Weaker GDP Growth, Changing drivers of Credit growth, SME IPOs and more...

This Week In Data #78

In this edition of This Week In Data, we discuss:

Moderation in India’s 1Q GDP growth to below 7%

The wide divergence between corporate and personal tax collections

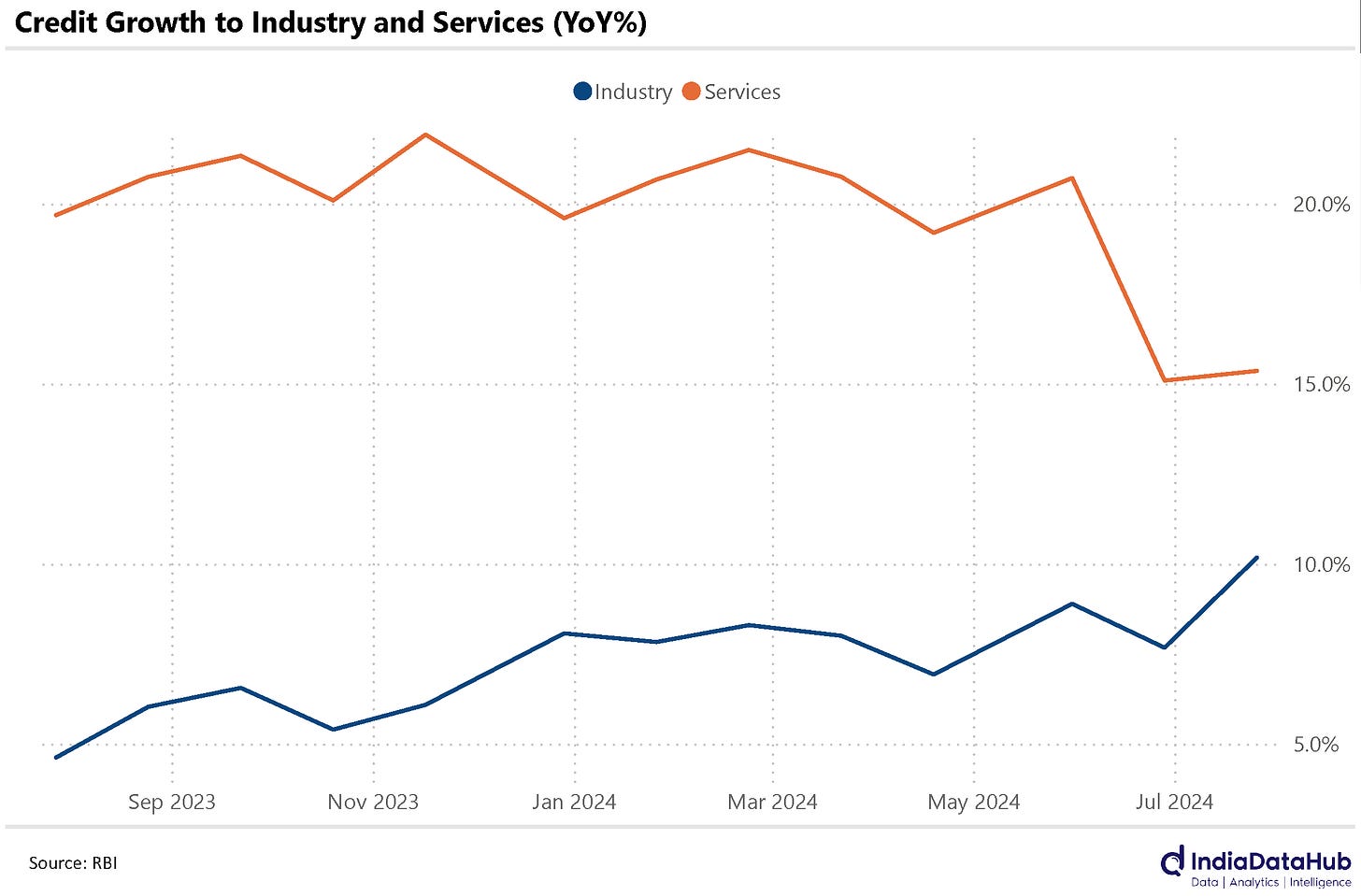

Rise in Industrial credit growth while moderation in services credit growth

Rise in secured personal loans while decline in unsecured lending

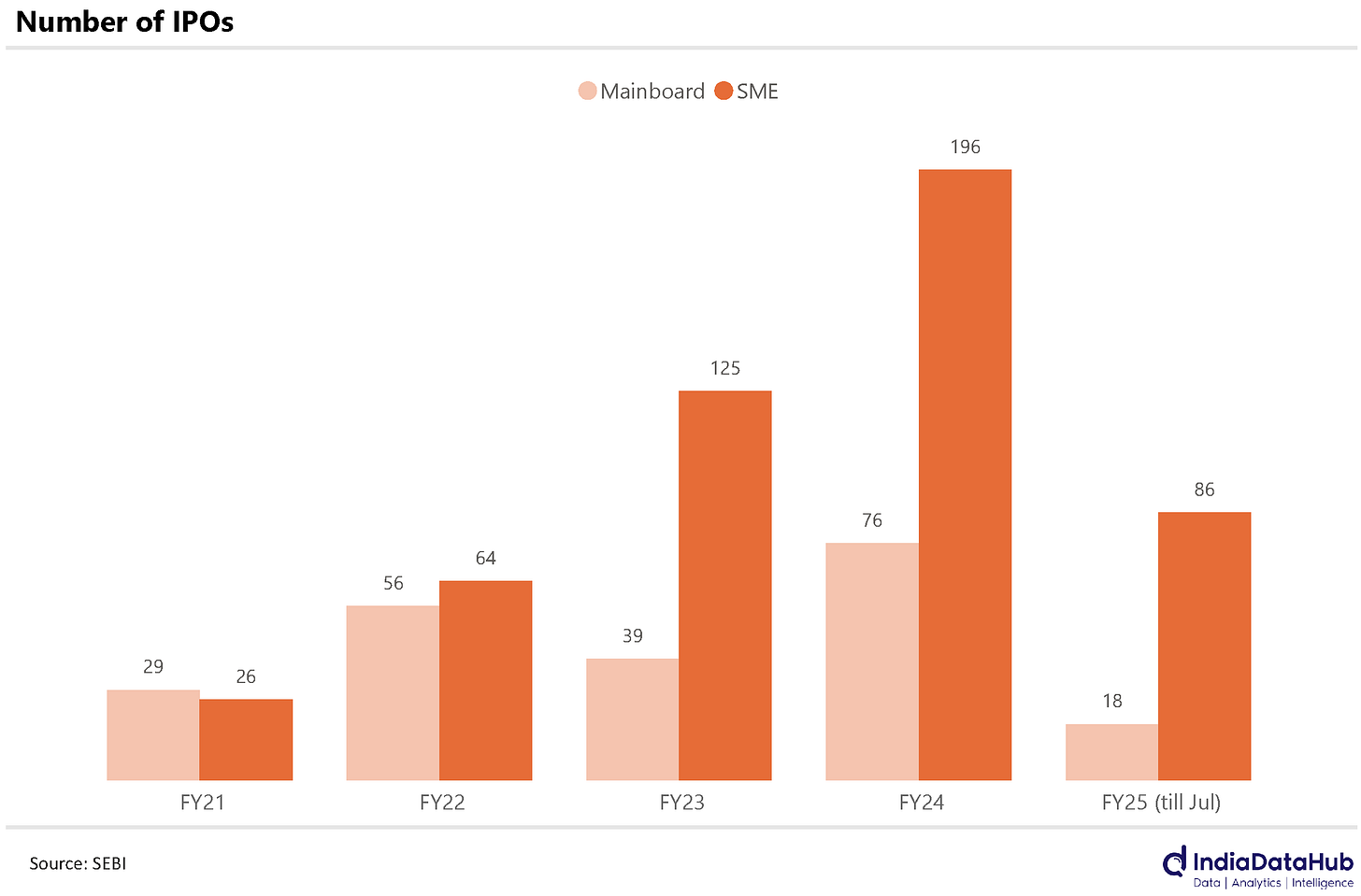

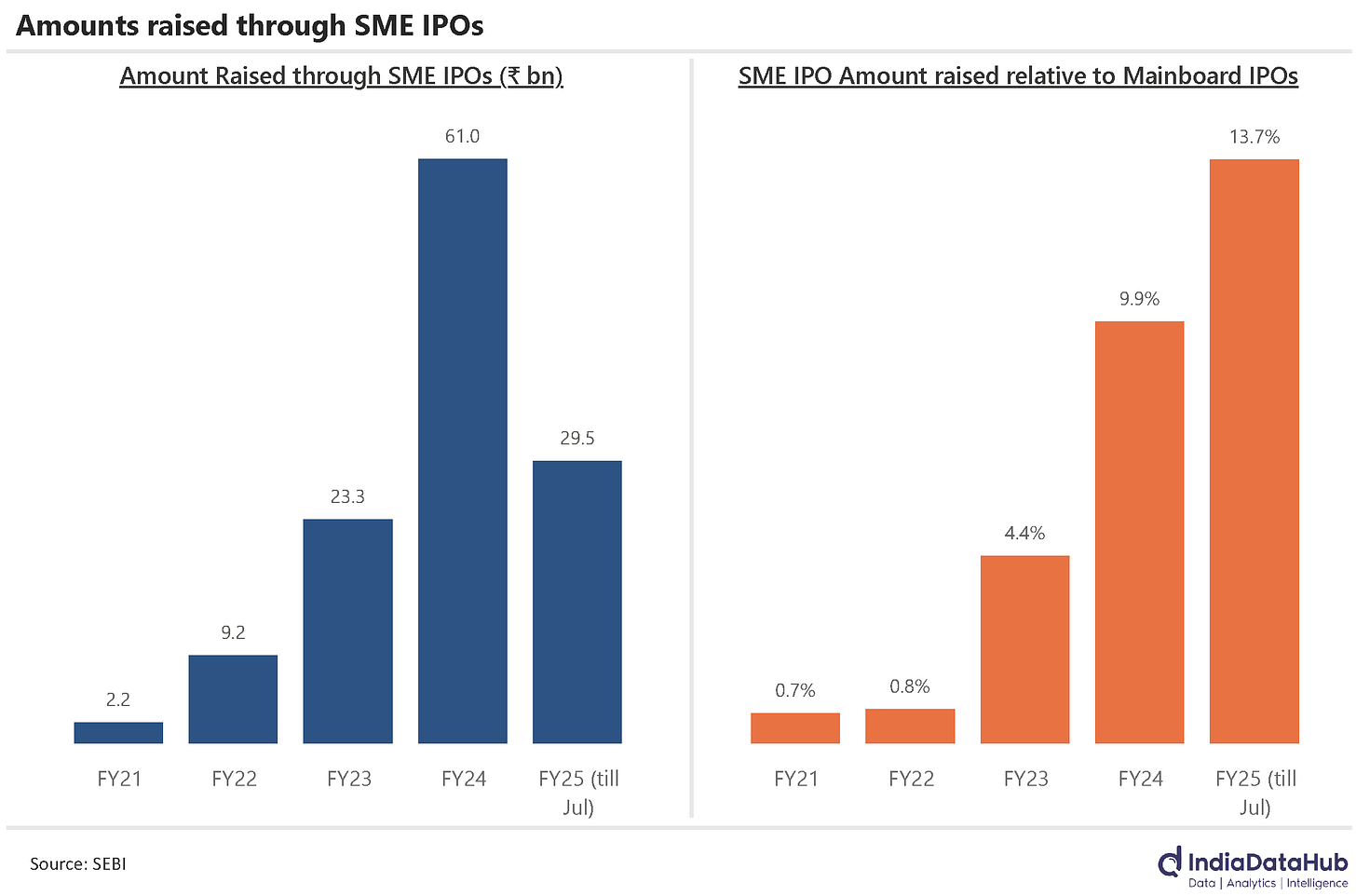

The growth in SME IPOs

GDP growth moderated to 6.7% YoY during the June quarter, down from 7.8% growth during the March quarter. Both the moderation in growth and its magnitude were largely along expected lines. We have been highlighting the fact that the high-frequency data was running soft during May and June and the slower GDP growth is just a manifestation of that. July data has picked up and data for August will start flowing in next week so we will have a better handle on how the current quarter is shaping up in the next couple of weeks.

Corporate tax collections continue to remain an enigma. Corporate tax collections had declined for 4 consecutive months between February and May this year. However, in June they had recovered sharply, growing almost 60% YoY and because June is a seasonally strong month for tax collections (due to the first instalment of advance tax), it took the YTD growth to a healthy 26%. However, July has seen an almost 75% decline in tax collections and consequently, the YTD growth in corporate tax collections is now just 5% YoY.

This is in sharp contrast to personal income tax collections. Personal income tax collections grew 63% YoY in July and YTD has grown by over 50%. The gap between corporate and personal income tax collections has seldom been this wide. What gives?

Overall credit growth has remained largely unchanged at ~15% over the past few quarters. There is however significant sectoral change in drivers of this credit growth. On one hand, Industrial sector credit growth has touched 10%, the highest since November 2022 and up 5ppt from July last year. On the other hand, the Services sector credit growth has moderated sharply to 15% as of July this year from almost 20% a year back.

Personal Loans have not seen a material change in growth rate. Growth in personal loans remains in the high teens. But the drivers have changed significantly – growth in secured loan categories has risen sharply while unsecured loans are seeing a slowdown. Thus, growth in housing loans has increased from 13% a year back to 19% as of July this year. Gold loans are growing at 40% YoY currently – a year ago they were growing at less than 20%. Loans against securities have seen an uptick from 5% a year back to 25% currently. While unsecured personal loans (excl. Credit cards) have seen a slowdown from 28% growth a year back to 14% currently.

And the rise in Real estate loans is not restricted to just residential housing. Commercial Real estate has also seen a sharp increase in credit. Credit growth to commercial real estate has increased from 14% as of July last year to 24% as of July this year.

Recollect the RBI Governor’s comments in the last monetary policy about the rise in certain secured lending categories like Gold loans and ‘Top-Up’ home loans where end-use monitoring may not have been done. What was implied in that comment is that perhaps credit is going to the same end use but just its form has changed.

Lastly, SME IPOs have been in the news recently. In particular the IPO of a certain automobile dealership. What is interesting is how large the SME IPOs are becoming relative to mainboard IPOs. In the first 4 months of this year, there have been a total of 86 SME IPOs as against just 18 main board IPOs. At this rate, the number of SME IPOs will be 50% higher on a YoY basis in FY25!

Admittedly, a given SME IPO is very small compared to any mainboard IPO and thus the total quantum of money being raised through SME IPOs is much smaller than that raised through mainboard IPOs. However given the increase in quantum of SME IPOs, the total amount of money being raised from SME IPOs has also risen relative to that of the mainboard IPOs. In the first 4 months of this year, for instance, the SME IPOs raised almost ₹30bn. This is 14% of the amount raised from mainboard IPOs. Three years back in FY22, the monies raised through SME IPOs was just 1% of the amount raised through mainboard IPOs.

That’s it for this week. Have a good weekend folks…