Welcome back to This Week in Earnings. We’re now at the end of the 1Q FY26 results season, with just over 4000 companies having reported their results as of the 16th of August. The broad contours remain familiar: revenues are growing in the mid-single digits, but profits are showing sharper swings as sector stories diverge.

This newsletter is structured in two sections. The first section covers the trends in aggregate, across sectors. And the second section reviews the key company results declared during the week grouped by sectors. Section 1: Aggregate Trends

Section 2: Key Results during the week

Consumer Discretionary

Financial Services

Industrials

Commodities

Services Sector

Information Technology

Healthcare

FMCG

Utilities

Energy

Telecom

Diversified Cos

Aggregate Trends

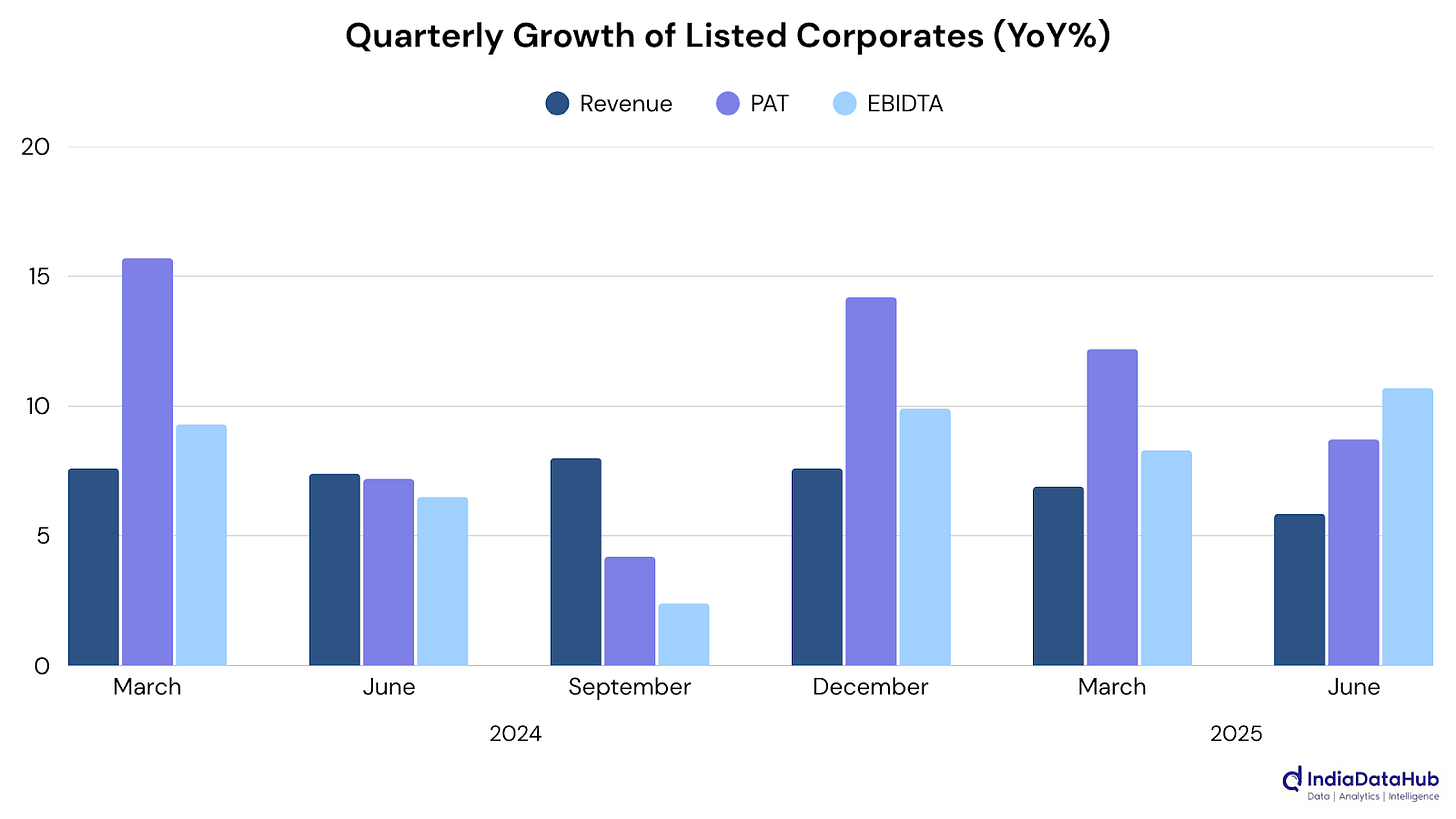

At the aggregate level, revenue growth has softened slightly to ~6%, while PAT is tracking higher at ~7%, with the gap largely explained by cost discipline and a few sharp company-level shifts.

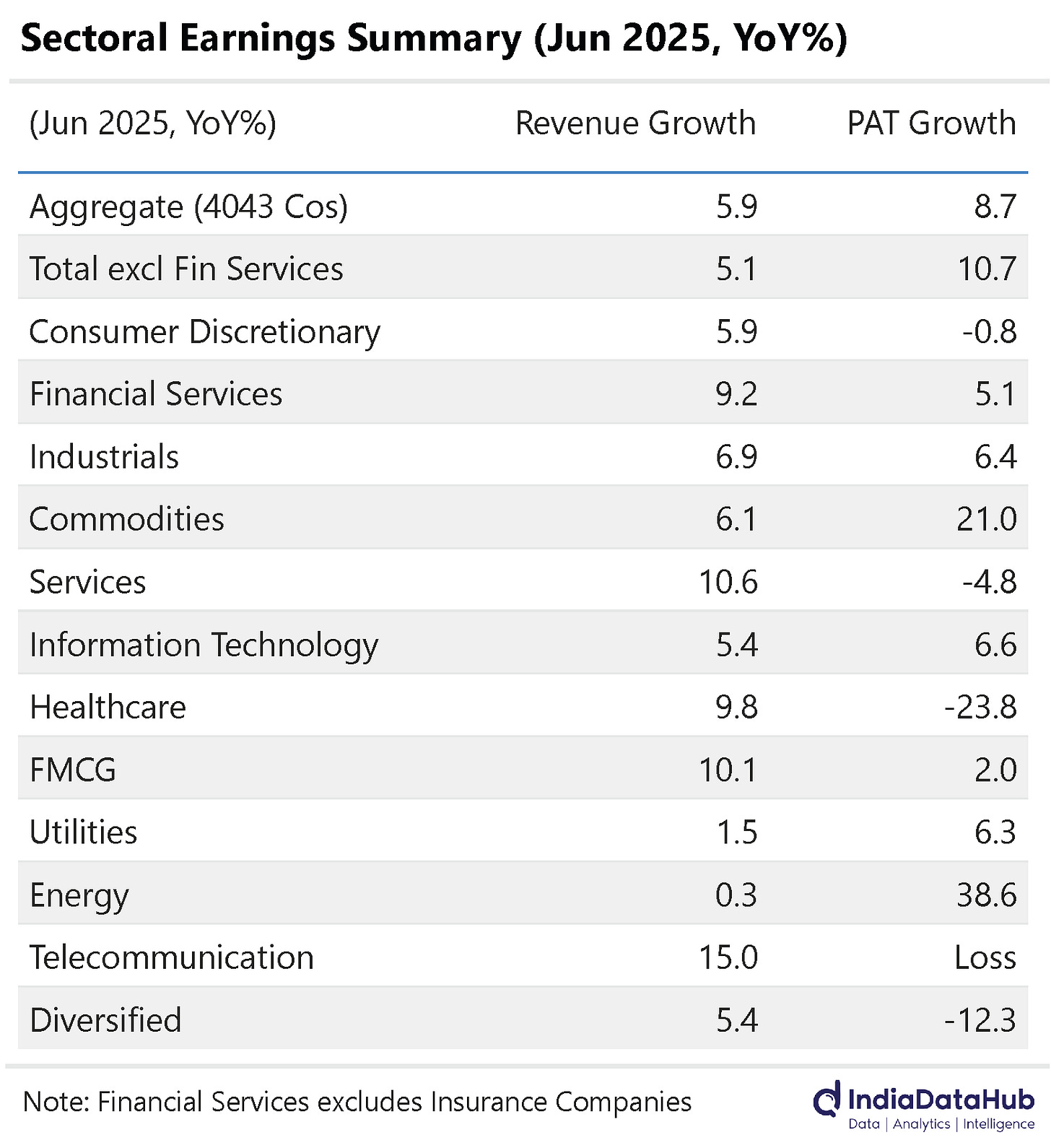

Sectorally, the divergences are widening. Industrials lost momentum this week, with profit growth cooling to 6% from 16% last week as a few large players weighed on the aggregate. Commodities held steady on revenues but turned in another strong profit surge (+21%), lifted by large-cap metal majors and a steel turnaround. Energy profits jumped nearly 39% on flat toplines, almost entirely on the back of IOC’s outsized quarter. Telecom delivered the biggest headline swing this week, though not for the right reasons. The sector, in profit until last week, has now slipped into aggregate losses despite double-digit revenue growth. The numbers were distorted by legacy players still bleeding heavily.

Elsewhere, Financial Services improved modestly, with Muthoot Finance’s bumper quarter offsetting steep losses at its microfinance arm. Consumer Discretionary stayed in mild decline, dragged disproportionately by Bata’s earnings collapse despite healthy performances across autos, retail, and real estate. FMCG looked similar: steady mid-cap growth was pulled down by misses at the very top, with Patanjali and United Spirits both posting weaker quarters.

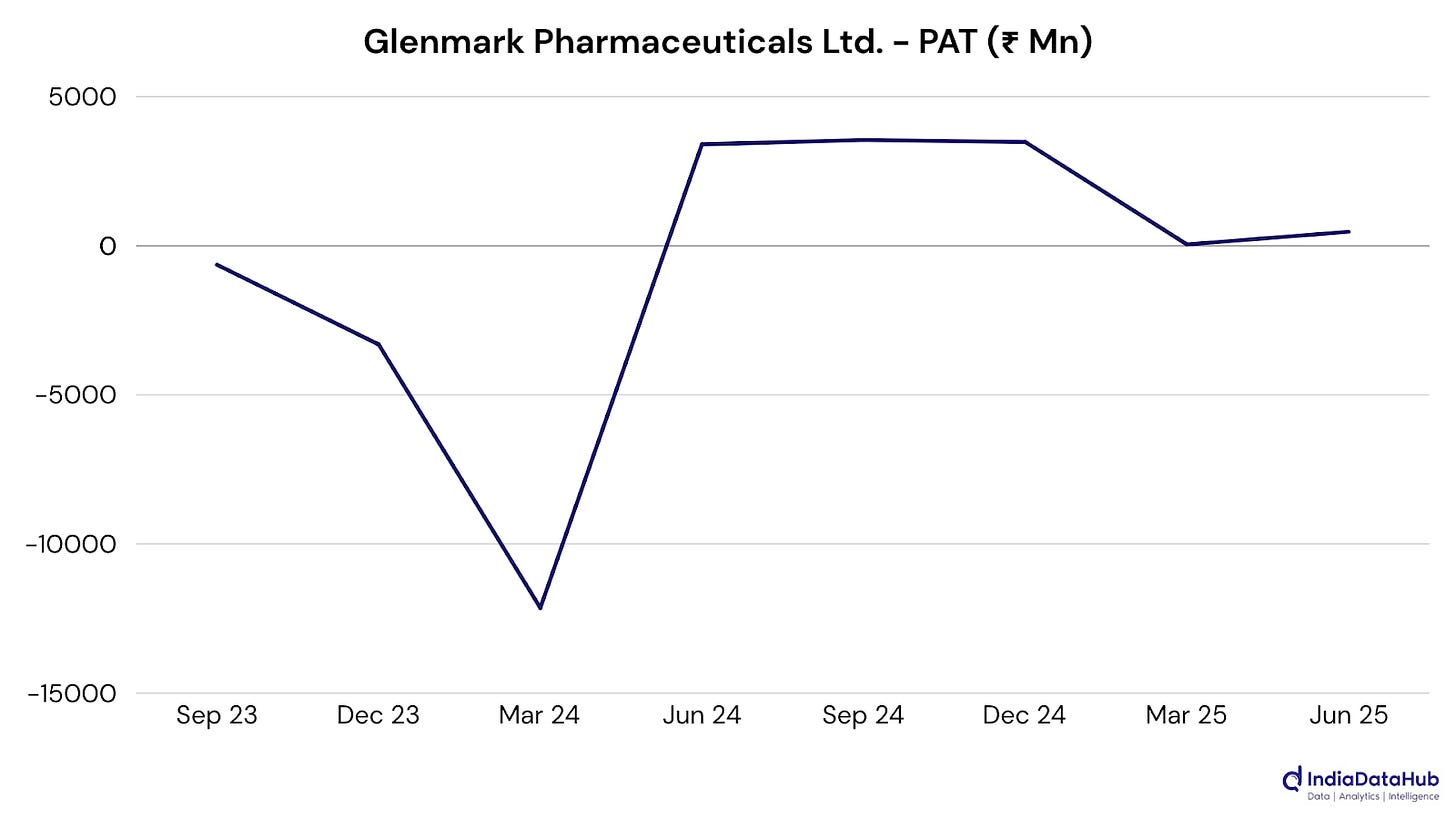

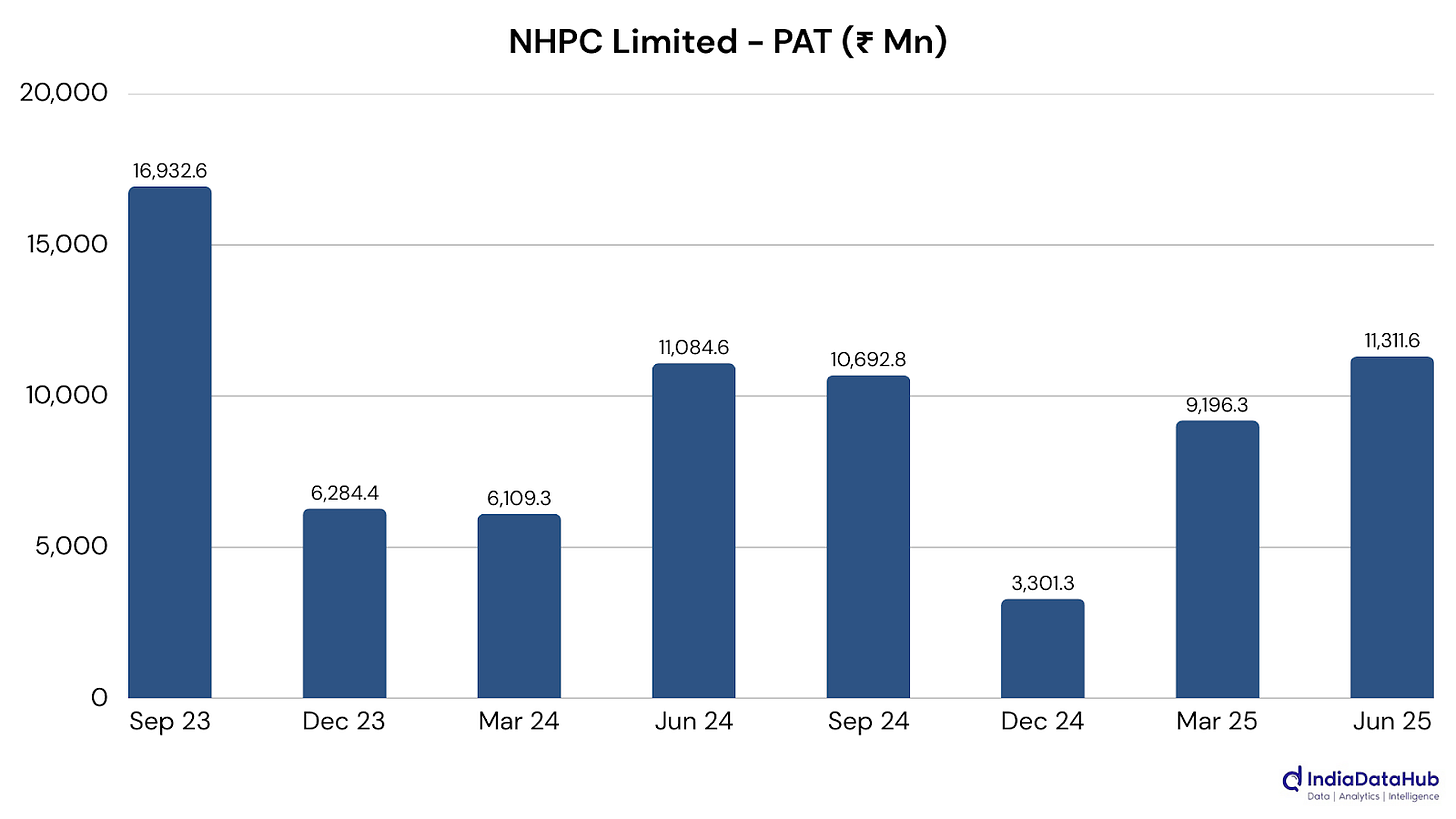

Healthcare remained the heaviest drag: revenues grew close to 10%, but profits fell 24% as Glenmark’s collapse offset strong showings by most other large pharma names. Services slipped further into the red, driven by weakness in logistics and infrastructure despite some bright spots in co-working. Utilities remained steady, with NHPC anchoring profits even as peers faltered.

In short, while revenues remain sluggish across the board, profit momentum is being defined by a handful of sector-heavyweights. In some cases, like Energy and Telecom, single-company swings reshaped the entire story; in others, like Consumer Discretionary and Healthcare, one drag erased the gains of many. The headline remains the same: margins matter more than growth right now, and the earnings season is being carried (or capsized) by a few decisive balance sheets.

1. Consumer Discretionary: [#1015] [Rev: +5.89%] [PAT: -0.75%]

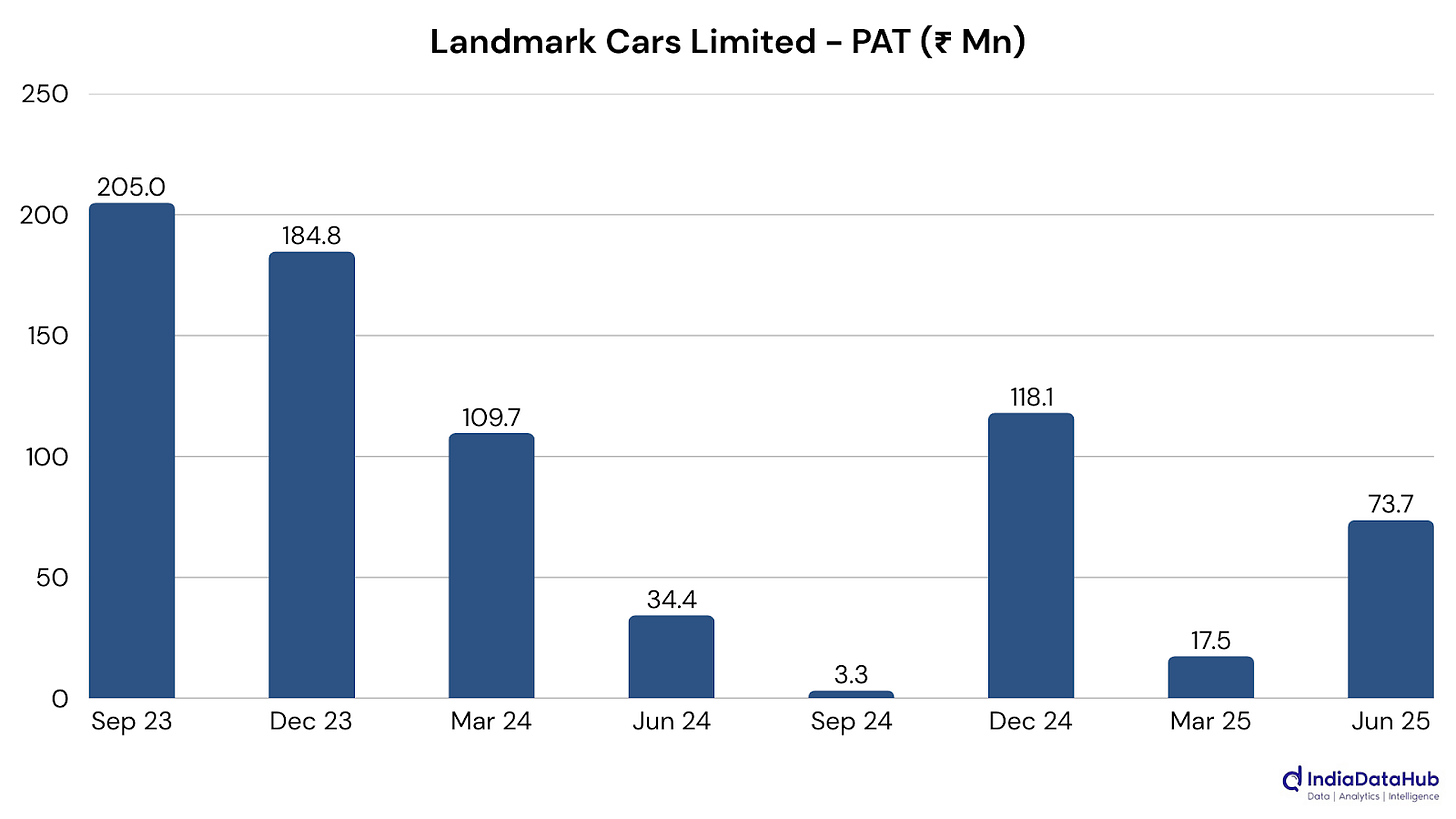

Landmark Cars Limited: Revenue jumped nearly 28% this quarter, well above the broader auto market, helped by stronger traction from newer brands like BYD and MG. Profit nearly doubled as higher volumes flowed through a leaner cost base.

Devyani International Limited: Revenue grew 11% but soaring costs and heavy expansion dragged down margins, with EBITDA slipping to 15.1% from 18.3%. Profit fell sharply despite a small sequential recovery.

Samvardhana Motherson International Limited: Revenue held up better than global auto production, but profits slumped nearly 40% as margins narrowed to 8.2%. Structural pressures in Europe, start-up costs from expansions, and currency swings all weighed on performance.

M.R.F. Ltd.: Revenue rose 6.7%, but higher rubber prices and rising expenses squeezed margins, with EBITDA slipping to 13.7%. Profitability took a hit as input cost inflation outpaced the company’s ability to adjust pricing.

Vishal Mega Mart Limited: Revenue jumped 20% with profit up 37%, fueled by new store openings and strong same-store sales growth. Own brands now make up over three-fourths of sales, boosting margins and reinforcing Vishal’s value-retail positioning.

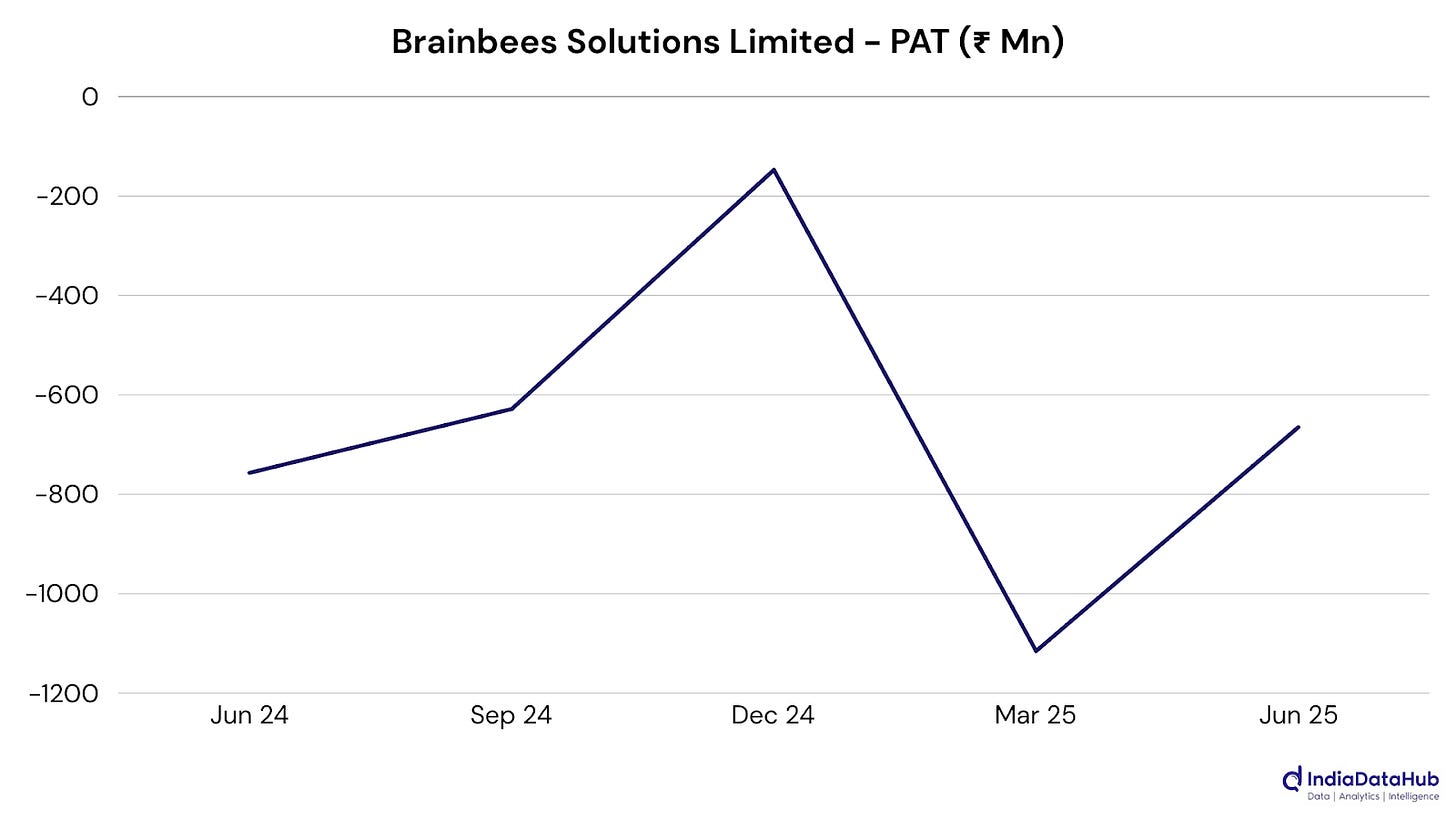

Brainbees Solutions Limited: Revenue rose about 12% with losses narrowing to ₹66.5 crore, helped by stronger international business and tighter cost controls. Domestic growth slowed due to delivery disruptions and weak discretionary demand, but cash flow turned positive this quarter.

Aditya Birla Lifestyle Brands Limited (ABLBL): Revenue inched up 3% and profit rose 5%, supported by stronger retail sales and growth in youth brands and innerwear. Gains were tempered by a 19% drop in e-commerce and the strategic exit from Forever 21.

Aditya Birla Fashion and Retail Limited (ABFRL): Loss widened to ₹238 crore despite higher revenue, as post-demerger transition costs, sluggish Pantaloons sales, and heavy marketing spends weighed on margins. Ethnic and digital-first brands grew, but upfront investments kept profitability under strain.

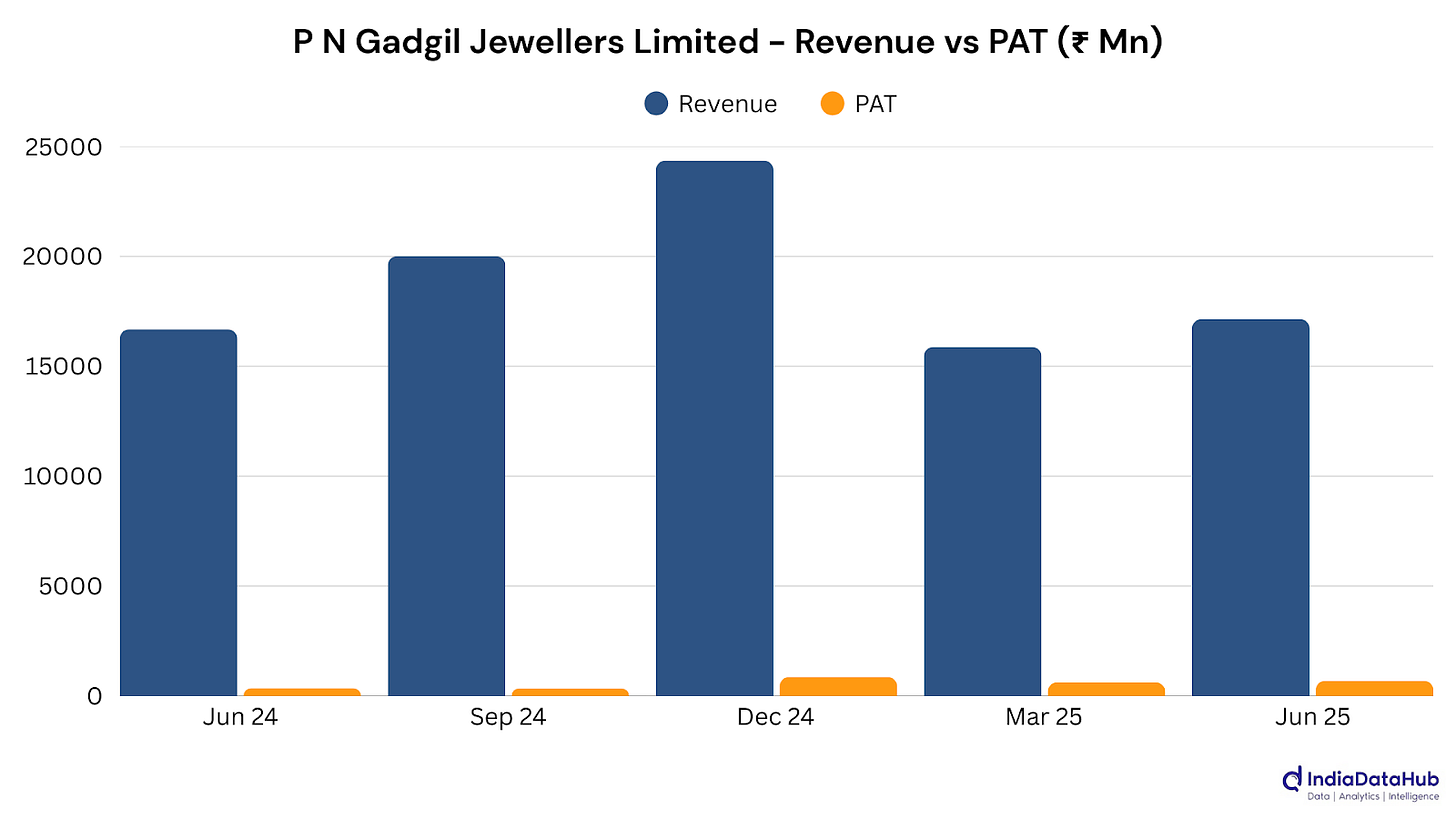

P N Gadgil Jewellers Limited: Revenue rose just 3%, but profit nearly doubled as studded jewellery sales surged over 40%, online revenue more than doubled, and retail expansion lifted margins. Strong festive demand and sharper product mix drove the standout quarter.

Indian Railway Catering & Tourism Corporation Ltd: Revenue grew just 4%, its slowest pace in many quarters, but profit still rose 7% as margins improved. Ticketing and tourism held firm, offsetting softer catering and flat Rail Neer sales, keeping IRCTC’s model resilient.

TVS Srichakra Ltd: Revenue rose just 3.6%, but profit nearly doubled as cost controls, better mix, and higher other income lifted the bottom line. Margins at the operating level stayed under strain, yet tax and efficiency gains drove the strong PAT jump.

Bata India Ltd: Profit dropped 70%, largely because last year’s numbers were flattered by a one-time land sale. Revenue slipped slightly as weather and weak urban demand hit store traffic.

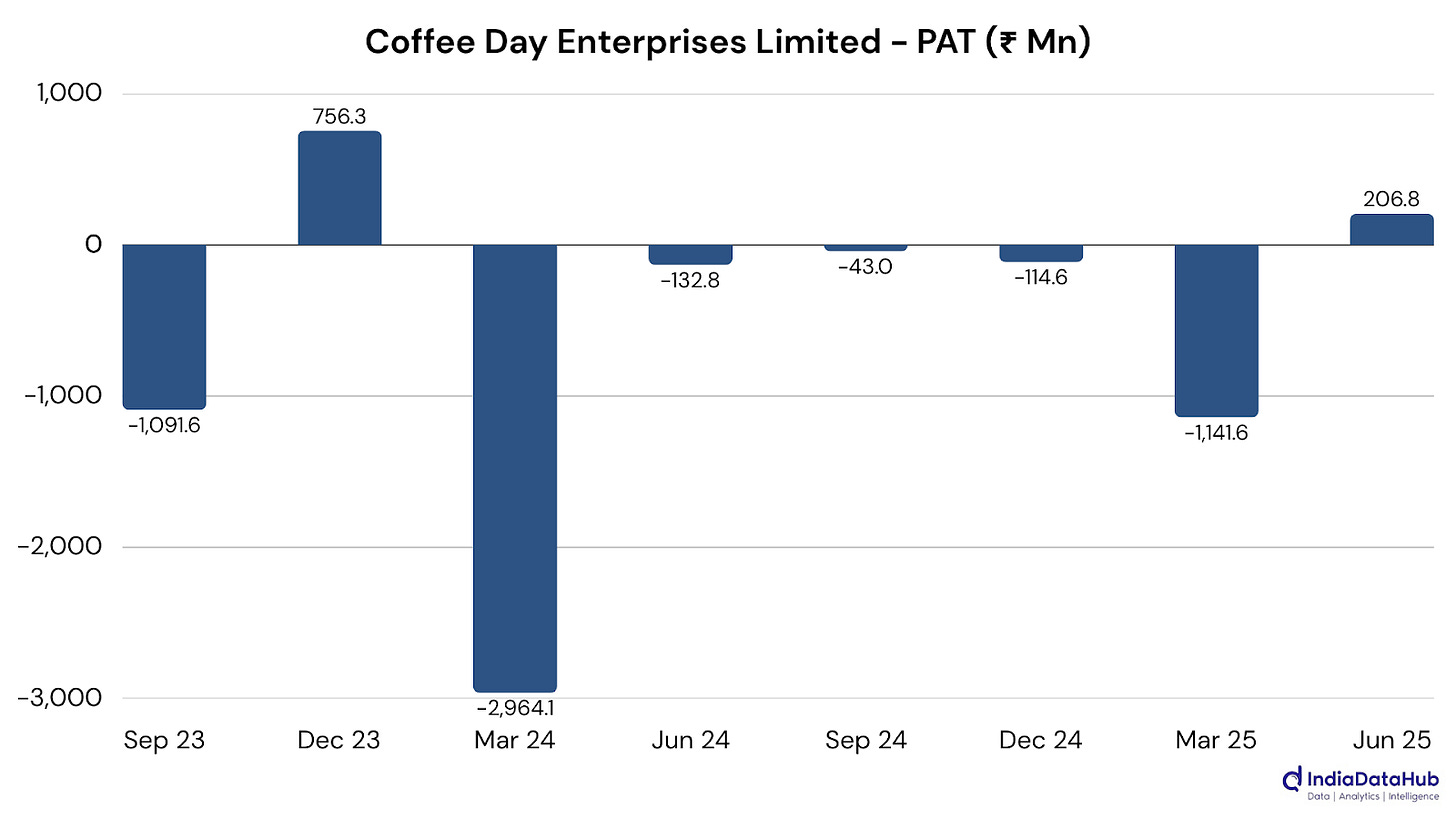

Coffee Day Enterprises Ltd: CDEL swung to a ₹23 crore profit from last year’s loss, aided by tighter cost controls and modest 3.6% revenue growth. Café Coffee Day trimmed losses as unprofitable outlets shut, while vending machines kept expanding at lower cost. The company has long struggled with debt since 2019. Unlike peers that rely heavily on café expansion, CDEL has doubled down on vending machines, which now exceed 55,000 units and provide steadier, lower-cost revenue. Café closures, while reducing scale, improved per-store efficiency and narrowed losses. Together, these moves highlight a recovery strategy distinct from most QSR or café operators.

S.P. Apparels Ltd: Revenue jumped 64% to a five-quarter high, with profit up 23% as new capacity and stronger order execution kicked in. Rising debt and higher interest costs weighed on cash flow, reflecting the strain of rapid expansion.

Ethos Ltd: Revenue surged nearly 27% on strong luxury watch demand and network expansion, but profit slipped 17% as costs rose faster than sales. Margins narrowed with heavier marketing and boutique rollout expenses weighing on short-term profitability.

Indo Rama Synthetics Ltd: Revenue jumped 38% to ₹1,306 crore, driving a swing to ₹52.8 crore profit from last year’s loss. Margins turned positive at 7.7% as cost controls, steadier input prices, and stronger polyester demand lifted operating performance. A near ₹72 crore swing in profit within a year signals more than just price stability. Indo Rama seems to have coupled demand recovery with disciplined cost management and sharper working capital control, evidenced by the dramatic cash flow turnaround. This is an industry where margins often evaporate with crude-linked volatility, and so such a strong bounce underscores how operational discipline can magnify the benefits of even modest tailwinds.

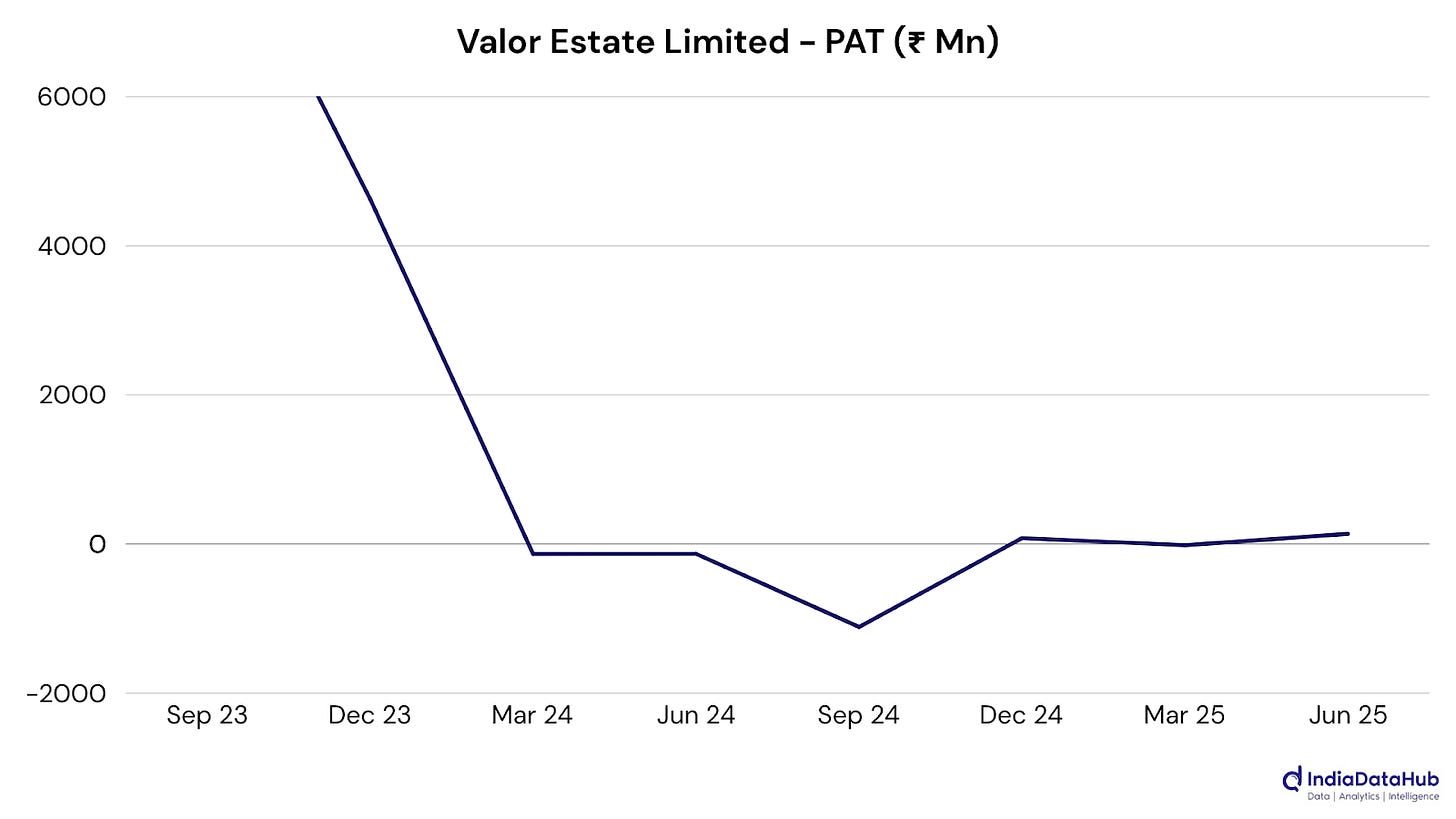

Valor Estate Ltd: Revenue rocketed to ₹840 crore from just ₹7 crore last year, almost entirely from the Ten BKC project, hitting revenue recognition. Profit swung into the black, aided by advances for new Mumbai redevelopments and a cleaner post-demerger structure.

Bhartiya International Ltd: Revenue climbed 22% to ₹280 crore, while profit swung to ₹5.6 crore from last year’s loss, helped by stronger export demand and tighter cost control. Margins widened notably, showing improved leverage in its leather-focused operations.

Arihant Superstructures Ltd: Revenue jumped 45% to ₹121 crore, while profit surged nearly sevenfold to ₹16 crore, driven by sharper margins above 30%. Strong project execution and a favourable mix in Mumbai’s housing market underpinned one of the sector’s standout quarters.

Jubilant Foodworks Ltd: Profit soared nearly 60% to ₹94 crore as revenue rose 17% to ₹2,261 crore, led by Domino’s strong order growth and resilient margins. Delivery sales surged, store expansion hit a record pace, and new brands added further scale.

Endurance Technologies Ltd: Revenue rose 17% to ₹3,355 crore, outpacing weak two-wheeler volumes through stronger product mix and pricing. Profit climbed 11% to ₹226 crore, with stable margins and Europe operations delivering standout growth despite broader industry headwinds.

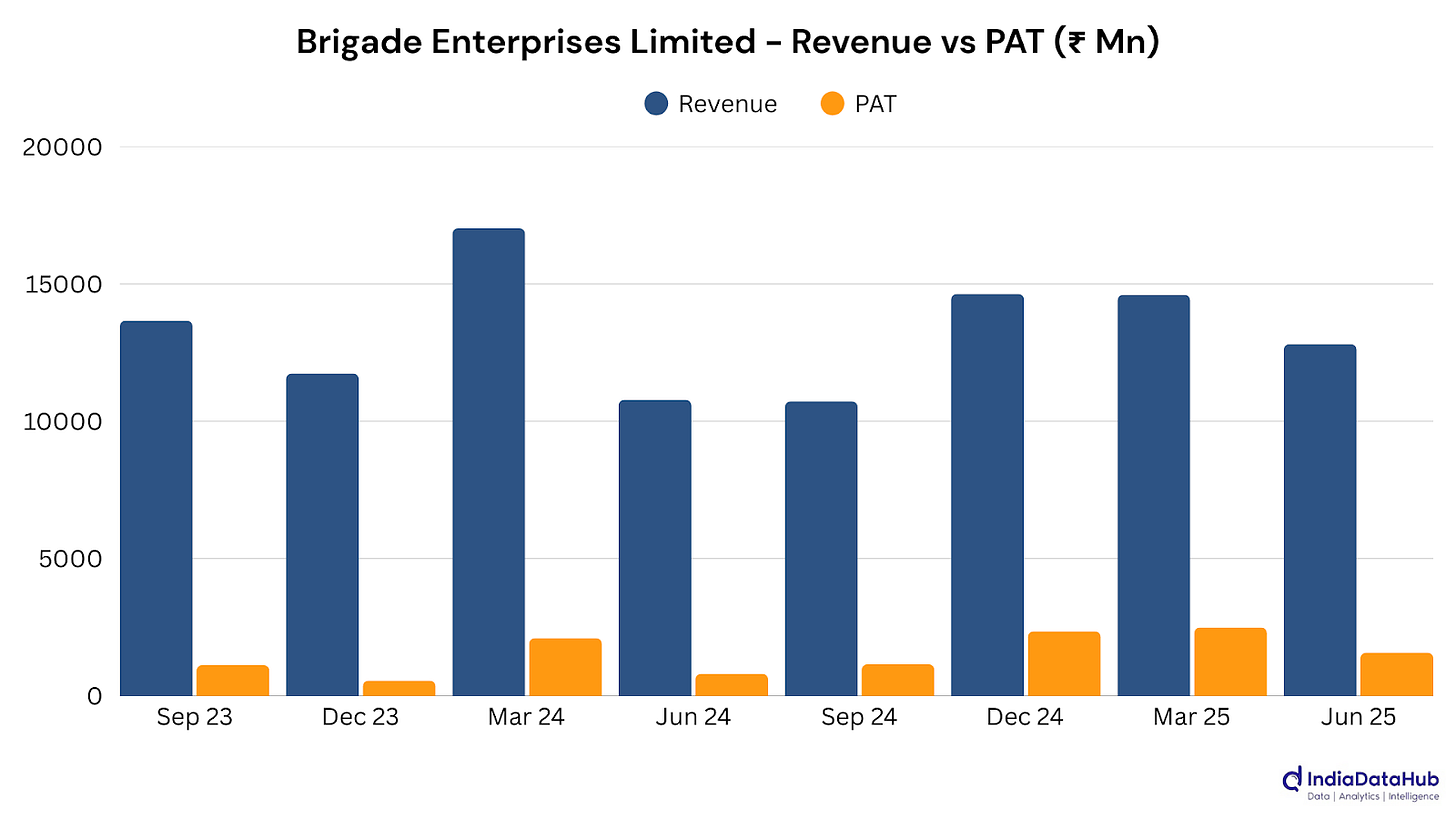

Brigade Enterprises Ltd: Revenue rose 19% to ₹1,281 crore, while profit nearly doubled to ₹158 crore on strong residential, leasing, and hospitality momentum. Pre-sales touched ₹1,118 crore with higher realizations, though margins tightened slightly on rising construction costs.

Nitco Ltd: Revenue more than doubled to ₹150 crore, with profit swinging to ₹47 crore from last year’s loss, largely aided by the Alibaug land monetization deal. Core tile sales also grew 31%, while tighter costs amplified the turnaround.

Minda Corporation Ltd: Revenue hit a record ₹1,386 crore, up 16% YoY, with margins steady at 11.3%. Growth came from premium products, a wider customer base, and resilient vehicle demand, while a new JV with Toyodenso signals longer-term tech expansion.

Ashiana Housing Ltd: Revenue more than doubled to ₹293 crore on project handovers in Gurugram and Chennai, but profit slipped 27% QoQ to ₹13 crore. Higher expenses and a tilt toward lower-margin projects tempered the otherwise sharp top-line surge.

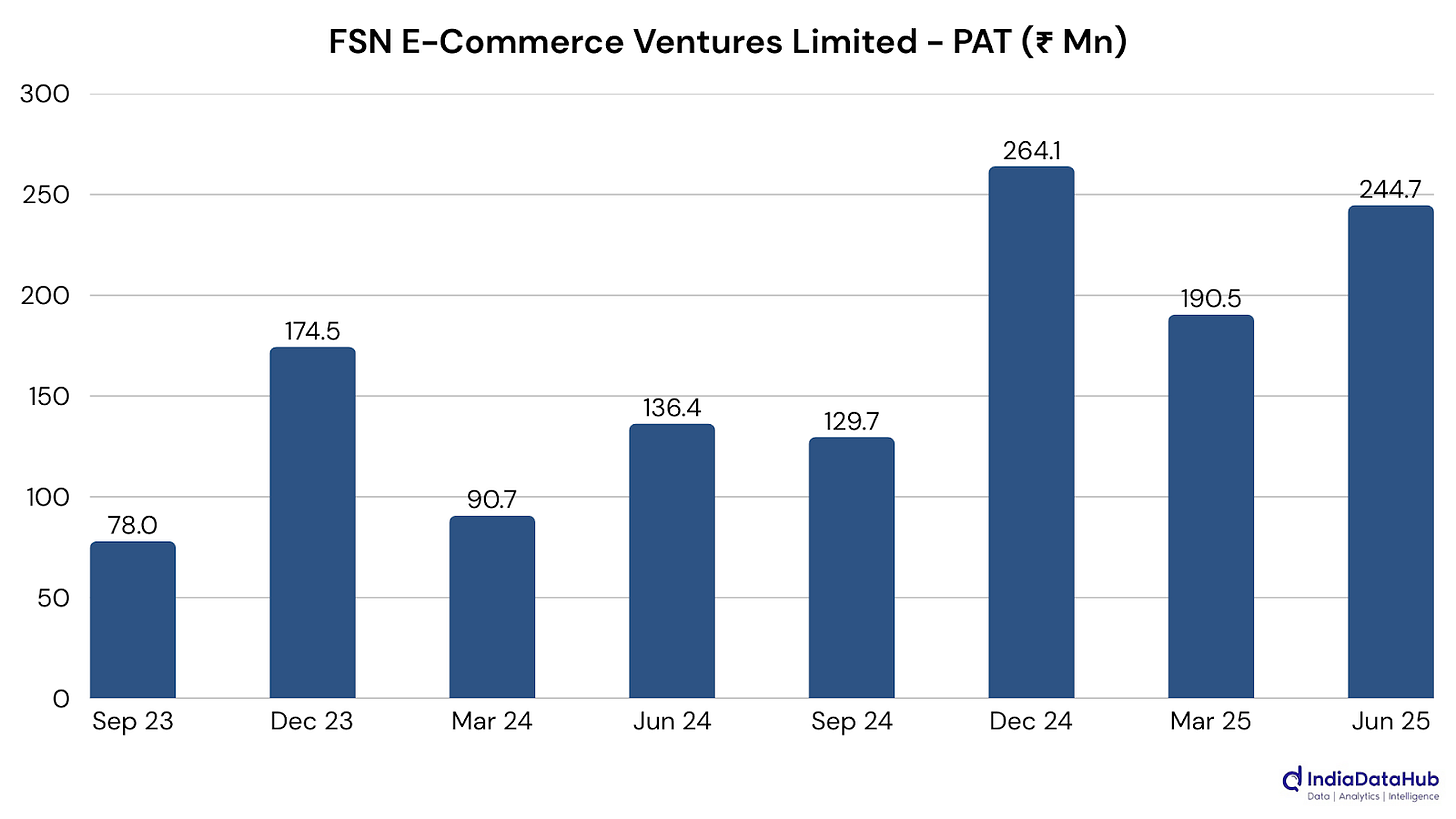

FSN E-Commerce Ventures (Nykaa): GMV climbed 26% to ₹4,182 crore, with profit up 79% to ₹24.5 crore as Nykaa leaned into premium products and its fast-growing House of Brands, now 18% of beauty GMV. Fashion rebounded 25%, while offline expansion hit 250 stores.

Renaissance Global Ltd: Revenue surged 43% to ₹530 crore, led by strong customer brand demand and 37% growth in D2C. Profitability, however, was hit by US tariffs and a ₹12 crore facility closure cost, masking otherwise solid operational efficiency gains.

Hubtown Ltd: Revenue nearly doubled to ₹235 crore, while profit jumped over twelvefold to ₹82 crore, aided by sharper project execution, lower costs, and a boost from other income. Margins swelled to 34%, though sustainability rests on recurring operations.

Senco Gold Ltd: Revenue grew 30% to ₹1,826 crore, while profit more than doubled to ₹105 crore, powered by festive demand, strong same-store sales, and an improved product mix tilted toward diamonds. Margins expanded to 10% as expansion and premiumization paid off.

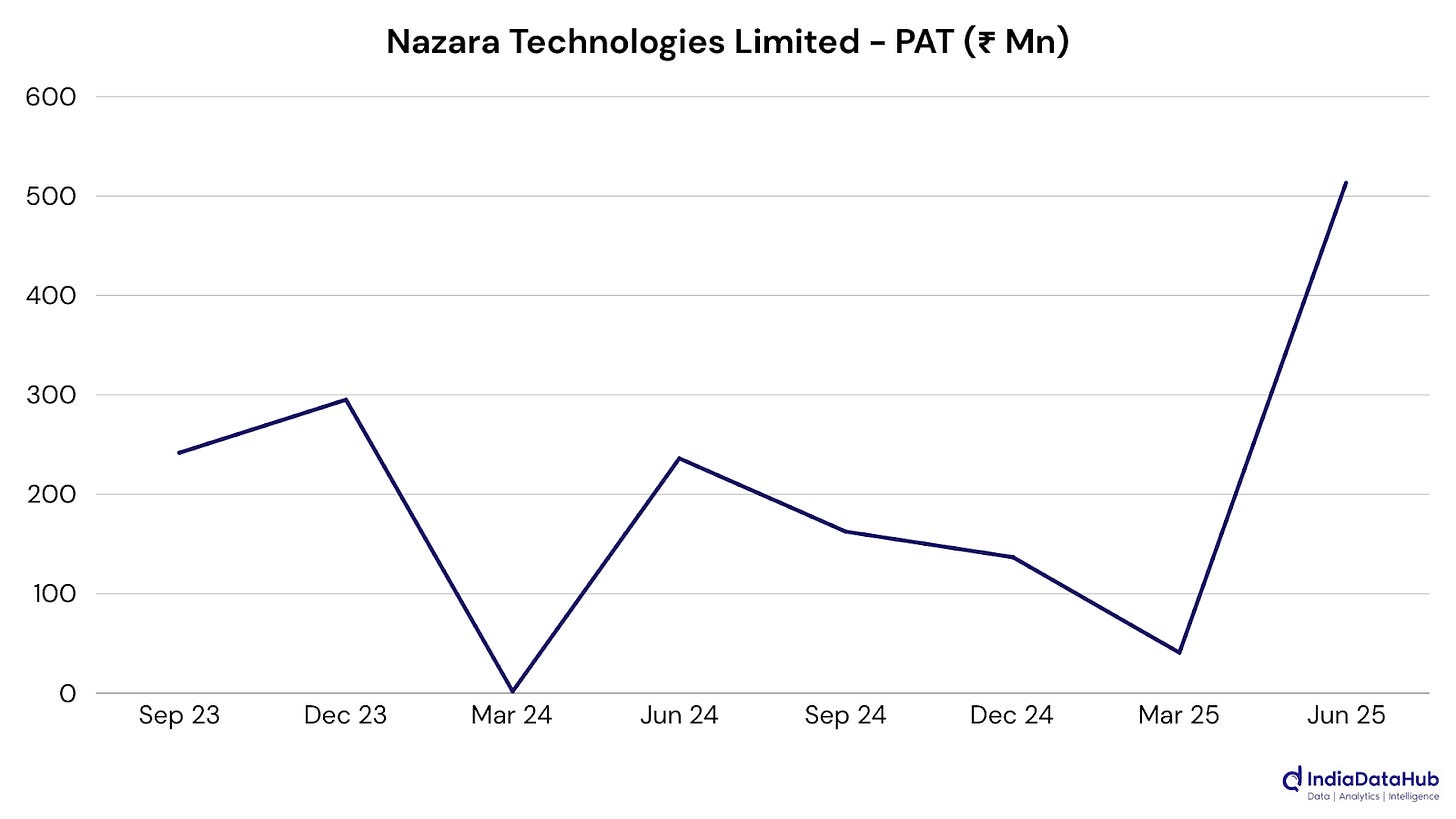

Nazara Technologies Ltd: Revenues nearly doubled this quarter, with profits more than doubling as well, fueled by breakout hits like Fusebox and Animal Jam. Slight margin compression aside, the scale of growth underlines a gaming portfolio firing on all cylinders. What makes this quarter feel like an inflection point is that growth isn’t coming from a single lucky hit, but from a portfolio firing across geographies and genres. Acquired studios are no longer mere add-ons but are delivering scale that rivals Nazara’s legacy businesses. Add in the stock split and bonus issue—signals of confidence in liquidity and investor appetite—and this looks like the foundation of Nazara’s next growth phase.

Indo Count Industries Ltd: Revenue held steady at ₹967 crore, but profit halved to ₹38 crore as US tariff headwinds, weaker volumes, and losses in new pillow and quilt categories squeezed margins. EBITDA margin slipped to 12.3% from 16.2% a year earlier.

Faze Three Ltd: Revenue hit a record ₹216 crore, up 42% YoY, with profit jumping 76% to ₹12.8 crore. Stronger order flows, category expansion, and operational leverage lifted margins to 13.2%, setting the stage for continued growth through FY26.

Rajapalayam Mills Ltd: Sales slipped 13% to ₹189 crore, the weakest in five quarters, but profit swung to ₹8.1 crore from last year’s loss on sharper cost control. Margins climbed above 12%, though liquidity fell to its lowest in recent periods.

Goldiam International Ltd: Revenue climbed 39% to ₹236 crore, while profit jumped 53% to ₹34 crore, powered by surging US demand for lab-grown diamonds. Margins held steady at 20% as cost controls and tariff pass-throughs supported strong operational efficiency.

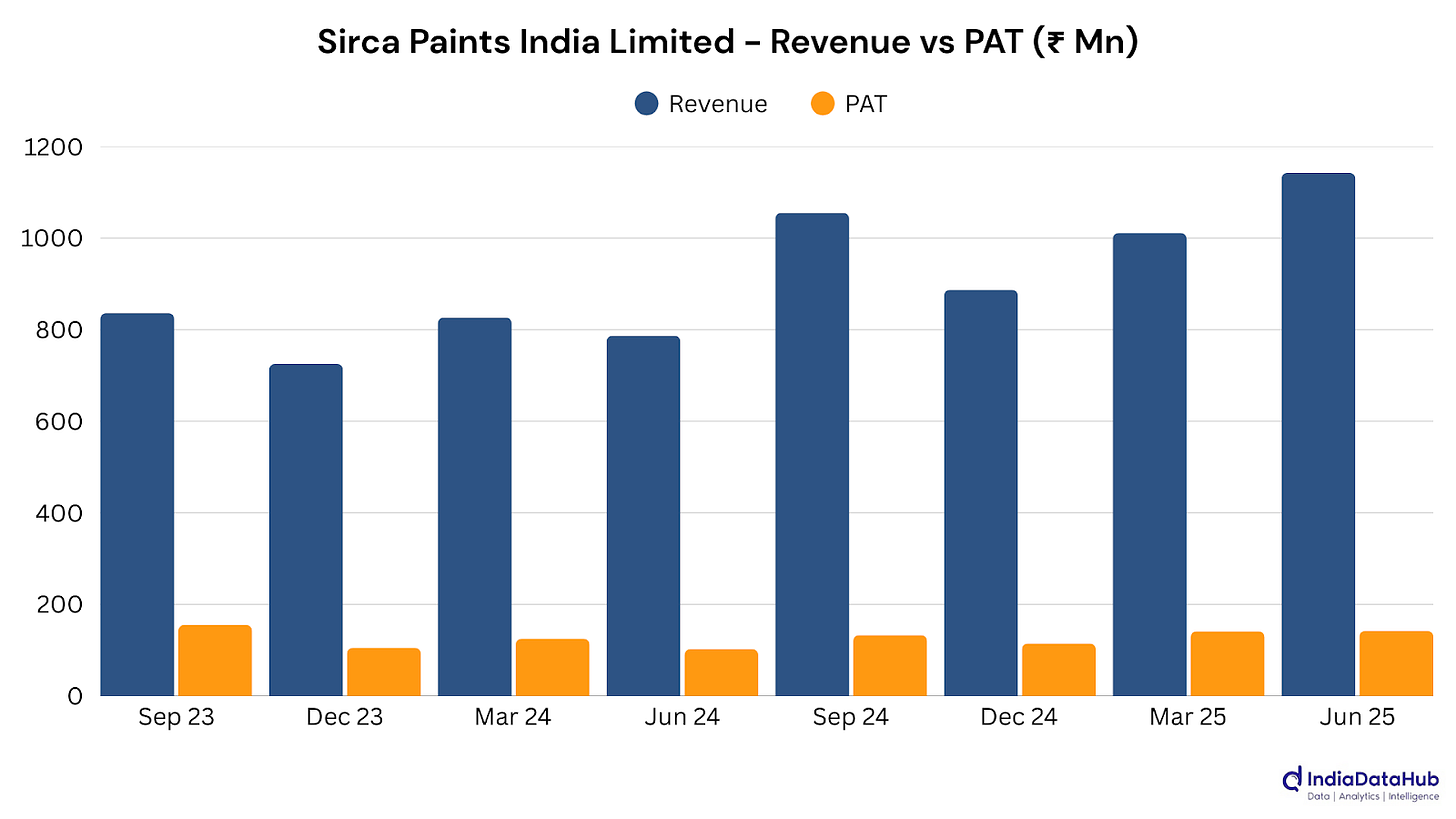

Sirca Paints India Ltd: Revenue surged 45% YoY to ₹114 crore, marking the strongest sales in five quarters, while PAT grew 39% to ₹14.2 crore. Margins held steady near 20% despite raw material cost pressures, supported by network expansion, portfolio pricing gains, and contributions from acquired brands.

2. Financial Services: [#589] [Rev: +9.24%] [PAT: +5.05%]

Kama Holdings Ltd: This was a standout quarter with profit soaring 76% YoY to ₹221 crore on the back of 10% revenue growth to ₹3,857 crore. Margins expanded sharply by 437 bps to 22.2%, driven by efficiency gains at SRF Ltd, its key subsidiary. Debt reduction strengthened the balance sheet, while recovery in chemicals and packaging segments, alongside disciplined cost control, powered profitability.

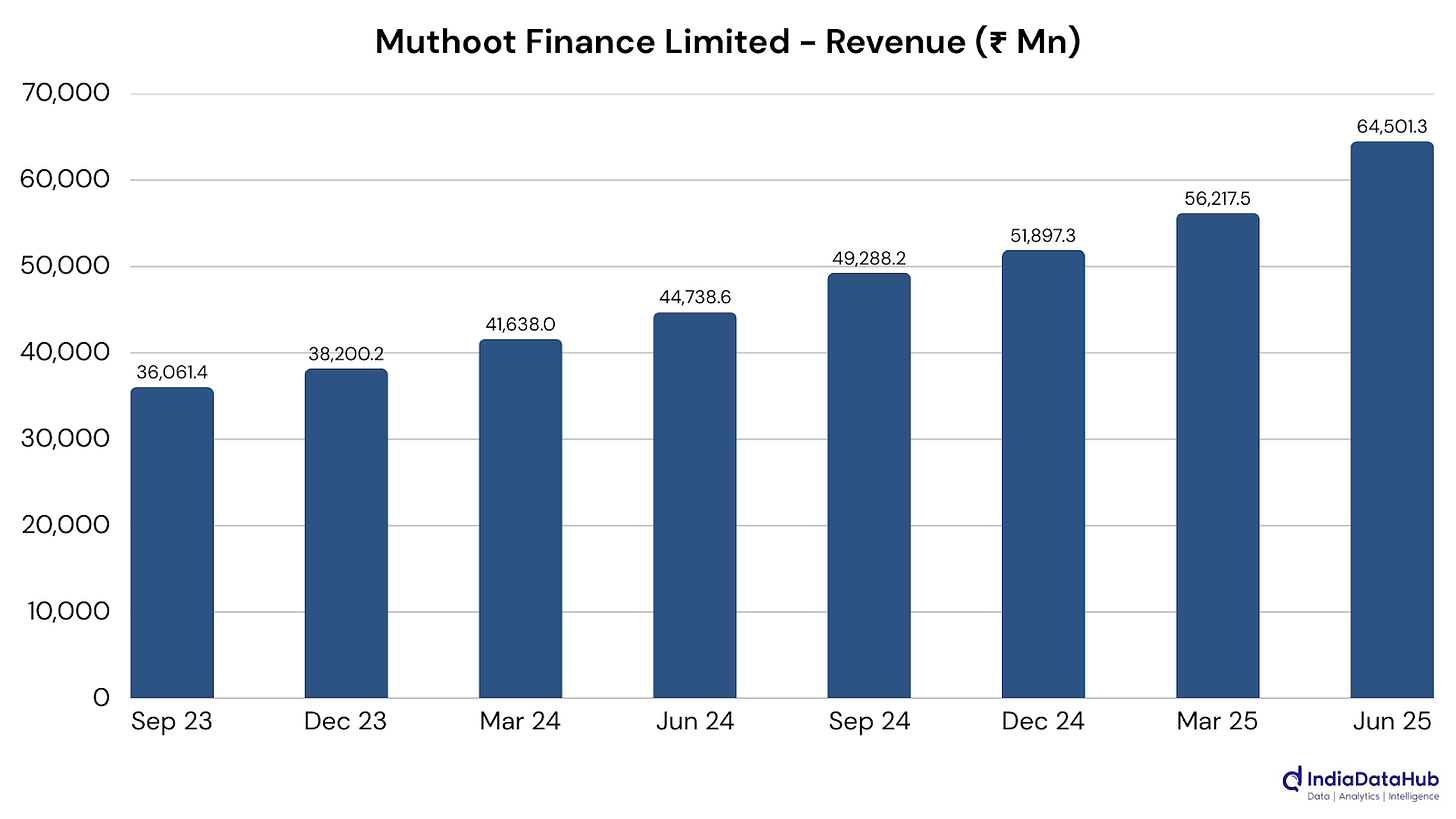

Muthoot Finance Ltd: Revenue went up 54% YoY to ₹6,450 crore, its highest ever, and net profit nearly doubled to ₹2,046 crore. Loan AUM surged 42% to ₹1.20 lakh crore, crossing the ₹1 lakh crore milestone in gold loans, cementing its dominance in the segment. The sharp profit growth outpaced revenue on the back of margin expansion, lower provisioning, and operational efficiency gains. Rising gold prices boosted borrowing capacity, while strong rural demand and festival-driven borrowing further supported growth.

Karnataka Bank Ltd: Deposits grew just 3.2% and advances contracted 1.6%, while net interest income slipped 20% to a five-quarter low of ₹755 crore. PAT dropped 27% to ₹292 crore, underscoring margin pressure from higher funding costs and weak credit demand. Despite profitability stress, asset quality improved, with gross NPA easing to 3.46% and net NPA to 1.44%, reflecting disciplined credit practices.

Muthoot Microfin Ltd: Muthoot Microfin delivered a weak Q1 FY26, with sales plunging 15.8% to ₹559 crore and profit collapsing 94.5% to just ₹6.2 crore. Operating margins compressed sharply to 40.5% from nearly 59% last year, weighed by elevated provisioning and asset quality stress. GNPA rose to 4.84% and NNPA to 1.34%.

Nuvama Wealth Management Ltd: Revenue and profit both climbed nearly 20% year-on-year, making it the company’s best quarter in five. Capital markets activity provided a major boost, while rising client assets and fee income underpinned steady momentum.

CSB Bank Ltd: Revenue jumped over 25% to a five-quarter high, yet profit barely moved as provisions climbed and operating income slipped. Rising NPAs and weaker margins dulled the impact of loan growth, leaving overall performance mixed.

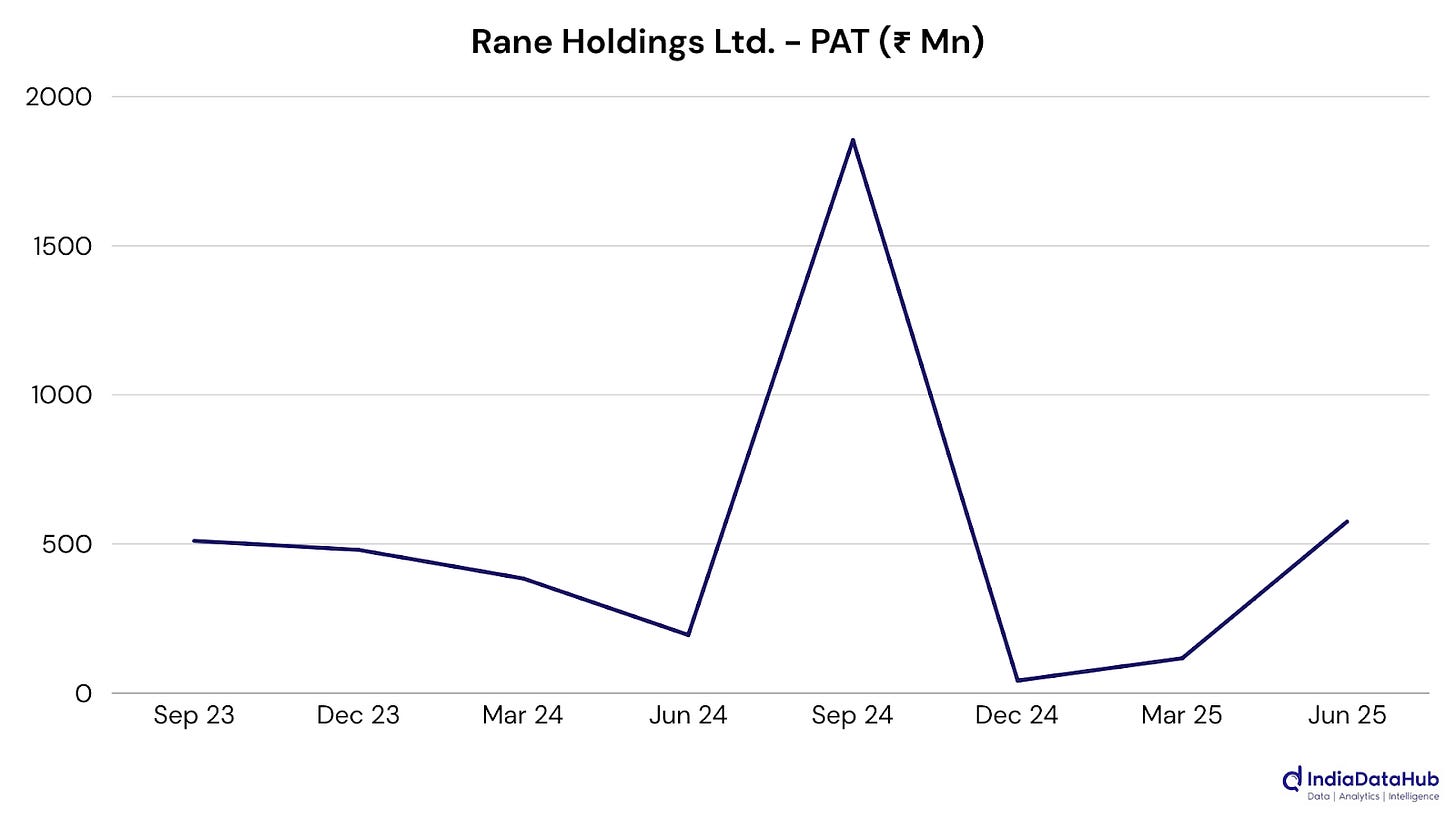

Rane Holdings Ltd: Revenue shot up over 60% while profit nearly quadrupled, helped by the full consolidation of its steering arm and one-off settlement gains. Beyond these boosts, margins also touched multi-quarter highs, signaling improved operational control.

AAVAS Financiers Ltd: Revenue rose nearly 16% and profit climbed 10%, supported by expanding margins and steady AUM growth. A broader branch network and a new promoter strengthened positioning, while asset quality held firm in the affordable housing space.

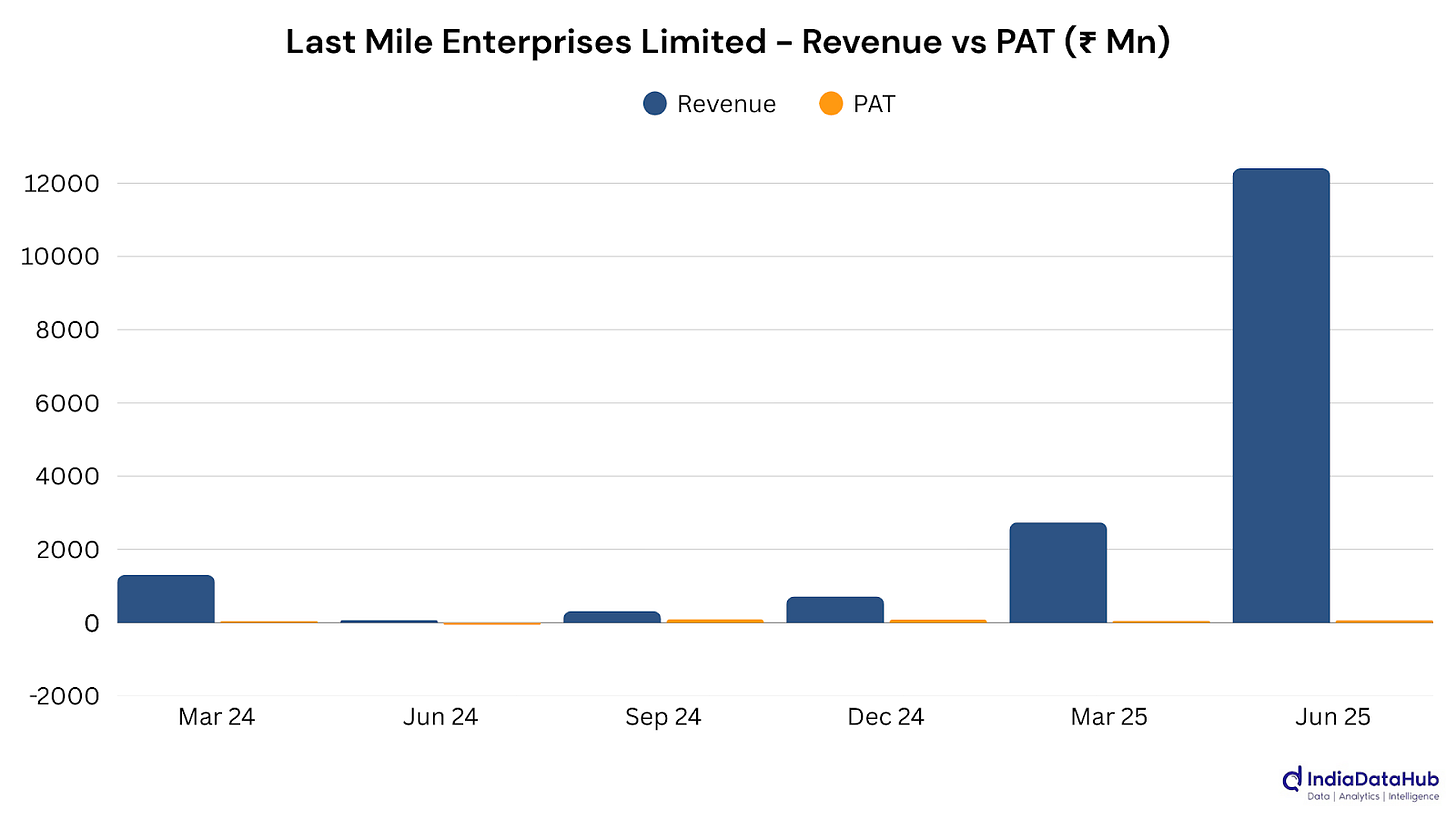

Last Mile Enterprises Ltd: Revenue leapt over 16,000% YoY, with both gadgets and real estate arms firing. A textbook turnaround after restructuring and diversification. A year ago, it was a near-invisible player with just ₹7.5 crore in revenue; this quarter, it clocked over ₹1,240 crore. Profit turned positive too, reversing a loss with both mobile accessories and real estate arms delivering. The swing suggests reinvention instead of mere recovery, with diversification and tighter operations transforming the business into one of the sharpest turnaround stories this earnings season.

UGRO Capital Ltd: Revenue jumped 40% while AUM grew 31%, but profit inched up just 12% as management leaned on caution over speed. Asset quality held steady, capital buffers thickened, and a big-ticket MSME acquisition is now underway.

3. Industrials: [#681] [Rev: +6.86%] [PAT: +6.37%]

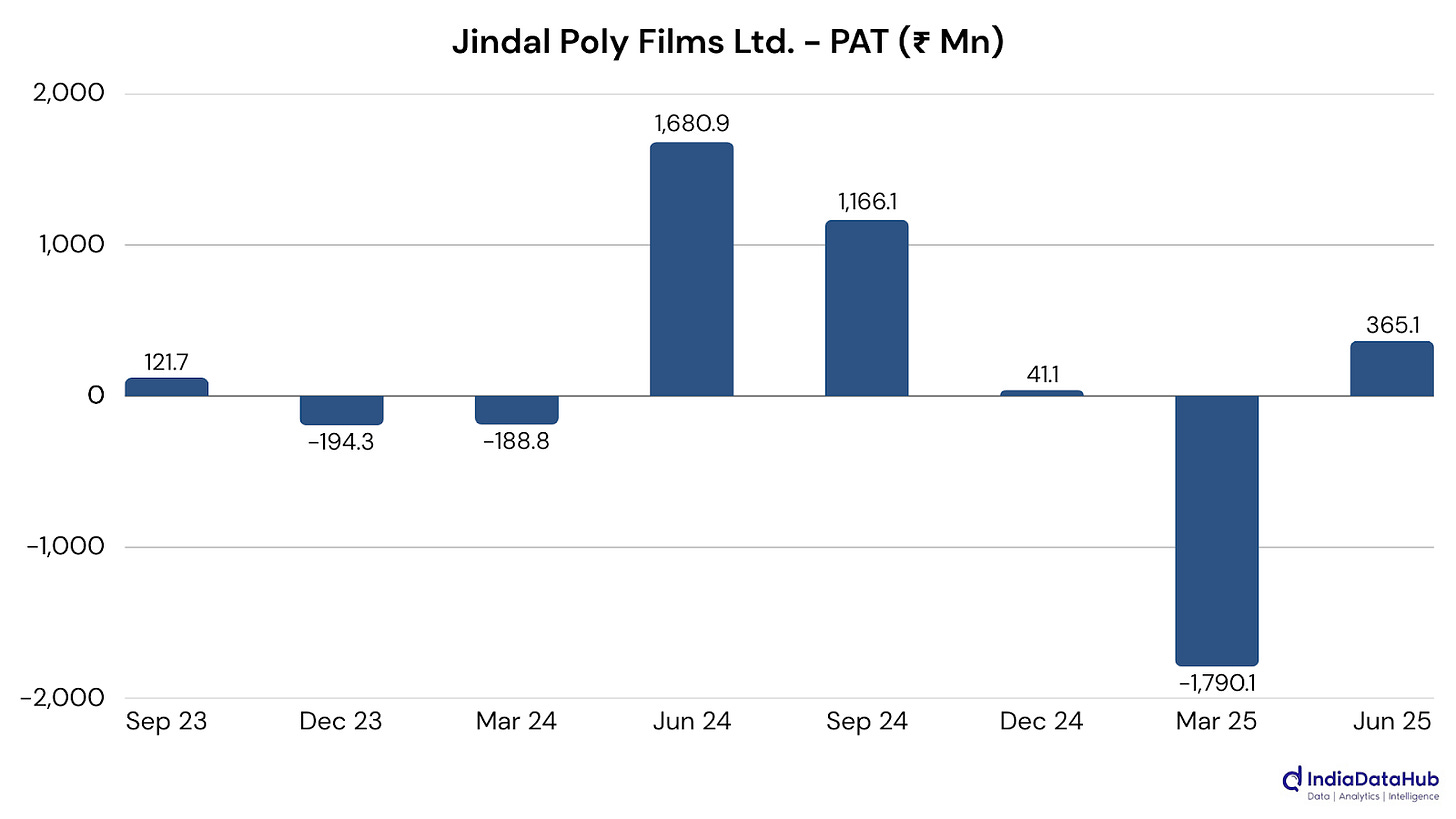

Jindal Poly Films Ltd: Revenue slid over 12% while profit collapsed nearly 80%, reflecting a brutal quarter for polyester films. Margin pressure from pricier inputs and weak global demand weighed heavily, leaving earnings a fraction of last year’s levels.

Engineers India Ltd: Revenue climbed nearly 40% with a healthy order book in tow, yet profit slipped 29% as higher taxes bit into earnings. Quarter-on-quarter volatility was stark, with profit down over 75% from March highs.

Bharat Dynamics Ltd: Profit more than doubled year-on-year while revenue grew nearly 30%, reflecting stronger defense orders and efficiency gains. Still, the sharp sequential drop in both sales and profit underscored the lumpy, seasonal nature of defense project execution.

Bharat Wire Ropes Ltd: Revenue inched up 6% year-on-year, but profit slipped 14% as margins tightened under raw material and energy cost pressure. Sequentially, both sales and earnings fell sharply, pointing to seasonal weakness and financing strain.

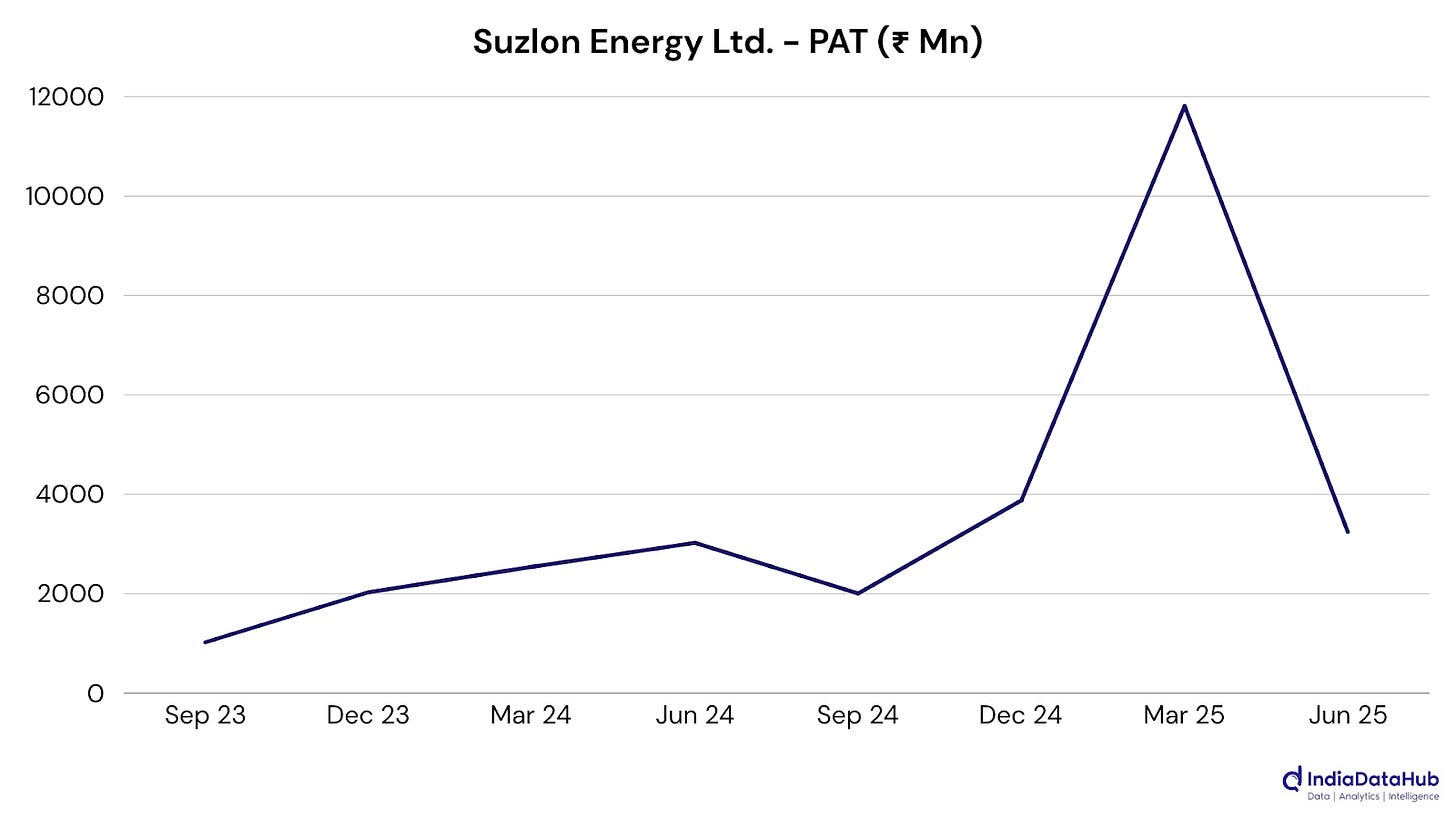

Suzlon Energy Ltd: This was Suzlon’s best-ever first quarter. Deliveries jumped to 444 MW, driving a 55% revenue surge and 62% EBITDA growth. Profit rose modestly, but the bigger story lies in the 1 GW of fresh orders, taking the order book to 5.7 GW. With 75% of these from C&I and PSU clients, demand looks structurally strong. An A+/Stable credit rating upgrade and ₹1,620 crore net cash add to the sense of a company that is now scaling with confidence in India’s renewable energy push.

Hindustan Aeronautics Ltd: Revenue rose 11% with margins expanding sharply, but higher taxes dragged profit down 4%. Still, a ₹1.89 lakh crore order book and stronger repair-and-overhaul revenues underline HAL’s scale and long-term visibility in India’s defense buildout.

Ashoka Buildcon Ltd: Profit jumped 45% even as revenue slipped 24%, thanks to higher-margin toll income and leaner debt levels. Execution delays hurt topline, but the pivot toward BOT assets is clearly reshaping Ashoka’s earnings profile.

PNC Infratech Ltd: Revenue plunged 34% and profit slipped 25% as project execution slowed and leverage rose. Asset sales continued, with 11 of 12 divestments done, pointing to a balance-sheet cleanup even as near-term performance stays pressured.

Cochin Shipyard Ltd: Revenue jumped nearly 39% on the back of a one-off naval refit, lifting profit modestly year-on-year. But with margins easing and order inflows muted, the reliance on lumpy ship-repair contracts raises questions about sustainability ahead.

Inox Wind Ltd: Profit more than doubled to a record high, backed by 29% revenue growth, stronger margins, and debt reduction after its merger. A 3.1 GW order book and new manufacturing capacity position it well to ride India’s wind energy surge.

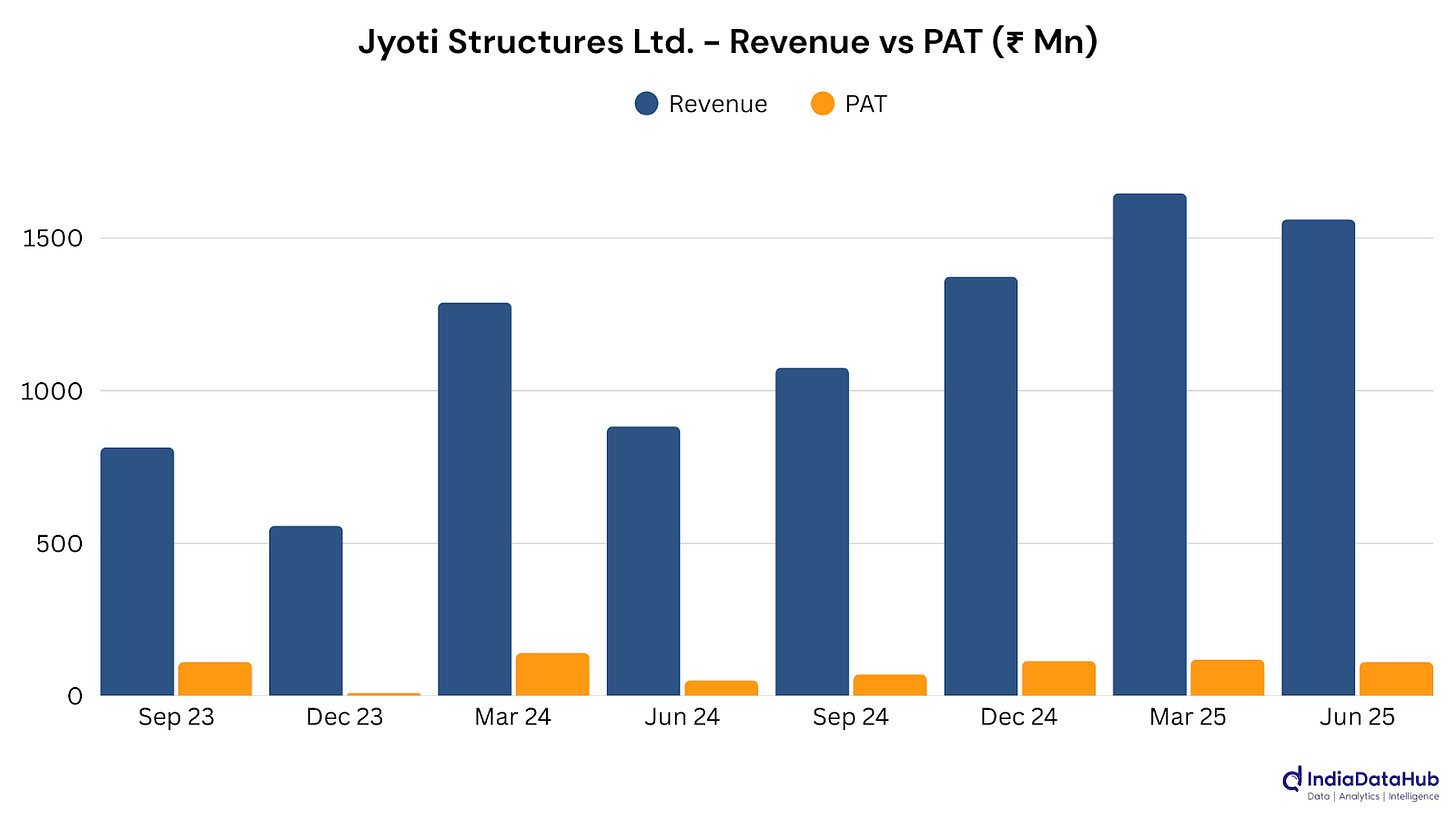

Jyoti Structures Ltd: Revenue surged 81% year-on-year while profit more than doubled, delivering the best quarter in the company’s history. Jyoti Structures has grown sales from just ₹16 crore in FY20 to nearly ₹500 crore in FY25, a stunning turnaround. Momentum is carrying through, with project execution in transmission and distribution networks benefiting directly from India’s infrastructure and power spending push. With profits now scaling alongside revenue, the company’s revival looks increasingly structural rather than cyclical.

Paramount Communications Ltd: Revenue jumped more than 40%, but profit slid 27% as expenses and taxes spiked, slicing margins in half. Strong demand in cables and wires is clear, yet scaling costs and raw material pressures weighed heavily on the bottom line.

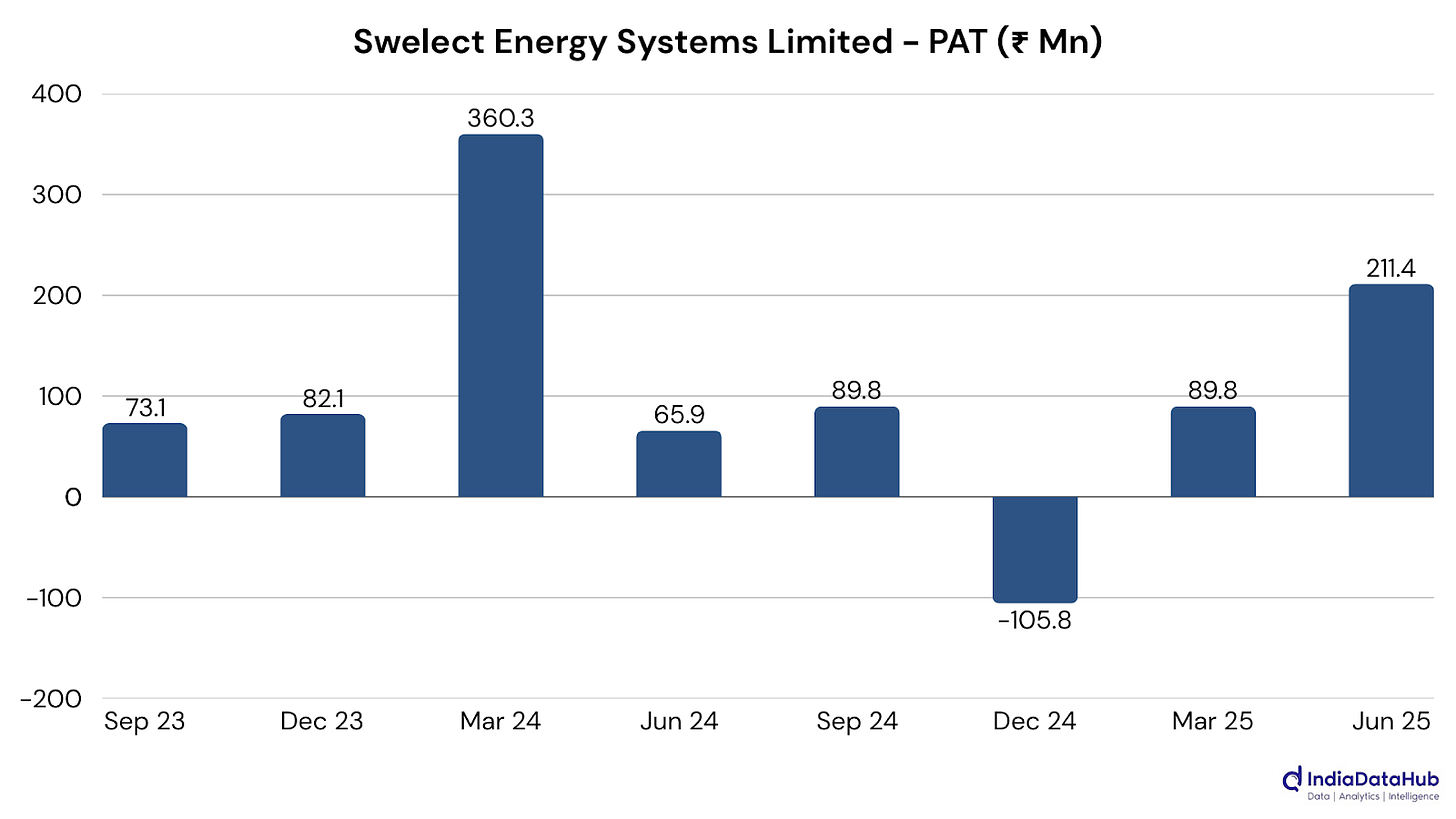

Swelect Energy Systems Ltd: Revenue soared 56% while profit more than tripled, marking Swelect’s best quarter in years. Margins climbed to a five-quarter high and operating cash flow touched its strongest level in three years, fueling a 17% post-results share price rally. The gains were underpinned by India’s solar expansion push and successful project execution, with new capacity investments signaling growth ahead. Yet, sustainability questions are there as over 40% of PBT came from non-operating income, and sequential sales momentum dipped. It’s a performance that highlights both the promise and volatility of scaling in the renewable energy space.

V.S.T. Tillers Tractors Ltd: Revenue jumped 48% to a record high, while profit nearly doubled with margins expanding sharply. Power tiller sales surged 92% on the back of a favorable monsoon, underscoring how rural demand and farm mechanization are driving this standout quarter.

Shaily Engineering Plastics Ltd: Revenue climbed 38% while profit more than doubled, with EBITDA margins soaring by over 800 bps on stronger utilization and exports. Healthcare demand and global diversification gave Shaily its sharpest margin-led growth in years.

Indo Tech Transformers Ltd: Revenue nearly doubled and profit jumped over 220%, with margins expanding sharply as transformer demand surged. Shares locked at the upper circuit after results, underscoring how power grid upgrades and renewable integration are fueling Indo Tech’s breakout momentum.

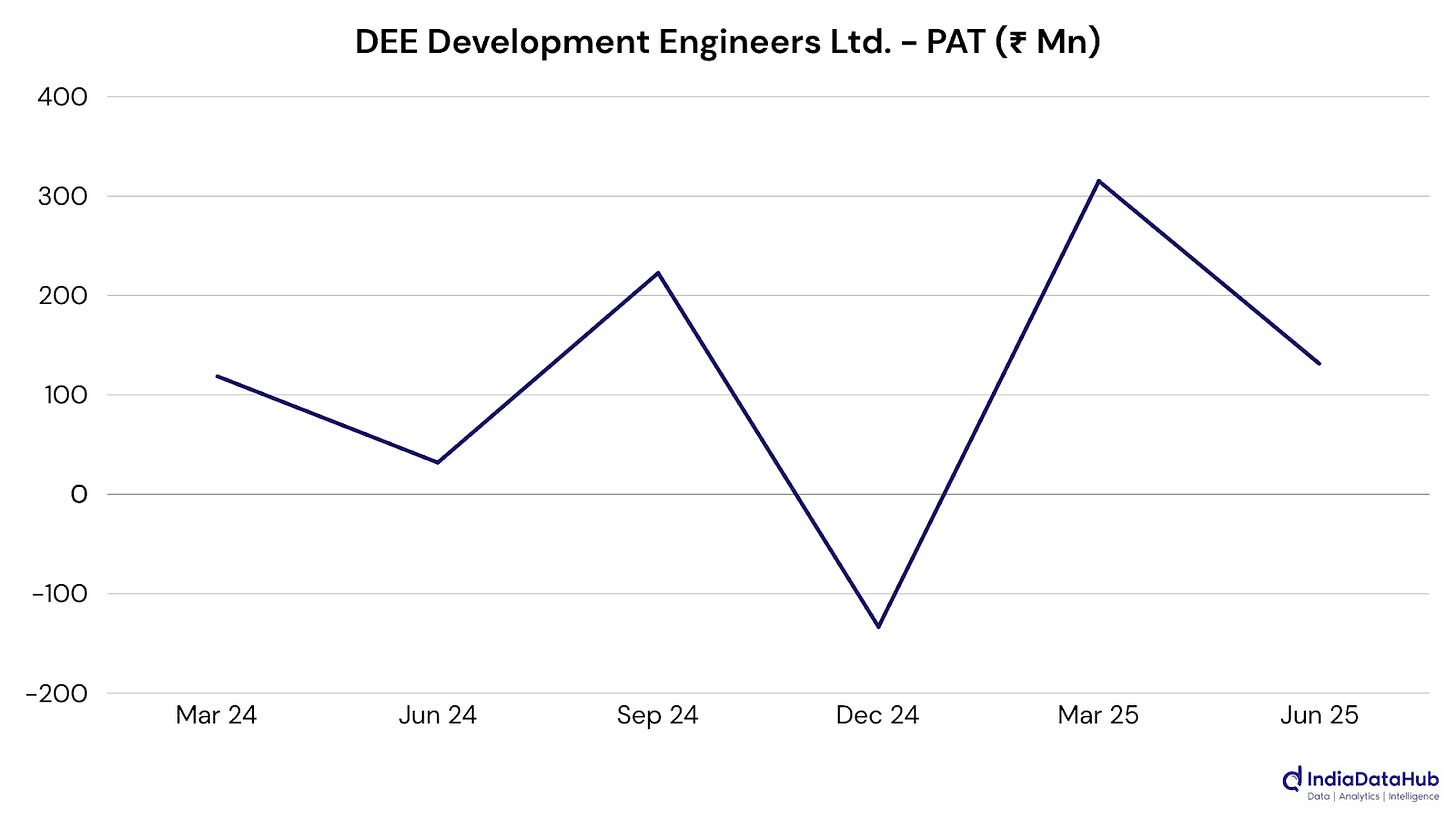

DEE Development Engineers Ltd: Revenue grew 21% while profit jumped over 300%, powered by stronger margins and a swelling order book above ₹1,200 crore. With new capacity coming online ahead of schedule and backward integration on track, DEE looks set for sustained momentum.

Websol Energy System Ltd: Revenue nearly doubled and profit surged almost 200%, with EBITDA margins climbing above 47%, a rare level in the sector. Over 90% capacity utilization and fully self-funded expansion to 1.2 GW underline Websol’s position as one of the clearest DCR-policy beneficiaries in India’s solar push.

Astra Microwave Products Ltd: Revenue grew 29% while profit more than doubled, with margins climbing to 20.5%, a clear sign of operating leverage at play. A ₹2,236 crore order book, including fresh DRDO wins, underscores Astra’s positioning in India’s defense electronics buildout.

4, Commodities: [#458] [Rev: +6.08%] [PAT: +21.03%]

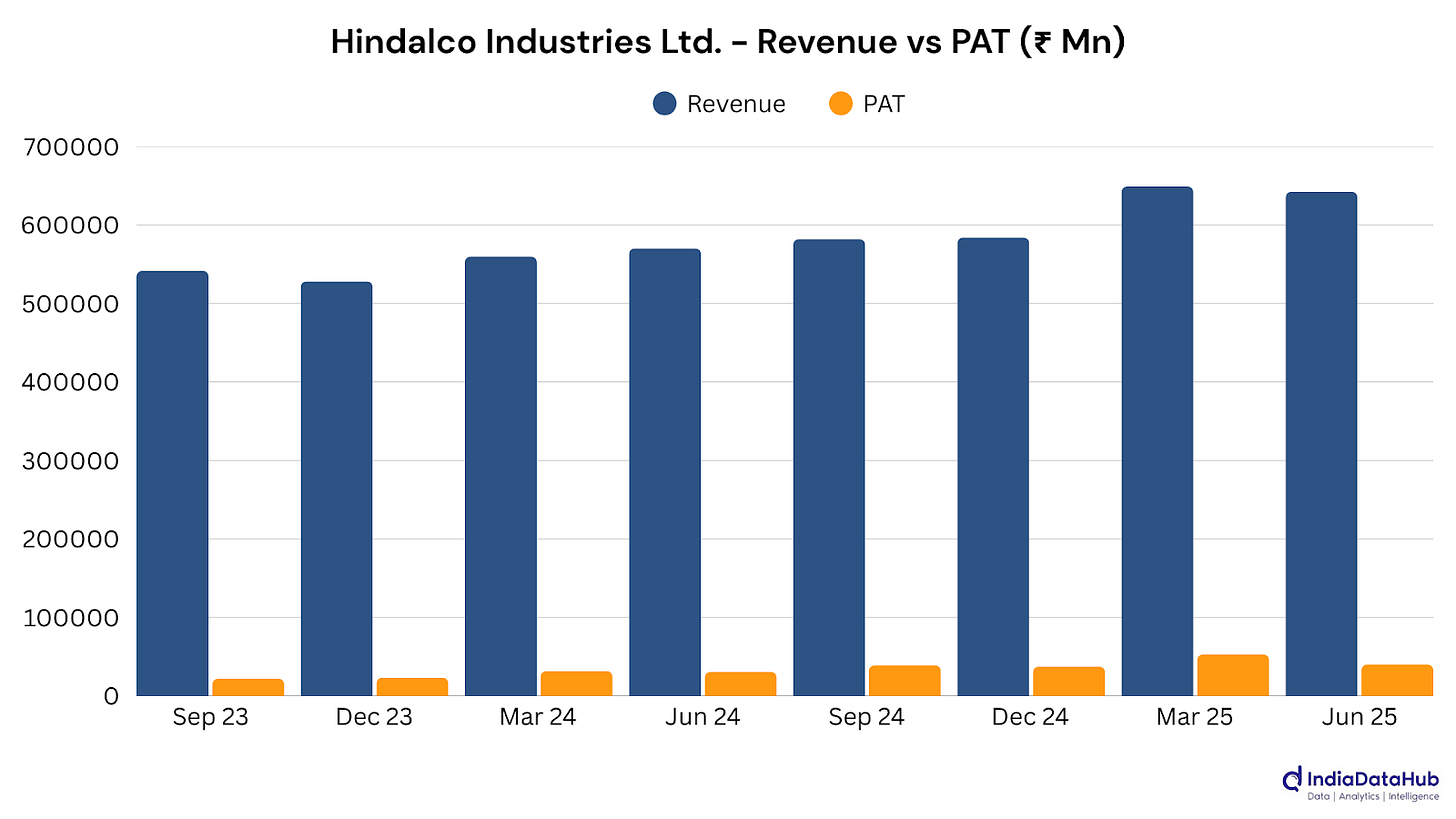

Hindalco Industries: Profits climbed 30% as aluminum prices firmed and efficiencies kicked in, with India upstream margins touching an industry-best 44%. Record downstream gains from value-added products and resilient copper operations rounded out a strong quarter.

Jindal Steel & Power (JSPL): Revenue fell nearly 10% on softer volumes, but profit rose 12% and EBITDA jumped 32% as margins swelled to 24%. Lower coal costs, richer product mix, and higher exports cushioned monsoon-led weakness, while Angul’s expansion promises momentum ahead.

NMDC: Revenue rose 25% on record iron ore production, but profit stayed flat as margins slipped under rising costs. Higher volumes and better realizations supported the top line, though expense growth and price cuts ahead may weigh on Q2.

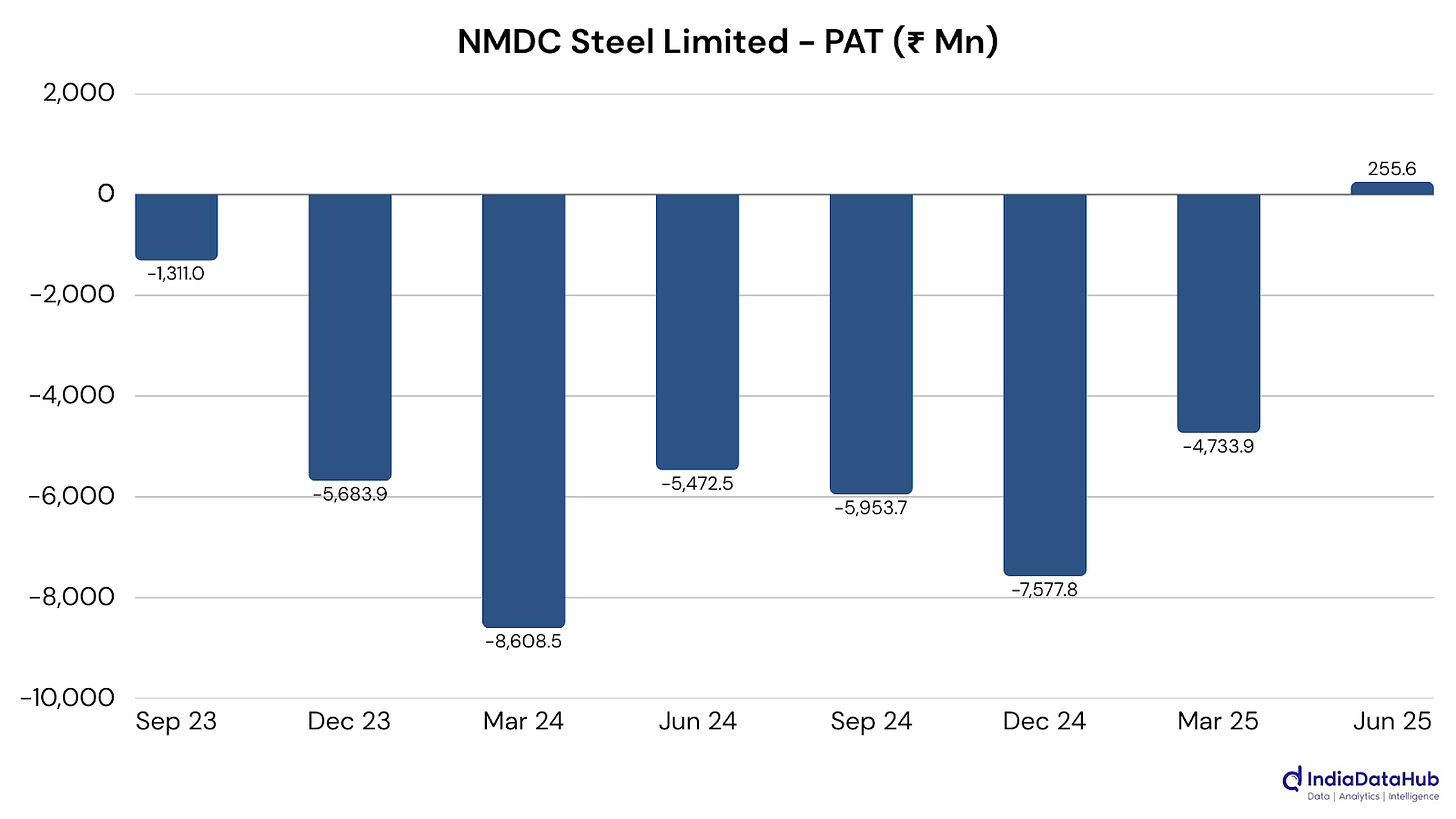

NMDC Steel: A landmark quarter saw the company swing to profit. Stronger steel prices, higher volumes, and tighter cost control turned years of commissioning losses into its first profitable run. The turnaround hinged on the Nagarnar plant finally running at scale, with fixed costs spread over record volumes. Access to captive iron ore from NMDC gave a clear cost edge, while stronger steel prices amplified margins.

Hindustan Copper: Margins expanded even as revenue growth stayed modest, with profits up nearly a fifth on the back of disciplined cost control. Flat expenses and tax relief helped turn steady sales into a sharp earnings climb.

Vinati Organics: Revenue growth was modest, but profits jumped nearly 24% as tighter cost control and richer product mix boosted margins. Strong demand for high-value specialty chemicals helped the company turn steady sales into significantly higher earnings.

Deepak Nitrite: Profits were cut nearly in half as revenue slipped 13%, with margins squeezed by Chinese oversupply and weak global demand. Both intermediates and phenolics dragged earnings, leaving management to lean on its “Destination Bharat” pivot for stability.

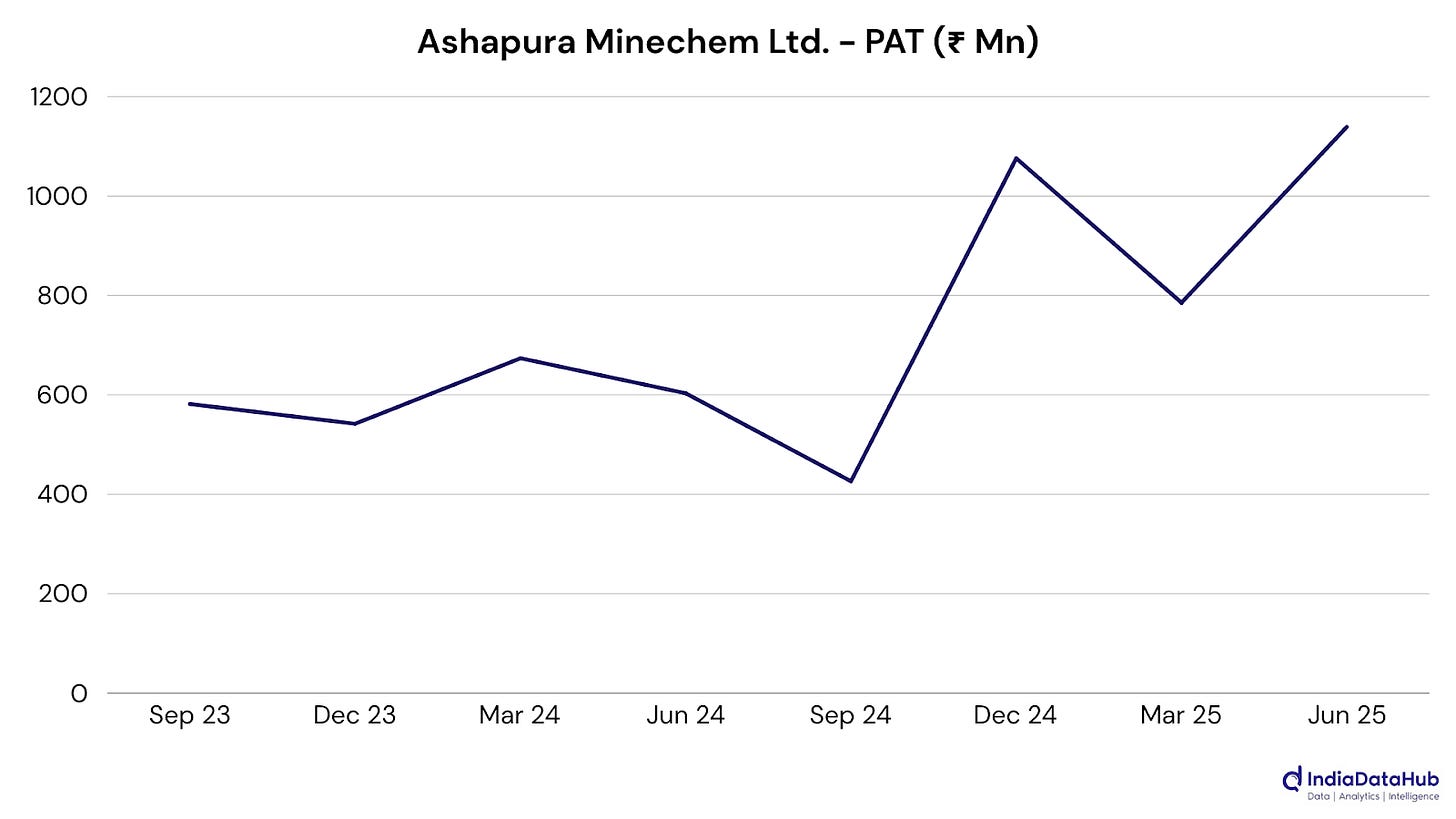

Ashapura Minechem: Revenue and profits nearly doubled, powered by record bauxite exports from Guinea and solid gains across Indian operations. With volumes at an all-time high and EBITDA almost doubling, this was a landmark quarter.

Galaxy Surfactants: Sales jumped more than 30% with volume gains across both core and specialty products, but rising costs kept profits flat. India showed a sequential lift, while Latin America and Asia-Pacific drove much of the growth abroad.

Sree Rayalaseema Hi-Strength Hypo Ltd: Revenue rose steadily while profits leapt over 30%, backed by stronger margins and a healthier balance sheet. With cash reserves climbing and EBITDA improving sharply, operations looked far more efficient this quarter.

Lloyds Enterprises Ltd: Profits soared more than thirteenfold despite flat revenue, lifted by a massive jump in other income. With a rights issue and dividend on the table, management signaled confidence in sustaining this sharp financial turnaround.

Maithan Alloys Ltd: Revenue jumped nearly 70% to a five-quarter high, while profits climbed 17% on the back of robust ferroalloy demand. Strong margins and higher operating leverage underlined efficiency gains, though rising debt costs may need watching.

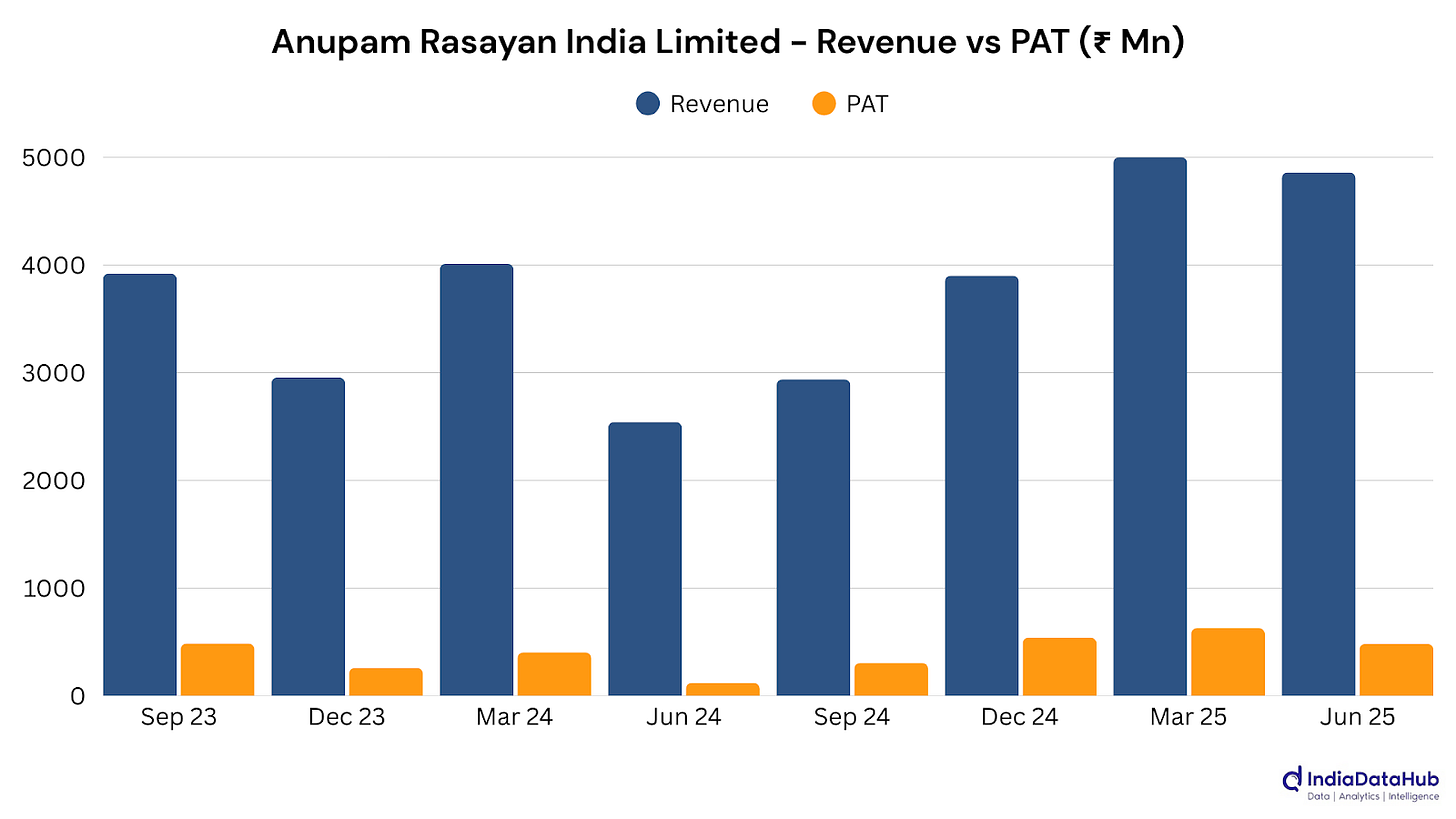

Anupam Rasayan Ltd: Revenue nearly doubled while profits quadrupled, powered by export strength and a swelling order book with marquee clients in the US and Japan. Margins improved too, pointing to volume-led growth in high-value pharma and polymer chemicals.

N.R. Agarwal Industries Ltd: Revenue climbed 30% while profits leapt nearly fourfold, marking a sharp turnaround from last quarter’s loss. Better cost control, higher other income, and firmer paper demand helped restore momentum in this recovery phase.

Bodal Chemicals Ltd: Revenue edged up 8%, but the real story was the swing back to profit after last year’s loss. Stronger EBITDA, tighter costs, and new specialty chemicals revenue helped the company regain footing in a tough market.

Premier Explosives Ltd: Revenue jumped more than 70% and profits more than doubled, powered by defence and space contracts that now make up most of the business. A swelling order book and fresh wins signal strong momentum despite near-term margin strain.

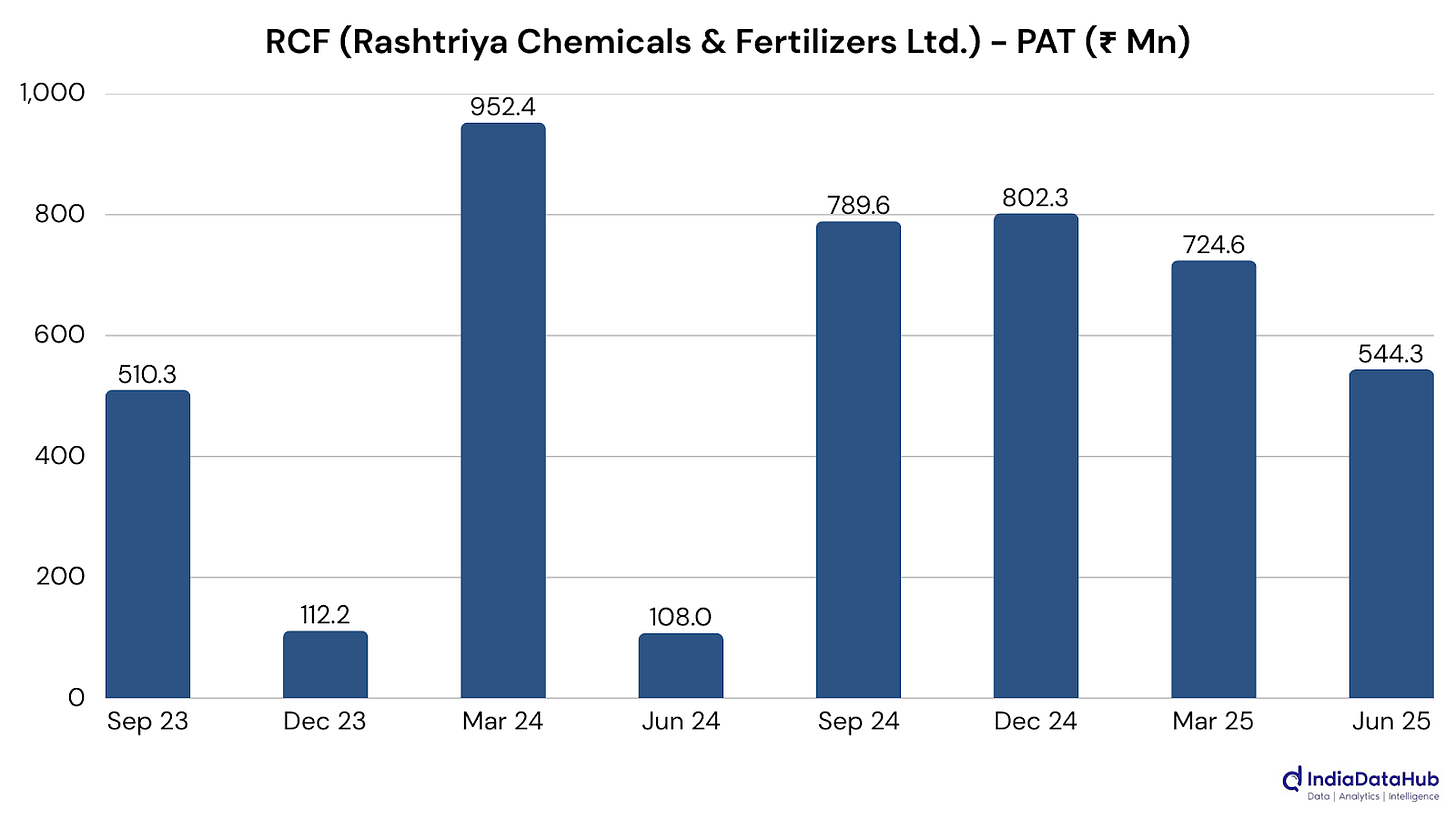

RCF (Rashtriya Chemicals & Fertilizers Ltd.): Profits shot up more than fourfold even as revenue slipped, thanks to tighter costs and a sharper focus on the fertilizer core. Margin gains and subsidy support helped offset weakness in trading and industrial chemicals.

Deccan Cements Ltd: Profits jumped more than fourfold despite a double-digit revenue drop, with margins hitting a five-quarter high. Aggressive cost cuts and efficiency gains turned weaker volumes into one of the cement sector’s sharper profitability rebounds.

Tamilnadu Petroproducts Ltd: Profits more than doubled even as revenue held steady, helped by lower raw material costs and leaner operations. Margins reached a five-quarter high, underscoring how efficiency gains turned flat sales into sharply improved earnings.

Indo Amines Ltd: Profits rose nearly 50% as revenue hit a five-quarter high, with margins widening on stronger specialty chemical demand. Sequential recovery was sharp too, showing how better mix and cost control boosted operating leverage.

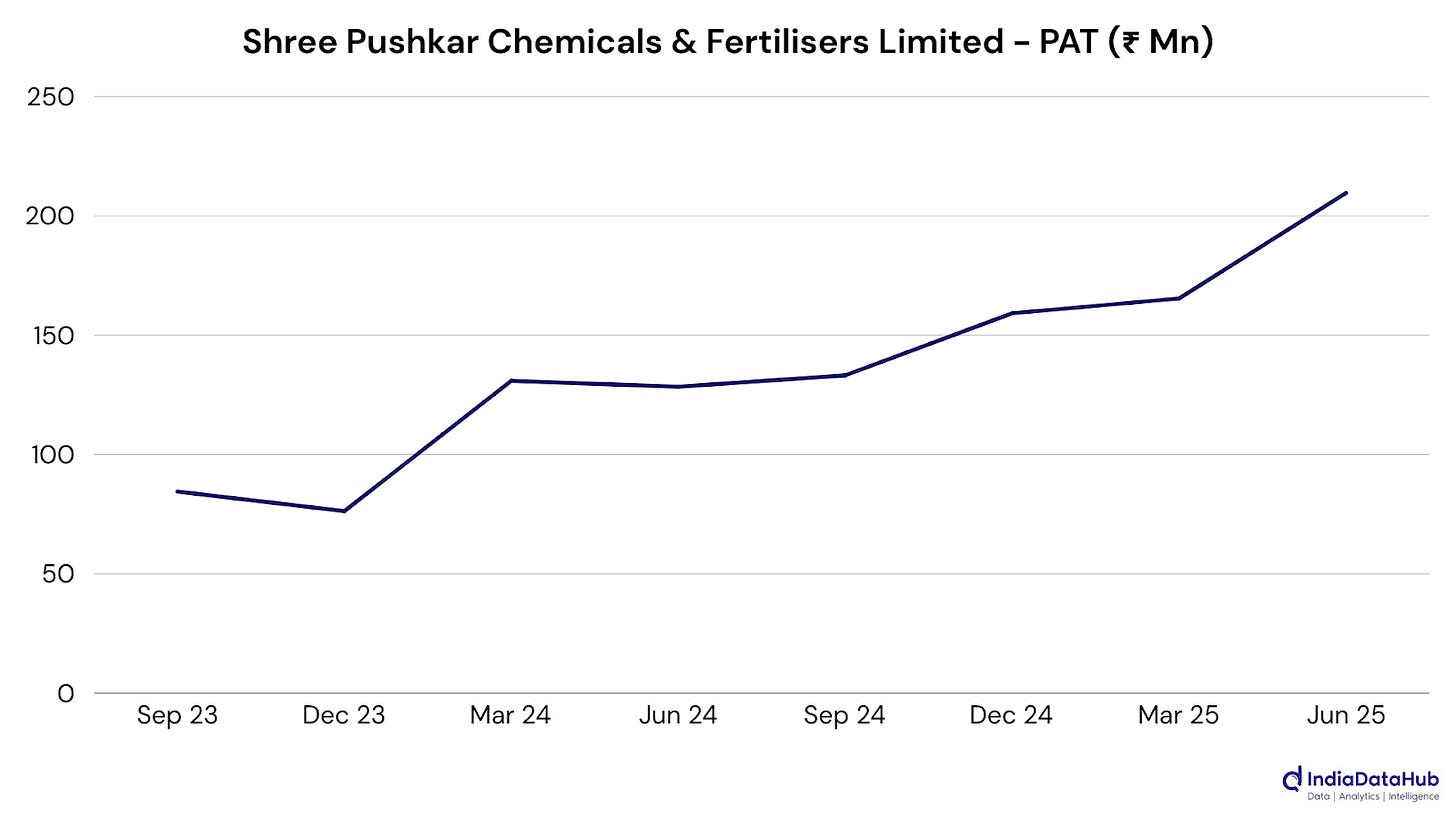

Shree Pushkar Chemicals & Fertilisers Ltd: Profits were lifted by a standout fertilizer quarter, with volumes up 9% and revenue surging 33% on better realizations. Margins strengthened too, while the chemical segment managed revenue gains despite softer volumes. That balance highlights Shree Pushkar’s strength: when agriculture cycles lift demand, fertilizers drive topline, and when markets tighten, chemicals can still deliver through realizations. Together, the mix acts as a natural hedge, cushioning volatility and reinforcing steady profitability.

Lloyds Metals & Energy Ltd: Margins widened sharply to 27% even though revenue stayed flat, as new pellet and slurry infrastructure boosted efficiency. With steady iron ore and DRI output plus fresh clearances for mine expansion, the company strengthened its growth runway.

K.C.P. Ltd: Profits nearly doubled on the back of lower costs and tax savings, even as revenue softened slightly. EPS hit a five-quarter high, with strong cash reserves giving the company a solid footing amid buoyant cement demand.

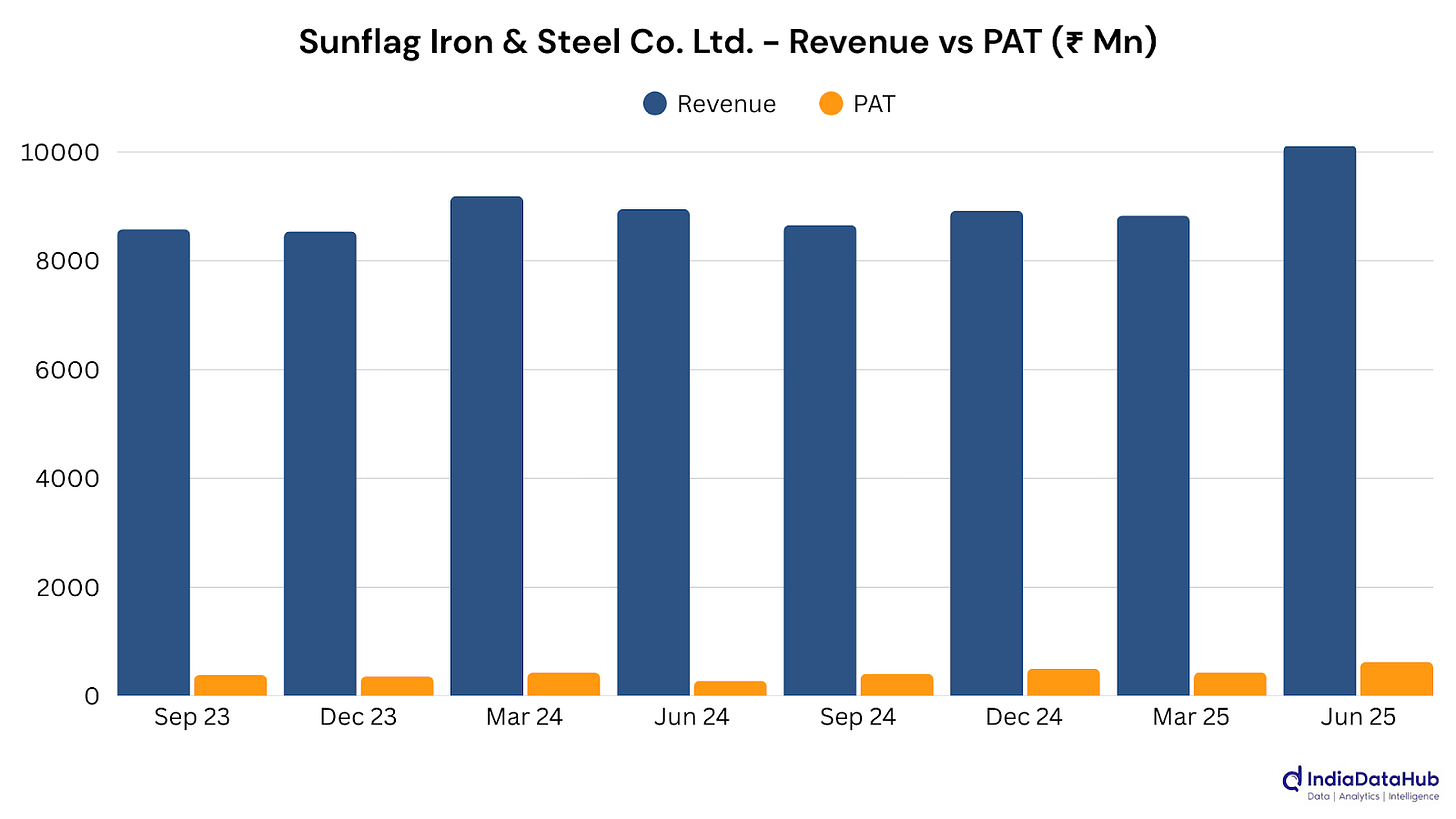

Sunflag Iron & Steel Ltd: Profits more than doubled on just 13% revenue growth, as margins widened sharply to 6.2%. Supportive steel prices, lower import pressure, and stronger operating leverage helped turn steady sales into a standout earnings surge. The safeguard duty created breathing room for domestic producers. For Sunflag, this meant more pricing power and better spreads, amplified by soft coking coal costs. Add in higher capacity utilization, and fixed costs were spread across stronger volumes, letting profits soar far faster than revenue.

Ddev Plastiks Industries Ltd: Revenue grew 23% on the back of strong wire and cable demand, with both volumes and realizations contributing. Margins held steady at 10%, while niche positioning in specialized polymers kept pricing power intact amid India’s infrastructure boom.

Heubach Colorants India Ltd: Profits more than tripled with margins doubling to 8%, helped by strong volume growth and leaner costs. Revenue rose 21%, while improved pricing power and efficiency gains turned a steady top line into a standout earnings surge.

5. Services: [#406] [Rev: +10.59%] [PAT: -4.75%]

Parle Industries Ltd: A tiny profit marked a swing back into the black after last quarter’s loss, helped by razor-thin costs and a debt-free balance sheet. Revenue stayed flat, reflecting the project-based, stop-start nature of its business.

TCI Express Ltd: Revenue dipped 3% and profits slipped 13% as election disruptions, SME strain, and higher freight costs weighed on volumes. Lower truck utilization and capex-linked expenses dragged margins, though management expects recovery once demand normalizes.

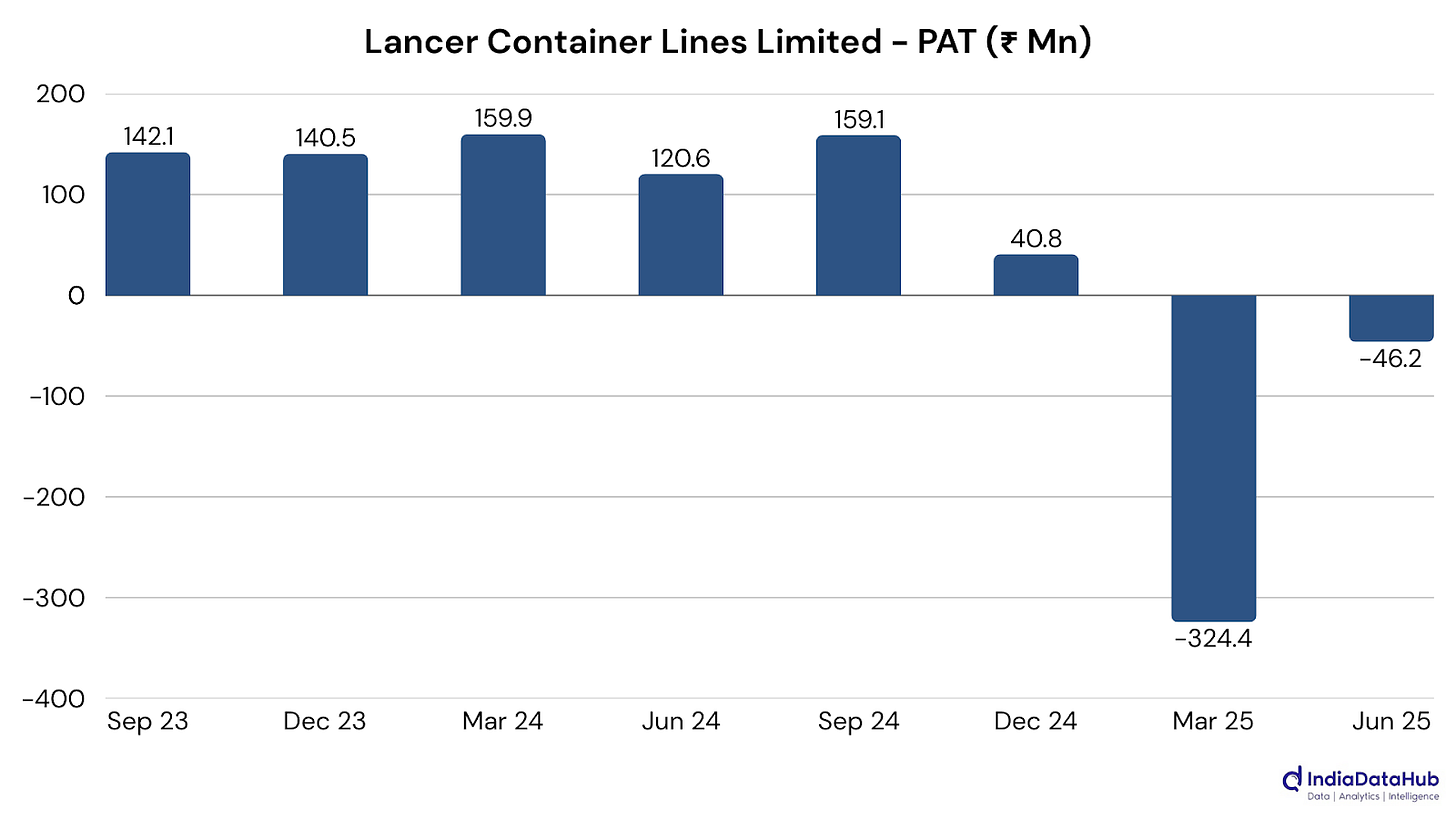

Lancer Container Lines Ltd: Revenue collapsed more than 80%, pushing margins deep into the red and leading to a quarterly loss. The Red Sea crisis has forced vessels to reroute around Africa, adding both cost and time, while freight rates have slipped sharply from their post-pandemic highs. For a mid-sized operator like Lancer, this double blow was punishing: lower volumes from disrupted trade routes collided with weaker pricing power. The business struggled to absorb the downturn as disrupted trade routes and weak pricing power hit margins.

Riddhi Siddhi Gluco Biols Ltd: Revenue exploded nearly tenfold, but profits sank 66% as margins collapsed from triple digits to barely 5%. Rising costs, higher interest outgo, and negative operating leverage turned eye-catching growth into a profitability squeeze.

Dredging Corporation of India Ltd: Revenue jumped 61% and EBITDA nearly quadrupled as better fleet utilization drove margins higher, cutting losses by a quarter. Without a ₹20 crore forex hit, the company said it would have broken even this quarter.

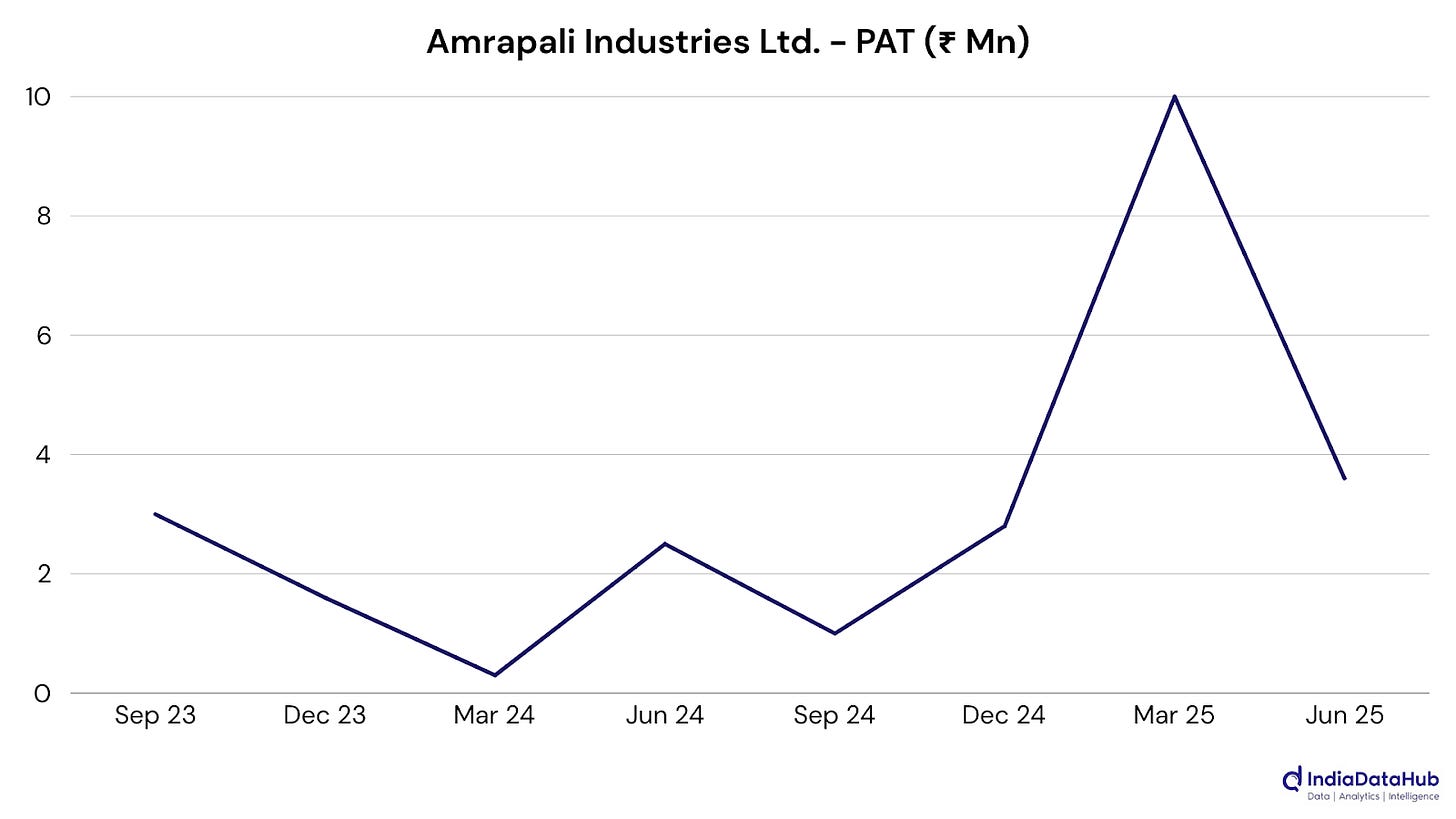

Amrapali Industries Ltd: Revenue shot up 61% and profit nearly quadrupled, with EPS at a multi-quarter high. While operating profit is just shy of breakeven, stronger trading volumes and tighter working capital control are clearly boosting momentum.

Awfis Space Solutions Ltd: Revenue climbed 30%. Enterprise clients are now the growth engine, with deeper penetration giving Awfis a more stable, recurring revenue base compared to the startup-heavy early years. The deliberate tilt toward Grade A assets has also sharpened pricing power and brand positioning, letting the company command higher yields while maintaining healthy occupancy.

Aviva Industries Ltd: Operations were virtually at a standstill with no revenue and a small quarterly loss, as fixed costs outweighed negligible activity. The results underline an ongoing struggle to sustain business momentum or generate meaningful income.

6. Information Technology: [#217] [Rev: +5.38%] [PAT: +6.63%]

Black Box Ltd: Revenue slipped 3% on delayed client spending, but profits still climbed 28% to ₹47 crore. A leaner cost structure and stronger order book suggest its turnaround is holding steady despite softer topline momentum.

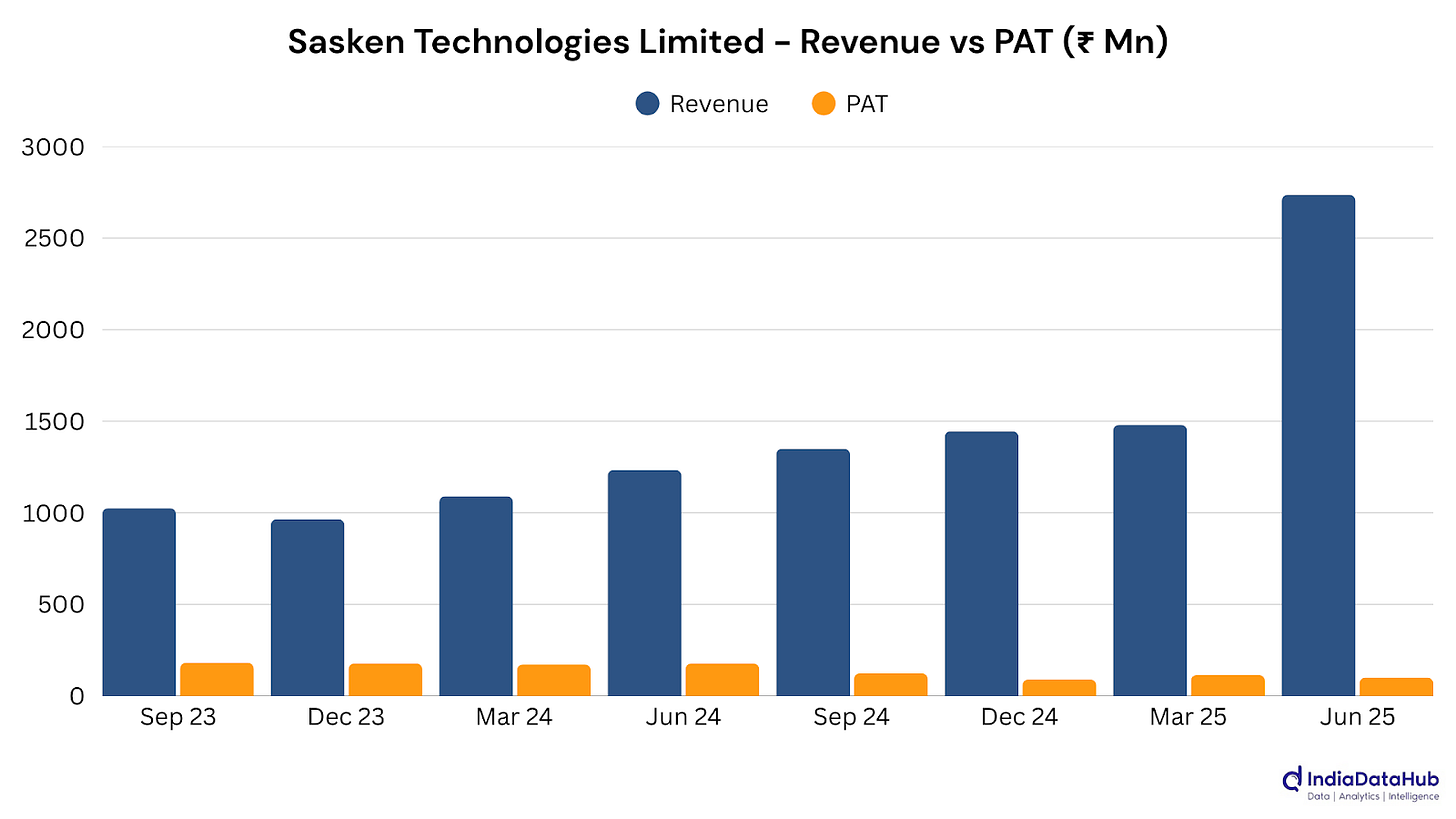

Sasken Technologies Ltd: Revenue more than doubled, and the order book swelled with high-profile contract wins, yet net profit slipped 43% as scaling costs weighed on margins. The company’s aggressive push into automotive, IoT, and 5G shows clear long-term promise, though near-term profitability remains under pressure.

Zaggle Prepaid Ocean Services Ltd: Posted its best-ever Q1 with profits soaring 56% and revenue up 31%. A mix of marquee client additions, expanding fintech reach, and AI-driven efficiency likely fueled the surge. Acquisitions and fund-raising appear to be laying the groundwork for a broader financial services play, while its leadership in prepaid cards continues to anchor momentum.

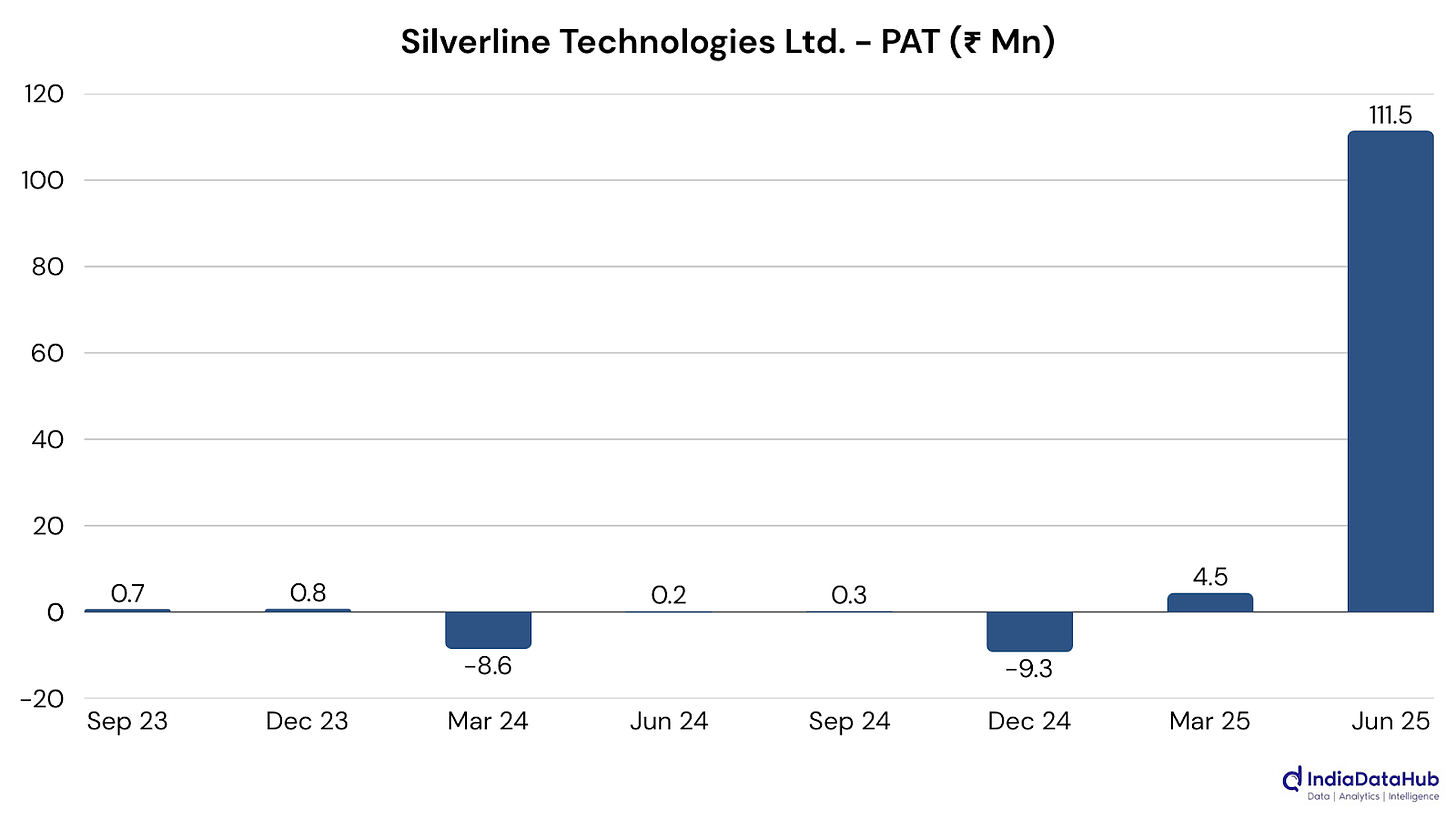

Silverline Technologies Ltd: Revenue shot up over 200% from the previous quarter, with profits swinging sharply into the black. After reporting zero revenue just two quarters ago, the company delivered ₹1,000+ crore this quarter with profits soaring past ₹11 crore. A surge in contracts and sharper cost discipline likely fueled the swing.

7. Healthcare: [#240] [Rev: +9.8%] [PAT: -23.76%]

Zydus Lifesciences Ltd: Revenue grew 6% with steady gains in India and modest US momentum, though margins slipped under cost pressure. Continued R&D investment and a stronger chronic portfolio suggest the company is building resilience for medium-term growth.

Apollo Hospitals Enterprises Ltd: Profits rose 42% to ₹433 crore on 15% revenue growth, with digital health and pharmacy arms adding momentum. Margin gains from tighter costs and a stronger patient mix suggest its integrated model is clicking into place.

Alkem Laboratories Ltd: Net profit climbed 22% on steady margin gains, while domestic sales outpaced the broader pharma market with strength across key therapies. A sharper portfolio focus and steady international growth suggest the company is tightening its grip in core segments.

Glenmark Pharmaceuticals Ltd: Profits plunged 86% on a hefty US settlement, masking a steadier underlying business where revenue inched up 1% and margins held broadly stable. Regional shifts and pricing pressures kept growth muted, but new launches hint at recovery ahead.

Ipca Laboratories Ltd: Revenue rose 10% with strong gains in exports to Europe and LATAM, while profits grew 21%. Domestic strength in chronic therapies and operational efficiencies helped offset margin pressures from its Unichem subsidiary.

Abbott India Ltd: Revenue rose 12% and profits climbed 11%, marking its best quarter in over a year. Strong pharmaceutical demand, tighter cost control, and a favorable product mix suggest the company is quietly strengthening its market position.

Pfizer Ltd: Profits surged 27% to a five-quarter high, with revenue up 7% and cash flows hitting a three-year peak. A sharper portfolio focus and leaner costs seem to have amplified gains well beyond topline growth.

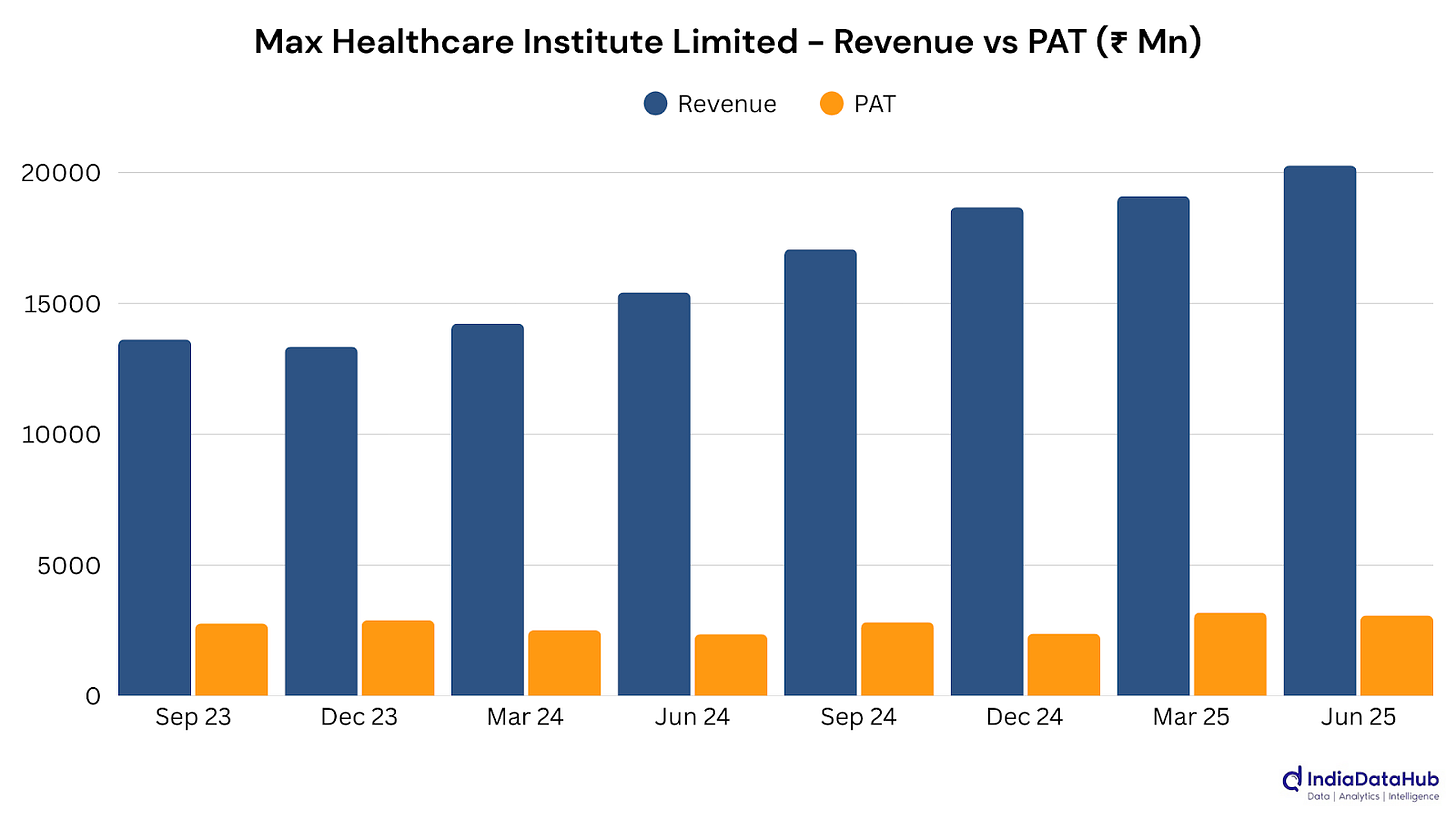

Max Healthcare Institute Ltd: Chalking up its 19th straight quarter of growth, the company delivered 27% higher revenue and 17% profit gains on the back of rising occupancy and network expansion. Brownfield additions in Mohali and upcoming projects like Dehradun point to an ambitious scale-up strategy, even as margins softened slightly. The steady run underscores its growing grip on premium urban healthcare.

Dishman Carbogen Amcis Ltd: Revenue jumped 40% and profits swung back into the black after last year’s heavy loss, helped by stronger CRAMS demand and tighter costs. While part of the recovery came from non-operating gains, the turnaround marks a striking reset.

AstraZeneca Pharma India Ltd: Revenue jumped 36% and profits swung from loss to ₹56 crore, with oncology therapies leading the charge. Strong new launches and margin expansion point to one of the quarter’s sharpest recoveries in the pharma space.

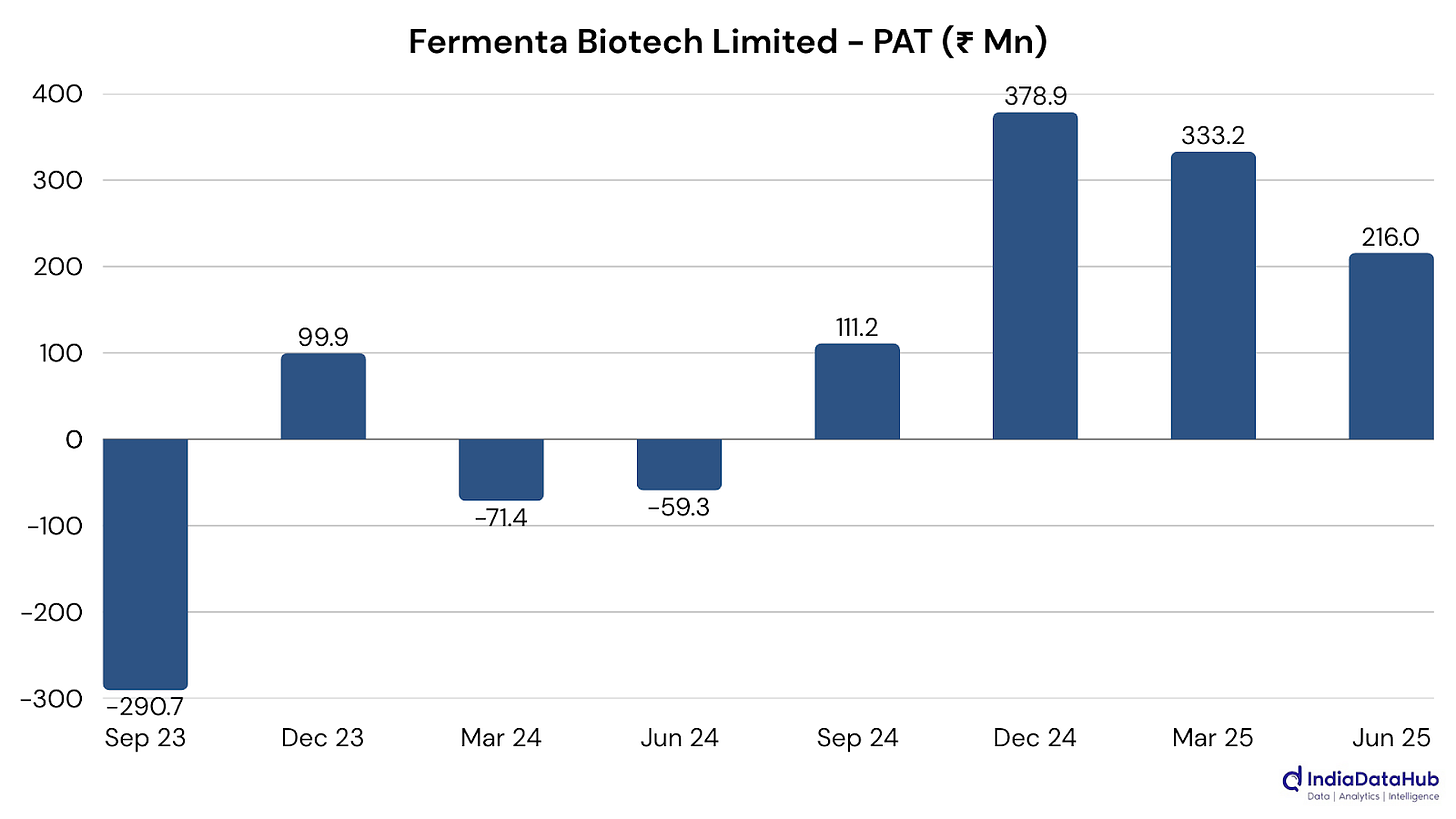

Fermenta Biotech Ltd: Revenue surged 79% and profits swung to ₹22 crore from a loss last year, with margins expanding sharply. Recovery in Vitamin D3 and stronger API demand appear to have powered one of the sector’s more dramatic turnarounds.

8. FMCG: [#290] [Rev: +10.09%] [PAT: +2%]

United Spirits Ltd: Revenue was flat, but profits slipped 14% as higher marketing spend and a one-off tax hit weighed on margins. Strong premium brand momentum and the Nao Spirits acquisition suggest the company is investing to defend long-term positioning.

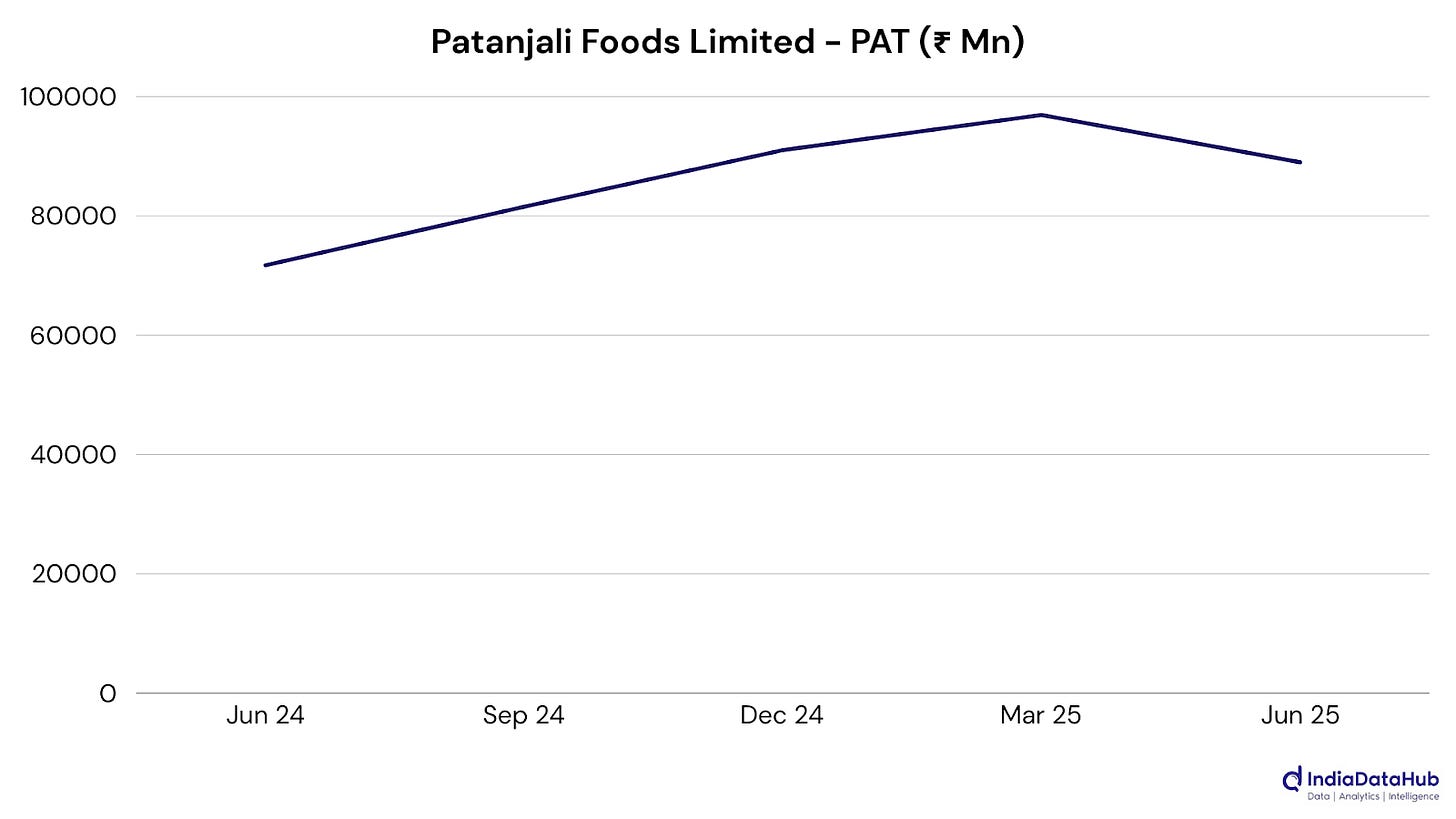

Patanjali Foods Ltd: Revenue jumped 24% to nearly ₹8,900 crore, yet profits fell 31% as margins slipped to a five-quarter low under soaring input costs. Edible oils drove the topline, while FMCG and HPC segments added depth. Global palm oil dynamics and domestic pricing pressures weighed on profitability, underscoring the challenge of balancing growth ambitions with margin stability.

Integrated Industries Ltd: Revenue soared 78% and profits nearly doubled, marking its strongest quarter in years. Gains in scale and efficiency likely supported the surge, with margins holding steady even as rapid expansion pushed sales to record highs.

Natural Products Ltd: Revenue rose 27% and profits more than doubled, though sequential growth softened on seasonal swings. Stronger demand for spice oils and marigold extracts boosted margins, while higher dividends signaled confidence despite some emerging cash flow pressures.

Uttam Sugar Mills Ltd: Revenue jumped 38% and profits surged nearly 150%, powered by better sugar realizations and seasonal demand tailwinds. Margins improved despite rising interest costs, underscoring how favorable market conditions are helping the company offset its debt burden.

BCL Industries Ltd: Revenue rose 25% and profits climbed 37%, marking its best quarter in five. Gains in edible oils and distillery operations, along with better cost control, helped margins hold steady as cash reserves and liquidity strengthened.

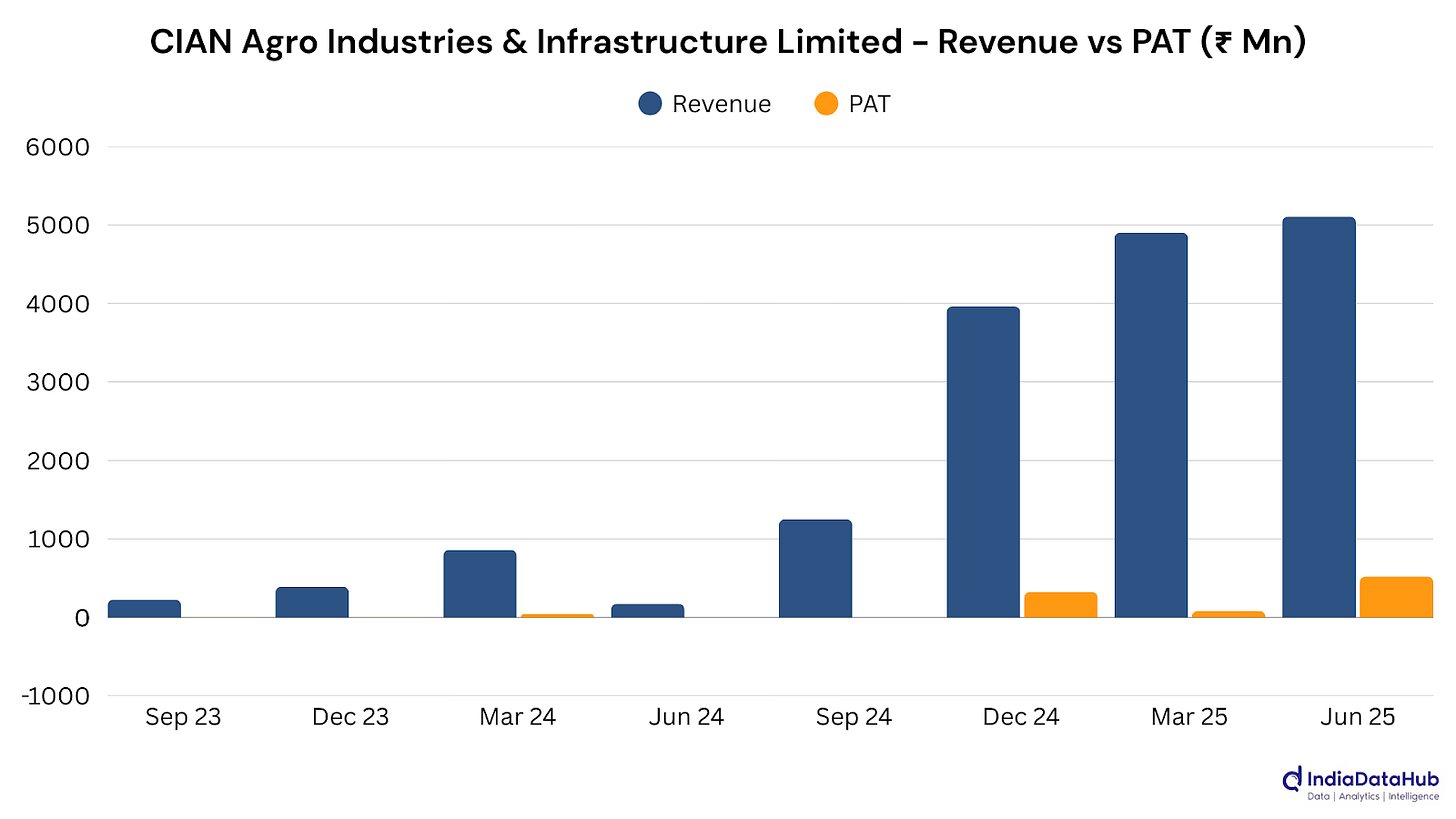

CIAN Agro Industries & Infra Ltd: From revenues of just ₹17 crore a year ago to ₹511 crore now, the company delivered a 2,820% surge with profits jumping over 52,000%. Margins expanded into double digits as operational scale kicked in, signaling a rarely seen growth. The turnaround suggests bold restructuring or market consolidation has vaulted CIAN Agro into an entirely new league.

Dhunseri Tea & Industries Ltd: Margins turned a corner this quarter with revenue climbing 18% and profits swinging sharply into the black. Strong cost discipline and tighter cash-cycle management seem to have helped convert improved sales into a rare full-scale turnaround. What makes this quarter remarkable is the sheer speed of the reversal. A year ago, losses weighed heavily, but now the business is running with its best debtor efficiency in years and margins touching 21%. For a tea company (where seasonal swings often distort results), such a broad-based turnaround in revenue, profitability, and working capital signals more than just a good crop cycle. It hints at structural shifts in efficiency and market positioning that could carry forward.

Tilaknagar Industries Ltd: Revenue leapt more than 30% with volumes up strongly across markets, while profits more than doubled. Margin expansion and brand-led demand helped deliver record operating performance, making this one of the company’s strongest quarters yet.

9. Utilities: [#49] [Rev: +1.54%] [PAT: +6.25%]

NHPC Ltd: Revenue climbed 19% on fresh capacity from Parbati-II and new solar additions, though profits grew just 3% as commissioning costs weighed. The expansion underscores its push to balance hydropower strength with a growing renewable footprint.

VA Tech Wabag Ltd: Revenue grew 17% on stronger project execution, with fresh wins in Saudi Arabia and Bengaluru bolstering a record ₹15,800 crore order book. Margins improved as O&M income gained share, highlighting its shift toward steadier recurring revenues.

SJVN Ltd: Revenue ticked up modestly, but profits slid sharply as higher finance costs weighed on the bottom line. Strong operating margins and a doubling in renewables contribution, however, signal efficiency gains and steady progress on green diversification.

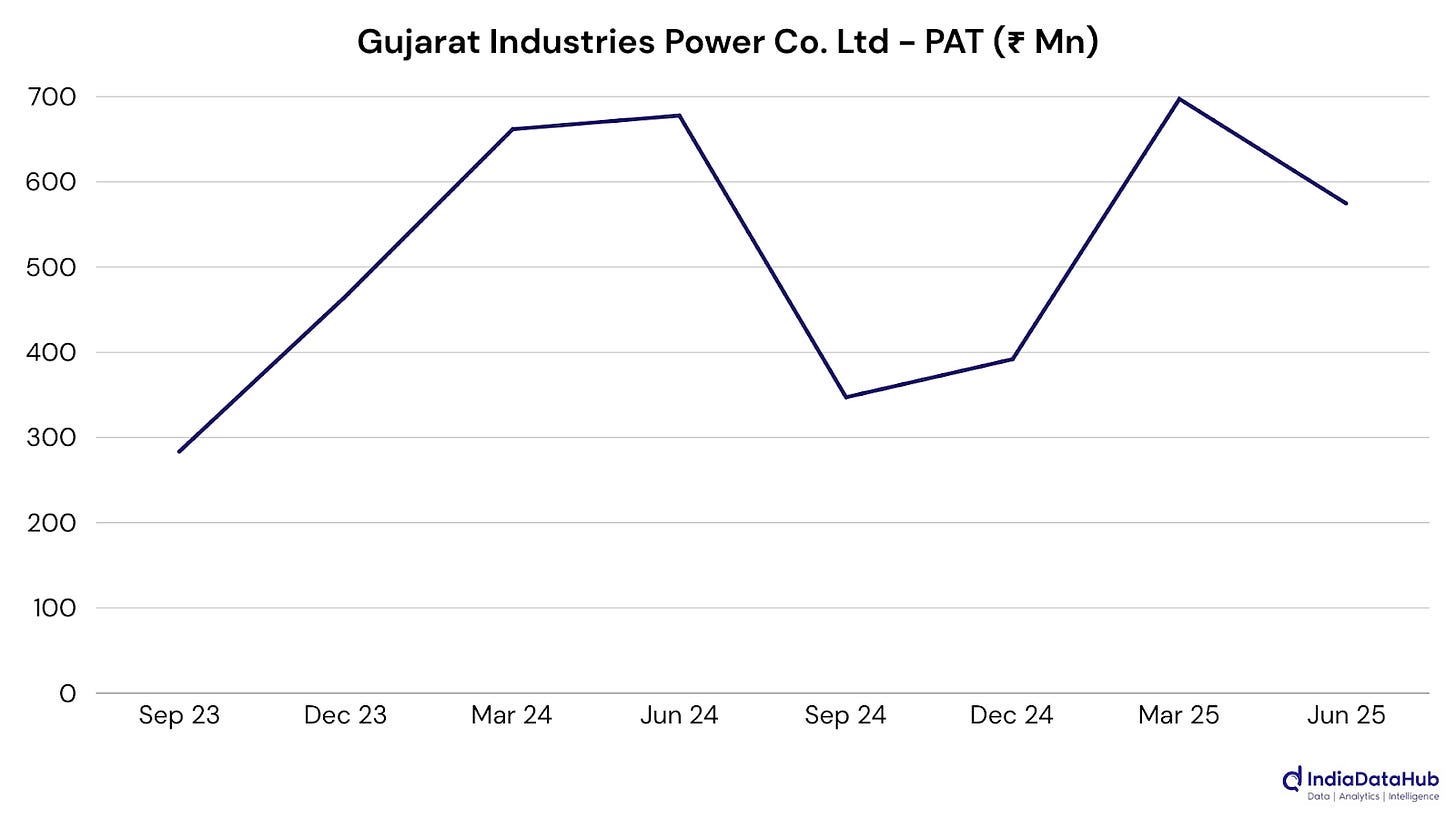

Gujarat Industries Power Co. Ltd: Sales hit a five-quarter high with double-digit growth, but profits slipped as rising fuel costs and heavier expenses ate into margins. Strong demand supported the topline, yet cost pressures kept overall performance under strain.

10. Energy: [#50] [Rev: +0.29%] [PAT: +38.58%]

Oil And Natural Gas Corporation Ltd: Consolidated profit rose 18% despite weaker crude realizations dragging revenue down 9%. Premium-priced gas from new wells and tighter costs provided the cushion, highlighting how ONGC is leaning on gas to offset oil price headwinds.

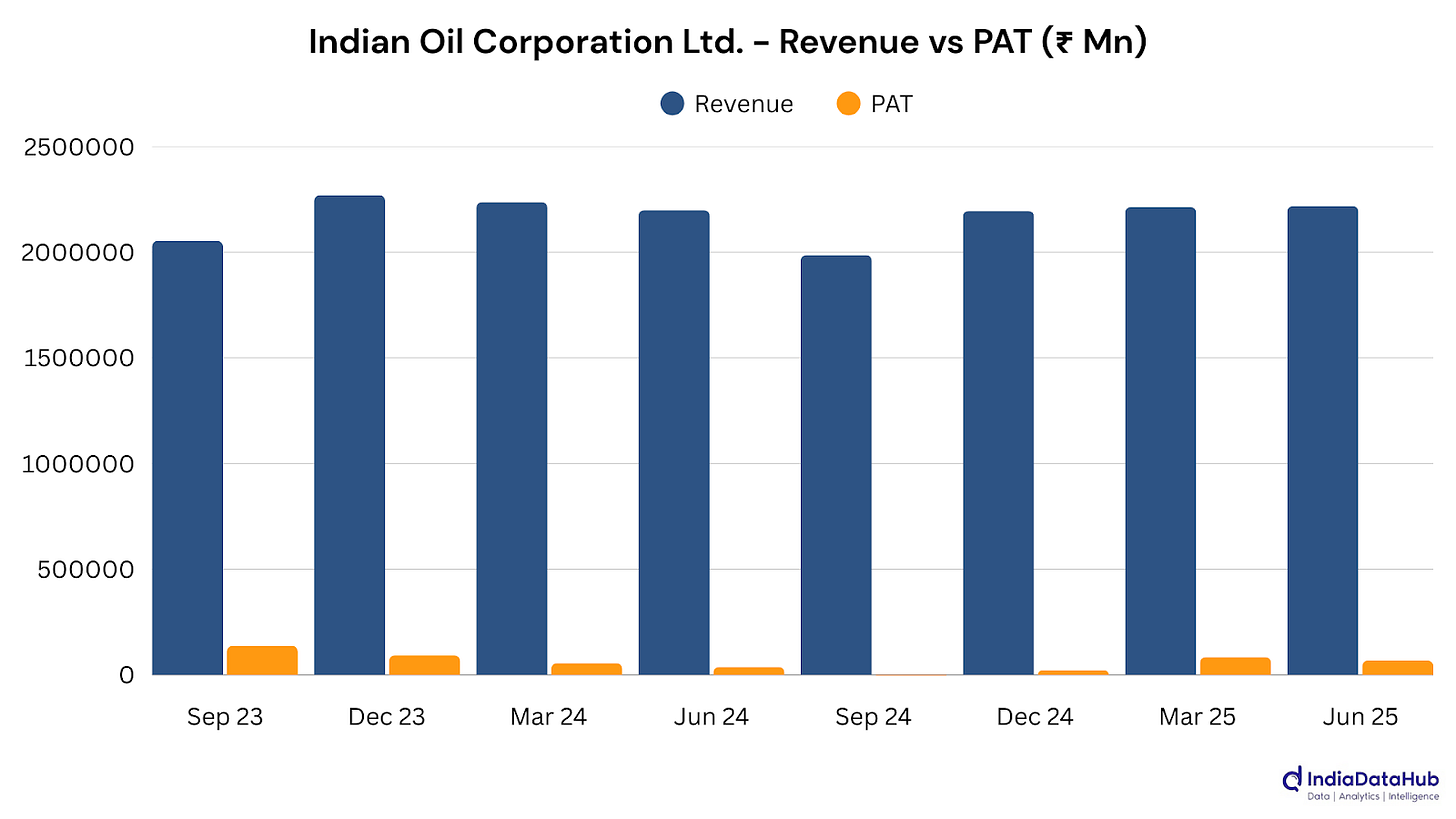

Indian Oil Corporation Ltd. (IOC): Profits surged 83% to nearly ₹6,800 crore even as revenue stayed flat, with lower crude costs and stronger refining spreads driving the beat. High utilization and discounted Russian crude reinforced its edge in a volatile market.

Bharat Petroleum Corpn. Ltd: Net profit jumped 141% as marketing margins widened and costs eased, even though revenue stayed nearly flat. Record sales and 118% refinery utilization underscored its strong execution, turning modest topline growth into a profitability windfall.

Oil India Ltd: Topline slipped nearly 10% as crude realizations weakened, but profits still jumped on stronger refining margins and investment gains. Stable production and steady subsidiary performance helped cushion the hit from global oil price volatility.

11. Telecommunications: [#33] [Rev: +14.98%] [PAT: +64.26%]

Vodafone Idea Ltd: Revenue edged up nearly 5% and ARPU jumped to ₹177, but losses stayed steep at over ₹6,600 crores, weighed down by massive finance costs. Subscriber base showed signs of stabilising as data demand kept climbing.

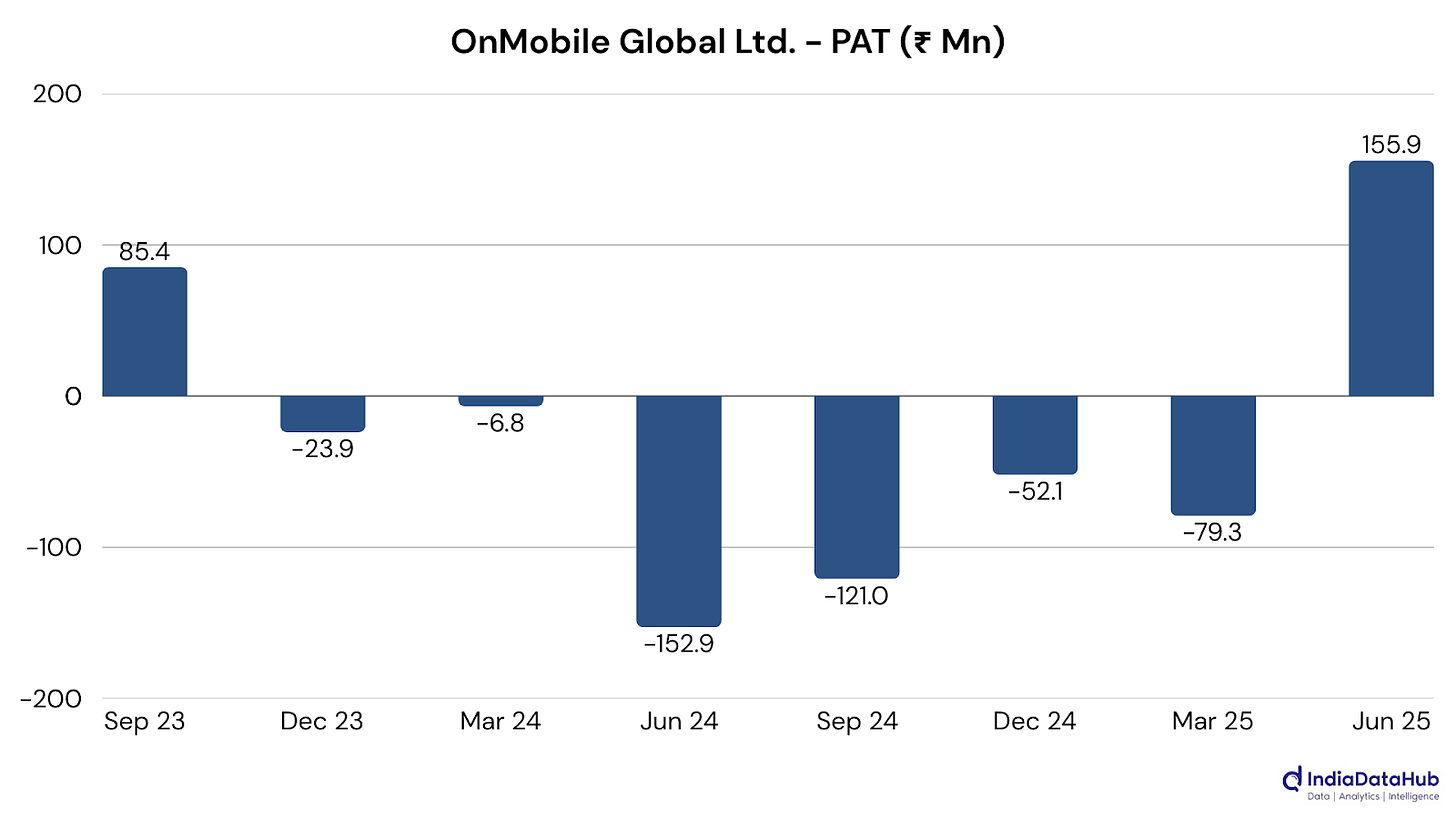

OnMobile Global Ltd: Profits swung back into the black after years of red, with gaming subscriptions surging and cash reserves hitting multi-quarter highs. This quarter is different because of the scale of the shift relative to topline movement. Revenue barely grew, yet profits jumped from losses to healthy margins, showing the business has broken past its breakeven trap. The gaming arm is delivering both volume growth and higher monetization, while disciplined cost control has brought in leverage. Add in the sharp boost to cash reserves, and this may be the early signs of a structural reset in how the company operates.

Reliance Communications Ltd: Revenue plunged 61% QoQ as the company, still stuck in insolvency proceedings since 2019, faces ₹40,413 crore in debt and mounting unpaid interest. Losses widened to ₹943 crore, with SBI labeling its loan account “fraud” in June. With no viable telecom operations, RCom’s results largely reflect liquidation efforts and creditor-driven resolution rather than business performance.

Mahanagar Telephone Nigam Ltd: Revenue collapsed to its lowest in five quarters, while losses deepened past ₹940 crores. With defaults piling up and expenses dwarfing income, the company’s position now looks more like a bailout case than a business turnaround. Unlike past quarters, where government backing kept the ship afloat, this one signals structural insolvency without urgent intervention.

12. Diversified: [#15] [Rev: +5.4%] [PAT: -12.3%]

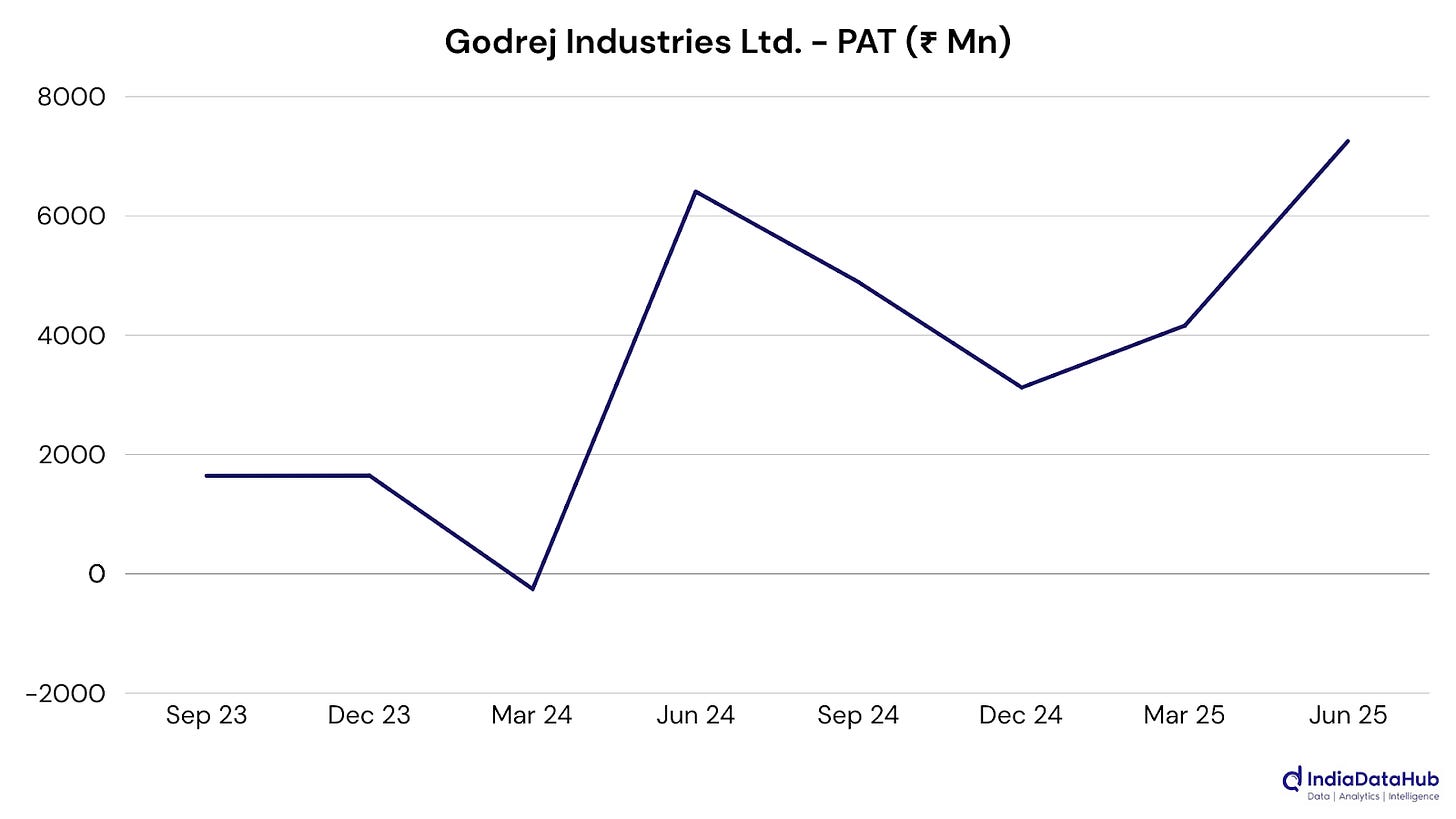

Godrej Industries Ltd: Consolidated PAT growth was 8.3% to ₹349 crore, driven by strong contributions from its FMCG, real estate, and agri-business subsidiaries. Consolidated revenue rose 5% YoY to ₹4,460 crore. However, standalone operations slipped into a ₹30 crore loss versus a ₹105 crore profit last year, as rising raw material costs and inflationary pressures squeezed margins in the core oleochemicals business.

Dhunseri Ventures Ltd: Posted ₹70.8 crore PAT, up 195% QoQ, despite a 31.5% revenue drop to ₹193 crore. The turnaround was powered by a 53% cut in expenses, with cost optimization in petrochemicals and disciplined operations cushioning revenue volatility. This “margin-first” approach shows Dhunseri’s ability to expand profits through operational agility, even in cyclical segments like tea and petrochemicals.

That’s a wrap on this week’s numbers. See you next week!