Weak Corporate Taxes, Recovering Aviation, Jio subscriber loss and more...

This Week In Data #106

In this edition of This Week In Data, we discuss:

Another month of decline for corporate tax collections

Personal tax collections offset the decline in corporate taxes

GST Collections continue to moderate

Weak December for Auto sales but relatively strong December qtr

Domestic Aviation logs fastest growth in over a year

Jio continues to lose subscribers while BSNL continues to gain

The central government’s tax collections recovered in November. Overall gross tax collections grew by 10% YoY, up from 1% growth in October. However, November was another weak month for corporate tax collections. They declined by over 25% YoY. Consequently, YTD (Apr-Nov), corporate tax collections have now declined, albeit modestly, on a YoY basis. Personal income tax collections were, however, strong, growing over 50% YoY, and they offset the decline in corporate taxes. The divergence between the growth in corporate tax and personal income tax collections – YTD corporate tax collections have declined while personal income tax collections have grown over 25% YoY – continues to remain a bit of an enigma. Hello Mr Turing 😊

Separately, GST collections continue to see a slowdown. December saw a growth of just 7% YoY, the slowest growth in the last 3 months and the 4th consecutive month of single-digit growth. And there is a fair bit of divergence amongst the states as well. Over the past three months, overall GST collections (excluding IGST on imports and Cess) have grown by 9.5% YoY.

On one hand, states like Haryana (14% growth), Maharashtra and Delhi (~13% growth) have seen significantly faster growth. On the other hand, Andhra Pradesh has seen a 2% decline in GST collections while Rajasthan, Madhya Pradesh and Uttar Pradesh have seen a modest 5% growth in collections. Many of the northeastern states have also seen a decline in collections.

December was a relatively weak month for automobile sales. However, the December quarter as a whole was better for sales growth compared to the September quarter. Car sales declined in December for the second consecutive month. However, the decline in November was due to the festival timing change due to which October had seen strong growth. Consequently, the December quarter as a whole saw 8% growth in sales against a 2% decline during the September quarter and 6% growth during the June quarter. Two-wheeler sales also declined in December. But like with cars, the December quarter was better compared to the September quarter for two-wheeler sales. December quarter saw sales grow 13% YoY as against 5% growth during the September quarter. Sales of trucks and other goods carriers similarly declined in December. And while sales declined for the quarter, the decline was slightly lower than during the September quarter.

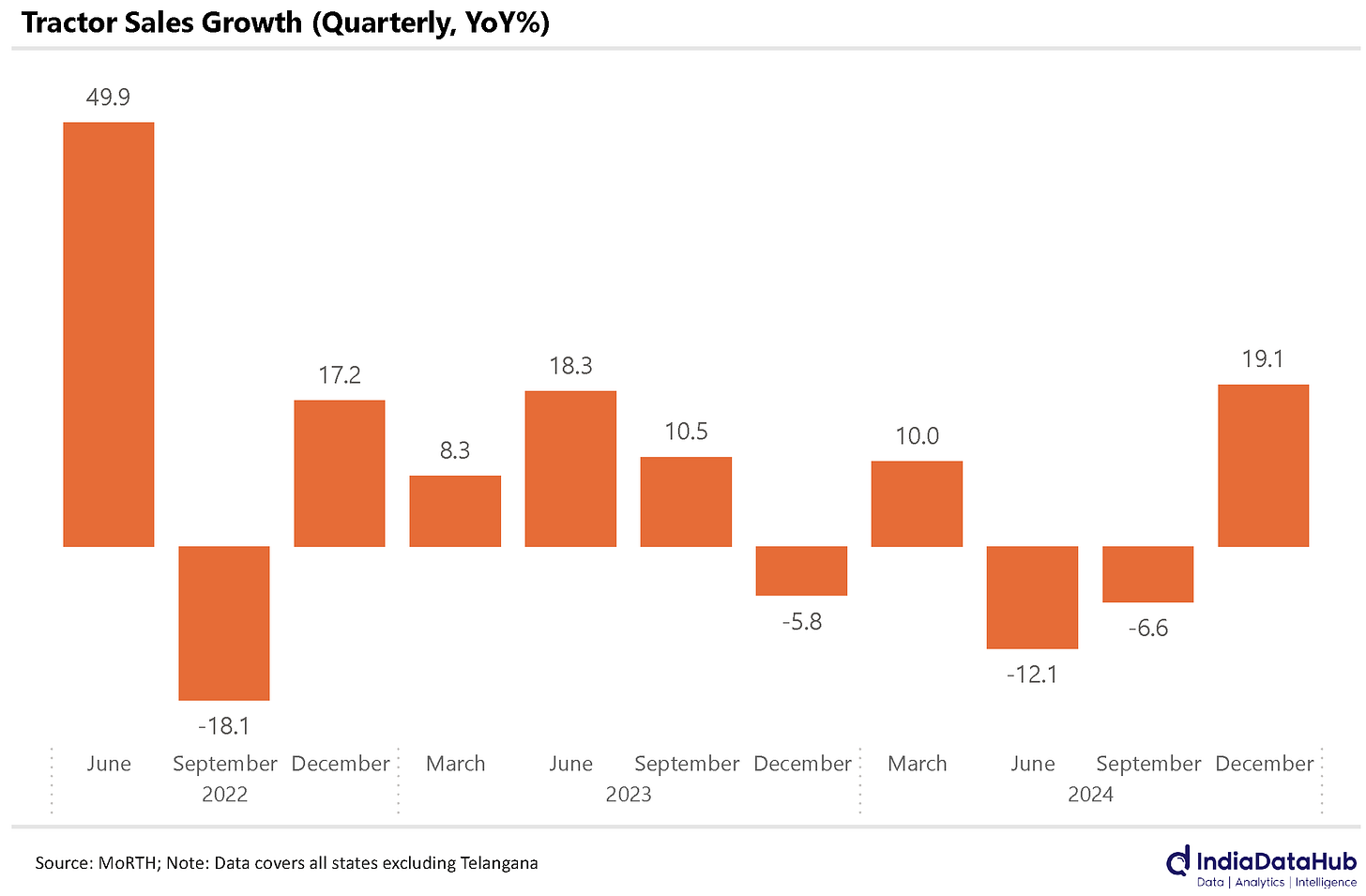

The one exception to this is tractors. Tractor sales grew over 20% YoY for the second consecutive month in December which resulted in a 19% growth for the quarter, the strongest growth in over two years.

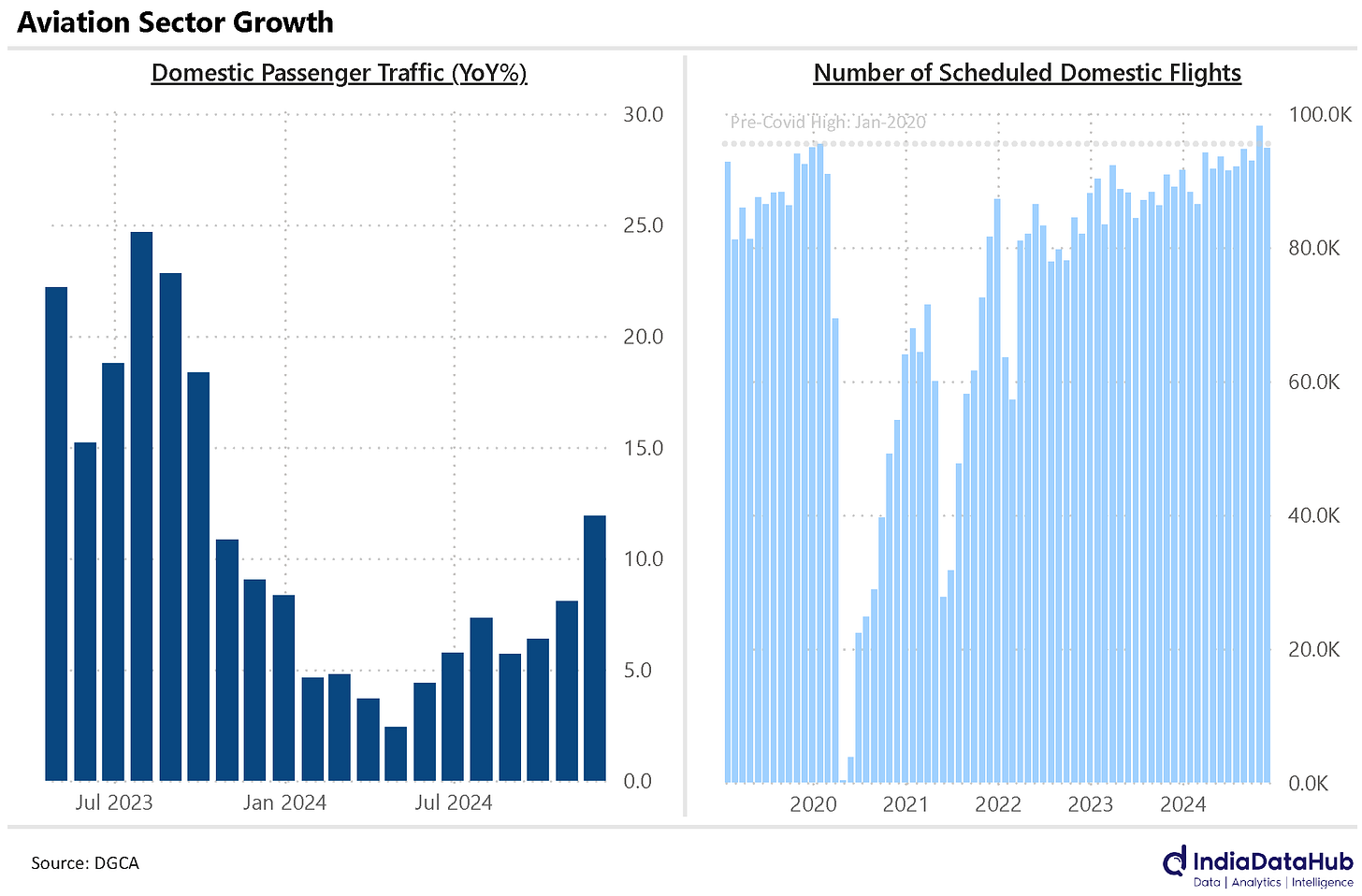

After a slowdown in the early part of 2024, the aviation sector is seeing a recovery. The domestic passenger traffic grew by 12% YoY in November, the highest growth since September last year. Also notably, the passenger load factor increased in November after declining for the preceding 7 consecutive months.

The domestic aviation sector has finally crossed the pre-Covid levels in terms of domestic flights. October 2024 saw just over 98,000 domestic flights which was higher than the pre-Covid high of 95,487 flights in January 2020. In terms of number of passengers, we had already crossed the pre-Covid levels in 2023.

The flux in the wireless telecom space since July has continued through October. October saw a further decline of 3.3 million wireless telecom subscribers – the 4th consecutive month during which the sector has lost a cumulative 20 million subscribers.

Jio continued to be the biggest loser. It lost another 3.8 million subscribers in October taking its cumulative subscriber loss to 16.5 million or 3.5% over the past 4 months. Vi also lost a further 2 million subscribers in October. However, Airtel gained almost 2 million subscribers in October. And BSNL continued to gain subscribers. In October 500k subscribers, the 4th consecutive month of subscriber growth. Cumulatively over the past 4 months, BSNL has seen a growth of 6.8 million or 8% in its subscriber base.

The reason for this churn was a price hike taken by the private operators in July. And we now have the data to quantify the price hike. The September quarter saw an almost 10% QoQ increase in wireless ARPU, the highest in the last two and half years. And this increase was almost entirely driven by the private operators. The PSU operators saw a modest 0.5% QoQ increase in ARPU. This divergence explains the sharp increase in subscribers for BSNL. But what it also highlights is the existence of a large number of price-sensitive subscribers.

That’s it for this week. See you next week…

Excellent read

Keep it up