Stagnant Exports, Weak FDI, Slowdown in Insurance and more...

This Week In Data #113

In this edition of This Week In Data, we discuss:

Exports declined in January and are largely stagnant YTD

Imports however continue to rise in high single digits

FDI Inflows into India remain weak

Bank credit growth has stabilised but LDRs are at all-time highs

Both Life and General Insurance sectors are seeing a slowdown

First, trade. Merchandise exports declined in January, the third consecutive month of decline. In January, they declined by 2%, taking the YTD (Apr-Jan) growth down to just over 1%. Essentially, India’s exports are stagnant this year. But this is largely a reflection of global trade. Global exports are also growing in the low single digits in the last few months.

Sectorally, a sharp decline in Petroleum products is the biggest drag on the exports. YTD petroleum product exports have declined by almost 25% YoY. Excluding petroleum, exports have grown by nearly 8% YoY. Gems and Jewellery exports have also declined almost 10% YoY and have been another key drag on total exports. Electronic exports continue to be the key driver of exports growing over 30% YoY YTD. India has exported electronic goods worth over US$30bn between Apr-Jan and electronic exports are now higher than Textile as well as Gems and Jewlery exports.

Imports however grew by 10% YoY in January and by 7% YTD. While petroleum exports have declined sharply YTD, Petroleum imports have increased by 6% YTD (in part driven by natural gas imports). Both electronics and machinery imports have also increased by ~10% YoY till January. While in percentage terms, Pulses have seen the fastest growth in imports in absolute terms by far Gold is the biggest driver of the growth in imports. Gold imports have grown 32% YoY till January (with over 40% growth in January) and almost 30% of incremental imports during Apr-Jan of this year are due to higher Gold imports! In the first 10 months of this year, Gold imports have totalled US$50bn! Higher prices driving down demand does not apply to Gold 😊

FDI Inflows continue to remain a worry. Gross FDI during the December quarter grew by less than 5% YoY. However, repatriation of existing FDI grew by over 50% YoY and consequently, net FDI received by India declined by over 50% YoY. And FDI by Indian companies is also growing. Till December it has grown by over 40% YoY and consequently, during the December quarter, there was a net outflow of FDI from India. So while the focus remains on large FPI outflows, even FDI inflows continue to remain a concern.

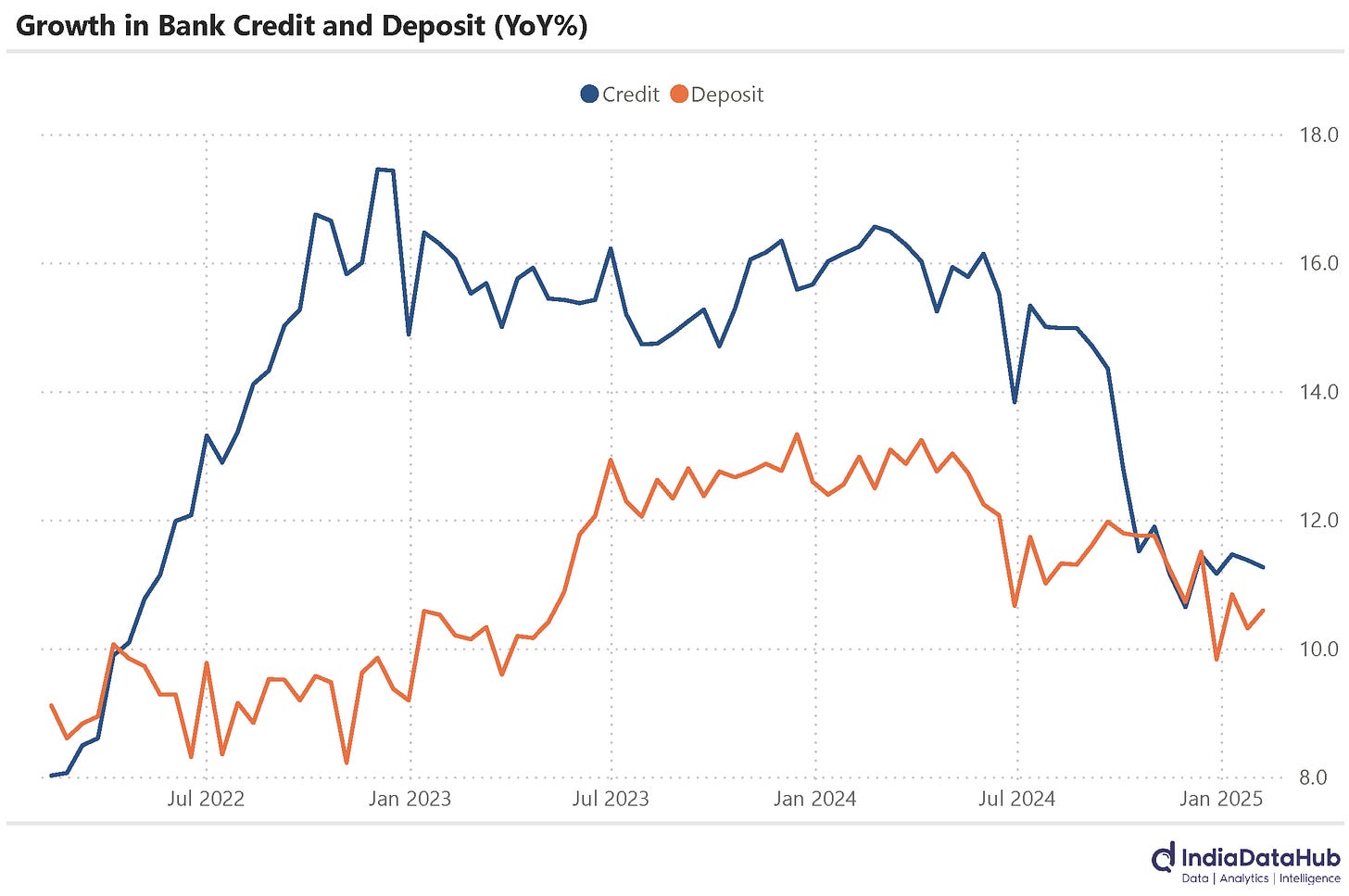

After having decelerated sharply in the last quarter, credit growth has stabilised at ~11-12% in the last few weeks. Deposit growth too has moderated and has now settled at just over 10% YoY.

However, the Loan-to-Deposit ratio for the banking system has now increased to over 80%, the highest ever. There is thus very limited slack on bank balance sheets. In the context of government borrowings likely to increase next year (due to lower small savings inflows), this does suggest that core domestic liquidity is likely to remain tight in FY26…

The life insurance sector is seeing a sharp slowdown. New business premiums collected have declined for 3 consecutive months ending January and new policies issued have declined for 4 consecutive months. While most of the decline is due to LIC, new policies issued by the private insurers have grown in low single digits in the last 4 months.

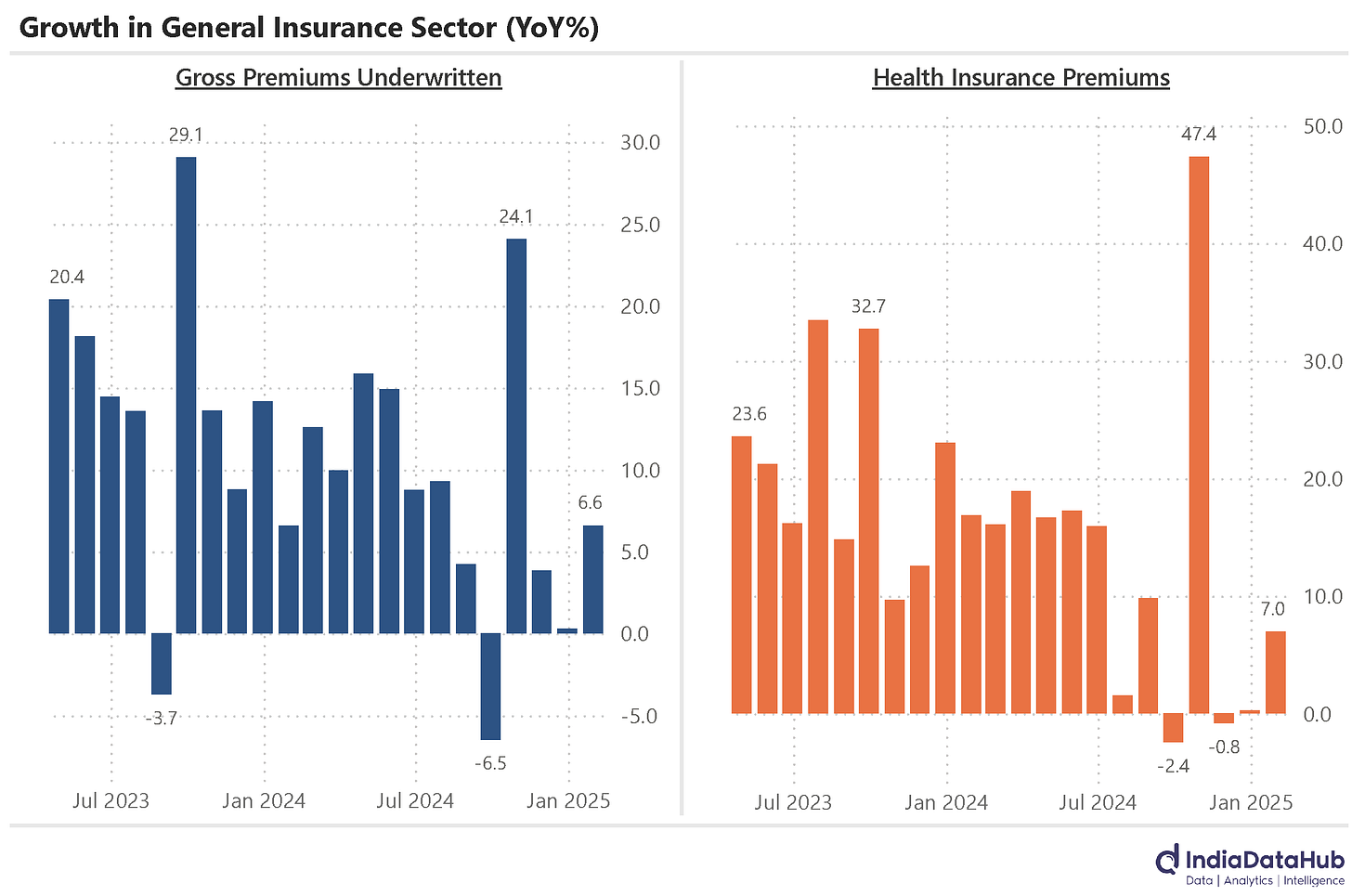

The general insurance sector is also seeing a slowdown. New premiums collected have grown in low single digits in the last 3 months and in single digits so far in FY25, down 5ppt from the growth in FY24. The health insurance segment is the key driver of this slowdown growing by just 2% YoY in the last 3 months.

That’s it for this week. More next week…