Inflation, Industrial Production, Mutual fund flows and more

This Week In Data #1

In a way, we're all economic animals. Our daily lives are inextricably linked to the state of the economy. What happens in the economy affects everything from how much we get paid to the interest rate on your EMIs. But most of us have little understanding of how the Indian economy operates. This is partly because economists and commentators make even the simplest things complicated. After all, their jobs depend on looking smart. It's a weird irony that we live in a world where simplifying things is considered bad and complicating stuff is a sign of intelligence.

We'd partnered with IndiaDataHub through Rainmatter when we saw the amazing work Ashutosh and his team were doing to make economic data accessible and understandable. Through all our educational initiatives, we've tried to simplify money and markets for years. With this newsletter, the goal is to do the same for economic topics. Every week, we'll analyze and simplify the key economic developments so that you can show off in front of your friends and colleagues.

With that, here's the first issue of the newsletter.

CPI inflation moderated further in December 2022 by ~20bps. At 5.7% YoY, CPI is below the 6% threshold for the third consecutive month and is the lowest since December 2021. However, as has been the case in the previous two months, the decline in inflation has not been broad-based. Food inflation is single-handedly contributing to this decline. Non-food inflation has ticked up during this period. Thus, there continues to remain a question mark over the sustainability or durability of this decline in inflation given that food inflation tends to be volatile.

The MPC is currently split 4-2 between the hawks and the doves. However, the fact that the forward guidance in the December policy did not change (see below for the exact text) despite this split implies that at least one more rate hike is likely unless the data changes materially.

“The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.”

Since the December policy meeting, while inflation has moderated the decline is almost entirely due to the fall in food and specifically vegetable prices. Equally, the growth data has remained strong. The big event that is still outstanding is the Budget. Given that the upcoming budget will be the last before the general elections in 2024 means that the budget could be expansionary. Thus, on balance, a further rate hike of 25bps in February looks more likely than not. But post this rate hike, the MPC is likely to be data dependent, and this should reflect in the changed forward guidance in the next meeting.

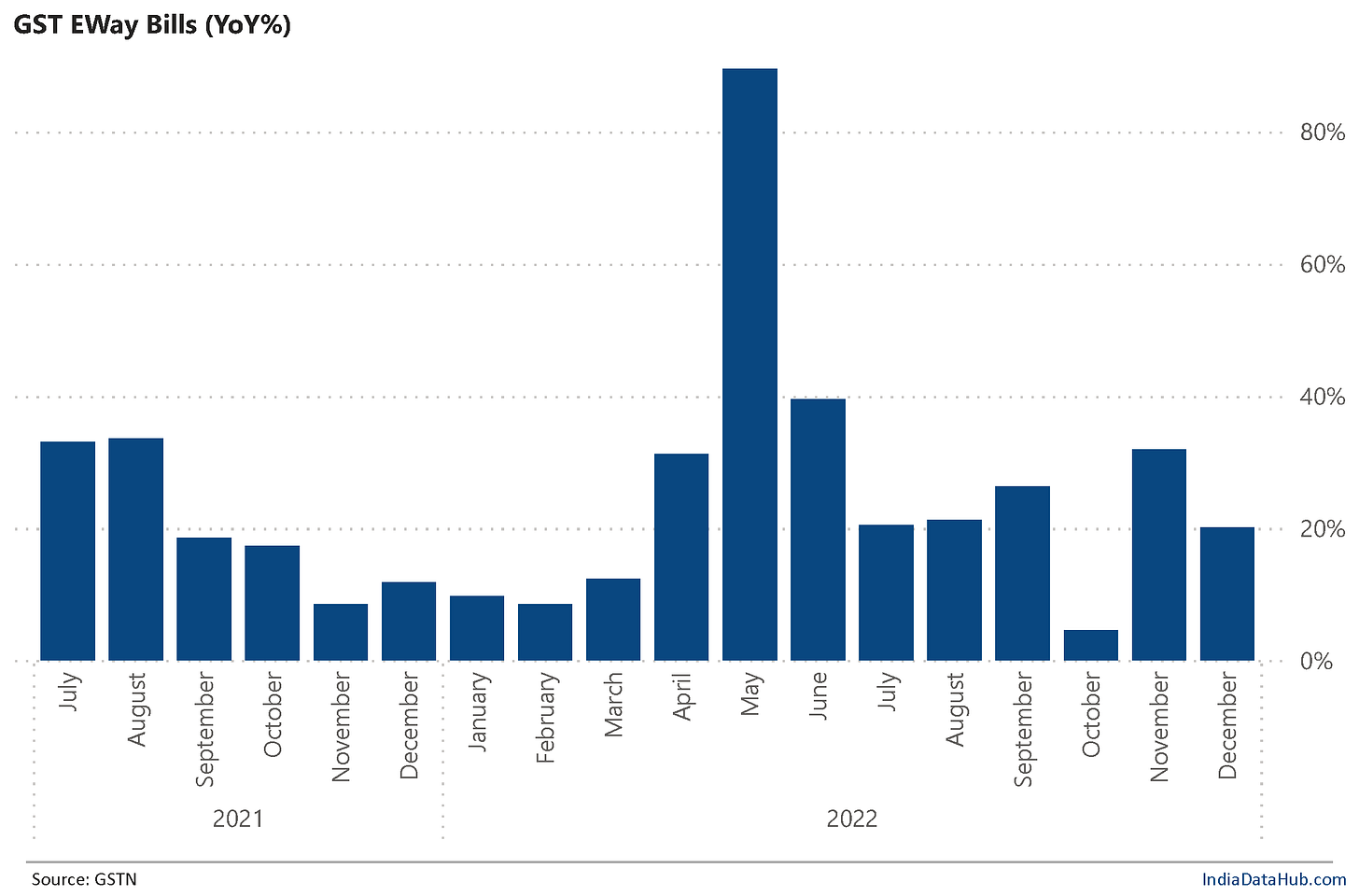

We got further evidence of reasonably strong economic data this week. Industrial production expanded 7% YoY in November after a decline in October. However, both the decline in October and the expansion in November are overstated due to the mismatch in the timing of Diwali this year relative to the last year. But the GST Eway bills grew 20% YoY in December and this was higher than the growth in the preceding two months (taken together to smoothen out the Diwali timing effect). And consumption of petroleum products grew 7% YoY in December. Rural wage growth also continues to see an uptick. In November wages grew almost 6.5% YoY up from 5% growth in September.

Bank Credit growth moderated sharply (~2.5ppt) on a YoY basis during the fortnight ending December 30th. This is most likely the quarter-end effect since the corresponding fortnight in the year-ago period was as of 31st December. And the last day of a quarter typically sees a spike in disbursals. Sequentially bank credit rose 1% during the fortnight. So not much to read in the decline in the credit growth in the last fortnight, unless credit growth does NOT tick back up in the current fortnight.

Inflows into domestic equity funds recovered to ₹73bn in December from ₹22bn in November. The larger picture though remains that equity inflows have moderated. In the last six months, inflows in equity funds have averaged ₹80bn a month. This is sharply lower than the average monthly inflows of ₹160bn in the preceding 12 months.

What however has remained unabated is the momentum behind SIP flows. SIP Inflows rose to ₹136bn in December 2022, 20% higher than in December 2021. SIP accounts in December 2022 were almost 25% higher than in December 2021. As of December 2022, there were 61m SIP accounts, this is over 40% of the total mutual fund folios with the MF industry. It looks like a majority of new MF accounts are being opened through the SIP route rather than through the lump sum route.

That’s it for this week! Next week will be relatively data-light, but we will get the first look at December trade data. While exports are struggling, growth in imports has been slowing down and thus the trade deficit has been moderating sequentially. We shall see if this trend has continued in December.

Check out IndiaDataHub and follow @IndiaDataHub on Twitter.

Thanks for an informative writeup. Some suggestions - 1. Request to elaborate when you use shortforms first time. It was difficult to understand MPC when it first appeared in writeup as there was no full form mentioned. 2. The transition between section was difficult to follow in long writeup. Will be good to give headings or highlight key points.

Hi folks. First of all, great initiative.

I am an illiterate when it comes to economics etc so i still found this to be at a level where it was difficult to understand.

Eg CPI and MPC is an alien concept.

This looks already simplified, but if you could further simplify it would be great. Ofcourse, it is just a thought and i thank you for the article again.