Rupee's continued underperformance, Rising rates, Lower FDI and more....

This Week In Data #153

In this edition of This Week In Data, we discuss:

Rupee continues to depreciate against the USD, but it has depreciated much more against other currencies

Rupee depreciates even as the US Dollar itself is depreciating against most currencies

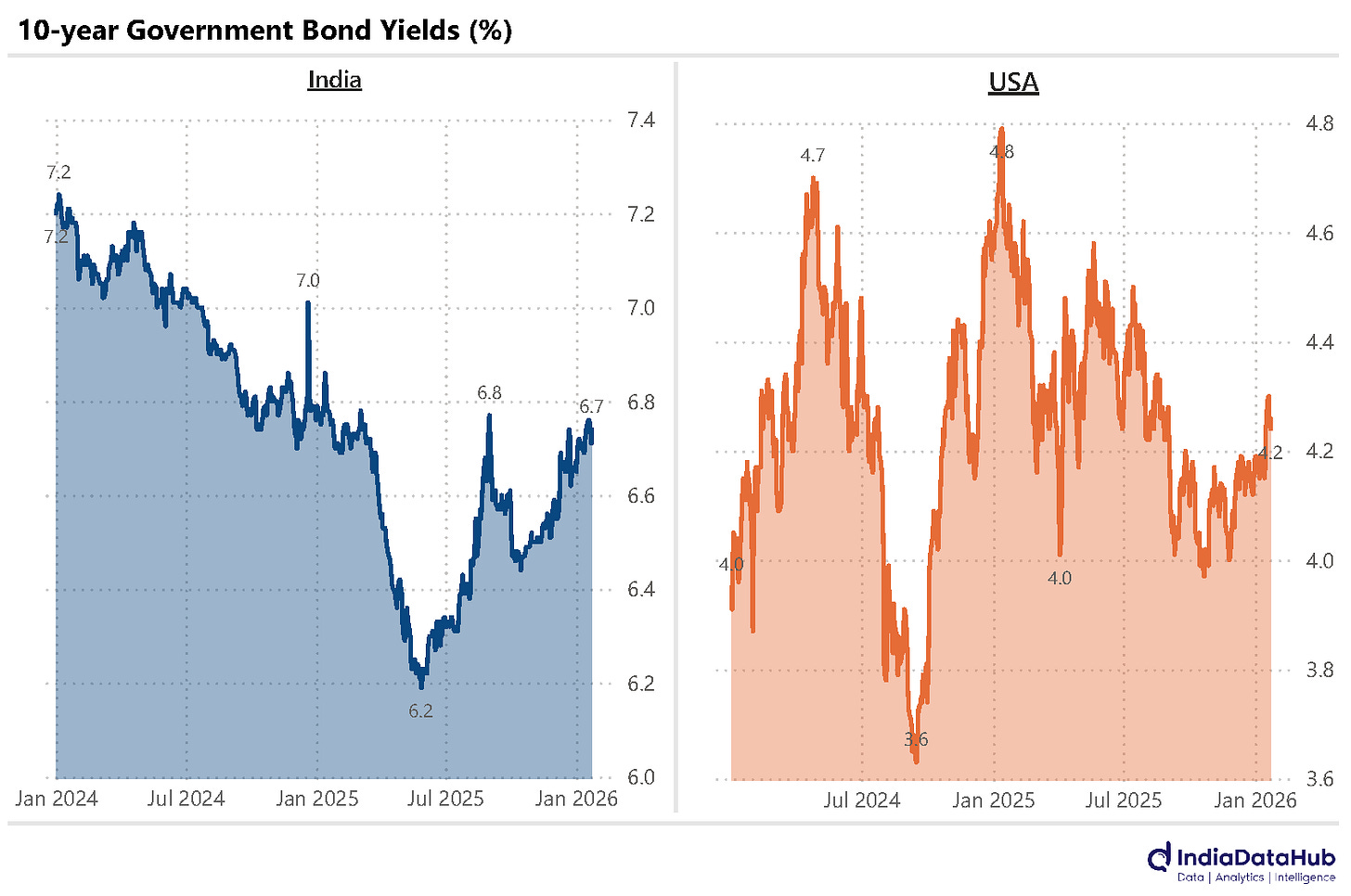

Long bond yields have risen both in India and the USA

RBI continues to intervene heavily to defend the rupee but gold price change is masking the fall in reserves

Net FDI received by India has been negative for the third consecutive month

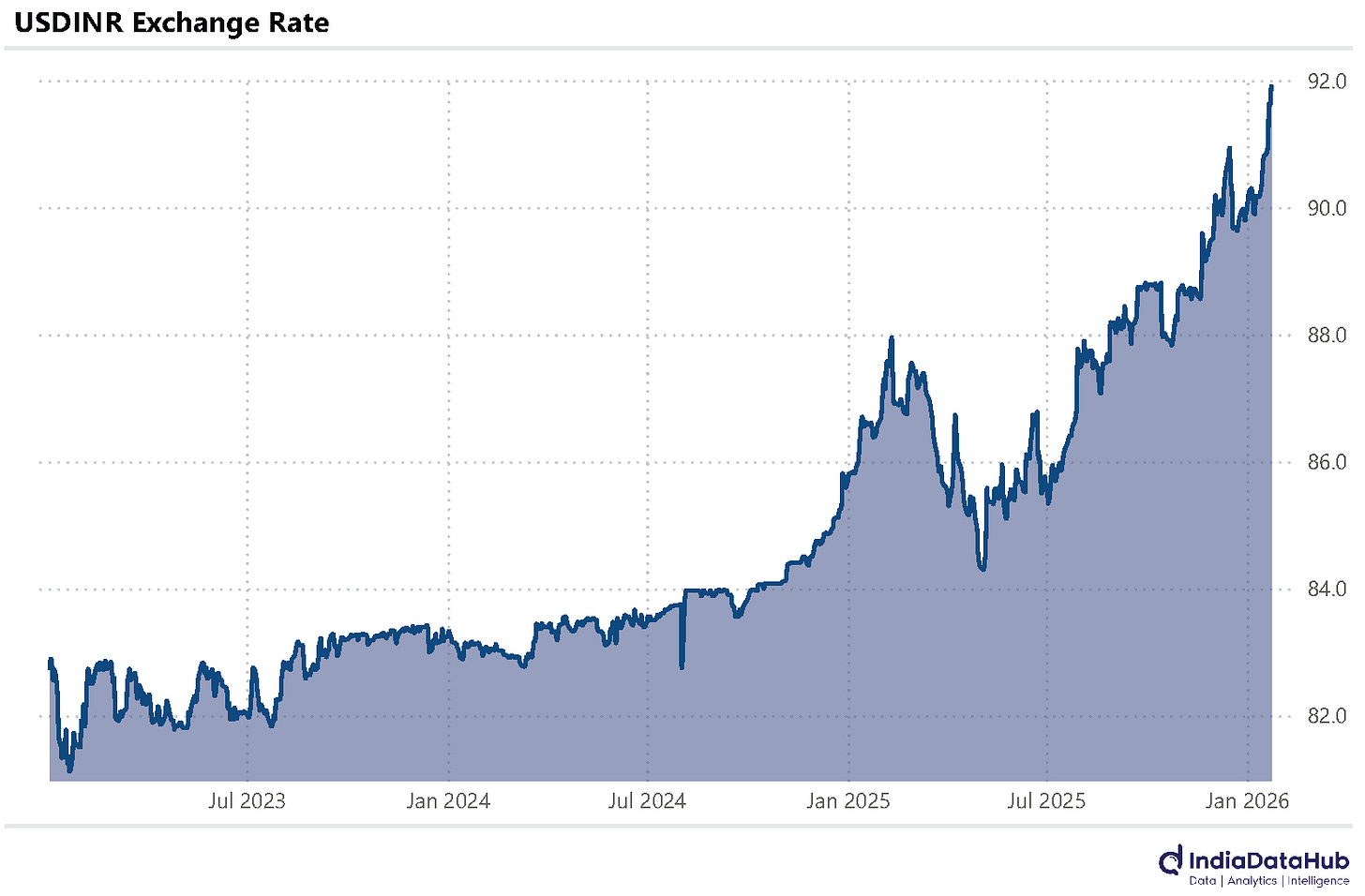

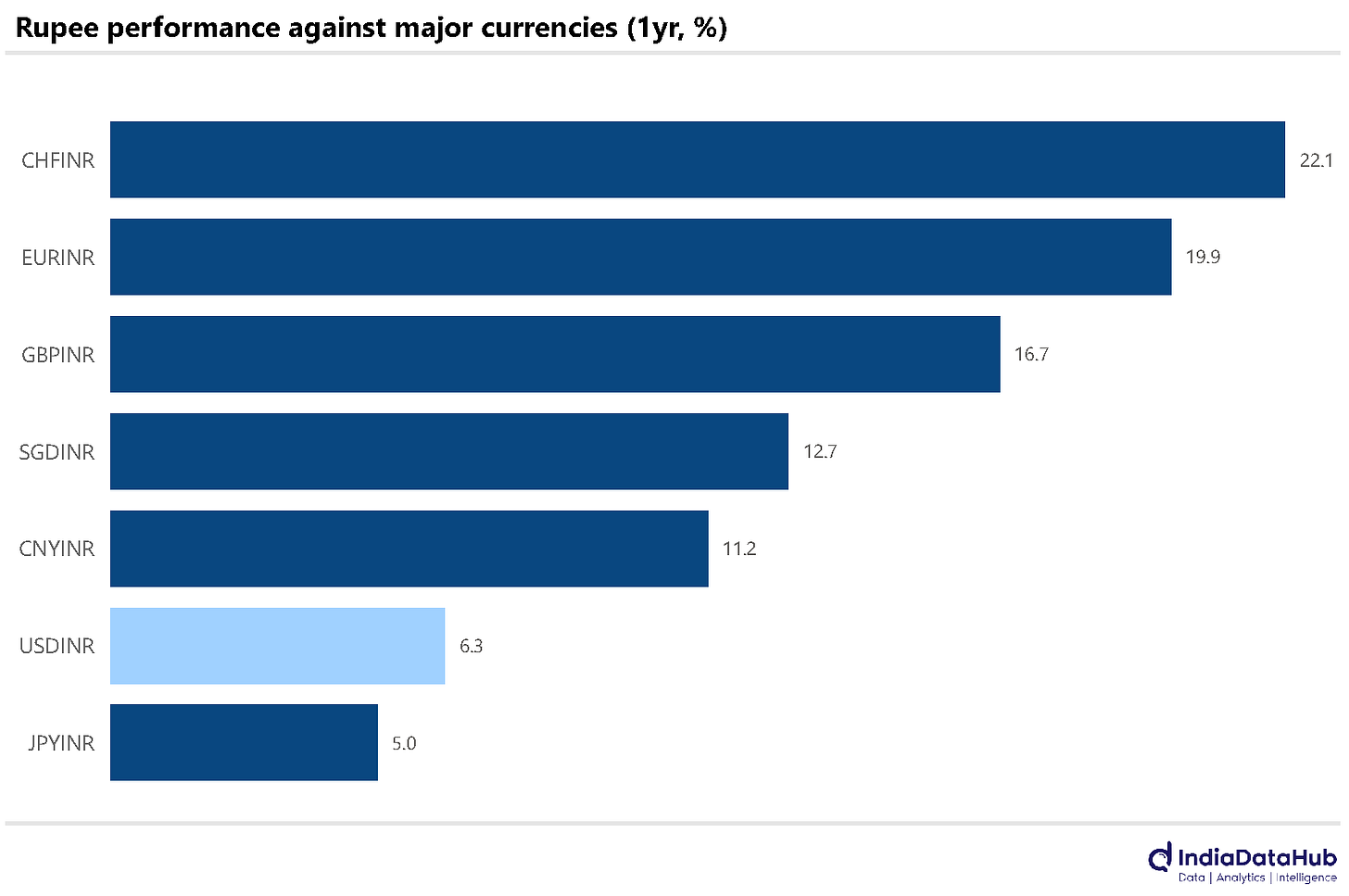

In case you missed, we now fairly comprehensively track the debt market in terms of issuances, trading activity, rating changes, yields and spreads, right down to entity and ISIN level. There are additional analytics based on this that we publish such as estimating bond/cp/cd redemptions, daily issuance etc. See a quick demo from hereWe start with the Rupee, which is now headed towards 92 against the USD. And while the focus remains on the rupee’s exchange rate against the US Dollar, the real story is the rupee’s exchange rate against the other major currencies. While the rupee has depreciated ~7% against the US Dollar over the past year, it has depreciated substantially more against the other major currencies. This is because the US Dollar itself has fallen sharply against most other currencies.

Thus, against the Euro, for instance, the rupee has depreciated by almost 20% over the past year and against the British Pound, the rupee has depreciated by over 15%. Even against the Chinese Renminbi, the rupee has depreciated almost 13% over the past year.

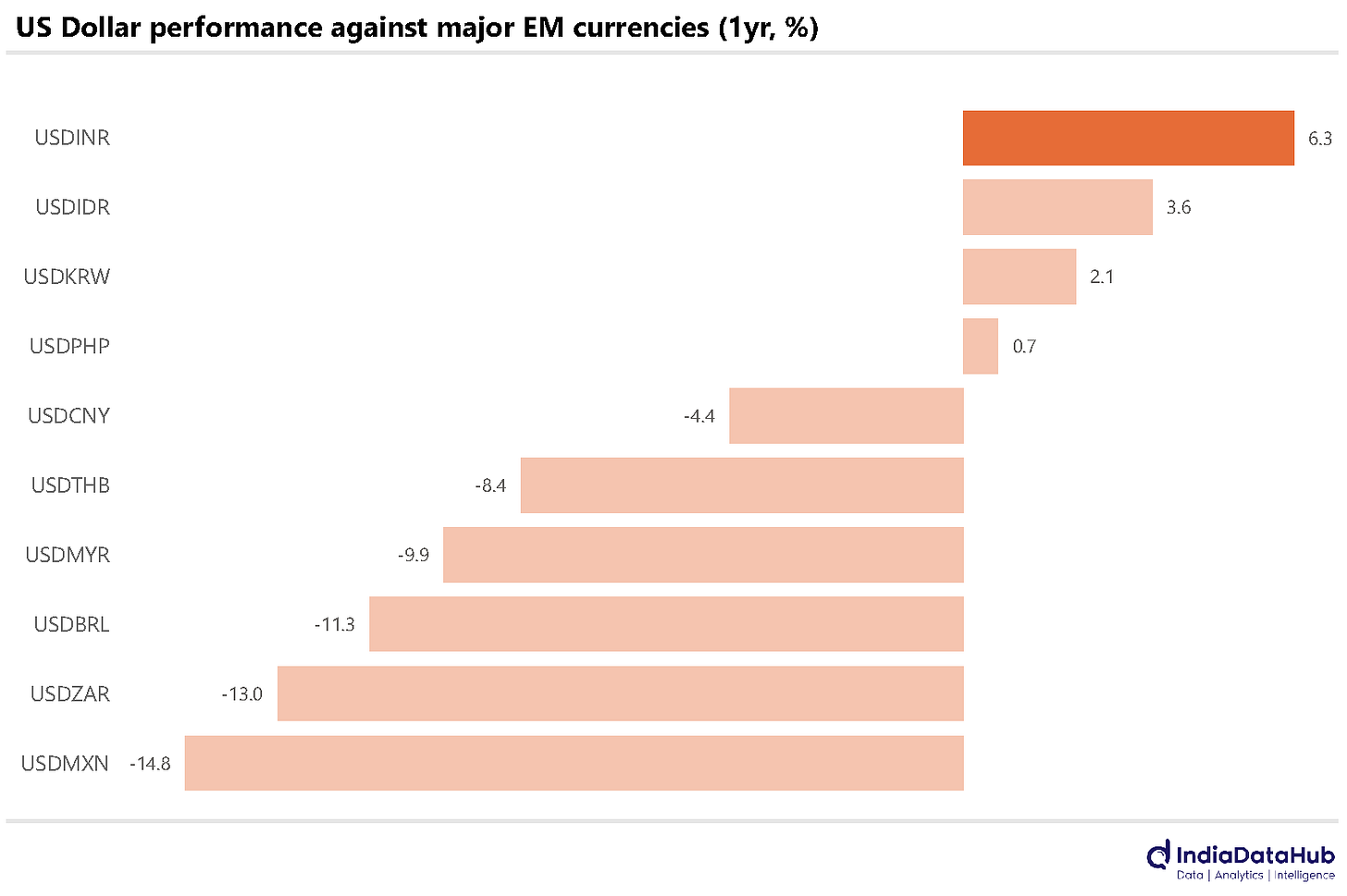

The rupee has been an outlier against other emerging market currencies, also. Over the past year, for instance, the Brazilian Real and the Mexican Peso have appreciated by over 10% against the USD. Even the South African Rand has appreciated in double digits against the USD, while the Malaysian Ringgit has appreciated 10% against the USD over the past year.

Apart from the Rupee, the Indonesian Rupiah has been the worst-performing Asian currency, and it has fallen by just 3% against the USD. Effectively, in the global USD depreciation trade, the INR (and a couple of other currencies) have massively underperformed by depreciating against the USD. And this is odd.

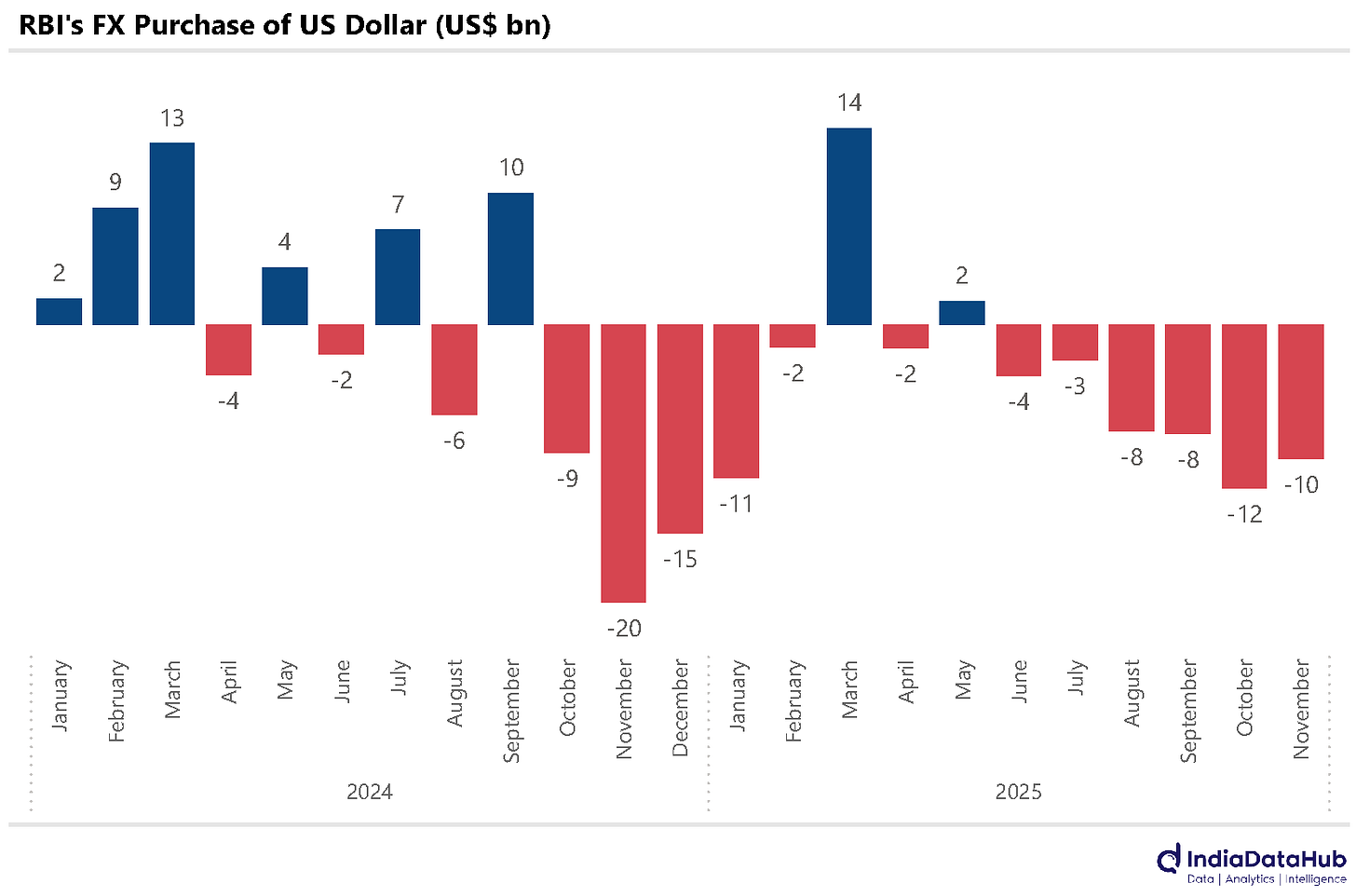

The RBI continues to intervene in the forex market to support the rupee. In November, it sold ~US$10bn of reserves, and between April and November, the RBI has cumulatively sold US$43bn of reserves to defend the rupee. This is, however, not manifesting itself in a decline in the FX reserves as the gains in the value of Gold due to rising prices have almost fully offset the fall in foreign currency assets.

Not surprisingly, this sharp currency depreciation is pushing up bond yields in both India and the USA. The 10-year bond yield in the USA is now ~4.25%, the highest in the last few months. It has now increased by 25bps since October and is the highest since late August. And this is despite the 75bps rate cut from the Federal Reserve during this period. The US yield curve (10yr – 3mth), which was basically flat till September, has now steepened and is over 50bps wide.

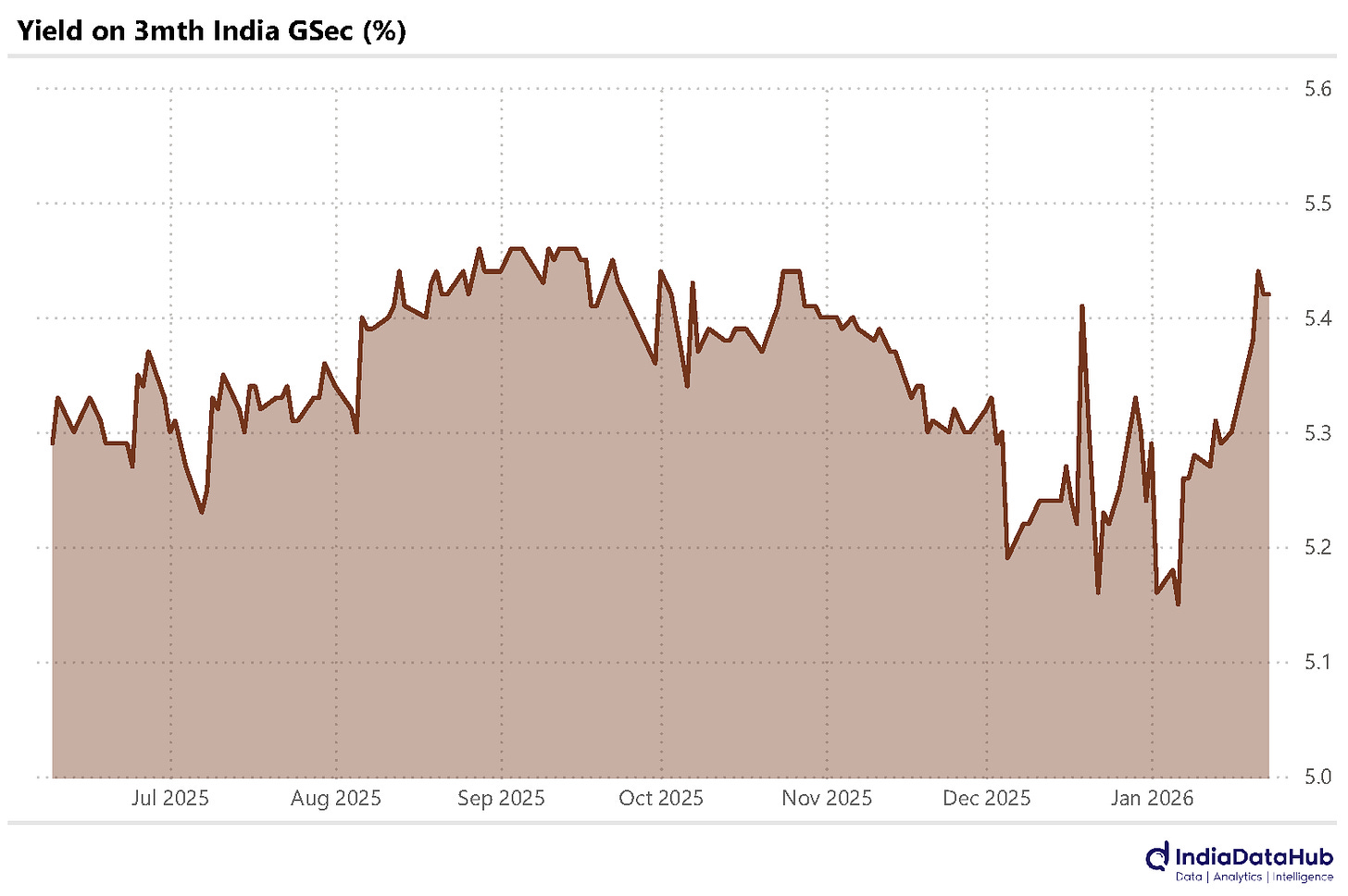

Similarly, in India, the 10-year yield is now above 6.7%, up 25bps since late October and is now the highest in almost a year. Indeed, even short-term rates have increased in the last few weeks. The yield on the 3-month GSec has increased by almost 25bps since the start of the year and is now over 5.4%, the highest since June 2025. And this is despite the 125bps of policy rate cut in 2025.

Not surprisingly, the RBI is boosting liquidity to reduce the stress in the money markets. With the Union Budget around the corner, one suspects the bond market will settle down only post the budget, once the deficit and borrowing numbers for FY27 are available.

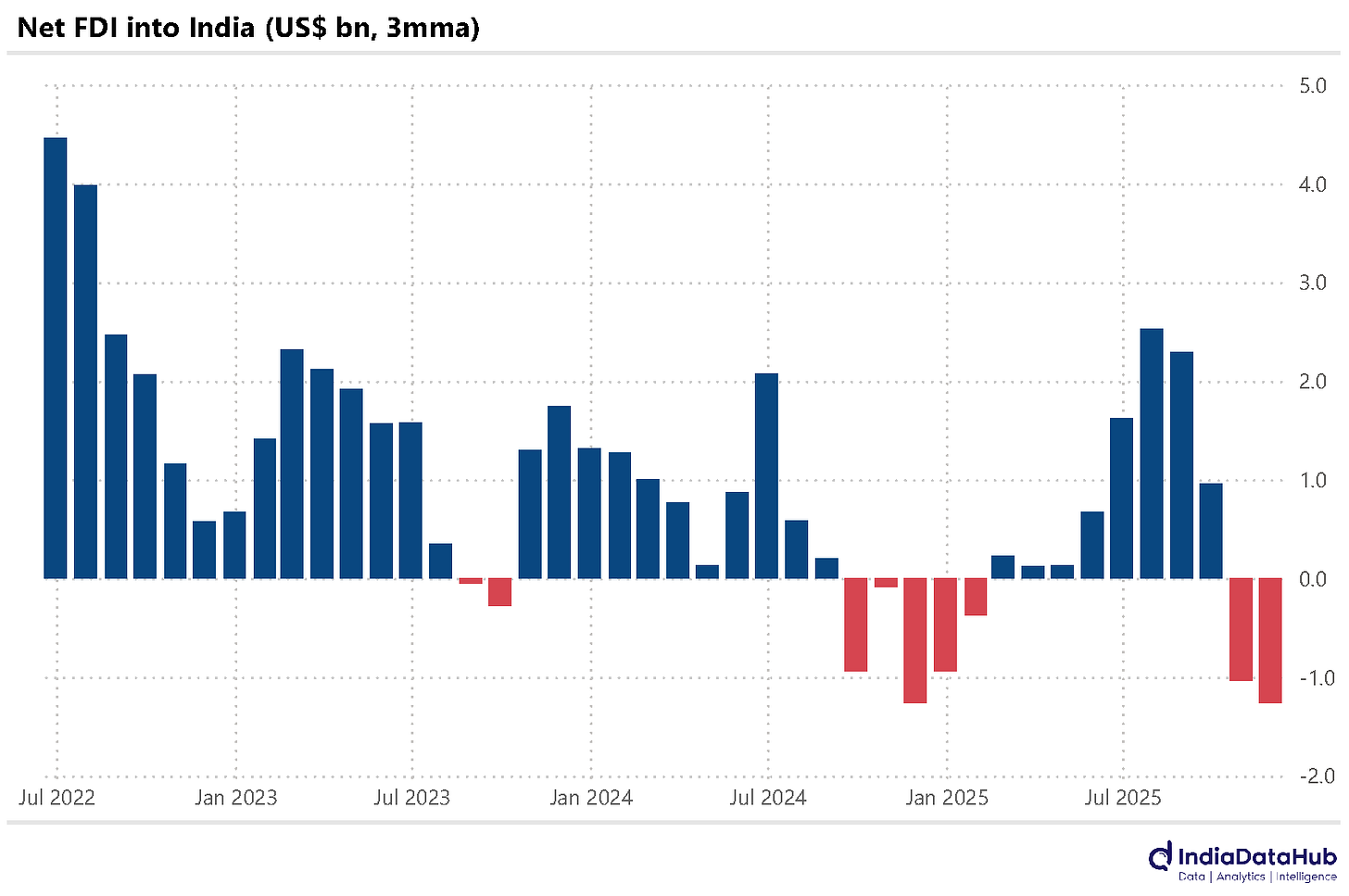

Lastly, one of the drags on the currency and by implication the interest rates is that while the trade deficit is contained, there is a lack of capital flows. And one of the factors here is the absence of FDI. Net FDI received by India (adjusted for repatriation as well as outward FDI by Indian corporates) was negative (meaning more money went out than came in) for the third consecutive month in November as per the provisional data from RBI released this week. Over these 3 months, India saw an outflow of FDI of almost US$4bn, taking the YTD cumulative net FDI inflow to a modest US$6bn.

For reference, India’s trade deficit (goods + services) has totaled just under US$100bn between April and December of FY26. This extremely low level of FDI relative to the trade deficit increases the vulnerability to swings in portfolio flows. And this is exactly what we are seeing currently.

That’s it for this week. It will be the budget next week(end!). So, we shall see if there is anything in the budget to change any of this. The flipside of the rupee depreciation and RBI’s FX intervention will be significantly higher realised FX gains for the RBI, which it can pay as a dividend to the Central government. Will the government use it to cut some taxes or boost spending? And will any of that turn around the sentiment? We shall find out soon! So long...

Well written and compiled!

India's domestic savings are weak enough relative to the economy's investment needs, and the financial system lacks the political and institutional ability to channel available savings into long term, productivity enhancing investment. As a result, growth increasingly depends on mobile foreign capital , capital that is cyclical, returns sensitive, and easily reversible. This is exactly what hurts the Indian rupee more than it's considering a trade shock due to U.S tariffs.