Budget Review, Auto sales, FX Reserves and more...

This Week In Data #4

In this edition of This Week in Data, we cover:

Review of the Union Budget and the big Capex push

First look at high frequency data for Jan - Auto sales and GST collections

Rising FX Reserves

Fed and RBI rate decision.

1) We received some love from the Anchor Spotlight contest last week when our DataSpot podcast was ranked 7th in its category in their December contest. We did 8 episodes of our podcast which you can check out from here. We have taken a break to brew some fresh episodes. (Did we hear someone say that it would be good to make it more visual? We heard you, that is exactly the concoction we are brewing.

2) We published our Data Book - State of India few months ago. We have the last few print copies left and you can now get them for an even lower price of ₹500. Get it from Amazon or IndiaDataHub website. We will start work on the third book in our Data Book series of publications (a trilogy, yay!) later this month. Why, you thought only superhero movies can have trilogy and tetralogy and so on?The biggest event of the week was of course the budget. So let us start with it. In one line, the budget presented by the FM was both conservative and pragmatic. Leading up to the elections next year (and some big state elections later in the year), it would have been easy to present a very populist budget or to go on a spending binge. But as we discussed in this newsletter last week, either option would have been unwise. And the FM rightfully avoided this impulse. And full credit to the government.

There are two things we look at when we try and analyse the budget: the fiscal math and the expenditure quality. And on both counts the budget delivers. Or attempts to deliver.

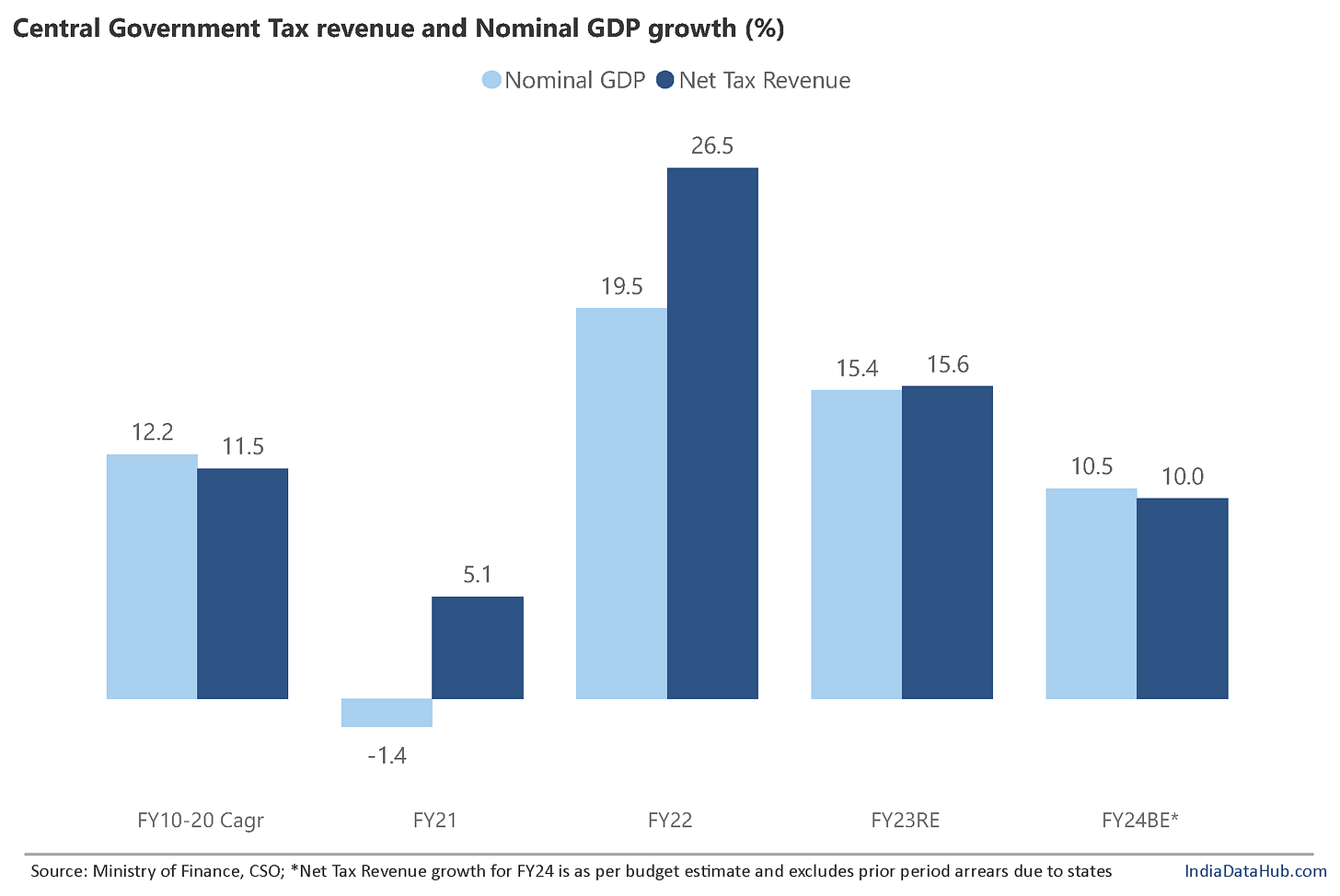

One of the first things we look at when we analyse the budget is the credibility of the fiscal math. The government makes assumptions for revenue growth, and expenditure growth and then projects a fiscal deficit number. But this year the fiscal math seems broadly credible. The budget estimate is for a 12% growth in tax revenues (10% after adjusting one-off arrears due to states) as against a nominal GDP growth assumption of 10.5%. Both numbers are broadly in the ballpark of what we would expect. There is a chance that GDP growth could be slightly lower, but that’s a minor quibble.

The second thing we look at in the budget is the quality of expenditure. One of the problems with the Central government’s finances is the domination of revenue expenditure. In FY22 for instance 85% of the expenditure was revenue expenditure. But in FY23 as per the revised estimates, this has changed slightly for the better and the government intends to continue down this path in FY24. As per the budget estimates, 78% of the expenditure is expected to be revenue expenditure. The share of capital expenditure is thus budgeted to increase from 15% in FY22 to 22% in FY24.

So, what is the catch? The biggest catch is that the expenditure plan is just a statement of intent. It is far from certain that this will materialise. As noble as the government’s intentions may be, there is no certainty that this will materialise. In the current year (FY23) for instance, despite tax revenues being higher than budgeted, the revised estimate for the capital expenditure is lower than the budget estimate.

There are basically two things that will decide whether the big capex push in the budget will materialise:

The most important question is whether the government be able to raise as much resources as it has budgeted. This boils down largely to what happens to economic growth and inflation (which will determine nominal growth). In the short run, both things are beyond the control of the government. As things stand now, a 10% nominal GDP growth and a 12% growth in tax revenues (10% after a one-time adjustment towards arrears to states), seem reasonable. But the actual growth will depend on how economic growth shapes up over the next few quarters.

The other important factor on which the higher capital expenditure rests is the ability to contain revenue expenditure to just 1% growth. This rests on several assumptions, one being that the government will be able to cut subsidy expenditures. This will depend on how commodity prices behave and this again is not something in Government’s control. Similarly, for example, the expenditure on NREGA is budgeted to decline by almost a third in FY24. This once again will depend on economic growth through the year – if growth slows, demand for NREGA will increase and so will the expenditure.

The bottom line is that the capex push in the budget is to a large extent dependent on economic growth. A sharp slowdown in growth will bring the overall budget math into question and the first casualty of it almost invariably tends to be the capital expenditure.

What else happened last week? We got the first look at the January data and it is a mixed bag. We discussed in our State of Economy report last week and our Payments Tracker report this week that some of the high frequency data for December has turned soft. So, assessing whether the December data was a blip or start of a downturn is important. Car sales growth accelerated in January to over 20% YoY, from 7.5% in December. 2W sales grew 10% YoY in January after a decline in December. GST collections grew 11% in January as against 16% in December. More data will become available in the current week and that will give us a better hold of how the economy is shaping up at the start of 2023.

Another small but incrementally positive change is the build-up in FX reserves. FX reserves rose by US$3bn in the last week of January to touch US$575bn. This is on top of a US$12bn increase in the preceding two weeks. Reserves are still US$65bn lower than the peak in September 2021, but they have risen by US$50bn in the last three months. This is being driven by a sequential moderation in the trade deficit and relatively healthy capital flows.

The US Fed raised the Fed Funds target rate by 25bps earlier this week and suggested that it was not yet done with its rate hikes. And the Non-Farm Payrolls data in the US (a key labour market indicator) came in especially strong yesterday and that suggests continued strong economic growth. So, the US interest rates are likely to continue to rise for some time.

The action now shifts to the RBI next week. The focus shifts to the RBI next week. The expectation is for a 25bps rate hike and along with it for the RBI to signal a pause in the rate tightening cycle. Let us see if the monetary policy plays out as per expectation.

That’s it for this week. Lots to cover next week. See you then…