Weak tax collections, Monetary transmission, Fed easing and more...

This Week In Data #144

In this edition of This Week In Data, we discuss:

Direct tax collections continue to remain soft

GST Collections slows down in October as expected

Monetary transmission has kept pace with policy rate changes

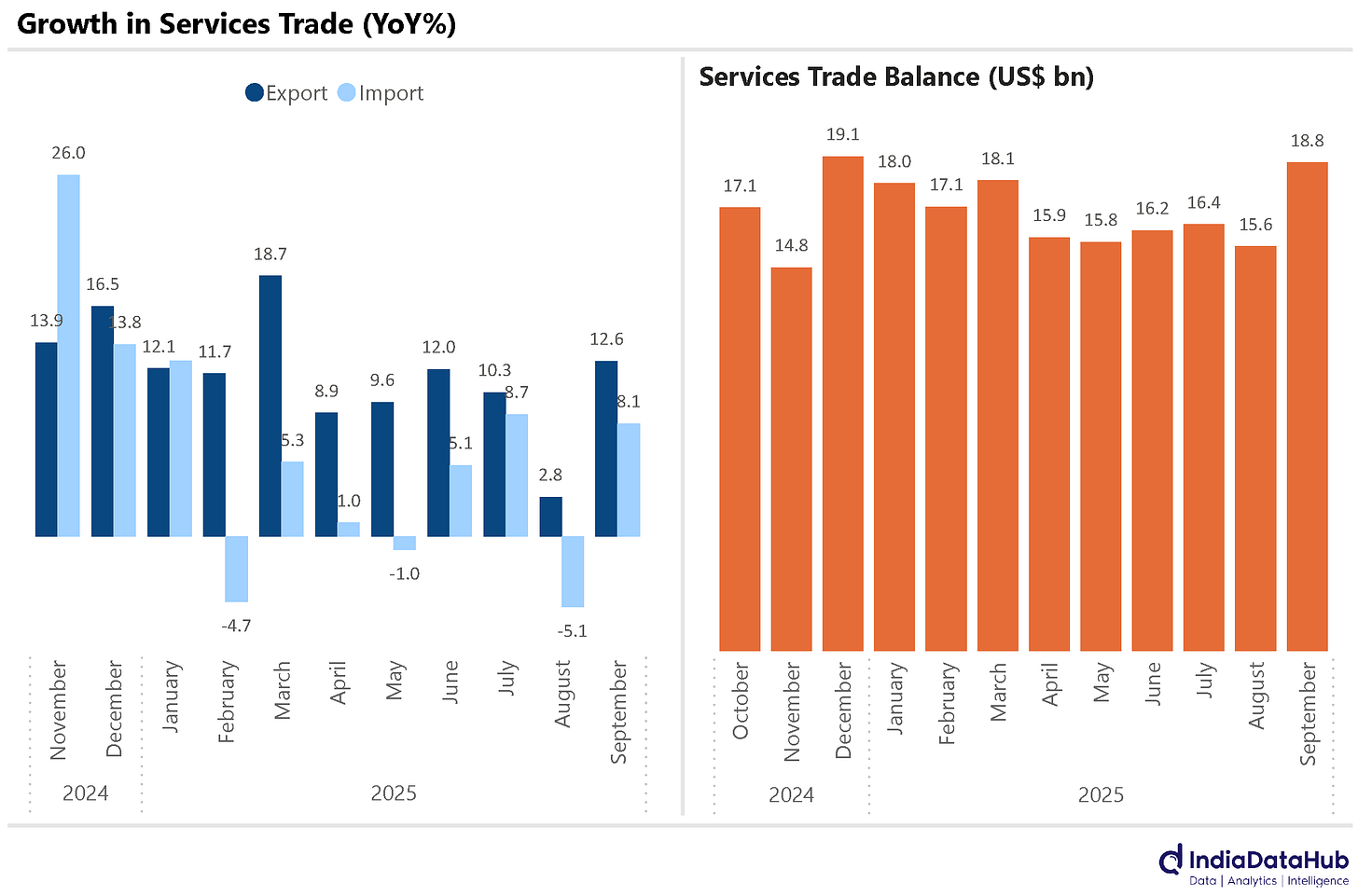

Services trade recovers in September and surplus rises in high teens

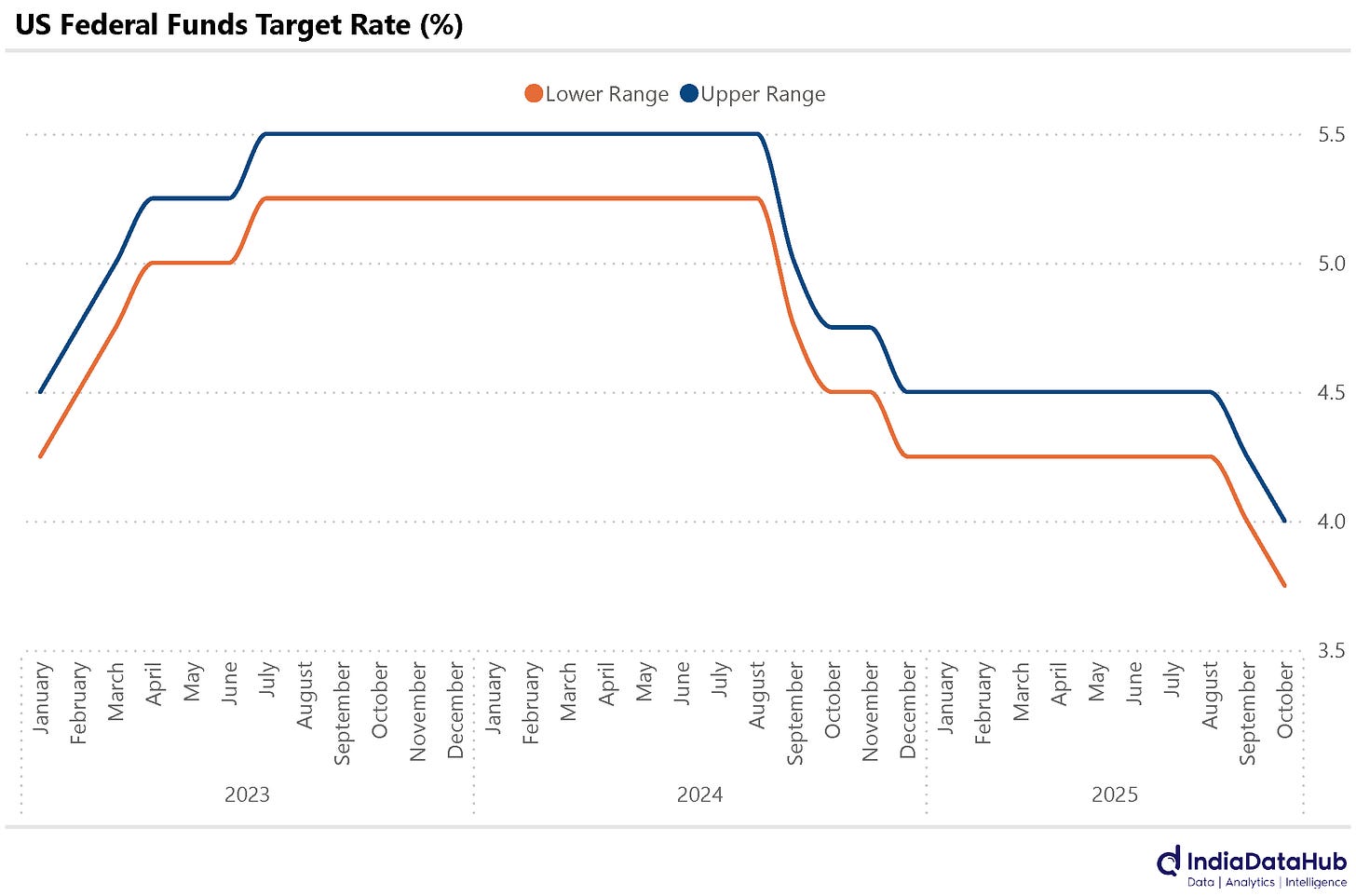

Fed cuts rate as expected and the Bank of Canada follows but ECB pauses

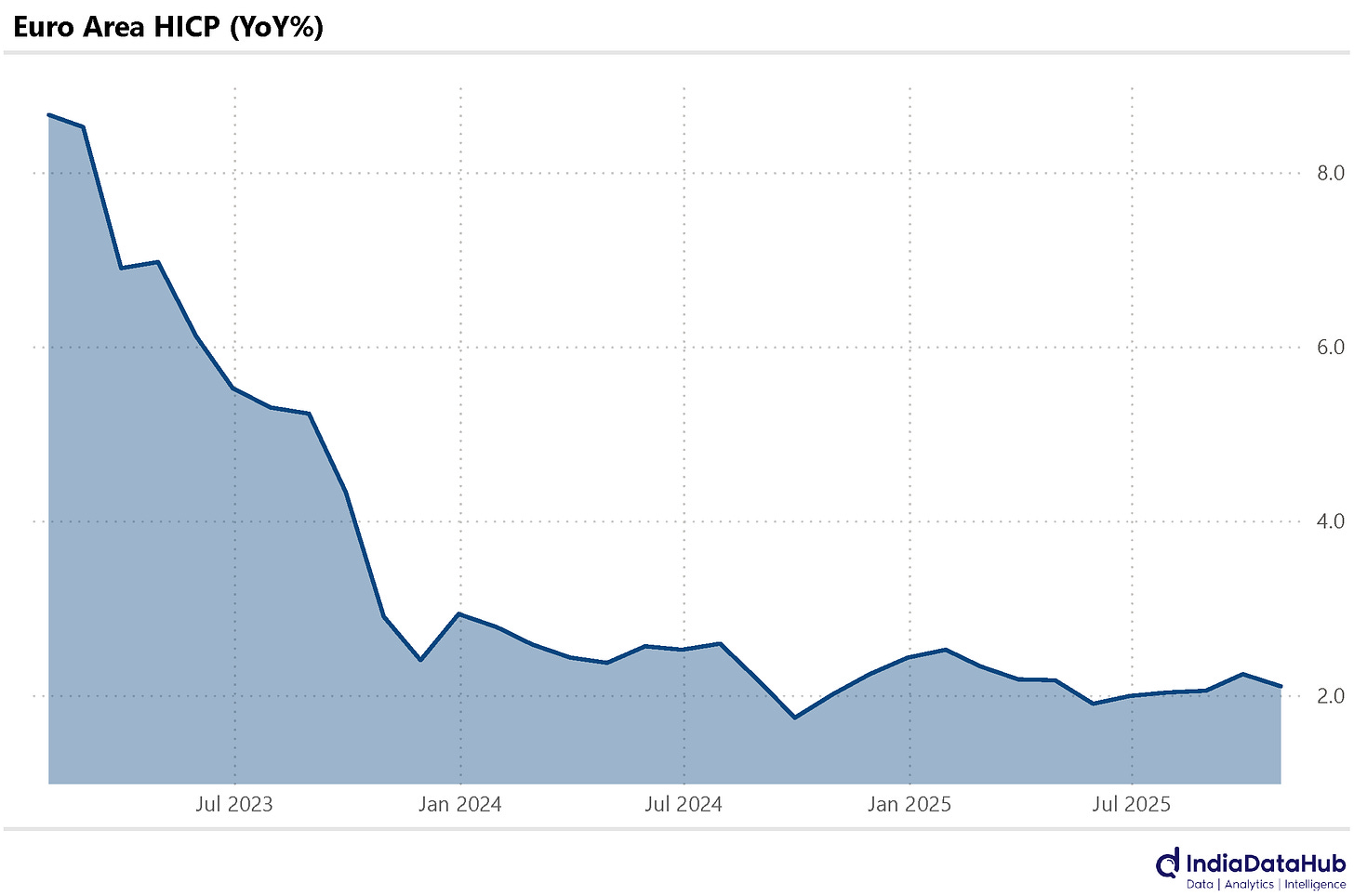

Euro area CPI moderates slightly in October but remains above 2%

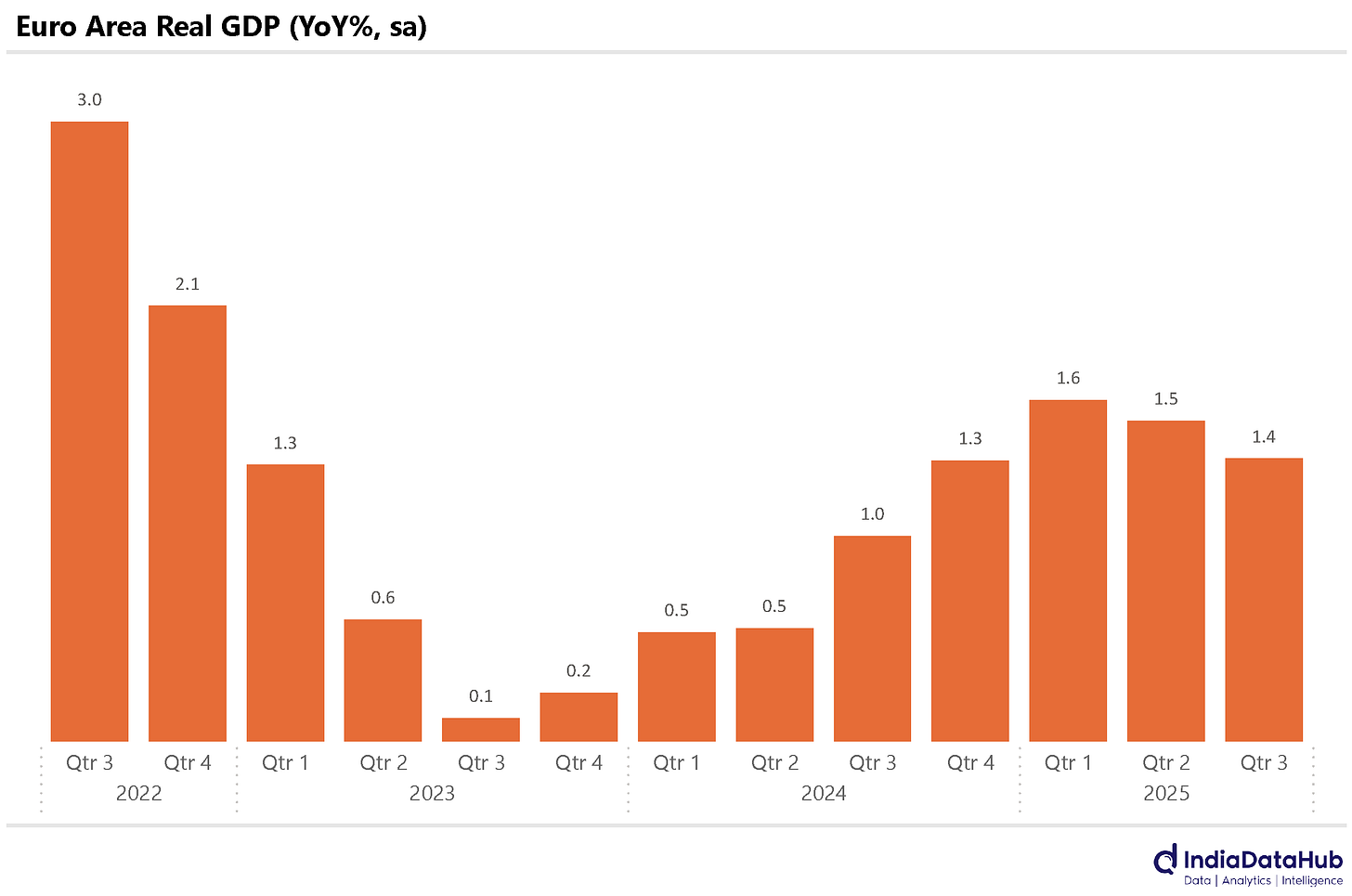

Euro area GDP grows at the slowest pace in 3 quarters

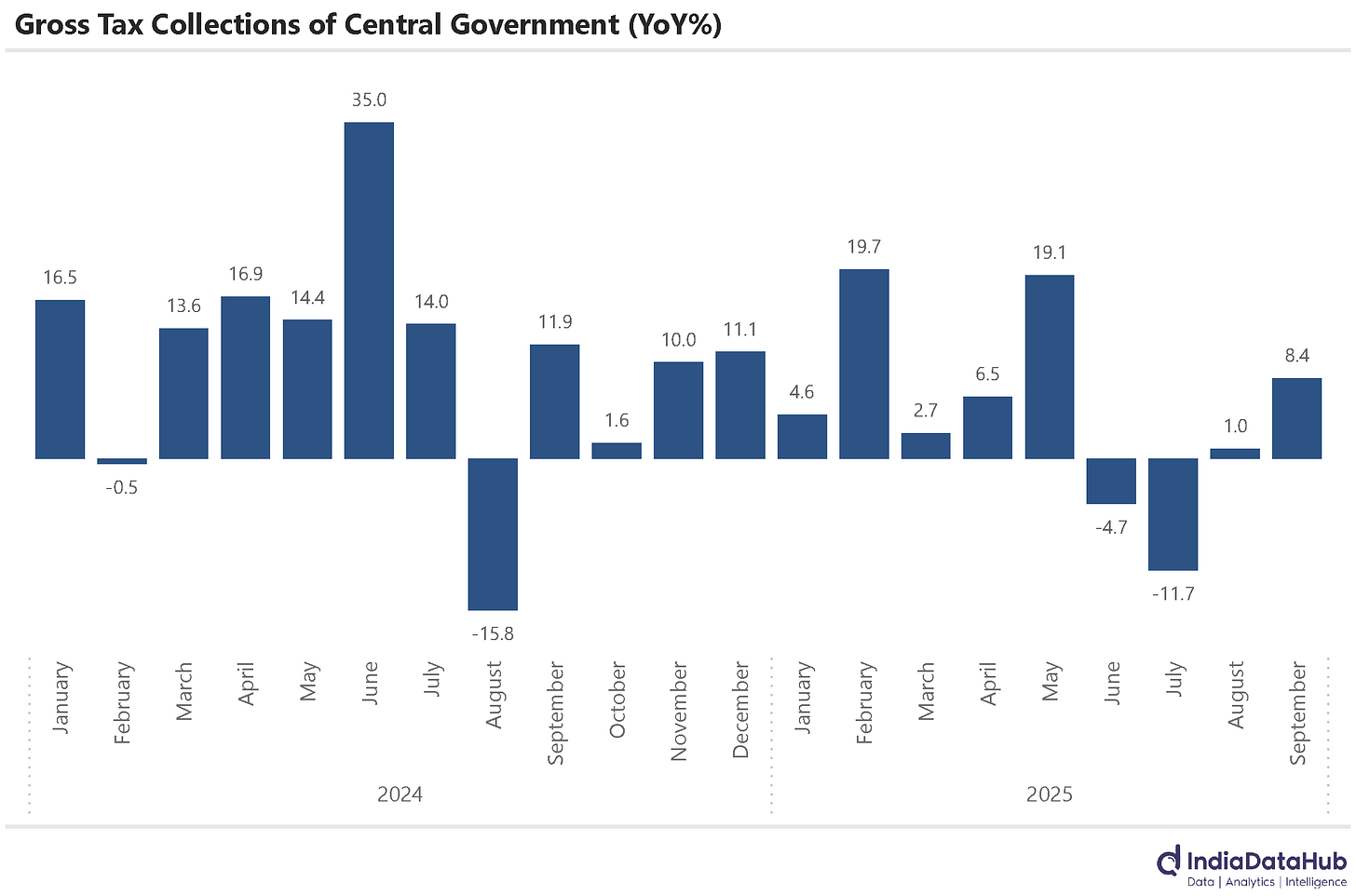

September was a reasonable month for tax collections. Overall, the central government’s gross tax collections grew by 8% YoY, the fastest growth since April-May this year.

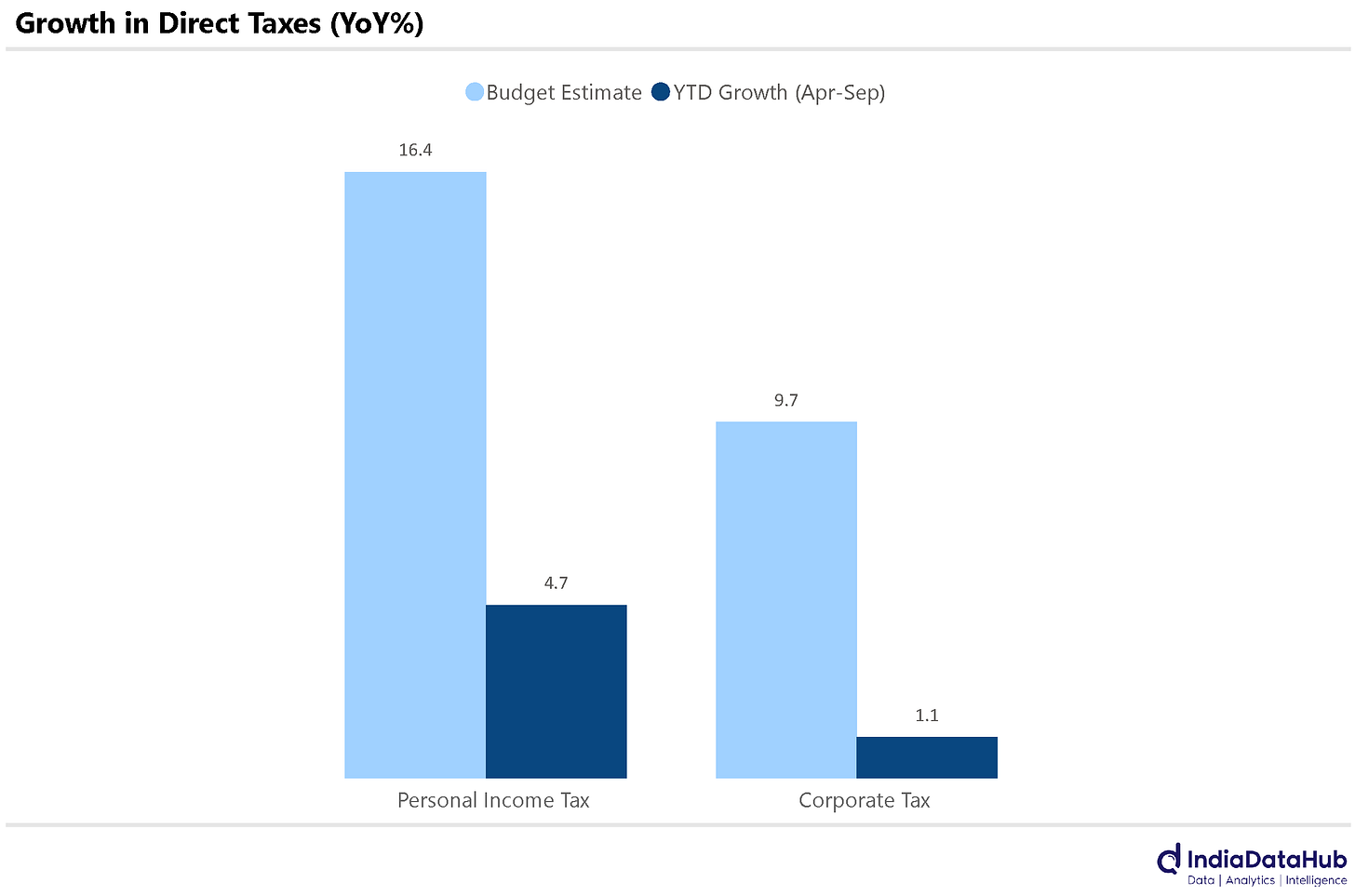

The entire growth, though, was due to higher personal income tax collections. Corporate tax collections were broadly flat on a YoY basis in September and have grown by a modest 1% YoY in the first half of the year (Apr-Sep). Given that September saw the second instalment of advance tax being paid, it seems like the corporates in aggregate (listed as well as unlisted, large as well as small, put together) are not seeing strong growth in profitability during the current year.

Personal income tax collections grew by over 30% YoY in September. This, though, largely reflects the shift in the date for filing tax returns for individuals from July to September. What is thus important to note is that the YTD personal income tax collections growth is a modest 5% YoY. Thus, direct taxes, which account for over 55% of total tax collections, are seeing low single-digit growth in tax collections as against double-digit growth estimated in the budget.

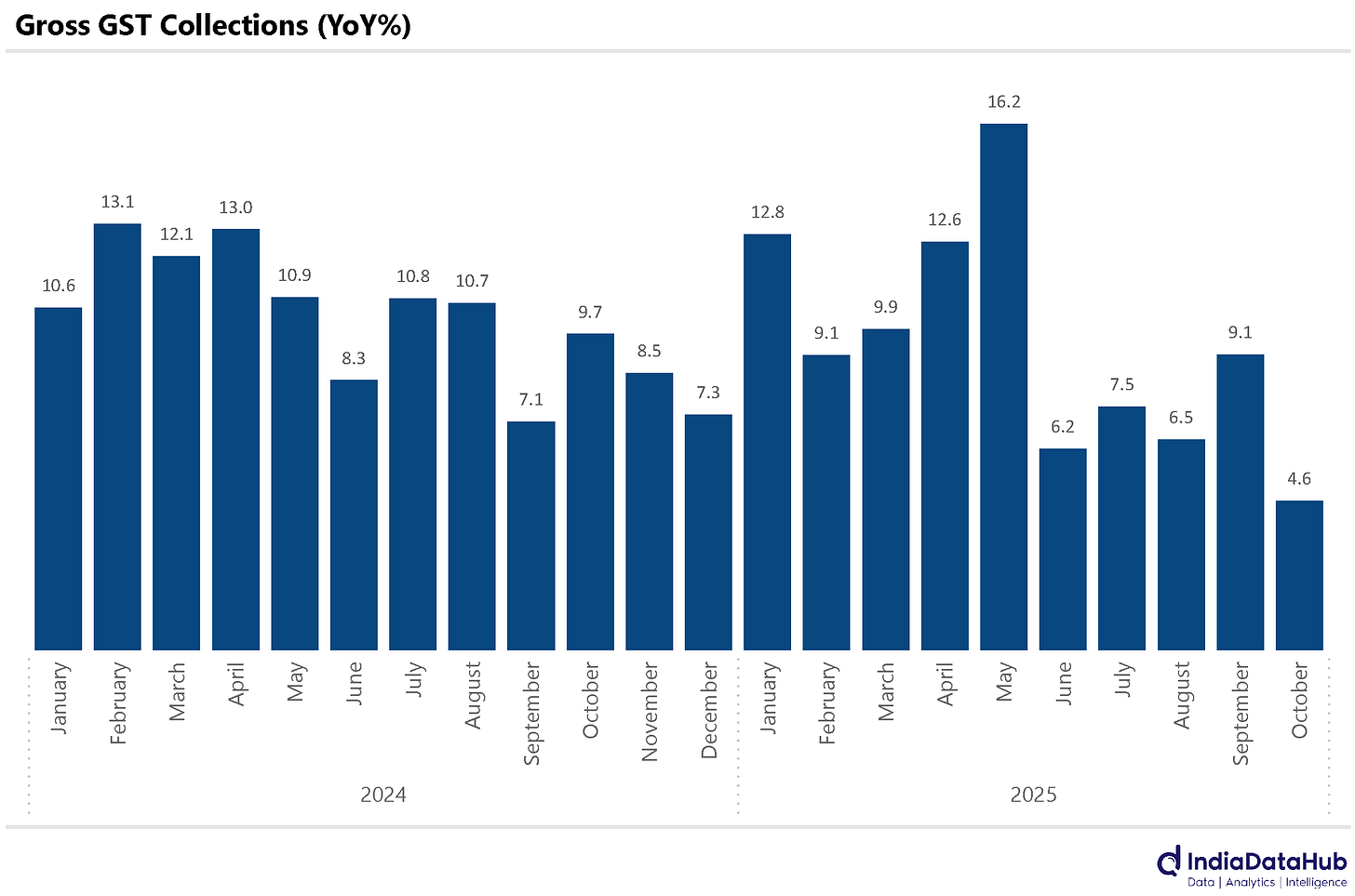

The GST rate cuts will impact indirect tax collections in the second half of this year. In October, the total GST collections grew by just 5% YoY. And the collections in October would reflect the business activity in September, when the GST rate cuts had only seen a partial impact. So, on balance, it appears likely that the central government will face a revenue shortfall this year. The first half of this year has already seen expenditure grow faster than the budget estimate. And if there is a revenue shortfall, it does suggest that there would need to be expenditure cutbacks in the second half of the year. And that will weigh on growth.

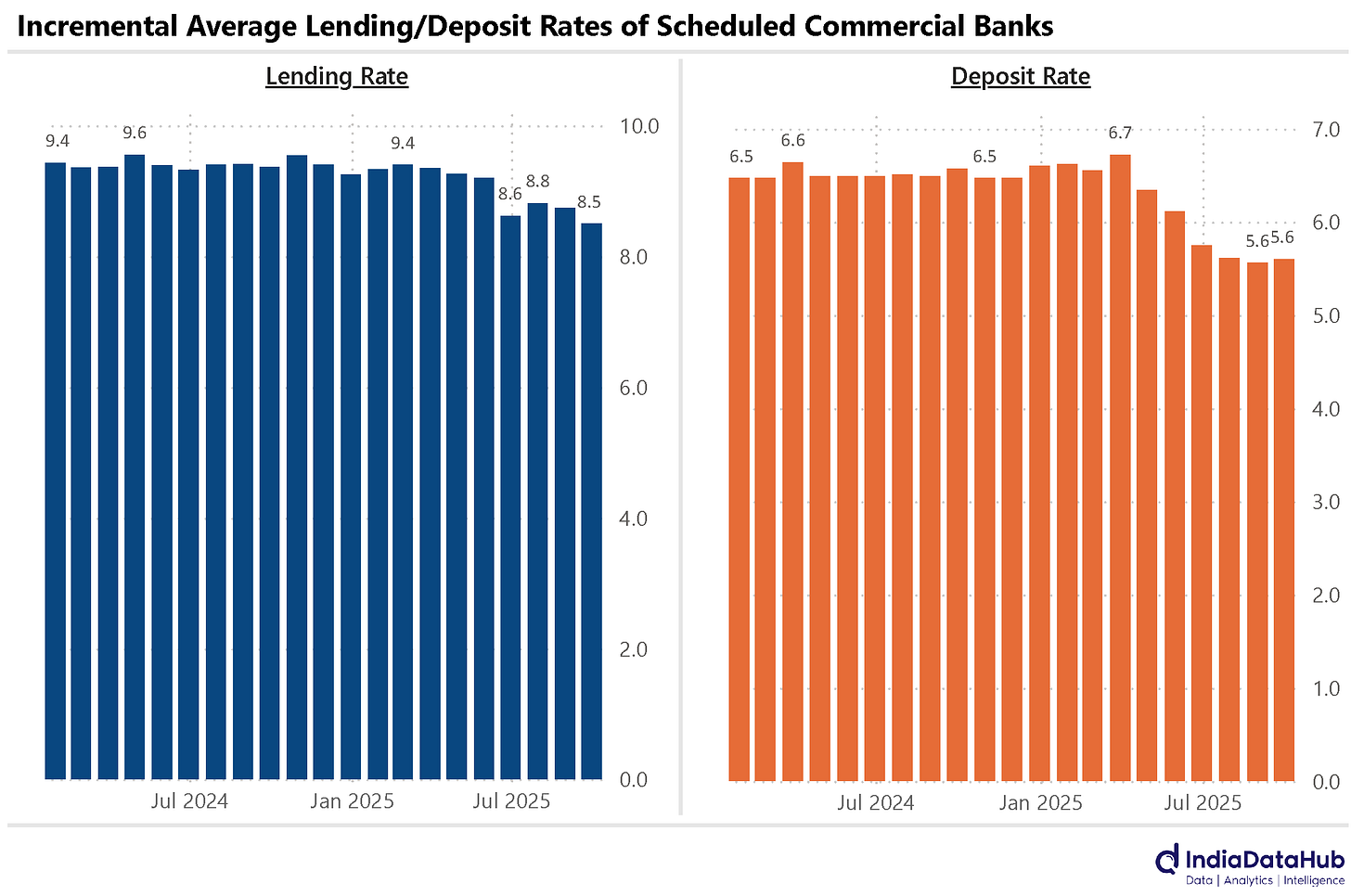

Monetary transmission has gathered pace in recent months. September saw a 25bps decline in the weighted average lending rate on fresh loans by the Scheduled Commercial Banks. Over the past year, the weighted average interest rate on fresh loans has declined by ~100bps, in sync with the reduction in the policy repo rate. Incremental average deposit rates have similarly seen a ~90bps decline over the past year, which is also in sync with the decline in the policy repo rate.

Weighted average interest rate on outstanding loans has also declined by ~60-70bps over the past year. Thus, a fair amount of monetary transmission has already happened, and there is not much left by way of dry powder, if the RBI continues to keep the repo rate unchanged…

After a blip in August, services trade recovered in September. Exports grew by 12.6% YoY, as against a modest 3% growth in August. Imports similarly grew by 8% YoY, as against a 5% decline in August. The faster growth in exports relative to imports meant that the services trade surplus grew by 17% to just under US$19bn, and the second highest on record.

Globally, this week was a busy week, with several key updates from central banks and fresh data on inflation and growth. Starting with central banks, the U.S. Federal Reserve lowered its key policy rate by 25 basis points to a target range of 3.75%–4.00%. The decision reflects slower job growth even as inflation has seen an uptick. Fed Fund futures are signally another rate cut in December followed by a pause in the first quarter of 2026.

The Bank of Canada also cut its overnight rate by 25 basis points to 2.25%, marking its second consecutive rate reduction. Meanwhile, the European Central Bank left all three of its key interest rates unchanged, keeping the deposit facility, main refinancing operations, and marginal lending facility steady at 2.00%, 2.15%, and 2.40% respectively. The Bank of Japan also maintained its uncollateralized overnight call rate at around 0.5%.

On the inflation front, Eurostat’s flash estimates showed that inflation in the Euro Area eased slightly in October. The Harmonised Index of Consumer Prices (HICP) edged down from 2.2% in September to 2.1% in October, with services recording the highest annual inflation rate at 3.4%.

Lastly, Eurostat’s flash estimate for GDP reported that the Euro Area economy grew by 1.3% year-on-year during the September quarter, marking the slowest pace of growth in three quarters. In contrast, South Korea’s real GDP expanded by 1.7% year-on-year during the same period, its fastest increase in five consecutive quarters.

That’s it for this week. The Women in Blue take on South Africa in the ICC Women’s World Cup Final tomorrow. Don’t miss it…