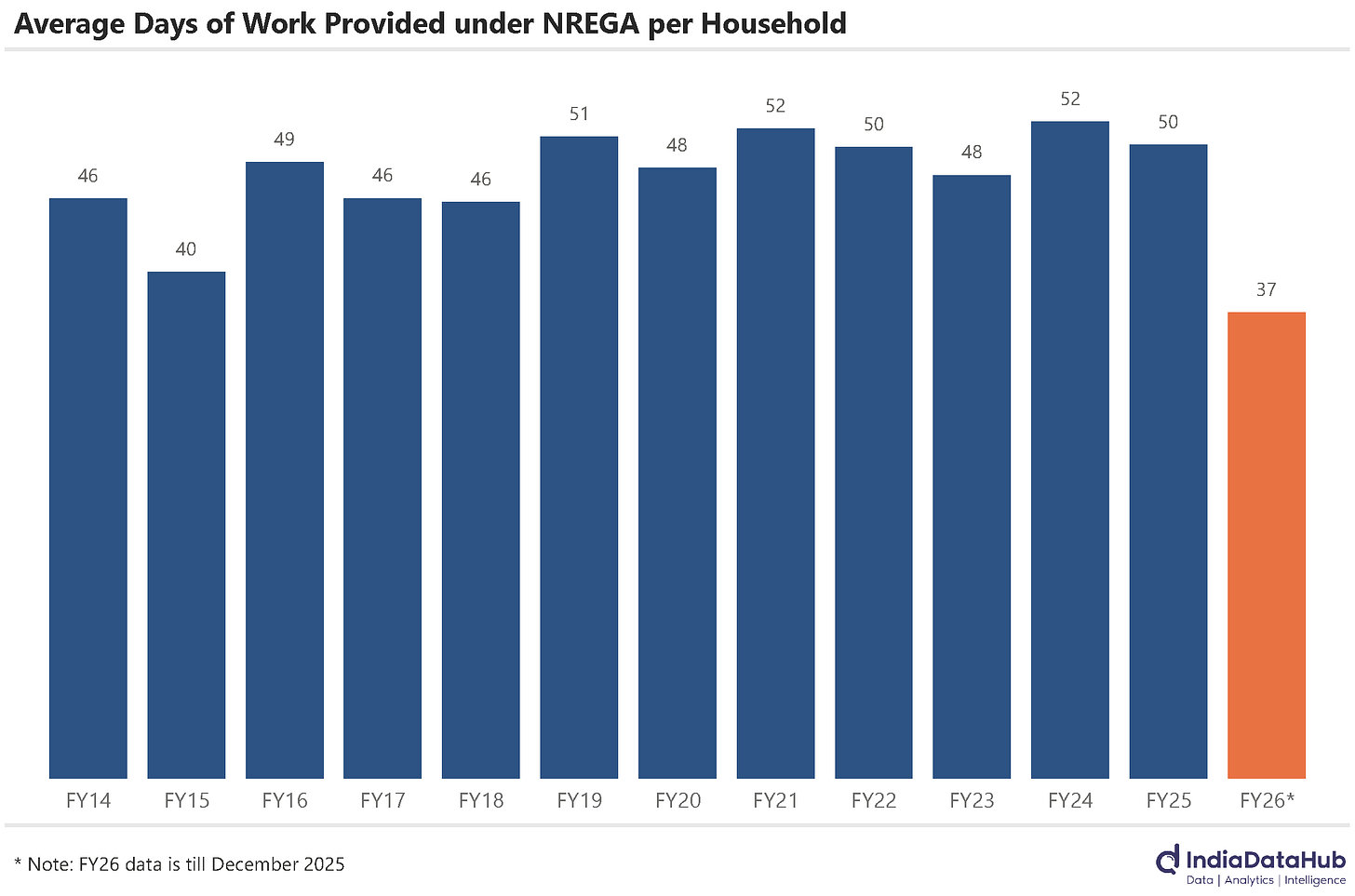

Demand for work under NREGA fell to decadal low in 2025 and work provided also fell to 7 year low

India’s dependence on Russian oil is reducing. In the last 3 months (Sep-Nov), the share of Russia in India’s crude oil imports stood at 32%, down from 37% in the same period last year. Over the past 12 months, 32% of India’s crude oil imports came from Russia (in value terms), down from 36% a year ago. That said, at 32% the number is still significantly above the pre-Russia-Ukraine war. Between 2019 and 2022, for instance, just 2% of India’s crude oil imports came from Russia.

Exports to the USA are also surprisingly holding firm despite the tariffs. After a decline in September and October, exports to the USA grew over 20% YoY in November, such that over the past 3 months, exports to the USA are largely flat on a YoY basis. This is only slightly worse than non-US exports, which grew by 4% during this period. This perhaps partially explains why there has been no seeming urgency on the part of the Government to quickly conclude the trade deal with the USA.

The other notable trend is the sharp surge in exports to China. Over the past 3 months, exports to China have surged over 50% YoY. In absolute terms, exports to China in the last 3 months were the highest in the last 4 years. This growth is, of course, coming off a low base – exports to China had declined 14% YoY. And despite this growth, exports to China this year (FY26) will be below the US$21 bn reached in FY21 and FY22. So this does not yet suggest a structural change in trend.

GST collections declined for the second consecutive month in December. After a 4% decline in November, collections declined by 1% YoY in December. Before the GST rate cuts, which became effective in September, GST collections were growing by 6-7% YoY. Thus, the increase in consumption post the sharp reduction in GST rates has not made up for lower rates – there has been revenue loss on a net basis. This does not mean that the GST rate cuts were a bad policy; it simply means that the Government will have to make up for this revenue shortfall through other sources of revenue or by cutting back on expenditure or simply running a higher deficit.

Wireless telecom operators are having a strong year. Between Jan-Nov 2025, they collectively added over 20 million new subscribers on a net basis, the highest since calendar year 2017, when they had added 40 million subscribers.

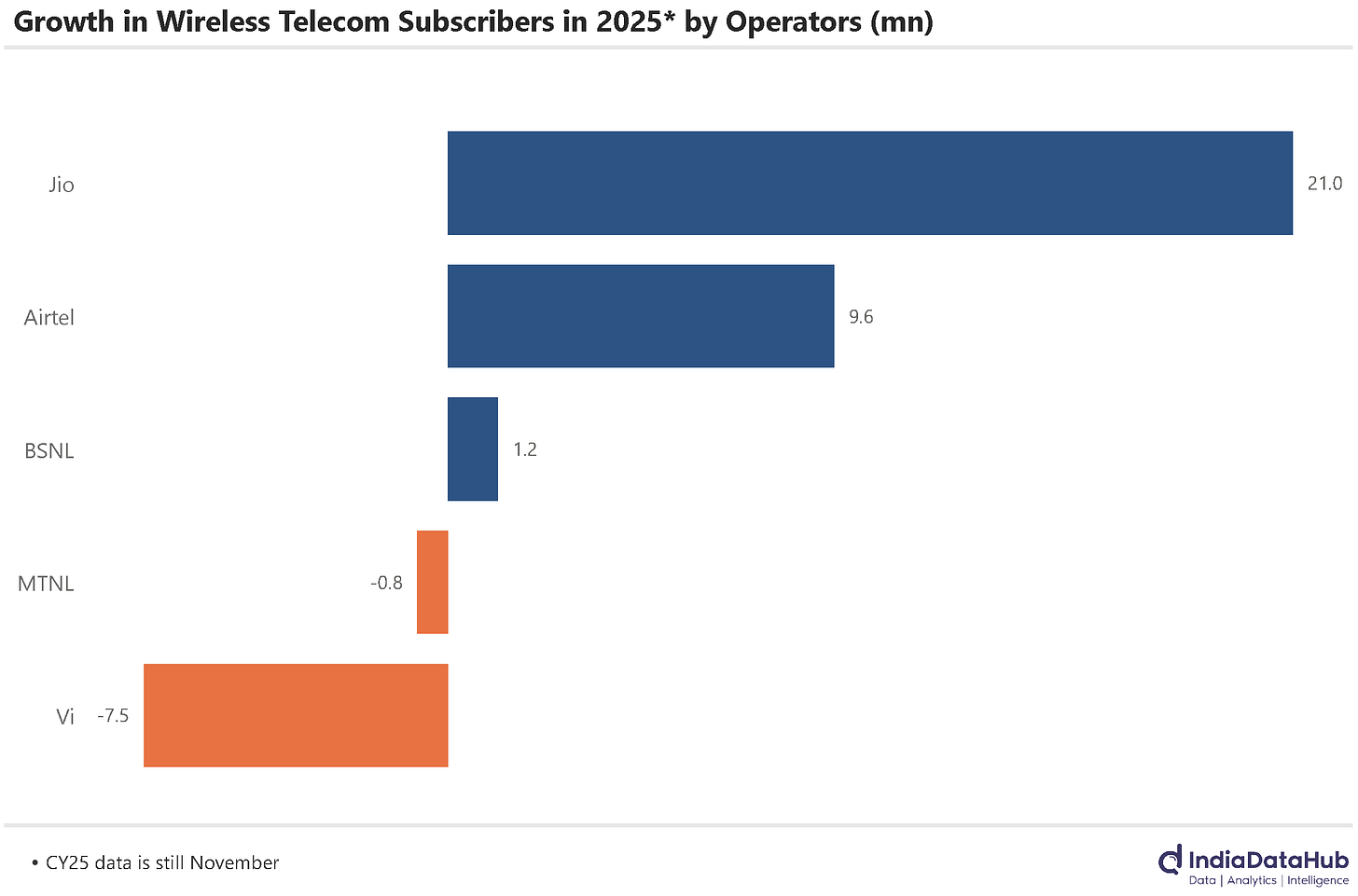

Jio continues to see outsized growth in subscribers. So far in 2025 (till November), Jio has added 20 million subscribers while Airtel has added just under 10 million subscribers. Vi continues to lose subscribers – so far in 2025, they have lost 7.5 million subscribers. Surprisingly, BSNL has gained subscribers this year, albeit a modest 1.2 million. This is the first time in the last several years that BSNL has gained subscribers.

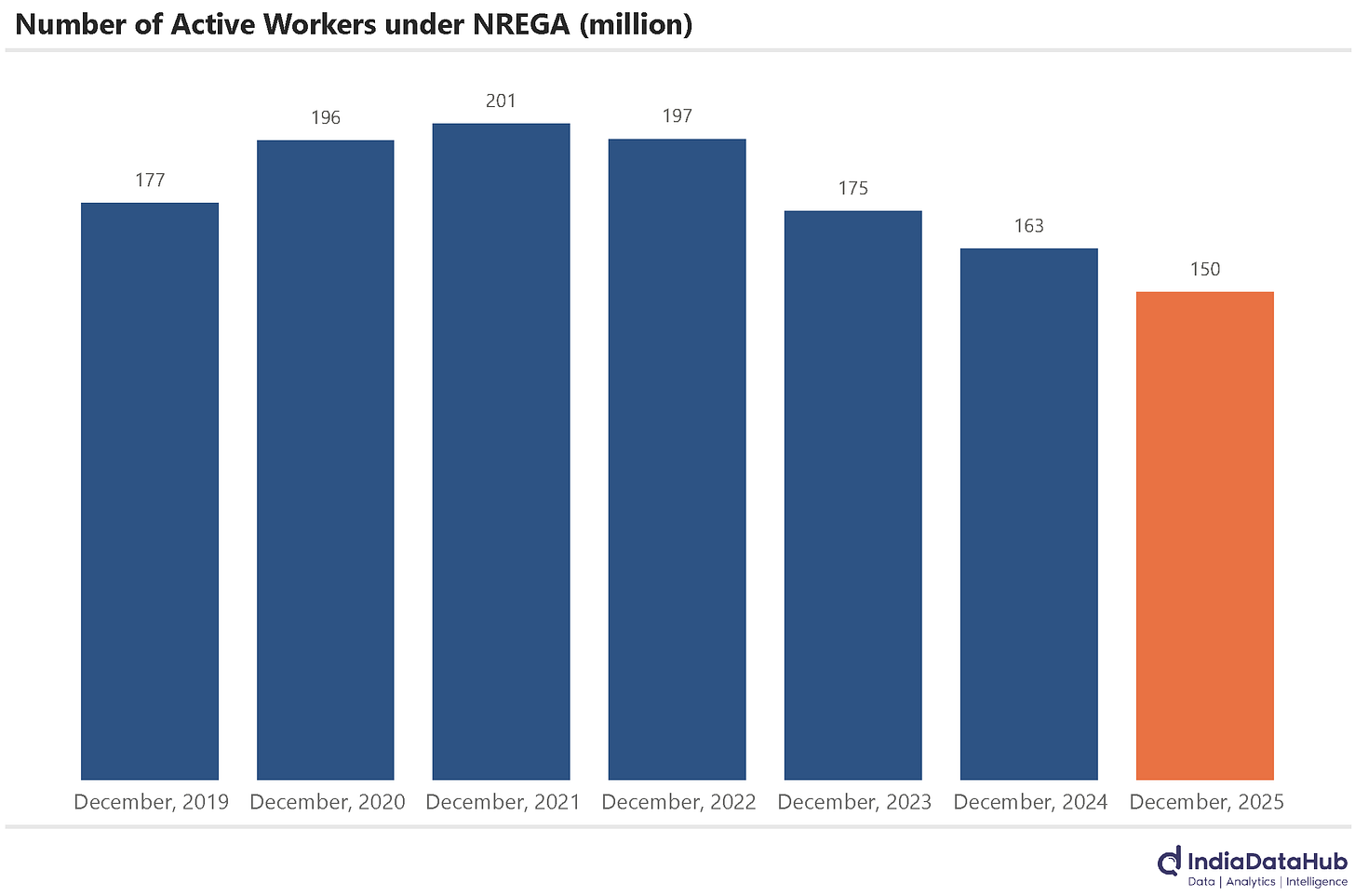

Lastly, NREGA has been in focus recently. The government intends to restructure the scheme quite significantly. While there has been a fair bit of debate over the appropriateness of this, what is interesting to note is how the scheme has shrunk in recent months. The number of active workers under the scheme, for instance, has declined to 150 million as of December 2025. At its peak, the scheme had over 200 million active workers.

While the number of person days of work created declined to a 7-year low of ~2500 million. And the number of people who demanded work under NREGA declined to 272 million in 2025, the lowest since 2015!

In theory, this should be good news. For the way this scheme was originally envisaged, almost two decades back, was a pure demand-driven scheme – a counter-cyclical policy that runs on autopilot, kicking in automatically when there is a paucity of jobs (in the rural areas), as people could simply demand 100 days of work at will. So if people are demanding less work under NREGA, it would imply they are finding enough otherwise.

But clearly, the scheme did not work as a purely demand-driven scheme. It was basically a supply-side scheme, and West Bengal is a good case in point. The state has basically seen zero implementation of the scheme for the past two and a half years - for a complex set of reasons that we will not get into. So it is a good thing that the scheme is being restructured lest it go into oblivion given the way it was progressing. The question is whether the scheme in its new avatar changes anything? Time will tell…

That’s it for this week. More next week…

Good insight

GST collections are actually up be 6% in Dec 2025