Weak Energy demand, Mixed Auto sales, Benign CPI and more...

This Week In Data #49

In this edition of This Week In Data we discuss:

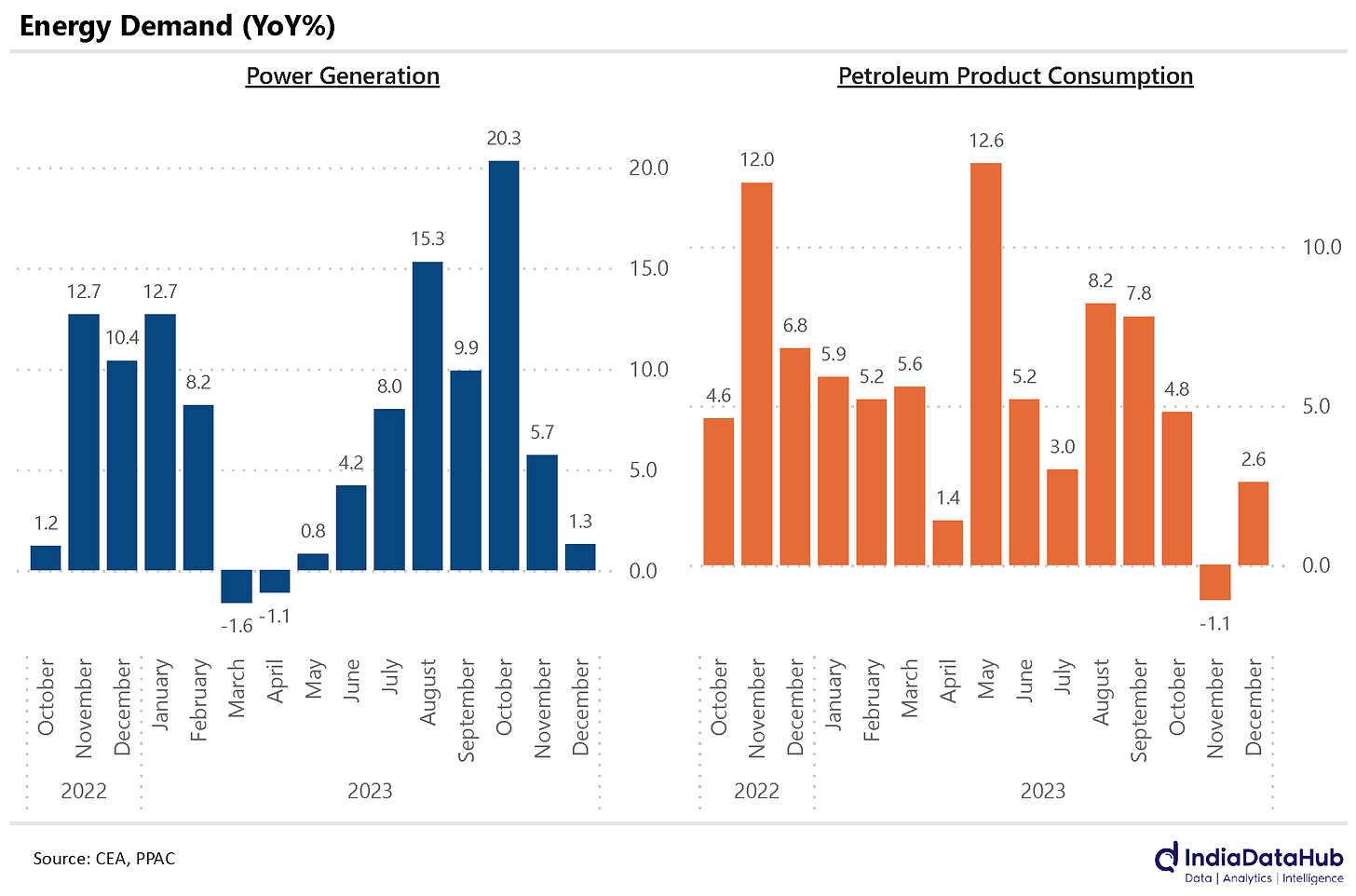

Weak growth in power generation and petroleum consumption in December

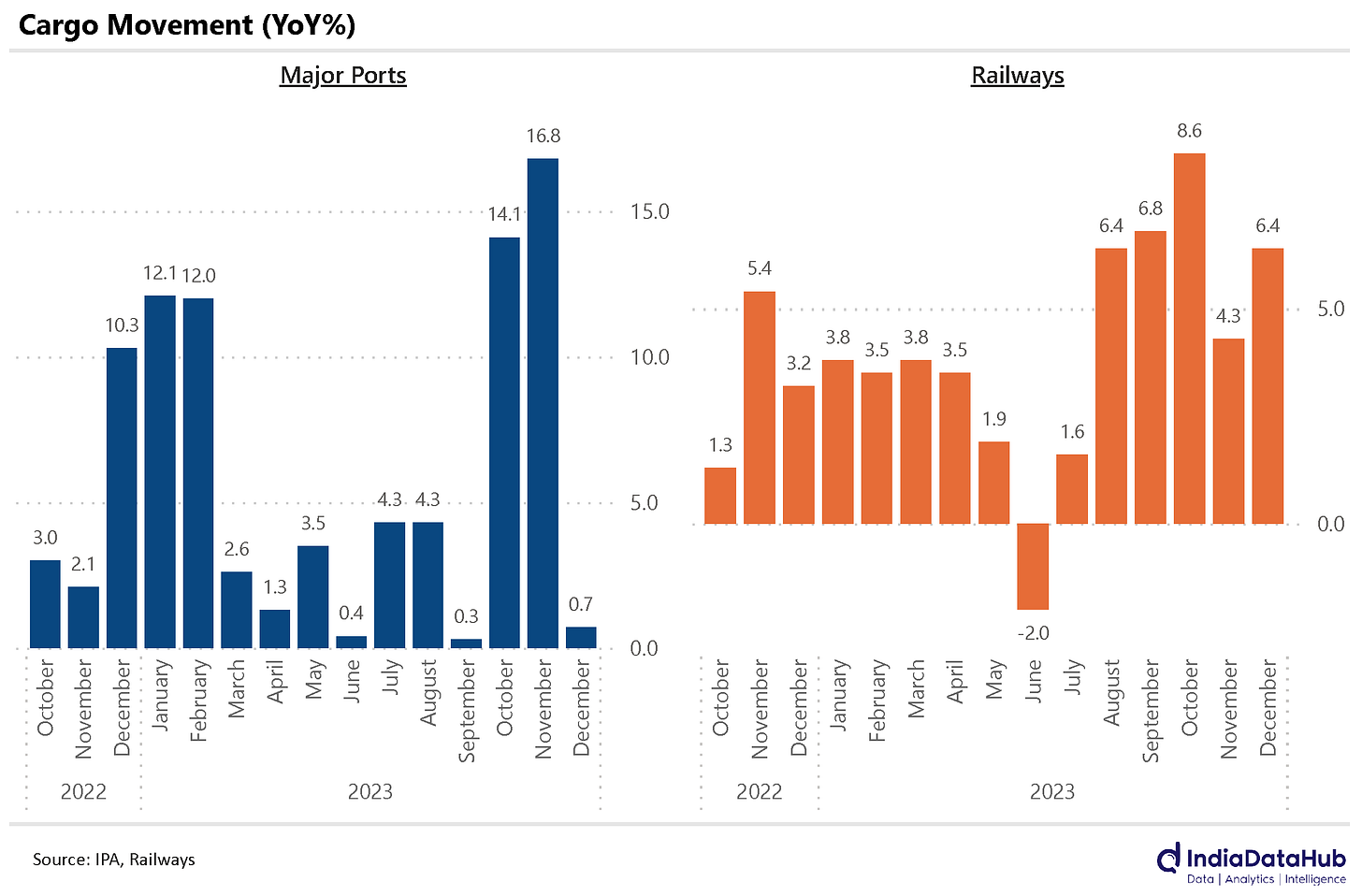

Weak growth in Cargo traffic at ports but strong growth in Railway freight

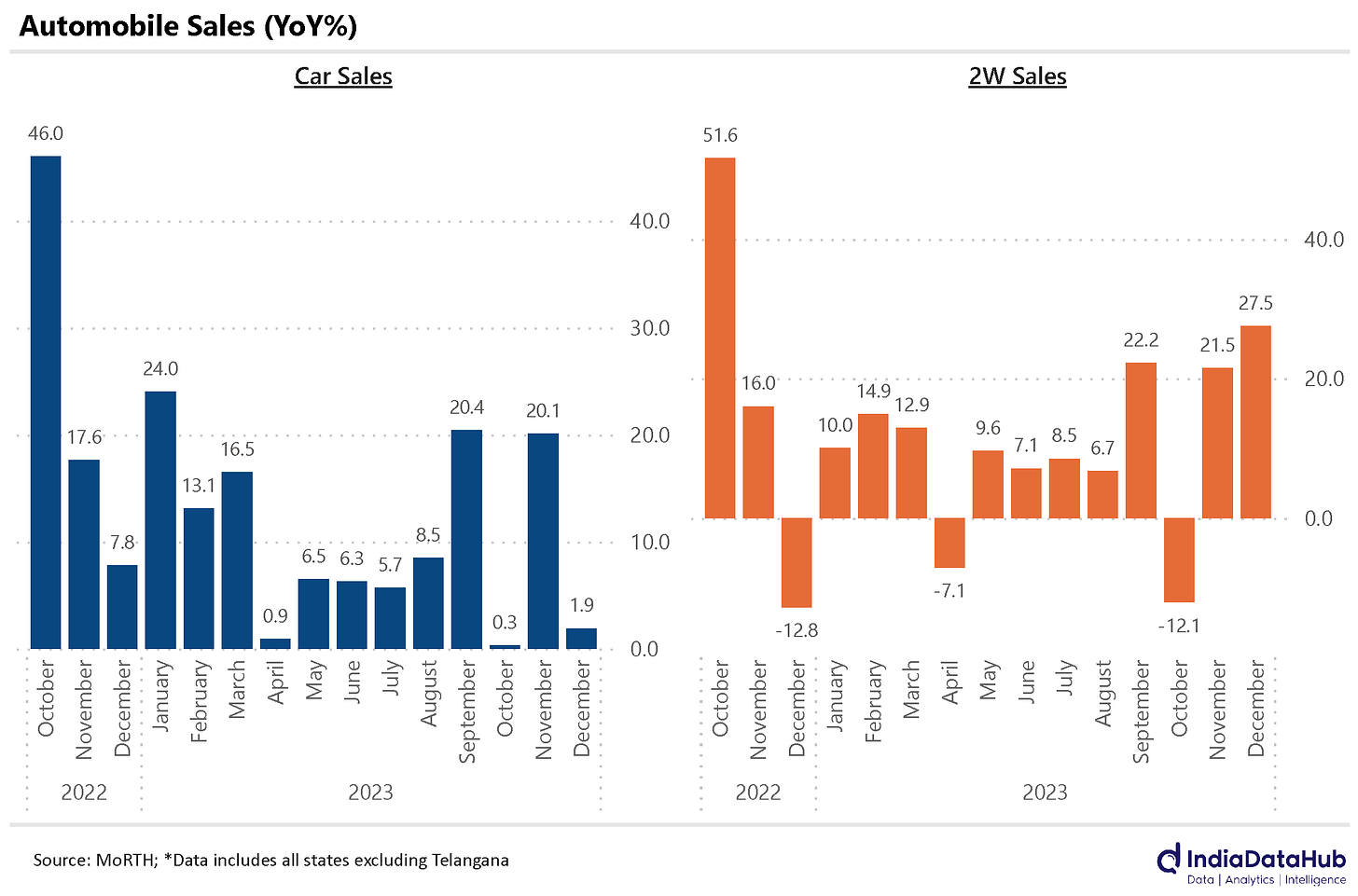

Strong growth in 2W sales but weak Car sales in December

Continued strong growth in EWay Bills

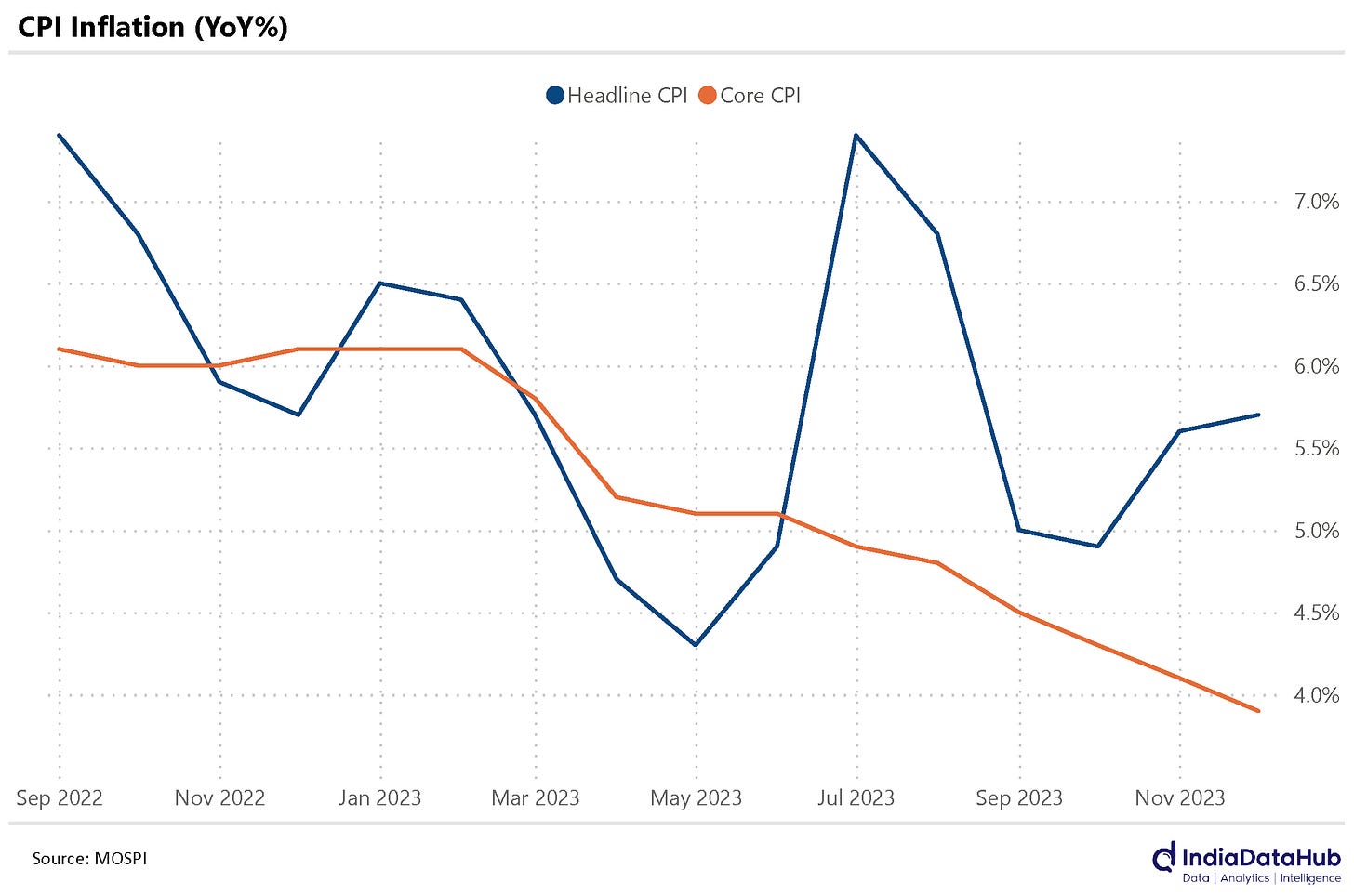

Uptick in headline CPI in December but continued decline in core CPI

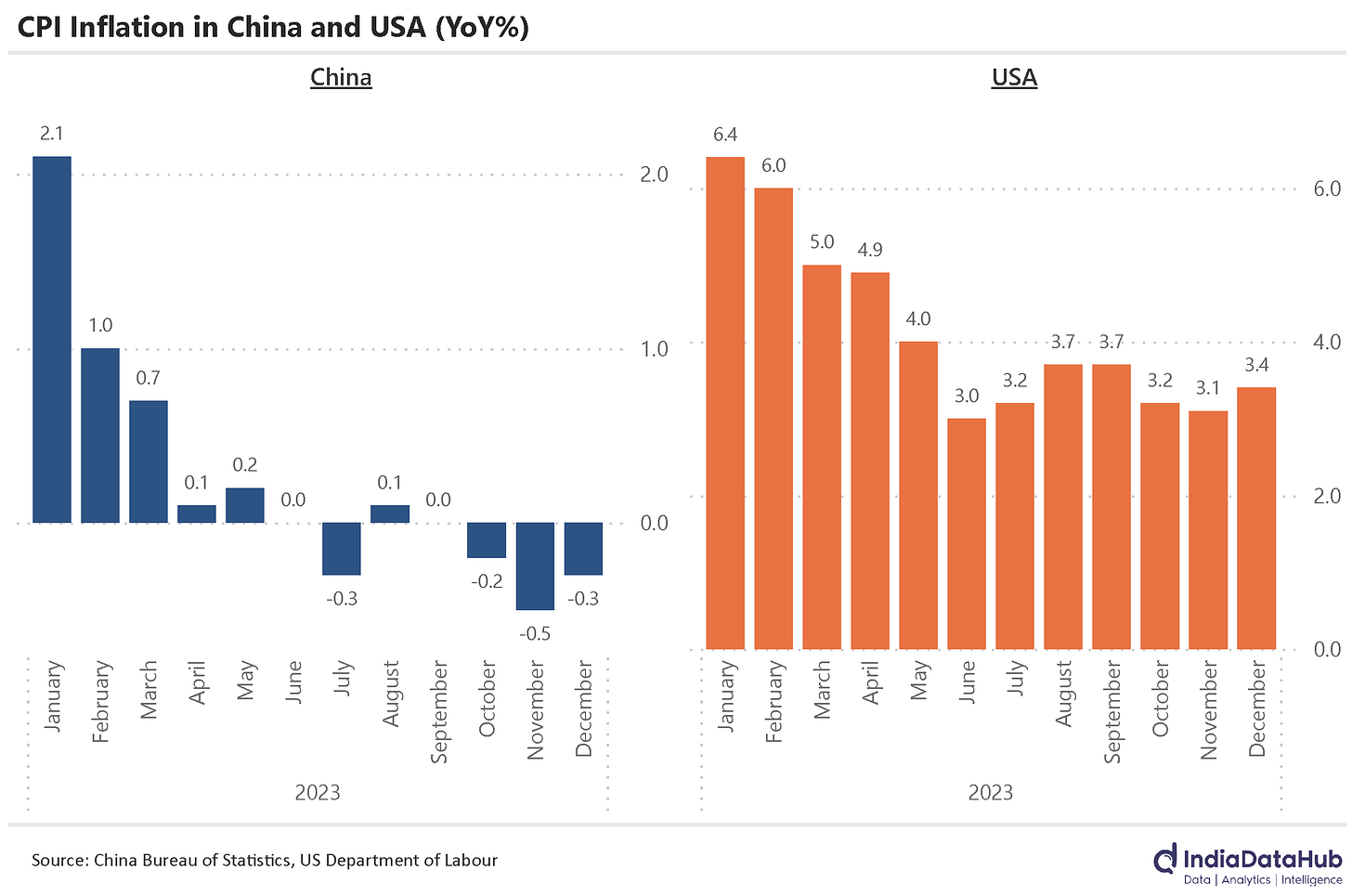

US and China CPI

Let’s do a review of the key high-frequency data released for December so far. That will give us a sense of the state of play currently. Let’s begin with energy.

After a few months of strong growth, power generation growth moderated to just 1% YoY, the lowest growth since May 2023. Growth in petroleum product consumption was also weak at 2.6% YoY in December. While this was higher than in November, when consumption had declined, that decline was largely due to the Diwali timing effect. Energy demand was thus weak in December.

Cargo traffic at the major ports was also weak in December. Aggregate cargo traffic grew less than 1% YoY after two months of mid-teens growth. While coal and iron ore traffic continued to see strong growth, other commodities, including containers have seen a sharp slowdown. Railway freight has however continued to see reasonable growth. In December total cargo carried by the Railways grew 6.4% YoY, broadly the same growth as in the last few months. So while EXIM cargo growth has slowed down, growth in domestic cargo movement has remained resilient.

Auto sales growth has been mixed. Two-wheeler sales grew a strong 27% YoY in December, the highest since October last year. Car sales however were soft, with a modest 2% growth in December. This is the slowest growth since July 2022. Tractor sales grew 0.5% YoY in December. This though is better than the growth in the preceding 3 months when sales had been declining.

GST collections grew 11% YoY in December. This is the slowest growth since November last year. But a double-digit growth is still reasonable given that nominal GDP growth is currently running in single digits. More importantly, EWay bills have continued to see strong growth. In December they grew 15% YoY, broadly the same growth as in the preceding few months.

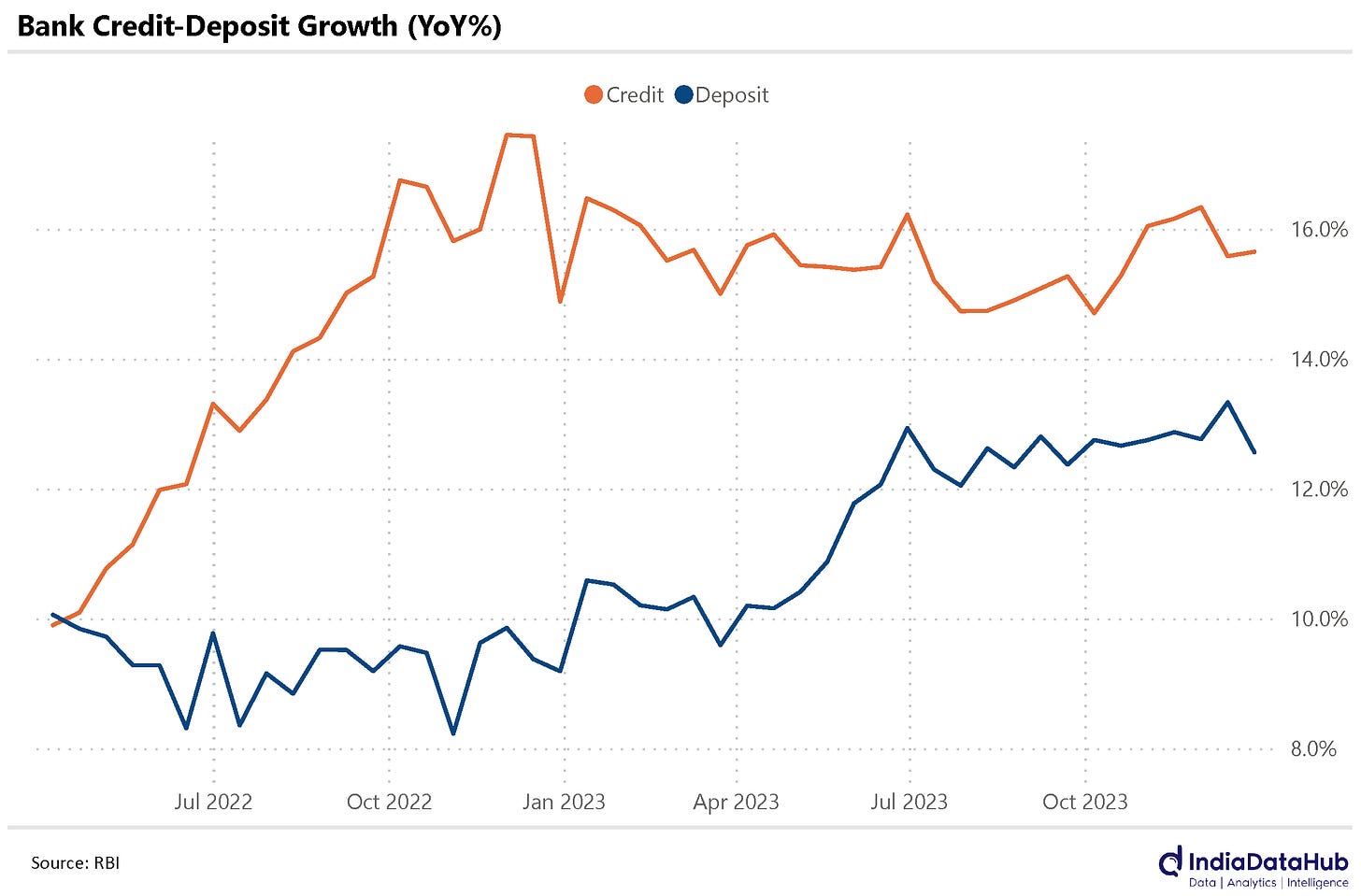

Lastly, Bank credit. Credit growth has remained largely stable at the mid-teens on a YoY basis in the last few months. As of the last fortnight of December, bank credit grew 15.6% YoY, which is well above the nominal GDP growth. Assuming credit growth sustains at this level, the credit to nominal GDP multiplier for the year would be just under 1.8x, among the highest in recent years. Deposit growth has also remained stable at close to 13%.

In summary, the incoming data thus has been slightly positive.

Lastly, Inflation. CPI Inflation for December rose 10bps to a four-month high of 5.7% YoY in December. This though was largely due to the uptick in Food and specifically Vegetable inflation. Excluding food, all other categories saw a decline in inflation. The uptick in Food and Vegetable inflation was expected and thus does not come as a surprise. The key positive takeaway was the further decline in core inflation to 3.9% YoY, the lowest in the last few years.

The MPC next meets in February, and this is the last CPI data before that. Given that the headline CPI reading is still very close to 6% and the hawkish stance in the last policy a rate cut in February is more or less ruled out.

Globally, this week we had China and the US reporting their CPI data. The China CPI saw a negative print (-0.3% YoY) for the third straight month. China's CPI has been in the deflationary zone for 4 of the past 6 months.

US CPI on the other hand edged up 30bps to a three-month high of 3.4% YoY in December. That said the big picture is that through the course of 2023, CPI Inflation in the US has almost halved, from 6.5% in December 2022 to 3.4% in December 2023. And perhaps as a consequence, the markets are now assigning a 75% probability that the Fed will cut interest rates by 25bps in March.

That’s it for this week. See you next week.