Slowing Credit Growth, Uptick in FDI, Broad band usage in Bihar and more...

This Week In Data #98

In case you missed, you can now download mutual fund data from our excel plugin. This is in addition to being able to pull this data through our APIs. To begin with we have enabled the daily NAVs for all the schemes as well as cash levels of all equity funds, as well as monthly scheme AUMs. Later this quarter we will also enable downloading scheme portfolio data directly through our excel plugin. See this video for a quick overviewIn this edition of This Week In Data, we discuss:

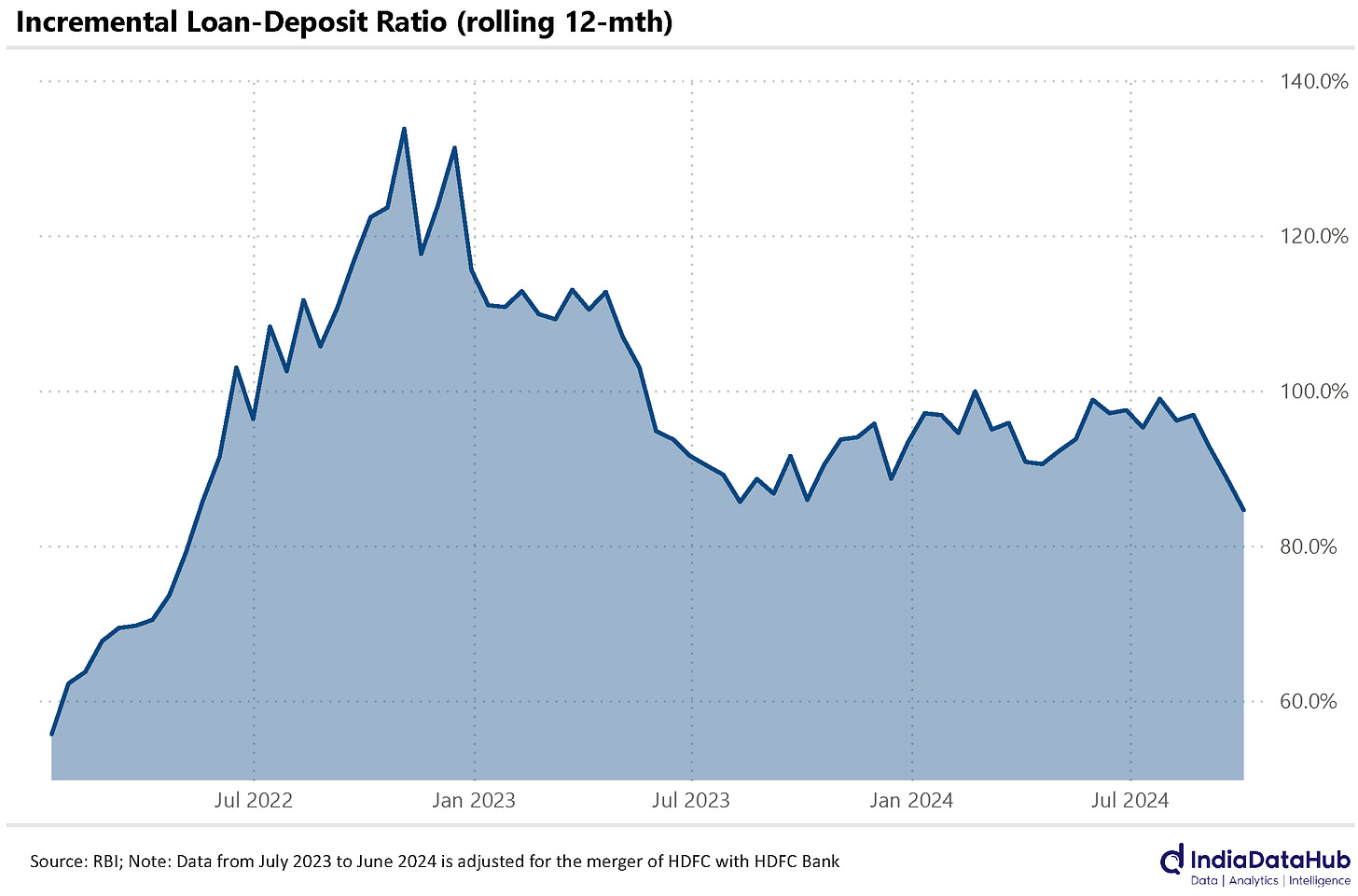

Slowdown in credit growth in the last few weeks resulting in moderating gap between credit and deposit growth

Incremental credit-deposit growth has fallen below 85% as of early October from over 100% a few quarters back

Outward remittances were the second highest ever in August

FDI flow into India continues to improve as does outward FDI by Indian companies

August was another weak month for private wireless telecom operators and BSNL continues to gain at their expense

Bihar has seen one of the strongest growth in fixedline telecom subscribers

Credit growth has gradually moderated over the past few weeks and as of early October, it has fallen to below 13% YoY. This is the lowest growth in over 2 years. Meanwhile, deposit growth has broadly remained stable at ~11-12% YoY. Consequently, the gap between the credit and deposit growth which was as high as 8ppt towards the end of 2022 has fallen to less than 1ppt as of early October.

Consequently, the incremental credit-deposit ratio has fallen from over 100% last year to under 85% as of early October. RBI’s stress on reducing the imbalance in the credit-deposit growth through moral suasion as well as by keeping the policy rate high seems to be working.

August saw the second-highest monthly outward remittances by Indians for overseas travel. Total outward remittances were just over US$2bn during the month, only 1% lower than the outflows in August last year (which was an all-time high). In the first 5 months of this year, outward remittances for travel have totalled US$7.5bn, only modestly lower than last year when outflows had increased due to the imposition of the TCS.

The trend of sequential improvement in FDI inflows has continued in August. As per the provisional data, August received a gross FDI of US$8.6bn, the highest in the last few years. More importantly, the FDI received was almost 75% higher than in August last year. Cumulatively in the first 5 months of the year, gross FDI received by India has totalled US$36bn, up 33% YoY.

As we highlighted last month, outward FDI from India has also picked up in recent months. August was the second consecutive month when outward FDI was above US$2bn. Cumulatively, in the first 5 months of the year, outward FDI has totalled US$8.7bn, up almost 70% YoY. And if we include March this year which had seen over US$3bn of outward FDI, then in just the last 6 months, Indian companies have almost doubled the outward FDI they have made on a YoY basis.

August was another weak month for the wireless telecom operators. Collectively they lost just under 6 million subscribers in August on top of the almost 1 million decline in July. And while it was Airtel and Vi that were the big losers in July, in August it was Jio that was the biggest loser. Jio lost 4 million subscribers in August while Airtel lost 2.4 million and Vi lost 1.9 million.

And BSNL continued to gain subscribers. On top of an almost 3 million increase in subscribers in July, BSNL saw an increase in its subscriber base by 2.5 million in August. In just the last 2 months, BSNL’s subscriber base has increased by over 6% in absolute terms. As we mentioned last month, this most likely reflects a downtrading amongst the subscribers given the recent tariff increases by the private operators.

In contrast to the trend in wireless sector, the fixed line operators continue to see growth. Indeed, growth picked up in August with over 600k new subscribers being added during the month, the highest since March this year. And one of the regions from where this growth is coming is the Bihar Circle (which includes Jharkhand).

Over the past year, the Bihar circle has seen over 400k new fixed-line subscribers being added. This is higher than the growth in either Delhi, Gujarat, Maharashtra (incl Mumbai), Tamil Nadu or West Bengal (incl Kolkata). The number of fixed-line subscribers in Bihar circle has increased by over 50% over the past year, the highest of any region in the country. The total fixed line user base still remains very low in Bihar (just 1/4th of Delhi) and so this growth is coming off a low base. But given that the growth in fixed-line subscribers is largely linked to demand for high-speed internet usage, this makes it very notable since Bihar is one of the least economically developed regions in the country.

That’s it for this week.