Monetary Policy, Petro consumption decline, Strong Auto sales, China trade and more...

This Week In Data #46

In this edition of This Week In Data, we discuss:

RBI’s monetary policy and outlook for interest rates

Liquidity easing

Decline in petroleum product consumption in November

Moderation in Power Generation

Strong growth in port traffic

Recovery in Auto sales

US Employment data remains strong

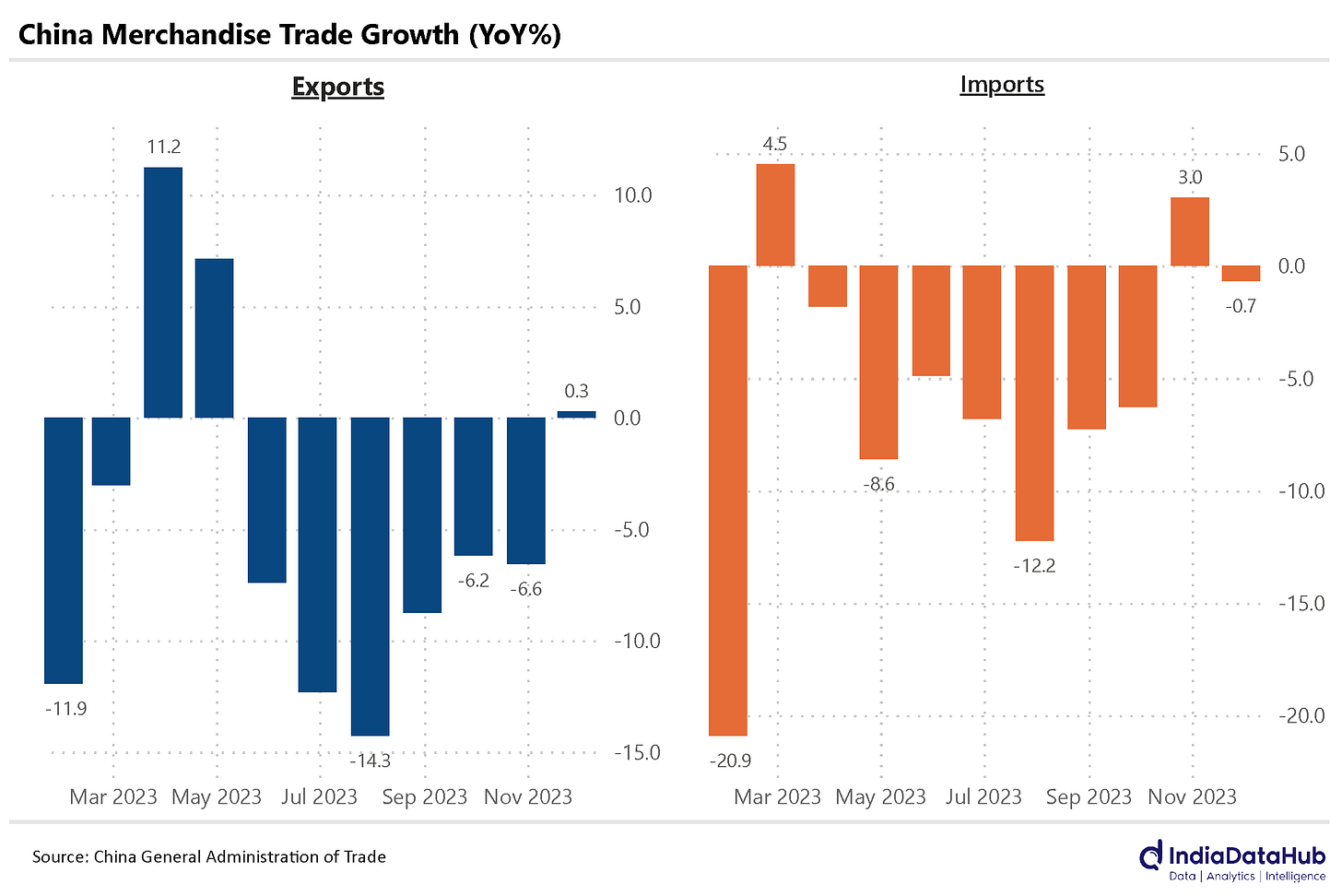

China Exports recover

In case you missed, we launched our self service API portal this week through which you can programmatically access all the data on IndiaDataHub through our APIs. Through these APIs you can directly consume all of our data directly into your analytics applications or tools such as Python, R or Power BI. This video below gives you a quick overview of how to use the API app for accessing the data from our Economic Monitor. So as expected, the MPC kept both the policy interest rate as well as the stance of monetary policy unchanged. The policy repo rate thus remained unchanged at 6% the last hike being in February this year. That said, at the margin, one could discern a sense of ‘job done’ from the MPC. While inflation will rise once again in November and December due to volatile vegetable prices, there is precious little the MPC can do about it, unless it spreads, or is expected to spread, to core inflation. And in that sense, one could sense the MPC more or less declaring ‘job done’ in the policy statement.

And it is worth noting what has been achieved in the last 18 months or so. Core inflation has moderated from above 7% in April last year to just over 4% in October. This moderation has happened through a combination of measures – higher interest rates, tighter liquidity, as well as some deft exchange rate management. And what makes it remarkable is that this has been achieved without any material growth sacrifice. So, while the MPC might suggest that it has done its job, we would add that it’s a job ‘well’ done. As things stand now, we seem to be on track for policy easing to begin in the first quarter or FY25. But things will change, and so we shall see how things play out.

In the short-term though the more relevant thing to track is liquidity. As we had mentioned a couple of weeks back, some of the liquidity tightening in early November was due to transitory due to cash withdrawals due to Diwali. And accordingly, the liquidity deficit has reduced – from a peak of ₹1800bn on 22nd November the liquidity was in surplus for a few days last week. And in sync with it, the overnight call rate has fallen by 10% to 6.7%. However the call rate is still 20bps above the policy repo rate and thus there is scope for it to decline further to be in alignment with the policy repo rate.

As expected after the strong growth in October, some of the trade indicators have moderated sharply in November reflecting the other half of the Diwali effect. However, the data flow has been a bit mixed. So on one hand, power generation grew 5% YoY in November, down from 20% growth in October. This is as expected. But over the two months (Oct-Nov) taken together, power generation grew almost 13% YoY, which is a very strong print.

However, cargo traffic at the major ports accelerated to almost 17% YoY in November from 14% growth in October. The growth in November is the fastest since June 2021 and was driven largely by higher Iron ore (large exports) and Coal traffic (almost entirely imports). Iron ore traffic more than doubled in November while Coal increased by almost 25% YoY. Over the two months of Oct-Nov taken together, cargo traffic at major ports grew by 15% YoY, which is significantly faster than in the preceding few months.

Consumption of petroleum products declined 2% YoY in November. October had also seen a relatively modest 4% growth. The decline in November was due to a 3% decline in Diesel consumption which is largely explained by lower freight movement in November. Bitumen consumption which had been growing over 20% YoY in the last few months also declined 25% YoY in November.

Automobile sales recovered in November, once again reflecting the flipside of the Diwali effect. Two-wheeler sales grew 21% in November after a double-digit decline in October. Car sales grew 17% YoY in November after a modest decline in October. Growth for the two months combined though is slightly slower than the average of the preceding few months.

Moving on to other parts of the world, the US Bureau of Labor Statistics released the non-farm payroll data yesterday. Non-farm payrolls increased by 199k in November, higher than the market expectation of 180k. Payroll data for September was revised down by 35k while that for October was unchanged. The unemployment rate also decreased by 20bps to 3.7%. So all in all, the labour market data in the US continues to remain resilient despite the unprecedented monetary tightening by the Fed.

China reported its merchandise trade data for November. And exports increased 0.3% YoY in November, the first YoY growth since April. Imports however declined by 0.7% YoY. And as a consequence, the trade surplus expanded, albeit modestly. YTD (Jan-Nov) China’s merchandise exports have declined by 5% YoY with rare earth minerals being the commodity with the biggest decline in exports in 2023 (over 25%).

That’s it for this week. November CPI beckons us on the other side. As does the trade data.