Road Construction, Petroleum Exports, Corporate Taxes and more...

This Week In Data #24

In this edition of This Week In Data we cover:

Strong traction from NHAI in project awards and completions

India’s stable petroleum exports and what it means

Weak corporate tax collections

Tight money market liquidity

Kharif acreage pick up

Next week we start a new monthly report ‘State of Markets’ that will give readers a comprehensive round up of financial markets - from equities to debt and commodities and currencies. Both domestic and global. Stay tuned…FY23 was a strong year for NHAI, both from the perspective of awarding new projects and completion of existing projects. During the year it awarded 6000km worth of road projects (construction as well as upgradation), the second highest in its history – the highest was in FY18 when it awarded almost 7400 km worth of projects. NHAI completed almost 4900kms worth of projects last year, comfortably the highest ever and 20% higher than the previous year (FY22).

Trivia: Rajasthan and Madhya Pradesh each have seen over 200km of 8-lane highways constructed in the last two years. This is more than all other states put together! In contrast, the state PWDs and BRO had a poor year. They completed road projects totalling 3500kms. This is the lowest completion rate of the last 6 years.

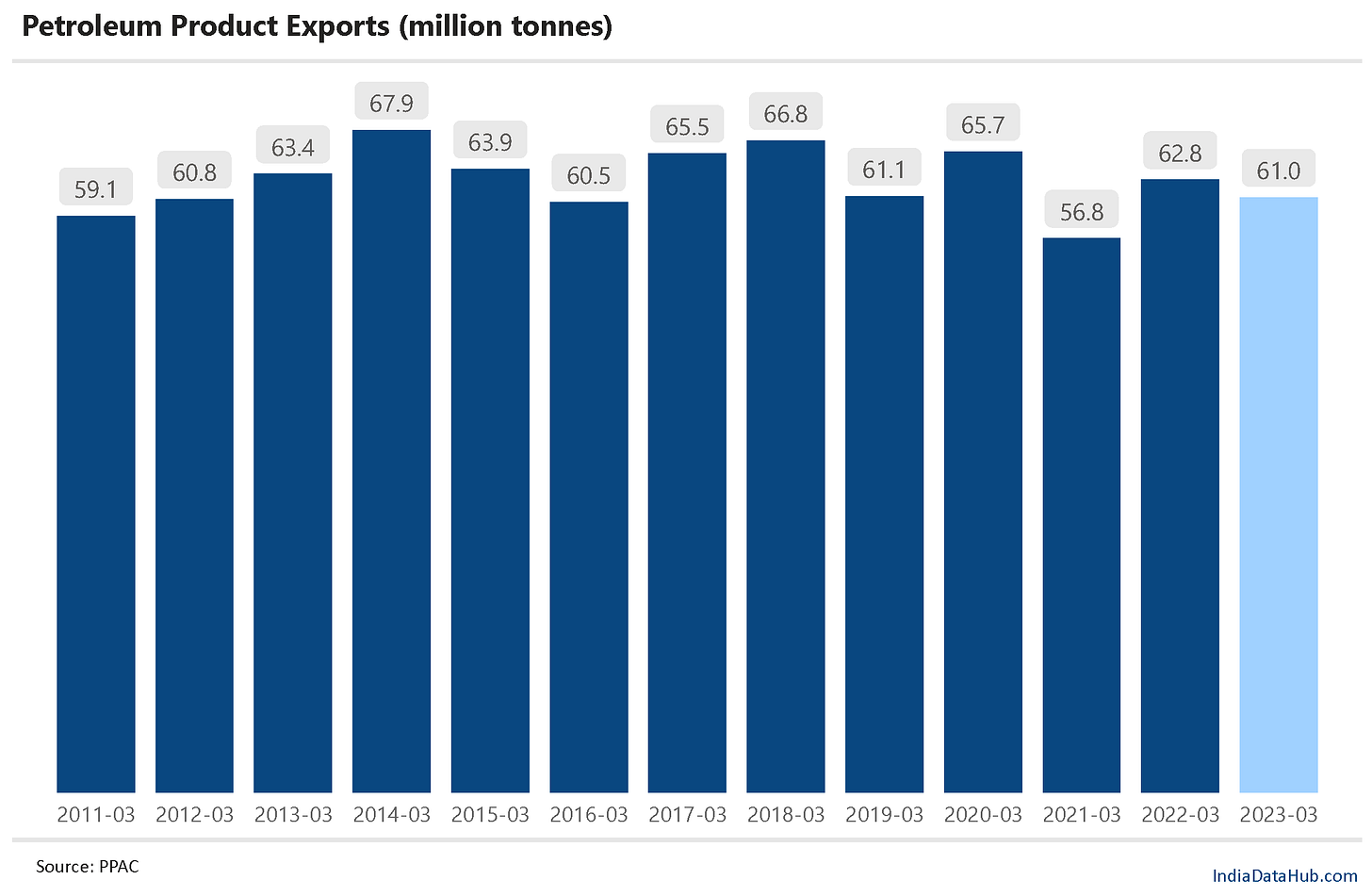

There has been a lot of talk about how India is importing cheap Russian oil, refining it and then exporting it across the world. India has thus, it is alleged, become a conduit for Russia to bypass its sanctions by redirecting its crude as finished products. But the data does not seem to match that claim.

India is indeed a large exporter of petroleum products due to its surplus refining capacity. However, petroleum exports from India declined in FY23 and are below the pre-pandemic levels. And in the first 2-months of the current year, petroleum exports from India have again declined on a YoY basis, albeit modestly. So it does not appear that the Indian refineries are working in overdrive and pumping out as much as they can to bypass the Russian sanctions.

FY23 has started on a weak note for Central government finances. Aggregate tax revenues have declined by 2% in the first 2 months of the year. While income tax collections grew in double digits, corporate tax collections have declined by almost 30%.

This is worrying but the extent of decline suggests that refunds (which tend to be bunched up) have distorted this data. Once the data for June (with the first instalment of advance tax due) is out the trend will be clear. Even Income tax collections grew in low double digits, the rate as the full-year estimate. So, the full-year tax collections target looks a bit challenging going by the initial two months' data.

Money market excess liquidity has reduced over the last week and while it remains in surplus, the inter-bank call money rate has risen above the repo rate. Last two days the call rate has averaged 6.8%, 30bps above the repo rate.

Money market liquidity typically tightens around the 15th of June due to advance tax outflows but it starts to improve in a week or two as government spending releases that liquidity back into the system. The increase this year though appears to be largely frictional as other overnight rates which have much larger volumes are lower than the call rate. Normalcy should thus return to money markets in the next few days.

Overall rainfall has improved in the last week with cumulative seasonal rainfall now just 13% below the long-term average. In sync with this, Kharif sowing has also picked up and is now slightly above last year’s.

However, the composition remains suboptimal. Rice acreage is 25% or 1 million hectares below last year’s and this has been more than offset by a 1.4-million-hectare higher acreage of Coarse cereals. Cotton is another crop where acreage is running materially below that of last year. Oilseeds acreage is also running significantly above that of last year.

That’s it for this week. A flurry of data awaits us next week. We are all set to face it with Raincoats, Umbrellas, hot piping Cutting Chai and Onion Pakoras…