Weak China data, Monetary policy review and more...

This Week In Data #30

In this edition of This Week In Data, we discuss:

Weak chinese export growth

Chinese PMI in contractionary zone

Negative Inflation in China

Resilient UK GDP growth

Monetary policy review

July CPI preview

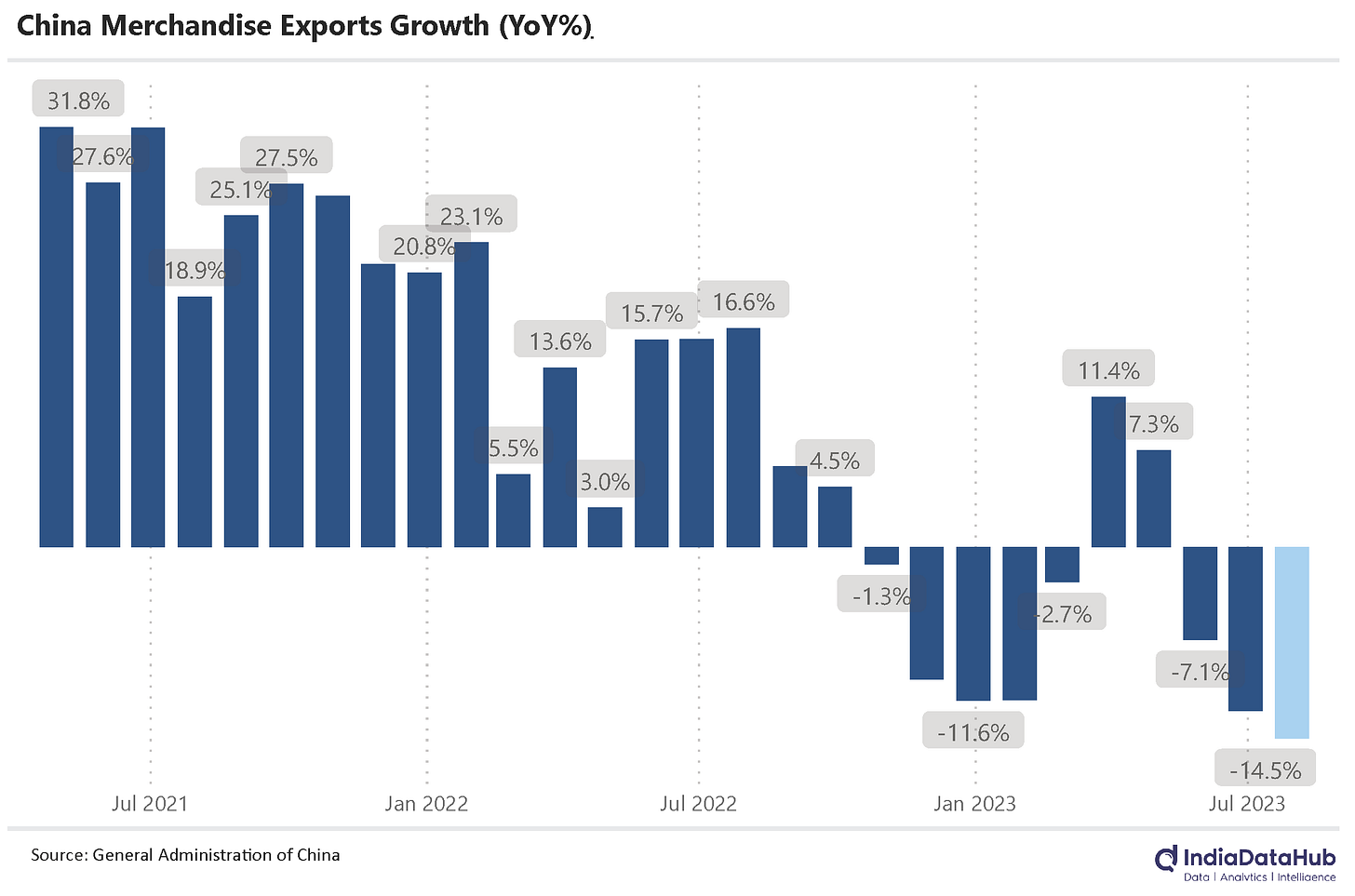

In case you missed we did this episode of DataSpot on Ethanol last week. The episode covers the recent strong growth in Sugarcane production to Government policy on Ethanol blending, Ethanol production in India among other things. Also, we released the first iteration of our DataBot. Built on top of the large language models that have come of age in recent months, it is a whole new way of interacting with data. And you can ask complex questions of it - like what would happen to inflation if medical prices went up by 5% or if vegetable prices declined by 10%. And this is just our beta version. Take a look at this video for a quick demo. This will get rolled out to all our Dashboards.China is the focus this week. Data for several indicators got released this week and they were generally weak. China’s exports declined almost 15% YoY in July. This is the sharpest decline since February 2020. It is also the third consecutive month of decline in exports. Aluminum (32% YoY), Automatic data processing equipment (25%) and rare earth minerals (21%) have seen the steepest decline in exports. Geographically, exports to the US and South Korea were especially soft. The July PMI for China ticked up marginally from the June level. However, it remained below 50 for the 4th consecutive month.

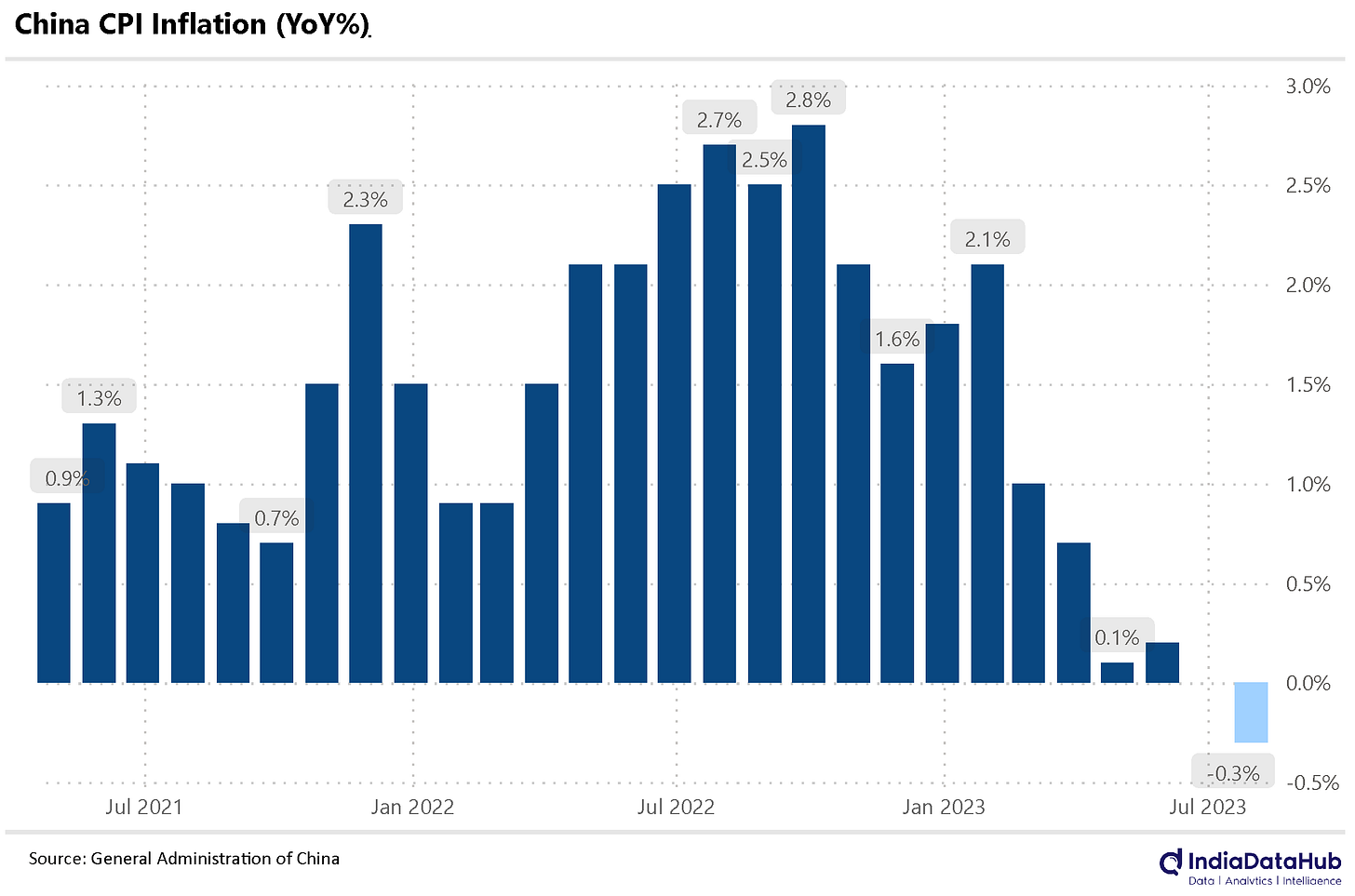

Chinese CPI inflation dipped into negative territory in July. July CPI declined 0.3% YoY, the first time in over 2 years. Food prices were the major driver for the decline (-1.7% YoY) followed by consumer goods.

Taken together, the data flow from China in this past week suggests an economy that is slowing down and this might cause the government or the central bank to stimulate the economy. China might thus be the first large economy to switch from trying to cool down its economy to contain inflation to boosting the economy due to slowing growth and deflation! The circle of economy…

And while on the topic of a strong economy, the UK reported 2Q GDP data last week. UK’s GDP expanded 0.2% QoQ during the June quarter. This is faster than the 0.1% QoQ growth reported in the last two quarters. So the economy continues to be resilient in the face of the unprecedented monetary tightening from the Bank of England. That said it is worth noting that a 0.2% QoQ GDP growth translates to less than 1% YoY growth on an annualised basis. But that is the rate at which some of these developed countries are currently growing…

Ok so now back to India and the RBI. So as expected, the RBI or the MPC kept rates unchanged. The so-called ‘hawkish pause’ continues. Acknowledging that the recent spike in vegetable prices will pass through to reported CPI numbers, the RBI has revised upwards its 2Q CPI estimate by 100bps to 6.2% from 5.2% in the June policy. However, its 4Q CPI estimate remains unchanged at 5.2%.

This then becomes the key from a monetary policy perspective. Implicit in this is that the RBI expects the spike in inflation to be transitory (yes, that word is back, albeit implicitly!). If however in the October or December policy meeting, it appears that the recent uptick in inflation is not likely to subside immediately, then the RBI will be forced to act – by raising interest rates. As things stand now, the RBI will need to make that evaluation in December rather than the October meeting.

What will provide comfort for the RBI is that economic growth is holding up despite the rate hikes. RBI’s forecast for FY24 GDP growth has remained unchanged at 6.5%. Even the consensus estimate for both FY24 and FY25 GDP growth as per the RBI’s professional forecasters’ survey has remained unchanged (increased by 10bps) in this survey round. So, neither the RBI nor the analysts are currently anticipating a big risk to growth.

What the RBI did do though was introduce a temporary liquidity measure. System liquidity has increased in the last two months largely due to the return of the ₹2k notes by way of deposits. As of 31st July around ₹2.7 trillion worth of 2k notes have come back to the banking system by way of deposits. This has increased system liquidity. This increase is likely to be temporary and thus as a temporary measure, the RBI has imposed an additional 10% reserve requirement. But impounding this liquidity through a defacto CRR increase has a cost. Banks were hitherto parking this liquidity under the RBI’s reverse repo window and earning 6.25%, the current SDF rate. Balances under CRR earn nothing and thus banks will lose that 6.25% annualised that they were earning. So this will push up short-term rates. The overnight call rate was hovering below the repo rate and it is now likely to align back to the repo rate. And this wouldn’t be in sync with what the current monetary policy stance is.

So that’s it for this week. July CPI awaits us on Monday. The consensus is that it will print closer to 7%. But as we discussed, what will be relevant to analyse is whether there are any signs that this spike is likely to last more than a couple of months.