In this edition of This Week In Data, we discuss:

US Imposes across the board tariffs on India

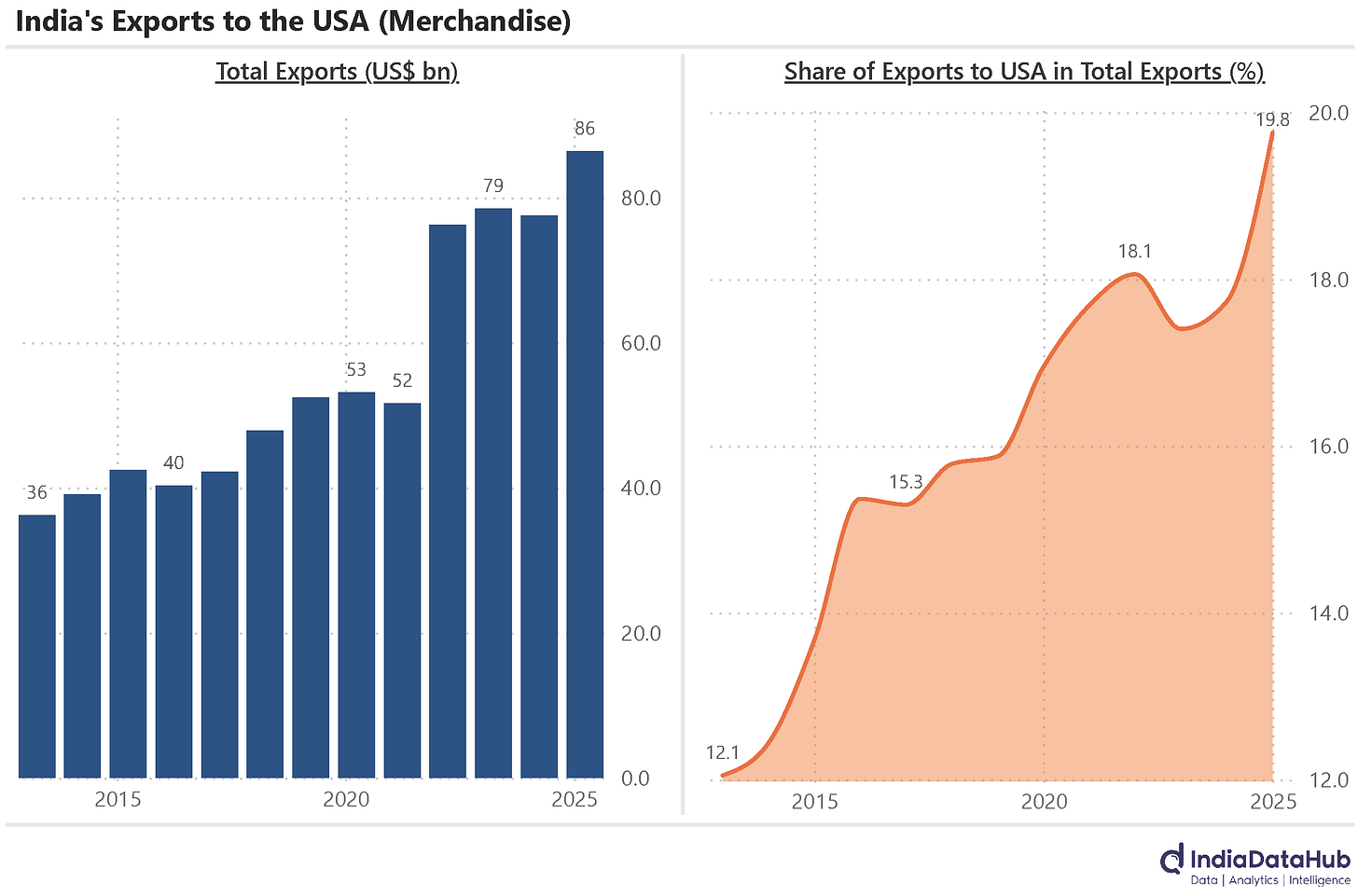

India’s exports to USA are large and growing rapidly

Corporate, Income Tax and GST collections remain weak

Govt front loads expenditure resulting in doubling of 1Q deficit

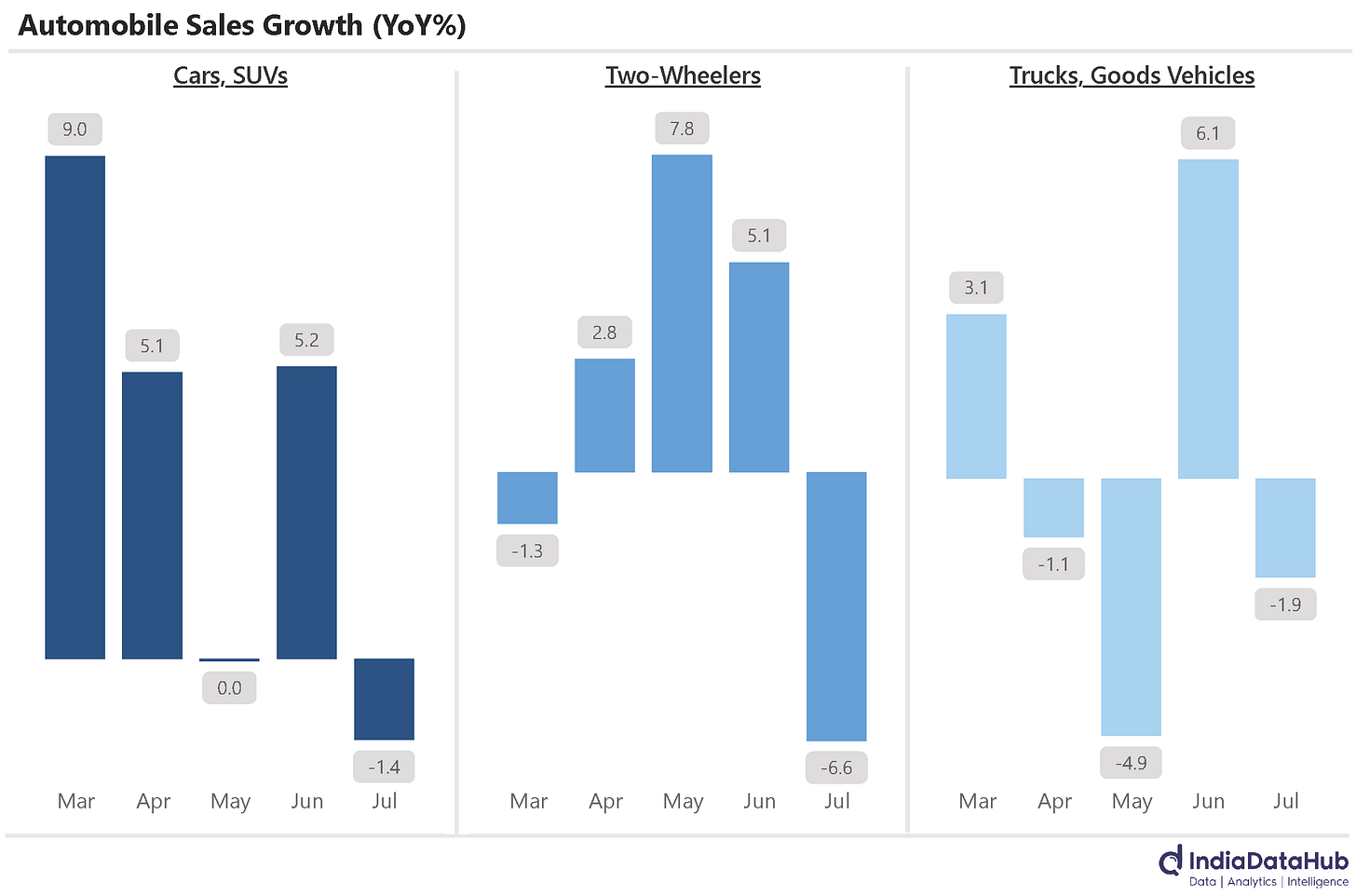

Auto sales were weak in July

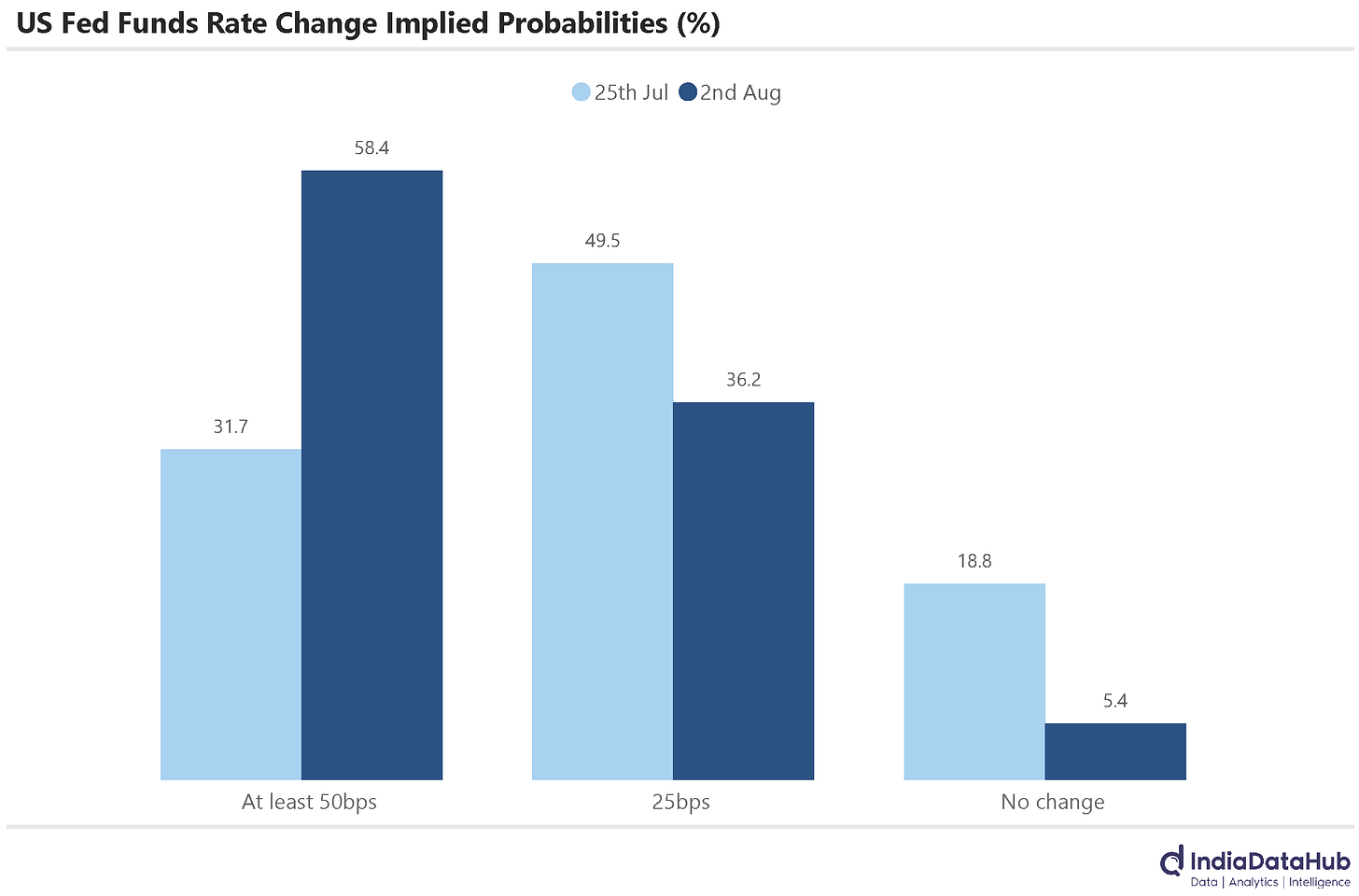

US Fed keeps rates unchanged but expectations have risen for rate cuts in Sept

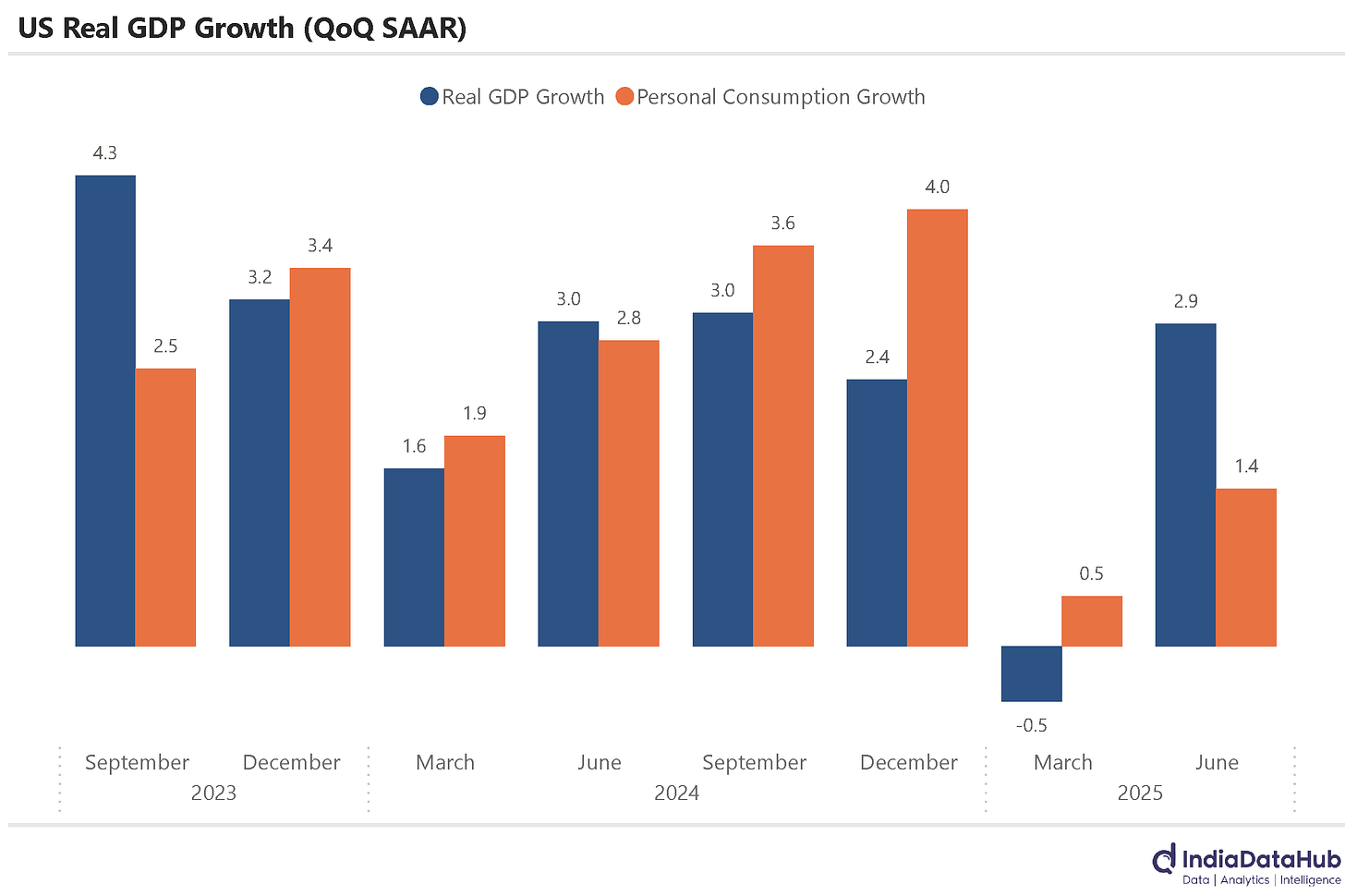

US GDP growth bounces back in June quarter but consumption remains weak

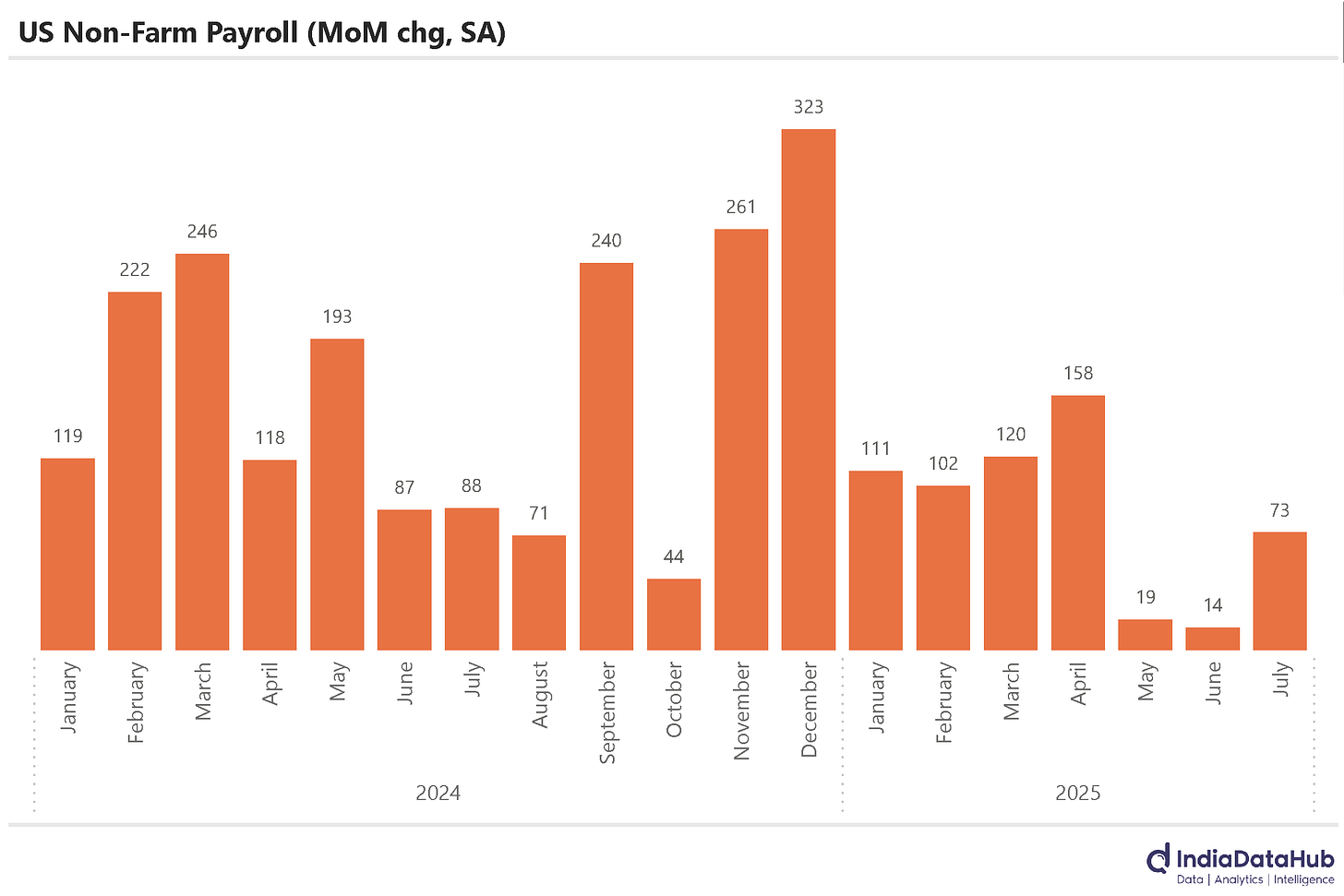

US labour market weakens sharply

The biggest story of the week was, of course, the Trump tariffs on India. US President Donald Trump has proposed a 25% blanket tariff on all goods from India entering the United States. We will be discussing tariffs today, and just a week back, we were discussing the free trade agreement between India and the UK! But such are the times we live in...

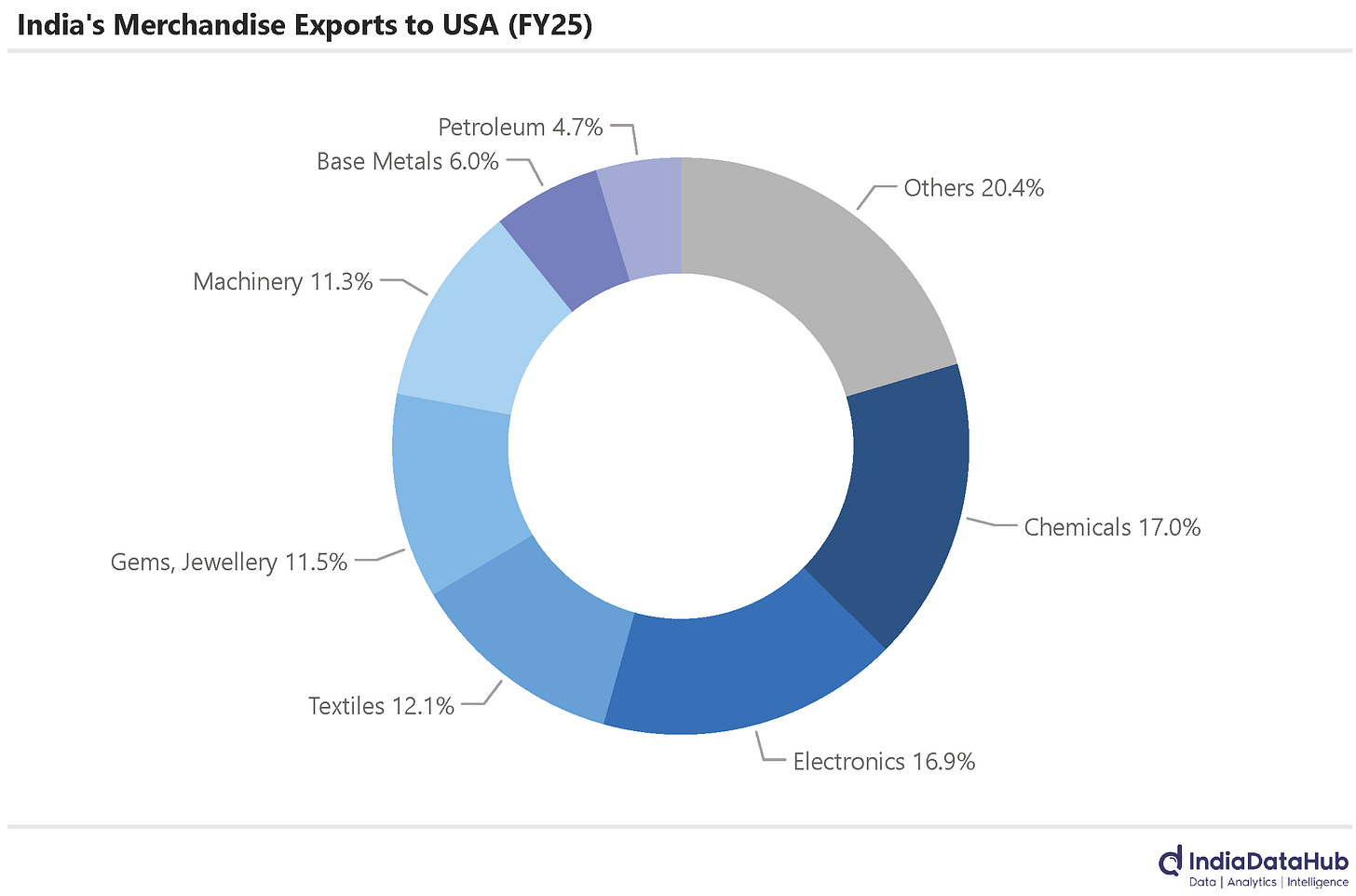

Unlike the UK, the USA is a very large trade partner for India. In FY25, for instance, India exported goods totalling just under US$90bn to the USA, making it the biggest export market for Indian goods and by some margin. The next biggest export market was the UAE, and exports to the UAE were less than half of those to the USA.

Needless to say, a 25% tariff (and potentially more) will negatively impact India’s exports. Government estimates peg the tariffs as shaving off 0.2-0.3% of GDP in the current year. But it is anybody’s guess at this point. India is not the only country facing tariffs, and so what matters is relative tariffs. And much will also depend on whether eventually there will be a trade agreement between the two countries which sees the tariffs being rolled back, either in full or partially. In the short run, though, there could be an abrupt impact on India’s exports.

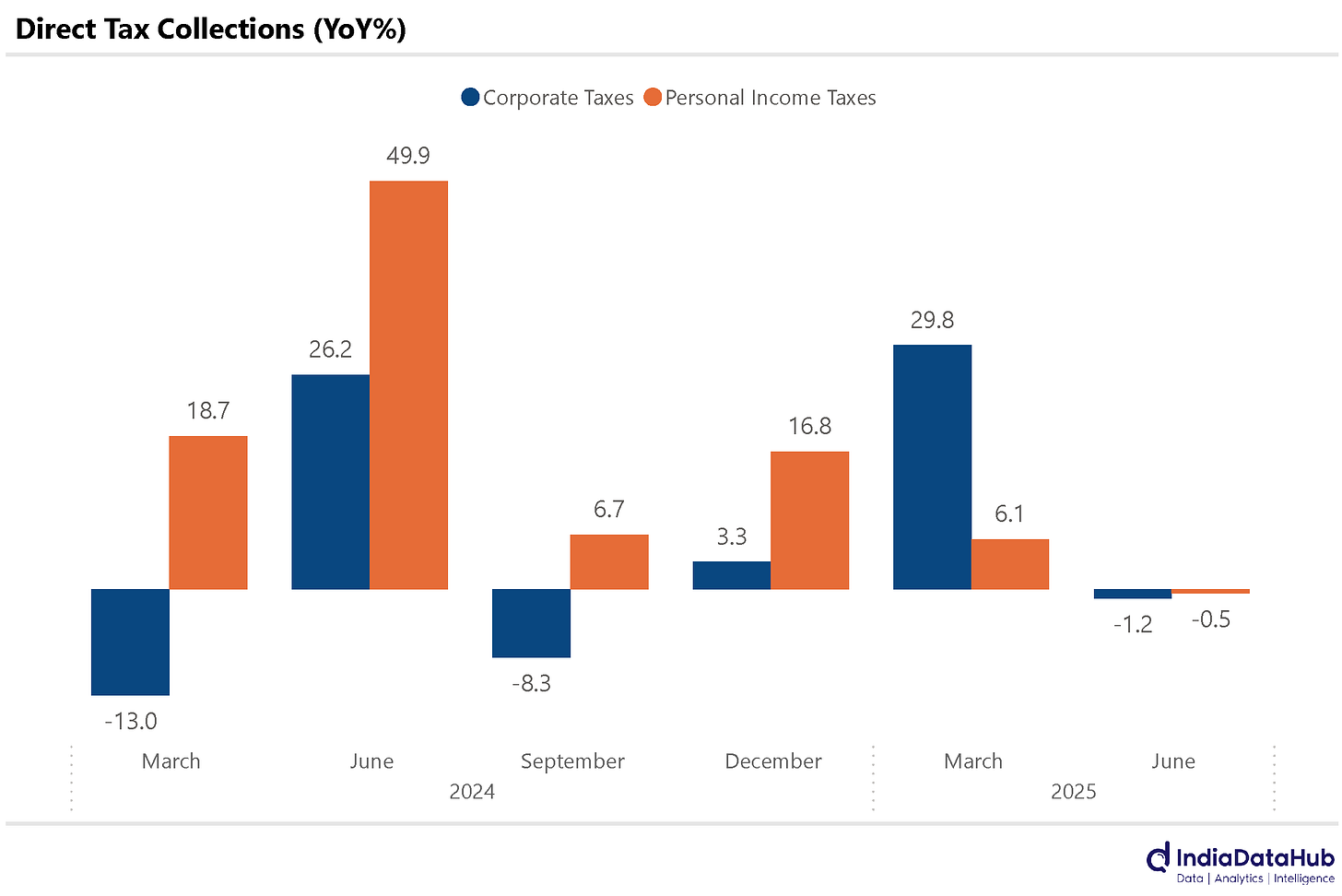

Central Government’s Gross Tax Collections declined in June after having seen a 20% growth in May. Corporate tax collections declined modestly in June, and they also saw a modest decline for the June quarter as a whole, continuing the trend of weak corporate tax collections.

Personal income tax collections declined in double digits in June. As we discussed last month, the shift in the date to file tax returns will result in personal income tax collections being weak. However, that effect should be most pronounced in July when tax returns are normally due. The majority of tax collections in June would be advance tax and tax deducted/collected at source – both of which pertain to current year income. So a decline in tax collections in June (and for the June quarter as a whole as well) is thus disconcerting.

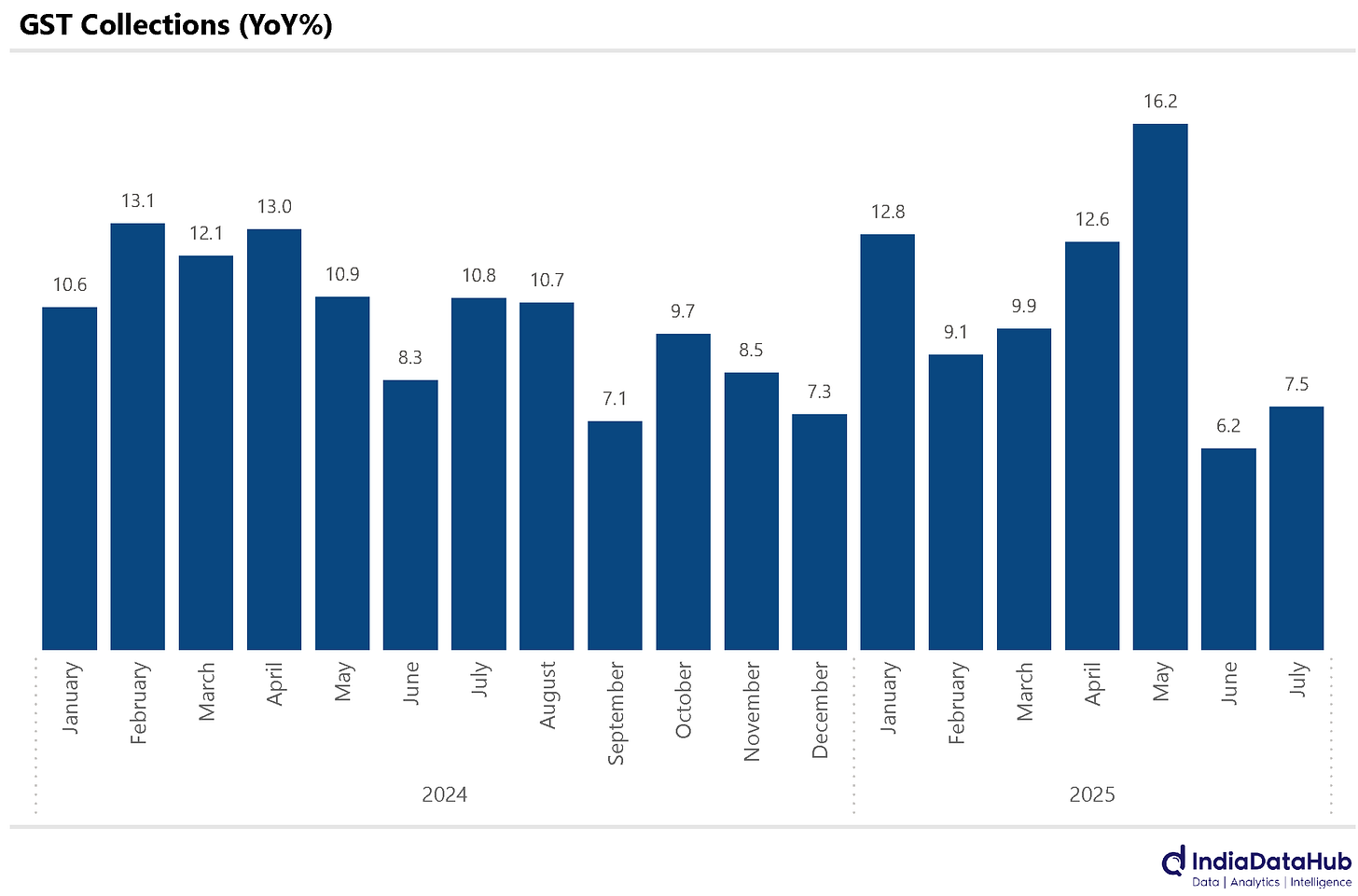

GST collections grew in the single digits for the second consecutive month in July, although there was a slight pickup. Overall GST collections grew by 7.5% YoY in July, as against 6.2% growth in June. So not just direct but even indirect tax collections are seeing weak growth.

Lower tax collections have been more than offset by higher non-tax collections – due to the higher-than-expected dividend from the RBI – and thus overall receipts have grown by almost 13% YoY. Central Government’s Total Expenditure has, however, grown by 25% YoY, driven by a 50% growth in capital expenditure and a 20% growth in revenue expenditure. This sharply higher growth in expenditure relative to receipts has resulted in a more than doubling of the fiscal deficit in the June quarter. This is not yet disconcerting as the expenditure is most likely to have simply got front-loaded rather than a sign of expenditure over-shooting the budget estimate.

July was a weak month for Automobile sales. Passenger Vehicle sales declined 1% YoY, the first time they declined since February. Two-wheeler sales declined 7% YoY in July, the weakest print since December last year. Sales of Trucks and other goods carriers also declined in July – the 3rd time in the last 4 months.

Buses and other passenger vehicles also saw a slowdown with sales growing just 3% YoY in July, the slowest pace since February. The one exception to this, though, was Tractor sales, which grew 11% YoY, the strongest growth since December last year.

Globally, a fair amount of data was released in the US, especially. The US Federal Reserve maintained the target range for the federal funds rate at 4.25% to 4.5%, citing robust labour market conditions and a lower unemployment rate. Similarly, the central banks of Brazil, Canada, and Japan kept their interest rates unchanged in their respective monetary policy committee meetings. However, the South African Reserve Bank cut its interest rate by 25 basis points, from 7.25% to 7%.

The US Bureau of Economic Analysis released its first advance estimate of US GDP for the June quarter. Real GDP grew at an annualised rate of 3.0%, rebounding from a 0.5% contraction in the previous quarter. While this seems impressive, the growth was primarily driven by a decline in imports, offset slightly by inventory liquidation. Personal consumption grew by 1.4% during the quarter. While this is higher than the 0.5% growth during the March quarter, it remains well below the 3% average growth since the preceding 6 quarters. The underlying momentum thus does not appear to be very strong.

And most disconcerting was the US labour market data released on Friday. In July, the economy added 73,000 non-farm jobs—significantly below the market expectation. Notably, there were substantial downward revisions to previous months' figures: May’s job additions were revised from 144,000 to 19,000, while June’s were revised down from 147,000 to just 14,000. These adjustments resulted in a net downward revision of 258,000 jobs. So the revised data suggests a fairly weak US labour market in the last few months.

A combination of weaker labour market data and mixed GDP data has meant that markets are decisively expecting a rate from the US Fed in September and also in October. A week ago, markets were assigning only a 32% chance of a 50bps rate cut by October. But today they are assigning an almost 60% chance for the same.

That’s it for this week. RBI meets next week to decide on rates. And while a pause was expected, the low CPI print for June has possibly opened the door for a further rate cut. Our vote, though, is for the status quo, but we shall see…

For the June quarter Gross Corporate Tax collection is up. Are you sure about your numbers?