Monetary Policy, Bond Yields, Record renewable power share and more...

This Week In Data #75

In this edition of This Week In Data, we discuss:

Monetary Policy Review

Financial Risks flagged by RBI Governor

Auto sales recover in July

Power generation moderates in July

Record high FX Reserves

Surplus Liquidity and decline in bond yields

China inflation ticks up but trade surplus moderates

Turkey CPI finally moderates

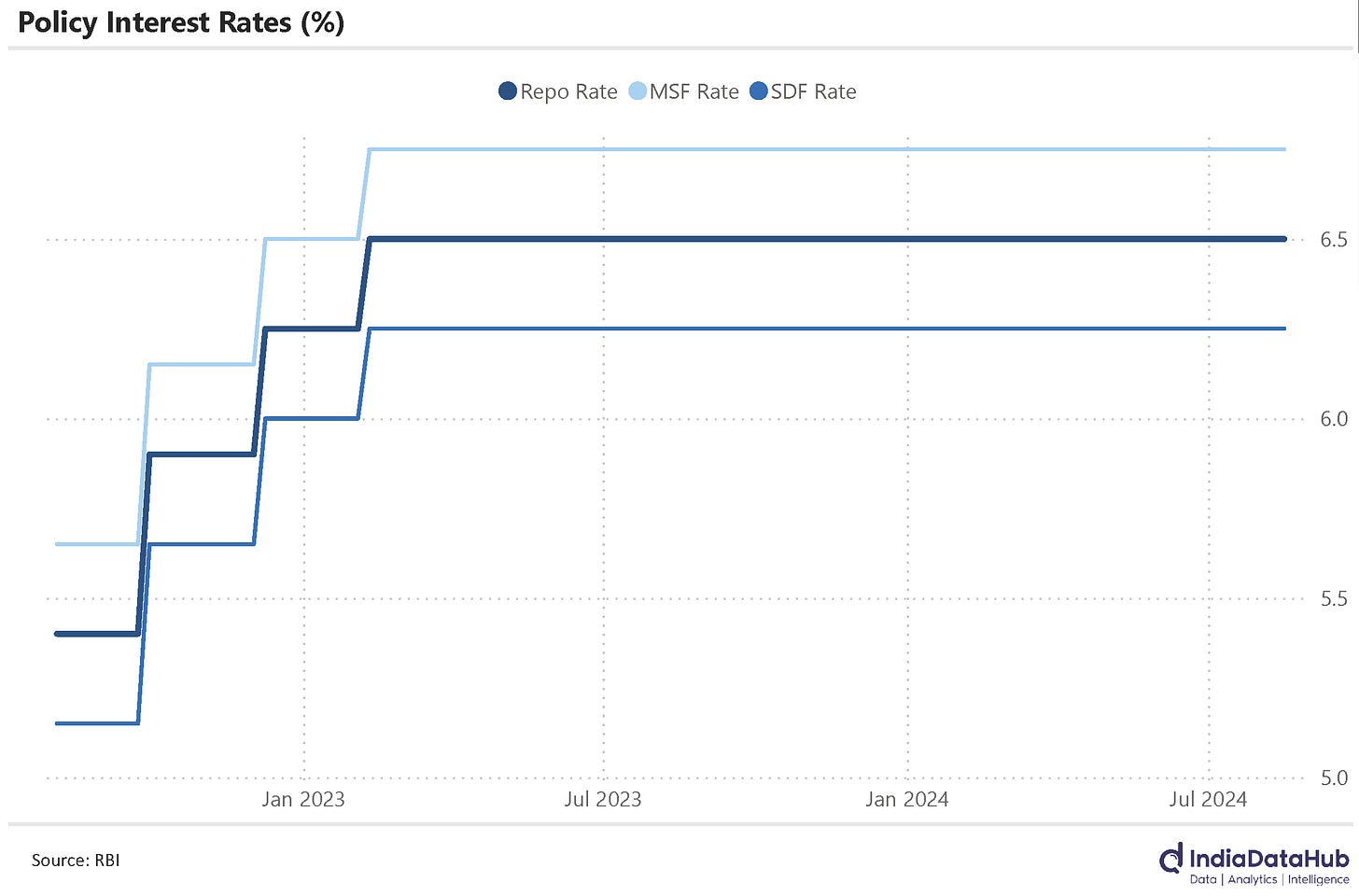

As expected, the Monetary Policy Committee (MPC) kept the policy interest rate unchanged at its meeting this week. And once again, this was a 4-2 split vote with the same two members who dissented in June, dissenting this time around as well. The policy rates have now remained since February last year. The policy stance ‘remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth’ also remains unchanged from June.

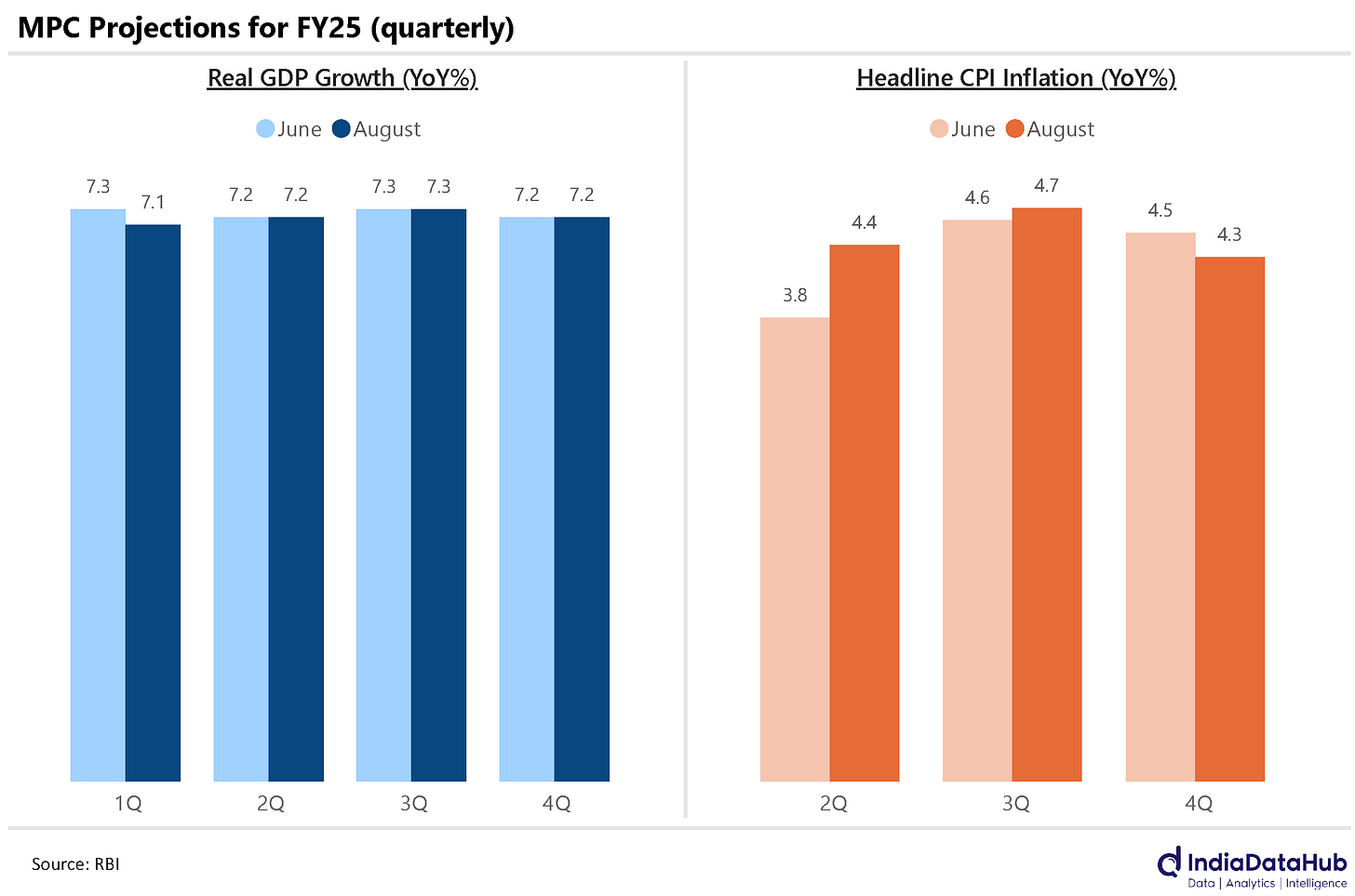

The MPC has made small tweaks to its growth and inflation projections. While its full-year FY25 GDP growth projection remains unchanged at 7.2%, for the first quarter, it has downgraded its growth projection by 20bps to 7.1%. Similarly, while its full-year FY25 CPI Inflation projection is unchanged at 4.5%, it has increased the projection for 2Q by 60bps to 4.4% and modestly downgraded the 3Q and 4Q projections. The big takeaway though is that from the MPC’s perspective, nothing much has changed since the June policy.

We had mentioned in this newsletter last month that apart from inflation and interest rates, the RBI is also tasked with ensuring monetary stability. Indeed it is an explicit mandate for the RBI. And while monetary stability does not figure in the MPC’s statement (since like liquidity, it is the remit of RBI), it does figure in the RBI Governor’s statement. And it was a much bigger comment this time around as compared to the June statement. And while the financial system remains strong overall, the Governor has flagged 3 risks:

The challenging funding environment for banks (bank deposits) due to the rise of other asset classes has made banks rely more on short-term non-retail deposits and other borrowings. This may expose banks to structural liquidity issues.

The growth in unsecured personal loans where the RBI has already taken action. And while credit growth has moderated in some areas, the Governor notes that some segments continue to see high growth.

The high growth in collateralised lending such as home equity loans or gold loans where regulatory prescriptions such as on LTV or end-use monitoring are not being adhered to by some entities.

Given that all of these revolve around strong credit growth in some of the other segments or a mismatch between credit and deposit growth, this will be an important consideration for the RBI in cutting rates, even if inflation and growth allow for it. Lower interest rates will at the margin only fuel more credit growth and make raising deposits more challenging.

Automobile sales recovered in July after a weak couple of months. Car (incl UVs) sales grew 10% YoY in July while 2W sales grew 17%. Tractor sales however continued to decline with a 13% decline in July. Sales of goods carriers grew by a modest 3% YoY.

Growth in Power generation however moderated to a 5-month low of 7.5% YoY. Renewable power generation however grew 14%, the highest in the last 5 months. Consequently, the share of renewable power in total power generation rose to over 16%, the highest ever!

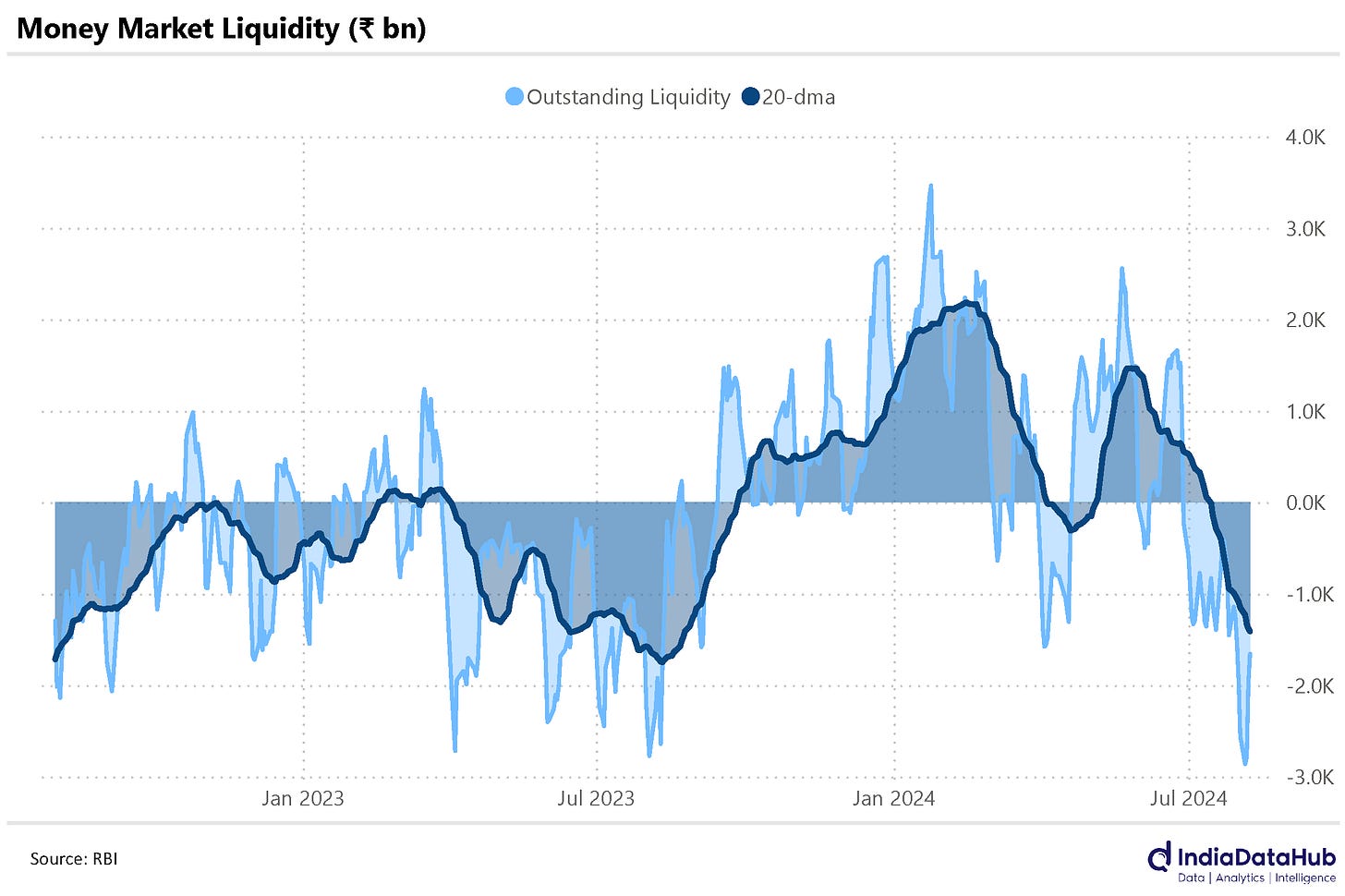

India’s FX reserves continue to increase. During the week ending 2nd August, FX Reserves rose by almost US$8bn to touch US$675bn. FX Reserves have increased by US$30bn since the start of the year. And not surprisingly, this increase in reserves has flown through domestic liquidity which is now firmly into surplus territory. Over the past month, the money market liquidity has averaged ₹-1410bn, the highest in over a year.

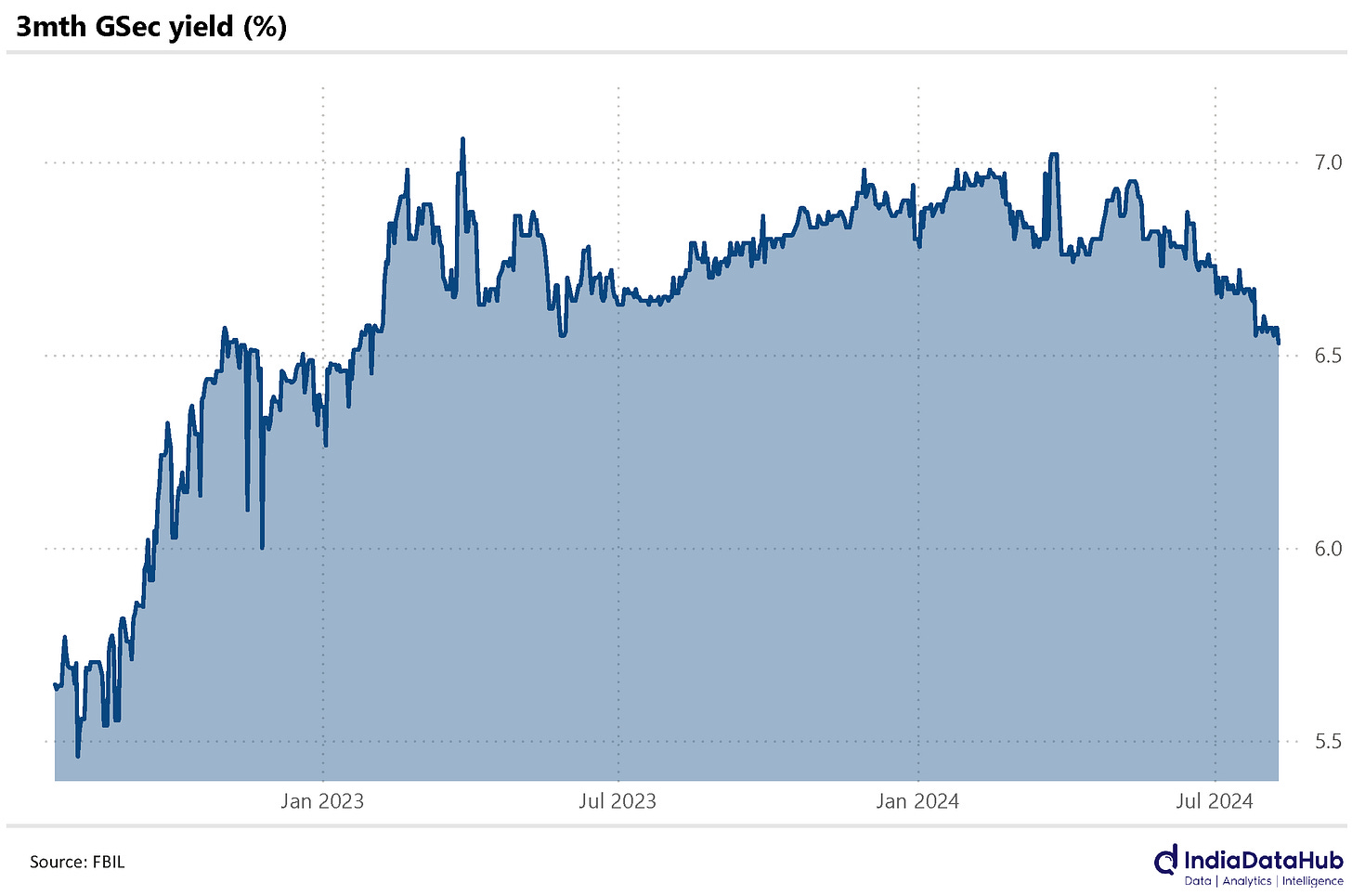

This coupled with expectations of change in monetary policy from the US Fed has pushed down domestic bond yields. The 3-month GSec yield has fallen to 6.5%, and the lowest since early 2023. The 10-year GSec yield has also fallen below 7% for the first time in over a year. More importantly, the 3-month bond yield is now aligned with the repo rate implying market expectation of a near-term rate cut – which based on this week’s policy does not suggest is likely in October.

Alright, let us turn our attention to the rest of the world. China's CPI edged up 30bps in July to 0.5% from 0.2% in July. The prices of food, tobacco, and alcohol increased by 0.2% YoY. Among food, the price of livestock and meat increased by 4.9%, and pork prices rose by 20.4%. Among the other categories, the prices of other supplies and services, education, culture, and entertainment increased by 4.0% and 1.7% respectively.

We also got China’s trade data for July. Exports rose 7% YoY, the slowest growth in 3 months. Imports also grew at 7% and consequently, the trade deficit narrowed by US$14bn to US$85bn.

Lastly, Turkey’s Inflation is finally dropping. Its CPI Inflation declined 10ppt to 62% YoY in July. This is the lowest rise in inflation since October last year.

That’s it for this week. Have a good weekend. And see you next week…

Thank you for what you are doing.