US Tariffs and not much more...

This Week In Data #119

In case you missed, we have expanded our coverage of prices by adding an Aviation Price Index. The Index tracks domestic airline prices across multiple routes - almost 100 routes in fact covering thousands of flight prices every day. You can read more from hereThere isn't much else to discuss other than US tariffs, so we start and end with them! As promised on the campaign trail the Trump administration has imposed sweeping tariffs on US imports from almost all countries. And as these tariffs have gone live, the global markets have corrected sharply. The explicit objective of the tariffs is the correct the imbalanced US trade. The US economy consistently runs large current account deficits driven by large deficit on the merchandise account. In the last few years, the US current account deficit has averaged over 3.5% of GDP, the highest since the global financial crisis.

Given how unprecedented the policy response (imposition of across the board tariffs) is, it is hard for anyone to say with any great precision what the impact of these tariffs on the US or the Global economy will be. The baseline expectation would be that these tariffs would increase inflation and trigger a slowdown in the economy. Either of these on a standalone basis is a negative development and for the two to happen together, is a double whammy, that will be difficult to deal with. And the fall in markets in a sense reflects that fear.

But beyond this, there are several unknowns. For instance, we do not know whether these tariffs will result in countries negotiating trade agreements with the US such that in a quarter or two we end up in a much lower overall tariff environment. Or perhaps we are entering a completely new order where cross-border trade is subject to significant tariffs as each country tries to maintain a balanced trade profile with each of its trading partners. So we will have to take it as it comes. Each day will bring something new. On a side note, one has to wonder if pressing the red button on the US President’s table gets a can of Coke or a can of Thums Up?

What is interesting is that leading up to these tariffs taking hold, US importers have loaded up on goods. US imports grew over 20% YoY in both January and February and March is also likely to have seen strong growth. December had also seen double-digit growth. Exports in contrast have seen low single-digit growth during this period. So while the higher tariffs have kicked in, its impact on the economy might take a quarter or so to show up in data. The effect of tariffs will probably not be visible in April CPI or Consumption data.

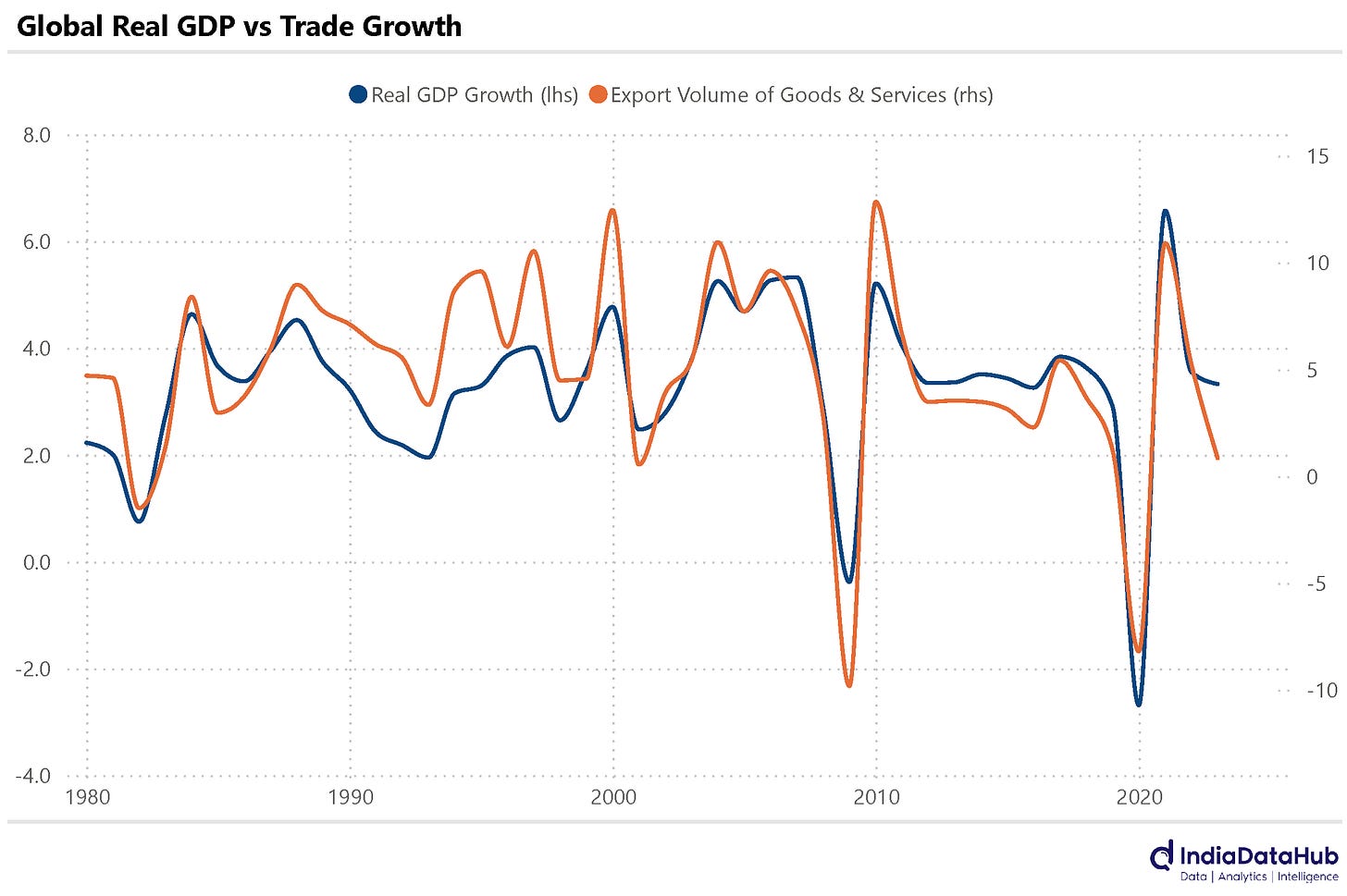

The big picture though is that the global equilibrium that existed till a few weeks ago has been disrupted. We will eventually settle into a new equilibrium. What the contours of what equilibrium will be will depend on how each country reacts to these tariffs. But suffice it to say that if the new equilibrium results in substantially lower global trade volume, that would be contractionary. For as the chart above shows, it is the significant expansion in global trade in the last almost 5 decades, that has contributed to the growth in the global economy. It is hard to imagine there being any winners in a situation where global trade contracts sharply. But then, we are in uncharted territory. So we should have strong opinions, but they should be weakly held.

How does all of this impact India? India’s merchandise exports to the USA totalled US$80bn in the calendar year 2024. This is approximately 18% of India’s total merchandise exports.

And India runs a large trade surplus with the US. In the calendar year 2024 for instance, India had a trade surplus (goods) with the US of almost US$38bn. This is 1% of India GDP. So a material share of India’s exports goes to the USA and India runs a fairly large trade surplus with the USA.

Five categories make up almost 70% of the total exports to the USA – Chemicals, Electronic Goods, Machinery, Gems & Jewellery, and Textiles. And some of these, like Textiles and Gems & Jewellery, are labour-intensive sectors. And the share of the US in these exports is large. So, for instance, almost 30% of India’s textile exports go to the USA. So a significant reduction in exports to the USA will have a non-trivial negative impact on India.

But there is a trade agreement with the USA in the works. We as yet do not know the contours of this agreement. Or whether there will finally be one in the first place. And while that trade agreement might result in a rollback in some of the tariffs, it will also likely result in a reduction in import duties on a host of American products. And that will have its own set of impact on domestic producers. So it might very well be that some domestic producers, rather than the exporters, will bear the consequences of these tariffs.

On this relatively somber note, that’s it for this week. The RBI’s Monetary Policy Committee meets next week and it is widely expected to cut the policy repo rate by 25bps. The recent fall in Oil prices will most likely add 1 more nail to the rate-cut coffin. Given the volatility in financial markets, markets will be like, ‘But me no buts’, so we shall see…

I like the way you write 👍