Strong GDP, Weak GDP, Tax Buoyancy, Small Savings and more...

This Week In Data #55

In this edition of This Week In Data, we discuss:

The strong GDP growth data

The weak GVA growth data

Continued strength in tax collections

Buoyant small savings collections

Euro Area CPI

Euro Area Unemployment

So, did India’s GDP grow at a 6-quarter high rate of 8.4% YoY or a 3-quarter low rate of 6.5% YoY, during the December quarter? Depending on which number you pick, you will reach a very different conclusion about the path of the economy. This difference comes because the CSO publishes GDP through two different metrics – one is the GVA (Gross Value Added) and the other is the GDP (Gross Domestic Product). One (GVA) measures the value of final Goods and Services produced in the economy while the other (GDP) measures the total final expenditure on Goods and Services in the economy.

Now globally, in most developed countries, it is the GDP metric that is the preferred metric. That is because it measures, consumption and investments separately the two most tracked metrics. So based on this metric, India’s GDP grew at a 6-quarter high of 8.4% YoY during the December quarter. And if we ignore the pandemic-driven disruption, this is the highest growth in almost the last 6 years. But historically, in India, it is the GVA data that has generally been accepted as being more reliable. This is because the high-frequency statistical data that is available in India is more amenable to relatively accurate GVA estimates. And this is true of most emerging economies as well. So on this basis, India’s economy grew at a 3-quarter low rate of 6.5% YoY during the December quarter.

It is also worth noting that this magnitude of difference between the two estimates is unprecedented. This is the highest difference between the two estimates in the last 12 years or so for which we have data for this series of national accounts (2011-12 base). Indeed a gap of 1ppt between the two estimates (GDP growth being 1ppt higher than GVA growth) has happened in only 6 previous quarters. And for what it's worth, in each of these six occasions, in the subsequent quarter, growth has slowed under both the metrics with growth slowing more as per GDP estimate than GVA estimate.

Tax revenues continue to remain buoyant though (note that this is nominal growth, while GDP is real growth). Central Government’s Gross Tax Revenues grew in the high teens during January, the third consecutive month of double-digit growth. Direct taxes grew over 20% YoY suggesting continued strong income/profit growth. GST Collections for Feb also grew in double digits. Expenditure however declined in January driven by a sharp (~40% YoY) contraction in Capital expenditure. Despite this, YTD (Apr-Jan) Capital expenditure has grown by 26% YoY with revenue expenditure being largely flat. So this decline in January is not unduly perturbing.

More interesting though is the strength in small savings inflows. YTD (Apr-Jan) Small savings (commonly referred to as Post Office Savings schemes) have seen inflows totalling ₹2,800bn. This is 45% higher than the inflows during the same period last year. This is approximately 15% of the incremental bank deposits during the current year and 70% of the net inflows received by Mutual Funds this year.

Given that small savings mobilisation generally happens from the relatively less affluent sections of the society and from relatively smaller towns and cities, this would suggest reasonably strong income growth in those section of the society/regions. Point in favour of those who oppose the ‘K’ shape recovery hypothesis.

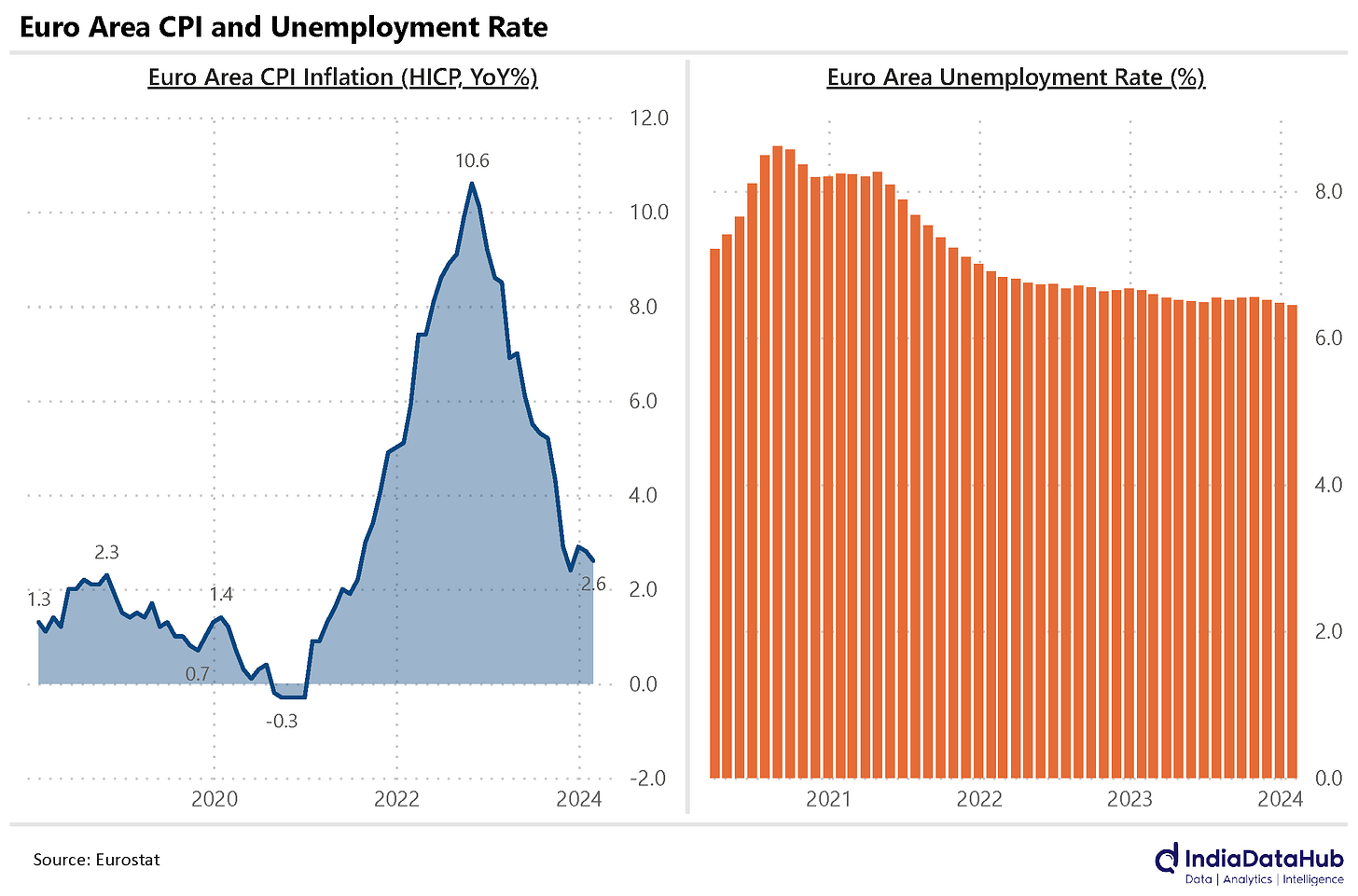

Alright, let us turn to the rest of the World. As per the Eurostat Flash Estimate released this week, the Euro Area's CPI Inflation (HICP) declined by 20 basis points MoM to 2.6% YoY in February. In February last year, the inflation was 8.5%. Among the key components, Energy prices declined by 3.7% YoY while Food prices increased by 4% YoY. Looking at the key countries – Germany and France – both saw inflation decline. Inflation in Germany declined to 2.7% in February from 3.1% in the previous month. In France, inflation declined by 30bps MoM to 3.1%.

Euro area unemployment rate however remained almost unchanged MoM in January. Even as inflation has moderated and growth has remained relatively strong, the Euro area unemployment rate has remained sticky around 6.5% since mid-2022.

That’s it for this week. The new F1 season starts today with the Bahrain Grand Prix later in the evening. A whole new year to chase down the Red Bulls, which last year for sure had Wings…