GDP growth, Strong tax collections, Rising reserves and more...

This Week In Data #48

In this edition of This Week In Data, we cover:

CSO’s first advance estimate of GDP for FY24

Continued strong growth in direct tax collections

Rising FX reserves

Uptick in Euro area inflation

Mixed US non-farm payroll data

After a short break to ring in the new year, we resume normal operations of this newsletter. And we start operations for 2024 on a positive note. The extreme foggy weather, especially in north India, notwithstanding, the data flow has generally been positive!

The CSO released its first advance estimate of GDP for FY24. As per it, India’s GDP is likely to grow by 7.3% YoY in FY24 in real terms. Now this is an advance estimate and subject to several revisions, including once next month when the CSO releases the second advance estimate. But there are two noteworthy things about yesterday’s GDP release.

The first is that as per these advance estimates, GDP growth is likely to have accelerated (ever so slightly) in FY24 compared to FY23. In FY23, as per the latest estimate, GDP growth was 7.2%. All through the year, the overwhelming belief was that given the interest rate hikes from the RBI in FY23, its impact on growth will be visible in FY24 in terms of slower growth. The consensus estimate has moved up through the year but as late as November, the estimate was for GDP to grow at 6.4% in the current year. The CSO’s estimate yesterday is almost 100bps higher than that. So if the CSO’s yesterday’s estimate holds through the several rounds of revisions as more data becomes available, then it will be quite a remarkable achievement. For reference, CSO’s advance estimate last year was for FY23 GDP growth of 7% and its current estimate is for FY23 GDP growth of 7.2% (so higher than the advance estimate). So, there is a fair probability that these advance estimates might hold.

The other noteworthy thing about yesterday’s release was the sharp slowdown in nominal GDP. Nominal GDP growth for FY24 is estimated at just under 9% down from 16% growth in FY23. Outside of the pandemic period, this is the slowest growth in nominal GDP since FY03! If one were to ever need an example of why real growth matters and why nominal growth is an illusion, FY24 is one such year! Not surprisingly then, most nominal macro variables have seen a slowdown in sync with this. The one big exception has been tax collections and specifically, direct tax collections where growth has accelerated this year.

November was another strong month for direct tax collections. Overall gross tax collections of the Central government grew 21% YoY driven by an almost doubling of the corporate tax collections.

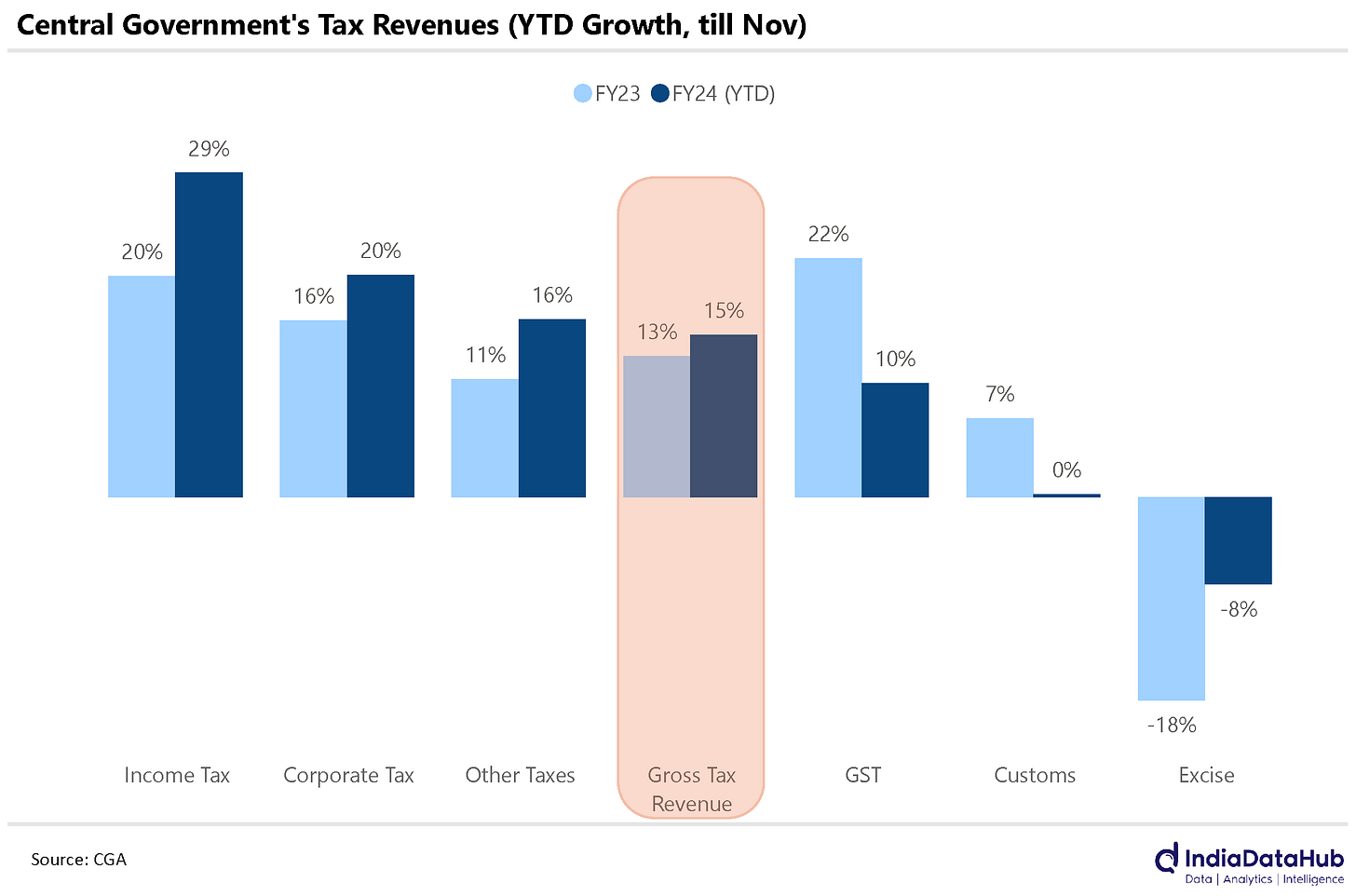

YTD, the Central Government’s gross tax collections have grown by 15% YoY, higher than the 13% growth in the full year FY23. This has been driven by 20% growth in corporate tax collections and almost 30% growth in personal income tax collections. Growth in both corporate and personal income tax collections in FY24 is running higher than in FY23. Clearly, there is strong income growth for both corporates and individuals!

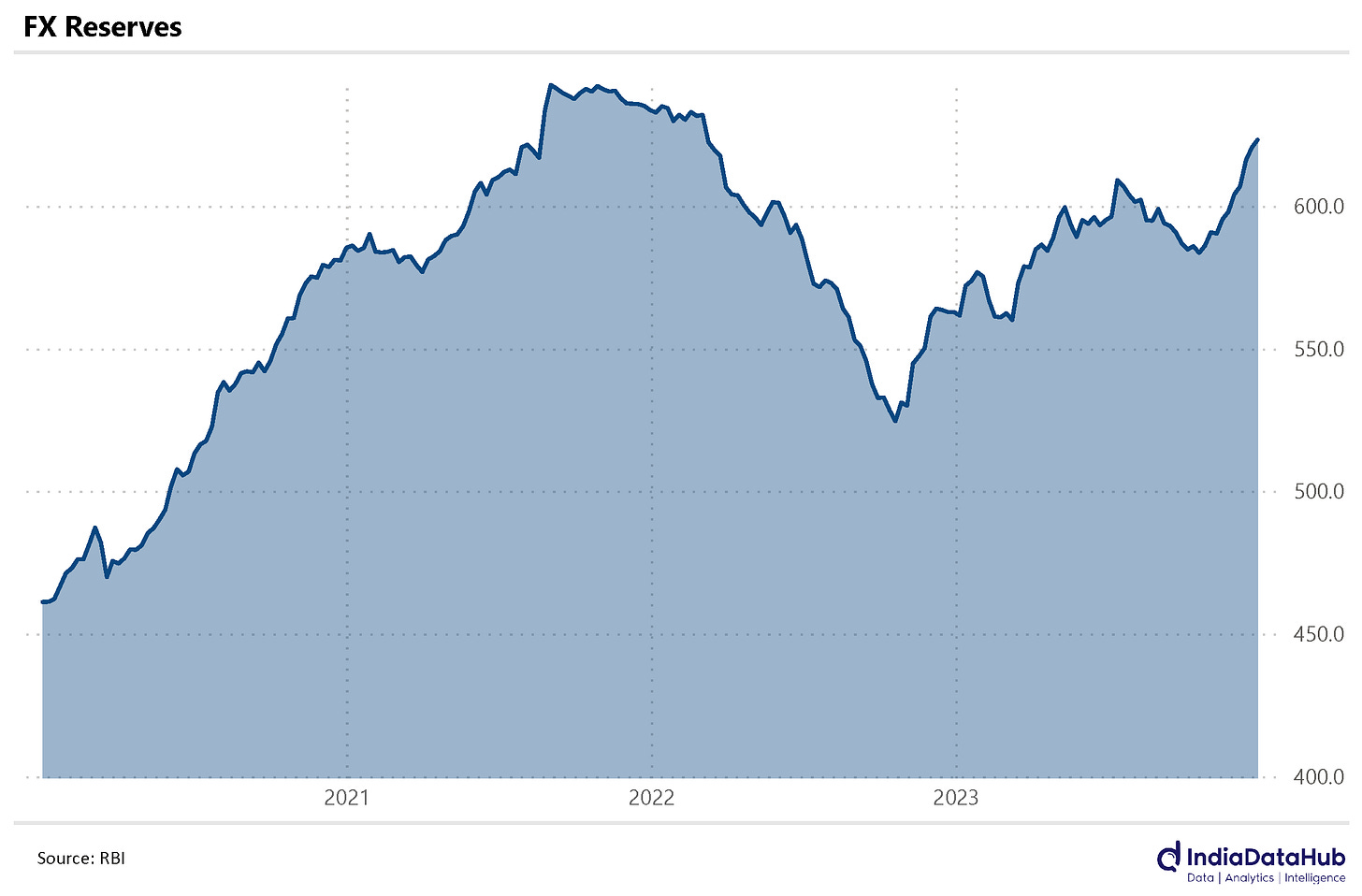

FX Reserves have seen a sharp increase in recent weeks. In the last two and half months, they have increased by a cumulative of US$40bn. As of 29th December, India’s FX reserves stood at US$623bn, the highest since March 2022.

And while they are still below the all-time high of US$642bn reached in September 2021, given the momentum in FPI flows, reserves could cross their all-time high during the current quarter. However even at the current level FX reserves still cover almost 11 months of merchandise imports and over 90% of external debt. Reserve coverage is thus comfortable.

Shifting gears to the rest of the world, the Euro area saw an uptick in Inflation in December. As per the flash estimate, Euro area CPI rose to 2.9% YoY in December, up 50bps from November. While energy prices are in negative territory, Food prices increased by almost 7% YoY and services inflation rose 4% YoY. And Turkey's Inflation increased steeply from 62% in November to 77% in December. Ouch!

The US saw stronger-than-expected non-farm payroll data. Payrolls increased by a higher-than-expected 216k in December and the unemployment rate remained steady at 3.7%. The strong ger payroll for December was though offset by a downward revision to payroll for both October and November by a cumulative 60k. And from a slightly longer-term perspective also, job creation is clearly slowing. In CY23 for instance, the net payroll addition was 2.7m as against 4.8m in CY22. So the job market is slowing. Consequently, the market continues to expect that March will see the first rate cut from the Fed.

That’s it for this week. We will do a roundup of the recent high frequency data releases next week. So long…