Wireless surprise, Jio galloping ahead, Exports decline, US Rates...

This Week In Data #81

In case you missed, the last couple of weeks we have had significant data releases. Firstly, we have released state budgets. A curated dataset that significantly enhances the timely understanding of public finances in India. And this week we released corporate fundamentals and aggregates as we continue to build this data set. Built from the ground up, this significantly enhances the understanding of corporate performance, at the level of individual company to sector to the overall corporate sector.In this edition of This Week In Data, we discuss:

Private telecom operators see sharp decline in wireless subscribers in July. a majority of whom shift to BSNL

In the wireline telecom sector, Jio continues to gallop ahead and its market share in subscribers is now higher than Airtel, Vi and Tata put together

India’s exports decline for the second consecutive month while imports continue to rise. Consequently, the trade deficit widens to second highest on record

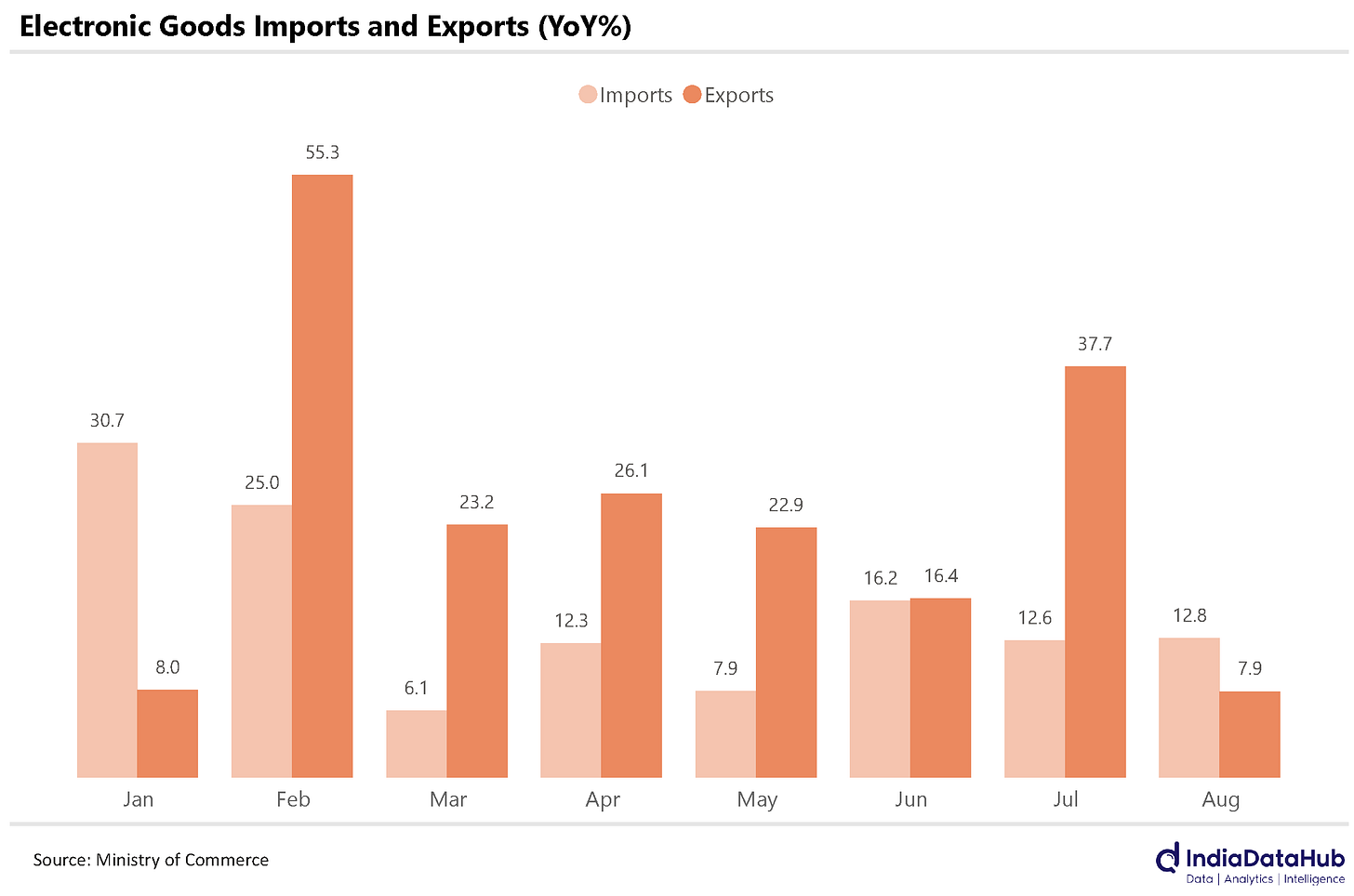

Electronic imports rise faster than exports for only the second time this year

The US Fed cuts US interest rates by 50bps with more aggressive easing being expected by the markets

We discuss whether the RBI will follow suit and whether this make Indian debt securities more attractive to foreigners

Something interesting happened in the telecom sector in July. The wireless operators lost almost 1 million subscribers during the month. And, surprisingly, the entire loss was with the private operators – Airtel lost 1.7 million subscribers, Vi lost 1.4 million subscribers and Jio lost 800k subscribers. For Vi it was a 0.7% loss in its subscriber base, for Airtel this was a 0.4% reduction in its subscriber base and for Jio it was a 0.2% loss in its subscriber base. For Jio this is the first month of subscriber decline since February 2022 and for Airtel the first decline since October 2021. And, more importantly, the loss of these operators was BSNL’s gain. BSNL gained almost 3 million subscribers. BSNL’s subscriber base increased by almost 3.5% in a single month!

Most of this gain and loss is due to people porting out from the private operators to BSNL – the number of porting requests in July was 2 million more than the average in the preceding 6 months! The wireless operators have increased prices recently and media reports suggest that BSNL has not followed suit. If so, these would be the most price-sensitive customers either discontinuing their services or porting out to BSNL. Not surprisingly then the entire decline in subscriber base was from rural areas. Urban areas saw an increase in subscriber base by 500k.

On the fixed line space though there is no such surprise. If anything, the pace at which Jio is growing is a surprise. Over the past year, Jio has added 3.5 million subscribers on a net basis. This is twice the number of subscribers added by Airtel, Vi and Tata combined! Airtel itself has added ‘only’ 1.5 million subscribers during this period. Jio’s subscriber base has increased 35% YoY and its share in the fixed line telecom subscribers is approaching 40% now – this is almost 4ppt more than Airtel, Vi and Tata combined.

India’s merchandise exports declined for the second consecutive month in August. In July exports had declined by 1.7% YoY while in August they declined by 9.3% YoY. Imports meanwhile continued to grow – they grew 3.3% YoY in August – and hence the trade balance widened sharply to US$30bn, the second highest ever on record – the highest being in October last year at just over US$30bn.

The decline in exports was largely due to the Petroleum sector. Petroleum product exports declined almost 40% YoY and excluding this, exports were largely flat on a YoY basis. Another (small) disconcerting thing in the data was that imports of electronic goods rose faster than exports. This is the first time in the last several months that this has happened.

One possible conjecture for this is that this is just the lead and lag in supply chains playing out, especially for Apple where production would have ramped up sharply in August (resulting in imports of components) for the new iPhones launched to be launched in September (resulting in dispatches picking up in September). We shall see in next month’s data if this conjecture plays out.

Lastly, the US Fed reduced the policy rate by 50bps. This is the first-rate cut from the Fed since 2020. More importantly, the markets are now assigning a 50% probability of another 50bps rate cut from the Fed in November when the Fed meets next. The US 3-month treasury bill yield at 4.75% is already below the effective fed funds rate at 4.83%.

So what does it mean for India? Firstly, the US interest rate cut does not ipso facto mean that the RBI will also start cutting rates. As we discussed last week, the sequential inflation trajectory in India and the US is different. Equally, the growth trajectories are different – while there is growing talk of recession in the US, growth remains robust in India, and in certain segments like unsecured personal loans, it is discomfortingly high. Of course, if there is a deep global recession, India will not remain unscathed. But for now, the domestic, growth-inflation dynamic does not warrant the RBI to aggressively follow the US Fed.

Secondly, the widening interest rate differentials make Indian assets (and specifically fixed-income ones) more attractive to foreign investors. And it will also make it attractive for Indian corporates to borrow from aboard. For reference, back in May for example the difference between 1yr Indian GSec yield and US GSec yield was 1.8ppt. As of yesterday, it has widened to 2.7ppt. So, potentially more capital flows into India. This is especially true if the rupee is expected to remain stable.

And in the short-run capital flows are reflexive - more capital flows into India will mean upward pressure on the rupee and as the interest rate gap widens, it will attract even more flows. But at some point, the fundamentals will catch up. So, the sustainability of these flows will depend to a large extent on domestic fundamentals - growth, inflation, trade deficit etc.

That’s it for this week. See you next week!