Welcome to the second edition of This Week In Earnings (TWIE) newsletter. Our aim, through this newsletter, is to help you screenshot the quarterly earnings season, which sees over 4000 companies declare their results every quarter, all in one place. We’re into the home stretch of the Q1 FY26 earnings season with nearly 2,000 companies having already declared their results. Since this is only the second edition, we are still fine tuning the format and structure. We would love your feedback on how to refine this publication…

You are receiving this newsletter because you are an existing subscriber to our other newsletter - This Week In Data (TWID). That newsletter continues and you can choose to opt out of this newsletter by clicking on the unsubscribe link at the bottom if you wish and continue to just receive the TWID newsletter.This newsletter is structured in two sections. The first section covers the trends in aggregate, across sectors. And the second section reviews the key company results declared during the week grouped by sectors. Section 1: Aggregate Trends

Section 2: Key Results during the week

Consumer Discretionary

Financial Services

Industrials

Commodities

Services Sector

Information Technology

Healthcare

FMCG

Utilities

Energy

Telecom

Diversified Cos

Aggregate Trends

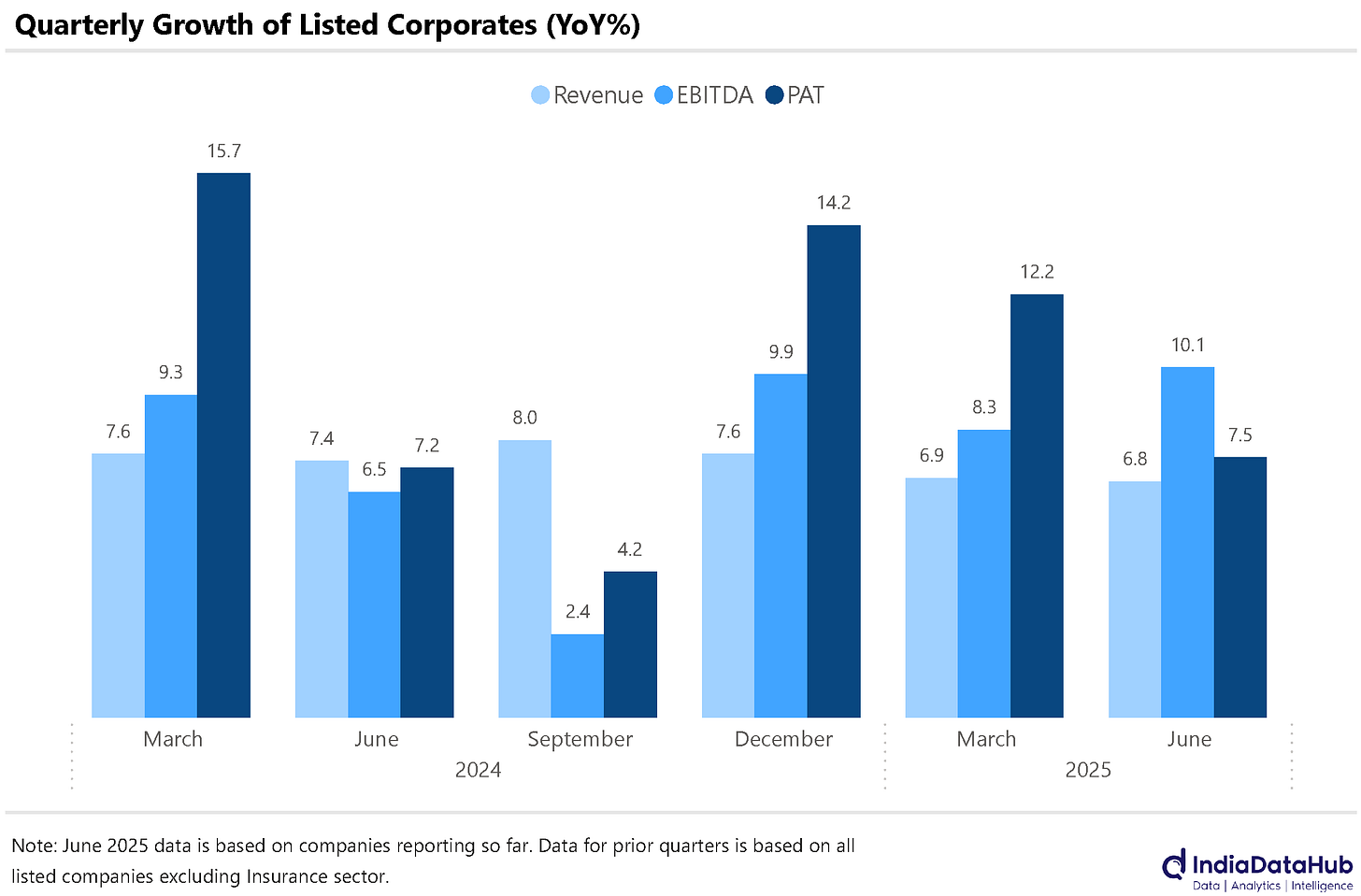

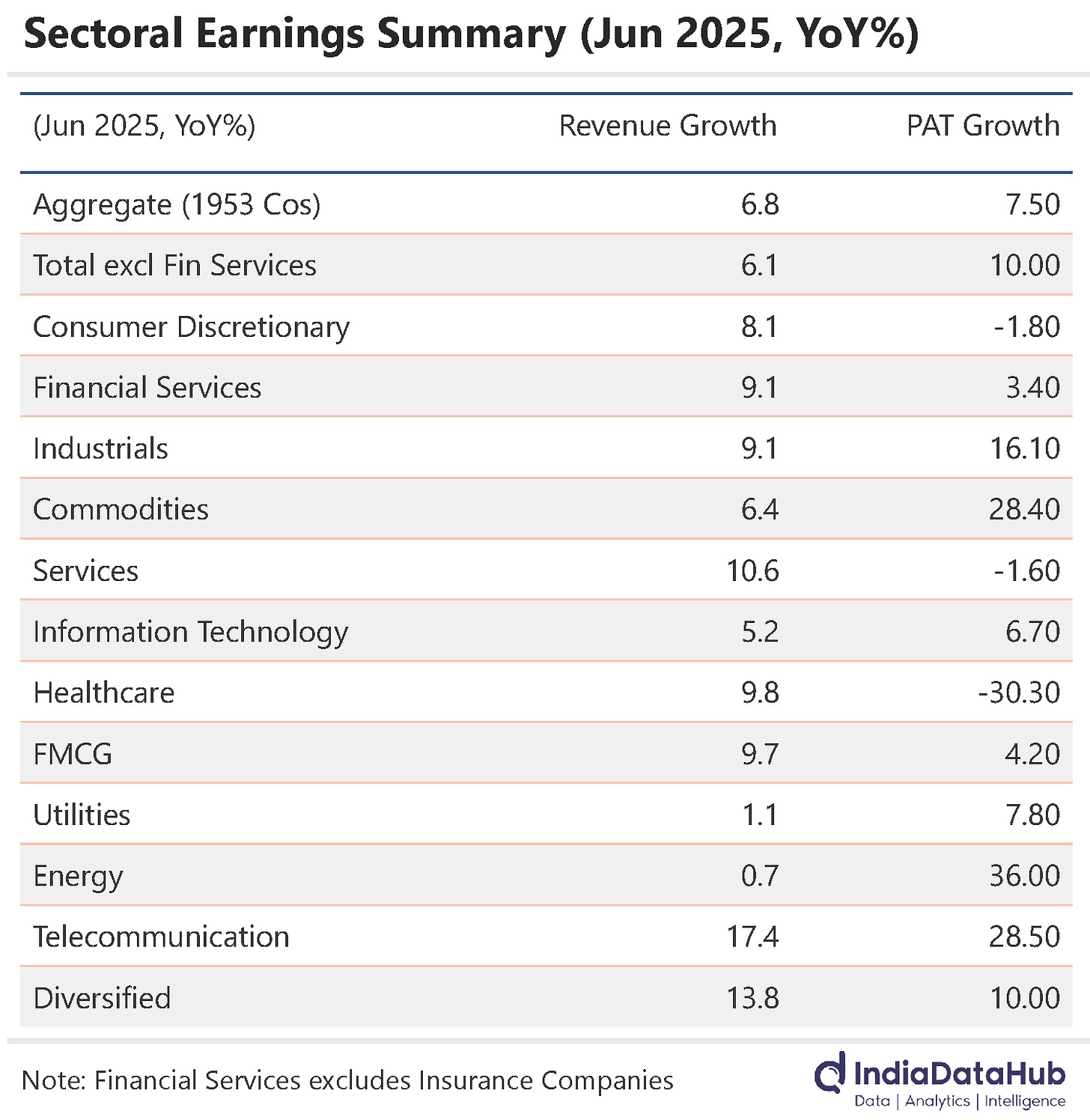

As of August 9, 1,953 companies have declared their 1Q FY26 results, and the results are getting sharper by the day. Revenue growth across the board has cooled a touch to 6.8% from 7.8% last week, but profits are looking healthier, ticking up to 7.5% from 5% as of last week. In other words, while toplines aren’t racing ahead, companies are squeezing more out of every rupee they earn. In sync with this, while revenue growth is tracking in single digits for the 9th consecutive quarter, EBITDA growth has so far been ~10% YoY, the highest in the last six quarters.

Industrials, Commodities, Energy, and Telecom are still carrying much of the profit momentum. Industrials kept their foot on the pedal with 16% PAT growth, all thanks to stronger execution and fatter margins. Commodities surprised again with a modest 6% revenue growth, translated into a 28% profit surge as cost discipline and pricing power did the heavy lifting. Energy is in its own lane. Revenue has barely moved (+0.7%), but PAT has jumped 36%, proving how far operational leverage can take you.

Not every sector is doing well, though. Healthcare is still in the red, with profits down over 30% despite almost 10% revenue growth. Consumer Discretionary and Services have also slipped into mild profit declines due to misses by a few large companies tilting the numbers. Financial Services has gotten back into positive territory on the profit front, but the gains are still patchy.

Consumer Discretionary: [#491] [Rev: +8.1%] [PAT: -1.8%]

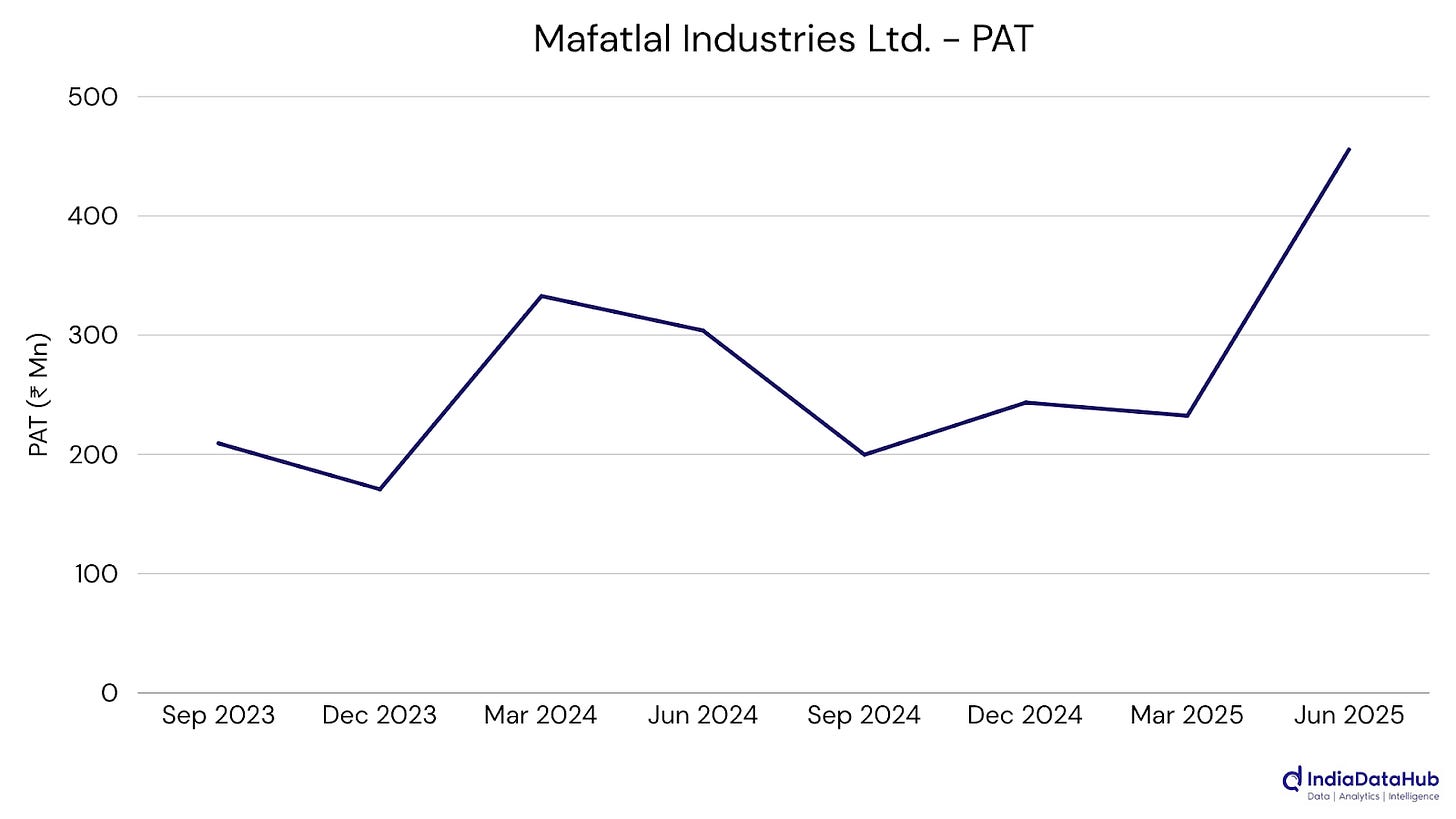

Mafatlal Industries Ltd.: PAT rose 51% YoY to ₹45.71 Cr as revenue jumped 174.5%, led by large institutional orders. Textile margins improved on value-added uniform solutions and operational efficiencies.

TVS Motor Company Ltd.: PAT rose 32% YoY, powered by record quarterly sales of 12.77 lakh units and all-round growth in motorcycles, scooters, and three-wheelers. Exports surged 40% to an all-time high, while EV sales grew 35%. Gains were further supported by margin expansion from a premium product mix and higher-margin export models, likely aided by industry recovery and rising demand for electric mobility.

Dixon Technologies (India) Limited: Revenue jumped 95% YoY to ₹12,836 Cr, with PAT doubling to ₹280 Cr, led by a 125% surge in mobile manufacturing. Growth likely also reflects new brand partnerships, capacity expansion, and deeper component integration.

Bosch Ltd: PAT jumped 139.4% YoY to ₹1,116 Cr, boosted by a ₹556 Cr gain from a business sale and strong automotive demand. Underlying profit growth likely also reflects localisation-driven cost savings and operational efficiency gains.

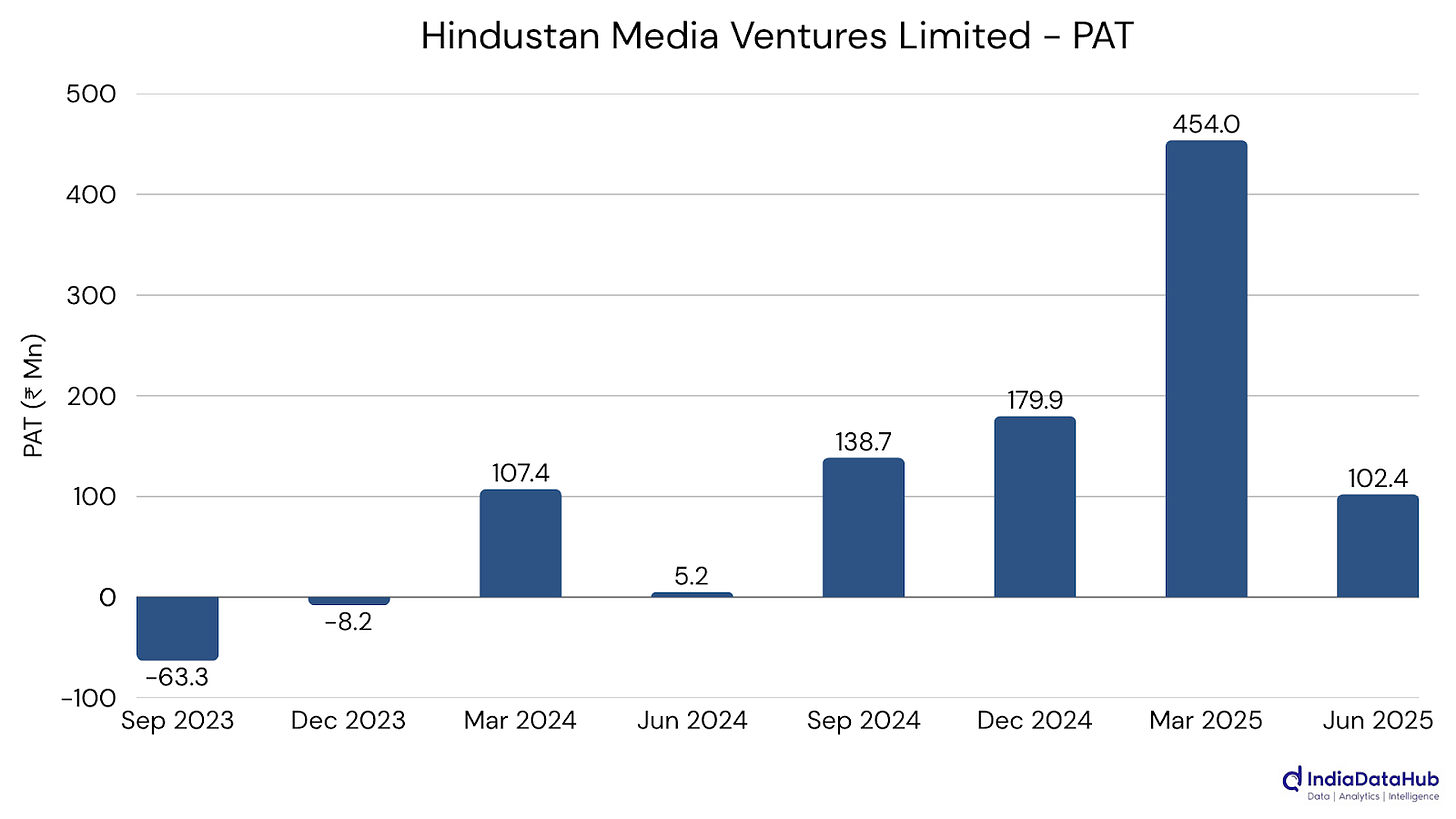

Hindustan Media Ventures Limited: PAT surged 1,869% YoY to ₹10.24 Cr from a low base, aided by 13% revenue growth, higher ad sales in Hindi print, and tighter cost control. Gains may also reflect a cyclical recovery in print media demand.

EIH Ltd: PAT fell 61.9% YoY to ₹33.9 Cr, hit by exceptional losses from Mashobra Resort and property impairments. Core operations stayed strong, with revenue up 8.9% and Oberoi brand RevPAR rising 21%, hinting at resilient luxury demand.

Veranda Learning Solutions Limited: Revenue rose 17% YoY to ₹139 Cr, led by 46% growth in commerce test prep and a PAT swing to ₹6 Cr. Improved margins and reduced finance costs may reflect operating leverage and debt reduction benefits.

Hero MotoCorp Limited: PAT jumped 65.2% YoY to ₹1,706 Cr, largely from a ₹722 Cr gain on Ather Energy’s IPO stake dilution. Core business stayed flat, but record exports and disciplined cost control helped maintain margins despite lower volumes.

V.I.P. Industries Ltd.: Revenue fell 12.1% YoY to ₹561 Cr, with volumes down 8% and e-commerce sales sliding 17%. Margin pressure from higher material costs and weaker travel-related demand suggests a post-pandemic reset in luggage buying patterns.

PVR Inox Limited: The business posted a Q1 loss of ₹54.5 Cr, narrowing 69.6% YoY as revenue grew 23.4% to ₹1,469 Cr and margins improved. Losses may persist due to high depreciation and interest, though merger synergies and strong film slates are boosting recovery.

Bharat Forge Ltd: PAT rose 62.6% YoY to ₹284 Cr, aided by lower finance costs, stronger overseas operations, and defence order wins worth ₹847 Cr. Margin gains despite a 4.8% revenue drop suggest effective cost control and operational restructuring.

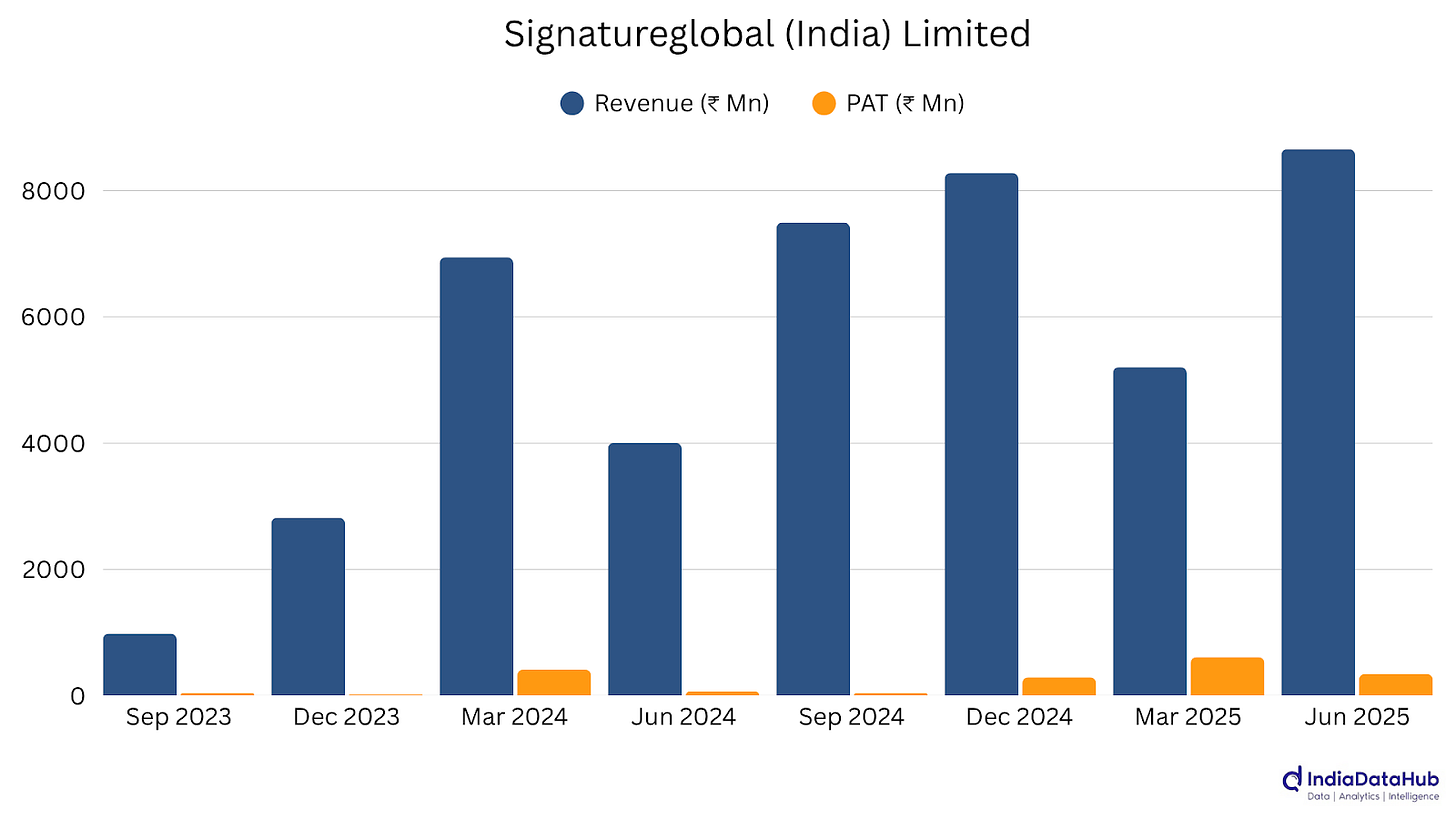

Signature Global (India) Limited: PAT surged 406.7% YoY to ₹34.43 Cr as revenue more than doubled on project completions and better realisations. The sharp jump may also reflect a shift toward premium housing and stronger margins from higher-value launches.

Titan Company Limited: PAT rose 52.4% YoY to ₹1,091 Cr, driven by broad-based revenue growth and margin expansion. Jewellery demand held strong despite high gold prices, watches delivered a standout quarter via premium launches, and international jewellery turned profitable for the first time.

Apollo Tyres Ltd: 95.7% PAT drop to ₹12.88 Cr in Q1 FY26 was entirely due to a ₹370.2 Cr exceptional loss—mainly a restructuring provision for closing its Netherlands plant—while core profit rose 26% YoY to ₹381 Cr on steady revenue growth.

Varroc Engineering Limited: PAT jumped 215.3% YoY to ₹105.06 Cr on modest 6.8% revenue growth, as margins improved and debt fell sharply. Gains may also be tied to high-margin order wins and benefits from the China JV stake sale.

Apeejay Surrendra Park Hotels Limited: Revenue grew 14.2% YoY to ₹154.25 Cr, with a swing to ₹13.41 Cr profit from a loss last year. This improvement may stem from sustained 90%+ occupancy, premium pricing, and post-pandemic luxury hospitality recovery.

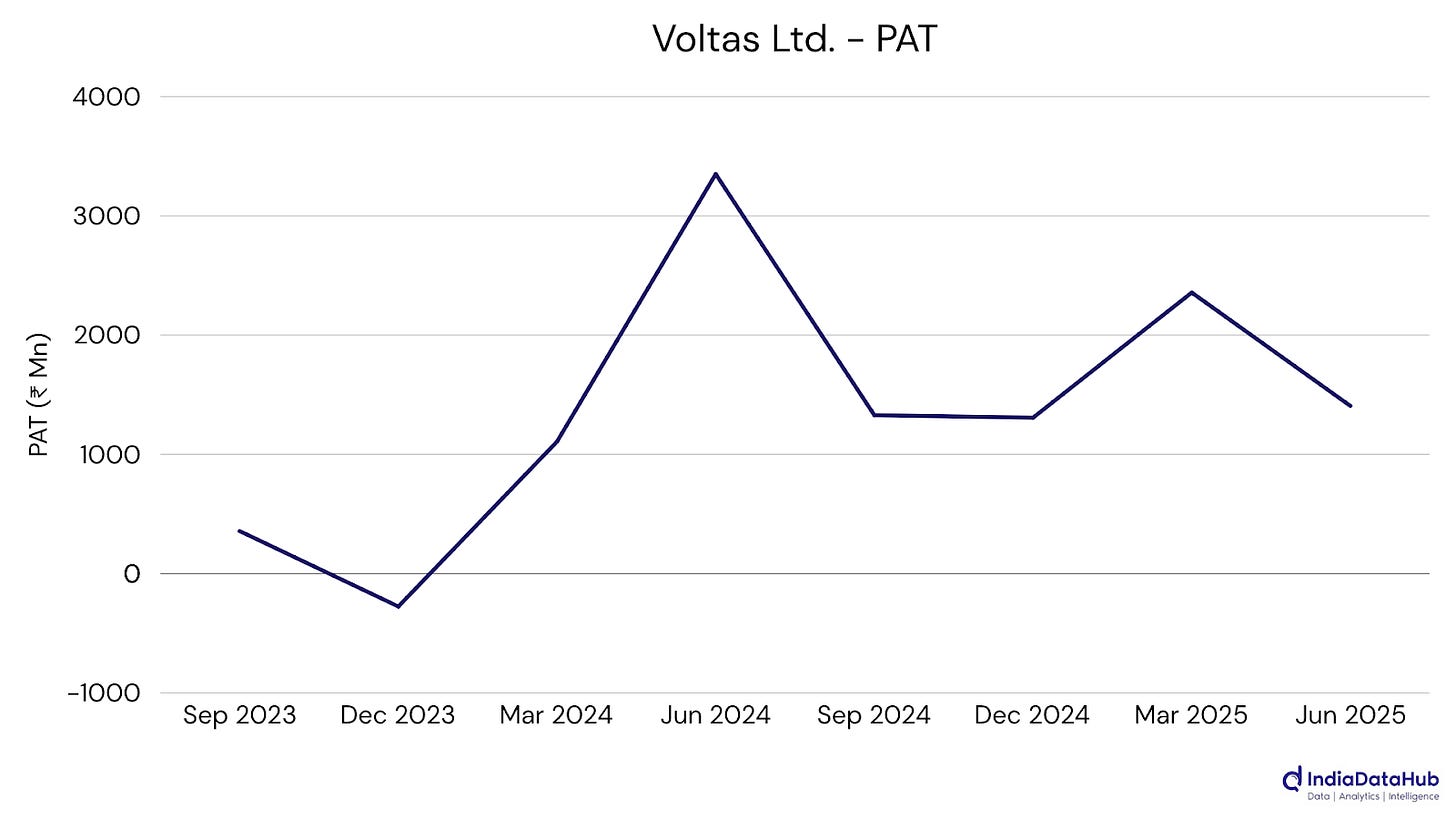

Voltas Ltd.: PAT fell 58% YoY to ₹141 Cr as revenue dropped 20% amid an unusually short and mild summer, hitting AC demand. Margin pressure may have worsened from high fixed costs, inventory buildup, and heavy promotional activity.

Tata Motors Ltd.: PAT fell 62.7% YoY to ₹3,924 Cr, largely due to a prior-year one-off gain and weaker JLR margins from US tariffs. Group results may also have been hit by softer domestic demand and adverse working capital.

Navneet Education Limited: PAT grew 227% YoY to ₹157 Cr on 83.5% revenue growth, though it fell 77.7% sequentially due to seasonality. The jump may also reflect benefits from its edtech demerger and curriculum change–driven demand.

Bajaj Auto Limited: PAT rose 13.8% YoY to ₹2,210.44 Cr on strong exports (+16% YoY) and EV/premium segment gains, despite domestic sales weakness (-8% YoY) and a 50 bps EBITDA margin dip from currency headwinds.

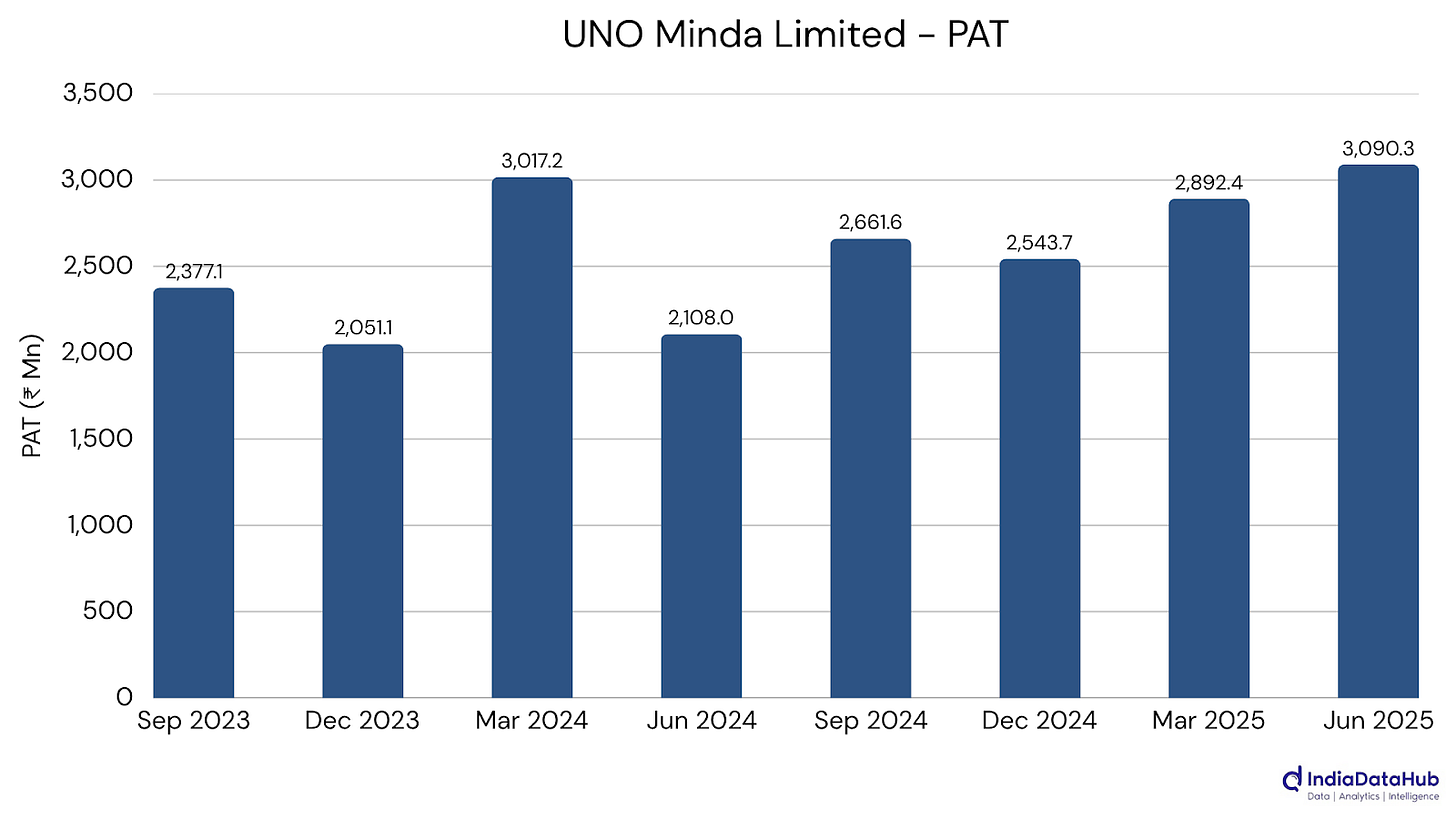

UNO Minda Limited: PAT rose ~46–47% YoY to ₹291–309 Cr, supported by 17–18% revenue growth to ₹4,489 Cr, broad-based segment gains, and margin expansion from higher-value products like sensors, controllers, and EV systems.

Trent Ltd [Lakme Ltd]: PAT rose 8.6% YoY to ₹424.7 Cr on 19% revenue growth to ₹4,883 Cr, with EBITDA margin expanding to 17.3%. Gains came from strong Zudio/Westside momentum and emerging category traction.

Financial Services: [#308] [Rev: +9.1%] [PAT: +3.4%]

Power Finance Corporation Ltd: PAT climbed 25% YoY to ₹8,981 Cr, powered by record disbursements of ₹95,660 Cr, 13% loan book growth, and sharply improved asset quality, with GNPA down to 1.47% and NNPA hitting an all-time low of 0.31%.

Federal Bank Ltd.: PAT fell 14.6% YoY to ₹861.75 Cr as provisions surged 41% to ₹695 Cr, with most slippages from MFI and agriculture. Still, deposits rose 8% YoY and other income hit a record ₹1,113 Cr.

Aditya Birla Capital Limited (ABCL): Posted ~9–10% YoY PAT growth to ₹835–851 Cr in Q1 FY26, with 30% lending portfolio growth, 70% surge in housing finance, and record mutual fund AUM of ₹4.03 lakh Cr. Asset quality improved 75 bps YoY.

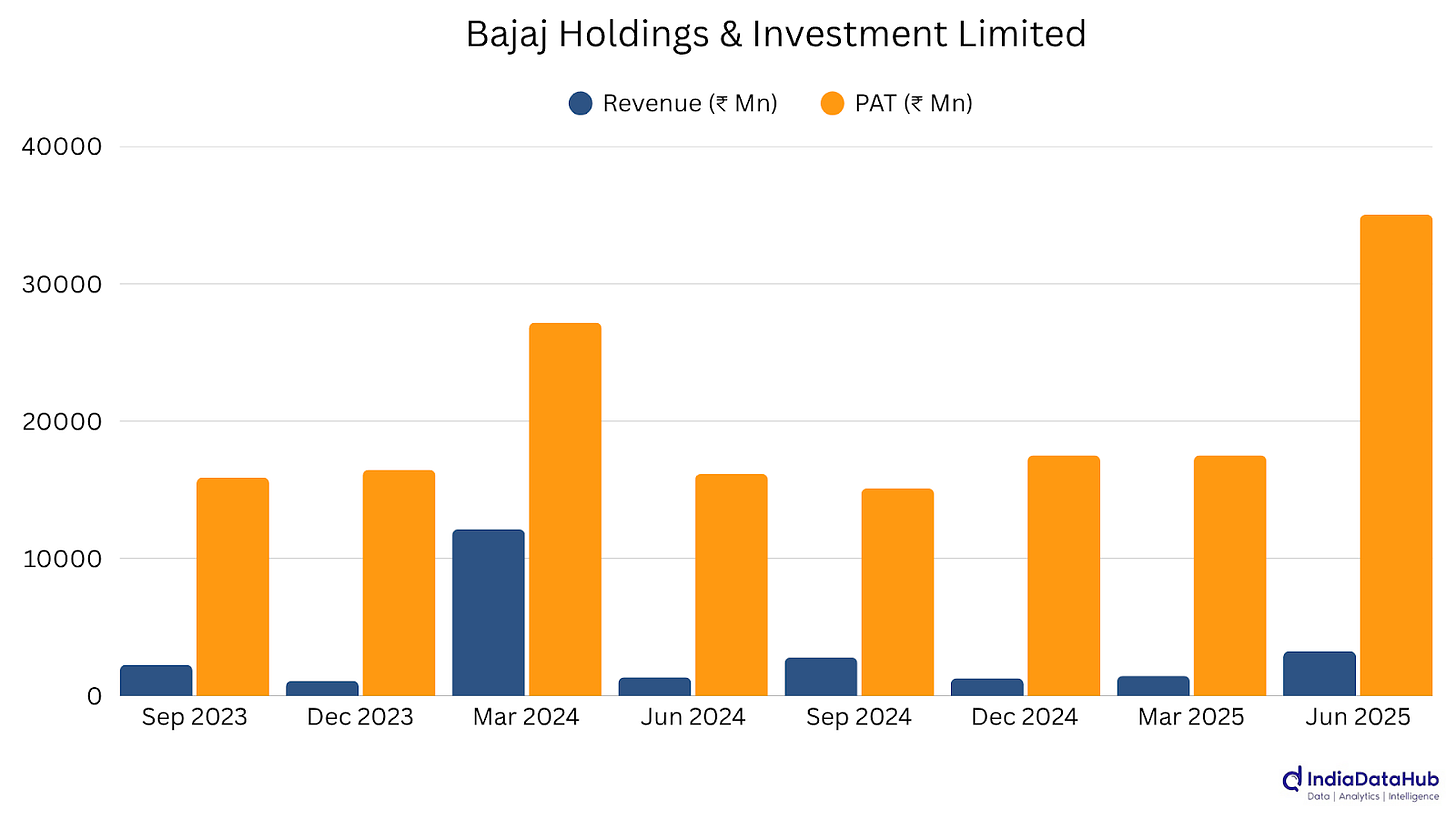

Bajaj Holdings & Investment Limited: PAT jumped 117% YoY to ₹3,487 Cr, boosted by a ₹1,983 Cr gain from selling Bajaj Finserv shares. Even excluding this, PAT grew 31% on strong dividends, investment gains, and group company performance.

Abans Financial Services Limited: A 34.7% YoY jump in profit to ₹29.95 cr, on the back of a staggering 540% revenue surge. Sequential growth was also strong, but profit gains trailed, hinting at expansion-phase costs.

India Shelter Finance Corporation Limited: Profit jumped 43% YoY to ₹119 cr, backed by 34% AUM growth and steady asset quality. Expanding to 290 branches, it’s widening reach in affordable housing while maintaining strong returns and margins.

Fusion Finance Limited: Revenue plunged 37% YoY to ₹434.4 cr, with AUM shrinking sharply and losses widening to ₹92.3 cr. Five straight loss-making quarters and breached debt covenants signal deep strain in its microfinance portfolio.

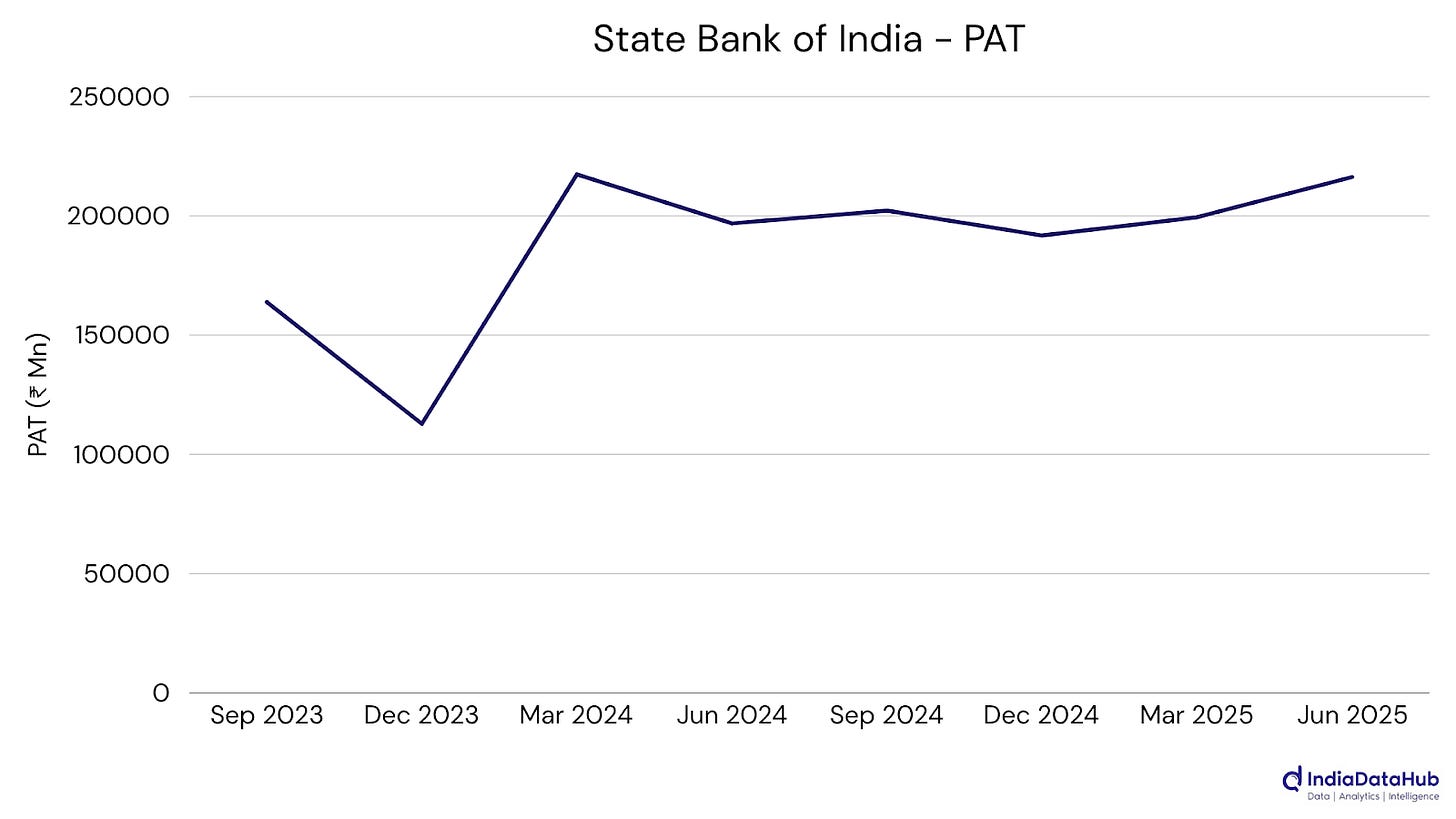

State Bank Of India: Profit rose ~10–12% YoY in Q1, helped by a 55% jump in non-interest income and record treasury gains. Loan growth was broad-based, and asset quality hit historic lows, though margins remained under pressure.

Cholamandalam Investment and Finance Company Ltd: Profit rose 20% YoY to ₹1,136 cr, with AUM up 23% despite flat disbursements. The lender’s shift away from low-margin products boosted profitability, though asset quality saw mild deterioration.

IFCI Ltd.: Profit jumped 66% YoY to ₹260.4 cr, aided by sharp margin expansion and improved recoveries. A turnaround from past losses, it also holds a valuable 5% NSE stake that could unlock gains post-IPO.

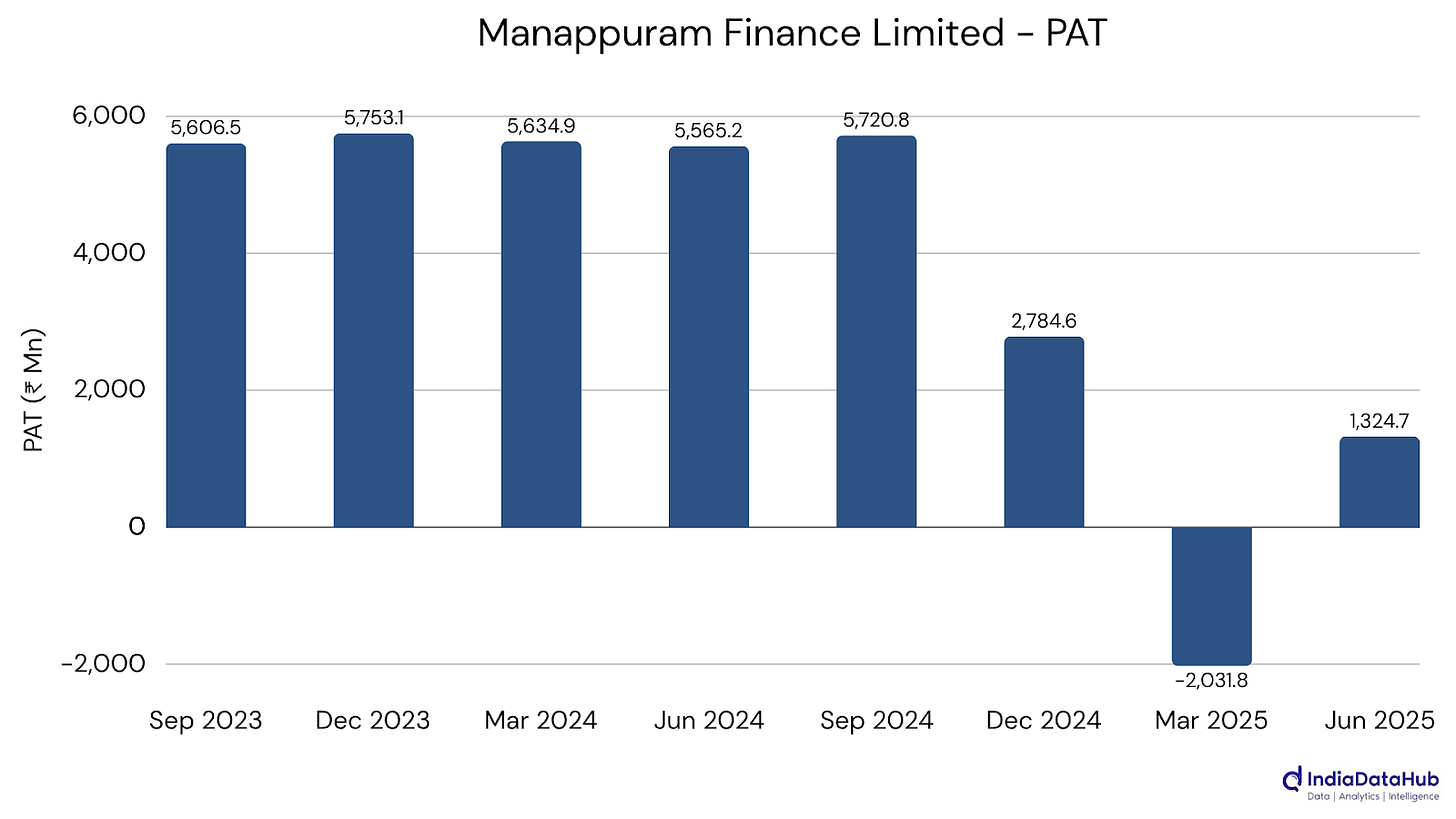

Manappuram Finance Limited: Profit plunged 76% YoY to ₹138 cr, hit by a ₹1,212 cr swing in its microfinance arm from profit to loss. Gold loans stayed resilient, with AUM up 22%, partly cushioning the impact.

Industrials: [#332] [Rev: +9.1%] [PAT: +16.1%]

Avalon Technologies Limited: Revenue soared 62.1% YoY to ₹323.3 Cr, fueled by strong mobility and industrial growth and balanced India–US performance. The jump likely reflects entry into semiconductor equipment manufacturing and order book strength.

Centum Electronics Ltd: Revenue rose 11.2% YoY to ₹273.4 Cr, led by a 35% surge in standalone sales from defence and space BTS orders. EMS order book expansion suggests ongoing demand despite softer subsidiary performance.

Bharat Heavy Electricals Ltd.: Revenue stayed flat at ₹5,487 Cr as execution delays on legacy power contracts offset industrial segment gains. Rising material costs and inefficiencies hurt margins, despite a ₹2 lakh Cr-plus order book.

Hindustan Construction Co. Ltd.: Revenue fell 39.9% YoY to ₹1,091.3 Cr, mainly due to the Steiner AG divestment and slower core construction execution. A strong order book remains, but milestone timing and project transitions hit quarterly sales.

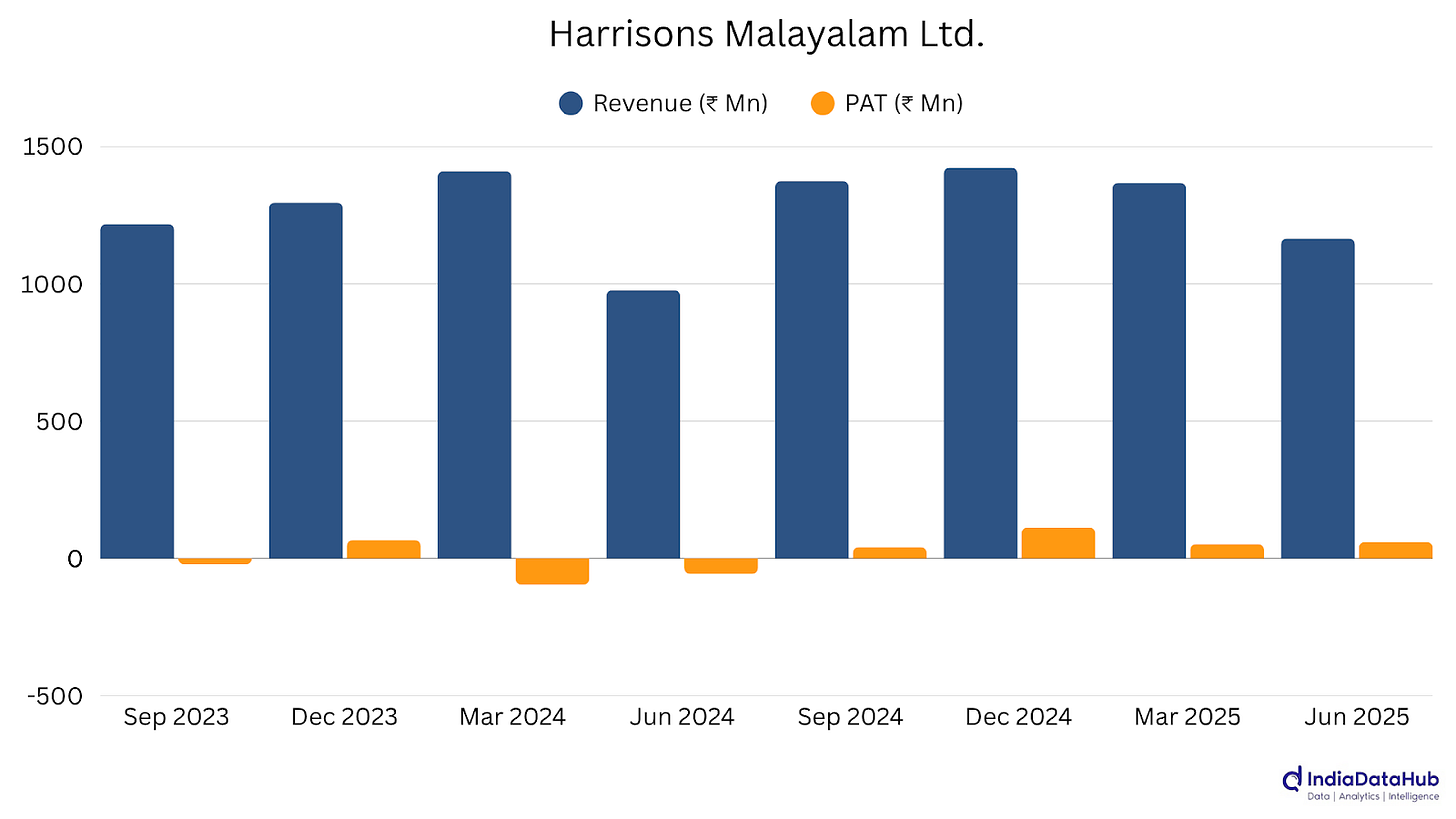

Harrisons Malayalam Ltd.: Revenue rose 17.9% YoY to ₹119.25 Cr, marking a sharp turnaround from last year’s slump. Better rubber and tea prices, cost discipline, and productivity gains helped lift both margins and profitability.

Siemens Ltd.: PAT fell 26.8% YoY despite 15.5% revenue growth, hit by lower other income and margin pressures. The Digital Industries segment showed recovery signs but still faced headwinds from prior destocking.

Cummins India Ltd.: PAT rose 30.5% YoY to ₹603.9 Cr on 26% sales growth, with both domestic and exports delivering strongly. Volume leverage and a 34% export surge boosted margins and profitability.

Commodities: [#235] [Rev: +6.4%] [PAT: +28.4%]

Grasim Industries Ltd: Profit rose 32% YoY to ₹1,419 cr as revenue grew 16% and EBITDA jumped 36%, led by strong cement and chemicals performance. Paints and B2B e-commerce continued scaling, though fibre margins stayed under pressure.

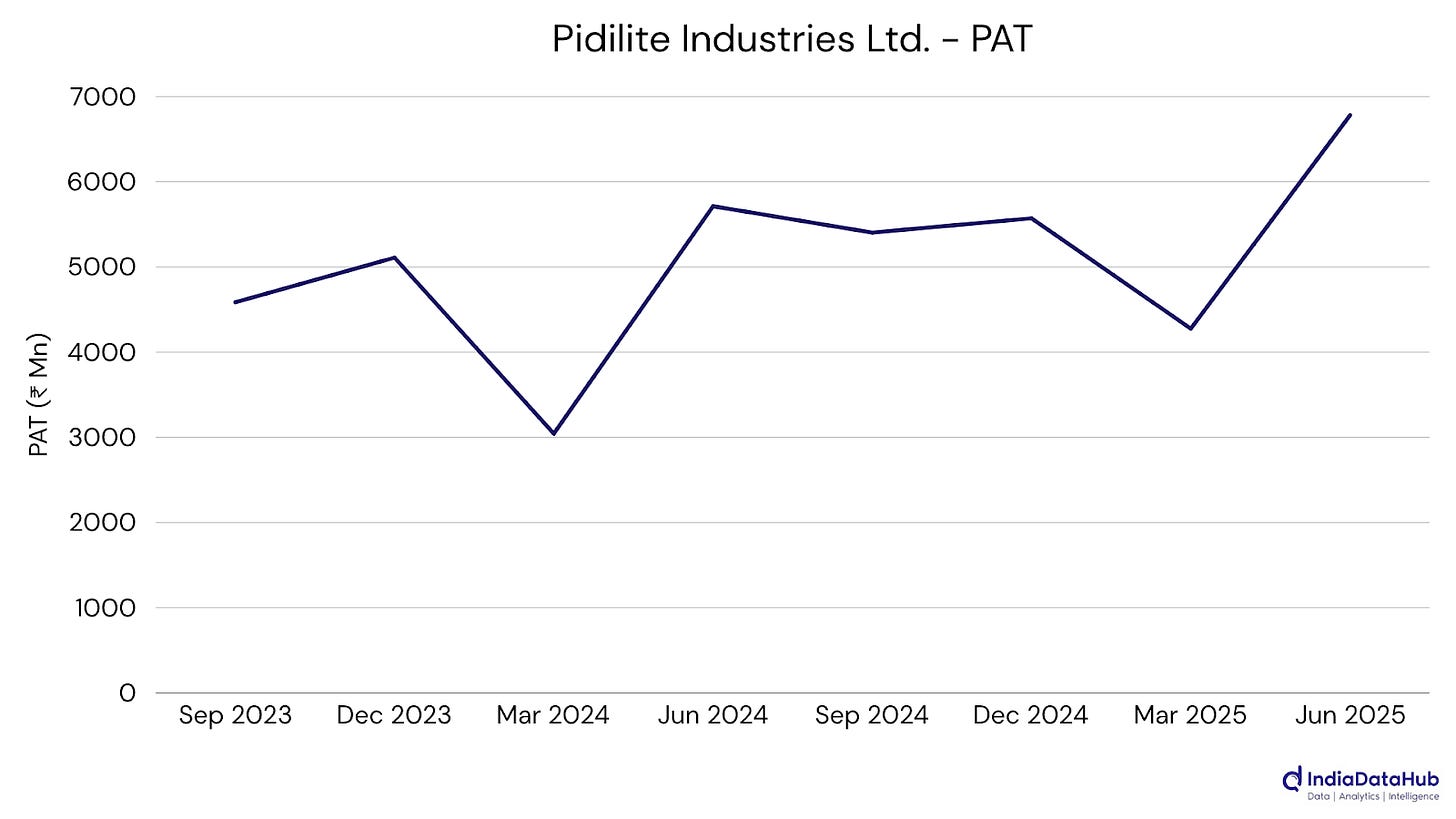

Pidilite Industries Ltd.: Profit rose 18.7% YoY to ₹678 cr as revenue grew 10.6% and volumes climbed 9.9%, with both consumer and B2B segments strong. Softer input costs and efficiency gains lifted EBITDA margins, while a bonus issue and special dividend signalled confidence.

Solar Industries India Limited: Posted its highest-ever quarterly revenue at ₹2,154 cr, up 28% YoY, with PAT up 17% to ₹353 cr. Defence sales more than doubled, and international revenue hit a record ₹826 cr, though margins tightened.

National Aluminium Co. Ltd.: PAT jumped 78% YoY to ₹1,049.48 cr on the back of 33% revenue growth and a sharp EBITDA margin expansion to 39.2%. Alumina exports more than tripled, chemicals revenue nearly doubled, and capacity utilisation rose across the board.

Linde India Limited: PAT slipped 5.7% YoY to ₹107 cr as revenue fell nearly 5% amid softer demand from steel and manufacturing. Margins held up better than volumes, but fixed costs still squeezed profitability.

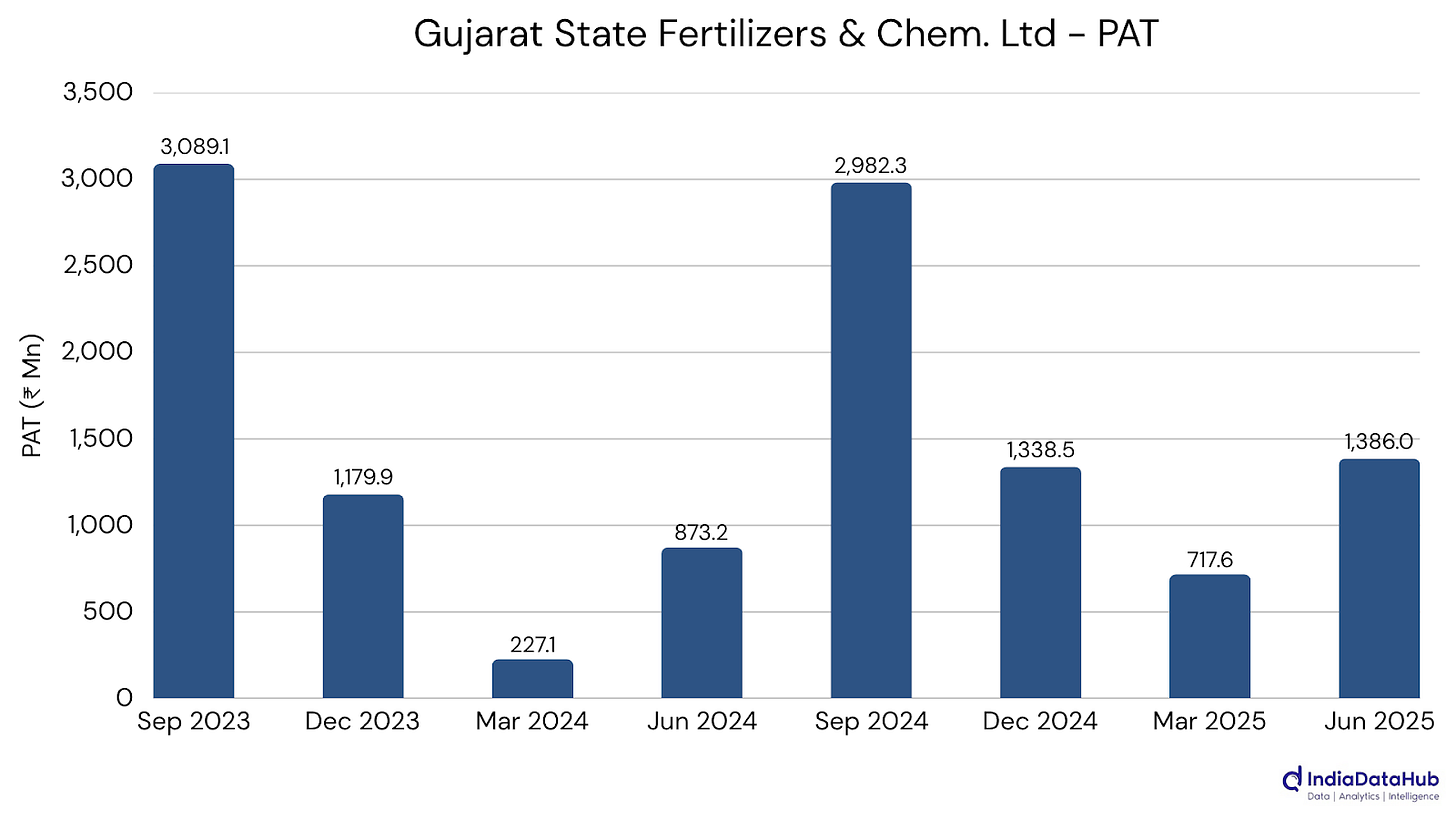

Gujarat State Fertilizers & Chem.Ltd: PAT surged 59% YoY to ₹140 cr, even though revenue was flat. Margins jumped as complex fertilizer sales rose and industrial products turned profitable after losses, helped by softer gas costs.

Bayer CropScience Limited.: PAT rose 9.6% YoY to ₹279 cr on 17% revenue growth, led by higher corn seed and Roundup sales after an early monsoon, though margins eased slightly on higher operating costs.

Jindal Stainless Limited: PAT rose 10.6% YoY to ₹715 cr as volumes grew 8.3% and margins held steady, aided by operational efficiency. However, shares fell 7% despite reaffirmed growth and expansion plans.

S H Kelkar and Company Limited: Revenue jumped 23.5% YoY to a record ₹580.63 cr, aided by strong flavour growth, a profitable turnaround in Global Ingredients, and better margins from a stable raw material environment and higher-value product mix.

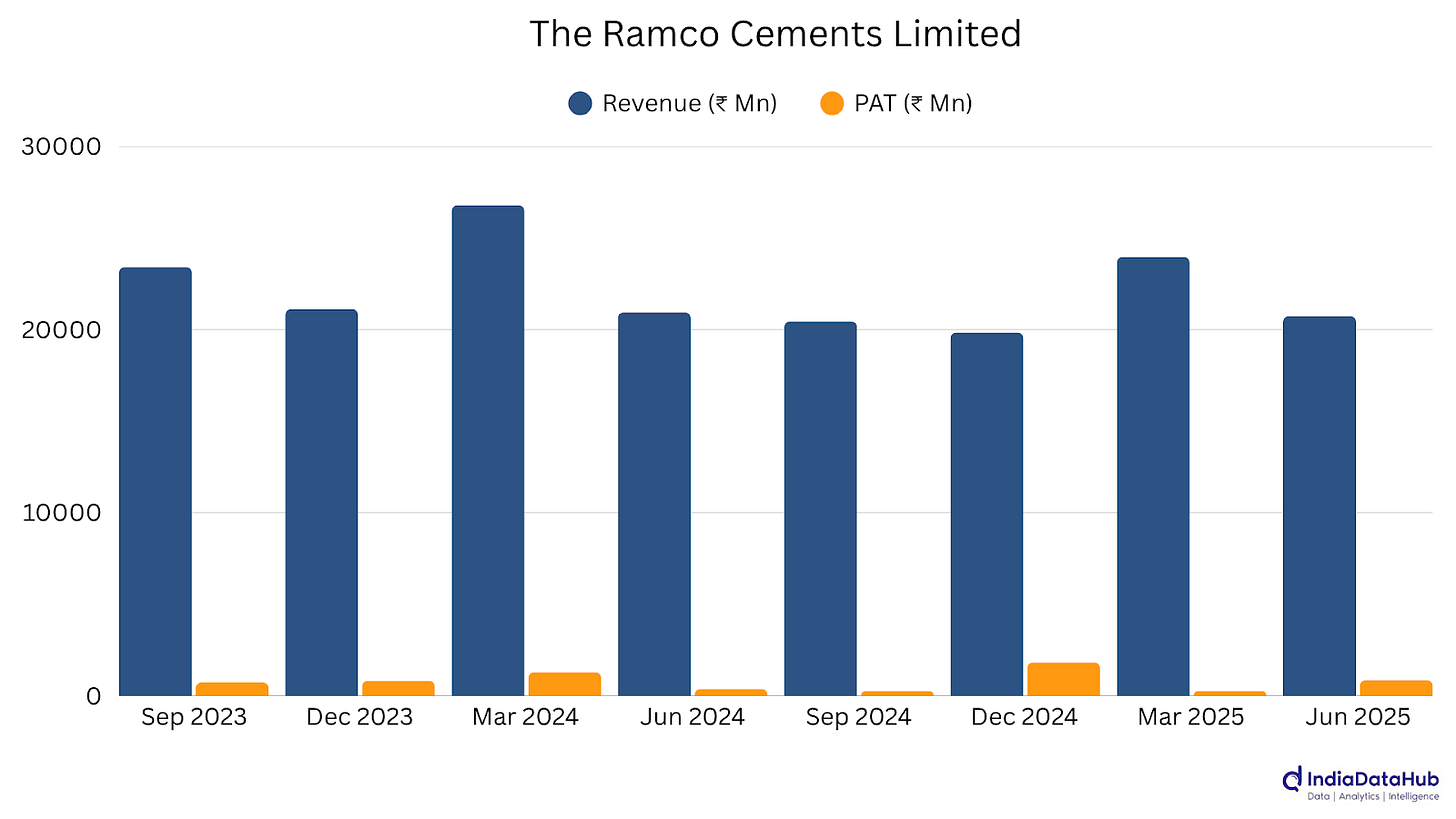

The Ramco Cements Limited: Profit more than doubled to ₹86 cr even as volumes fell 7%, helped by stronger prices and leaner costs. Margin gains offset softer sales, hinting at effective pricing discipline in a tough quarter.

E.I.D. Parry (India) Ltd.: Profit more than doubled to ₹464.5 cr as revenue rose 29% and margins improved. Strong farm input demand helped offset continued sugar weakness, underscoring the benefits of its diversified operations.

Rain Industries Limited: Revenue grew 7.5% YoY to ₹4,401 cr, but the real story was the swing to an ₹83 cr profit from a loss last year, reflecting sharper margins and operational recovery despite cyclical headwinds.

Gujarat Fluorochemicals Limited: Profit rose 70% YoY to ₹184 cr as margins widened to 26.9% on stronger fluoropolymer demand. Expansion plans, especially in EV-related chemicals, suggest positioning for sustained growth in high-value segments.

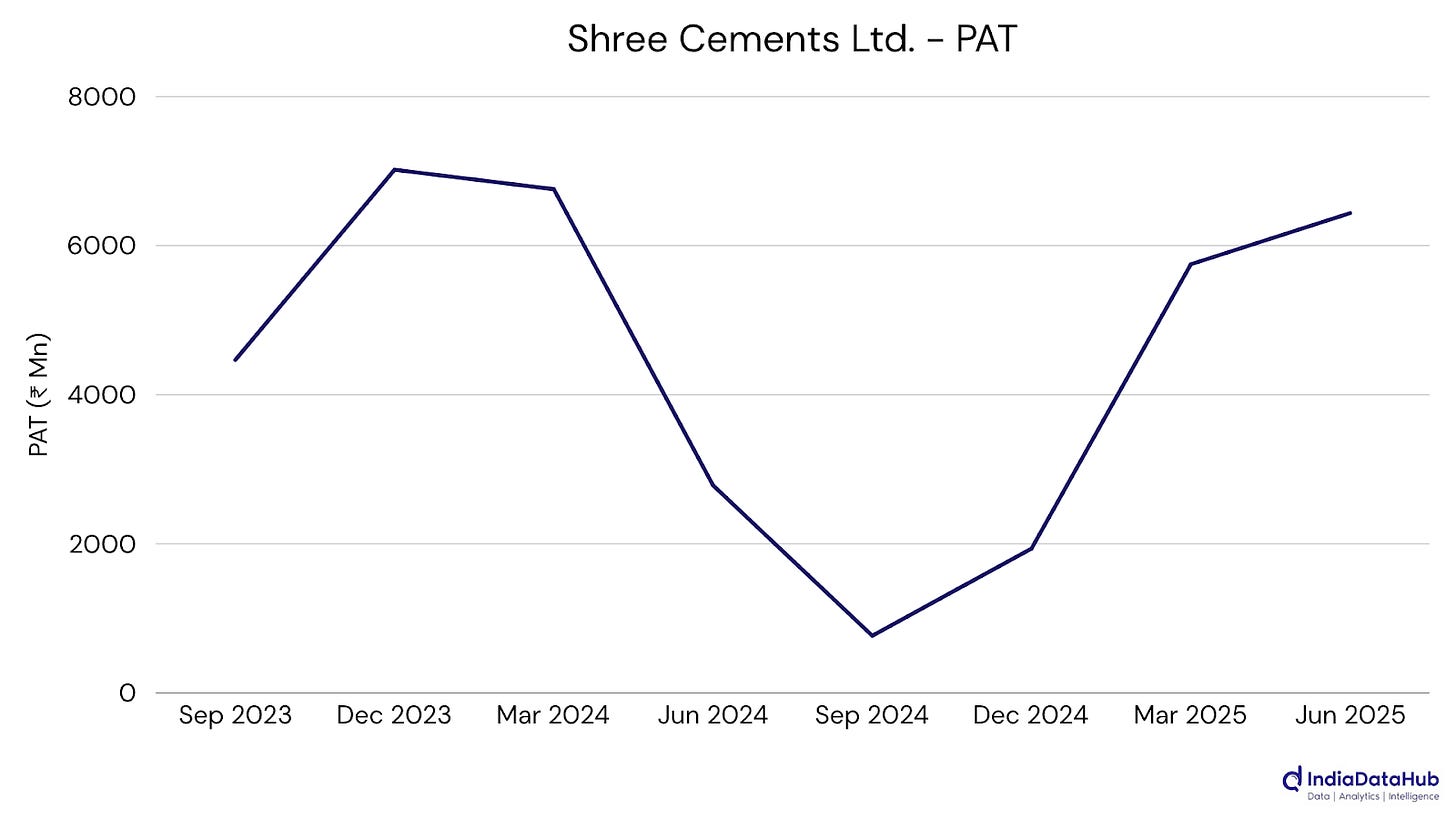

Shree Cements Ltd.: Profit more than doubled to ₹643.7 cr as margins widened to 25.2% on leaner costs and a richer product mix. Other income also gave a notable boost to the bottom line.

Services: [#155] [Rev: +10.6%] [PAT: -1.6%]

Shipping Corporation of India Ltd: Profit rose 21.5% YoY to ₹354.2 cr even as revenue fell 13%. Margin gains and higher other income, including a vessel sale, helped offset softer topline performance.

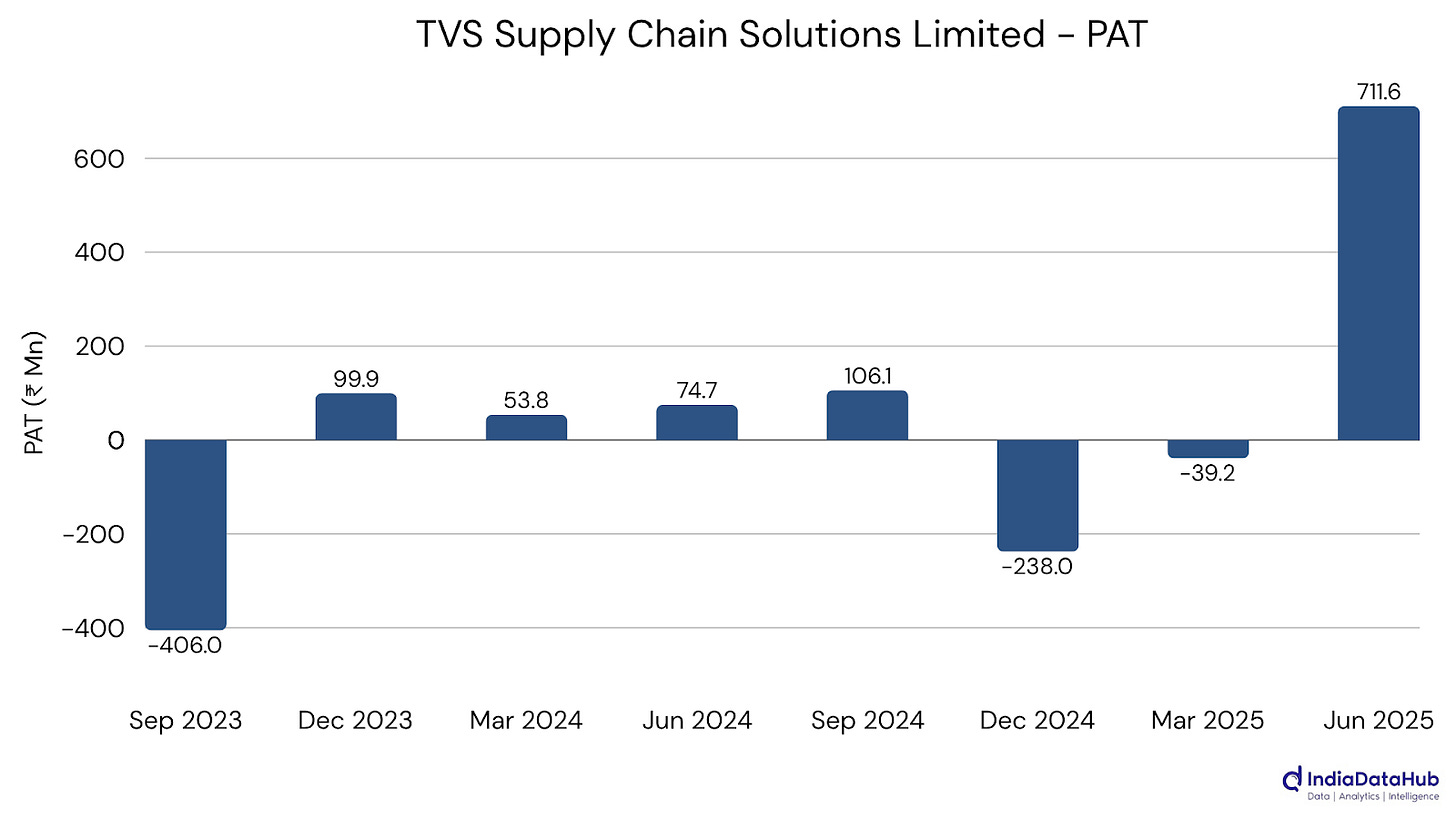

TVS Supply Chain Solutions Limited: Profit soared 853% YoY to ₹71.2 cr, largely boosted by a one-time ₹177 cr gain from its TVS ILP InVIT listing. Underlying operations improved modestly, with revenue up 2.1% and margins firmer.

VRL Logistics Limited: Profit jumped 272% YoY to ₹50 cr as margins widened to 20.4% on lower freight and handling costs. Modest revenue growth combined with sharp cost cuts delivered a standout quarter for the transporter.

Information Technology: [#110] [Rev: +5.2%] [PAT: +6.7%]

Birlasoft Limited: Revenue fell 3.2% YoY, its second straight drop, and profit slid 29%. Manufacturing weakness outweighed growth elsewhere, while pricing cuts to win deals squeezed margins to 12.4%.

BLS E-Services Limited: PAT rose 38.7% YoY to ₹17.5 Cr, with revenue more than tripling after acquiring Aadifidelis and expanding its BC network. Growth likely also reflects fintech partnerships and rural banking digitisation.

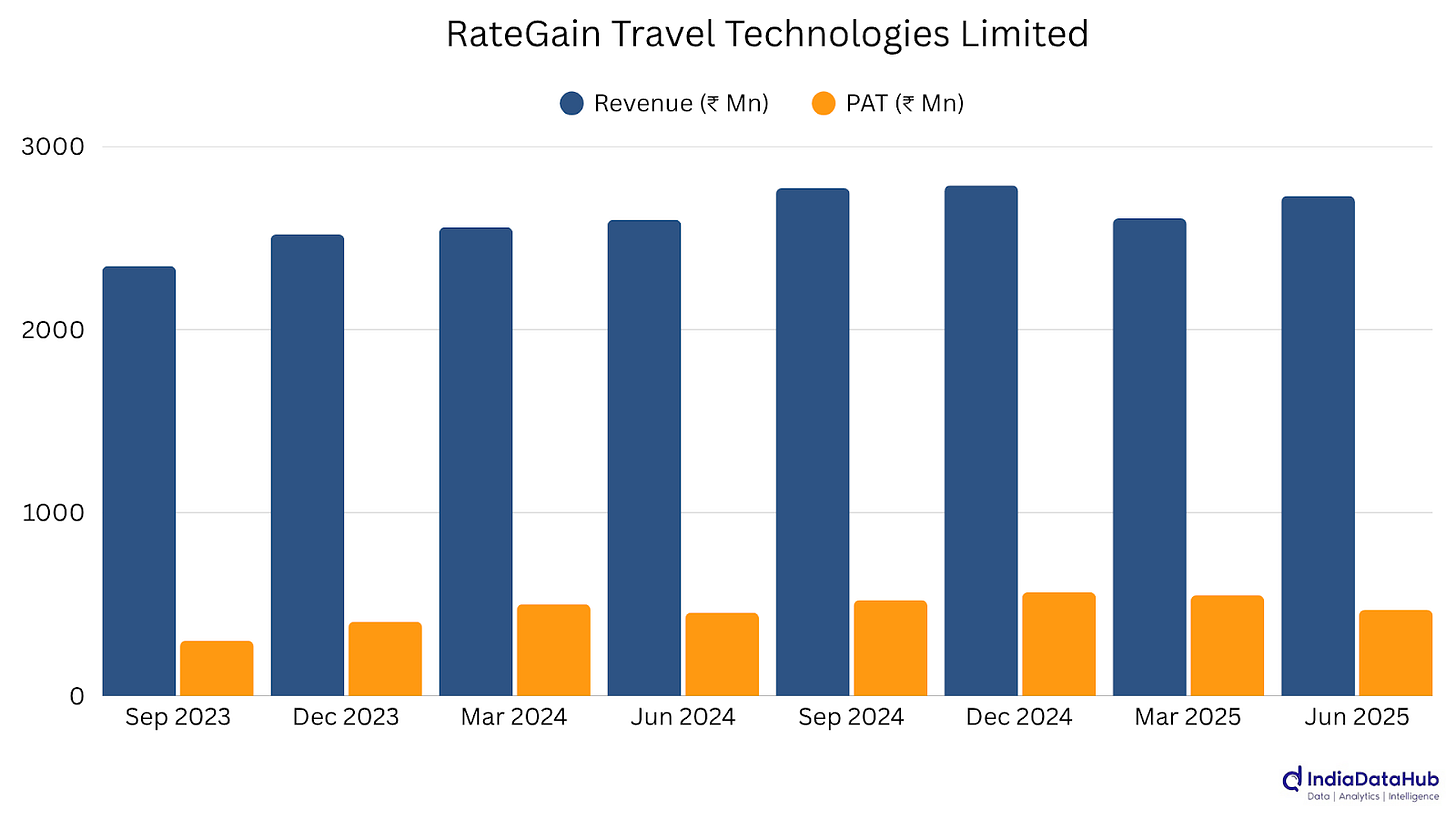

RateGain Travel Technologies Limited: PAT inched up 3.4% YoY as revenue grew 5%, powered by record new contract wins and APAC–Middle East expansion. Margins dipped as the company invested heavily in scaling and AI-driven travel tech solutions.

Protean eGov Technologies Limited: PAT rose 13.1% YoY, aided by margin expansion to 18.8%, steady revenue growth, and a ₹100 Cr IRDAI mandate. Strong market share gains in tax services and zero debt further reinforced the performance.

Healthcare: [#125] [Rev: +9.8%] [PAT: -30.3%]

Biocon Ltd.: Profit fell 90% YoY to ₹31 cr, but this was due to last year’s one-time gain. Operationally, revenue grew 15% with strong biosimilars momentum and margin expansion, reflecting a healthier underlying performance.

Divi's Laboratories Ltd.: Profit rose 27% YoY to ₹545 cr on 14% revenue growth, led by strong custom synthesis and nutraceutical demand. Generics stayed soft, and sequential earnings dipped on logistics costs and seasonal factors.

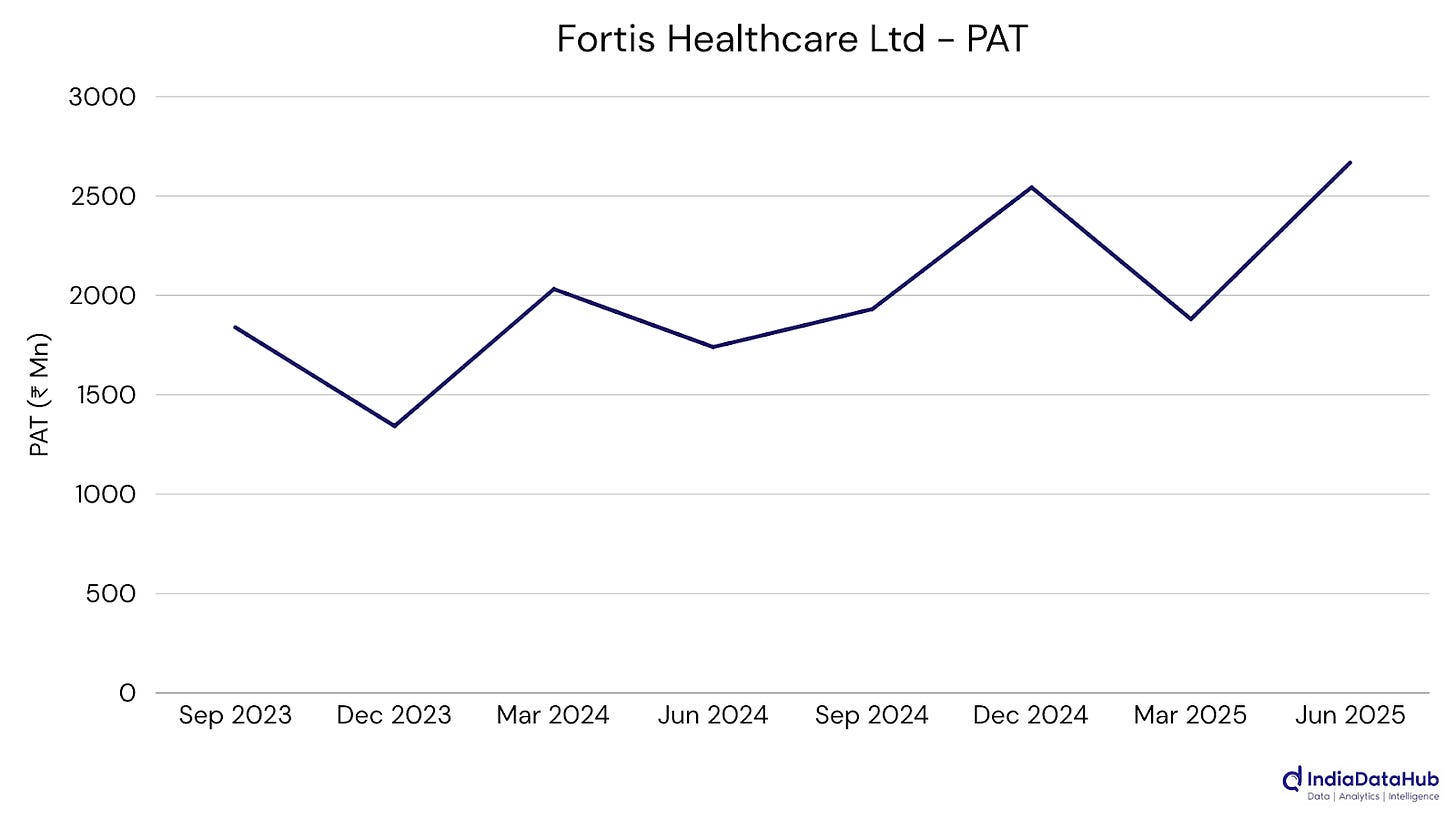

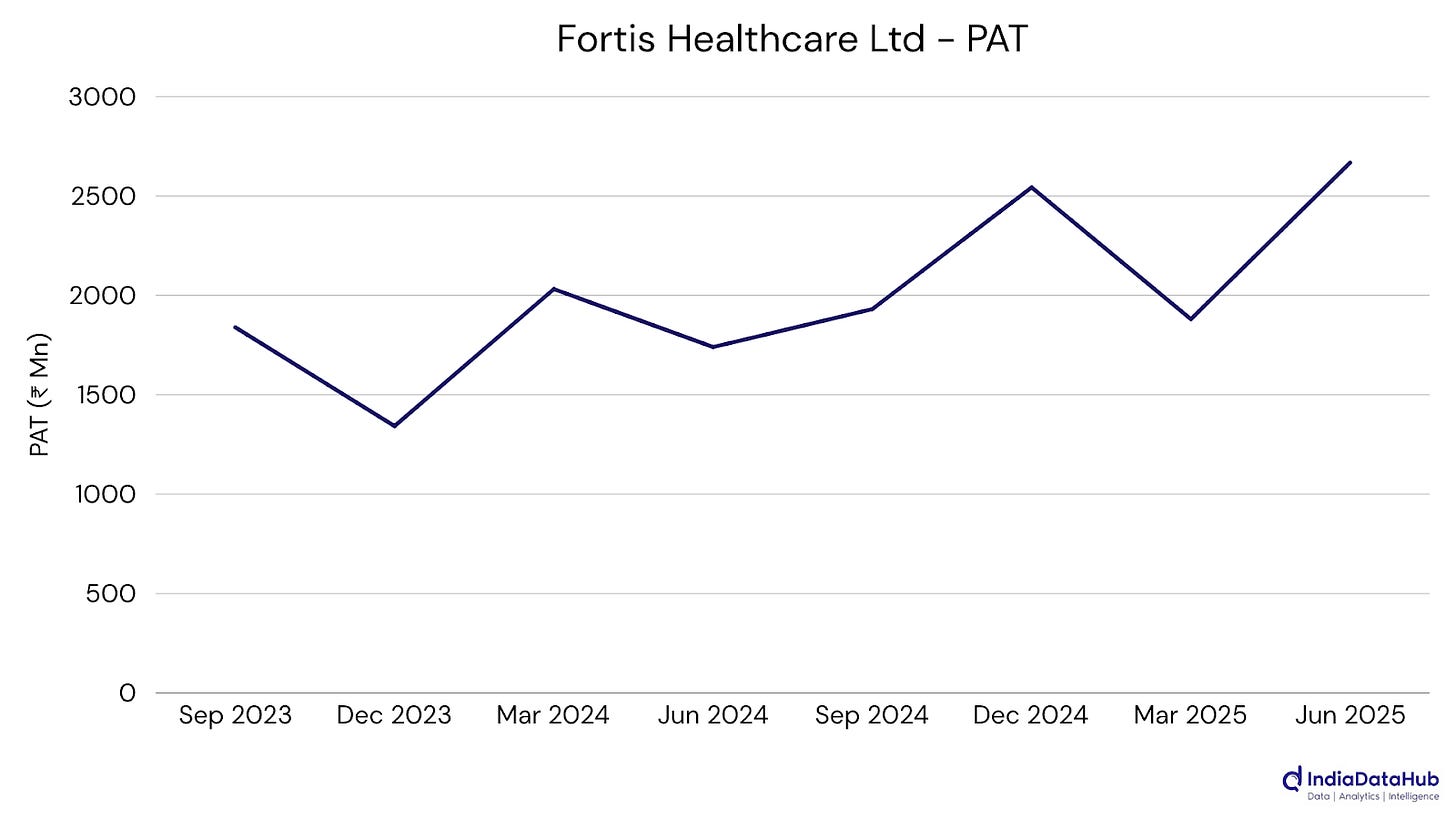

Fortis Healthcare Ltd: Profit jumped 53% YoY to ₹266.8 cr as both hospitals and diagnostics delivered strong growth. Margins widened sharply on higher occupancy, rising ARPOB, and expansion in high-value specialities like oncology and robotic surgery.

Metropolis Healthcare Limited: Profit rose 19% YoY to ₹45.1 cr as revenue grew 23%, boosted by organic expansion and recent acquisitions. Patient and test volumes climbed double digits, though margins eased on integration costs and competitive pressures.

Global Health Limited: PAT jumped 50% YoY to ₹1,590 cr, with revenue up nearly 20% on higher patient volumes, better ARPOB, and strong international business. Developing hospitals grew sharply, reinforcing the Medanta model’s expansion momentum.

Sanofi Consumer Healthcare India Limited: Profit more than doubled YoY to ₹61 cr as sales rose 28%, aided by new launches like Allegra D. Margin gains and a recovery from past disruptions bolstered this strong quarter.

Lupin Ltd: Profit jumped 52% YoY to ₹1,221.5 cr as revenue grew 12% and EBITDA margin expanded sharply to 29.3%. Strong US generics growth and steady India performance drove the gains, alongside a strengthened net cash position.

Gland Pharma Limited: Profit rose 50% YoY to ₹215.5 cr as EBITDA margin widened to 24.4%, aided by a turnaround at its European arm, Cenexi. Growth in Europe and other regulated markets offset mild US revenue softness.

Sequent Scientific Limited: Profit rose 94% YoY to ₹176 cr as revenue grew 13% and EBITDA margin improved to 13.6%. Growth was broad-based across geographies and segments, aided by a richer product mix and operational efficiency gains.

FMCG: [#121] [Rev: +9.7%] [PAT: +4.2%]

Godrej Consumer Products Ltd.: Posted a marginal 0.4% YoY profit growth in Q1 FY26 as higher palm oil costs, Indonesia market headwinds, and soaps segment volume-price rebalancing squeezed margins. India revenue grew 8%, led by 16% growth in home care, partly offsetting international weakness. Management expects palm oil cost relief and Indonesia recovery to support performance from H2 FY26.

KRBL Ltd.: Profit jumped 74% YoY, powered by a 98% surge in exports, lower basmati procurement costs, and sharper operational efficiency. Strong domestic growth and private-label export momentum further boosted the quarter’s performance.

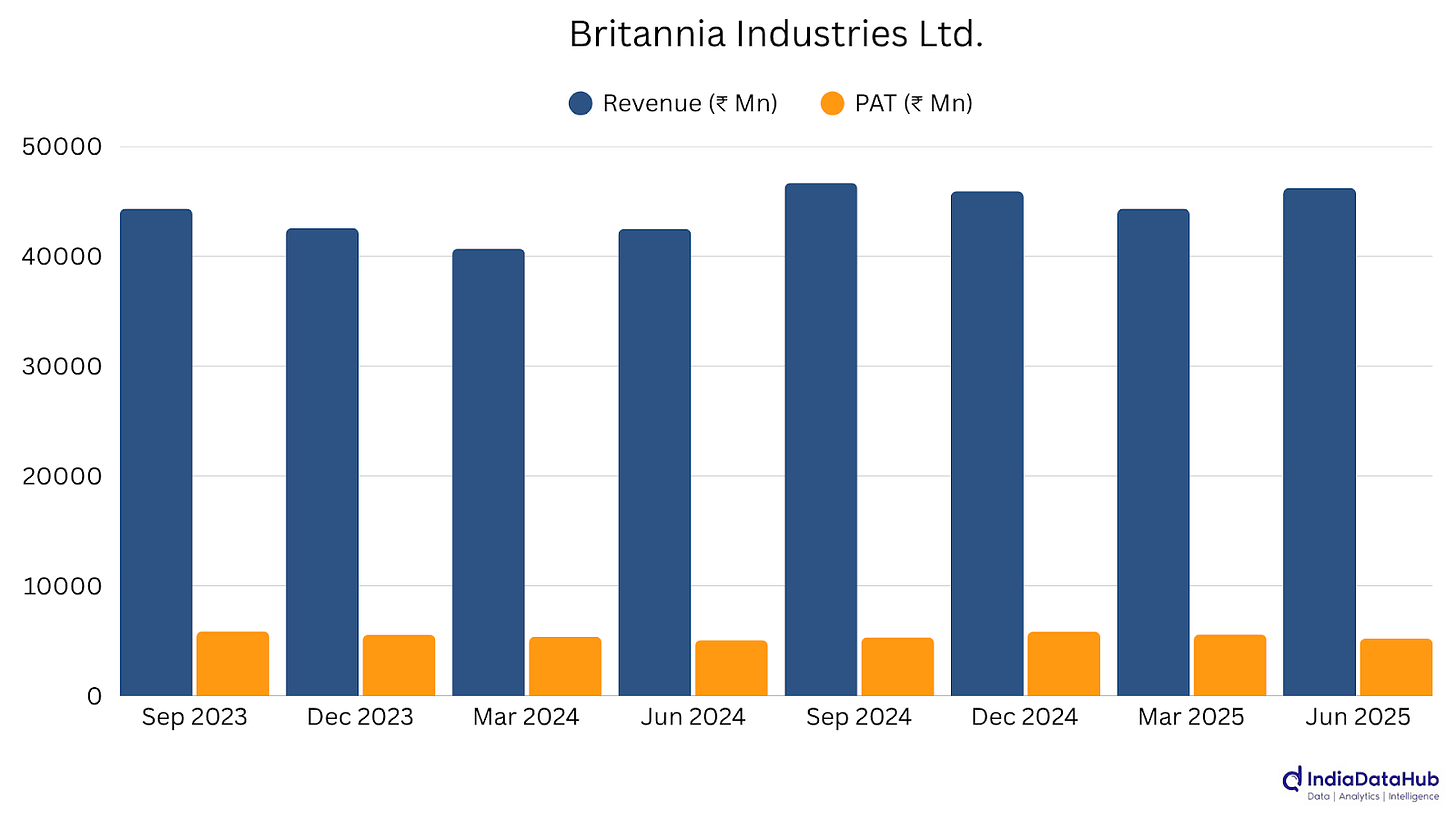

Britannia Industries Ltd.: Profit inched up 3% YoY as revenue grew 9.8%, but margins narrowed on wheat, palm oil, and cocoa inflation. Modest 2% volume growth and higher costs kept EBITDA flat despite strong bakery category gains.

Marico Limited: Profit rose 9% YoY on 23% revenue growth, but EBITDA margin fell 360 bps to 20.1% as copra and other commodity costs surged. Strong India volume gains and steady international growth helped offset inflationary pressures.

Godrej Agrovet Limited: Profit rose 13% YoY, led by a sharp turnaround in Vegetable Oils on stronger CPO/PKO prices and solid animal feed volume growth. Efficiency gains and Astec LifeSciences' recovery further boosted the quarter.

Godfrey Phillips India Ltd.: Profit jumped 55.9% YoY to ₹206 cr on 26% sales growth, led by strong cigarette demand and export gains. Margin pressure from higher input costs and taxes was offset by scale benefits and brand strength.

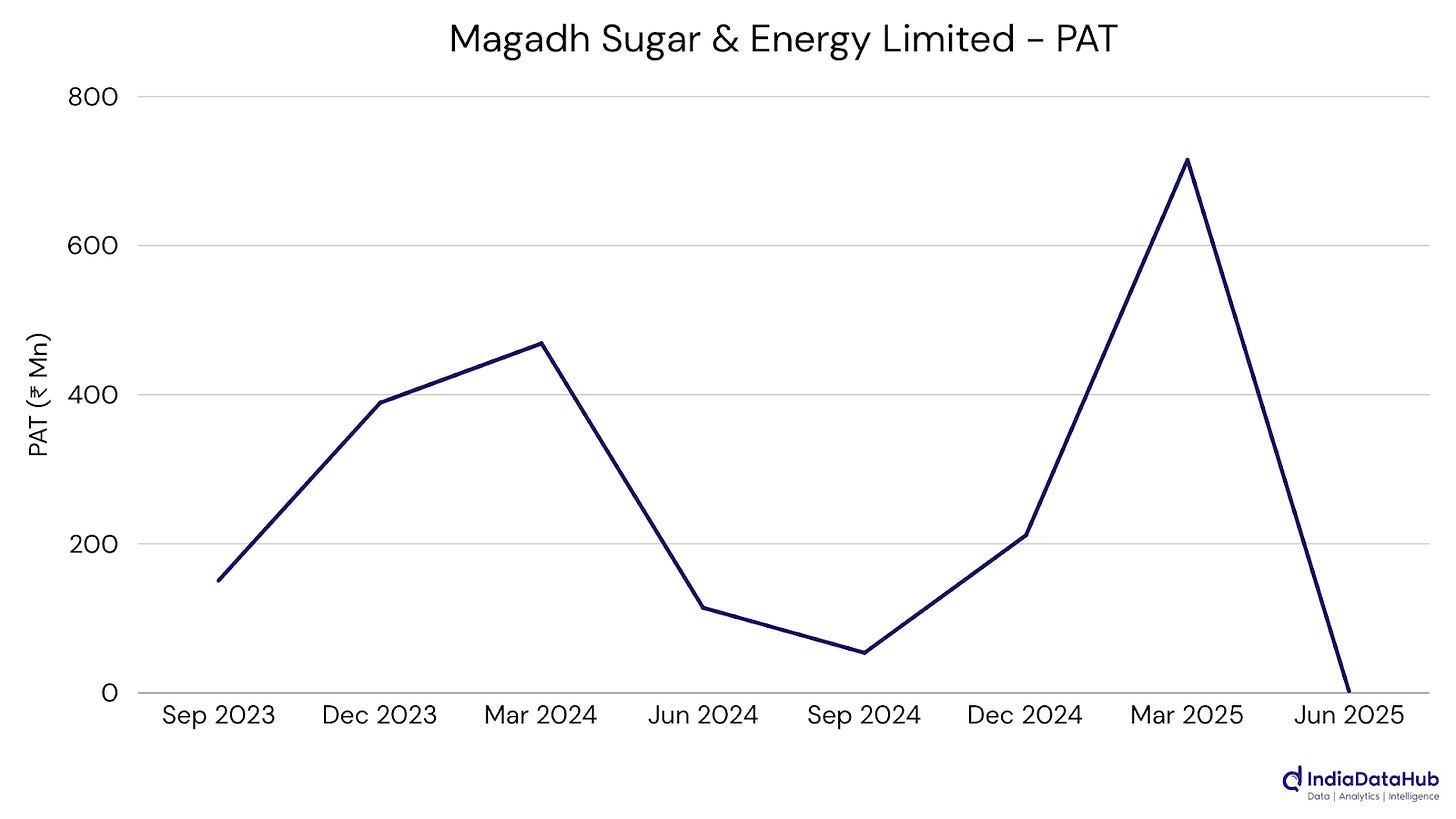

Magadh Sugar & Energy Limited: Profit collapsed 98% YoY to ₹0.22 cr as revenue fell 7% and margins halved. Climatic disruptions, high cane costs, and interest expenses eroded gains, leaving only a marginal bottom line.

Bannari Amman Sugars Ltd.: Profit surged 137% YoY to ₹15.25 cr, aided by monetising high-value sugar stocks, better realisations, and operational efficiency. Diversified by-product revenues and strong debt management further supported the gains.

Venky's (India) ltd.: Profit plunged 78.9% YoY to ₹30.2 cr as its core poultry segment swung to a loss on weak broiler prices, higher feed costs, and April’s heatwave-triggered panic selling. Oilseed and animal health units offered partial relief.

Utilities: [#29] [Rev: +1.1%] [PAT: +7.8%]

NLC India Limited: Profit jumped ~48% YoY to ₹839 cr, led by 25% mining revenue growth, higher thermal power output, and fresh capacity additions—plus record capex execution at over 113% of target.

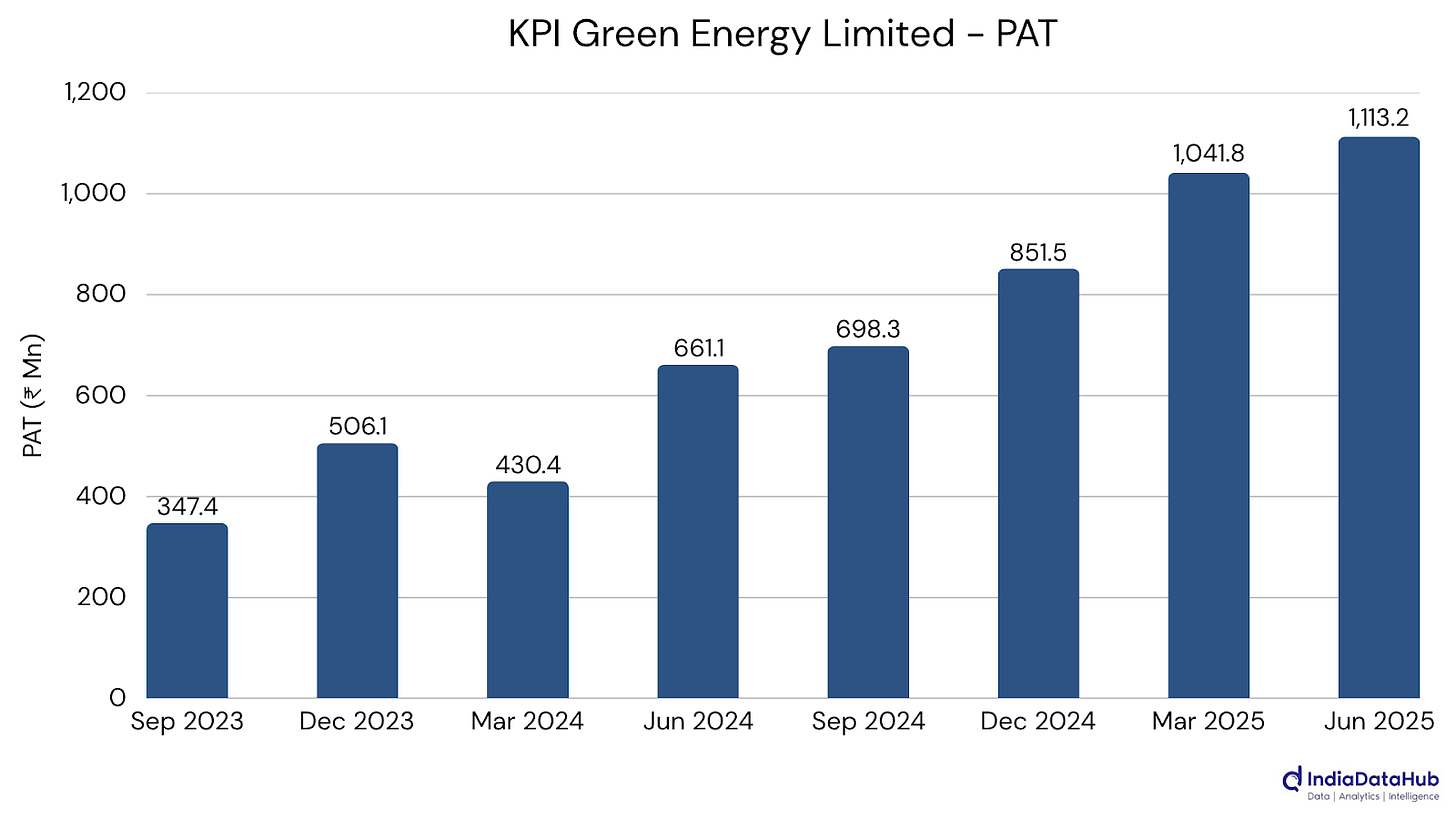

KPI Green Energy Limited: Posted its fifth straight record quarter, with Q1 FY26 profit up 68% YoY to ₹111 cr on 75% revenue growth. Gains came from strong CPP and IPP execution, hybrid project momentum, and Gujarat-driven renewable demand.

PTC India Ltd: PAT rose 28% YoY to ₹242.9 cr, powered by a 207% surge in subsidiary PFS’s profit from major asset recoveries, alongside 13% higher trading volumes despite lower overall revenue.

Energy: [#24] [Rev: +0.7%] [PAT: +36%]

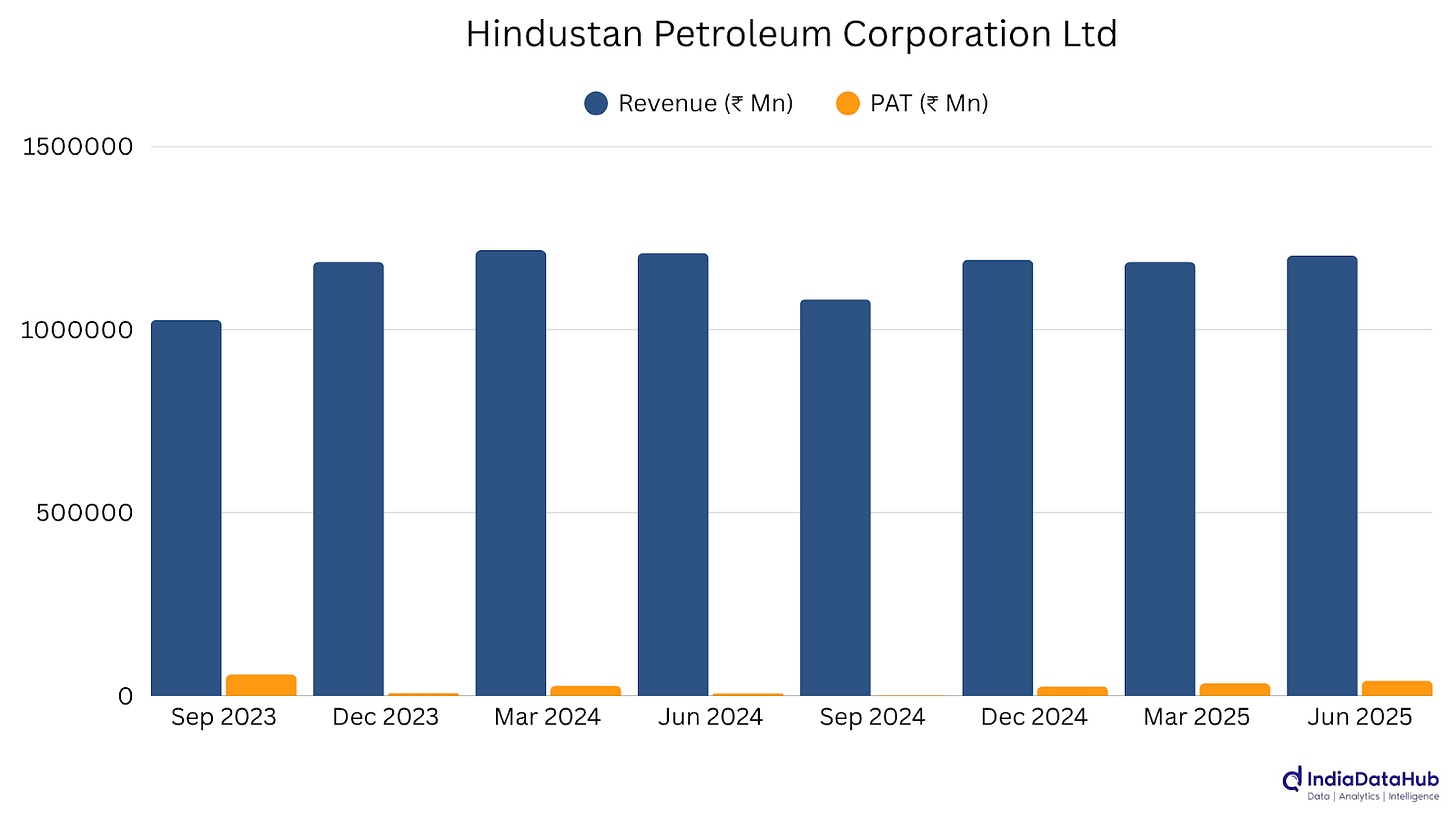

Hindustan Petroleum Corporation Ltd: Profit soared 548% YoY to ₹4,111 cr, driven by stronger refining margins, record throughput at 109% capacity, and efficiency gains. Revenue stayed flat, underscoring how operational leverage powered this dramatic earnings jump.

Aegis Logistics Ltd.: Profit rose 11% YoY to ₹175 cr as record LPG volumes drove revenue up 7%. Liquid terminal growth stayed flat, and margins softened, but strong energy demand kept overall momentum intact.

Deep Industries Limited: Profit jumped 59% YoY to ₹61.7 cr on a 62% revenue surge, backed by record orders of ₹3,051 cr. Broad-based service growth and strong contract wins signal sustained momentum in oil and gas field services.

Savita Oil Technologies Limited: PAT rose 40% YoY to ₹55.95 cr, with margins widening on strong domestic demand in transformer oil and lubricants. EBITDA jumped 31%, aided by product mix gains and expansion into EV-focused speciality fluids.

Telecommunications: [#19] [Rev: +17.4%] [PAT: +28.5%]

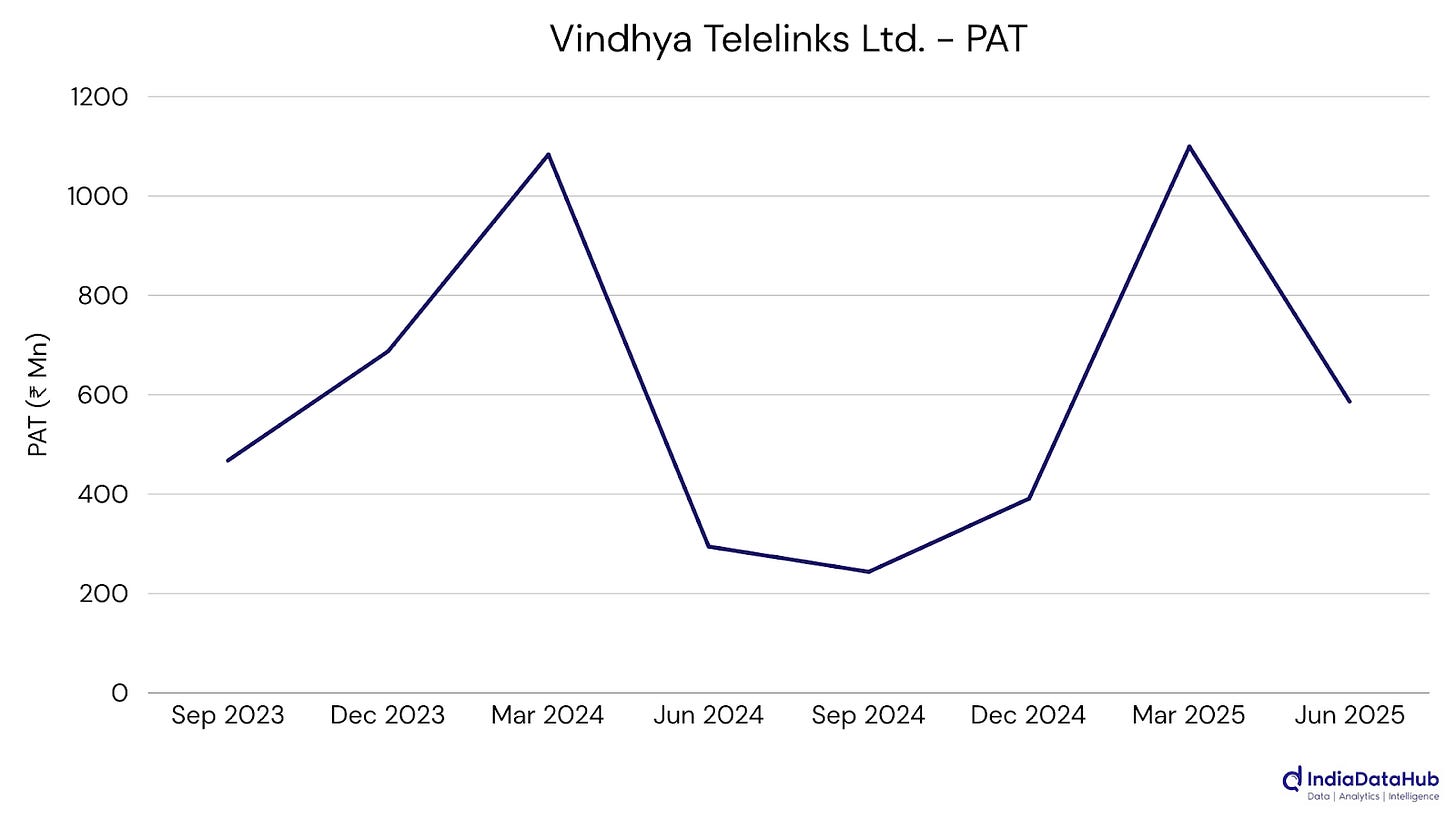

Vindhya Telelinks Ltd.: Profit nearly doubled YoY to ₹58.6 cr on 9% revenue growth, powered by strong cable segment gains and a ₹6,593 cr order book spanning telecom, power, and water infrastructure projects.

Bharti Airtel Ltd.: Profit rose 57% YoY to ₹7,422 cr on 29% India revenue growth, record ARPU of ₹250, and margin gains from cost control, premium customer additions, and strong 5G rollout momentum.

Diversified: [#5] [Rev: +13.8%] [PAT: +10%]

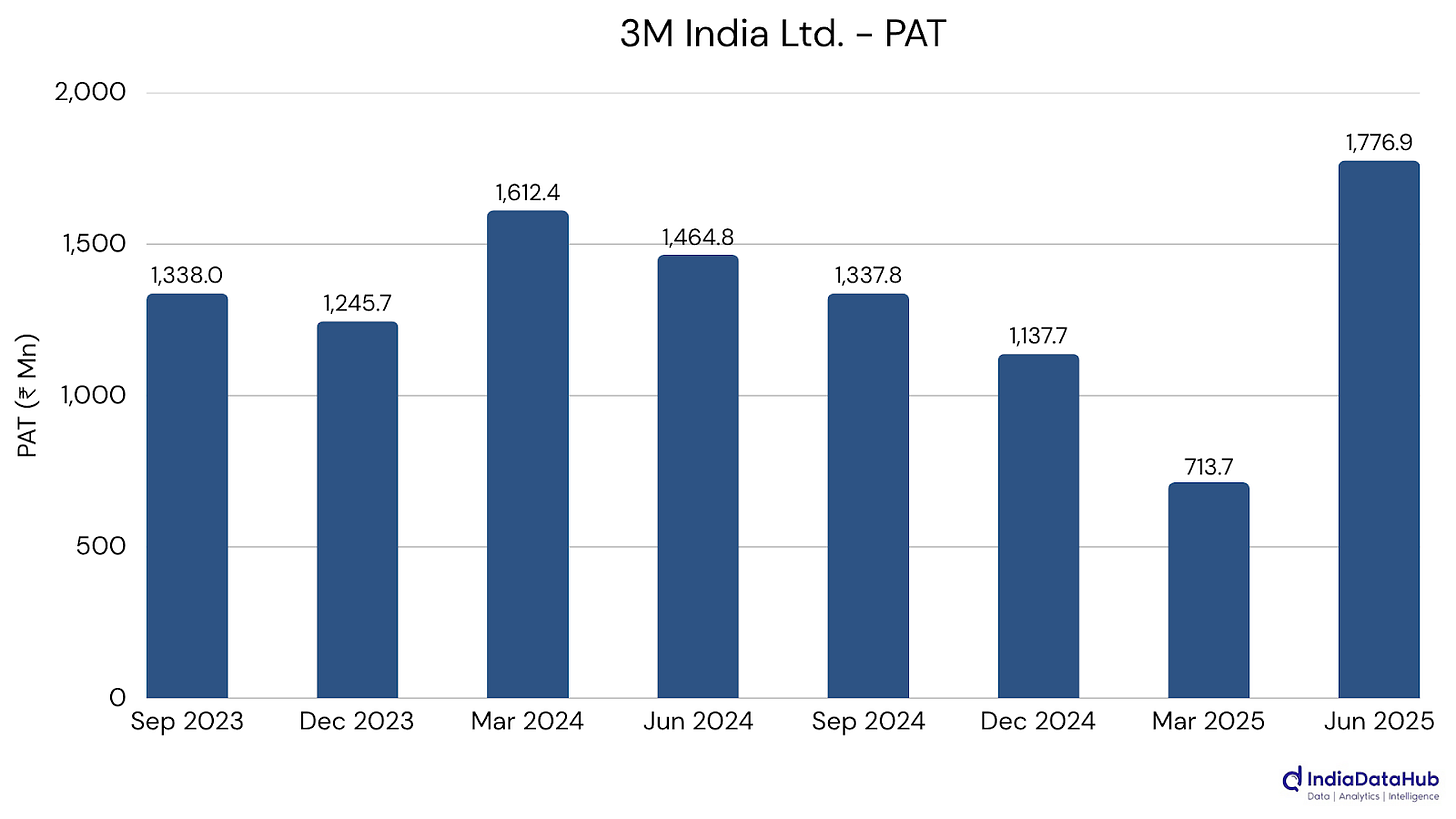

3M India Ltd.: Profit climbed 23% YoY to ₹192.8 cr on 14% revenue growth, with all segments expanding and margins hitting a five-quarter high thanks to stronger sales execution and material cost efficiencies.

That’s it for this one. See you next week!

Wow this is some crazy level analysis! Good to see growth still giving - next quarter is going to be super interesting!