Budget, Income Tax reform by Stealth and US GDP...

This Week In Data #73

In this edition of This Week In Data, we discuss:

The Union Budget for FY25

Income Tax reforms by act of omission

US GDP Growth

Going into the budget, the biggest concern was whether post the general election results, the government’s expenditure priorities will change. Will there be a shift towards ‘populism’ and a consequent increase in the fiscal deficit, or a reduction in the capital expenditure, or an increase in taxes? And the big picture takeaway is that those concerns were unfounded.

The fiscal deficit target for FY25 is 4.9% of GDP, down 20bps from the interim budget. The revenue assumptions are reasonable and if growth remains resilient through the year, there could be some upside for tax revenues. The budgeted capital expenditure for FY25 is unchanged from the interim budget and implies a 17% growth in the current year, as against a modest 6% growth budgeted for the revenue expenditure.

The lower fiscal deficit will mean that the government has budgeted for almost 10% lower borrowings from the market this year compared to both the interim budget as well as the actual borrowings last year. In the context of credit growth continuing to outpace deposit growth, lower take from the government will help the domestic liquidity situation. So at a high level, there is not much to quibble about the budget.

But there is one important silent tax reform that has happened in the last few years that has generally gone unnoticed. And that deserves some discussion.

One of the things everyone keeps lamenting about around the budget is how only a small proportion of people pay income tax in India. And while we can quibble over the exact number of people paying taxes (it is not as low as some of the numbers floating around), the fact is that income tax collections in India are very low. One of the important reasons for this is the relatively high level at which one becomes liable to pay income tax. This is a fairly well-documented issue, and you can read one of the good pieces on this from here. This is not to say other factors are not relevant, but this is certainly one of the important factors.

Now one of the things the current government has done, or rather not done, is keep on increasing the tax exemption limit. The income tax threshold for individuals was last revised 10 years ago (in the post-election budget in 2014) from Rs2 lakhs to Rs2.5 lakhs. And it stands there currently. For the individuals opting for the new tax regime, it stands at Rs3 lakhs. During these 10 years, inflation has averaged 5%. The price level has thus increased by ~65%. While it is politically impossible for a government to reduce the income tax threshold, the next best is to reduce the threshold in ‘real’ terms and that is what has happened over the past decade.

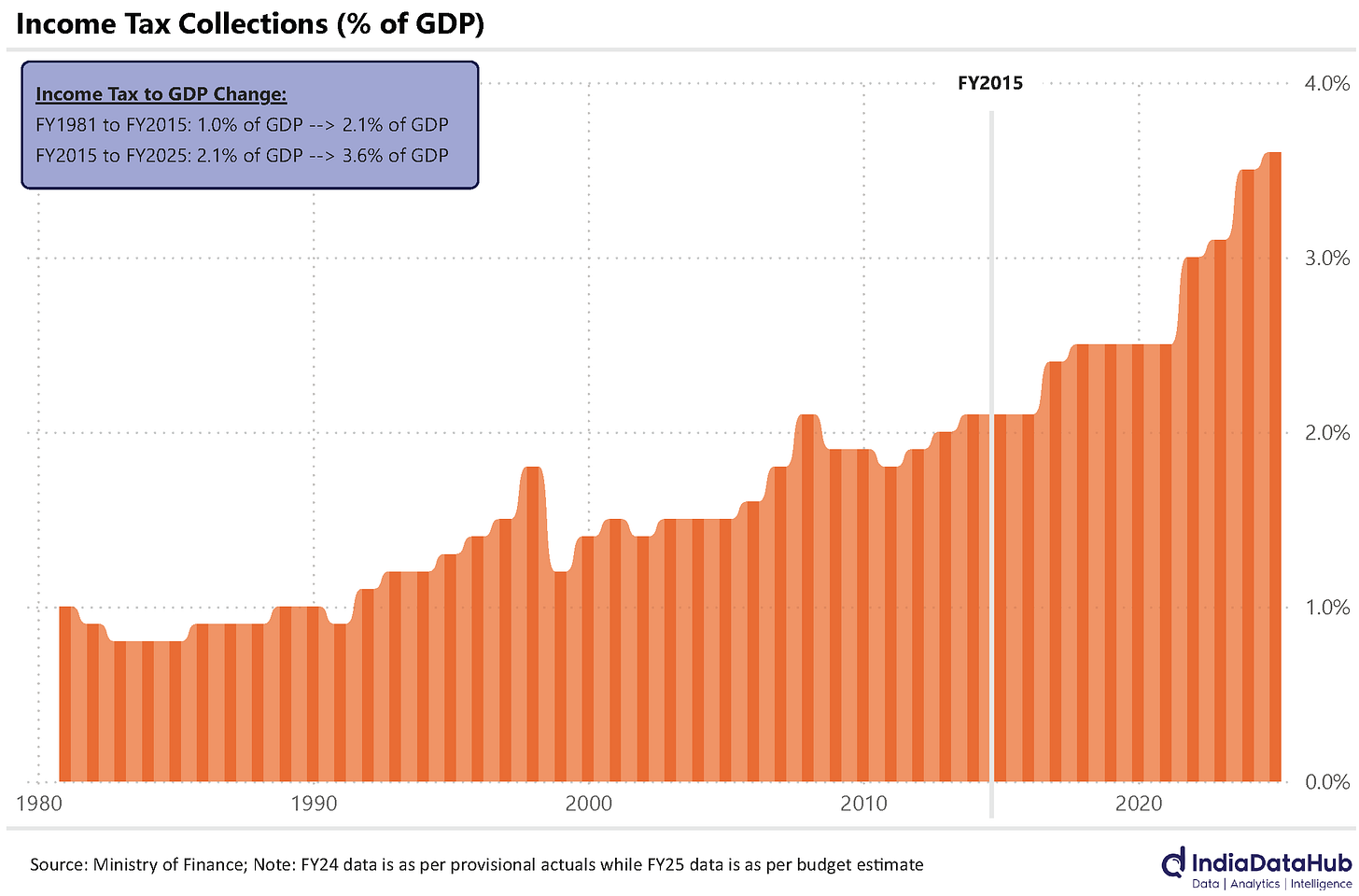

And the past decade has also seen very strong tax buoyancy on the personal tax front. In FY25 as per the budget estimate (which is conservative), income tax collections will total 3.6% of GDP. This is 1.6ppt higher than what the level was a decade back in FY15. For reference, in the preceding almost 35 years, the income tax to GDP ratio had increased by just 1ppt. Income tax collections are now 15% more than corporate tax collections – in FY15 they were 40% lower than corporate tax collections. This is the highest in the last few decades (excluding FY98 where income tax collections were unduly high due to the Voluntary Disclosure of Income Tax scheme).

The number of taxpayers has increased – in FY22 just under 9 crore individuals either filed income tax returns or paid tax through TDS (but did not file their tax returns). This was an increase of 25% in the preceding 5-year period. Safe to assume that the number this year would have been above 10 crores. Effectively over 10% of India’s adult population or 15% of the workforce is filing tax returns or paying taxes without filing their tax return.

One of the best pieces of direct tax reforms in the last 10 years then perversely has been an act of omission – the omission to increase the income tax exemption limit.

Otherwise, this was a fairly data-light week, both domestically as well as globally, barring the US GDP release. The US Bureau of Economic Analysis released its first advance estimate of US GDP for the second quarter of 2024. Real GDP increased at an annual rate of 2.8% in 2QCY24 as compared to a 1.4% growth in the previous quarter. The 2.8% growth is also well above the average growth of the last few quarters. Effectively, the US economy continues to hum along fine this late into the cycle.

That’s it for this week. Have a good weekend folks…