Slowdown in Insurance, EV penetration, Aviation and more...

This Week In Data #77

In this edition of This Week In Data we discuss:

Slowdown in new business of Life Insurnace sector

LIC is regaining some market share

General insurance sector is also seeing slowdown

Electric 2W sales continue to gain market share

State wise EV penetration trends

Domestic Airlines seeing an uptick in growth

Indigo starting to lose market share while Vistara + Air India is gaining share

Growth in the life insurance sector has been slowing down for the last few months. New Business Premium (NBP) for the sector grew 14% YoY in July, the slowest since November last year. This slowdown is largely due to the Private insurers where NBP grew just 7% YoY in July. NBP growth accelerated to 20% YoY for LIC.

And it is not just in July that LIC has grown faster than other insurers. Since the start of this year, LIC has grown faster than other insurers in 5 of the 7 months. Consequently, LIC’s share in NBP (on a rolling 12-month basis to adjust for seasonality) has risen to almost 60%, the highest in the past year and up almost 3ppt from its low towards the end of 2023.

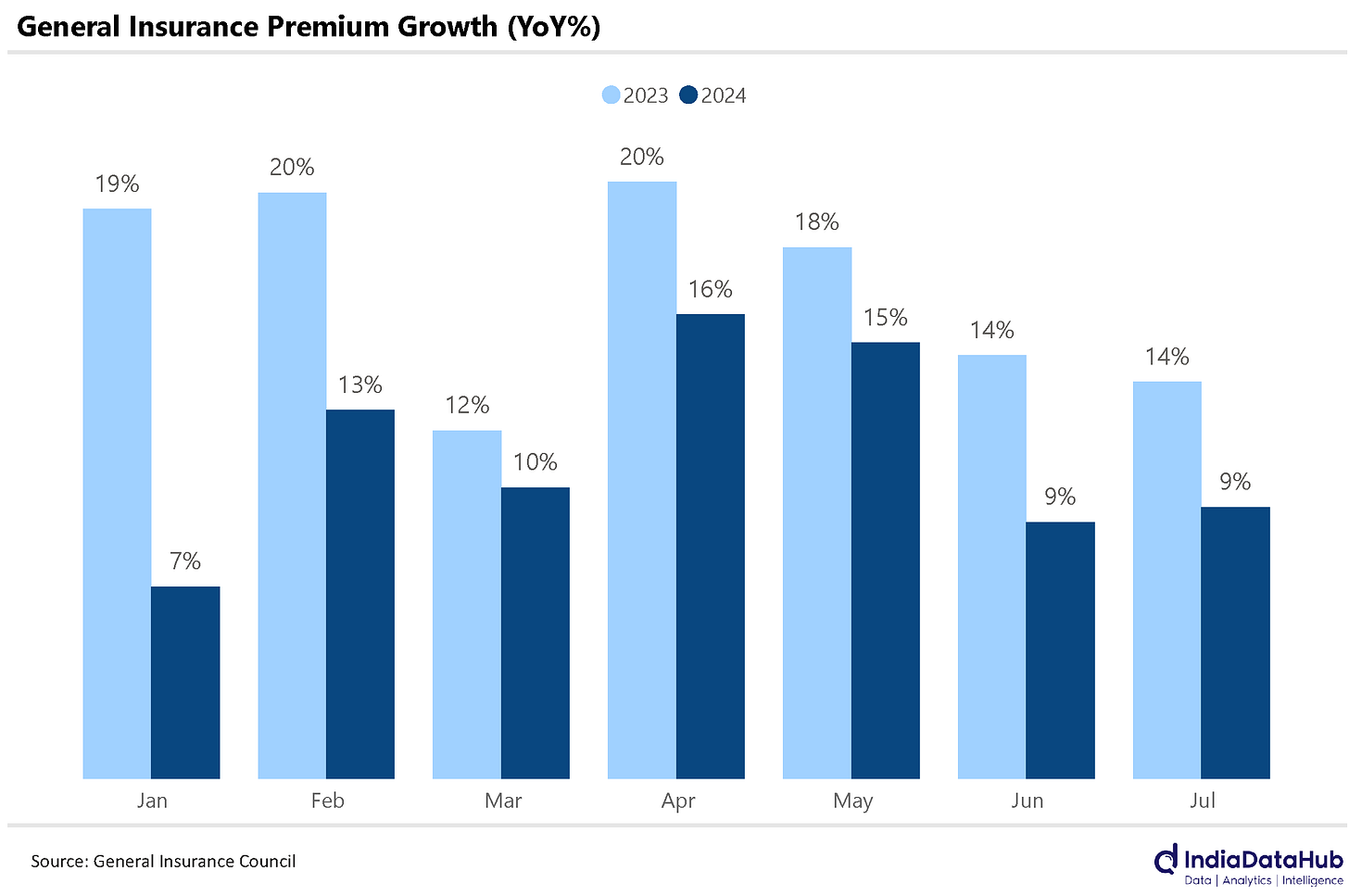

The general insurance sector is also seeing a slowdown. Overall premium collections have moderated to single digits in the last two months from mid-teens growth in the preceding two months. Growth in each of the first 7 months of this year has been slower than the corresponding months of 2023.

While overall the sector has still seen a 12% YoY growth YTD, several companies have seen a single-digit growth or even a decline. Among the larger companies, IFFCO-Toyko and Bajaj have seen a decline YTD while New India has seen a modest 4% growth. At the other end of the spectrum, the two specialised health insurance companies, Niva Bupa and Care Health have seen the strongest growth YTD at over 30%.

Electric vehicles continue to gain market share in the 2W market. In July, sales of electric 2Ws grew almost 100% YoY whereas total 2W sales grew 17% YoY. EVs constituted 7% of total 2W sales in July, the second highest ever – the highest being 9% in March this year.

EV adoption though differs quite significantly across states. And the adoption rates are not intuitive. One would have expected the more urbanised states to have a higher adoption, but while this is generally true, there are exceptions. Goa for example has the highest adoption of 2W EVs in the country. In the first 4 months of this year, 20% of the 2Ws sold in the state were EVs – one in five 2Ws sold in the state is an EV! Kerala is the other state with high EV adoption – 11% of the 2Ws sold in the state in this financial year have been EVs. But quite counter-intuitively, Odisha has a higher EV adoption than either Andhra Pradesh or Tamil Nadu or cities like Chandigarh and Delhi. And Uttar Pradesh and Haryana, are lagging with just 3% of the 2W sales being of EVs so far in FY25 and West Bengal is even lower at just over 2% of 2W EV sales.

The domestic aviation sector is seeing an uptick in growth. Between January and May, the sector saw a low single-digit growth in passengers carried. However, June saw growth edge up to 6% YoY and in July growth ticked up further to 7%. The load factor has also improved on a YoY basis for the third consecutive month after remaining flat to decline in the preceding 3 months.

While Indigo remains the predominant airline with over 60% share of passenger traffic, at the margin it has lost market share in the last 2 months. Vistara-Air India combine has been steadily gaining market share with its share rising above 20% this year. Both SpiceJet and Akasa have also lost market share in the last few months. As has AirAsia (AIX Connect). Effectively, the Vistara-Air India combine has been gaining market share at the expense of every other airline.

That’s it for this week. Have a good weekend, folks…