Falling reserves, Impossible Trinity, Declining mobile users and more...

This Week In Data #102

In this edition of This Week In Data, we discuss:

Record decline in FX reserves in the latest week

RBI faces the impossible trinity

Continued fall in wireless operators

Fixed line subscriber base continues to rise

Unchanged interest rates in China

Falling CPI and Interest rates in South Africa

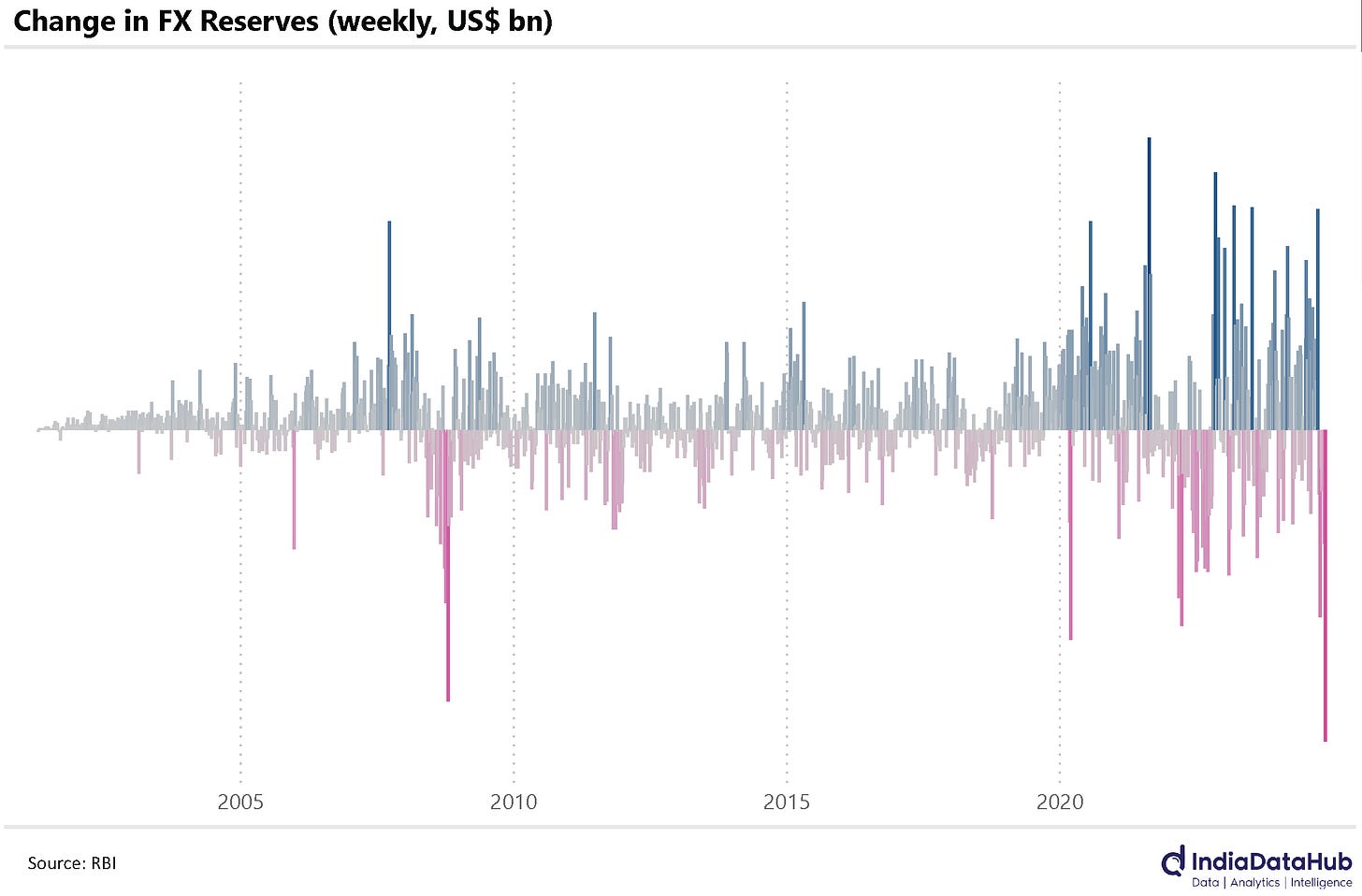

First off FX reserves. FX Reserves declined by US$18bn during the week ending 15th November. This is the highest weekly decline in reserves ever (with the data starting from April 2001). More importantly, this is the 7th consecutive week of decline in FX reserves. Cumulatively in the past 7 weeks, FX reserves have declined by almost US$50bn or just under 7%. The last time reserves declined by this magnitude was in the last quarter of 2008 when the entire financial world was falling apart. Even during the taper tantrum in 2013, reserves did not see this magnitude of decline.

And this is the thing. In both 2008 and 2013, the (financial) world was falling apart, figuratively speaking. However, that is not the case today. The decline in reserves is down to India-specific factors. Two specific factors. One is the outsized FPI selling but second and more importantly, the changed RBI’s reaction function.

Historically, the RBI was willing to allow the rupee to depreciate, it only cared about the depreciation being orderly and in sync with global trends. However, in the recent few weeks, the RBI has been aggressively defending the rupee (and hence the decline in FX reserves) so much so that the rupee is outperforming most EM currencies. Previously, the RBI would have been comfortable to let the rupee fall and appreciate back up when the flows reversed. Unrestricted capital flows, floating exchange rates and independent monetary policy form the impossible trinity. A sharp depreciation in the currency would be inflationary warranting a tighter monetary policy. The RBI does not want to give up control of monetary policy this way, especially at this stage of the business cycle. And it cannot restrict capital flows. And so by default, it needs to manage the exchange rate. So that is what we are seeing.

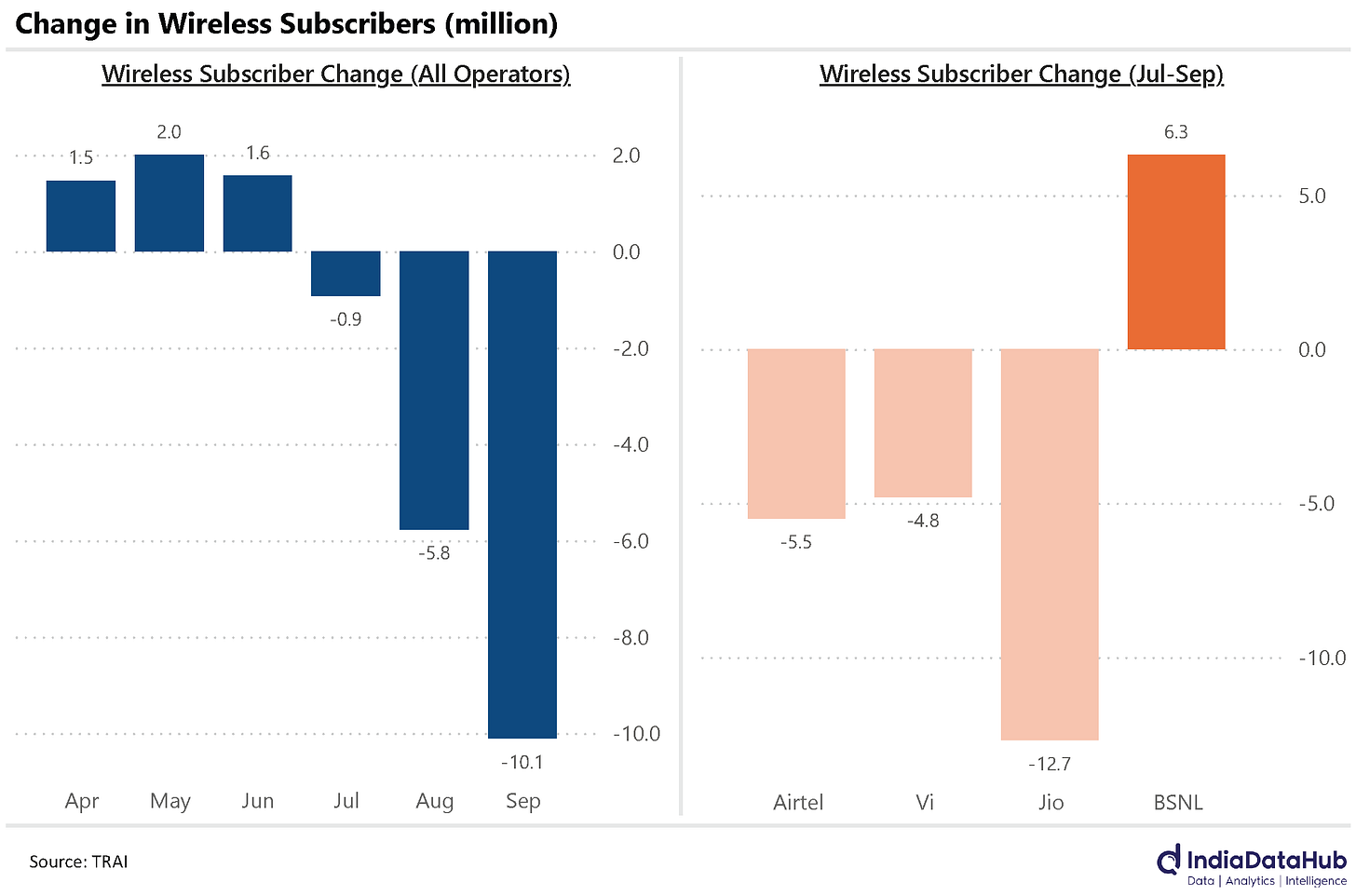

For the third consecutive month, the wireless telecom operators continue to see churn in the subscriber base. In September the wireless operators in total lost 10 million subscribers on top of an almost 6 million loss in August. This is the highest monthly subscriber loss since December 2021. Interestingly, the fall in subscriber base is pretty much across the board. Except Himachal Pradesh, every other region has seen a decline in subscriber base with Maharashtra, UP and Rajasthan seeing the biggest decline at over 2 million each in the last 3 months.

Both Airtel and Vi lost ~1.5 million subscribers but Jio lost almost 8 million subscribers in September. BSNL gained subscribers for the third straight month – in September it gained 800k subscribers. As we have discussed before, this dislocation in the market most likely reflects the price hikes taken by the private operators in July. But this magnitude of dislocation suggests that there were a whole lot of price-sensitive subscribers – BSNL has gained over 6 million subscribers in the last 3 months from other operators!

Meanwhile, fixed-line operators continue to see subscriber growth. September saw 700k subscriber additions, the highest since January. And in just the last 4 years, the fixed-line subscriber base has increased by over 80%. BSNL continues to lose market share while the private operators especially Jio continue to gain market subscribers. In just the last 6 months, Jio’s market share in fixed line subscriber base has increased by 5ppt!

Globally, this week saw several central bank meetings. PBOC kept its policy rate unchanged in China. With growth stuttering and inflation below 1%, one might have expected the PBOC to cut rates, but it has kept the 1-year Loan Prime Rate unchanged at 3.1%.

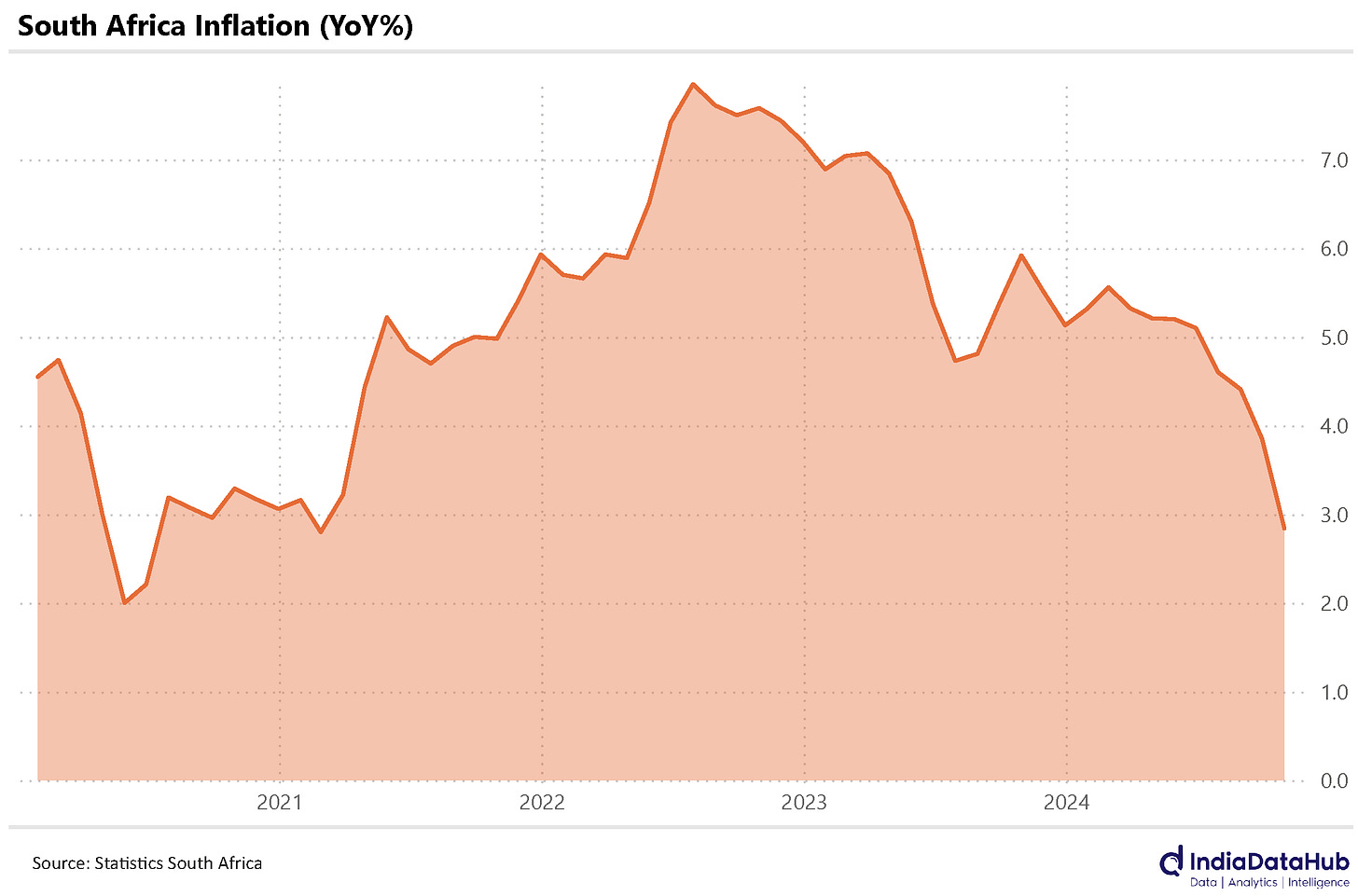

Inflation eased by 100bps to 2.8% YoY in South Africa. This is the lowest print since June 2020. And not surprisingly then, the South African Reserve Bank lowered its policy rate by 25bps to 7.75%. The Central Bank of Indonesia and Turkey also kept rates unchanged last week.

That’s it for this week. In addition to lots of data, next week also sees the start of the World Chess Championship in Singapore where India’s D Gukesh takes on China’s Ding Liren. Games start at 2.30 pm India time and the good folks at ChessBase India will bring you live coverage. Don’t miss it…

Maybe simplify some complex parts of this?

Great write up!