Rising Steel & Gas imports, Rising cost of deposits for PSU Banks and more...

This Week In Data #117

In this edition of This Week In Data we discuss:

India’s Steel Imports are rising rapidly

Natural gas imports are also rising rapidly, but only in volume terms

PSU Banks cost of deposits is now higher than that of Private Banks

US Fed and most major central banks keep rates unchanged, but…

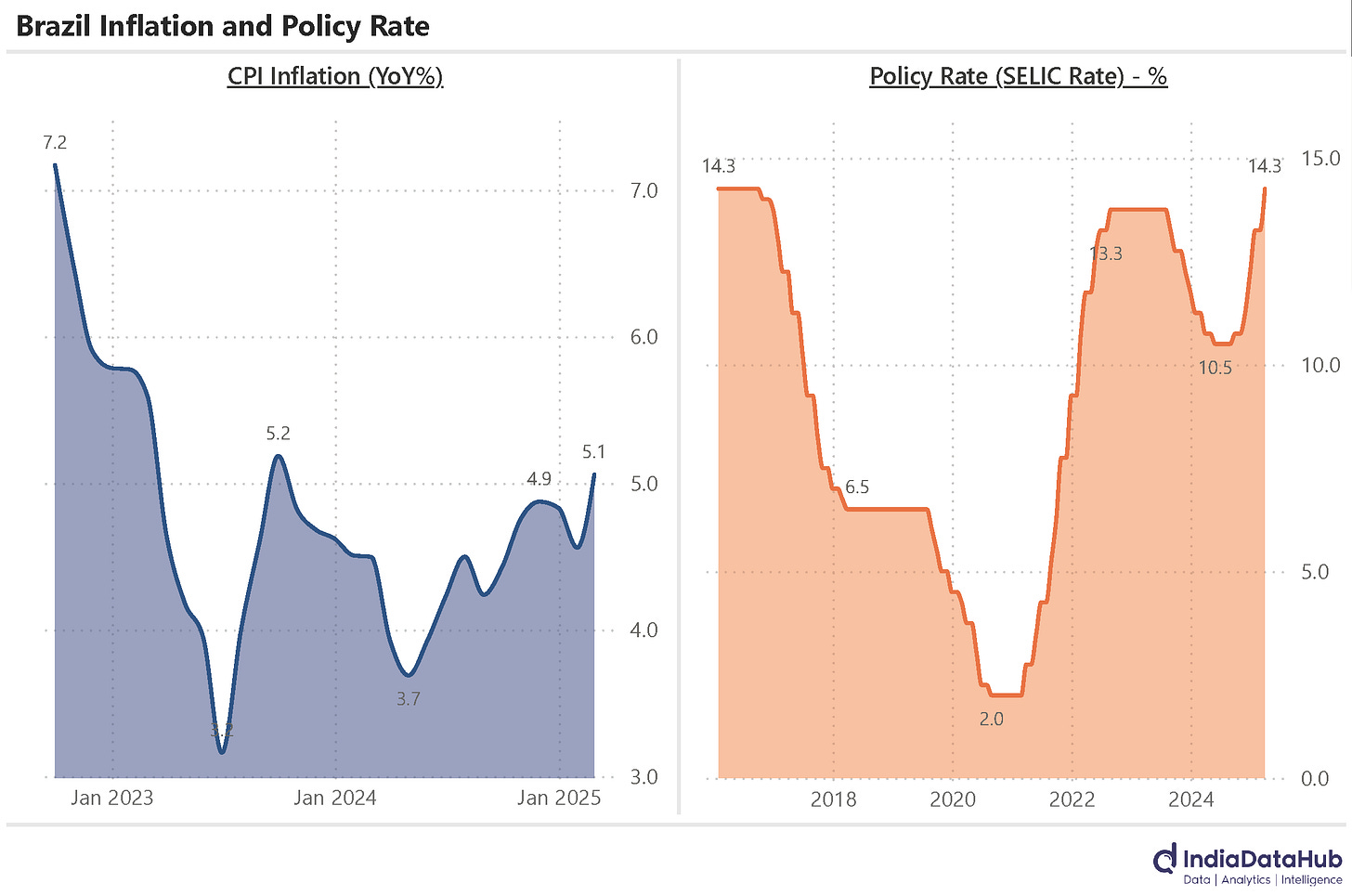

Brazil raises interest rates to 9-year high as inflation rises to 2-year high

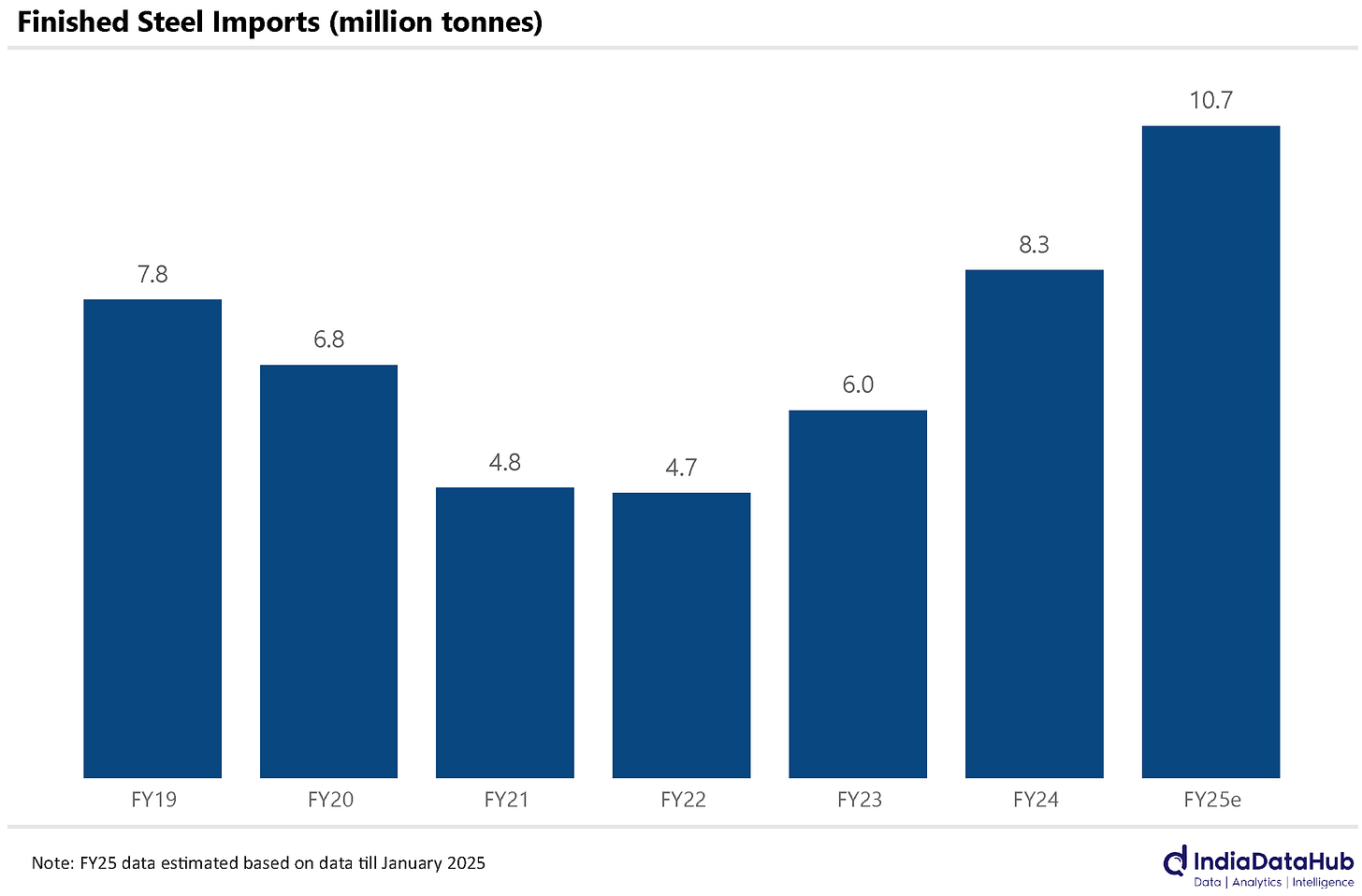

India’s Directorate General of Trade Remedies has proposed a 12% safeguard duty on steel imports to “to eliminate the serious injury and threat thereof to the domestic industry” as per this story in Business Line. This proposal comes due to a sharp increase in steel imports in the last couple of years. In FY2022, India’s finished steel imports totalled 4.7 million tonnes. But in the current year (FY2025), this is likely to have more than doubled to over 10.5 million tonnes (extrapolating the data till January).

And while imports are small relative to domestic production, the share of imports is rising. Imports of finished steel products this year will total 7% of domestic production of finished steel products, up from 4% in FY2022. Imports have thus grown significantly faster than domestic production and if this trend continues, they pose a threat to the domestic industry. Hence the safeguard duty.

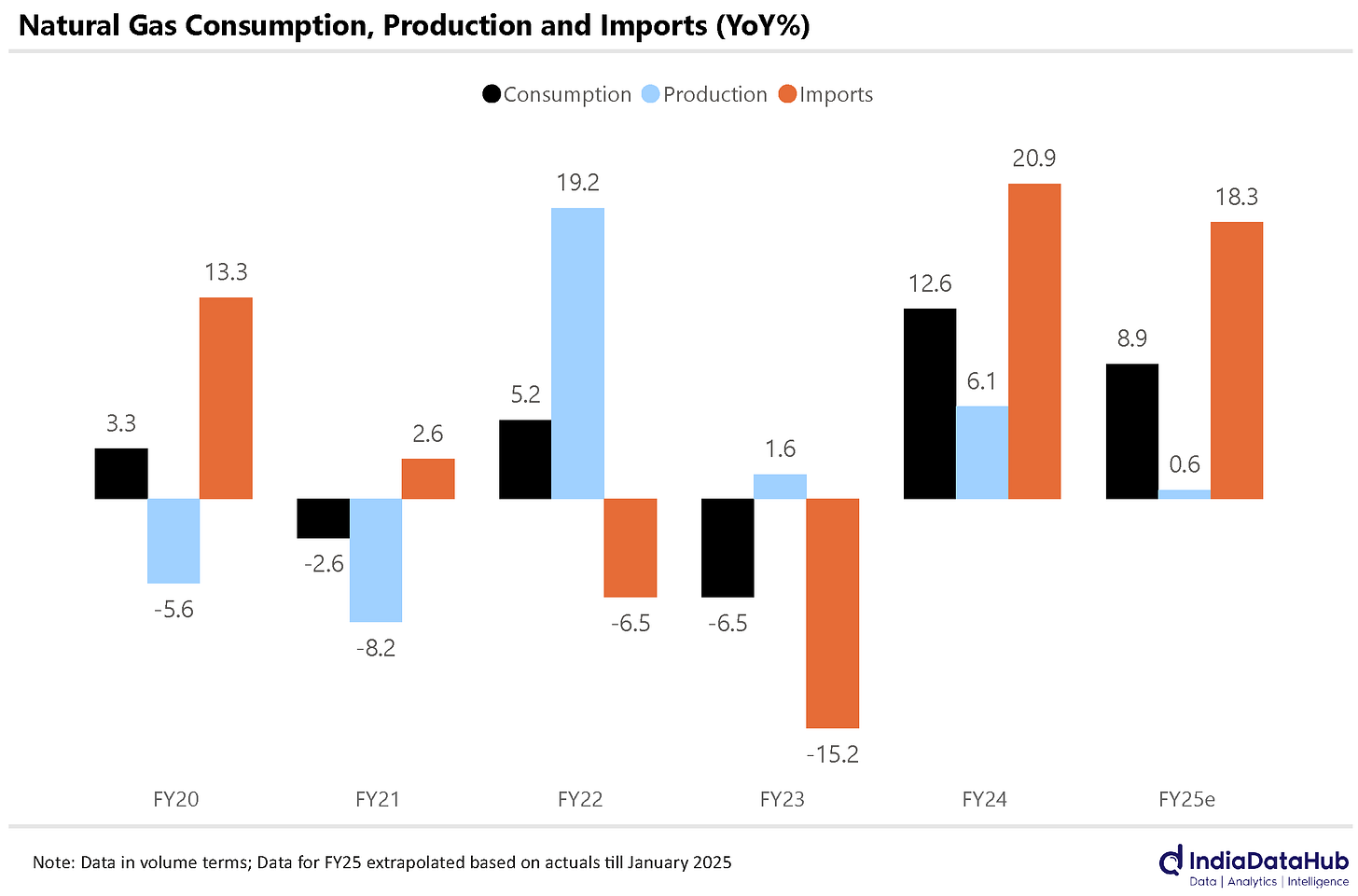

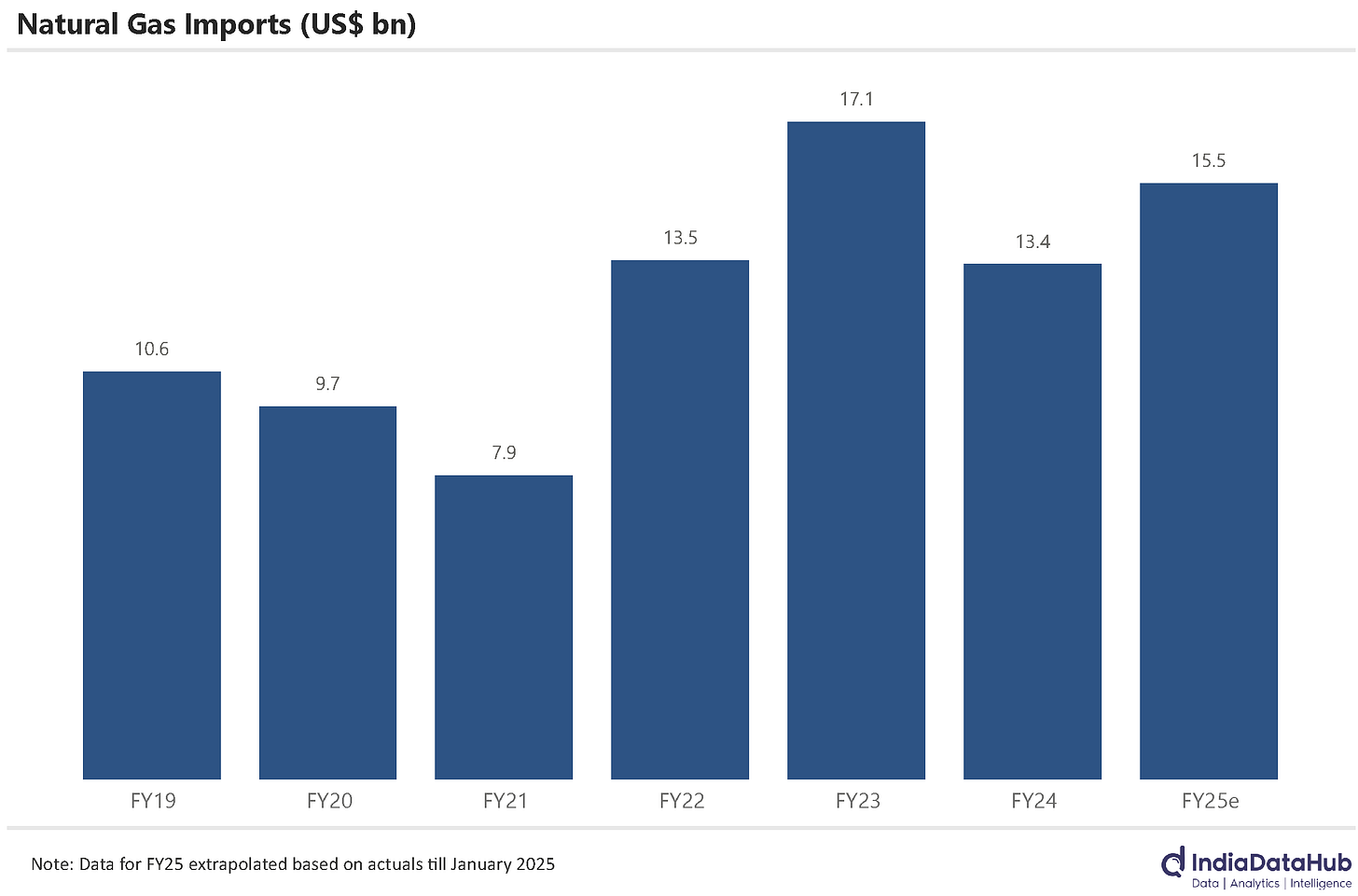

On the topic of imports, India’s imports of natural gas are seeing strong growth because while domestic consumption is seeing double-digit growth but domestic production is struggling to see any growth at all. Consumption of natural gas grew 13% in FY24 and based on data till January this year is likely to grow 9% in FY25. Domestic production is however struggling to keep pace – it grew 6% in FY24 but is likely to see just 1% growth during the current year. As a consequence, Gas imports are likely to have grown by ~40% in just the last 2 years.

The rise in imports though is entirely in volume terms. Global natural gas prices have fallen sharply. And the lower prices will mean that in value terms, imports in FY25 will likely be lower than in FY23!

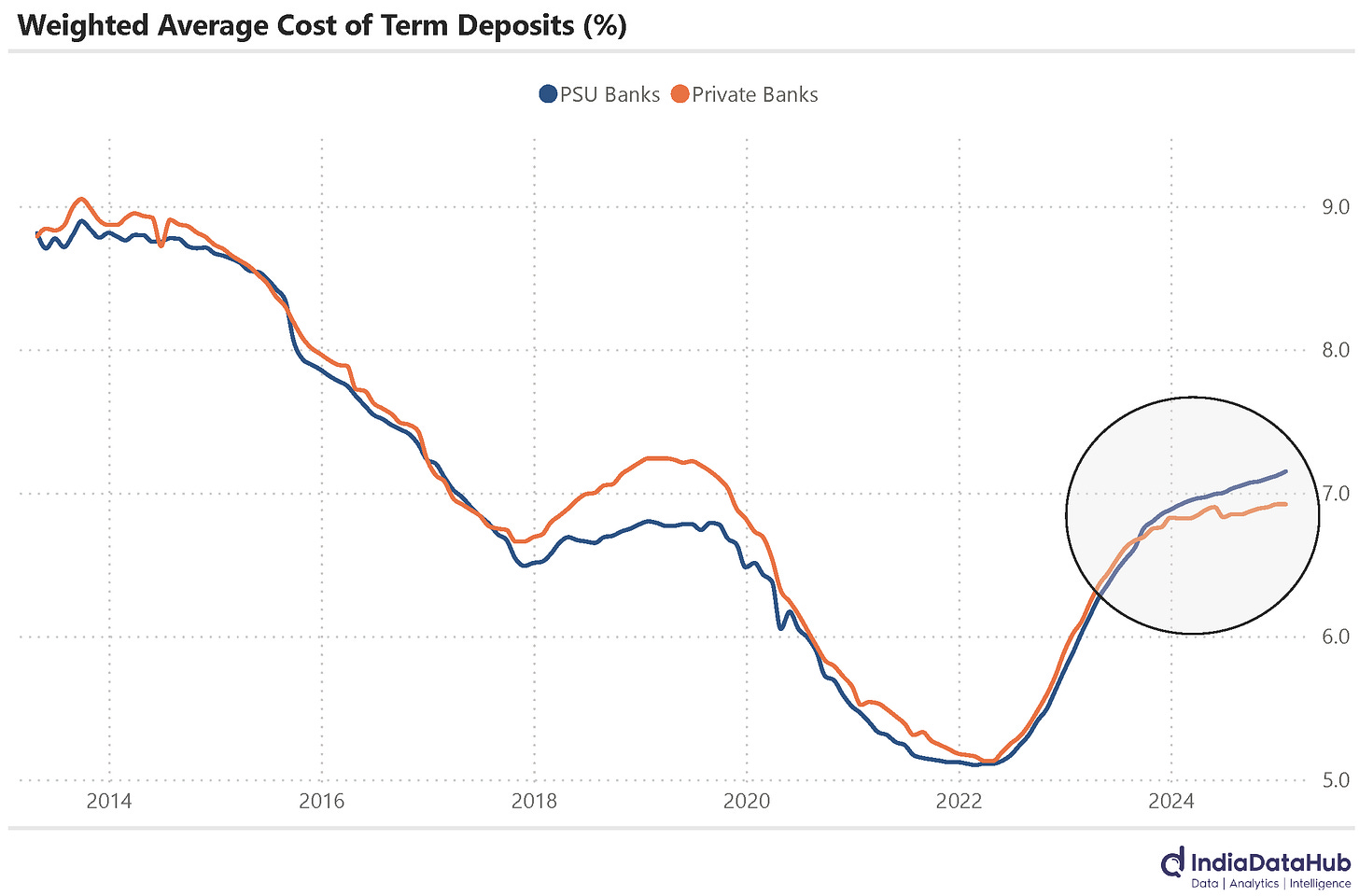

An interesting change has happened in Banking. Historically, the public sector banks (PSU banks) had the advantage of lower cost of (term) deposits. The private sector banks have had to offer higher interest rates to attract deposits. The government ownership of PSU banks added an extra element of trust allowing these banks to raise deposits at slightly lower rates of interest. Thus, between FY14-23, the weighted average cost of term deposits for the public sector banks was ~15bps lower than that for the private sector banks, in aggregate. This does not sound large, but given how leveraged banks tend to be, every basis point makes a difference.

But this advantage of PSU banks has vanished in the last couple of years. Indeed, the PSU banks are now having to pay more and more. In CY2024 for instance the weighted average cost of deposits for PSU banks was 15bps higher than that of Private sector banks. And as of January this year the weighted average term deposit rate for the PSU banks was 23bps higher than that for the Private sector banks.

Globally we had several central banks in action this past week. The US Federal Reserve kept its policy rate unchanged reflecting the stabilised labour market conditions. The markets are now expecting a 25bps rate cut from the Fed in June and another 25bps rate cut in September and then a 25bps rate cut in December. Following the Fed's lead, the Central banks in China, Japan and the UK also chose to keep their policy rates unchanged.

In contrast to this, the central bank of Brazil raised its policy rate, the Selic Rate, by 100 basis points to 14.25%. This is the highest policy rate in Brazil since September 2016. Recall that Brazil’s inflation in February rose to 5.1% YoY, the highest in the last 18 months.

That’s it for this week. See you next week.